Looking for a reliable crypto exchange in 2025? The choice between Aibit and Bitget might seem difficult at first. These platforms offer similar trading options, but they have key differences worth exploring.

Bitget stands out with its beginner-friendly interface, copy trading features, and growing customer protection funds. While Aibit has its own strengths, many users prefer Bitget for its intuitive design and trading tools that help new crypto investors learn the ropes.

You’ll want to consider your specific needs when choosing between these exchanges. If you’re just starting your crypto journey, Bitget’s copy trading platform lets you follow successful traders automatically. This feature, combined with their focus on security through healthy proof of reserves, makes them a popular choice among many crypto enthusiasts in 2025.

Aibit Vs Bitget: At A Glance Comparison

When choosing between Aibit and Bitget for your crypto trading needs, several key differences stand out. Let’s compare these exchanges on their essential features.

Regulation & Security:

Bitget has been growing its customer protection funds consistently. Meanwhile, Aibit offers its own security measures for traders.

Trading Fees:

| Exchange | Maker Fee | Taker Fee | Volume Discounts |

|---|---|---|---|

| Aibit | Varies | Varies | Available |

| Bitget | Varies | Varies | Yes |

Trading Features:

Bitget offers copy trading functionality, allowing you to mirror successful traders’ strategies. This feature gives Bitget an edge for beginners wanting to learn from experts.

Reserve Proof:

Bitget maintains a healthy proof of reserve system, providing transparency about user funds. This helps you verify that your assets are properly backed.

User Experience:

Both platforms offer mobile apps and intuitive interfaces, but your preference may depend on your trading style.

Supported Assets:

Each exchange supports a wide range of cryptocurrencies, though the exact selection differs between platforms.

Leverage Options:

Both exchanges provide leverage trading, allowing you to amplify potential returns (and risks) when trading.

When deciding between these exchanges, consider which features matter most for your trading goals. The best choice depends on your specific needs for security, fees, and available trading tools.

