Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bitmart and Kraken are two popular platforms that offer different features for crypto investors. The main differences between these exchanges include fees, available cryptocurrencies, and platform services, with Kraken known for its security while Bitmart offers a wider range of altcoins.

Many users have started comparing these exchanges more closely in 2025. Kraken has built a reputation for reliable service and strong security measures, but some traders find that competitors like Bitmart provide better options for certain needs. Bitmart may appeal to you if you’re looking for access to more altcoins, while Kraken might be your choice if security and regulation are top priorities.

You should consider several factors when deciding between these exchanges. These include trading fees, deposit methods, cryptocurrency selection, and user interface. Kraken takes 15% from staking rewards, which affects your potential earnings. Understanding these differences will help you pick the platform that best matches your crypto trading goals.

Bitmart Vs Kraken: At A Glance Comparison

When choosing between Bitmart and Kraken for your crypto trading needs, several key differences stand out. Based on recent evaluations, Kraken generally receives higher ratings across multiple categories.

Fees

- Kraken: Known for low fees (around 0.15% for transactions)

- Bitmart: Typically higher fee structure

Platform Quality

- Kraken: More robust platform with better analytics tools

- Bitmart: Functional but less comprehensive features

Security

- Kraken: Industry-leading security measures

- Bitmart: Standard security protocols

User Experience

| Feature | Kraken | Bitmart |

|---|---|---|

| App Quality | Higher rated | Basic functionality |

| Website Interface | Intuitive | Less streamlined |

| Customer Support | More responsive | Variable response times |

Additional Features

- Kraken offers superior staking rewards

- Kraken provides better tools for experienced traders

- Bitmart may offer some coins not available on Kraken

You’ll find Kraken particularly suitable if you value lower fees and enhanced security. The platform stands out for serious traders who need advanced analytics.

For newer crypto users, Kraken’s more intuitive interface might be worth the slightly steeper learning curve.

Bitmart Vs Kraken: Trading Markets, Products & Leverage Offered

BitMart and Kraken offer different trading options to meet your crypto needs.

BitMart provides access to over 1,000 trading pairs, making it a good choice if you’re looking for variety. You can find many altcoins here that aren’t available on larger exchanges.

Kraken offers fewer cryptocurrencies but focuses on quality over quantity. It supports about 200+ cryptocurrencies and trading pairs.

Leverage Trading Options:

| Exchange | Max Leverage | Margin Trading | Futures |

|---|---|---|---|

| BitMart | Up to 100x | Yes | Yes |

| Kraken | Up to 5x | Yes | Yes |

Kraken is well-known for its security in leverage trading. They offer margin staking and OTC (over-the-counter) desks for larger trades.

BitMart’s higher leverage limits (up to 100x) might appeal to experienced traders who want more risk exposure. However, higher leverage comes with greater risk.

Additional Products:

- Kraken: Offers staking services, futures trading, and an OTC desk for large trades

- BitMart: Provides futures trading, launchpad for new tokens, and mining services

Kraken focuses on providing a robust platform for serious traders with advanced order types. Their margin trading features are designed for experienced users.

If you’re looking for exotic altcoins and higher leverage options, BitMart might be more suitable. For security-focused trading with reliable margin features, Kraken is the better choice.

Bitmart Vs Kraken: Supported Cryptocurrencies

When choosing between BitMart and Kraken, the variety of cryptocurrencies available on each platform is an important factor to consider.

