When choosing a cryptocurrency exchange, the decision between Binance and BYDFi can feel overwhelming. Both platforms offer unique features that might suit your trading style and goals. Many traders are comparing these exchanges in 2025 to find their best match.

BYDFi scores higher overall with a 9.0 rating compared to Binance US, making it a strong competitor in the cryptocurrency exchange market. While Binance is widely known for its low fees, BYDFi uses a different approach with a tiered fee structure based on user activity.

The two exchanges differ in their approach to trading. Binance offers high liquidity as a centralized exchange, while BYDFi may have lower liquidity but provides different benefits. Your choice depends on what you value most – whether that’s lower fees, specific trading features, or user experience.

Binance Vs BYDFi: At A Glance Comparison

When choosing between Binance and BYDFi, it helps to see how they stack up against each other. Based on recent 2025 comparisons, BYDFi has an overall higher score of 9.0 compared to Binance US.

Both exchanges offer cryptocurrency trading, but they differ in several key areas:

| Feature | Binance | BYDFi |

|---|---|---|

| Overall Score | Lower than BYDFi | 9.0 |

| Trading Fees | Competitive | Competitive |

| Cryptocurrency Options | Wide range | Growing selection |

| User Interface | Complex but powerful | More beginner-friendly |

| Security Features | Strong | Strong |

Binance is known for its extensive selection of cryptocurrencies and trading options. You’ll find more advanced trading tools and deeper liquidity on this platform.

BYDFi offers a more straightforward approach that might work better if you’re newer to crypto trading. The platform scores higher in overall ratings according to multiple comparison sites.

When considering returns on investment, Binance stands out as one of the top choices. The exchange provides various ways to earn from your crypto holdings.

Your choice between these exchanges should depend on your specific needs. If you want more trading options and don’t mind complexity, Binance might be better. If you prefer a higher-rated platform with a simpler approach, BYDFi could be the right fit.

Binance Vs BYDFi: Trading Markets, Products & Leverage Offered

When choosing between Binance and BYDFi, understanding their trading offerings helps you make the right choice for your needs.

Binance offers a wider range of cryptocurrencies with over 350 coins available. You can access spot trading, futures, options, and margin trading on the platform.

BYDFi has fewer cryptocurrencies but excels in leverage trading options. According to search results, BYDFi is considered “a great option for leverage trading” in the cryptocurrency market.

Both exchanges offer futures contracts, but their leverage limits differ:

| Feature | Binance | BYDFi |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Yes | Yes |

| Max Leverage | Up to 125x | Various options |

| Coins Available | 350+ | Fewer than Binance |

BYDFi provides leverage options for different cryptocurrencies, making it suitable if you want to amplify your trading potential. This might explain why BYDFi scored higher (9.0) in overall comparison scores than Binance in some reviews.

Binance gives you access to more advanced trading products like liquid swap, staking, and lending services. You’ll find more trading pairs and higher liquidity on Binance.

For beginners, BYDFi’s interface might be more straightforward, while experienced traders often prefer Binance’s comprehensive toolkit and deeper markets.

