Looking for the right cryptocurrency exchange can be tough. You want a platform that fits your trading style, has the features you need, and keeps your assets secure. Bitget and KuCoin are two popular options in 2025, each with distinct strengths.

Bitget excels in copy trading while KuCoin stands out for its derivatives trading and advanced features. Bitget offers margin trading with up to 3x leverage, making it accessible for newer traders wanting to amplify their positions. KuCoin provides 3-5x leverage depending on the asset and caters to more experienced traders with its comprehensive suite of tools.

These exchanges differ in their core focus and target audience. If you’re considering which platform to use for your crypto trading, understanding these differences is crucial. Both have earned their place among top exchanges, but your specific needs will determine which one is the better fit for your trading journey.

Bitget Vs KuCoin: At A Glance Comparison

Bitget and KuCoin are popular cryptocurrency exchanges with unique features that appeal to different traders. Here’s how they stack up against each other in key areas.

Trading Options

| Feature | Bitget | KuCoin |

|---|---|---|

| Leverage Trading | Up to 125x | 3-5x depending on asset |

| Spot Trading | Yes | Yes |

| Futures | Yes | Yes |

| Margin Trading | Up to 3x | 3-5x |

- Bonuses & Rewards: Bitget offers new users up to $8,000 in bonuses, significantly higher than KuCoin’s $700 welcome bonus. These incentives can be appealing if you’re just getting started.

- User Experience: Both platforms provide comprehensive trading tools, but they cater to different experience levels. KuCoin has a more complex interface that might require some learning.

- Security Features: Both exchanges implement standard security measures like two-factor authentication and cold storage for funds. Your assets’ safety is a priority for both platforms.

- Unique Offerings: Bitget stands out with its copy trading feature, allowing you to automatically mimic successful traders’ moves. KuCoin offers a wider variety of altcoins and smaller cap tokens not found on many exchanges.

- Mobile Access: You can trade on the go with both exchanges through their mobile apps, which include most of the functionality of their desktop versions.

Bitget Vs KuCoin: Trading Markets, Products & Leverage Offered

KuCoin and Bitget both offer a variety of trading options for crypto enthusiasts. Each platform has unique strengths when it comes to markets and leverage capabilities.