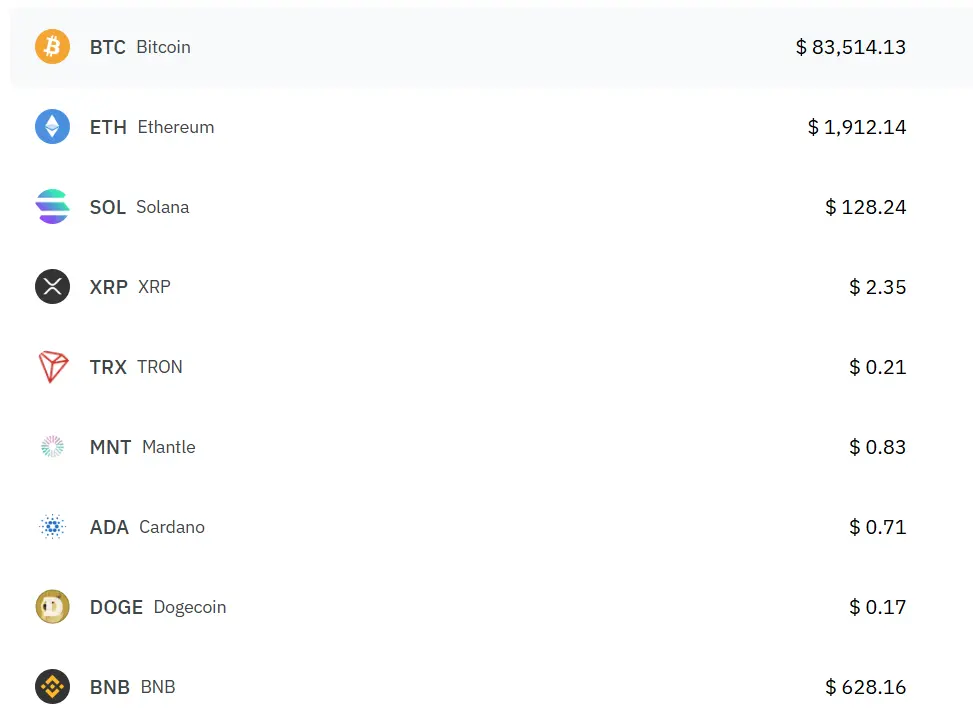

Kraken offers around 200+ cryptocurrencies for trading. This includes major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), as well as many altcoins and tokens.

BitMart provides access to over 1,000 cryptocurrencies and trading pairs. This makes BitMart a better option if you’re looking for more obscure or newer tokens that aren’t available on larger exchanges.

Cryptocurrency Availability Comparison:

| Feature | Kraken | BitMart |

|---|---|---|

| Total cryptocurrencies | ~200+ | ~1,000+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Newer tokens | Limited | Extensive |

| Staking options | Multiple | Limited |

Kraken tends to be more selective about which cryptocurrencies it lists. This can mean better quality control but fewer options for traders interested in emerging projects.

BitMart is known for listing many small-cap coins and new tokens shortly after their launch. This gives you early access to potential high-growth investments, but comes with increased risk.

If you primarily trade established cryptocurrencies, either platform will meet your needs. However, if you want to explore a wider range of altcoins and newer tokens, BitMart offers significantly more options.