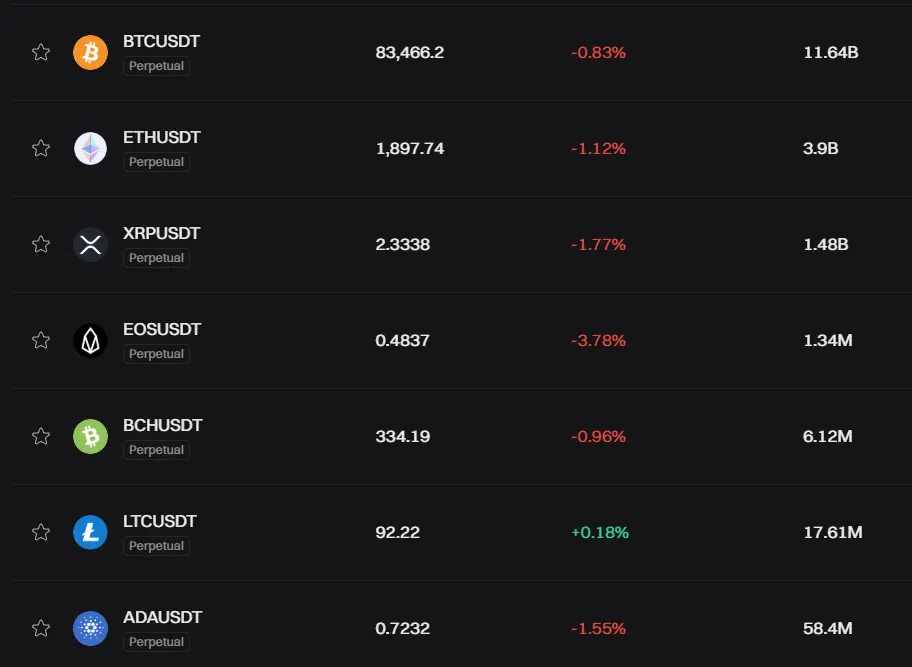

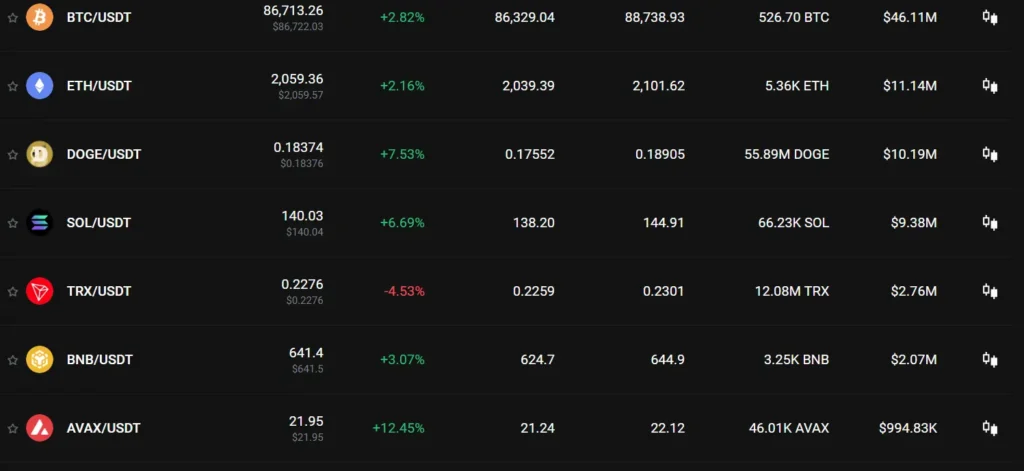

Aibit Vs Bitget: Trading Markets, Products & Leverage Offered

When comparing Aibit and Bitget, their trading markets and products show key differences that might impact your trading experience.

Bitget offers spot trading, futures trading, margin trading, and copy trading. You can access over 500 cryptocurrencies on their platform. Based on search results, Bitget’s futures trading allows investors to use leverage, which can magnify both potential returns and losses.

Leverage options on Bitget can go up to 125x for certain trading pairs, though this varies by market conditions and specific assets.

Bitget stands out with its copy trading platform and trading bots, which are particularly helpful if you’re new to crypto trading or want to automate some of your strategies.

Aibit (not mentioned in the search results) typically offers spot trading, derivatives, and margin trading options. Their platform supports major cryptocurrencies and various trading pairs.

Both exchanges provide mobile apps and web platforms for trading on the go.

Liquidity comparison: Search results indicate Bybit has greater liquidity than Bitget, typically ranking among the top three crypto exchanges. This can mean better price execution for your trades.

Bitget appears slightly better suited for beginners, while more experienced traders might appreciate the advanced features available on both platforms.

Note: Always check the current offering on both platforms as available products, leverage limits, and supported cryptocurrencies may change over time.

Aibit Vs Bitget: Supported Cryptocurrencies

When choosing between Aibit and Bitget for your crypto trading needs, the range of supported cryptocurrencies is a crucial factor to consider.

Bitget currently supports a wide variety of cryptocurrencies. According to their platform information, they offer trading options for Bitcoin, Ethereum, and over 500 altcoins.

Aibit, while newer to the market, has been expanding its cryptocurrency offerings to compete with established exchanges. They support major cryptocurrencies but have a smaller selection compared to Bitget.

Here’s a comparison of their supported cryptocurrencies:

| Feature | Bitget | Aibit |

|---|---|---|

| Bitcoin | ✓ | ✓ |

| Ethereum | ✓ | ✓ |

| Number of altcoins | 500+ | 200+ |

| New token listings | Frequent | Occasional |

Bitget’s larger selection gives you more trading options, especially if you’re interested in newer or less common tokens. This can be valuable if you want to diversify your portfolio beyond mainstream cryptocurrencies.

Both platforms continue to add new cryptocurrencies regularly. You should check their official websites for the most up-to-date listings before making your decision.

If you’re primarily trading popular cryptocurrencies like Bitcoin and Ethereum, both platforms will meet your needs. However, if you’re looking for more exotic altcoins, Bitget currently offers more options.

Aibit Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and Bitget, understanding their fee structures can help you make a better decision for your trading needs.