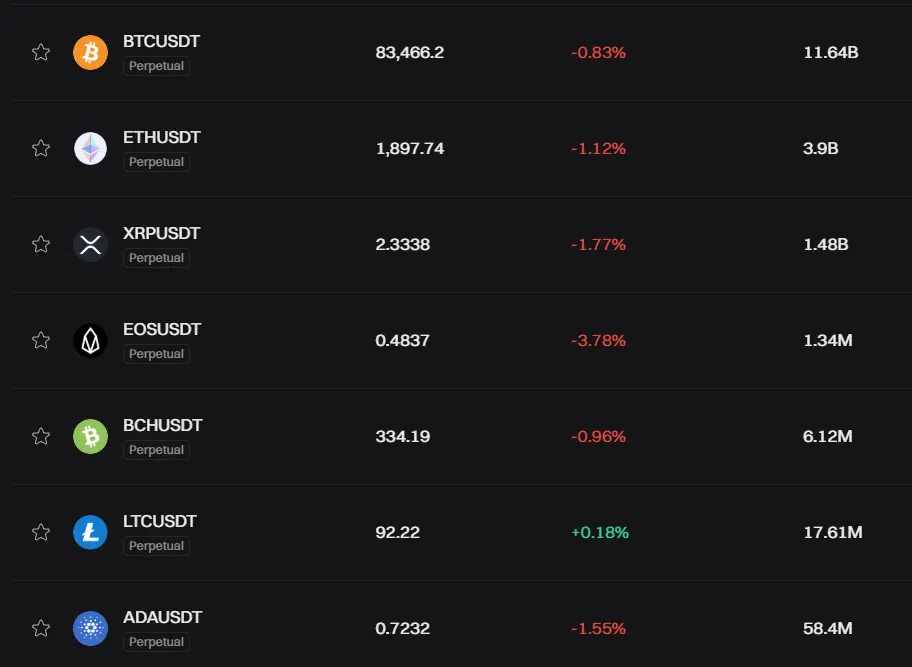

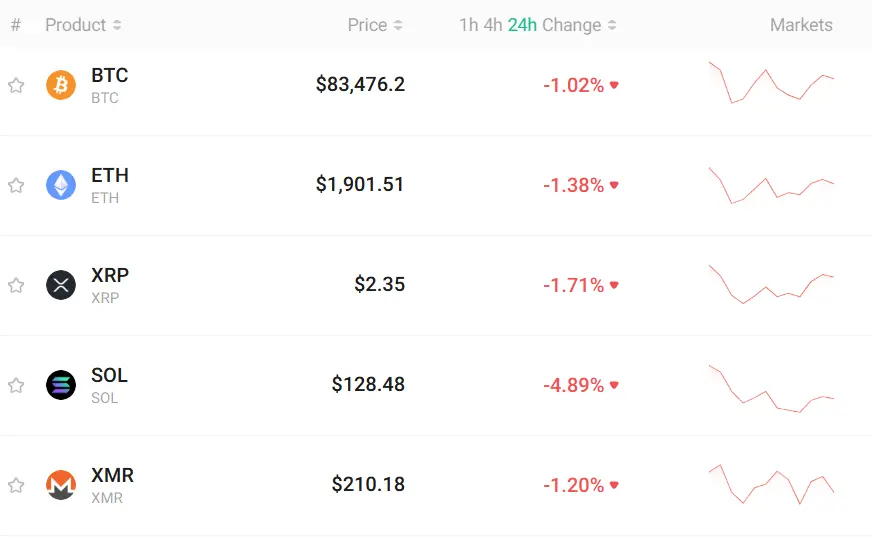

Trading Markets

- KuCoin: Offers a wider range of cryptocurrencies

- Bitget: Focused on popular tokens but with fewer overall options

KuCoin stands out with its NFT trading feature, which Bitget currently lacks. This gives KuCoin users more diverse investment opportunities beyond standard cryptocurrencies.

Leverage Trading

| Exchange | Maximum Leverage |

|---|---|

| KuCoin | 3-5x (varies by asset) |

| Bitget | Up to 3x |

When you trade on KuCoin, you’ll find more flexibility in leverage options depending on which asset you’re trading. Bitget offers a more standardized approach with up to 3x leverage across its supported assets.

Both exchanges provide margin trading for users seeking to amplify their potential returns. However, remember that leverage also increases your risk exposure.

KuCoin offers more crypto earning options compared to Bitget. You’ll find staking, lending, and other passive income opportunities that can help diversify your crypto strategy beyond just trading.

Also Read: Are Crypto Options Legal in Canada, Australia & India?

For features overall, KuCoin generally provides a more comprehensive package. But Bitget’s streamlined approach might appeal to you if you prefer a more focused trading experience with just the essential tools.

Bitget Vs KuCoin: Supported Cryptocurrencies

When choosing between Bitget and KuCoin, the variety of available cryptocurrencies is often a deciding factor for traders and investors.

Bitget offers an impressive selection of approximately 750 cryptocurrencies for trading. This wide range gives you access to both established coins and emerging tokens.

KuCoin isn’t far behind with support for over 700 cryptocurrencies. The platform features more than 1,200 trading pairs, providing you with numerous options for diversifying your crypto portfolio.

Cryptocurrency Comparison:

| Feature | Bitget | KuCoin |

|---|---|---|

| Number of Cryptocurrencies | ~750 | 700+ |

| Trading Pairs | Not specified | 1,200+ |

Both exchanges give you access to major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. You’ll find a comprehensive selection regardless of which platform you choose.

The slight edge in cryptocurrency variety goes to Bitget with its larger coin selection. However, KuCoin’s extensive trading pair options might better serve you if you’re looking for specific trading combinations.

Your trading needs should guide your choice here. If you’re searching for obscure or newer tokens, check both platforms specifically for those coins before deciding.

Remember that available cryptocurrencies can change as exchanges add or remove support for different tokens over time.

