Exploring Binance Options gives you access to a wide range of trading possibilities. With its comprehensive selection of cryptocurrencies and numerous trading pairs, this platform allows you to engage in options trading with ease. Whether you’re a seasoned trader or a newcomer to the crypto world, you’ll find robust tools and features that support diverse trading strategies.

Navigating the Binance interface offers flexibility and precision for all your trading activities. The platform supports advanced trading options, including margin trading and a demo trading mode or paper trading for practice. These features make it attractive for those looking to hone their trading skills or explore creative strategies in a risk-managed environment.

You will appreciate Binance’s commitment to security and transparency. With user security as a priority, it provides an array of protection measures while maintaining a seamless trading experience. Engaging with this exchange means trusting in a platform that continues to innovate while catering to both individual and professional traders.

What Are Binance Options?

Binance Options are a type of derivative product available on the Binance cryptocurrency exchange, offering a flexible approach to trading cryptocurrency assets.

This feature allows you to engage in options trading without needing extensive expertise, making it accessible to both beginners and seasoned traders. Binance Options are designed for those who want an alternative to traditional spot trading.

Key Characteristics:

- Settlement in Stablecoin: Transactions are priced and settled in stablecoins, helping you navigate the complexities of volatile markets with ease.

- Low Capital Requirement: You pay an options premium, which is less than the cost of holding equivalent Futures or Spot positions.

- Flexible Strategies: Choose from various strategies such as hedging or amplifying returns, adjusting your exposure depending on market conditions.

Trading Experience:

- Intuitive Platform: The Binance platform is developed for different proficiency levels, providing you with various tools and interfaces to enhance your trading experience.

- Order Types: Experience flexibility with multiple order types, including limit and market orders.

When trading Binance Options, you interact with a robust system that connects you with significant market makers. This setup offers some of the lowest fees in the options trading market. Binance Options act as a pathway to new opportunities for diversifying your investment portfolio in the crypto space.

Binance Options Products Offerings

Binance Options provides a variety of products tailored for traders, offering unique features to enhance your trading strategy. By integrating user-friendly interfaces and robust tools, they cater to both beginners and seasoned traders.

Key Offerings:

- Stablecoin Options: Trades are priced and settled in stablecoins, ensuring transparent cost and profit calculations. This feature helps minimize risks associated with price volatility.

- Low Capital Requirement: You can obtain equivalent exposure to Futures or Spot positions by just paying the required Options Premium. This also allows you to amplify your trading outcomes with a smaller capital outlay.

Options can be utilized as hedging instruments. Purchasing Put Options on your current coin holdings can safeguard investments if the coin’s value declines. Exercising these options helps offset potential losses, keeping your financial strategy secure.

Binance offers options contracts for crypto that use the Options Greeks tools to help you better understand market sensitivities. This supports informed trading decisions, giving you an edge in the fast-paced crypto market.

You can enter and exit positions with ease. The platform is designed to accommodate both bullish and bearish market forecasts, allowing you to respond dynamically to market changes.

These products, backed by Binance’s reputation as a leading crypto exchange, enable a broad spectrum of trading opportunities.

Binance Supported Coins For Options Trading

When exploring Binance for options trading, you’ll find it provides a diverse range of supported coins. This diversity ensures that you have multiple pathways to optimize your trading strategy.

Binance offers options trading primarily with popular cryptocurrencies. Bitcoin (BTC) and Ethereum (ETH) are two of the mainstays available, providing a solid foundation for most traders.

A significant advantage is the platform’s use of stablecoins, such as USDT (Tether) and BUSD (Binance USD), which helps simplify cost and profit calculations. These options offer stability in the dynamic crypto market.

Here’s a quick reference list of some supported coins for options trading on Binance:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance USD (BUSD)

Having these coins at your disposal can greatly influence your options trading decisions. Their liquidity and market relevance make them popular choices among traders on Binance.

In essence, Binance equips you with popular and stable coins for options trading, providing both flexibility and security in your trading decisions. This curated selection reflects Binance’s commitment to offering optimal trading conditions.