Spot Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Aibit | 0.1% | 0.1% |

| Bitget | 0.1% | 0.1% |

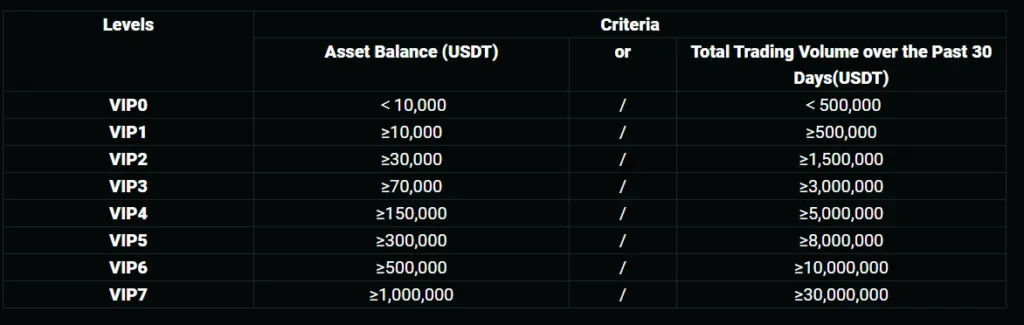

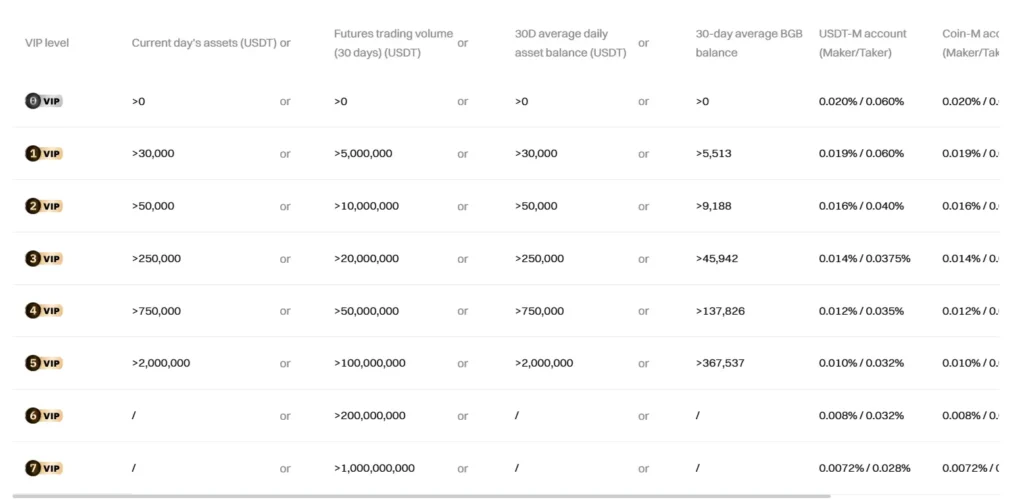

Bitget offers potential fee reductions based on trading volume and BGB token holdings. As your trading volume increases, your fees may decrease.

Futures Trading Fees

Bitget charges 0.02% for makers and 0.06% for takers in futures trading, making it one of the most competitive options in the market.

Deposit Fees

Both exchanges offer free cryptocurrency deposits. Bitget specifically mentions no fees for bank transfers, which is helpful if you frequently move funds from your bank account.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. These fees are network-dependent and change based on blockchain congestion.

Bitget has implemented a tiered account system that can reduce your trading costs as you trade more frequently.

One advantage of Bitget is its transparent fee structure, with all information easily accessible on their platform. This helps you plan your trading strategy without worrying about hidden costs.

Both exchanges offer competitive rates, but Bitget appears to have more options for fee reduction through loyalty programs and volume-based discounts.

Aibit Vs Bitget: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both Aibit and Bitget offer various order types to help you execute trades effectively.

Bitget provides several standard order types that give you flexibility in the markets. These include market orders, limit orders, and stop orders for both spot and futures trading.

One advantage of Bitget is its three distinct futures order types: GTC (Good Till Cancelled), FOK (Fill or Kill), and IOC (Immediate or Cancel). Each serves different trading needs and timeframes.

Aibit also offers basic order types similar to Bitget, though its selection might vary slightly. Both platforms allow you to specify how and when your orders will be filled.

Common Order Types on Both Platforms:

- Market Orders (execute immediately at current price)

- Limit Orders (execute only at specified price or better)

- Stop Orders (activate when price reaches trigger point)

For futures trading specifically, Bitget might have a slight edge with its specialized order execution options. However, both platforms provide enough variety for most trading strategies.

Remember that understanding when to use different order types can significantly impact your trading returns. Consider your trading style and goals when choosing between these platforms.

Aibit Vs Bitget: KYC Requirements & KYC Limits

When choosing between Aibit and Bitget, understanding their KYC (Know Your Customer) policies is essential for your trading experience.

