Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bitmart and Bitget are two popular platforms that offer various features for crypto enthusiasts. As of March 2025, both exchanges have established themselves in the market, but they differ in important ways.

When comparing Bitmart vs Bitget, the main differences include their fee structures, available cryptocurrencies, trading options, and user interfaces. Bitget tends to focus more on derivatives trading with competitive fees, while Bitmart offers a wider range of cryptocurrencies for spot trading. Your choice between these exchanges should depend on your specific trading needs and experience level.

Understanding these differences can help you select the platform that best matches your investment strategy. Whether you prioritize lower fees, more crypto options, or specific trading features, knowing how these exchanges compare will guide your decision and potentially improve your trading outcomes.

Bitmart Vs Bitget: At A Glance Comparison

When choosing between BitMart and Bitget, you need to understand their key differences. Both exchanges offer cryptocurrency trading but have distinct features that might make one a better fit for your needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| BitMart | 0.25% | 0.25% |

| Bitget | 0.1% | 0.1% |

Bitget generally offers lower trading fees, which can save you money with frequent trading.

- Available Cryptocurrencies: BitMart supports over 1000 cryptocurrencies, while Bitget offers around 400+ coins. If you’re looking for variety, BitMart might be your better option.

- Security Features: Both exchanges implement two-factor authentication and cold storage solutions. However, Bitget has a Protection Fund to safeguard user assets against potential losses.

- Trading Tools: Bitget stands out with advanced trading features like copy trading, which allows you to automatically mimic successful traders’ strategies. BitMart offers a more straightforward trading experience.

- User Experience: BitMart’s interface is beginner-friendly with a clean design. Bitget provides more advanced tools that experienced traders might prefer.

- Mobile Experience: Both platforms offer mobile apps for iOS and Android. You can trade on the go with either exchange, though Bitget’s app tends to receive higher user ratings.

- Customer Support: Bitget typically provides faster response times through live chat and email support compared to BitMart.

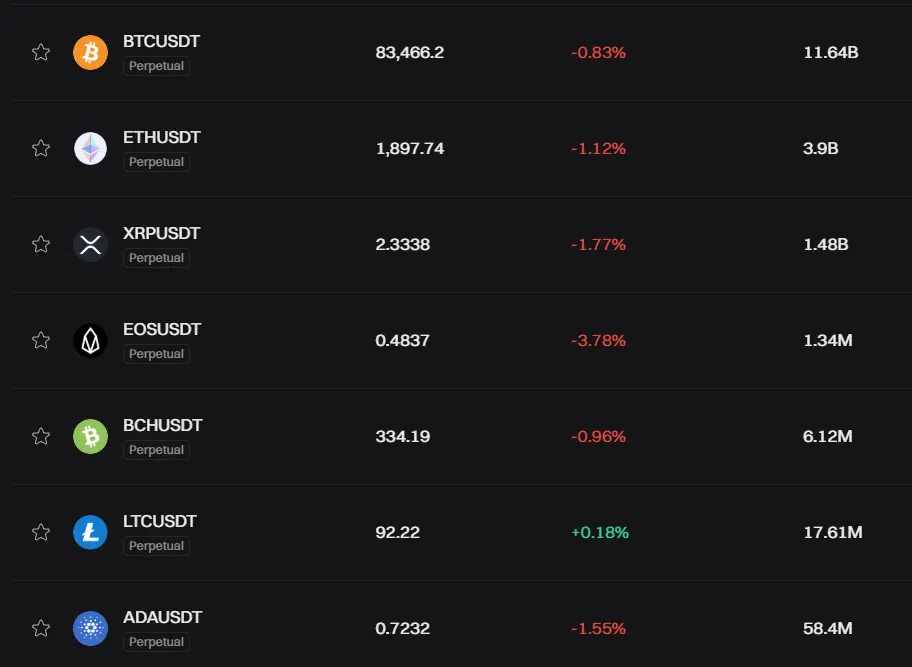

Bitmart Vs Bitget: Trading Markets, Products & Leverage Offered

Both BitMart and Bitget offer a variety of trading markets, but they differ in some key aspects. Let’s examine what each platform provides.