Binance Options Leverage

When engaging in Binance options trading, leverage is a tool you can utilize to amplify your potential returns. This feature allows you to control a larger position with a relatively smaller amount of capital.

Leverage Benefits:

- Increased Potential Returns: Leverage can magnify your profits if the trade goes in your favor.

- Flexibility: You can enter larger positions without committing substantial capital upfront.

However, using leverage involves increased risk, so caution is advised.

Risk Considerations:

Leverage can amplify losses just as quickly as it can increase profits. Be aware that your exposure to potential market movements increases with higher leverage ratios.

When trading options with leverage, it’s essential to manage your risk appropriately. Set clear stop-loss orders and consider your risk tolerance before engaging in leveraged trades.

Leverage Ratios:

On Binance, the leverage ratio depends on the specific options contract and market conditions. It’s critical to understand the terms of the specific trade you are entering.

Summary Tools:

- Stop-Loss Orders: Helps mitigate potential losses.

- Capital Management: Don’t risk more capital than you can afford to lose.

Use these tools to manage your leverage effectively and protect your investments.

Binance Options Calculator

The Binance Options Calculator is a valuable tool for traders. It helps you estimate potential profits and losses for your options trades. By inputting specific data such as strike price, premium, and expiry, you can gain a clearer picture of your financial exposure at the options expiry date.

You have the ability to visualize your possible outcomes and make more informed decisions. This is crucial in managing risk and planning your trades effectively. Understanding your payoff scenarios can guide your strategies and enhance your trading experience.

Additionally, the crypto options calculator supports a variety of option types available on Binance. This flexibility allows you to explore different strategies according to your trading preferences and market conditions. Whether you’re new to options trading or an experienced trader, the calculator serves as an essential tool in your trading arsenal.