Bitmart Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

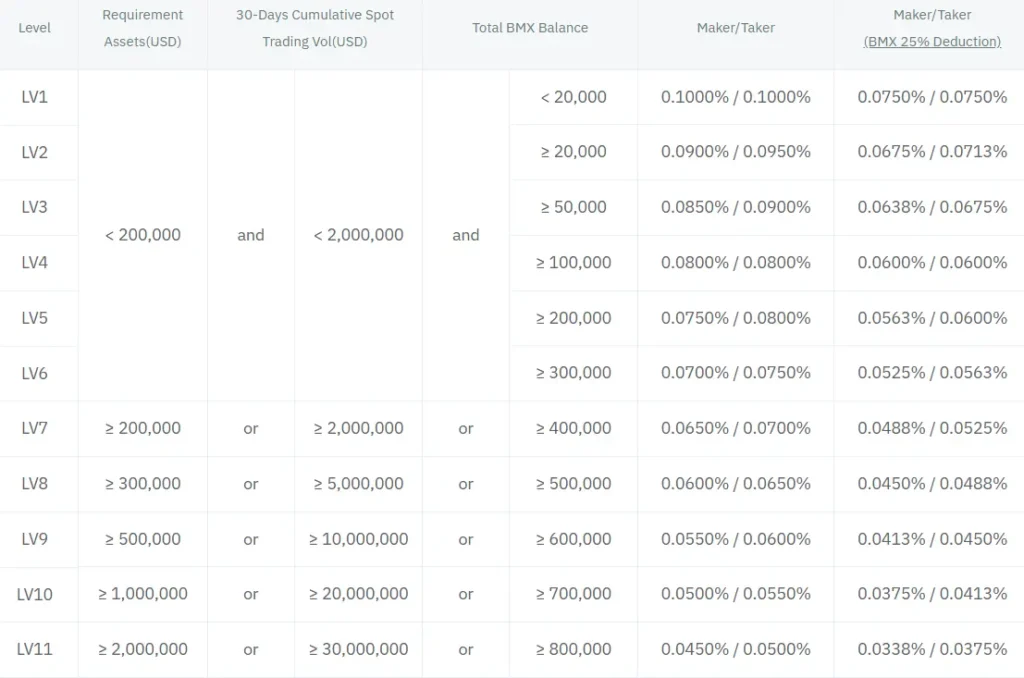

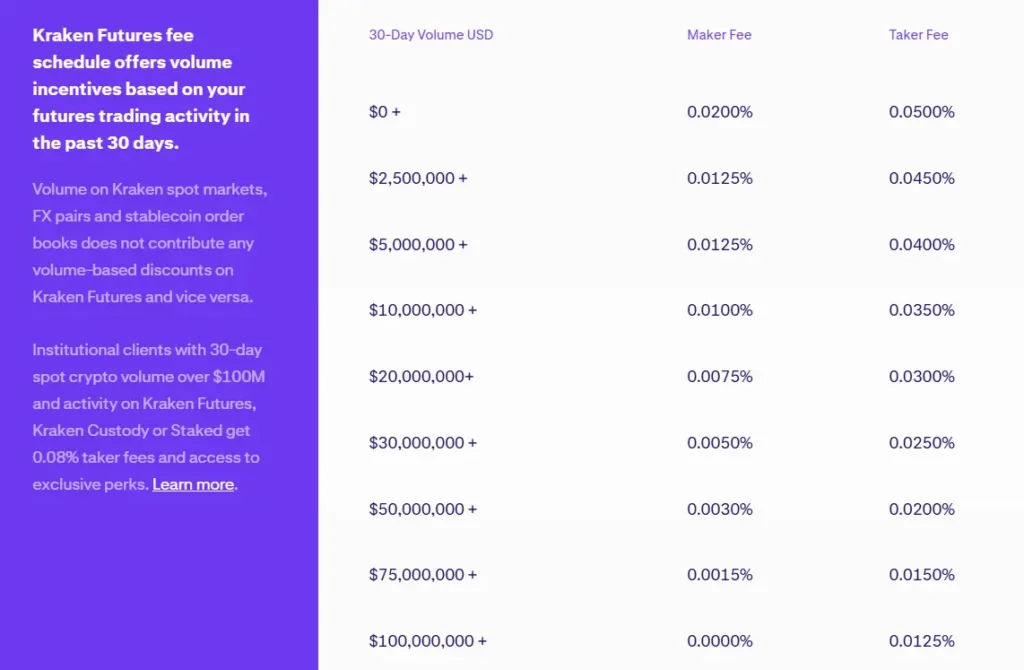

When choosing between BitMart and Kraken, understanding their fee structures can save you money in the long run.

Trading Fees

Kraken offers more competitive trading fees compared to BitMart. Based on recent data, Kraken’s trading fees are generally lower, making it more cost-effective for frequent traders.

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Kraken | Lower | Lower |

| BitMart | Higher | Higher |

Withdrawal Fees

For Bitcoin withdrawals, the fees differ significantly:

- Kraken: 0.0002 BTC

- BitMart: 0.0005 BTC

This means you’ll pay less than half the withdrawal fee when using Kraken compared to BitMart.

Deposit Methods

Both exchanges offer multiple deposit options, but Kraken typically provides more variety in fiat currency deposit methods.

Fee Benefits

Kraken stands out for users seeking low fees. Their fee structure is more transparent and generally more affordable across different transaction types.

If you trade frequently or make regular withdrawals, these fee differences can add up quickly. Kraken’s lower withdrawal fees make it particularly attractive if you plan to move your crypto off the exchange regularly.

Remember that fees may change over time, so it’s worth checking both platforms for their current rates before making your decision.

Bitmart Vs Kraken: Order Types

When trading cryptocurrency, the types of orders available can greatly impact your trading strategy. Both BitMart and Kraken offer different order options for their users.

BitMart Order Types:

- Market orders

- Limit orders

BitMart keeps things simple with just two basic order types. Market orders execute immediately at the current market price. Limit orders let you set a specific price at which you want to buy or sell.

Kraken Order Types:

- Market orders

- Limit orders

- Stop loss

- Take profit

- Stop limit

- Trailing stop

- Settlement

Kraken offers a much wider variety of order types. This gives you more control over your trading strategy and risk management.