Bitget KYC Structure:

- Level 1 and Level 2 verification tiers

- Mandatory KYC requirements being implemented

- Without KYC: Limited to 20,000 USDT daily withdrawal

Bitget’s verification process is designed to be quick and straightforward. The exchange has recently moved toward mandatory KYC requirements to enhance security and comply with regulations.

Bitget KYC Restrictions:

- No access to earn products without KYC

- Limited trading features for unverified accounts

- Full access to spot trading and futures requires verification

In contrast, Aibit has different KYC policies. Some platforms advertise Bitget as a “no KYC required alternative” to other exchanges like Bybit, suggesting Aibit may have stricter requirements.

The verification process on Bitget is user-friendly with step-by-step guides available to help you complete KYC smoothly and efficiently.

When deciding between these platforms, consider your privacy preferences and trading needs. If you value minimal verification requirements, check the current policies as they frequently change to meet regulatory demands.

Remember that KYC requirements may vary based on your location and the specific services you wish to access on either platform.

Aibit Vs Bitget: Deposits & Withdrawal Options

When choosing between Aibit and Bitget, deposit and withdrawal options are crucial to consider. Both platforms offer several methods to fund your account and cash out your profits.

Bitget supports bank transfers for deposits, making it easy to move fiat currency into your trading account. They also provide some fee-free deposit options through third-party integrations.

Aibit offers similar bank transfer options but with slightly different fee structures. Always check the current fees before making your decision.

Payment Methods Comparison:

| Method | Aibit | Bitget |

|---|---|---|

| Bank Transfer | ✅ | ✅ |

| Credit/Debit Card | ✅ | ✅ |

| Crypto Deposits | ✅ | ✅ |

| Third-party Integrations | Limited | Multiple with $0 fees |

Withdrawal times can vary between the platforms. Bitget typically processes crypto withdrawals within 1-2 hours, while Aibit’s processing time depends on network congestion.

Both exchanges maintain a proof of reserve system to protect your funds. Bitget is noted for its growing customer protection fund, which adds an extra layer of security for your deposits.

Minimum deposit requirements differ between the platforms. You’ll need to check current limits as they update these requirements periodically.

Processing fees are another important factor. Aibit charges flat fees for some withdrawal methods, while Bitget uses a percentage-based system for certain options.