Binance Options Types

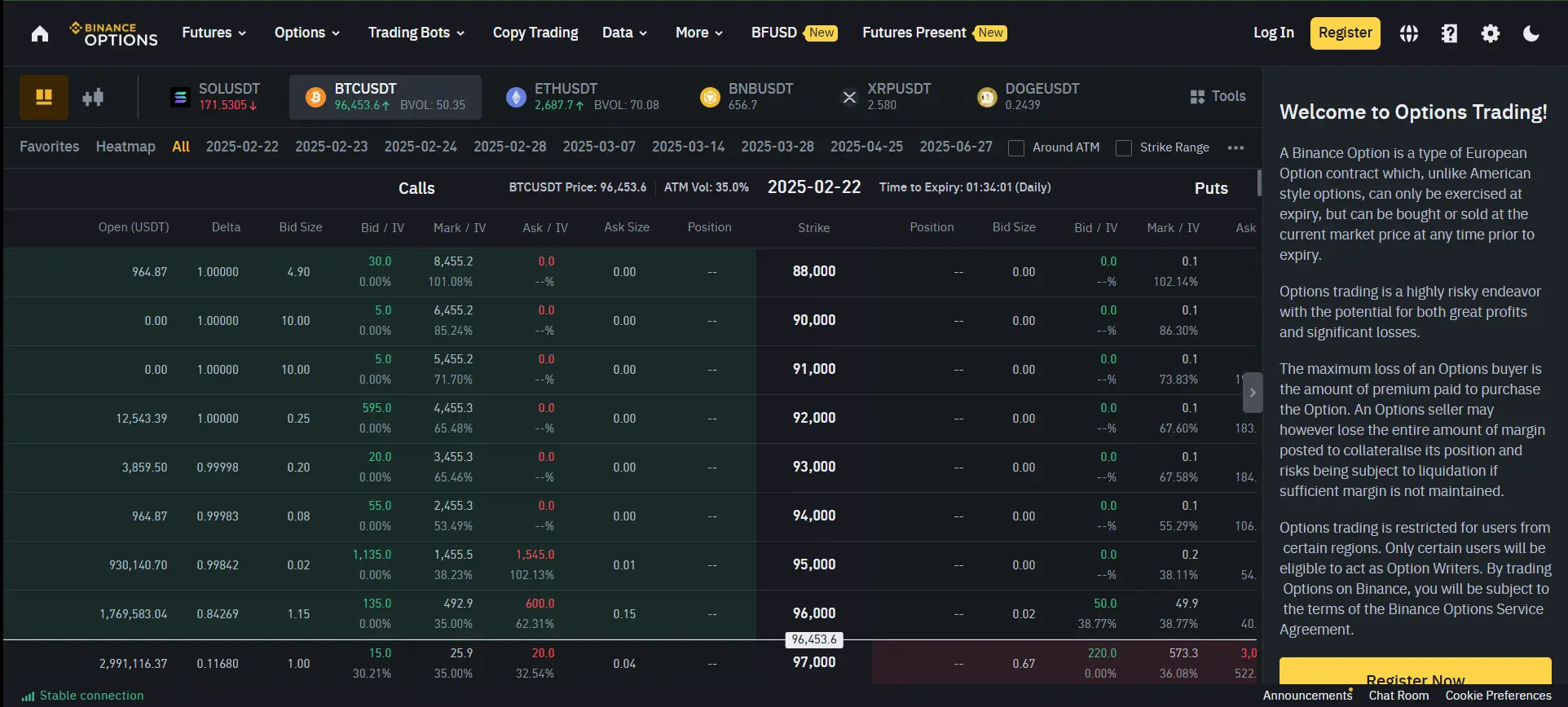

On the Binance platform, you’ll find several types of options designed to cater to diverse trading needs. These types primarily include European-style options. European options can only be exercised at expiration, providing traders with defined opportunities and risks.

European Options:

These are the standard offering on Binance and require you to wait until the expiration date to exercise it. Such options are commonly used due to their simplicity and straightforward nature.

Supported Assets:

Binance supports options contracts for popular cryptocurrencies like BTC, ETH, BNB, XRP, DOGE, and SOL. This broad range allows you to trade options based on a wide array of digital assets.

Collateral:

The options trading on Binance uses stablecoins like Tether (USDT) as collateral. Using stablecoins helps ensure stability in value, simplifying cost and profit calculations.

Trading Fees:

Trading fees are competitive, set at 0.03% for both the maker and taker. These fees apply to the trades you execute on the platform.

This setup aims to provide you with a robust environment for engaging in options trading on one of the leading cryptocurrency exchanges. With these well-defined options types, you get the opportunity to leverage the growing world of crypto assets.

Binance Order Types

Binance offers a range of order types to cater to different trading strategies and needs. Understanding these options can enhance your trading experience and allow you to execute your trades with precision.

1. Market Order: This is an order to buy or sell a cryptocurrency at the best available price. It’s executed immediately and is useful when speed is more critical than price.

2. Limit Order: Here, you set a specific price at which you want to buy or sell. The trade is executed only when the market reaches your set price.

3. Stop-Limit Order: A stop-limit order combines a stop order and a limit order. Once the stop price is reached, a limit order is automatically triggered to buy or sell at the specified limit price.

4. Stop-Market Order: Similar to a stop-limit order, except it executes as a market order once the stop price is reached.

5. Trailing Stop Order: This order allows you to set a trailing amount at a predefined distance below or above the market price. It helps lock in profits while giving your trades room to grow.

Binance supports advanced trading with OCO (One-Cancels-the-Other) orders. This option allows you to place two orders simultaneously. If one is executed, the other is automatically canceled, giving you flexibility and risk management.

