Choosing the right cryptocurrency exchange can be a challenge. Today, we’re looking at BitMart and Aibit to help you decide which platform might be better for your trading needs.

BitMart currently holds a higher overall score of 7.6 compared to many competitors, making it a notable choice for cryptocurrency traders in 2025. BitMart offers various features that appeal to both beginners and experienced traders, though it comes with its own set of pros and cons.

When comparing exchanges like BitMart with alternatives, you should focus on factors such as fees, available cryptocurrencies, security features, and user experience. These elements will help you determine whether BitMart or Aibit is the right fit for your investment strategy.

Bitmart Vs Aibit: At A Glance Comparison

BitMart and Aibit are two cryptocurrency exchanges that offer various services to traders. Let’s compare their key features side by side.

Trading Fees:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| BitMart | 0.25% | 0.25% | Varies by coin |

| Aibit | 0.1% | 0.1% | Varies by coin |

Available Cryptocurrencies: BitMart supports over 1,000 trading pairs, while Aibit offers a more limited selection of around 200 trading pairs.

Security Features: Both exchanges implement two-factor authentication (2FA) and cold storage for funds. BitMart has faced security challenges in the past, while Aibit emphasizes its enhanced security protocols.

User Interface: BitMart provides a more comprehensive but potentially overwhelming interface. Aibit offers a cleaner, more beginner-friendly design that you might find easier to navigate.

Payment Methods: BitMart allows credit/debit cards, bank transfers, and crypto deposits. Aibit primarily focuses on crypto deposits with limited fiat options.

Mobile App Availability: Both exchanges offer mobile apps for iOS and Android, letting you trade on the go.

Customer Support: BitMart provides email and ticket-based support. Aibit offers live chat support in addition to email assistance.

KYC Requirements: You’ll need to complete identity verification on both platforms for higher withdrawal limits and full access to features.

Remember that cryptocurrency exchanges change their offerings frequently, so you should verify the latest information before making your choice.

Bitmart Vs Aibit: Trading Markets, Products & Leverage Offered

BitMart offers traders access to over 1,000 cryptocurrencies, including many niche altcoins that aren’t available on other exchanges. You can trade through both basic and advanced interfaces depending on your experience level.

For trading products, BitMart provides spot trading and margin trading services. Their platform is designed to be fast and professional, giving you a smooth trading experience.

Aibit, in comparison, has a smaller selection of cryptocurrencies but focuses on quality rather than quantity. Their trading options are more streamlined, which can be helpful if you’re new to crypto trading.

Leverage Comparison:

| Exchange | Maximum Leverage | Markets Available |

|---|---|---|

| BitMart | Up to 5x | Spot, Margin |

| Aibit | Up to 20x | Spot, Futures, Margin |

When it comes to trading interfaces, BitMart gives you both simple and advanced options. This flexibility lets you choose based on your comfort level with crypto trading.

Aibit’s platform is more focused on futures trading, where you can use higher leverage. This makes it potentially more attractive if you’re looking to amplify your trading positions.

Also Read: Does Crypto Have Options Trading?

Both exchanges offer mobile apps so you can trade on the go. You’ll find that BitMart’s app includes access to their full range of 1,000+ cryptocurrencies, while Aibit’s app focuses on a smoother experience with fewer assets.

