Choosing the right cryptocurrency exchange can make a big difference in your trading experience. When it comes to BitMEX and Bybit, both platforms offer derivative trading options with their own unique features and fee structures. Both BitMEX and Bybit are popular choices for crypto derivatives trading, but they differ in their fee structures, available cryptocurrencies, and user interface.

These exchanges have evolved since their launches, with BitMEX having been around longer but Bybit gaining popularity for its user-friendly approach. As of 2025, traders continue to compare these platforms based on factors like trading fees, available crypto options, and overall trading experience.

Your choice between these two platforms will depend on your specific trading needs. Some traders prefer BitMEX for its established history, while others find Bybit’s interface more straightforward. This comparison will help you decide which platform aligns better with your cryptocurrency trading goals.

BitMEX vs Bybit: At A Glance Comparison

When choosing between BitMEX and Bybit, understanding their key differences helps you make the right decision for your trading needs.

Trading Fees

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| BitMEX | Lower | Higher |

| Bybit | Competitive | Straightforward |

- Available Cryptocurrencies: BitMEX offers a slightly wider selection with two more cryptocurrencies than Bybit. However, both platforms cover the major digital assets that most traders look for.

- User Experience: Bybit provides a more user-friendly interface that beginners find easier to navigate. BitMEX tends to cater to more experienced traders with its advanced features.

- Trading Features: Both exchanges offer derivatives trading, but they differ in execution. Bybit is known for faster execution speeds and less overload during high market volatility.

- Security: Each platform implements strong security measures to protect your funds. They use cold storage solutions and two-factor authentication to secure accounts.

- Mobile Trading: Bybit’s mobile app receives higher ratings for functionality and ease of use. BitMEX also offers mobile trading but with a slightly steeper learning curve.

- Customer Support: Bybit typically responds faster to user inquiries with multiple support channels. BitMEX provides solid support but may have longer response times during peak periods.

Many traders have started exploring other options like Bitget, which combines the strengths of both platforms with additional features.

BitMEX vs Bybit: Trading Markets, Products & Leverage Offered

BitMEX and Bybit both offer cryptocurrency derivative trading, but with some key differences in their available markets and leverage options.

BitMEX Trading Products:

- Bitcoin and cryptocurrency futures

- Perpetual swaps

- Leverage up to 100x

- $1 contract sizes (very cost-effective)

- Supports slightly more cryptocurrencies than Bybit

Bybit Trading Products:

- Perpetual contracts

- Futures trading

- USDT pairs

- Leverage up to 100x

- Straightforward fee structure

When trading on either platform, you can access popular cryptocurrencies like Bitcoin and Ethereum. BitMEX has a slight edge with two additional cryptocurrencies in its offerings.

The contract sizes on BitMEX start at just $1, making it accessible if you want to start small. Both platforms allow you to amplify your trading power with up to 100x leverage, though this comes with higher risk.

Bybit’s interface is often considered more user-friendly for beginners. The platform has a cleaner fee structure that many traders find easier to understand.

Also Read: What is Crypto options insurance?

Your trading style will determine which platform works better for you. If you prioritize having more cryptocurrency options, BitMEX might be your choice. If you prefer an easier-to-navigate fee structure, Bybit could be the better option.

BitMEX vs Bybit: Supported Cryptocurrencies

When choosing between BitMEX and Bybit, the variety of cryptocurrencies available for trading is an important factor to consider.

BitMEX offers slightly more cryptocurrencies than Bybit. BitMEX lists two more cryptocurrencies in their offerings compared to Bybit.

Both exchanges focus primarily on cryptocurrency derivatives trading rather than spot trading. This means you can trade contracts based on crypto prices without owning the actual assets.

BitMEX Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- XRP

- Bitcoin Cash (BCH)