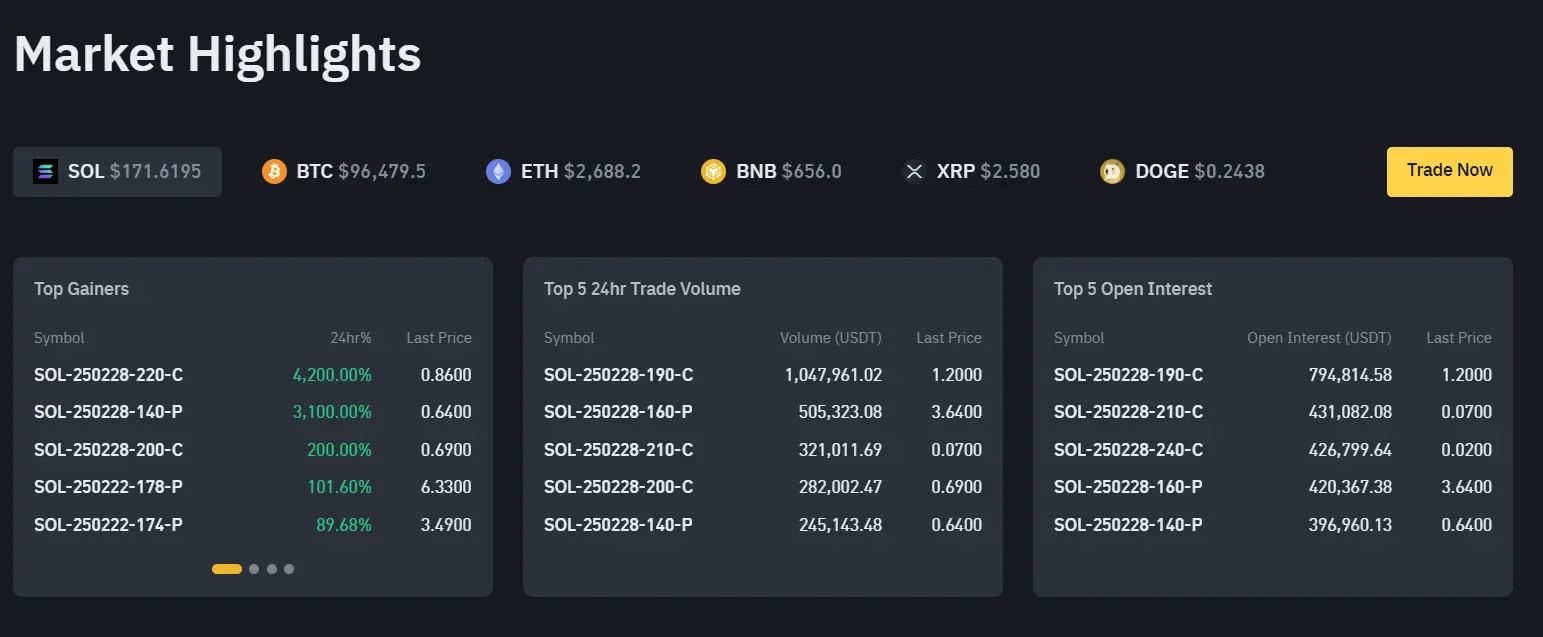

Binance Options Data: Volume & Prices

When analyzing Binance Options, two key metrics stand out: trading volume and price data. These provide insight into market activity and potential trends.

Trading Volume: This reflects the total number of options contracts traded within a specific time frame. Monitoring the 24hr Volume can help you gauge market liquidity and investor interest. Higher trading volumes often indicate higher market participation and activity.

| Date | Call Volume | Put Volume |

|---|---|---|

| 01-01-2025 | 5000 | 3500 |

Prices of options contracts are influenced by various factors, including underlying asset price, market volatility, and time until expiration. On Binance, you’ll find detailed data that captures these fluctuations, providing an in-depth view of market dynamics.

Real-Time Data: Access to real-time prices and volume data can assist you in decision-making by offering a snapshot of current market conditions. This includes Open Interest, which denotes the total number of outstanding options contracts.

You might also consider the Put Call Ratio, which helps measure market sentiment. A higher ratio indicates a bearish outlook, while a lower ratio suggests bullish sentiment.

By staying informed about these metrics, you can make more informed trading decisions. Binance offers tools and charts that reflect changes in volume and pricing, enabling you to navigate the options market effectively.