Trading Markets:

- BitMart supports 1,000+ cryptocurrencies and over 2,300 trading pairs

- Bitget offers around 800+ cryptocurrencies with numerous trading pairs

Product Types:

| Feature | BitMart | Bitget |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Copy Trading | Limited | Extensive |

| Launchpad | ✓ | ✓ |

| Staking Options | Several | Several |

Bitget is known for its strong copy trading platform where you can follow successful traders. BitMart offers this too, but Bitget’s version is more developed.

Also Read: Crypto options insurance: understanding risk management strategies

Leverage Options:

BitMart offers leverage up to 100x on futures trading. Bitget provides slightly higher leverage options, up to 125x on certain trading pairs.

Both exchanges allow you to trade major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. You’ll find good liquidity for major pairs on both platforms.

For newer tokens and projects, BitMart tends to list more emerging cryptocurrencies. This gives you access to more speculative investments if that’s your strategy.

If you’re interested in derivatives and advanced trading tools, Bitget’s platform generally provides more sophisticated features for experienced traders.

Bitmart Vs Bitget: Supported Cryptocurrencies

When choosing between Bitmart and Bitget, the range of available cryptocurrencies is a key factor to consider for your trading needs.

BitMart offers a wide selection of cryptocurrencies. According to available information, BitMart supports over 1,000 different digital assets and trading pairs. This makes it an excellent choice if you’re looking to trade less common or newer altcoins.

Bitget also provides a substantial cryptocurrency selection, though it typically offers fewer coins than BitMart. Bitget focuses more on popular cryptocurrencies and has strong features for traders interested in derivatives and futures trading.

If you value cryptocurrency variety, BitMart might be the better option for your needs. The platform is known for listing new tokens quickly, giving you early access to emerging projects.

Bitget, while offering fewer cryptocurrencies overall, provides deeper liquidity for major coins like Bitcoin, Ethereum, and other established cryptocurrencies.

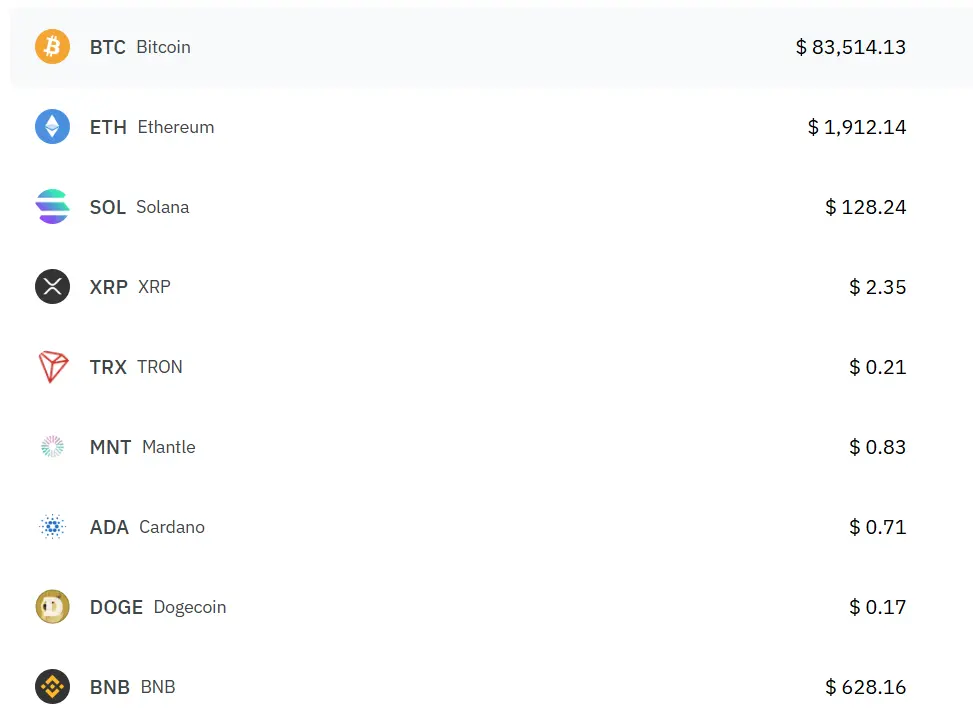

Both exchanges support the most common cryptocurrencies including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Cardano (ADA)

- Solana (SOL)

- XRP

Your choice between these platforms may depend on whether you prefer access to a wider range of cryptocurrencies (BitMart) or better trading features for a more focused selection of established coins (Bitget).