With Kraken, you can use stop loss orders to limit potential losses. Take profit orders automatically sell when prices reach your target.

Stop limit orders combine features of stop and limit orders for more precise trading. Trailing stops adjust automatically as the market moves in your favor.

The difference in available order types makes Kraken better suited for advanced traders who need more sophisticated tools. If you’re new to trading, BitMart’s simpler approach might be easier to understand.

Your trading style and experience level should guide which platform’s order types will work best for you.

Bitmart Vs Kraken: KYC Requirements & KYC Limits

Both BitMart and Kraken require Know Your Customer (KYC) verification, but they have different approaches to this process.

BitMart offers two KYC levels: Starter and Advanced. Each level provides different withdrawal limits and trading privileges. The Starter level requires basic personal information, while the Advanced level needs more documentation.

KYC-verified BitMart users enjoy higher withdrawal limits compared to unverified accounts. This tiered system allows you to choose the verification level that suits your trading needs.

Kraken also implements KYC procedures and is regulated by FinCEN in the USA. It operates legally in 48 US states with proper verification. Kraken’s verification system is known for being thorough and compliant with regulations.

When comparing the two exchanges:

| Feature | BitMart | Kraken |

|---|---|---|

| KYC Levels | Starter and Advanced | Multiple tiers |

| Regulation | FinCEN registered | FinCEN regulated |

| US Availability | Available with KYC | Available in 48 states |

| Verification Process | Can be completed online | Can be completed online |

Your choice between these platforms may depend on how much personal information you’re willing to share and what withdrawal limits you need.

Remember that completing KYC is essential for accessing full features on both platforms, including higher withdrawal limits and additional trading options.

Bitmart Vs Kraken: Deposits & Withdrawal Options

When looking at crypto exchanges, how you can deposit funds and withdraw your assets matters a lot. Both BitMart and Kraken offer several options, but they differ in important ways.

Deposit Methods:

Kraken supports bank transfers, credit/debit cards, and cryptocurrency deposits. You can fund your account through ACH transfers, wire transfers, and various international payment systems.

BitMart allows crypto deposits and some fiat payment options. However, it has fewer fiat deposit methods compared to Kraken.

Withdrawal Options:

| Feature | Kraken | BitMart |

|---|---|---|

| Withdrawal Fees | Up to $60 | Up to 0.001 BTC |

| Fiat Withdrawals | Multiple options | Limited |

| Crypto Withdrawals | All supported coins | All supported coins |

Kraken’s withdrawal process is known for being secure but may take longer due to additional security measures. You’ll typically pay withdrawal fees that can reach up to $60 depending on the currency and method.

BitMart charges withdrawal fees that can go up to 0.001 BTC for crypto withdrawals. The exact fee varies based on which cryptocurrency you’re withdrawing.

For most users in the US and Europe, Kraken offers more convenient deposit and withdrawal options, especially for fiat currencies. This makes it easier to move money in and out of your account.

If you primarily trade crypto-to-crypto, both platforms offer sufficient options, but fee structures differ significantly.

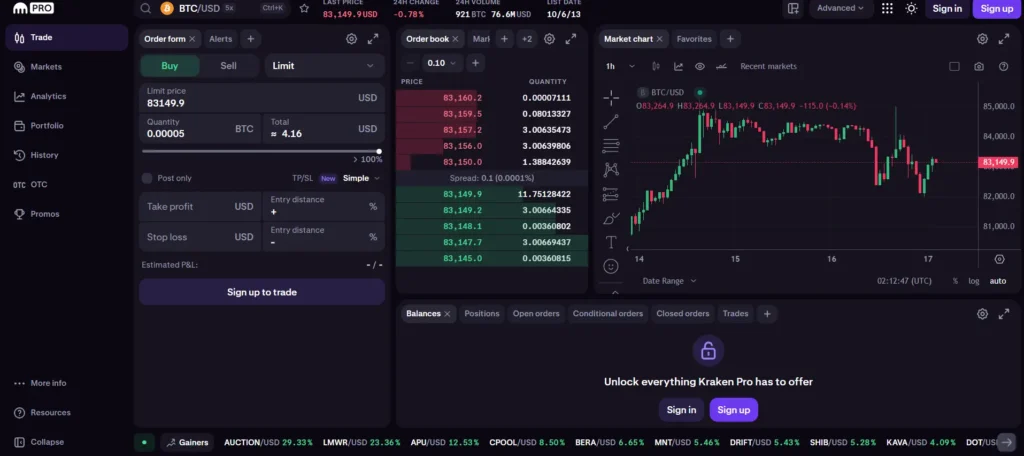

Bitmart Vs Kraken: Trading & Platform Experience Comparison

When choosing between Bitmart and Kraken, the trading experience differs significantly.