- Plus additional altcoins

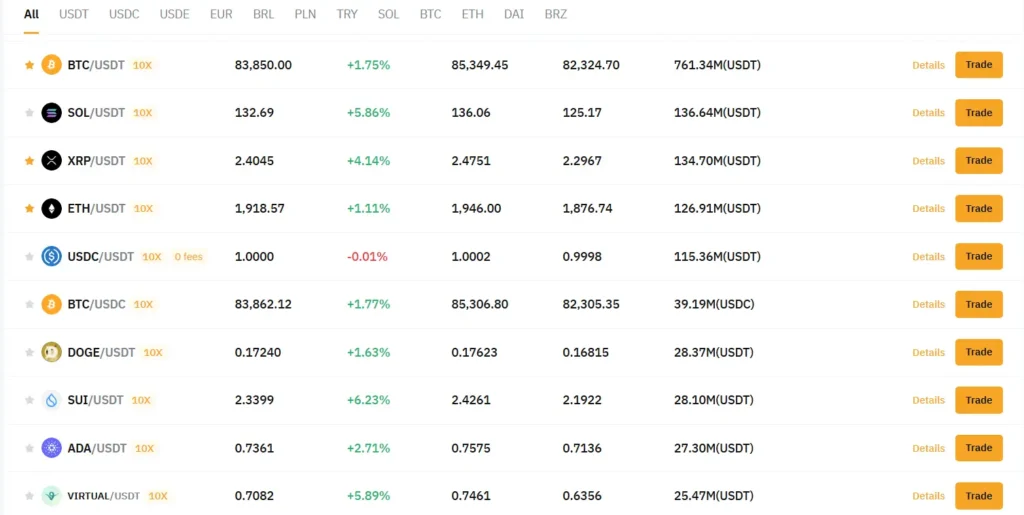

Bybit Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- EOS

- Plus other popular altcoins

While BitMEX may have a slight edge in the number of cryptocurrencies offered, Bybit is known for its user-friendly interface. This makes it potentially more accessible if you’re new to crypto derivatives trading.

Keep in mind that cryptocurrency offerings can change over time as exchanges expand their services. You should check each platform’s current listings before making your final decision.

The availability of specific trading pairs and contract types may differ between the platforms as well, so consider which cryptocurrencies are most important for your trading strategy.

BitMEX vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

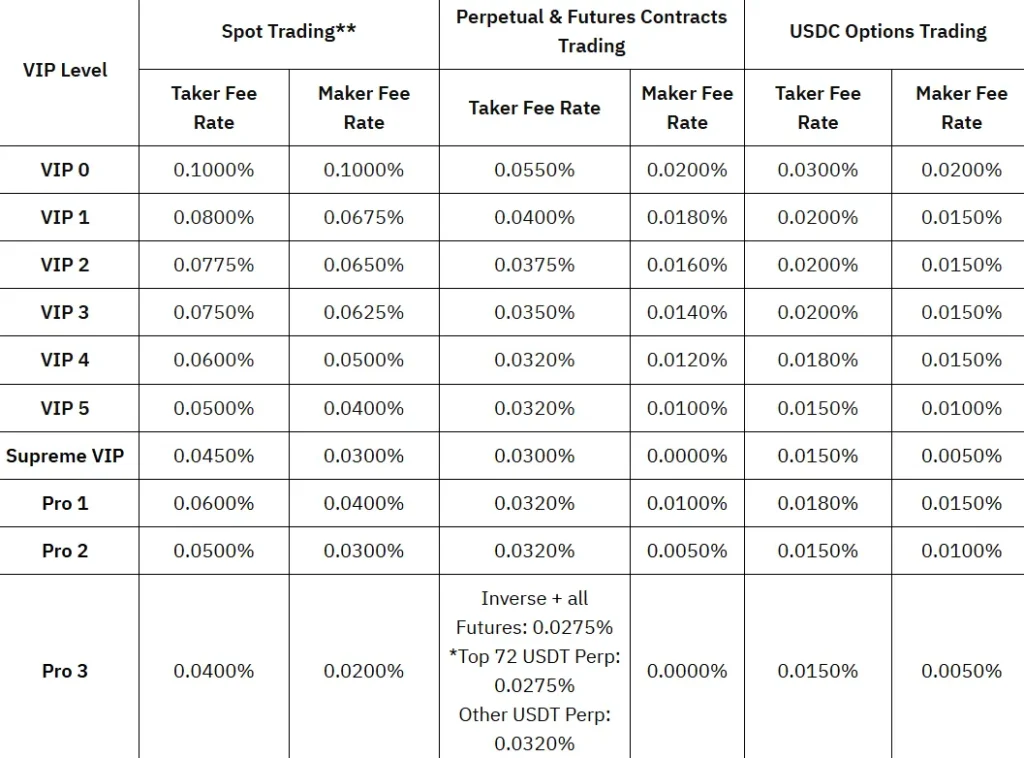

When comparing BitMEX and Bybit, fees play a crucial role in determining which platform might work better for your trading strategy.