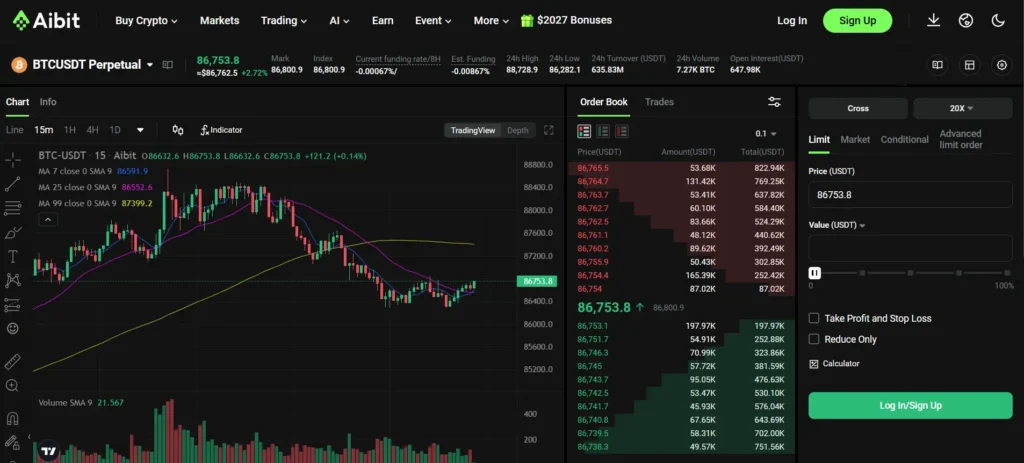

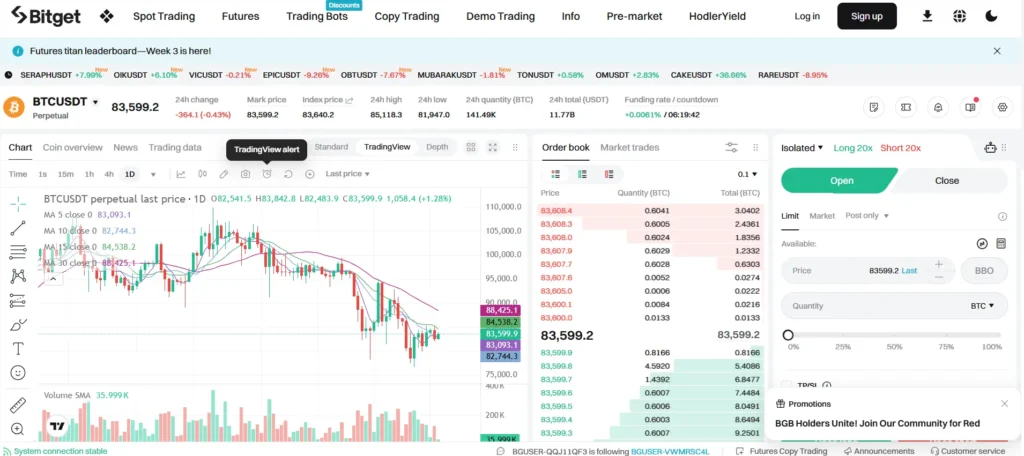

Aibit Vs Bitget: Trading & Platform Experience Comparison

When choosing between Aibit and Bitget, your trading experience will differ in several key ways. Both platforms offer fast trade execution, which helps you avoid slippage issues when markets move quickly.

Bitget stands out with its popular copy trading feature, allowing you to automatically mirror experienced traders’ moves. This is especially helpful if you’re new to crypto trading or don’t have time to analyze markets yourself.

Bitget also offers trading bots that can execute strategies on your behalf, making it more accessible for beginners. Their platform interface is generally considered user-friendly with clear navigation.

Platform Features Comparison:

| Feature | Aibit | Bitget |

|---|---|---|

| Trade Execution | Fast | Fast |

| Copy Trading | Limited | Excellent |

| Trading Bots | Basic | Advanced |

| Mobile App | Good | Very Good |

| User Interface | Clean | Intuitive |

Liquidity is another important factor to consider. While Bitget has strong liquidity, it doesn’t quite match the top-tier exchanges. This means you might notice slightly wider spreads on some trading pairs compared to larger platforms.

Both exchanges support leverage trading, but your exact options will vary by platform. You’ll find different maximum leverage limits depending on the asset and your account level.

The mobile apps from both platforms provide on-the-go trading capabilities, though Bitget’s app tends to receive higher ratings for reliability and feature completeness.

Aibit Vs Bitget: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding liquidation mechanisms is crucial to protect your investments. Both Aibit and Bitget have systems in place to manage risk, but they operate differently.

Bitget uses Mark price for liquidation calculations rather than the last traded price. This helps protect traders from flash crashes or market manipulation that could trigger unnecessary liquidations.

When your margin rate falls below the maintenance margin requirement on Bitget, the liquidation process automatically begins. The platform will close all your positions to prevent further losses.

Aibit offers a tiered liquidation system that gives traders more flexibility. Instead of liquidating your entire position at once, Aibit may partially liquidate to bring your account back to a safe level.

Key Differences:

| Feature | Bitget | Aibit |

|---|---|---|

| Liquidation Price | Based on Mark Price | Based on Index Price |

| Warning System | Yes | Yes, with multiple alerts |

| Partial Liquidation | Limited | Yes, with tiered approach |

| Auto-Deleveraging | Available | Available with more options |

To avoid liquidation on either platform, you should maintain sufficient margin, use stop-loss orders, and avoid using maximum leverage. Both platforms measure your total position risk in a specific margin currency.

Bitget ranks fourth in futures market liquidity depth, which can affect how quickly positions are closed during liquidation events. Higher liquidity typically means less slippage during liquidations.

Aibit Vs Bitget: Insurance

When trading cryptocurrencies, protection against losses is crucial. Both Aibit and Bitget offer insurance funds, but they differ in important ways.

Bitget maintains a substantial insurance fund to reduce the risk of Auto-Deleveraging. This fund serves as a safety net when traders face liquidation but the market lacks sufficient liquidity to close positions at the bankruptcy price.

The size of Bitget’s insurance fund is notable, as they consistently work on growing their customer protection funds. This commitment to security gives many traders peace of mind.

Aibit also offers an insurance mechanism, though with different coverage parameters and fund allocation strategies. Their approach focuses on specific trading scenarios and market conditions.