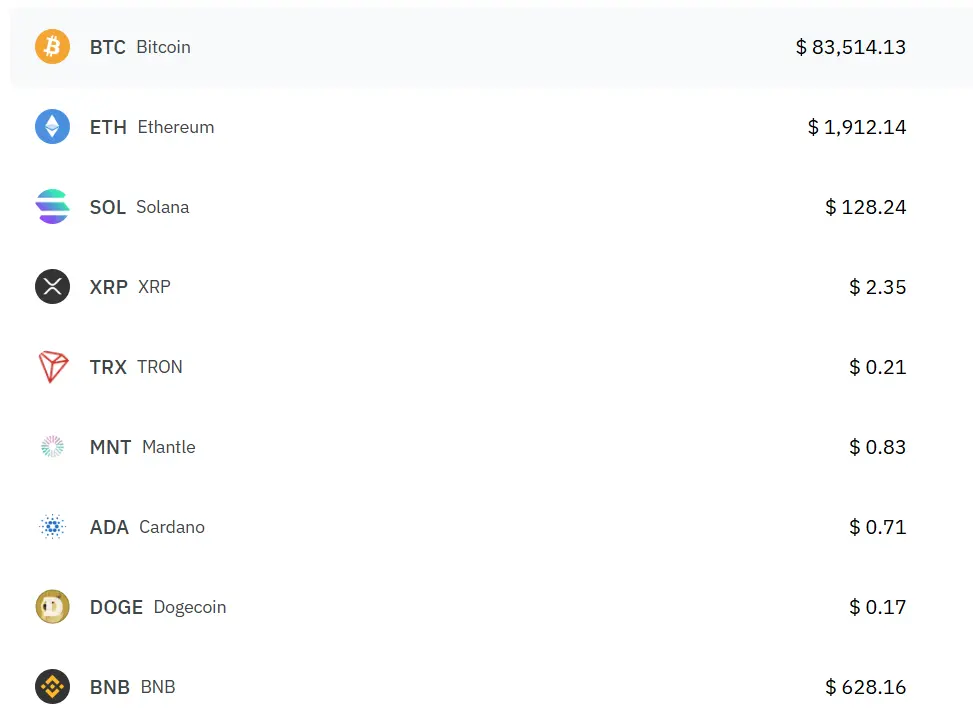

Bitmart Vs Aibit: Supported Cryptocurrencies

When choosing between Bitmart and Aibit, the range of supported cryptocurrencies is an important factor to consider.

Bitmart offers a wide selection of cryptocurrencies. According to current information, Bitmart supports over 1,000 different tokens and coins. This includes major cryptocurrencies like Bitcoin and Ethereum, as well as numerous altcoins and newer tokens.

Aibit generally has a more limited selection compared to Bitmart. While Aibit supports the major cryptocurrencies, its total offering is smaller.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Major Coins | Altcoins | Total Supported |

|---|---|---|---|

| Bitmart | All major | Extensive | 1,000+ |

| Aibit | All major | Limited | 150-200 (est.) |

Bitmart’s larger selection gives you more options if you’re interested in trading newer or less common tokens. This can be particularly valuable if you’re looking to diversify your portfolio with emerging cryptocurrencies.

However, quantity isn’t everything. Aibit may offer better liquidity for the coins it does support. This means you might find it easier to buy and sell at reasonable prices.

You should check both platforms for specific coins you’re interested in trading. Remember that supported cryptocurrencies can change as exchanges add new listings or remove underperforming tokens.