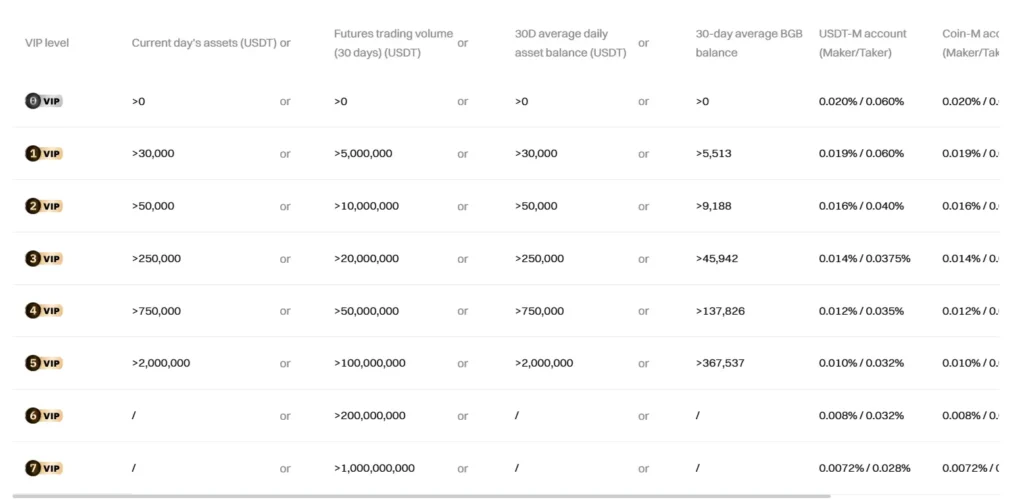

Bitget Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitget and KuCoin, understanding their fee structures is crucial for your trading strategy. Both exchanges charge two main types of fees: trading fees and deposit/withdrawal fees.

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | Discount with Native Token |

|---|---|---|---|

| Bitget | 0.02% | 0.06% | Available |

| KuCoin | 0.02% | 0.06% | Available |

The trading fees between these platforms are identical, even with native token payment discounts. This makes them equally competitive in this aspect.

For spot trading, both platforms start at around 0.1% for makers and takers. However, Bitget’s fees can be lower than many competitors in the market, with maker fees of 0.02% and taker fees of 0.06%.

Deposit and Withdrawal Fees:

Deposit and withdrawal fees are also comparable between the two exchanges. These fees vary depending on the cryptocurrency you’re using and network conditions.

KuCoin stands out for futures trading with its competitive fee structure. This makes it an excellent choice if you’re interested in derivatives trading.

Both platforms offer ways to reduce your fees. Using their native tokens (Bitget’s BGB or KuCoin’s KCS) can help you qualify for trading fee discounts.

Your trading volume will also affect your fee tier on both platforms. Higher trading volumes typically result in lower fees, rewarding active traders.

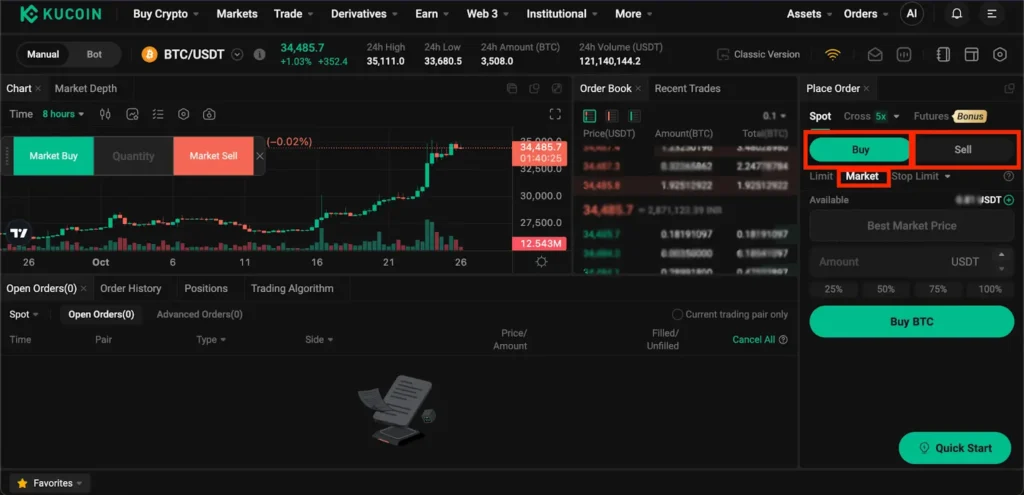

Bitget Vs KuCoin: Order Types

Both Bitget and KuCoin offer a variety of order types to meet different trading needs. Understanding these options can help you choose the platform that best suits your trading strategy.

Bitget Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels Other)

- TWAP (Time-Weighted Average Price)

Bitget’s interface makes these order types accessible even for newer traders. The platform’s design emphasizes simplicity while still providing advanced options.