Trading Fees

| Platform | Maker Fee | Taker Fee |

|---|---|---|

| Bybit | -0.025% | 0.075% |

| BitMEX | -0.025% | 0.075% |

Both exchanges offer identical maker and taker fees. The negative maker fee means you actually receive a rebate when adding liquidity to the market.

Withdrawal Fees

| Platform | Fee |

|---|---|

| Bybit | Up to $60 |

| BitMEX | 0.0001 BTC |

BitMEX keeps its withdrawal fee structure simple with a flat 0.0001 BTC charge. Bybit’s fees can vary and may go up to $60 depending on the cryptocurrency and network congestion.

When comparing payment methods, Bybit offers more options than BitMEX. This gives you greater flexibility when funding your account.

It’s worth noting that while the basic fee structures are similar, Bybit has been described as having a “cheaper and straightforward fee” system overall by some users.

You should also consider that fees might change based on your trading volume or VIP status on either platform. Higher volume traders typically enjoy lower fees.

BitMEX vs Bybit: Order Types

When trading on cryptocurrency exchanges, the available order types greatly impact your trading strategy. Both BitMEX and Bybit offer a variety of order types, but with some key differences.

BitMEX Order Types:

- Market orders

- Limit orders

- Stop orders

- Take profit orders

- Hidden orders

- Iceberg orders

- Trailing stop orders

Bybit Order Types:

- Market orders

- Limit orders

- Conditional orders (includes stop loss and take profit)

- Trailing stop orders

- Reduce-only orders

BitMEX provides more specialized order types like hidden and iceberg orders. These can be helpful if you’re trading large volumes and don’t want to reveal your full position to the market.

Bybit focuses on a more streamlined selection but excels with its conditional orders. The platform makes it easy to set up stop losses and take profits directly when opening positions.

Both exchanges support trailing stop orders, which automatically adjust your stop price as the market moves in your favor. This feature helps you lock in profits while giving your trade room to grow.

For beginners, Bybit’s order interface tends to be more intuitive with clearer labels and explanations. BitMEX’s interface assumes more prior trading knowledge.

You’ll find that both platforms allow you to use reduce-only orders to help manage risk by ensuring positions don’t flip from long to short (or vice versa) during volatile markets.

BitMEX vs Bybit: KYC Requirements & KYC Limits

When trading cryptocurrency, understanding the KYC (Know Your Customer) requirements is essential for accessing platform features. Both BitMEX and Bybit have different approaches to identity verification.

BitMEX has implemented stricter KYC policies in recent years. You’ll need to complete identity verification to access their trading platform fully. This typically involves submitting government ID and proof of address documents.

Bybit offers more flexibility with KYC requirements. Based on the search results, Bybit’s account opening process is “incredibly fast compared with most other crypto exchanges” since many KYC requirements are not needed.

BitMEX KYC Levels:

- Basic verification: Limited trading options

- Full verification: Access to all features and higher withdrawal limits

Bybit KYC Levels:

- Unverified: Basic trading functionality

- Verified: Higher withdrawal limits and additional features

For traders valuing privacy, Bybit may be the preferred option. However, remember that regulations change frequently in the crypto space.

Trading limits on both platforms are directly tied to your verification level. The more information you provide, the higher your trading and withdrawal limits become.

Your location may also impact KYC requirements, as both exchanges follow different regional regulations. Always check the current requirements for your specific country before signing up.

BitMEX vs Bybit: Deposits & Withdrawal Options

Both BitMEX and Bybit offer cryptocurrency deposit and withdrawal options, but they differ in important ways that might affect your trading experience.

BitMEX accepts Bitcoin (BTC) as its primary deposit option. The platform operates mainly on a crypto-to-crypto basis, meaning you’ll need to already own Bitcoin to start trading.

Bybit provides more flexibility with deposit options. You can fund your account with Bitcoin, Ethereum, XRP, EOS, and several other cryptocurrencies. This gives you more choices based on which coins you already hold.

Withdrawal Processing Times:

- BitMEX: Processes withdrawals once daily at 13:00 UTC

- Bybit: Processes withdrawals multiple times throughout the day

Withdrawal fees vary between the platforms. BitMEX charges a flat fee for Bitcoin withdrawals. Bybit’s fees depend on the cryptocurrency you’re withdrawing.