Kraken offers a more professional trading interface that appeals to experienced traders. You’ll find advanced charting tools and order types that help with complex trading strategies.

Bitmart provides a simpler, more accessible platform that beginners might find less intimidating. Its mobile app gets good reviews for ease of use.

Geographic Availability

- Bitmart: Available in 180 countries

- Kraken: Available in about 100 countries

Trading Fees Comparison

| Exchange | Maker Fee | Taker Fee | Special Features |

|---|---|---|---|

| Kraken | 0.16% | 0.26% | Volume discounts |

| Bitmart | 0.25% | 0.25% | BMX token discounts |

Kraken is known for lower fees, especially for high-volume traders. You can save money on trades if you plan to trade frequently.

Bitmart offers more cryptocurrencies to trade, with many smaller altcoins not found on Kraken. This gives you access to more emerging projects.

Kraken’s security features are industry-leading, with strong cold storage practices and a clean security record. You might feel more secure keeping larger amounts on Kraken.

Bitmart’s interface is more colorful and user-friendly, but Kraken’s platform provides more detailed market information and analysis tools.

Both platforms offer mobile apps, but user reviews suggest Kraken’s app is more reliable for executing trades during high market volatility.

Bitmart Vs Kraken: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for managing your risk.

Kraken uses a tiered liquidation system that gradually reduces your position before full liquidation. This gives you more time to respond when markets move against your position.

BitMart’s liquidation process tends to be more immediate. When your margin ratio reaches the liquidation threshold, the system may close your position without the same graduated approach that Kraken offers.

Kraken sends multiple notifications as your position approaches liquidation levels. You’ll receive warnings via email and platform alerts, giving you opportunities to add margin or reduce your position size.

BitMart also provides liquidation alerts, but users report they can be less frequent or timely than Kraken’s notification system.

Liquidation Fee Comparison:

| Exchange | Liquidation Fee |

|---|---|

| Kraken | 0.5% – 1% |

| BitMart | 1% – 2% |

Kraken’s lower liquidation fees can save you money if you experience a liquidation event.

Kraken offers partial liquidations on larger positions, allowing only a portion of your position to be liquidated to bring your account back to required margin levels.

BitMart typically performs full liquidations, closing your entire position when the liquidation threshold is reached.

Both platforms use insurance funds to protect against negative balances, but Kraken’s more established fund provides better protection for traders in volatile market conditions.

Bitmart Vs Kraken: Insurance

When comparing cryptocurrency exchanges, insurance protection is a critical factor to consider for your security. Both BitMart and Kraken offer different insurance options to protect your assets.

Kraken provides robust insurance coverage for digital assets held in their custody. They maintain a crime insurance policy that covers theft of digital assets from their hot wallets. However, this doesn’t cover cold storage funds or losses from unauthorized account access.

BitMart has historically had weaker insurance protections compared to Kraken. After experiencing a significant hack in December 2021, BitMart pledged to cover user losses, but their standard insurance policies aren’t as comprehensive as Kraken’s.

Kraken also maintains a proof of reserves system that allows you to verify that your funds are being held properly. This adds an extra layer of transparency that BitMart doesn’t currently offer.

For U.S. customers, it’s important to note that neither exchange offers FDIC insurance on USD deposits like traditional banks. This is typical of most crypto exchanges.

Here’s a quick comparison of their insurance features:

| Feature | Kraken | BitMart |

|---|---|---|

| Hot wallet insurance | ✓ | Limited |

| Cold storage protection | Strong security | Standard |

| Proof of reserves | ✓ | ✗ |

| History of reimbursing users | Strong track record | Mixed record |

Bitmart Vs Kraken: Customer Support

When choosing between crypto exchanges, customer support quality can make a big difference in your experience. Both Bitmart and Kraken offer support options, but they differ in quality and response times.