KuCoin Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

- Post-only orders

- Iceberg orders

KuCoin offers slightly more specialized order types, which can be beneficial if you engage in more complex trading strategies. Their iceberg orders allow you to place large orders without revealing the full size to the market.

Both exchanges support conditional orders that execute based on price triggers. This feature is particularly useful for managing risk in volatile market conditions.

For futures trading, both platforms offer additional order types like trailing stops. KuCoin’s advanced order routing system tends to provide better execution for large orders.

If you’re new to trading, Bitget’s simpler approach might be more appealing. For experienced traders, KuCoin’s wider range of order types provides more flexibility to implement sophisticated strategies.

Bitget Vs KuCoin: KYC Requirements & KYC Limits

Both Bitget and KuCoin implement Know Your Customer (KYC) procedures to comply with regulations, but they differ in their requirements and limitations.

Bitget KYC Requirements:

- KYC is mandatory for certain features

- All traders must complete KYC to participate in specific trading activities

- User verification enables greater platform functionality

KuCoin KYC Requirements:

- KYC is tiered based on user needs

- Non-verified accounts have access to basic trading

- Full verification unlocks all platform features

Withdrawal Limits:

| Exchange | No KYC | Basic KYC | Full KYC |

|---|---|---|---|

| Bitget | Limited | Increased | Highest |

| KuCoin | 20,000 USDT daily | Higher limits | Highest limits |

KuCoin offers more flexibility for users who prefer to remain unverified, allowing withdrawals up to 20,000 USDT daily without KYC.

Bitget’s approach is more restrictive, requiring KYC verification for eligibility in several of its trading products and features.

Both platforms increase your withdrawal limits as you progress through their verification levels. Additional documents like proof of identity and address are typically required for higher verification tiers.

Your choice between these exchanges might depend on how much importance you place on privacy versus accessing advanced features.

Bitget Vs KuCoin: Deposits & Withdrawal Options

When deciding between Bitget and KuCoin, deposit and withdrawal options are key factors to consider. These features directly impact how easily you can move your money in and out of the exchanges.

KuCoin offers more payment options than Bitget. You can deposit funds to KuCoin using bank transfers and credit/debit cards, while these options aren’t available on Bitget.

For those who prefer traditional banking methods, KuCoin has a clear advantage. The platform supports electronic payment methods that Bitget doesn’t offer.

KuCoin vs Bitget Deposit Methods:

| Method | Bitget | KuCoin |

|---|---|---|

| Bank Transfer | No | Yes |

| Credit/Debit Card | No | Yes |

| Electronic Payments | No | Yes |

| Crypto Deposits | Yes | Yes |

Both exchanges allow crypto deposits without fees. This is good news if you already hold cryptocurrency and want to transfer it to either platform.

For withdrawals, the process works similarly. KuCoin provides more options to cash out your funds, making it more flexible for different user needs.

If you need variety in how you fund your account or withdraw your earnings, KuCoin provides more flexibility. This might be especially important if you’re new to crypto and still rely on traditional banking methods.

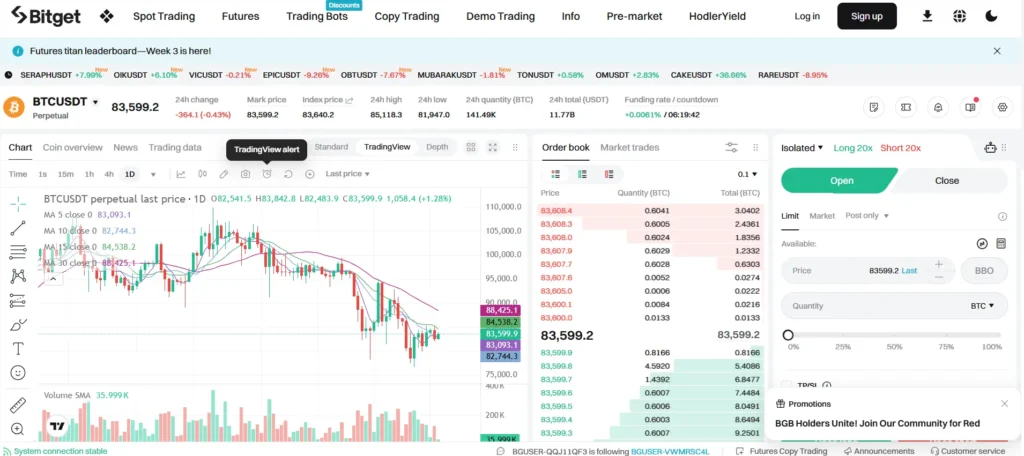

Bitget Vs KuCoin: Trading & Platform Experience Comparison

Both Bitget and KuCoin offer robust trading platforms, but they differ in several key aspects.