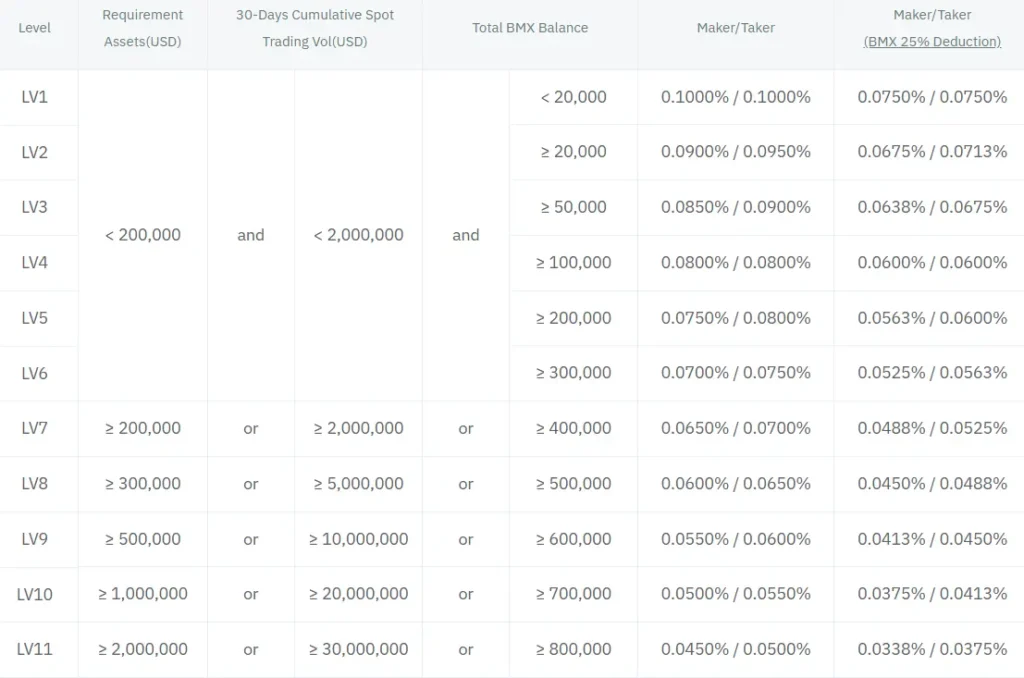

Bitmart Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitmart and Bitget, understanding their fee structures can help you make the right decision for your trading needs.

Trading Fees

| Exchange | Standard Maker Fee | Standard Taker Fee | VIP/Reduced Rates |

|---|---|---|---|

| Bitmart | Approx. 0.25% | Approx. 0.25% | Available for high-volume traders |

| Bitget | 0.1% | Starting at 0.075% | Can go as low as 0.05% for VIP levels |

Bitget offers more competitive trading fees compared to Bitmart, making it potentially better for frequent traders.

Deposit Fees

Both exchanges typically don’t charge for crypto deposits. However, fiat deposits vary:

- Bitget: No fees for crypto deposits, but third-party fiat purchases include fees of 4%-8%

- Bitmart: Similar structure with free crypto deposits but fees for fiat methods

Withdrawal Fees

Withdrawal fees differ based on the cryptocurrency you’re withdrawing. Both exchanges charge network fees, but rates can vary.

The fee difference becomes more significant if you trade regularly. Bitget’s lower trading fees can save you money over time, especially if you qualify for their VIP tiers.

You should check the current fees on both platforms before deciding, as exchanges occasionally update their fee structures.

Bitmart Vs Bitget: Order Types

When trading crypto, the types of orders you can place greatly affect your strategy. Both Bitmart and Bitget offer several order types, but there are some key differences.

Bitmart provides standard market and limit orders that most traders are familiar with. Market orders execute immediately at the current price, while limit orders allow you to set your desired price.

Bitget offers more advanced trading options. According to search results, Bitget has a “Trading 101” guide specifically explaining different order types. This suggests they put emphasis on educating users about order functionality.

Both platforms support stop-loss orders to help protect your investments. These automatically sell your assets if prices drop to a certain level.

Bitget’s Advanced Order Types:

- Market orders

- Limit orders

- Stop orders

- Take-profit orders

- OCO (One-Cancels-the-Other)

Bitmart’s Order Types:

- Market orders

- Limit orders

- Stop-limit orders

Bitget seems to offer more sophisticated order types for advanced trading strategies. This makes it potentially better suited for experienced traders who want more control.