Kraken stands out with its highly-rated customer service team. Based on search results, Kraken invests significant resources into maintaining a 5-star support team. This focus on quality customer service helps users resolve issues quickly.

Bitmart’s customer support system includes standard channels like email tickets and chat support. However, users often report longer wait times compared to Kraken.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| Kraken | Faster (hours) | Yes |

| Bitmart | Slower (days) | Limited |

Kraken offers more support channels including:

- Live chat

- Phone support

- Email tickets

- Extensive help center

Bitmart’s support options are more limited, which can be frustrating when you need quick assistance with trading issues or account problems.

If you value responsive customer service, Kraken’s reputation for excellent support might be worth the slightly higher fees they charge compared to Bitmart. Many users report that Kraken’s support team is knowledgeable and can resolve complex problems effectively.

Bitmart Vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitmart and Kraken offer security features, but there are important differences.

Kraken stands out with its strong security record. Since launching in 2011, Kraken has never experienced a major security breach. This impressive track record makes it one of the most secure exchanges available.

Bitmart, founded in 2017, has faced security challenges. In December 2021, Bitmart suffered a significant hack resulting in approximately $200 million in losses. They have since improved their security measures.

Kraken’s Security Features:

- Two-factor authentication (2FA)

- Global Settings Lock

- SSL encryption

- 95% of assets stored in air-gapped cold storage

- Regular security audits

- Proof of reserves auditing

Bitmart’s Security Features:

- Two-factor authentication (2FA)

- Advanced encryption

- Cold and hot wallet systems

- Risk control systems

- Manual review processes

Kraken offers more robust account protection options. You can set up email verification for withdrawals and configure strict timeout settings for added security.

Bitmart has worked to rebuild trust by strengthening their security infrastructure after their breach. They now provide insurance coverage for some assets.

For regulatory compliance, Kraken maintains licenses in numerous jurisdictions and follows strict KYC procedures. Bitmart also implements KYC verification but operates in fewer regulated markets.

If security is your main concern, Kraken’s unblemished security history and comprehensive security features make it the stronger choice between these two exchanges.

Is Bitmart A Safe & Legal To Use?

Bitmart is a legitimate cryptocurrency exchange operating in over 180 countries with approximately nine million users. The platform is properly regulated, which provides a layer of security for your investments.

According to search results, Bitmart is not a scam. It follows legal requirements and allows users to trade with both cryptocurrencies and fiat currencies.

However, you should be aware that some users have reported issues with customer service. The search results indicate that customer support may be “pretty rough,” which could be frustrating if you encounter problems.

Bitmart implements standard security measures to protect user accounts and funds. Like most reputable exchanges, they likely use features such as two-factor authentication and cold storage for assets.

The exchange’s fee structure is described as “reasonable” compared to industry standards. This suggests you won’t face excessive costs when trading on the platform.

When comparing Bitmart to Kraken, search results indicate that Kraken scores higher in features and in-depth evaluations. This suggests Kraken might offer a more robust trading experience.

Before opening an account, you should:

- Research current user reviews

- Understand the fee structure

- Familiarize yourself with their security features

- Check if they support your preferred cryptocurrencies

Is Kraken A Safe & Legal To Use?

Kraken is generally considered a safe cryptocurrency exchange to use. Founded in 2013, it has established a solid reputation in the crypto industry over the years.

In terms of security, Kraken stores about 95% of its crypto funds in cold wallets, which are offline storage solutions that protect assets from online threats. This approach significantly reduces the risk of hacking.

Kraken has implemented strong security measures to protect user accounts and funds. These include:

- Two-factor authentication (2FA)

- Email confirmation for withdrawals

- Global settings lock

- SSL encryption

Regarding legality, Kraken operates as a regulated entity in many jurisdictions. However, it’s worth noting that in 2023, the SEC charged Kraken for operating as an unregistered securities broker, dealer, and clearing agency.

Despite this legal challenge, Kraken continues to serve traders worldwide. The exchange complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations in countries where it operates.

Kraken’s popularity stems partly from its low fees and user-friendly platform. It’s especially suitable for experienced traders who value advanced features.

When using Kraken, you should still follow basic security practices. Use strong passwords, enable all security features, and never share your account credentials with others.

Remember that while exchanges implement security measures, you’re ultimately responsible for your account safety.