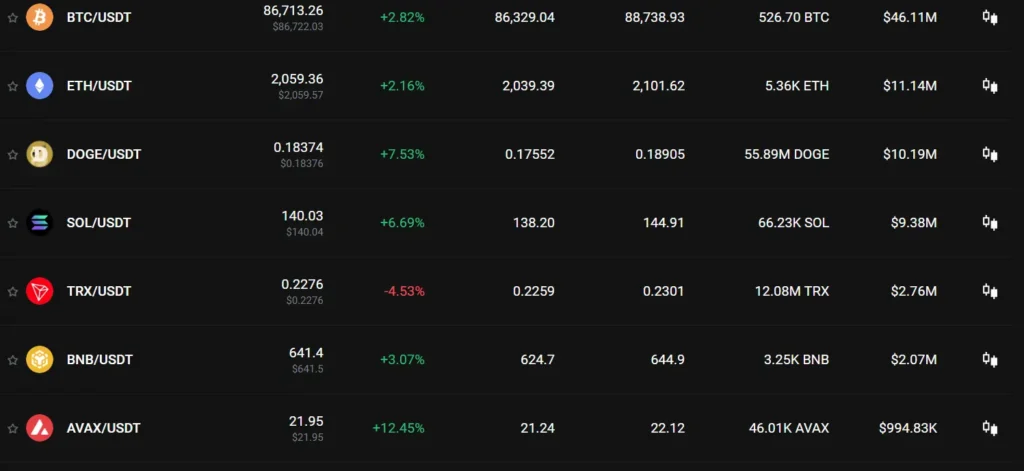

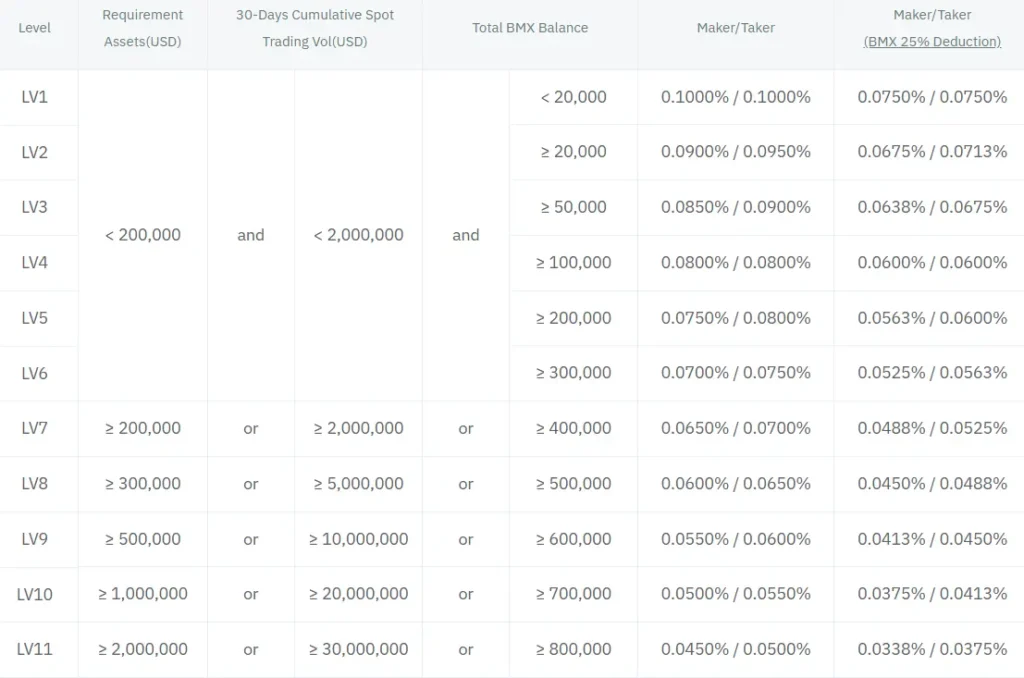

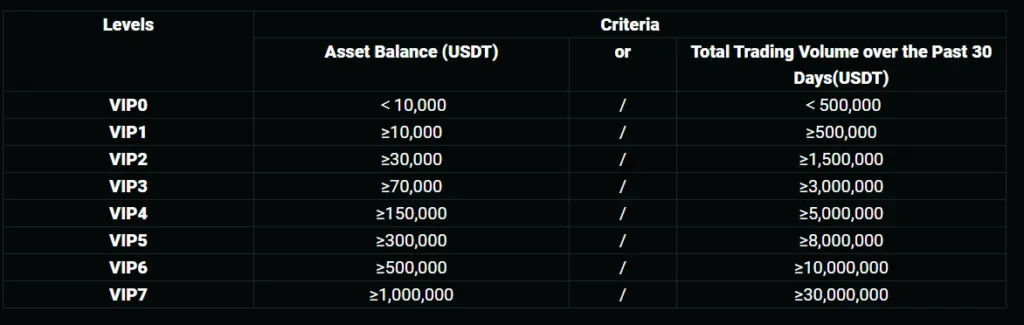

Bitmart Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing BitMart and Aibit, fees play a crucial role in your decision-making process. BitMart offers a competitive fee structure with a flat 0.1% trading fee for both makers and takers in spot trading.

For withdrawal fees, BitMart regularly adjusts these based on blockchain conditions. This means the cost to withdraw your crypto can change depending on network congestion and other factors.

Aibit’s fee structure differs slightly from BitMart. While specific information on Aibit’s fees isn’t provided in the search results, it’s important for you to check their current rates before making a decision.