Both exchanges have minimum withdrawal amounts to protect against dust transactions. These minimums may change based on network conditions and cryptocurrency values.

Neither platform directly supports fiat deposits or withdrawals. To convert your profits to traditional currency, you’ll need to withdraw your crypto to another exchange that offers fiat off-ramps.

Security measures for withdrawals include two-factor authentication on both platforms. Bybit also implements withdrawal address whitelisting for added protection against unauthorized transfers.

BitMEX vs Bybit: Trading & Platform Experience Comparison

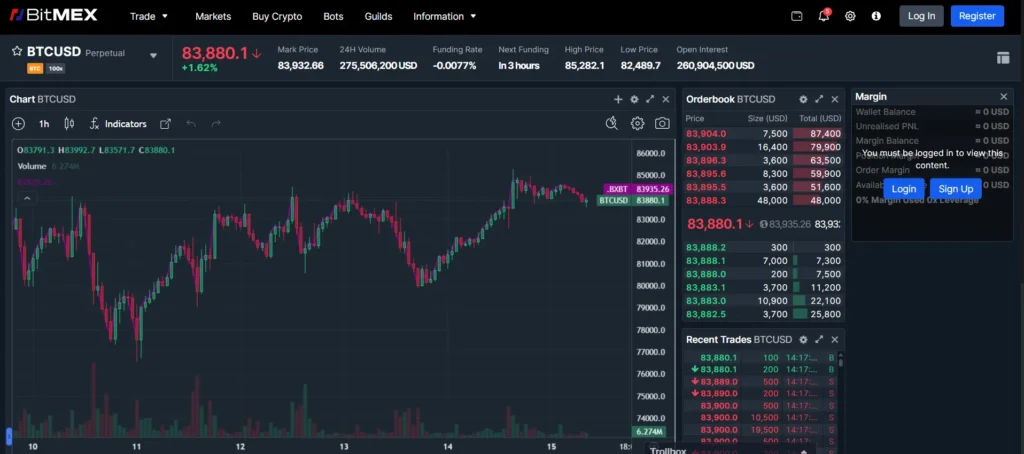

When comparing BitMEX and Bybit’s trading platforms, user experience is a key factor in choosing which exchange works better for you.

BitMEX offers a more traditional interface that experienced traders might appreciate. The platform provides deep liquidity and has been operating since 2014, giving it a well-established presence in the market.

Bybit, on the other hand, offers a more modern and intuitive interface that many new traders find easier to navigate. The platform loads faster and experiences fewer overloads during high market volatility.

Key Platform Differences:

- Speed: Bybit typically has faster order execution

- Downtime: BitMEX has experienced more outages during high volatility periods

- Mobile Experience: Bybit’s mobile app is generally rated higher for usability

Both platforms offer leverage trading, but Bybit tends to provide a more stable trading environment with fewer system overloads.

The trading tools available on each platform are comparable, including limit orders, stop-losses, and take-profit options. However, Bybit’s order matching engine processes orders more efficiently during peak trading times.

For beginners, Bybit’s cleaner interface and helpful guides make it easier to get started. BitMEX’s platform might feel overwhelming if you’re new to crypto derivatives trading.

Trade settlement is another difference – Bybit processes transactions faster, while BitMEX sometimes experiences delays during high activity periods.

BitMEX vs Bybit: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial. Liquidation happens when your position can’t meet the required maintenance margin.

BitMEX uses a sophisticated liquidation process that tries to protect traders. Their system attempts to avoid immediate liquidation by first increasing your maintenance margin requirements. This gives you a chance to add funds before your position is closed.

Bybit takes a different approach with its partial liquidation system. Instead of liquidating your entire position at once, Bybit may close portions of it gradually as your margin ratio decreases.

Key Differences:

| Feature | BitMEX | Bybit |

|---|---|---|

| Liquidation Approach | Progressive maintenance margin | Partial liquidation system |

| Warning System | Price alerts before liquidation | Notifications at different margin ratios |

| Liquidation Fund | Insurance fund to prevent socialized losses | Similar protection mechanism |

Both platforms use funding rates in their liquidation calculations, but they determine these rates differently. Bybit’s funding rate comes from the premium index (the difference between market price and contract price).