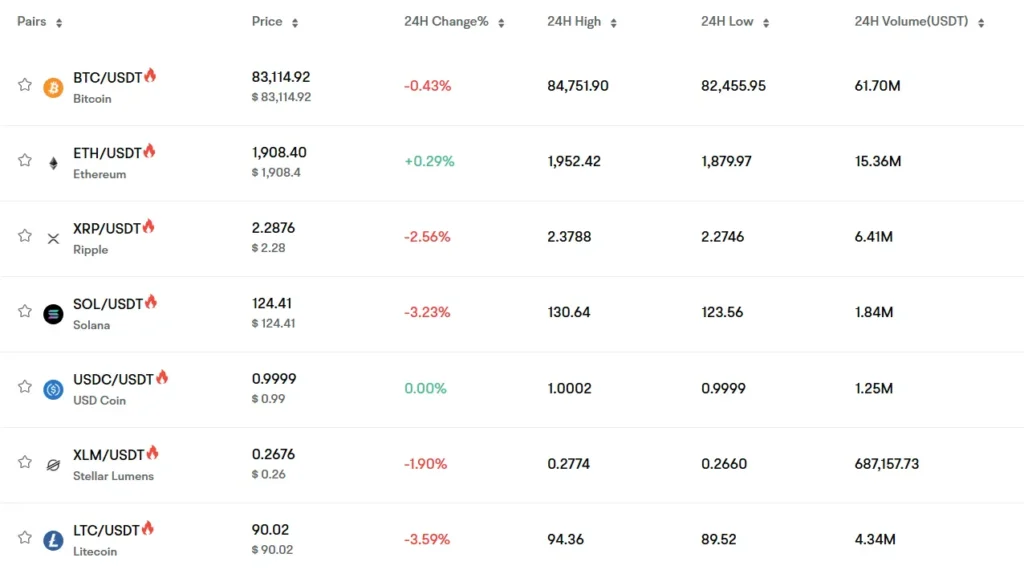

Binance Vs BYDFi: Supported Cryptocurrencies

When choosing between Binance and BYDFi, the range of supported cryptocurrencies is a key factor to consider. Binance clearly leads in this category with a much larger selection of digital assets available for trading.

Binance supports thousands of cryptocurrencies and trading pairs. This extensive selection makes it an attractive option if you want access to both mainstream coins and newer, emerging tokens.

BYDFi offers a more limited but still substantial range of cryptocurrencies. While the exact number isn’t specified in the search results, BYDFi provides enough variety for most traders’ needs.

Comparison at a Glance:

| Feature | Binance | BYDFi |

|---|---|---|

| Number of cryptocurrencies | Thousands | Hundreds |

| Mainstream coins | ✓ | ✓ |

| Niche/emerging tokens | Extensive selection | More limited |

Both platforms support popular cryptocurrencies like Bitcoin, Ethereum, and other major altcoins. However, if you’re looking for more obscure or newly launched tokens, Binance is more likely to have them listed.

The difference in supported cryptocurrencies reflects each platform’s market position. Binance’s larger user base (224 million compared to BYDFi’s 500,000) allows it to support a wider range of trading pairs with sufficient liquidity.

Your choice between these platforms may depend on whether you need access to specific cryptocurrencies that might only be available on one exchange.

Binance Vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and BYDFi, fees play a major role in your decision. Let’s compare their fee structures to help you make an informed choice.

Trading Fees:

- Binance US: Up to 0.6% (lowest in comparison)

- BYDFi: 1%-0.3% for spot trading, 0.02%-0.06% for futures trading

Binance generally offers more competitive trading fees compared to BYDFi, which can make a significant difference if you trade frequently or in large volumes.

Withdrawal Fees:

Both exchanges have variable withdrawal fees depending on the cryptocurrency and network you’re using. These fees can change based on network congestion and other factors.

Deposit Methods:

The platforms differ in their supported deposit methods. This might affect your choice depending on how you prefer to fund your account.

When comparing the overall fee structure, Binance typically comes out ahead with lower trading fees. However, BYDFi might offer advantages in specific trading scenarios, particularly for futures trading.

You should consider your trading style and frequency when evaluating these differences. High-volume traders might benefit more from Binance’s lower spot trading fees, while derivatives traders might find BYDFi’s futures fees more appealing.

Remember that fee structures can change, so it’s worth checking the latest information on both platforms before making your final decision.

Binance Vs BYDFi: Order Types

When trading cryptocurrency, the types of orders available can make a big difference in your trading strategy. Both Binance and BYDFi offer various order types, but they differ in what they provide.

Binance offers basic order types including market orders and limit orders for spot trading. These let you buy or sell at current market prices or set your own price points.

BYDFi appears to have an edge when it comes to advanced order types. Based on the search results, BYDFi provides more sophisticated options like stop-loss orders and trailing stop orders, which Binance may lack in some trading sections.

Binance Order Types:

- Market orders

- Limit orders

- Some advanced orders (varies by trading type)

BYDFi Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Trailing stop orders

- Customizable trading strategies

Advanced traders might appreciate BYDFi’s greater flexibility with order types. These features can help you manage risk better and create more nuanced trading strategies.