KuCoin ranks 7th among major cryptocurrency exchanges, while Bitget sits at 11th based on CMC scores. This ranking reflects their market presence and overall reliability.

User Interface

- KuCoin: Clean design with comprehensive tools, though potentially overwhelming for beginners

- Bitget: More streamlined interface that balances functionality with ease of use

The trading experience on both platforms includes spot trading, futures, and margin options. KuCoin offers a wider variety of advanced trading types, which might appeal to experienced traders.

Mobile Experience

Both exchanges provide mobile apps that mirror their desktop functionality. Bitget’s app tends to receive slightly better reviews for speed and reliability.

Trading Features Comparison:

| Feature | Bitget | KuCoin |

|---|---|---|

| Trading Pairs | 700+ | 1,100+ |

| Leverage Options | Up to 125x | Up to 100x |

| Demo/Practice Mode | Yes | Yes |

| Trading Bots | Limited | Extensive |

KuCoin stands out with its Trading Bot marketplace, offering more automated trading options. Bitget counters with a more intuitive copy trading system that lets you follow successful traders.

Both platforms provide real-time market data and analysis tools. KuCoin offers more detailed charting tools, while Bitget focuses on delivering a smoother, less cluttered trading experience.

Execution speed is comparable on both platforms, with minimal slippage during normal market conditions.

Bitget Vs KuCoin: Liquidation Mechanism

Liquidation occurs when your margin balance can’t support your open positions in leveraged trading. Both Bitget and KuCoin have mechanisms to handle this, but they work differently.

Bitget uses a tiered liquidation system that starts with warnings at around 80% margin ratio. When your margin ratio drops to about 10%, full liquidation happens. Bitget employs a partial liquidation approach when possible to help you maintain some of your position.

KuCoin, on the other hand, typically initiates liquidation when your margin ratio falls below 100%. They use an insurance fund to manage the liquidation process and prevent negative balances.

Key differences in liquidation approaches:

| Feature | Bitget | KuCoin |

|---|---|---|

| Warning threshold | ~80% margin ratio | ~100% margin ratio |

| Full liquidation | ~10% margin ratio | Varies by market |

| Partial liquidation | Yes | Limited |

| Insurance fund | Yes | Yes |

| Liquidation fees | 0.1-0.3% | 0.1-0.5% |

Bitget offers more flexible position adjustment tools to help you avoid liquidation. Their system allows for partial liquidations that can save portions of your position.

KuCoin tends to be stricter with liquidation thresholds but provides detailed notifications before action is taken. Their interface clearly shows your current margin ratio.

Both platforms offer liquidation insurance funds, but their coverage amounts differ by market. You should regularly monitor your positions on either platform to avoid unexpected liquidations.

Bitget Vs KuCoin: Insurance

When comparing cryptocurrency exchanges, insurance protection is a critical factor for your investment safety. Both Bitget and KuCoin offer insurance funds to protect users against potential losses.

Bitget maintains a Protection Fund that reached $300 million in 2023. This fund serves as a safety net for users in case of security breaches or unexpected platform issues.

KuCoin also offers an insurance fund, which they call their Safeguard Fund. This fund was established to protect users against significant market volatility and potential liquidations.

The key difference is in their coverage levels. Bitget’s insurance protection tends to be more robust with a higher dedicated fund amount compared to KuCoin’s offering.

Both exchanges update their insurance fund sizes periodically. These funds are maintained separately from operational funds to ensure they remain available in emergency situations.

Insurance Comparison Table:

| Feature | Bitget | KuCoin |

|---|---|---|

| Insurance Fund Name | Protection Fund | Safeguard Fund |

| Fund Size (2023) | $300 million | Not publicly disclosed |

| Coverage Focus | Security breaches, platform issues | Market volatility, liquidation protection |

| Regular Updates | Yes | Yes |

| Transparency | High (publicly announces fund size) | Moderate |

Neither exchange guarantees complete protection against all types of losses. It’s important for you to understand that while these insurance funds provide a layer of security, they don’t eliminate all risks associated with cryptocurrency trading.