Frequently Asked Questions

Investors often wonder about specific differences between Bitmart and Kraken before choosing where to trade cryptocurrencies. These common questions address key factors that impact trading experience, costs, and security.

What are the main differences in security features between Bitmart and Kraken?

Kraken offers superior security features with a strong track record of maintaining platform integrity since its founding. The exchange stores most funds in cold wallets, implements two-factor authentication, and conducts regular security audits.

Bitmart has worked to improve security after experiencing a hack in December 2021. The platform now offers two-factor authentication and some cold storage solutions, but doesn’t match Kraken’s comprehensive security infrastructure.

Kraken’s security rating consistently ranks higher in industry evaluations, making it the preferred choice for security-conscious traders.

How do Bitmart and Kraken compare in terms of transaction fees?

Kraken typically charges lower fees than Bitmart for most trading activities. On Kraken, maker-taker fees range from 0.16% to 0.26% for regular users, with discounts available as trading volume increases.

Bitmart’s fee structure tends to be higher, with trading fees generally starting around 0.25%. Both platforms charge network fees for cryptocurrency withdrawals, but Kraken’s overall fee structure is more transparent and competitive.

Volume discounts are more significant on Kraken, making it more cost-effective for frequent traders.

Which exchange offers a broader selection of cryptocurrencies, Bitmart or Kraken?

Bitmart typically lists more cryptocurrencies than Kraken, including many smaller altcoins and newer tokens. This makes Bitmart appealing if you’re looking to trade emerging or niche cryptocurrencies.

Kraken focuses on established cryptocurrencies with stronger market fundamentals. While offering fewer total coins, Kraken’s listed assets undergo more stringent evaluation processes before being added to the platform.

Your choice depends on whether you prioritize access to a wide variety of tokens or prefer trading established cryptocurrencies with higher liquidity.

How do user experiences differ when trading on Bitmart versus Kraken?

Kraken offers a more refined user experience with an intuitive interface, comprehensive educational resources, and responsive customer support. The platform appeals to both beginners and advanced traders with its range of tools.

Bitmart’s interface can be more challenging to navigate, especially for newcomers. Customer support response times are typically slower on Bitmart compared to Kraken.

Many users report preferring Kraken’s trading interface, mobile app functionality, and overall platform stability during high-volume trading periods.

What are the distinctive advantages of using Kraken over Bitmart for crypto trading?

Kraken provides institutional-grade trading tools, advanced order types, and margin trading options not fully available on Bitmart. The platform also offers superior staking rewards for supported cryptocurrencies.

Kraken’s regulatory compliance across multiple jurisdictions offers additional peace of mind. The exchange operates with licenses in various countries and maintains transparent banking relationships.

Kraken also provides better analytical tools and market insights that help inform trading decisions, particularly valuable for active traders.

Can users expect higher liquidity on Bitmart or Kraken?

Kraken consistently demonstrates higher liquidity for major cryptocurrencies like Bitcoin and Ethereum. This results in less price slippage and more stable trading conditions during market volatility.

For popular trading pairs, Kraken’s 24-hour trading volumes significantly exceed those on Bitmart. This liquidity difference becomes especially important when executing larger trades.

While Bitmart may offer comparable liquidity for certain altcoins not listed on Kraken, overall trading depth remains stronger on Kraken for most widely-traded cryptocurrencies.

Kraken Vs Bitmart Conclusion: Why Not Use Both?

Many traders actually use both Kraken and BitMart rather than choosing between them. This approach gives you access to the strengths of each platform.

Kraken offers superior security with its spotless record, making it ideal for cautious traders. It’s generally more beginner-friendly and has a strong reputation for reliability.

BitMart provides access to a wider range of cryptocurrencies and caters to both individuals and institutions needing a professional trading platform. Its features are designed for more experienced traders.

Using both exchanges allows you to:

- Trade the coins exclusive to each platform

- Take advantage of different fee structures when beneficial

- Reduce risk by not keeping all assets on a single exchange

- Use Kraken for its security and BitMart for its variety

The best strategy might be starting with Kraken if you’re new to crypto trading, then expanding to BitMart as you gain experience and want access to more trading pairs.

Remember to consider your specific needs when deciding how to use these platforms. Your trading volume, security concerns, and which cryptocurrencies you want to trade should guide your decision.

Both exchanges have their strengths, and using them strategically can enhance your overall trading experience.