You should consider which order types matter most for your trading style. If you’re a beginner, basic orders might be enough. More experienced traders may want the additional control that advanced order types provide.

Binance Vs BYDFi: KYC Requirements & KYC Limits

When choosing between Binance and BYDFi, understanding their KYC (Know Your Customer) requirements can help you make a better decision.

BYDFi stands out by not requiring KYC verification for most functions. You can use many features without providing personal information. BYDFi sets daily withdrawal limits for non-verified accounts, which might be enough for casual traders.

Binance offers a tiered verification system. At Level 1, you need basic information like your email. Without full KYC, you can still trade but with limited withdrawal amounts.

For users concerned about privacy, both exchanges offer options. BYDFi is generally more privacy-friendly with fewer verification requirements for basic trading.

Here’s a simple comparison:

| Feature | Binance | BYDFi |

|---|---|---|

| Basic Trading | Minimal KYC | No KYC |

| Withdrawal Limits | Lower without full KYC | Daily limits for non-verified accounts |

| Privacy Level | Moderate | Higher |

| Full Features | Requires complete KYC | Most features available without KYC |

If you value privacy and minimal personal information sharing, BYDFi might be your better choice. If you need higher withdrawal limits and don’t mind verification, Binance’s complete KYC process will give you access to all features.

Remember that regulations change frequently, so verification requirements may update over time.

Binance Vs BYDFi: Deposits & Withdrawal Options

When choosing between Binance and BYDFi, understanding their deposit and withdrawal options is crucial for smooth transactions.

Binance offers fast and secure transfers for deposits and withdrawals. You can quickly move funds to and from your trading account with their advanced platform that supports various payment methods.

BYDFi provides secure transaction options as well. Their platform allows for easy deposits and withdrawals, with some users finding their processes more straightforward than Binance’s.

Both exchanges support standard cryptocurrency deposits and withdrawals. You can transfer popular coins like Bitcoin and Ethereum on either platform.

For fiat currency options, Binance typically offers more payment methods including bank transfers, credit/debit cards, and third-party payment processors in many regions.

BYDFi has been developing its fiat options but may have fewer choices depending on your location. However, some users report that BYDFi’s third-party payment integration works well for those looking for alternatives.

Withdrawal fees differ between the platforms:

- Binance tends to have competitive withdrawal fees that vary by cryptocurrency

- BYDFi’s fee structure may be more favorable for certain coins or transaction amounts

Processing times also vary between the exchanges. Cryptocurrency withdrawals typically process faster than fiat withdrawals on both platforms, with most crypto transactions completing within minutes to hours.

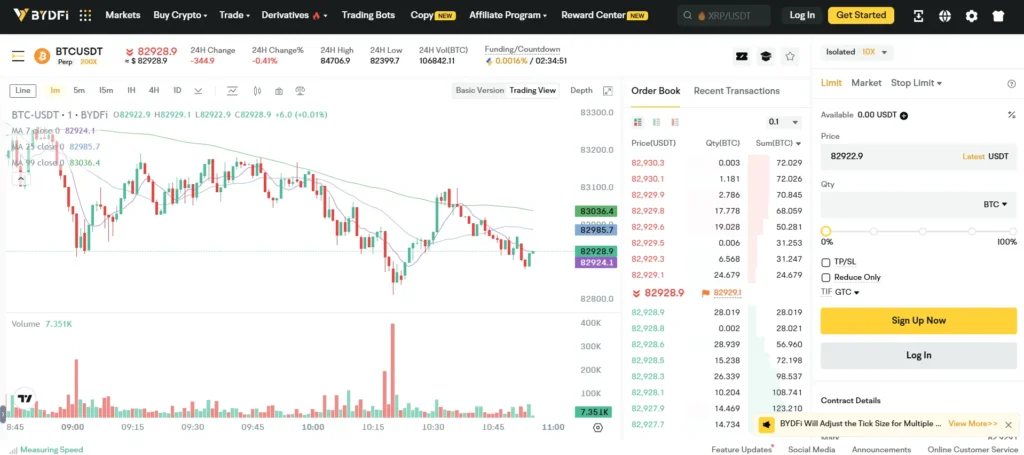

Binance Vs BYDFi: Trading & Platform Experience Comparison

When comparing Binance and BYDFi trading platforms, several key differences stand out. Both exchanges offer cryptocurrency trading, but with varying features and user experiences.