Bitget Vs KuCoin: Customer Support

When choosing between Bitget and KuCoin, customer support quality can make a big difference in your trading experience. Both exchanges offer multiple support channels to help you resolve issues.

Bitget provides 24/7 customer support through live chat, email, and a comprehensive help center. Their response times are generally quick, with most chat queries answered within minutes.

KuCoin also offers around-the-clock support via live chat, email, and ticket systems. They’ve expanded their support team in 2025, which has improved their previously criticized response times.

Support Channels Comparison:

| Feature | Bitget | KuCoin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Ticket System | ✓ | ✓ |

| Help Center | Extensive | Comprehensive |

| Community Forums | Limited | Active |

| Response Time | Fast (minutes) | Moderate (hours) |

KuCoin stands out with its active community forums where you can find answers from other users. This peer support often resolves common questions faster than waiting for official responses.

Bitget offers more language options for support, making it more accessible if English isn’t your first language. They currently support 12 languages compared to KuCoin’s 8.

Also Read: What happens when crypto options expire?

Both platforms have improved their self-help resources in 2025, with detailed guides and video tutorials to walk you through common processes and troubleshooting steps.

Bitget Vs KuCoin: Security Features

When comparing crypto exchanges, security should be your top priority. Both Bitget and KuCoin offer strong security measures, but there are some key differences to consider.

Bitget has maintained a stronger security track record with fewer security incidents. The platform implements two-factor authentication (2FA), cold storage for most assets, and regular security audits.

KuCoin experienced a major security breach in 2020 but handled it well by reimbursing affected users. The exchange has since strengthened its security protocols with multi-layered encryption and advanced risk control systems.

Key Security Features Comparison:

| Feature | Bitget | KuCoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | ✓ | ✓ |

| Security Breach History | Minor incidents | Major breach in 2020 |

| IP Verification | ✓ | ✓ |

| Anti-phishing Code | ✓ | ✓ |

Both exchanges offer withdrawal protection measures to prevent unauthorized access. You’ll find email confirmations and withdrawal limits on both platforms.

KuCoin provides a trading password feature that adds an extra layer of security for transactions. This is separate from your login password.

For additional protection, Bitget offers a fund protection mechanism that safeguards user assets. This gives you peace of mind when trading on their platform.

Neither exchange has perfect security, but both prioritize protecting your assets. You should enable all available security features regardless of which platform you choose.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered a safe and legal cryptocurrency exchange to use. It has built a reputation as one of the most respected and secure platforms in the crypto space.

The exchange employs various security measures to protect your funds and personal information. These include two-factor authentication (2FA), though according to search results, KuCoin may have a slightly higher level of security overall.

Bitget offers protection funds of up to 12 million USDT as insurance for users. This provides an additional safety net should any issues arise with the platform.

From a legal standpoint, Bitget operates in compliance with regulations in most countries where cryptocurrency trading is permitted. However, you should always check your local laws regarding cryptocurrency trading.

The platform has been operating for several years, building credibility in the market. Its longevity suggests a certain level of trustworthiness and reliability.

When trading on Bitget, you’ll benefit from competitive fees. The maker fees are around 0.02% and taker fees are about 0.06%, which are lower than many competitors.

While no exchange is completely risk-free, Bitget has established itself as a reputable option. Always use strong passwords, enable all security features, and follow best practices when trading cryptocurrencies.

Is KuCoin A Safe & Legal To Use?

KuCoin is considered a reputable cryptocurrency exchange with millions of users worldwide. Security is a top priority for them, especially after experiencing a large-scale hack in 2020.

Since that incident, KuCoin has significantly improved its security measures. The platform now offers multiple safety features including Google 2FA verification, email verification, and other protective measures to keep your assets secure.

When comparing security levels between exchanges, KuCoin appears to have stronger protection mechanisms than some competitors like Bitget.

However, no exchange is completely risk-free. Some users have reported issues with KuCoin’s deposit policies, including minimum deposit requirements that could potentially result in lost funds if not followed correctly.