Binance Liquidation Mechanism

Binance’s liquidation mechanism is designed to protect both you and the platform during leveraged trading. When you engage in such trading, your position is subject to risk management by Binance. If your losses reach a set threshold, a liquidation is triggered to prevent further financial harm.

Your margin call notifications will alert you through email or app notifications if your margin ratio falls below specific levels. This proactive measure helps you take action to avoid liquidation. The calculation of the liquidation price is pivotal in initiating the liquidation process.

The liquidation price depends on various factors including your leverage and margin mode. Higher leverage brings the liquidation price closer to the entry price, increasing the risk, so it’s important to adjust your strategy accordingly.

Binance uses a liquidation engine which consolidates and sells collateral assets. This is done efficiently to ensure all liabilities and obligations are covered. The mechanism’s goal is to minimize disruption in your account while securing the platform’s stability.

The presence of adequate liquidity in assets is crucial. In cases where asset liquidity is low, the system transfers assets and liabilities to a designated liquidation account for processing. Each action optimally aims to cover losses without excessive penalties.

Understanding these components is critical for anyone using margin or futures on Binance. Use these insights to manage your positions effectively and mitigate risks associated with liquidations.

Binance Options Trading Fees

When trading options on Binance, you will encounter two primary types of fees: transaction fees and exercise fees.

Transaction Fees:

These are incurred when opening or closing an options position. The transaction fee is based on the underlying asset’s Spot Index price at the time of order completion. Typically, the transaction is set as a percentage of the option’s value, with a cap at 10%.

Exercise Fees:

Exercise fees apply when an option is exercised. The fee calculation is based on the settlement price, capped at 10% of the option’s value. An exercise fee rate often used is around 0.015%.

Here is a simplified comparison of fees:

| Fee Type | Rate/Calculation Method |

|---|---|

| Transaction Fee | Maximum of 10% of option value |

| Exercise Fee | 0.015% of settlement value |

Binance’s competitive fee structure allows you to manage costs effectively. Different asset classes and trading tiers might affect rates slightly. Familiarize yourself with the specific fees associated with each option to optimize your strategies.

Binance Options Funding Rates/Fees

When trading options on Binance, you encounter two primary fees: transaction fees and exercise fees.

Transaction Fees

These fees apply when you open or close an options position. The transaction fee rate is typically 0.3% of the contract’s value. This fee is essential to consider when planning your trades, as it affects your overall cost.

Exercise Fees

If you decide to execute your option, an exercise fee is charged. This rate is often set at 0.015% of the option’s value. It’s calculated after a transaction completes based on the settlement price, ensuring fairness in fee application.

Example Calculation

In a scenario where you trade an option valued at 2,000 USDT, the transaction fee you encounter would be 6 USDT (0.3% of 2,000). If you exercise this option, the exercise fee would be 0.3 USDT (0.015% of 2,000).

Fee Caps

Both transaction and exercise fees are capped. The exercise fee is capped at 10% of the option’s value, preventing excessive costs as market conditions change.

Understanding these fees helps you navigate Binance’s options market efficiently, allowing you to strategize and manage expenses effectively.

Binance Account Types & KYC Tiers & Limits

When you open a Binance account, you choose between different account types tailored to your needs.

For those engaging in basic trading, a standard account suffices. It provides access to various markets and trading pairs.

Binance offers identity verification through KYC (Know Your Customer) tiers. These tiers determine your access and privileges on the platform.

- Verified: This is the first level. You submit your full legal name, date of birth, address, and a government ID. A selfie holding your ID is often required.

- Verified Plus: This tier demands additional documentation and verification. It may include proof of address and you gain higher withdrawal limits compared to the previous level.

- Advanced: The top tier offers the highest withdrawal limits and trading privileges. Comprehensive documentation and extensive verification are necessary.

Withdrawal limits vary based on your verification level. Basic verification allows limited withdrawals, while higher tiers offer significant daily allowances, like up to 100 BTC daily for top-tier users.