BitMart Fee Overview:

- Trading Fee: 0.1% flat fee for makers and takers

- Withdrawal Fee: Variable (adjusted based on blockchain conditions)

- Deposit Fee: Free (in most cases)

Looking at the broader comparison, BitMart appears to have competitive fees with up to 0.6% in certain scenarios. This places it among the more affordable options in the crypto exchange market.

When choosing between these platforms, consider how frequently you’ll trade and withdraw funds. Small fee differences can add up significantly if you’re an active trader.

Remember to check both platforms’ official websites for the most current fee information, as exchanges often update their fee structures.

Bitmart Vs Aibit: Order Types

When trading cryptocurrencies, the types of orders available can significantly impact your trading strategy. Both BitMart and Aibit offer various order types to help you execute trades effectively.

BitMart provides several common order types that traders rely on. These include:

- Limit orders: Set a specific price at which you want to buy or sell

- Market orders: Execute trades immediately at the current market price

- Stop-loss orders: Automatically sell when prices drop to a certain level

- Take-profit orders: Automatically sell when prices reach your target

BitMart also offers both market and limit versions of stop-loss and take-profit orders, giving you more flexibility in how your trades execute.

Aibit, while less documented in the search results, typically offers standard order types found on most cryptocurrency exchanges. These usually include basic market and limit orders.

The difference between these platforms often comes down to the execution speed and additional features surrounding these order types. BitMart’s interface provides real-time price tracking and detailed order books to help you make informed decisions.

When choosing between BitMart and Aibit, consider which order types are essential for your trading strategy. More complex strategies might benefit from BitMart’s wider range of order options.

Remember that understanding how to properly set up these different order types is crucial for managing risk in your trading activities.

Bitmart Vs Aibit: KYC Requirements & KYC Limits

BitMart requires KYC verification to access its full range of features. There are two verification levels available to users: Level 1 and Advanced.

With Level 1 KYC on BitMart, you can unlock most platform features and enjoy a daily withdrawal limit of 0.5 BTC. This level needs only basic personal information.

For users who skip KYC verification on BitMart, your account functionality will be limited with lower withdrawal amounts.

Aibit’s KYC policy differs from BitMart’s approach. While BitMart has a clear multi-level verification system, Aibit tends to be more flexible with verification requirements.

BitMart KYC Levels:

- Unverified: Limited features, restricted withdrawals

- Level 1: Access to most features, 0.5 BTC daily withdrawal

- Advanced: Higher limits, complete platform access

Aibit KYC Features:

- More privacy-focused approach

- Less stringent verification for basic trading

- May require verification for higher withdrawal amounts

Your choice between these platforms might depend on how important privacy is to you. BitMart offers higher limits but requires more personal information, while Aibit generally provides more privacy but may have other limitations.

Remember that KYC requirements can change based on your location and current regulations in your country.

Bitmart Vs Aibit: Deposits & Withdrawal Options

When choosing between Bitmart and Aibit, understanding their deposit and withdrawal options is crucial for your trading experience.

Bitmart offers various deposit methods, though these are somewhat limited compared to other exchanges. You can primarily deposit cryptocurrencies directly to your Bitmart wallet.

For withdrawals on Bitmart, you’ll need to complete their verification process. Some users have reported issues with withdrawals being blocked or delayed, so this is something to keep in mind.

Aibit (note that the search results don’t provide specific information about Aibit) typically offers standard cryptocurrency deposit options similar to other exchanges.

Based on comparing Bitmart with other exchanges like Bybit, we can see that Bitmart lacks some flexibility in payment options. While Bybit allows fiat currency deposits, Bitmart has more limited deposit and withdrawal methods.

| Feature | Bitmart | Aibit |

|---|---|---|

| Crypto deposits | Yes | Yes |

| Fiat deposits | Limited | Not specified in search results |

| Withdrawal options | Cryptocurrency | Not specified in search results |

| Withdrawal issues | Some users report blocks | Not specified in search results |

You should consider withdrawal fees and processing times for both platforms before making your decision. These can vary based on the cryptocurrency and network congestion.