Binance provides a more comprehensive trading environment with advanced charting tools and technical analysis options. You’ll find a wider range of order types on Binance, including limit, market, stop-limit, and OCO (One-Cancels-the-Other) orders.

BYDFi scores higher in overall user experience with a 9.0 rating compared to Binance US. Its interface is often considered more intuitive for beginners while still offering enough tools for experienced traders.

Trading Features Comparison:

| Feature | Binance | BYDFi |

|---|---|---|

| Order Types | Multiple advanced options | Basic to intermediate options |

| Trading Pairs | Extensive selection | Smaller but focused selection |

| Charting Tools | Comprehensive | Adequate for most traders |

| Mobile Experience | Full-featured app | User-friendly mobile platform |

Binance excels in trading volume and liquidity, making it easier to execute larger trades without significant price slippage. This is particularly important if you trade high volumes or less common cryptocurrencies.

BYDFi offers a cleaner interface that many new traders find less intimidating. You won’t face as steep a learning curve when starting out on this platform.

Both platforms provide real-time market data and price alerts, though Binance typically offers more detailed market analysis tools and educational resources.

Binance Vs BYDFi: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanisms is crucial for your risk management strategy. Both Binance and BYDFi have systems in place to handle overleveraged positions, but they operate differently.

Binance uses an auto-deleverage queue system designed to prevent liquidation cascades during high market volatility. This mechanism helps maintain market stability by systematically reducing positions when necessary.

In contrast, BYDFi’s liquidation process follows a more standard approach. The platform monitors your position’s maintenance margin requirements and initiates liquidation when thresholds are crossed.

Key Differences:

| Feature | Binance | BYDFi |

|---|---|---|

| Liquidation Prevention | Auto-deleverage queue | Standard margin monitoring |

| Market Volatility Protection | Higher | Standard |

| Warning System | Multiple notifications | Basic alerts |

You’ll receive alerts from both platforms when your positions approach liquidation levels. This gives you time to add margin or reduce position size.

Binance’s system tends to be more sophisticated, potentially offering more protection during extreme market conditions. However, BYDFi’s straightforward approach may be easier for beginners to understand.

Your trading style should influence which platform you choose. If you frequently use high leverage in volatile markets, Binance’s auto-deleverage queue might provide better protection against sudden liquidations.

Binance Vs BYDFi: Insurance

When trading cryptocurrencies, protecting your assets from potential hacks or breaches is crucial. Both Binance and BYDFi have implemented security measures, but their insurance approaches differ.

Binance offers the Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. This fund holds 10% of all trading fees collected and can be used to compensate users in case of a security breach.

BYDFi’s insurance protection is less comprehensive compared to Binance. While BYDFi emphasizes security through advanced encryption and two-factor authentication, it doesn’t match Binance’s dedicated insurance fund.

Binance Insurance Features:

- SAFU emergency fund

- Regular security audits

- Cold storage for majority of assets

- Dedicated security team

BYDFi Insurance Features:

- Basic security protocols

- Two-factor authentication

- Encryption technology

- Limited compensation policies

You should note that Binance’s larger user base (approximately 224 million compared to BYDFi’s 500,000) allows it to maintain a more substantial insurance fund.

For maximum protection of your digital assets, you might want to consider the extent of insurance coverage when choosing between these exchanges. Binance clearly offers more robust insurance options.

Remember that even with insurance, you should always practice good security habits like using strong passwords and enabling all available security features.

Binance Vs BYDFi: Customer Support

When choosing a crypto exchange, customer support quality can make a big difference in your trading experience. Both Binance and BYDFi offer support options, but they differ in several ways.

Binance Support Options:

- Live chat

- Email ticket system

- Extensive FAQ section

- Community forums

Binance has a large support team due to its massive user base of around 224 million users. However, response times can be slower during high-volume periods or market volatility.