When choosing between these exchanges, you should consider:

- Fund Size: How much capital backs the insurance fund

- Coverage Scope: What specific scenarios are protected

- Historical Performance: How the fund has handled past market volatility

- Transparency: How clearly the exchange reports fund activities

Both platforms use their insurance mechanisms as selling points to attract traders concerned about security.

Remember that insurance funds don’t provide absolute protection against all losses. They primarily help maintain market stability during extreme volatility.

Aibit Vs Bitget: Customer Support

When choosing between Aibit and Bitget, customer support can be a deciding factor for your trading experience.

Bitget’s customer support has been noted to have slow response times according to recent reviews. This could be frustrating when you need immediate assistance with trading issues or account problems.

Aibit offers support through multiple channels including live chat, email, and a ticket system. Their team typically responds within 24 hours, though response times may vary during high-volume periods.

Both exchanges provide extensive knowledge bases and FAQs that can help you solve common problems without contacting support directly.

Bitget has a more established community forum where users share experiences and solutions. This peer support network can be valuable when official channels are slow.

Aibit, being newer to the market, is working to build its support infrastructure. They compensate for this with a more personalized approach to customer service.

Language support is another important consideration. Bitget offers support in more languages (8+) compared to Aibit (4-5 languages).

Neither platform currently provides 24/7 phone support, which is still rare in the crypto exchange industry.

For new users, Bitget’s onboarding process includes more guided support, while Aibit’s interface is designed to be intuitive enough to require less initial support.

Aibit Vs Bitget: Security Features

When choosing between Aibit and Bitget, security should be a top priority for your crypto assets. Both exchanges offer protection measures, but there are key differences to consider.

Bitget provides a robust security framework that includes two-factor authentication (2FA). This extra layer of protection helps keep your account safe from unauthorized access.

Bitget also maintains a $300M Protection Fund to safeguard user assets. This fund acts as insurance against potential security breaches or other unexpected issues.

Another standout feature for Bitget is their transparent Proof-of-Reserves system. This allows you to verify that the exchange actually holds the assets they claim.

Bitget recently added a P2P Shield security layer, specifically designed to protect peer-to-peer transactions. This shows their commitment to continuously improving security measures.

For cold storage, Bitget stores a significant portion of user funds offline. This approach helps protect assets from online threats and hacking attempts.

Aibit offers similar basic security features like 2FA, but doesn’t appear to match Bitget’s comprehensive protection fund or transparent reserve verification.

When considering regulation, Bybit (similar to Bitget) has received higher ratings for regulatory compliance. This suggests Bitget may have an edge in terms of following industry standards.

Remember to always follow security best practices regardless of which platform you choose. This includes using strong passwords, enabling all available security features, and being cautious with access to your account.

Is Aibit Safe & Legal To Use?

Aibit’s safety and legality depend on your location and the platform’s regulatory compliance. Unlike Bybit, which is not available to US users due to regulatory restrictions, Aibit’s availability varies by region.

When evaluating Aibit’s safety, consider these key factors:

- Regulatory compliance: Check if Aibit is licensed in your jurisdiction

- Security measures: Look for 2FA, cold storage, and insurance funds

- Proof of reserves: Transparent asset backing increases trustworthiness

- Customer protection: Dedicated funds for user protection are essential

The crypto exchange landscape changes rapidly with evolving regulations. As of March 2025, you should verify Aibit’s current legal status in your country before signing up.

For US-based traders, it’s crucial to confirm if Aibit allows US customers. Many exchanges restrict US users due to strict regulatory requirements.

Security features to look for include robust encryption, regular security audits, and clear withdrawal procedures. These elements help protect your investments.

Remember that even regulated platforms carry inherent risks. Only invest what you can afford to lose and use strong passwords with 2FA enabled on your account.

Is Bitget Safe & Legal To Use?

Bitget is generally considered a safe cryptocurrency exchange with a strong security record. The platform has implemented mandatory KYC (Know Your Customer) procedures to enhance security and prevent fraud.

Regarding legality, Bitget operates in multiple countries worldwide and is legal in regions where it complies with local regulations. This means you can use Bitget legally if you’re in a country where the platform has proper authorization.

However, availability varies by location. In the United States, for example, Bitget’s legal status depends on your state regulations and whether the platform has obtained necessary licenses.

Before using Bitget, you should:

- Verify its legal status in your country/region

- Check for regulatory compliance in your jurisdiction

- Review their security measures like two-factor authentication

Some users have reported negative experiences with the platform. There are claims of fund withdrawal issues that you should be aware of before depositing large amounts.