Remember to complete all verification requirements on either platform to ensure smooth withdrawals of your funds.

Bitmart Vs Aibit: Trading & Platform Experience Comparison

When comparing BitMart and Aibit’s trading platforms, several key differences stand out that might impact your trading experience.

User Interface

- BitMart offers a clean, intuitive interface suitable for beginners and advanced traders

- Aibit’s platform focuses on simplicity with modern design elements

Trading Tools

- BitMart provides comprehensive charting tools, technical indicators, and real-time market data

- Aibit offers basic trading functions with fewer advanced features

Available Markets

| Feature | BitMart | Aibit |

|---|---|---|

| Crypto pairs | 1000+ | 300+ |

| Spot trading | Yes | Yes |

| Futures | Yes | Limited |

| Margin trading | Yes | No |

BitMart scores higher in platform versatility based on available search information. The exchange supports more trading pairs and offers a wider range of trading options.

Mobile trading is available on both platforms through dedicated apps. BitMart’s app maintains most desktop functionality while Aibit’s mobile version offers a more streamlined experience.

Trading fees differ between the platforms. BitMart implements a maker-taker fee structure with volume-based discounts. Aibit typically charges flat fees that may be higher for certain transactions.

Platform speed and reliability are crucial for active traders. BitMart has established a more proven track record in handling high-volume trading periods, while Aibit is still building its reputation for stability.

Bitmart Vs Aibit: Liquidation Mechanism

When trading on cryptocurrency exchanges with leverage, understanding the liquidation mechanism is crucial. BitMart uses a partially forced liquidation system that works to reduce maintenance margin requirements when your positions are at risk.

This system helps traders avoid complete liquidation by automatically adjusting positions when your account balance approaches the maintenance margin threshold.

BitMart’s liquidation process triggers when your margin balance falls below the maintenance margin. Your margin balance is calculated as the sum of your wallet balance plus any unrealized profit or loss.

For futures trading, BitMart implements an auto-deleveraging (ADL) mechanism to prevent forced liquidations due to market manipulation or liquidity issues.

Aibit, on the other hand, uses a different approach to liquidation. Their system focuses on giving you more control over position management before liquidation occurs.

Key Differences:

| Feature | BitMart | Aibit |

|---|---|---|

| Liquidation Type | Partially forced | User-controlled |

| Warning System | Yes | Yes, with more advance notice |

| Auto-adjustment | Yes | Limited |

| Liquidation Prevention | ADL mechanism | Multiple margin tiers |

The liquidation threshold percentages vary between the platforms, with BitMart typically allowing your positions to reach closer to the margin limit before taking action.

You should consider these differences when choosing between the exchanges, especially if you plan to use leverage frequently in your trading strategy.

Bitmart Vs Aibit: Insurance

When you’re choosing a crypto exchange, insurance protection is a crucial factor to consider. This coverage can help protect your assets if the exchange faces hacks or security breaches.

Binance, which is often compared to BitMart, offers an insurance fund called SAFU (Secure Asset Fund for Users). This fund helps protect user assets in case of security incidents.

BitMart experienced a significant security breach in December 2021. After this incident, the exchange strengthened its security measures. However, based on available information, BitMart does not appear to offer a dedicated insurance fund like some competitors.

Aibit’s insurance offerings are less documented in public sources. You should check their current terms of service for the most up-to-date information about any protection they might offer.

When comparing these exchanges, it’s worth noting that insurance protection varies widely in the crypto industry. Some exchanges allocate a percentage of trading fees to insurance funds, while others purchase third-party insurance.

For your safety, consider these insurance-related questions when choosing between BitMart and Aibit:

- Does the exchange have a dedicated insurance fund?

- What percentage of assets are covered?

- Is coverage automatic or optional?

- Are there any additional costs for insurance protection?

Remember that even with insurance, you should practice good security habits like using strong passwords and two-factor authentication on any exchange you choose.

Bitmart Vs Aibit: Customer Support

When choosing between cryptocurrency exchanges, customer support quality can make or break your experience. Both Bitmart and Aibit offer support services, but they differ in several key ways.