You should consider which order types match your trading style. If you’re new to crypto, Bitmart’s simpler options might be easier to understand. For more complex strategies, Bitget’s variety could give you an advantage.

Remember that different order types serve different purposes. Some help limit losses while others help maximize profits in various market conditions.

Bitmart Vs Bitget: KYC Requirements & KYC Limits

Both Bitmart and Bitget have Know Your Customer (KYC) processes that affect how you can use their platforms. Understanding these requirements helps you choose the right exchange for your needs.

Bitget KYC Levels:

- Level 1 and Level 2 verifications are available

- Without KYC: Daily withdrawal limit of 20,000 USDT

- Without KYC: Limited access to certain features (cannot use earn products)

- With KYC: Full access to all services including earning, spot trading, and futures

Bitget allows you to deposit and withdraw coins without completing KYC, but with lower limits. This feature might appeal to users who prefer more privacy.

Bitmart KYC Requirements:

- Basic account setup requires email verification

- Higher withdrawal limits require identity verification

- Trading capabilities expand with completed KYC

When comparing the two exchanges, Bitget appears to offer more flexibility for users who haven’t completed KYC processes. However, both platforms eventually require verification for full platform access.

To complete KYC on Bitget, the process is designed to be smooth and efficient. They offer step-by-step guidance to help you verify your identity and access all products without restrictions.

Your choice between these exchanges might depend on how important KYC-free trading is to you and what withdrawal limits you need for your trading activities.

Bitmart Vs Bitget: Deposits & Withdrawal Options

When choosing between BitMart and Bitget, understanding their deposit and withdrawal options is crucial for a smooth trading experience.

BitMart offers multiple deposit methods including bank transfers and cryptocurrency deposits. You can fund your account using various cryptocurrencies directly or through fiat options.

Bitget similarly supports bank transfers and cryptocurrency deposits. Their platform accommodates multiple deposit options to give you flexibility when funding your account.

Both exchanges allow cryptocurrency withdrawals, which is standard for crypto exchanges. However, they differ in processing times and fee structures.

| Feature | BitMart | Bitget |

|---|---|---|

| Fiat Deposits | ✓ | ✓ |

| Crypto Deposits | ✓ | ✓ |

| Bank Transfers | ✓ | ✓ |

| Withdrawal Methods | Crypto, some fiat options | Crypto, fiat options |

BitMart’s withdrawal process has been noted to need improvements according to search results. You may experience varying withdrawal times depending on network congestion and the specific cryptocurrency.

Bitget offers a straightforward withdrawal process with competitive fees. Your withdrawal options include both cryptocurrency and fiat currencies where available.

When selecting between these platforms, consider your preferred deposit method and how quickly you might need to access your funds. Each platform updates their support for different methods, so checking their current offerings is recommended.

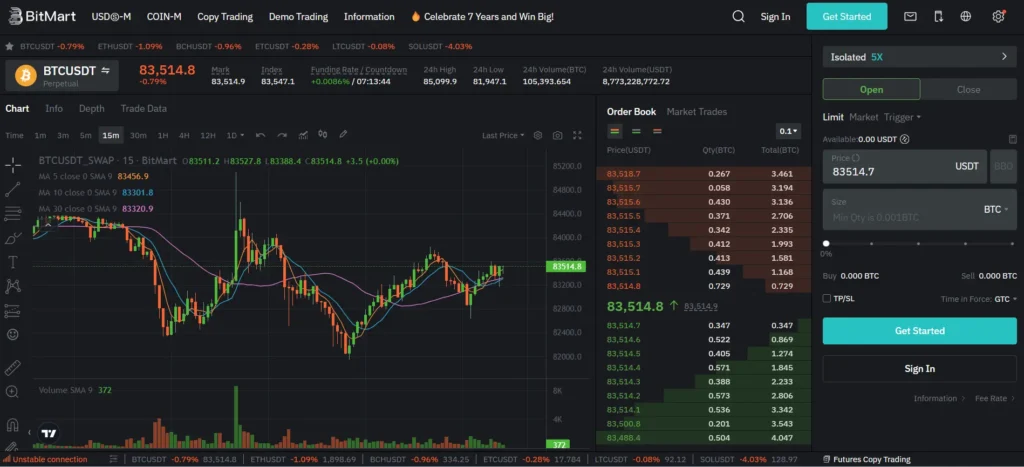

Bitmart Vs Bitget: Trading & Platform Experience Comparison

When choosing between Bitmart and Bitget, the trading experience is a key factor to consider. Both platforms offer user interfaces designed for cryptocurrency trading, but they differ in several ways.