BYDFi Support Options:

- Live chat

- Email support

- Help center

- Social media assistance

BYDFi has received praise for its customer support quality. According to search results, users specifically mention BYDFi’s “excellent customer support” as a standout feature.

With a smaller user base of approximately 500,000 users, BYDFi can often provide more personalized attention. You might experience faster response times compared to larger exchanges like Binance.

Both platforms offer support in multiple languages, but Binance covers more languages due to its global reach. If English isn’t your primary language, check if your preferred language is supported.

For beginners, BYDFi’s more attentive support might be valuable as you learn to navigate crypto trading. Experienced traders might find Binance’s extensive knowledge base sufficient for most needs.

Response time can vary based on your issue complexity and current market conditions. Consider reaching out to both platforms with a test question if support quality is a deciding factor for you.

Binance Vs BYDFi: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and BYDFi offer strong security features to protect your assets.

Binance provides robust security through two-factor authentication (2FA), which adds an extra layer of protection to your account. They also use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

BYDFi implements advanced encryption algorithms and multi-layer security protocols to create a secure trading environment. Their security measures are designed to protect your assets while maintaining a user-friendly experience.

Key Security Features Comparison:

| Feature | Binance | BYDFi |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Advanced Encryption | ✓ | ✓ |

| Multi-layer Security | ✓ | ✓ |

Both platforms take security seriously and regularly update their systems to address new threats. You should enable all available security features regardless of which platform you choose.

Remember to practice good security habits on your end too. Use strong, unique passwords and keep your authentication apps updated for the best protection.

While both exchanges offer solid security features, you should consider your specific needs when making a choice between Binance and BYDFi.

Is Binance Safe & Legal To Use?

Binance employs a multi-system security architecture to protect user funds and information. This makes it a generally safe platform for cryptocurrency trading. The exchange uses two-factor authentication (2FA), advanced encryption, and cold storage for most cryptocurrencies.

Regarding legality, Binance operates differently across regions. In the United States, Binance US (a separate entity) complies with local regulations and has implemented measures to ensure user fund safety.

Security Features:

- Two-factor authentication (2FA)

- Advanced encryption protocols

- Cold storage for most assets

- Anti-phishing measures

- Regular security audits

The main Binance platform has faced regulatory challenges in certain countries. You should check your local laws before using Binance, as cryptocurrency regulations vary widely by location.

Binance has grown to become one of the world’s largest cryptocurrency exchanges. This growth suggests a level of trust from millions of users worldwide.

For extra protection, consider using additional security measures when trading on Binance. This includes strong passwords, hardware wallets for long-term storage, and staying alert to potential phishing attempts.

Remember that all cryptocurrency exchanges carry some risk. No platform can guarantee 100% safety against all threats. You should only invest what you can afford to lose.

Is BYDFi Safe & Legal To Use?

BYDFi operates as a legal cryptocurrency exchange based in Singapore. According to the search results, it complies with laws in regions like New York, having obtained necessary licenses and registrations to offer its services.

Security is a top priority for BYDFi. The platform implements advanced security features to protect user funds and personal information. This commitment to security helps establish BYDFi as a reliable platform for exchanging digital currencies.

When trading on BYDFi, you can expect:

- Regulatory Compliance: Legal operation in regulated markets

- Security Measures: Advanced protection for your assets

- Transparent Trading: Clear policies and practices

BYDFi received a high overall score of 9.0 in comparison evaluations, suggesting strong performance across multiple assessment criteria. This rating indicates that the platform meets important safety and reliability standards.

For users in New York and other highly regulated markets, BYDFi offers a compliant option for cryptocurrency trading. Before signing up, you should verify that BYDFi is licensed in your specific location.

The platform features a user-friendly interface that makes trading accessible while maintaining security standards. This balance of usability and protection helps make BYDFi a trusted option for both new and experienced traders.

Frequently Asked Questions

Here are the answers to common questions about Binance and BYDFi exchanges. These points cover fees, security, available cryptocurrencies, and other features that may help you decide which platform better suits your trading needs.

What are the key differences in fees between Binance and BYDFi?

Binance is known for its competitive fee structure, with spot trading fees starting as low as 0.1%. These fees can be reduced further if you use BNB (Binance’s native token) to pay for them.