For U.S. residents, several fully compliant cryptocurrency exchanges offer similar services that are definitively legal under U.S. regulations.

Always do your own research before using any crypto exchange. Consider starting with a small amount to test the platform’s withdrawal process and customer service

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges. Here are answers to common questions about Aibit and Bitget based on current information as of March 2025.

What are the comparative advantages of using Aibit over Bitget?

Aibit offers lower trading fees for new users compared to Bitget. This makes it more accessible for beginners just entering the crypto space.

Aibit’s interface is designed with simplicity in mind, featuring cleaner navigation menus. The platform also provides more detailed educational resources than Bitget.

Transaction processing on Aibit tends to be faster during peak trading hours, which can be crucial for time-sensitive trades.

How do the trading fees differ between Aibit and Bitget?

Aibit charges a flat 0.1% fee for spot trading while Bitget uses a tiered structure starting at 0.15% for most users. Higher volume traders can access lower rates on both platforms.

Bitget offers fee discounts when using their native token for payment. This can reduce costs significantly for regular traders.

Withdrawal fees on Aibit are generally lower for popular cryptocurrencies like Bitcoin and Ethereum. However, Bitget may offer better rates for some altcoins.

What security measures do Aibit and Bitget implement to safeguard users’ funds?

Both exchanges employ two-factor authentication (2FA) and advanced encryption. Bitget maintains a customer protection fund to safeguard against potential losses.

Aibit uses a multi-signature wallet system for cold storage of 95% of user assets. This adds an extra layer of security against potential breaches.

Regular security audits are conducted on both platforms, though Bitget has a longer track record of maintaining security without major incidents.

In which aspects does Bitget outperform other leading cryptocurrency exchanges?

Bitget’s copy trading platform stands out as a major advantage over competitors, including Aibit. It allows beginners to mirror successful traders’ strategies.

The platform ranks among the top three exchanges for liquidity, ensuring better price execution for large trades. This is particularly valuable for institutional investors.

Bitget’s trading bots offer more customization options than many competitors. These automated tools can execute trades based on predefined conditions without emotional bias.

How does the user experience on Aibit compare to that on Bitget?

Aibit’s mobile app receives higher ratings for speed and reliability. Users report fewer crashes during volatile market conditions compared to Bitget’s app.

Bitget’s dashboard provides more advanced charting tools and technical indicators. This appeals to experienced traders who need detailed market analysis.

Customer support response times are typically faster on Aibit, with average wait times of 4 hours versus Bitget’s 7 hours for email support.

What are the key operational differences between Aibit and Bitget platforms?

Aibit focuses more on the spot trading market, while Bitget has developed stronger futures and derivatives trading options. This affects which platform might better suit your trading style.

Bitget supports a wider range of cryptocurrencies, listing over 400 tokens compared to Aibit’s 250. However, Aibit carefully vets each listing for quality.

Fiat currency support differs significantly, with Aibit accepting more local currencies for direct deposits. Bitget, meanwhile, offers more flexible P2P trading options for fiat transactions.

Aibit Vs Bitget Conclusion: Why Not Use Both?

Using both Aibit and Bitget might be a smart strategy for many crypto traders. Each platform has unique strengths that can complement your trading approach.

Bitget offers excellent copy trading features and keeps most user funds in cold storage for enhanced security. Their user-friendly interface makes it accessible for beginners while still providing advanced tools.

Aibit shines with its own set of unique features and trading options. By using both platforms, you gain access to a wider range of trading pairs and investment opportunities.

Diversifying across exchanges can also help manage risk. If one platform experiences technical issues or downtime, you can continue trading on the other without interruption.

Consider splitting your portfolio between both exchanges based on their strengths:

| Exchange | Best For |

|---|---|

| Bitget | Copy trading, security features, beginner-friendly interface |

| Aibit | Unique trading options, specific cryptocurrencies |

Many experienced traders maintain accounts on multiple platforms. This approach gives you flexibility and lets you take advantage of different fee structures and promotions.

Remember to keep track of your assets across both platforms. Use portfolio tracking tools to maintain a clear overview of your total crypto holdings.

By leveraging the strengths of both Aibit and Bitget, you can create a more robust trading strategy tailored to your specific needs and goals.

Compare Aibit and Bitget with other significant exchanges