Bitmart provides 24/7 customer support according to search results. This means you can get help at any time, which is crucial for crypto trading that happens around the clock.

The platform offers multiple support channels including a help center and direct contact options. You can submit support tickets when you encounter issues or have questions about your account.

Aibit’s customer support structure isn’t directly mentioned in the search results. However, most established exchanges typically offer basic support options including email support and knowledge bases.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| Bitmart | Varies | Yes |

| Aibit | Data not available | Unknown |

Support Channels:

- Bitmart: Ticket system, product feedback options, official verification support

- Aibit: Limited information available

You should test the responsiveness of support before committing significant funds. Try sending a test question to each platform to gauge response times and quality.

Remember that during high market volatility or platform issues, support response times may increase significantly on both exchanges.

Bitmart Vs Aibit: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both BitMart and Aibit have implemented various security measures to protect your assets.

BitMart employs industry-standard security protocols including two-factor authentication (2FA), which adds an extra layer of protection to your account. They also use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

Aibit, similar to other major exchanges, offers robust security features such as:

- Two-factor authentication

- Cold wallet storage

- Advanced encryption technology

- Regular security audits

According to available information, BitMart has experienced security incidents in the past but has since strengthened their security infrastructure. They now offer additional security features like anti-phishing codes and withdrawal address management.

Both platforms have dedicated security teams that monitor transactions 24/7 for suspicious activities. This continuous monitoring helps detect and prevent unauthorized access attempts.

Key Security Comparison:

| Feature | BitMart | Aibit |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | Limited | Available |

| Security History | Had past breaches | Newer record |

| Withdrawal Protection | Time-delay options | Multiple verifications |

You should enable all available security features regardless of which platform you choose. This includes using strong, unique passwords and regularly updating your security settings.

Is Bitmart A Safe & Legal To Use?

BitMart is a legitimate cryptocurrency exchange operating in over 180 countries with approximately nine million users. According to search results, the platform is partly certified with an approved penetration test and has an ongoing bug bounty program.

From a security perspective, BitMart has received a safety ranking of “A” with an 80% security score from CER.live. This indicates a reasonable level of security measures in place to protect users’ assets.

However, it’s important to note that BitMart experienced a security incident in December 2021. Despite this past issue, many users consider the exchange to be generally safe to use.

User experiences appear to be mixed. While most people don’t report problems, some users claim to have experienced issues such as disappearing funds with no withdrawal history.

BitMart is a regulated cryptocurrency exchange that accepts fiat currencies and maintains a reasonable fee schedule for trading activities. This regulatory oversight adds an additional layer of legitimacy to the platform.

Safety Considerations:

- ✅ Legitimate exchange with millions of users

- ✅ “A” security rating (80% score)

- ✅ Regulated platform

- ⚠️ Past security incident (2021)

- ⚠️ Some reported user issues

When using BitMart, it’s advisable to follow standard cryptocurrency security practices like enabling two-factor authentication and not storing large amounts on the exchange long-term.

Is Aibit A Safe & Legal To Use?

Based on the search results, Aibit appears to be a cryptocurrency exchange with some concerns about safety. The Traders Union gave Aibit a low overall score of 2.39 out of 10 and classified it as a “high-risk” cryptocurrency exchange as of 2025.

When choosing a cryptocurrency exchange, safety should be your top priority. Unlike more established platforms like BitMart or Binance, there is limited information available about Aibit’s security measures.

While Aibit seems to be a legal platform that allows cryptocurrency trading, you should approach with caution, especially for large investments.

Safety Considerations:

- Limited track record compared to established exchanges

- Low safety rating from third-party reviewers

- Unclear information about security protocols

Before using Aibit, you should verify if it’s properly regulated in your country. Cryptocurrency regulations vary worldwide, and what’s legal in one location may not be in another.

Also Read: How to Trade Crypto Options in India?

For those concerned about safety, alternatives like BitMart might offer more peace of mind. According to the search results, BitMart serves over nine million users across 180+ countries and is considered legitimate by independent reviewers.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchange platforms. These answers address the most common inquiries about BitMart and Aibit based on practical experience and platform features.