BYDFi takes a different approach with a tiered fee structure based on your trading volume and account level. While BYDFi’s overall score is higher at 9.0 compared to Binance, specific fee rates vary depending on your activity.

For frequent traders, both platforms offer volume-based discounts. Your trading costs will ultimately depend on how much you trade and which features you use regularly.

How do the security measures on Binance compare to those of BYDFi?

Binance implements multiple security layers including two-factor authentication (2FA), address whitelisting, and advanced encryption for user data. They also maintain a Secure Asset Fund for Users (SAFU) to protect against potential breaches.

BYDFi also prioritizes security with similar protective measures like 2FA and cold storage for most customer funds. Their platform includes regular security audits and monitoring systems to detect unusual activities.

Both exchanges have security protocols in place, but Binance’s longer track record and larger user base has allowed them to develop more robust security infrastructure over time.

Which platform offers a wider range of cryptocurrencies, Binance or BYDFi?

Binance generally offers a more extensive selection of cryptocurrencies, with support for hundreds of different tokens and coins. This includes major cryptocurrencies and numerous smaller altcoins.

BYDFi provides a more focused selection but still covers most major cryptocurrencies that traders commonly seek. They regularly add new listings based on market demand and thorough vetting processes.

Your choice might depend on whether you need access to obscure altcoins or are satisfied trading the more established cryptocurrencies that both platforms offer.

What are the advantages of using BYDFi over other crypto exchanges?

BYDFi has earned a higher overall score (9.0) in comparison reviews, suggesting strong performance across multiple evaluation criteria. Their user interface is designed to be more approachable for newer traders.

They offer competitive trading fees and a straightforward registration process that many users find convenient. BYDFi also provides dedicated customer support that responds promptly to user inquiries.

For traders looking for alternatives to larger exchanges, BYDFi presents a balanced option with sufficient liquidity and trading pairs without overwhelming complexity.

How user-friendly are the trading interfaces on Binance and BYDFi for beginners?

Binance offers both basic and advanced trading interfaces. The basic view is suitable for beginners but can still be overwhelming due to the platform’s extensive features and options.

BYDFi’s interface is generally considered more intuitive for newcomers to cryptocurrency trading. The layout is cleaner with fewer distractions, making it easier to execute your first trades.

Both platforms offer mobile apps, but new users typically report a shorter learning curve with BYDFi’s trading interface compared to Binance’s feature-rich environment.

Can users earn interest on their holdings with Binance and BYDFi, and how do the rates compare?

Binance provides multiple options to earn passive income including staking, savings products, and liquidity pools. Interest rates vary by cryptocurrency but are generally competitive within the industry.

BYDFi also offers earning opportunities through their yield products, though their offerings may be more limited than Binance’s extensive ecosystem of earning options.

Interest rates on both platforms fluctuate based on market conditions, but Binance typically provides more diverse options for different risk appetites and investment timeframes.

BYDFi Vs Binance Conclusion: Why Not Use Both?

Both BYDFi and Binance offer strong features for crypto traders. BYDFi scores slightly higher overall with a 9.0 rating compared to Binance in some comparisons.

Binance has a slight edge in terms of available features and offerings. It’s known for its extensive coin selection and trading options that experienced traders value.

BYDFi may appeal to those looking for a platform with good user experience and competitive fees. The platform has been gaining recognition in the crypto exchange market.

Instead of choosing just one, consider using both exchanges to maximize your trading potential. Each platform has unique strengths that can complement your trading strategy.

Benefits of using both platforms:

- Access to a wider range of cryptocurrencies

- Different fee structures for various transaction types

- Risk diversification across platforms

- Ability to capitalize on different promotional offers

- Alternative options when one platform experiences downtime

Your trading volume, preferred coins, and feature needs should guide which platform you use for specific transactions. Many experienced traders maintain accounts on multiple exchanges.

Remember to consider security measures like two-factor authentication on both platforms. Creating separate strong passwords for each exchange adds an extra layer of protection.

By leveraging the strengths of both BYDFi and Binance, you can create a more flexible and robust trading strategy.

Compare Binance and BYDFi with other significant exchanges