Explore each tier’s benefits to maximize your trading experience on Binance.

Binance Trading Platform & Tools

Binance offers a comprehensive trading platform designed for both novice and experienced traders. With a variety of options available, you can engage in spot trading, which involves purchasing and selling cryptocurrencies directly.

For those looking to expand their trading strategies, Binance provides margin trading. This feature allows you to borrow digital assets to capitalize on price movements.

You also have access to advanced trading tools. These include charting tools that enable technical analysis without needing external platforms.

Whether you prefer a straightforward interface or require more sophisticated tools, Binance’s platform accommodates both via its basic and advanced interfaces.

One notable aspect of Binance’s platform is its extensive list of supported cryptocurrencies, ensuring you have multiple options for diversifying your portfolio.

For seamless trading operations, Binance integrates various order types, such as limit and market orders, providing more flexibility in executing trades.

Binance Insurance Fund

When trading on Binance’s options exchange, you benefit from a robust insurance fund designed to protect users.

The fund is essential in managing risks associated with liquidations. When a trader’s position liquidation occurs, the insurance fund absorbs the position if market conditions prevent it from being executed at a price better than the bankruptcy price.

Key Features

- Composed of multiple assets for flexibility, including BTC, ETH, and BNB for USDT-margined contracts.

- Maximum leverage offered can reach up to 75x for certain contracts.

This fund also serves to safeguard users against unexpected losses, ensuring greater reliability in the trading environment. Liquidation fees collected by Binance contribute to maintaining the insurance fund balance, thus providing an additional layer of security.

As part of its risk management strategy, Binance’s insurance fund plays a critical role. This aspect is vital for both new and seasoned traders seeking assurance of secure trading.

Binance Deposit Methods

When it comes to depositing funds into your Binance account, there are multiple methods available that cater to different needs. You have the flexibility to choose according to your preferences and comfort. Below, you’ll find the most commonly used methods for making deposits on Binance.

1. Crypto Deposits

You can deposit various cryptocurrencies directly. Simply transfer your crypto from other wallets to your Binance wallet using the provided deposit address. This method is usually free of charge and quick, subject to network confirmation times.

2. Bank Transfers

To deposit funds using your bank account, you can utilize the bank transfer option. This involves transferring fiat currencies like USD or EUR directly into your Binance account. The process is secure and can take a few business days depending on your bank and country.

3. Credit/Debit Card Payments

Depositing through credit or debit cards is another option. You can use your Visa or Mastercard to buy cryptocurrencies directly. This method is convenient but often comes with additional processing fees, so keep an eye out for any associated costs.

4. Binance P2P

The Binance P2P platform allows you to trade directly with other users. You can deposit funds by purchasing crypto from other users using local payment options available in your region.

Each deposit method has its own set of benefits and considerations. Your choice would largely depend on your convenience, the currencies you are dealing with, and any applicable fees.

Binance Security Features

When using Binance, you benefit from multiple security measures designed to protect your assets and data. Two-factor authentication (2FA) is one of the key features, providing an additional layer of security by requiring a second verification step through Google Authenticator or SMS.

To enhance security further, Binance employs Advanced Encryption Technology for data protection. This ensures that your personal information and transaction data remain safe from unauthorized access.

Another important feature is the Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund to protect users’ funds in case of security breaches. This fund provides an extra level of reassurance for your assets.

The platform also monitors transactions for suspicious activity and employs anti-phishing codes to ensure that you are interacting with legitimate communications from Binance. Setting up these codes helps you recognize official Binance emails, reducing the risk of fraudulent activity.

Additionally, withdrawal address management lets you whitelist trusted wallet addresses. This means that even if an unauthorized party gains access to your account, they cannot withdraw funds to untrusted addresses without your approval.

These robust features make Binance a secure choice, providing you with peace of mind while engaging in crypto activities. Always ensure to stay updated with any new security measures Binance rolls out to maximize your account protection.