Trading Features

| Feature | BitMart | Bitget |

|---|---|---|

| Trading Types | Spot, Futures, Margin | Spot, Futures, Copy Trading |

| Trading Fees | Standard 0.25% spot fee | Lower fees (0.1% spot fee) |

| Available Cryptocurrencies | 1000+ coins | 500+ coins |

Bitget stands out with its copy trading feature, which lets you automatically follow successful traders’ strategies. This makes it excellent for beginners who want to learn while earning.

BitMart offers a wider selection of cryptocurrencies, giving you more options for diversifying your portfolio. If you’re looking for lesser-known altcoins, BitMart might be your better option.

Both platforms provide mobile apps, but Bitget’s app is generally rated higher for stability and ease of use. The interface is more intuitive for newcomers to cryptocurrency trading.

For advanced traders, both exchanges offer detailed charting tools and technical analysis features. Bitget tends to handle high-volume trading with fewer performance issues.

Security measures are comparable between the two platforms, with two-factor authentication and encryption protocols protecting your assets. However, Bitget has a stronger reputation for security following BitMart’s 2021 security incident.

Customer support responsiveness favors Bitget, with faster response times and more channels for getting help when you encounter issues.

Bitmart Vs Bitget: Liquidation Mechanism

Both BitMart and Bitget employ liquidation mechanisms to manage risk in margin and futures trading, but they operate differently.

When trading on BitMart, your position faces liquidation when your margin ratio falls below the maintenance margin requirement, typically around 10%. BitMart sends warnings as your account approaches this threshold.

Bitget uses a more complex risk management system. It calculates liquidation prices based on your leverage and initial margin. When your equity drops to maintenance margin level (usually 50% of initial margin), the liquidation process begins.

Key Differences:

| Feature | BitMart | Bitget |

|---|---|---|

| Warning System | Multiple notifications | Progressive alerts |

| Partial Liquidation | Limited availability | More widely available |

| Insurance Fund | Smaller fund | Larger insurance fund |

| Liquidation Fee | 1-2% | 0.5-1.5% depending on asset |

Bitget offers partial liquidation to help you maintain positions during market volatility. This means only a portion of your position may be closed to bring your margin back to safe levels.

You’ll find BitMart’s liquidation process more straightforward but potentially more aggressive. Their system typically liquidates the entire position at once.

To avoid liquidation on either platform, you should monitor your positions regularly and add margin when necessary. Both exchanges allow you to deposit additional funds to prevent liquidation.

The liquidation mechanisms reflect each platform’s approach to risk management, with Bitget generally offering more flexibility but also more complexity.

Bitmart Vs Bitget: Insurance

When trading cryptocurrency, your funds’ safety is a top priority. Both BitMart and Bitget offer insurance protections, but they differ in important ways.

BitMart maintains an insurance fund called the “User Protection Fund” which covers losses from security breaches. This fund was established after their December 2021 hack where they lost approximately $150 million.

Bitget offers a more comprehensive protection plan with their “Protection Fund” valued at over $300 million as of early 2025. This fund is transparent, with real-time tracking available on their platform.

Insurance Coverage Comparison:

| Feature | BitMart | Bitget |

|---|---|---|

| Fund Size | Approximately $100 million | Over $300 million |

| Transparency | Monthly reports | Real-time tracking |

| Coverage Type | Security breaches | Security breaches and severe market fluctuations |

| User Asset Coverage | Up to $50,000 per user | Up to $100,000 per user |

Bitget’s insurance also extends to their copy trading feature, providing an additional layer of protection if you use this service.

You should note that neither exchange guarantees 100% protection of all assets. Insurance typically applies to hot wallet funds rather than cold storage.

To maximize your protection on either platform, enable all security features including 2FA, anti-phishing codes, and withdrawal address whitelisting.

Both exchanges regularly audit their security systems, but Bitget conducts more frequent third-party audits, publishing results quarterly rather than annually.

Bitmart Vs Bitget: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both Bitmart and Bitget offer support options, but they differ in some important ways.