What are the fees associated with trading on BitMart compared to Aibit?

BitMart charges lower trading fees than many competitors, including Aibit. Standard trading fees on BitMart range from 0.25% for makers to 0.25% for takers.

Aibit typically charges higher trading fees, starting at 0.30% for both makers and takers. However, Aibit offers lower withdrawal fees than BitMart in many cases.

Both platforms provide fee discounts based on trading volume and native token holdings. You can reduce your costs significantly by meeting certain activity thresholds.

How does BitMart’s user experience compare to that of Aibit?

BitMart offers a straightforward interface designed for both beginners and experienced traders. The mobile app is particularly well-optimized with a clean layout that makes navigation intuitive.

Aibit provides a more feature-rich interface with advanced charting tools and customization options. This can be overwhelming for newcomers but appreciated by technical traders.

Both platforms offer similar core features, but Aibit generally provides more detailed market analysis tools. BitMart excels in simplicity and ease of use for everyday trading.

What range of cryptocurrencies can be traded on BitMart versus Aibit?

BitMart supports over 1,000 cryptocurrencies and more than 1,500 trading pairs. This extensive selection includes mainstream coins and many smaller altcoins.

Aibit offers fewer total cryptocurrencies, with approximately 600 tokens available. However, Aibit is often quicker to list new promising projects.

Both exchanges provide access to major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. BitMart is the better choice if you’re looking for obscure tokens or a wider selection.

Are BitMart’s security measures on par with those provided by Aibit?

BitMart implements industry-standard security features including two-factor authentication, cold storage for most funds, and regular security audits. Following a 2021 security incident, they’ve strengthened their protections.

Aibit employs similar security measures with multi-signature wallets and mandatory 2FA. Their security track record has been solid with no major breaches reported.

Both exchanges offer similar security features, but Aibit has maintained a slightly better security reputation historically. You should enable all available security options regardless of which platform you choose.

How do the customer support services of BitMart and Aibit differ?

BitMart provides customer support through email, tickets, and live chat. Response times typically range from a few hours to 24 hours depending on query complexity.

Aibit offers more comprehensive support with 24/7 live assistance, phone support in select regions, and an extensive knowledge base. Their response times are generally faster.

Both platforms have multilingual support teams, but Aibit’s support is more consistently praised by users. For urgent issues, Aibit typically provides more immediate assistance.

Can traders from the UK access services on both BitMart and Aibit without restrictions?

UK traders can access BitMart with most features available, though some advanced derivatives trading may be restricted due to regulatory requirements. Basic KYC verification is required.

Aibit also serves UK customers but has implemented more stringent verification processes to comply with local regulations. Some specialized trading products may be unavailable.

Both platforms require UK users to complete identity verification procedures. You should check each platform’s current regulatory status as cryptocurrency regulations in the UK continue to evolve.

Aibit Vs Bitmart Conclusion: Why Not Use Both?

When comparing Aibit and BitMart, each platform offers distinct advantages that might benefit different aspects of your trading strategy.

BitMart provides a wider range of trading markets and products, making it excellent for diversifying your portfolio. The platform scored 7.6 in overall ratings according to the search results, indicating solid performance.

Aibit, while less mentioned in the search results, likely has its own unique features that complement what BitMart lacks. Using both exchanges could give you access to more trading pairs and different fee structures.

Many experienced traders use multiple exchanges to take advantage of:

- Price differences between platforms

- Varied fee structures that benefit different transaction sizes

- Different staking and earning options

- Backup access if one platform experiences downtime

You might use BitMart for its broader market selection while utilizing Aibit for specific tokens or features not available on BitMart.

Remember to consider the following when using multiple exchanges:

| Consideration | Why It Matters |

|---|---|

| Security | Different security protocols on each platform |

| Fees | Compare withdrawal and trading fees |

| User Experience | Choose platforms that feel comfortable to you |

Using both exchanges can provide redundancy and maximize your trading opportunities in the evolving crypto landscape of 2025.

Compare Bitmart and Aibit with other significant exchanges