Binance Customer Support

Binance offers various options for customer support to ensure a seamless experience.

You can reach out for help via 24/7 live chat. This feature allows you to get quick answers to your queries.

An alternative is email support, where you can address more detailed issues. If you prefer to tackle problems independently, the help section boasts a rich collection of resources that might assist you.

The FAQ section is another handy tool. It’s comprehensive and addresses common questions users encounter.

For those needing more personal interaction, having no phone support might feel limiting. Yet the multiple channels available typically resolve most issues efficiently. Make sure to explore these resources when faced with challenges trading on Binance.

Is Binance A Legal & Safe Platform?

Binance is one of the largest cryptocurrency exchanges globally, supporting a comprehensive range of digital assets. It’s important to understand its legality and safety aspects.

Legal Compliance

Binance operates in numerous countries and must adhere to the legal and regulatory frameworks of various jurisdictions. It constantly updates its practices to align with international regulations, providing a legitimate platform for trading. Licensing and regulatory information can typically be found on its website, reflecting its commitment to compliance.

Security Measures

For security, Binance implements multiple protective mechanisms. Encryption safeguards transactions, ensuring your data and assets remain secure. Additionally, the majority of funds are stored in offline cold wallets, minimizing the risk of online attacks.

Two-factor authentication (2FA) gives an extra layer of protection for your account. Enabling it can significantly reduce the risk of unauthorized access.

User Trust

With a huge user base numbering over 250 million, Binance’s reputation is reinforced by community trust. Common practices like educational resources help users navigate securely within the platform. Low trading fees offer a financial incentive, which is an attractive feature for many traders.

To ensure your safety, remain informed about the platform’s updates and regional compliance changes. Always enable available security features for your account, and be cautious of phishing attempts to maintain your security.

Frequently Asked Questions

Binance Options offers a variety of trading opportunities for both beginners and experienced traders. Below are answers to common questions regarding options trading on Binance.

Can you trade options on Binance?

Yes, you can trade options on Binance. The platform provides a wide range of options contracts, including both calls and puts, allowing you to hedge positions or speculate on market movements.

What is the leverage of Binance options trading?

Binance Options provide leverage options, giving you the ability to trade with more capital than you initially invest. This can amplify both potential gains and losses, so it’s important to understand the risks involved.

What is the fee for Binance options trading?

Standard fees apply to trading options on Binance. These can include trading fees and exercise fees. It’s crucial to review the fee structure on Binance’s official site for the most up-to-date information.

Can you write options on Binance?

Binance does not currently allow users to write their own options contracts. Instead, you can trade the available options contracts offered on their platform.

How do I close the option position in Binance?

To close an option position on Binance, you can either sell the option in the market or hold it to expiration. Make sure to regularly monitor market conditions before making a decision.

What is the minimum amount required to trade options on Binance?

The minimum amount required to trade options on Binance varies depending on the specific contract. It is advisable to check the platform for details on the minimum capital needed for different options trades.

Conclusion

Binance remains a dominant force in the cryptocurrency exchange landscape. Its extensive options trading allows you to work with a variety of assets such as Bitcoin, Ethereum, Binance Coin, Ripple, and Dogecoin. This broad selection helps expand your investment opportunities.

The platform offers an Advanced View with technical analysis tools like Fibonacci lines and moving averages. This can enhance your trading experience and provide deeper market insights.

Binance’s reputation as the largest cryptocurrency exchange highlights its reliability and capacity to handle high trade volumes. As you explore its offerings, you can take advantage of features like crypto loans, interest-earning accounts, and payment solutions through the Binance card.

Access to over 300 digital assets further solidifies Binance as a versatile platform, catering to diverse trading needs. Whether you’re a beginner or a seasoned trader, the platform provides a comprehensive suite of services.

Overall, Binance offers a robust environment for options trading, backed by powerful features and tools. It caters to both novice and experienced traders, making it a top choice in the cryptocurrency market.

Want more options? Check out these crypto exchanges: