Choosing between BitMart and Deepcoin can be challenging when you’re looking for a cryptocurrency exchange. Both platforms offer various features for crypto trading, but they differ in important ways. BitMart scores higher overall with an 8.1 rating compared to Deepcoin, suggesting it might be a better choice for many traders.

When comparing these exchanges, you’ll want to consider factors like fees, available cryptocurrencies, and trading options. Each platform has its strengths – BitMart may excel in certain areas while Deepcoin might offer advantages in others. Understanding these differences will help you select the exchange that best fits your trading needs and preferences.

Bitmart Vs Deepcoin: At A Glance Comparison

When choosing between BitMart and Deepcoin, understanding their key differences can help you make the right decision for your trading needs.

According to recent data, BitMart has earned a higher overall score of 8.1 compared to Deepcoin’s lower rating. This difference reflects several factors that impact user experience.

Trading Features Comparison:

| Feature | BitMart | Deepcoin |

|---|---|---|

| Overall Score | 8.1 | Lower than BitMart |

| Trading Volume | High | Moderate |

| Available Cryptocurrencies | Wide selection | More limited |

| User Interface | User-friendly | Less intuitive |

| Security Features | Strong | Basic |

Both exchanges offer standard crypto trading services, but BitMart stands out with more trading pairs and higher trading volumes.

Fee Structure:

- BitMart typically charges competitive fees that align with industry standards

- Deepcoin’s fee structure may vary but generally doesn’t offer significant advantages over BitMart

You’ll find BitMart more suitable if you prioritize platform reputation and variety of trading options. Its higher trust score indicates better reliability in the cryptocurrency community.

Deepcoin might still be worth considering if you’re looking for specific coins or features unique to their platform. However, based on overall metrics, BitMart currently offers a more robust trading environment.

Also Read: Crypto Options Scalping vs. Swing Trading

Remember to verify the most current information before making your final decision, as exchange features and ratings can change rapidly in the cryptocurrency market.

Bitmart Vs Deepcoin: Trading Markets, Products & Leverage Offered

BitMart and Deepcoin both offer crypto spot trading, allowing you to buy and sell popular cryptocurrencies like Bitcoin, Ethereum, and Tether. BitMart has earned a higher overall score of 8.1 compared to Deepcoin in recent comparisons.

When looking at trading options, both exchanges provide spot trading services with various trading pairs. BitMart particularly emphasizes its fast and professional trading services for both spot and margin trading.

Available Products:

- Spot Trading (Both)

- Margin Trading (Both)

- Derivatives Trading (Both)

BitMart offers a user-friendly platform with real-time trading services. Their interface is designed to make cryptocurrency trading accessible, even if you’re new to crypto markets.

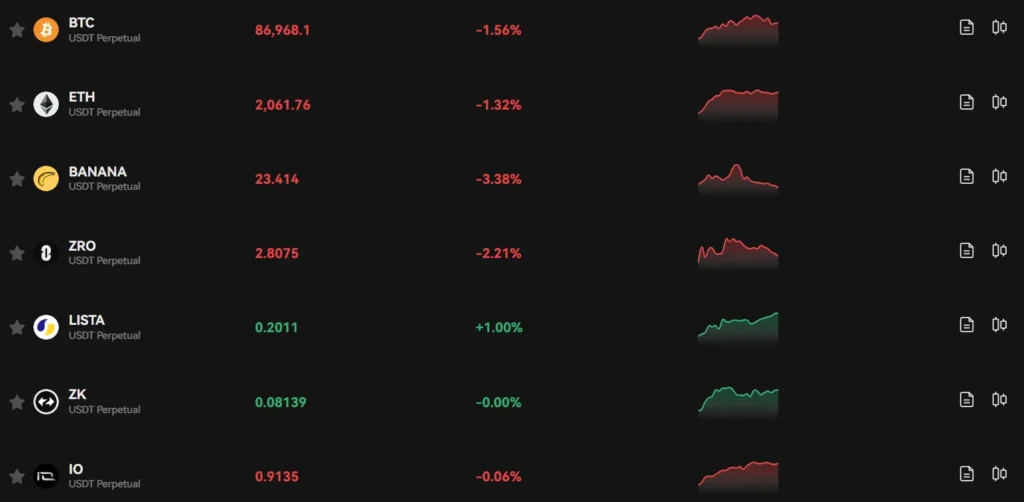

Deepcoin positions itself as a cryptocurrency derivatives exchange, focusing on futures and options trading for traders seeking more advanced products.

Leverage Options:

| Exchange | Maximum Leverage |

|---|---|

| BitMart | Up to 100x (on select pairs) |

| Deepcoin | Up to 125x (on select pairs) |

The leverage offered depends on the specific trading pair and your account level. Higher leverage means potentially higher profits but also carries increased risk.

Trading fees vary between the platforms, so you should compare their fee structures before choosing where to trade. Both exchanges regularly update their supported cryptocurrencies and trading pairs to stay competitive in the market.

Bitmart Vs Deepcoin: Supported Cryptocurrencies

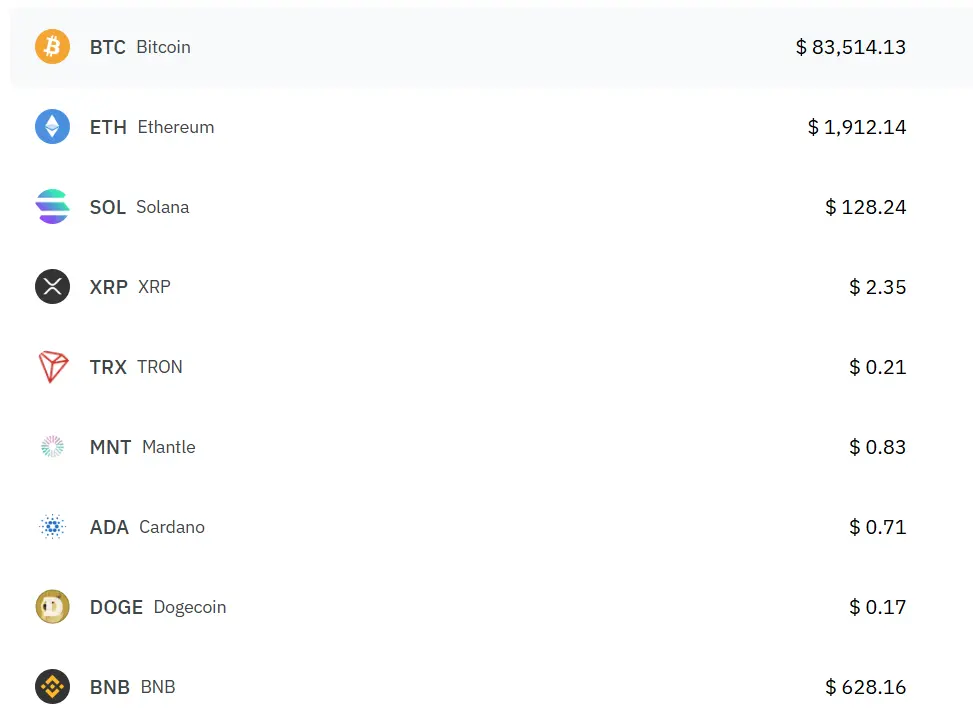

When choosing between BitMart and Deepcoin, the range of available cryptocurrencies is a key factor to consider. Both exchanges offer a variety of digital assets, but there are some notable differences.

BitMart supports over 1,000 cryptocurrencies and more than 2,300 trading pairs. This extensive selection includes popular coins like Bitcoin (BTC), Ethereum (ETH), and numerous altcoins and tokens.

Deepcoin offers fewer cryptocurrencies compared to BitMart, though the exact number varies as they regularly update their listings. They focus on providing the most popular and established cryptocurrencies.

Popular cryptocurrencies available on both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

BitMart may be more suitable if you’re looking to trade lesser-known altcoins or newer tokens. Their larger selection gives you more options for diversifying your portfolio.

Deepcoin tends to be more selective about which cryptocurrencies they list. This can mean fewer choices but potentially higher quality assets.

You should check each platform’s current listings before signing up, as supported cryptocurrencies can change. Both exchanges periodically add new coins and occasionally delist others based on market conditions and regulatory requirements.

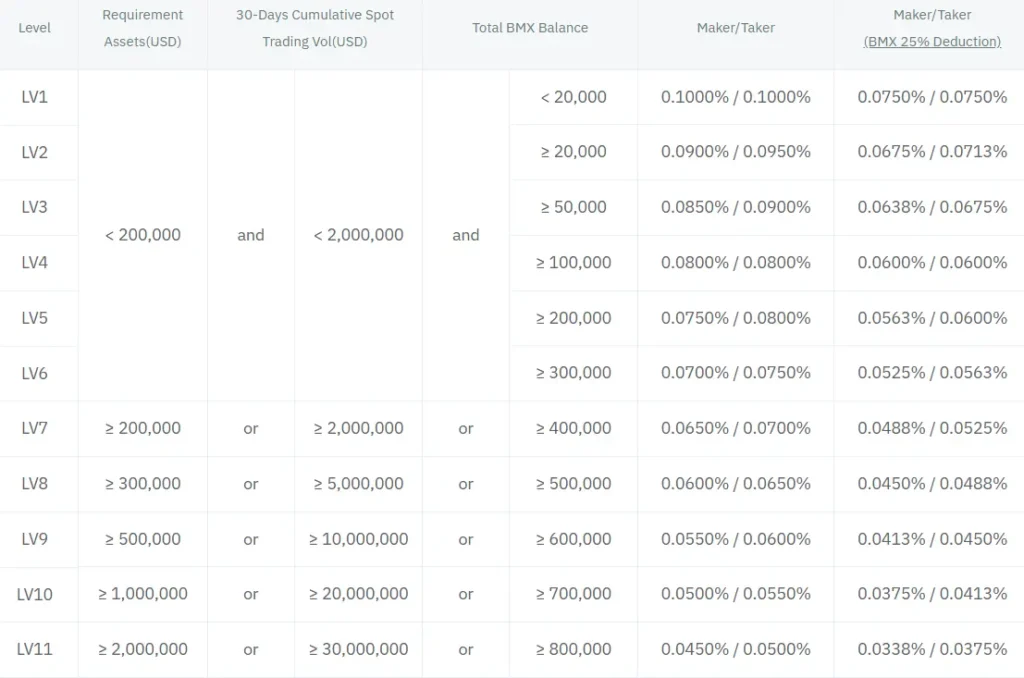

Bitmart Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and Deepcoin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Trading Fees |

|---|---|

| BitMart | Up to 0.2% |

| Deepcoin | Up to 0.6% |

BitMart offers more competitive trading fees compared to Deepcoin. With BitMart, you’ll pay a maximum of 0.2% per trade, while Deepcoin charges up to 0.6%.

Withdrawal Fees

| Exchange | Bitcoin (BTC) Withdrawal Fee |

|---|---|

| BitMart | 0.0001 BTC |

| Deepcoin | Up to 0.001 BTC |

BitMart has significantly lower withdrawal fees for Bitcoin. You’ll pay only 0.0001 BTC to withdraw from BitMart, while Deepcoin may charge up to 0.001 BTC—ten times more expensive.

Both exchanges offer various payment methods for deposits, though specific options may vary by region. When depositing funds, always check the current fee structure as these can change.

The fee difference becomes more noticeable with higher transaction volumes. If you’re a frequent trader, BitMart’s lower fees could save you considerable money over time.

Remember to factor in these costs when calculating your potential profits. Lower fees directly impact your bottom line, especially for active traders.

Bitmart Vs Deepcoin: Order Types

When trading on cryptocurrency exchanges, order types can significantly impact your trading experience. Both BitMart and Deepcoin offer various order options to suit different trading strategies.

BitMart Order Types:

- Market orders (instant execution at current market price)

- Limit orders (execution at your specified price)

- Stop-limit orders (combines stop and limit features)

- OCO (One-Cancels-Other) orders

- Trailing stop orders

BitMart’s interface makes it relatively easy to select and customize these order types. You can set specific parameters for each order based on your trading preferences.

Deepcoin Order Types:

- Market orders

- Limit orders

- Stop orders

- Take profit orders

- Conditional orders

- Advanced trailing options

Deepcoin places emphasis on their advanced order types, which can be useful for more experienced traders. Their platform includes some sophisticated conditional orders that BitMart doesn’t offer.

Both exchanges support basic order types necessary for everyday trading. However, Deepcoin appears to have a slight edge with more specialized order options.

For beginners, BitMart’s order interface might be more approachable. You’ll find the basic order types clearly labeled and easy to use.

Advanced traders might prefer Deepcoin’s comprehensive selection of order types. These additional options provide more flexibility for implementing complex trading strategies.

Bitmart Vs Deepcoin: KYC Requirements & KYC Limits

BitMart requires all users to complete KYC verification. The exchange offers two different KYC levels: Starter and Advanced. Each level has different verification requirements and daily limits.

For BitMart users, completing KYC is mandatory for trading and withdrawals. Without verification, you’ll face significant restrictions on your account activities.

Deepcoin takes a different approach to KYC. The platform does not enforce mandatory KYC verification for all users. This makes Deepcoin more accessible if you value privacy or want to start trading immediately.

The no-KYC policy at Deepcoin gives you the ability to trade cryptocurrencies without sharing personal identification documents. This feature sets Deepcoin apart from many other exchanges in 2025.

BitMart KYC Overview:

- ✓ Mandatory verification

- ✓ Two-tier system (Starter and Advanced)

- ✓ Required for withdrawals

- ✓ Different daily limits based on level

Deepcoin KYC Overview:

- ✓ No mandatory KYC

- ✓ Begin trading immediately

- ✓ Greater privacy protection

- ✓ Simpler onboarding process

Your choice between these platforms may depend on your comfort with sharing personal information. BitMart offers more regulation compliance, while Deepcoin provides more privacy and easier access.

Bitmart Vs Deepcoin: Deposits & Withdrawal Options

When choosing between BitMart and Deepcoin, understanding their deposit and withdrawal options is crucial for your trading experience.

Deposit Methods

Both exchanges offer cryptocurrency deposits, but their supported networks and coins differ. BitMart provides more payment method options compared to Deepcoin, giving you more flexibility when funding your account.

Withdrawal Fees

BitMart’s withdrawal fees vary based on the cryptocurrency and network you choose. For Bitcoin, the fee can be up to 0.001 BTC.

Deepcoin charges up to 0.0001 BTC for Bitcoin withdrawals, making it potentially more cost-effective for BTC transactions.

Fee Comparison Table

| Feature | BitMart | Deepcoin |

|---|---|---|

| Withdrawal Fees (BTC) | Up to 0.001 BTC | 0.0001 BTC |

| Trading Fees | Up to 0.2% | Up to 0.6% |

| Deposit Fees | Free | Free |

BitMart’s withdrawal fees are dynamic and adjust based on market conditions, which means they can change frequently. This flexibility allows the platform to adapt to network congestion.

Deepcoin generally maintains lower withdrawal fees for popular cryptocurrencies, but offers fewer payment methods overall.

You should check both platforms’ current fee structures before making your decision, as these can change over time.

Bitmart Vs Deepcoin: Trading & Platform Experience Comparison

BitMart and Deepcoin offer different trading experiences that cater to various types of crypto traders. Based on trust scores, BitMart has an overall higher rating of 8.1 compared to Deepcoin.

User Interface

BitMart provides a clean, intuitive interface that beginners can navigate easily. Deepcoin’s platform is similarly user-friendly but offers more advanced charting tools that experienced traders might prefer.

Trading Options

Both exchanges support spot trading, but their advanced features differ:

| Feature | BitMart | Deepcoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Copy Trading | Limited | More extensive |

| Trading Bots | Basic | Advanced |

BitMart is available in over 180 countries, making it more accessible globally than Deepcoin. This wider reach gives you more flexibility depending on your location.

Mobile Experience

Both exchanges offer mobile apps for iOS and Android. BitMart’s app is highly rated for its simplicity, while Deepcoin’s app includes more technical analysis tools.

Trading Volume

BitMart typically maintains higher trading volumes, which can result in better liquidity for popular trading pairs. This means you’ll likely experience less slippage when executing larger trades.

When selecting between these platforms, consider your trading style and needs. BitMart might be better if you value simplicity and wide market access, while Deepcoin could be preferable if you need advanced trading tools and deeper market analysis capabilities.

Bitmart Vs Deepcoin: Liquidation Mechanism

When trading futures on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for managing risk. Both BitMart and Deepcoin have specific processes that trigger when your margin falls below required levels.

BitMart’s liquidation system activates when your margin balance drops below the maintenance margin. This balance includes your wallet funds plus any unrealized profits or losses from open positions.

Deepcoin follows a similar approach but may differ in specific thresholds and warning systems.

Here’s a comparison of their liquidation features:

| Feature | BitMart | Deepcoin |

|---|---|---|

| Liquidation Trigger | When margin falls below maintenance threshold | When margin falls below maintenance threshold |

| Warning System | Yes – alerts before liquidation | Yes – risk indicators available |

| Partial Liquidation | Available on select markets | Available on most futures contracts |

| Insurance Fund | Used to prevent complete losses | Similar protection mechanisms in place |

Both exchanges calculate liquidation prices based on your position size, leverage used, and account equity. Higher leverage means liquidation can happen more quickly with smaller price movements.

To avoid liquidation on either platform, you can:

- Use lower leverage

- Set stop-loss orders

- Add more funds to your margin

- Close positions partially when approaching margin limits

Always monitor your positions carefully, especially during volatile market conditions when liquidations are more common.

Bitmart Vs Deepcoin: Insurance

When comparing cryptocurrency exchanges, insurance is a key factor to consider for your asset protection. Both BitMart and Deepcoin have different approaches to security and insurance.

BitMart doesn’t prominently advertise a dedicated insurance fund for user assets. After experiencing a significant hack in December 2021, the exchange promised to cover losses, but this was a reactive measure rather than a structured insurance program.

Deepcoin reportedly maintains some form of protection for users, though specific details about their insurance coverage aren’t widely documented in reliable sources.

In contrast, other major exchanges like Binance have established formal insurance funds to protect users. Binance’s SAFU (Secure Asset Fund for Users) is a concrete example of what robust exchange insurance looks like.

When choosing between BitMart and Deepcoin, you should directly ask each platform about their current insurance policies. Important questions include:

- What percentage of assets are covered?

- Are both hot and cold wallets protected?

- What specific scenarios does the insurance cover?

- Is the insurance fund independently verified?

Remember that insurance is just one aspect of exchange security. You should also consider:

- Two-factor authentication options

- Cold storage practices

- Regular security audits

- Transparency about security measures

Your crypto assets deserve protection, so insurance coverage should factor into your decision between BitMart and Deepcoin.

Bitmart Vs Deepcoin: Customer Support

When choosing between cryptocurrency exchanges, customer support can make or break your experience. Both BitMart and Deepcoin offer support options, but there are some differences worth noting.

BitMart provides 24/7 customer support through multiple channels. You can reach their team via email, live chat, and support tickets. Many users appreciate their responsive live chat feature for quick resolution of basic issues.

Deepcoin also offers 24/7 support according to available information. Their support channels include email and a ticket system. Some users report that response times can vary depending on the complexity of the issue.

Response Time Comparison:

| Exchange | Average Response Time | Support Channels |

|---|---|---|

| BitMart | 1-24 hours | Email, Live Chat, Tickets |

| Deepcoin | 12-48 hours | Email, Tickets |

BitMart’s support team handles a wide range of issues including account verification, deposit/withdrawal problems, and trading questions. Their support is available in multiple languages to serve their global user base.

Deepcoin’s support team focuses on similar areas but may have fewer language options available. This could be important if you prefer support in a specific language.

Both platforms offer knowledge bases and FAQs that can help you solve common problems without contacting support. These self-service options can save you time when dealing with basic questions.

Neither exchange is perfect in terms of support. During high-volume trading periods or market volatility, both platforms may experience longer response times.

Bitmart Vs Deepcoin: Security Features

When choosing between BitMart and Deepcoin, security should be a top priority for your crypto investments. Both exchanges have implemented various security measures, but they differ in specific features.

BitMart experienced a security breach in 2021, which led to significant improvements in their security infrastructure. They now offer two-factor authentication (2FA), advanced encryption protocols, and regular security audits.

Deepcoin emphasizes its security framework with multi-signature wallets and cold storage solutions. They store the majority of user funds offline, reducing vulnerability to online attacks.

Key Security Features Comparison:

| Feature | BitMart | Deepcoin |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Partial | Majority |

| Insurance Fund | Limited | Yes |

| KYC Requirements | Required | Required |

| History of Breaches | Yes (2021) | No reported major breaches |

Both exchanges require KYC (Know Your Customer) verification to comply with regulatory standards and prevent fraud. This adds an extra layer of security for your account.

BitMart has strengthened its security team following past incidents, while Deepcoin has maintained a relatively clean security record.

When considering which platform to use, you should weigh these security features against your specific needs. Remember that no exchange is completely immune to security risks, so always practice good security habits regardless of your chosen platform.

Is Bitmart A Safe & Legal To Use?

BitMart is a legitimate cryptocurrency exchange operating in over 180 countries with approximately nine million users. According to search results, BitMart has earned an overall score of 8.1, which is higher than Deepcoin’s score.

The platform is generally considered safe for trading cryptocurrencies. It follows regulatory requirements and allows users to trade with fiat currencies, which adds a layer of legitimacy to its operations.

However, some users have reported negative experiences. There are claims that BitMart has used its User Agreement to withhold funds without proper accountability. This has left some customers feeling powerless when issues arise.

It’s worth noting that BitMart experienced a security incident in December 2021. Despite this past breach, many still consider the exchange safe to use today.

When considering whether to use BitMart for your investments, you should:

- Research current user reviews

- Start with smaller amounts before making large investments

- Enable all available security features

- Understand the terms of service thoroughly

BitMart’s fee schedule is described as reasonable compared to other exchanges in the market. This makes it a potentially cost-effective option for your trading needs.

Also Read: Crypto Options Market Makers & Their Role in Liquidity

For large investments, some experts on Quora suggest BitMart is sufficiently safe, particularly because it’s a governed exchange with established trading services.

Is Deepcoin A Safe & Legal To Use?

Deepcoin is considered one of the safer cryptocurrency exchanges available today. It employs a self-developed third-generation security system to protect user assets and information.

For most countries, Deepcoin is legal to use. However, there’s an important consideration for US-based traders.

While Deepcoin does technically allow US investors on its platform, these users have no fund protection. This creates a significant risk for American users, as they would lack the safety nets available to traders from other regions.

The exchange operates with standard security features expected of cryptocurrency platforms, including:

- Two-factor authentication (2FA)

- Cold storage for most assets

- Regular security audits

When considering Deepcoin’s safety, you should always follow recommended security practices:

- Use strong, unique passwords

- Enable all available security features

- Consider using external wallets for long-term storage

The legality of using Deepcoin varies by country. You should check your local regulations before signing up, especially if you reside in a country with strict cryptocurrency laws.

Remember that cryptocurrency exchanges operate in a rapidly evolving regulatory environment. What’s permitted today might change tomorrow, so staying informed about regulatory changes in your region is crucial.

Frequently Asked Questions

Traders looking to choose between BitMart and Deepcoin need answers to specific questions about fees, security, and trading options. Here are the most common questions comparing these two cryptocurrency exchanges.

What are the differences in trading fees between BitMart and Deepcoin?

BitMart charges standard trading fees of 0.25% for makers and takers. They offer fee discounts when using their native BMX token.

Deepcoin generally provides lower fees starting at 0.2% for spot trading. Their fee structure includes additional discounts for high-volume traders and holders of their native DPC token.

For futures trading, Deepcoin’s fees are more competitive, which appeals to frequent derivatives traders.

How do BitMart and Deepcoin compare in terms of security measures?

BitMart employs two-factor authentication, cold storage for most funds, and regular security audits. They experienced a significant hack in 2021 but have since strengthened their security protocols.

Deepcoin utilizes multi-signature wallets and maintains the majority of user assets in cold storage. They emphasize their zero security incidents record.

Both platforms offer insurance funds to protect users, but Deepcoin’s security track record appears stronger in recent years.

Which platform offers a wider range of cryptocurrencies, BitMart or Deepcoin?

BitMart supports over 1,000 cryptocurrencies and more than 2,100 trading pairs. This extensive selection includes many smaller altcoins and new tokens.

Deepcoin offers approximately 600 cryptocurrencies and around 1,000 trading pairs. Their focus is more on established tokens and high-liquidity pairs.

If you’re looking for obscure altcoins or newly launched projects, BitMart typically lists these faster and more frequently.

Can you outline the unique features that distinguish BitMart from Deepcoin?

BitMart offers launchpad services for new token projects, allowing users early access to token sales. Their BMX token ecosystem includes staking options and voting rights for new listings.

Deepcoin stands out with its advanced derivatives trading platform, offering perpetual futures with up to 200x leverage. Their mobile app receives higher ratings for user experience and stability.

BitMart includes more fiat on-ramps with support for credit cards and bank transfers across more currencies than Deepcoin.

What are users saying about the customer support experience on BitMart versus Deepcoin?

BitMart users report mixed experiences with customer support. Response times can range from hours to days, with some users mentioning difficulty resolving account issues.

Deepcoin receives more positive feedback for their support, with 24/7 live chat in multiple languages. Users appreciate their faster response times.

Both platforms provide knowledge bases and FAQ sections, but Deepcoin’s documentation is generally considered more comprehensive and up-to-date.

How do the futures trading options vary between BitMart and Deepcoin?

BitMart offers futures trading with up to 125x leverage across about 100 contracts. Their interface is geared toward intermediate traders with standard features.

Deepcoin specializes in derivatives, providing up to 200x leverage on perpetual futures. They offer more advanced tools like cross-margin and isolated margin options.

Deepcoin’s futures platform includes more order types and risk management features. Their trading engine also processes orders faster with less slippage during volatile market conditions.

Deepcoin Vs Bitmart Conclusion: Why Not Use Both?

Both BitMart and Deepcoin offer strong features for crypto traders. BitMart scores higher overall with an 8.1 rating compared to Deepcoin, according to comparison data.

BitMart provides a smoother user experience, which is important if you’re new to crypto trading. The platform has improved its security significantly since a 2021 breach.

Deepcoin shines with its flexible trading markets suited for different types of traders. You won’t face restrictions when trading across these different markets.

Key Differences:

- BitMart: Better overall score, improved user interface

- Deepcoin: Flexible trading markets, fewer restrictions

You might find that each platform serves different needs in your trading strategy. BitMart could be your go-to for everyday trading due to its ease of use.

Deepcoin might become your platform of choice when you need specific trading options not available elsewhere.

Consider using both platforms strategically. This approach lets you take advantage of the best features each exchange offers while minimizing their individual drawbacks.

Your trading volume, preferred cryptocurrencies, and fee sensitivity should guide which platform you use for specific transactions. Many experienced traders maintain accounts on multiple exchanges for precisely this reason.

Compare Bitmart and Deepcoin with other significant exchanges