Key Security Features:

- Google 2FA authentication

- Email verification

- Trading password

- Regular security audits

Regarding legality, KuCoin operates in a gray area in some countries. You should check your local regulations before using the platform, as cryptocurrency regulations vary significantly by region.

While KuCoin works to comply with global standards, they don’t hold licenses in every jurisdiction. This means you should exercise caution and understand the legal implications in your country before trading.

Remember to follow best security practices regardless of which exchange you use. This includes using strong passwords, enabling all security features, and storing larger amounts in cold wallets when not actively trading.

Frequently Asked Questions

Traders often need specific information when comparing Bitget and KuCoin exchanges. These common questions address key differences in features, fees, security, and accessibility between the two platforms.

What are the comparative advantages of using Bitget over KuCoin for trading?

Bitget offers copy trading functionality that KuCoin doesn’t have natively. This feature allows you to automatically mirror the trades of successful traders.

Bitget provides up to 125x leverage on certain trading pairs, which can be attractive if you’re looking for higher-risk, higher-reward opportunities.

KuCoin offers more comprehensive trading tools and a wider ecosystem of services, including its own token launchpad and trading bot marketplace.

How do the trading fees compare between Bitget and KuCoin?

Both exchanges offer competitive fee structures that decrease as your trading volume increases.

KuCoin typically charges 0.1% maker and taker fees for spot trading, which can be reduced by holding KCS tokens or maintaining higher trading volumes.

Bitget’s fee structure is similar, with base fees around 0.1% for spot trading, but offers additional discounts through their platform token and VIP tiers.

What are the differences in security measures between Bitget and KuCoin?

Both exchanges employ industry-standard security protocols including two-factor authentication, cold storage for most assets, and regular security audits.

KuCoin experienced a major hack in 2020 but fully reimbursed affected users, subsequently strengthening their security infrastructure.

Bitget emphasizes their insurance fund to protect user assets and implements strict risk management systems, particularly for their leveraged trading products.

Which platform offers a broader selection of cryptocurrencies, Bitget or KuCoin?

KuCoin generally offers a wider selection with over 700 cryptocurrencies and 1,200+ trading pairs, earning its nickname as the “People’s Exchange” for listing many smaller altcoins.

Bitget has a more focused selection of around 300+ cryptocurrencies but ensures high liquidity for the assets it does list.

Your choice depends on whether you prioritize access to niche altcoins (KuCoin) or prefer trading more established tokens with higher liquidity (Bitget).

Can users from all countries access both Bitget and KuCoin, or are there geographic restrictions?

Both exchanges face restrictions in certain jurisdictions, particularly the United States due to regulatory requirements.

KuCoin doesn’t officially serve US customers but has a global presence in most other countries with limited KYC requirements for basic accounts.

Bitget has expanded its regulatory compliance in recent years and operates in over 100 countries, but you should check their current terms of service for your specific location.

Which exchange provides better customer support, Bitget or KuCoin?

KuCoin offers 24/7 support through multiple channels including live chat, ticket systems, and email, but response times can vary during peak periods.

Bitget has invested significantly in customer service, with multilingual support teams and claims of faster response times than industry averages.

User reviews suggest that both platforms have room for improvement in customer support, with response quality sometimes inconsistent during high-volume periods.

Bitget Vs KuCoin Conclusion: Why Not Use Both?

After comparing these popular crypto exchanges, it’s clear that both Bitget and KuCoin offer strong features for crypto traders in 2025.

Bitget stands out with its copy trading feature, allowing you to automatically mirror successful traders’ moves. This can be especially helpful if you’re new to trading or want to learn from experts.

KuCoin, while lacking native copy trading, offers automatic trading options and a wide range of coins. Its trading fees are also competitive with Bitget.

Key similarities between the platforms:

- Low trading fees

- Various methods to earn crypto interest

- Wide selection of cryptocurrencies

You don’t necessarily need to choose between them. Many crypto traders maintain accounts on multiple exchanges to take advantage of different features.

Using both platforms gives you access to Bitget’s copy trading and KuCoin’s unique offerings. This strategy also helps spread your risk across different platforms.

The right choice depends on your specific needs. If copy trading is important to you, Bitget has the edge. If you want certain coins only available on KuCoin, that platform might be better.

Remember to consider security, user experience, and available trading pairs when making your decision. Both exchanges have proven themselves reliable options in the crypto space.

Compare Bitget and KuCoin with other significant exchanges