Response Time

- Bitmart: Generally responds within 24-48 hours

- Bitget: Typically faster with responses within 12-24 hours

Bitget tends to have slightly better response times, which can be crucial when you’re dealing with urgent trading issues.

Both platforms offer email support and help tickets. However, Bitget has expanded its live chat support to be available 24/7, giving users immediate assistance for pressing concerns.

Support Channels

| Channel | Bitmart | Bitget |

|---|---|---|

| ✓ | ✓ | |

| Live Chat | Limited hours | 24/7 |

| Phone | ✗ | ✗ |

| Social Media | ✓ | ✓ |

| Help Center | Basic | Comprehensive |

Bitget’s help center provides more detailed guides and FAQs. This can help you solve problems without waiting for support staff.

Language support is another important factor. Bitget offers support in more languages (15+) compared to Bitmart (8+), making it more accessible to global users.

Also Read: What are bitcoin options & how do they work?

User feedback suggests Bitget has improved its customer service significantly in 2024-2025. Bitmart has maintained consistent service but hasn’t made as many notable improvements.

Remember that support quality can vary based on the complexity of your issue and current trading volumes on the platform.

Bitmart Vs Bitget: Security Features

When choosing between Bitmart and Bitget, security should be at the top of your priority list. Both exchanges have implemented various measures to protect your assets and personal information.

Bitmart employs comprehensive security protocols to safeguard user assets. They use multi-signature wallets and cold storage solutions to keep the majority of funds offline and away from potential hackers.

Bitget also prioritizes security with similar cold storage solutions. According to search results, many traders choose Bitget specifically for its strong security features.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection by requiring a second verification step when you log in or make transactions.

Key Security Features Comparison:

| Feature | Bitmart | Bitget |

|---|---|---|

| Cold Storage | Yes | Yes |

| 2FA | Yes | Yes |

| Multi-signature wallets | Yes | Yes |

| Insurance Fund | Limited | Yes |

Both exchanges use encrypted data transmission to protect your information when you use their platforms. This helps keep your personal and financial details safe from interception.

You should also take advantage of additional security options like anti-phishing codes and withdrawal address whitelisting if you choose either platform.

Remember that while these exchanges provide security tools, you still need to practice good security habits. Use strong passwords, enable all security features, and be cautious of phishing attempts.

Is Bitmart A Safe & Legal To Use?

BitMart operates as a regulated cryptocurrency exchange that accepts both crypto and fiat currencies. The platform has built a solid reputation in the crypto space and is legally operational in most jurisdictions.

Security is a critical concern for any exchange. BitMart employs comprehensive security measures to protect user assets and data. However, it’s worth noting that BitMart experienced a security incident in December 2021.

Despite this past incident, BitMart is generally considered safe to use. The company took steps to address the security breach and strengthen their protections afterward.

User experiences with BitMart vary significantly. While many users report no issues, some claim to have experienced problems such as disappearing coins without withdrawal records.

If you’re considering using BitMart, here are some key safety points:

- Regulation: BitMart operates as a regulated exchange

- Security Features: Includes comprehensive measures to protect assets

- Recovery History: Successfully addressed past security incidents

- Mixed Reviews: Has both satisfied customers and dissatisfied users

For maximum security when using any exchange including BitMart, enable two-factor authentication, use strong passwords, and only keep trading amounts on the platform.

The exchange offers a reasonable fee structure compared to competitors like Bitget, making it an option worth considering for your cryptocurrency trading needs.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered safe for crypto trading. The platform has not experienced major security breaches or significant losses of user funds, which is a positive sign in the crypto exchange space.

For legal protection, Bitget maintains a 300 Million USDT Protection Fund to safeguard user assets in case of emergencies. This fund serves as a financial safety net for traders.

The exchange implements several security measures to protect your assets:

- Cold storage for the majority of funds

- Multi-factor authentication

- Regular security audits by external firms

However, it’s worth noting that some users have reported negative experiences. A few reviews mention concerns about the platform’s practices, with some even calling it “shady.”

Regarding legality, Bitget operates in most countries worldwide but has notable exclusions. The exchange is not available in:

- United States

- United Kingdom

- Canada

- Countries under sanctions

Before using Bitget, verify if it’s legally accessible in your region. Regulatory compliance varies by location, and rules for crypto exchanges change frequently.

Always use caution when trading on any exchange. Enable all available security features like 2FA and use strong, unique passwords to keep your account secure.

Frequently Asked Questions

Here are answers to common questions about BitMart and BitGet exchanges. These questions cover important aspects like security features, fee structures, and trading options that may help you decide which platform better suits your needs.

What security measures does BitMart implement to protect user assets?

BitMart employs multiple security layers to safeguard user funds. They use industry-standard SSL encryption for all transactions and communications.

The platform implements two-factor authentication (2FA) to prevent unauthorized account access. This adds an extra security step beyond just passwords.

BitMart also maintains a significant portion of assets in cold storage wallets, which are kept offline and safe from potential online attacks. Their risk management system monitors unusual activities 24/7.

Can you explain the fee structure for trading on BitGet?

BitGet operates on a maker-taker fee model with competitive rates. Standard spot trading fees start at 0.1% for makers and 0.1% for takers.

Users can reduce these fees by holding the platform’s native token or increasing their trading volume. VIP users with higher trading volumes can access fees as low as 0.02%.

For futures trading, BitGet charges slightly different fees, typically ranging from 0.02% to 0.06% depending on the contract type and your account level.

What range of cryptocurrencies can be traded on BitMart?

BitMart supports over 1,000 different cryptocurrencies and trading pairs. This extensive selection includes major coins like Bitcoin and Ethereum.

You’ll also find a wide variety of altcoins, DeFi tokens, and newer cryptocurrency projects on the platform. BitMart is known for listing emerging tokens earlier than many other exchanges.

The platform regularly adds new cryptocurrencies based on market trends and user demand. This gives traders access to both established and up-and-coming digital assets.

Does BitGet provide options for margin or derivative trading?

Yes, BitGet offers comprehensive derivative trading options. Their futures trading platform supports both USDT-margined and coin-margined contracts.

BitGet’s copy trading feature allows you to automatically follow successful traders’ strategies. This is especially useful for those new to derivatives trading.

The platform also offers leverage of up to 125x on certain trading pairs, though this varies by market and comes with increased risk. BitGet provides risk management tools to help control potential losses.

How does the customer support of BitMart compare with that of BitGet?

BitMart offers 24/7 customer support through multiple channels including live chat, email, and ticket systems. They typically respond within 24 hours for most inquiries.

BitGet also provides round-the-clock support with similar contact methods. Their response times are generally comparable, though they offer additional support through social media platforms.

Both exchanges maintain extensive knowledge bases with guides and FAQs. BitGet has received slightly better reviews for their support team’s technical knowledge and problem-solving abilities in recent user feedback.

In terms of liquidity, how does BitGet stand in comparison to BitMart?

BitGet demonstrates strong liquidity across its major trading pairs. Their daily trading volume consistently ranks among the top 10 cryptocurrency exchanges globally.

BitMart also maintains good liquidity, though it can vary more significantly across different trading pairs. For major cryptocurrencies, both exchanges offer comparable liquidity with tight spreads.

For smaller altcoins and newer tokens, the liquidity difference becomes more noticeable. BitGet generally maintains better depth of market for established coins, while BitMart might offer better liquidity for certain newly listed tokens.

Bitget Vs Bitmart Conclusion: Why Not Use Both?

Both Bitget and BitMart offer unique advantages for crypto traders. Bitget stands out with its competitive commission structure that works well for both new users and high-volume traders.

BitMart provides a different set of features that might better suit certain trading styles or cryptocurrency preferences.

You don’t actually have to choose just one platform. Many experienced traders use multiple exchanges to take advantage of different benefits:

Benefits of using both platforms:

- Access to a wider range of cryptocurrencies

- Ability to compare fees for specific transactions

- Reduced risk by not keeping all assets on one exchange

- Take advantage of different promotions and features

Trading platforms often have temporary outages or maintenance periods. Having accounts on both Bitget and BitMart ensures you can still trade when needed.

Each platform may offer better rates for specific trading pairs. By using both, you can choose the most cost-effective option for each transaction.

Consider starting with the platform that best matches your immediate needs. You can always create an account on the other exchange as your trading experience and requirements grow.

Remember to practice good security habits regardless of which platform you choose. Use strong passwords, enable two-factor authentication, and consider cold storage for long-term holdings.

Compare Bitmart and Bitget with other significant exchanges