You’ll receive warnings as your position approaches liquidation on both platforms. However, Bybit’s interface tends to make these warnings more visible and easier to understand for newer traders.

Remember to set stop-losses and manage your position sizes carefully. This helps you avoid liquidations regardless of which platform you choose.

BitMEX vs Bybit: Insurance

When trading cryptocurrencies, protection against unexpected losses is crucial. Both BitMEX and Bybit offer insurance funds to safeguard traders.

BitMEX maintains an insurance fund that has grown substantially over the years. This fund helps prevent auto-deleveraging (ADL) when traders experience negative equity due to market volatility.

Bybit also provides an insurance fund, designed to protect users from bankruptcy and maintain platform stability. Their insurance mechanism aims to cover liquidation losses when market conditions are volatile.

The key difference between these platforms is how they handle insurance fund transparency. BitMEX publishes daily updates of their insurance fund size on their website, allowing traders to verify the platform’s financial health.

Bybit follows a similar approach to transparency but with different fund allocation strategies. They maintain separate insurance funds for different trading pairs.

Here’s a quick comparison:

| Feature | BitMEX | Bybit |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Transparency | Daily reports | Regular updates |

| Purpose | Prevent ADL | Cover liquidation losses |

| Fund Segregation | Single fund | Multiple funds by pairs |

You should check each platform’s current insurance fund size before trading. This information can help you assess the risk level of each exchange during extreme market conditions.

Neither exchange offers direct account insurance for individual traders like traditional brokerages might provide. The insurance funds primarily protect the platforms themselves from cascading liquidations.

BitMEX vs Bybit: Customer Support

When trading crypto, reliable customer support can make a big difference in your experience. Both BitMEX and Bybit offer support options, but they differ in availability and response times.

BitMEX provides customer support through email tickets and a help center with FAQs. Their response times typically range from 24-48 hours for most issues. They don’t offer live chat support, which can be frustrating when you need immediate help.

Bybit, on the other hand, offers more comprehensive customer support options. You can reach their team through 24/7 live chat, email, and social media channels. Their average response time is significantly faster, often within minutes for live chat and within 24 hours for email inquiries.

Both platforms provide knowledge bases and FAQs to help you solve common problems. Bybit’s resources tend to be more user-friendly and cover a wider range of topics.

Support Comparison

| Feature | BitMEX | Bybit |

|---|---|---|

| Live Chat | No | Yes (24/7) |

| Email Support | Yes | Yes |

| Response Time | 24-48 hours | Minutes to 24 hours |

| Languages Supported | English | Multiple languages |

| Help Center | Yes | Yes (more extensive) |

If you value quick responses and multiple contact methods, Bybit’s customer support system gives them a clear advantage over BitMEX.

BitMEX vs Bybit: Security Features

When trading cryptocurrencies, security should be your top priority. Both BitMEX and Bybit understand this concern and have implemented robust security measures.

BitMEX protects your assets using industry-standard two-factor authentication (2FA), which adds an extra layer of security to your login process. They also store the majority of user funds in cold wallets, keeping them offline and away from potential hackers.

Bybit matches these security features with their own 2FA system. They also utilize a multi-signature wallet system that requires multiple approvals before transactions can be processed.

Both exchanges perform regular security audits to identify and fix potential vulnerabilities. This proactive approach helps protect your funds and personal information.

Key Security Features Comparison:

| Feature | BitMEX | Bybit |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Multi-signature Wallets | Limited | ✓ |

| Regular Security Audits | ✓ | ✓ |

| Insurance Fund | ✓ | ✓ |

Bybit has gained popularity partly due to its user-friendly interface that doesn’t sacrifice security. Their platform makes it easier for you to enable and manage security features.

BitMEX has been operating longer and has weathered several major crypto market events, which speaks to their security infrastructure’s resilience.

Also Read: What are bitcoin options & how do they work?

Remember to always enable all available security features regardless of which platform you choose. Creating strong, unique passwords and using a separate authentication app rather than SMS verification adds significant protection to your account.

Is BitMEX A Safe & Legal To Use?

BitMEX operates in a gray area of regulation. While it continues to function as a cryptocurrency exchange, it lacks oversight from major financial authorities.

BitMEX has faced legal challenges in the past. In 2020, the U.S. Commodity Futures Trading Commission (CFTC) filed charges against BitMEX for operating an unregistered trading platform.

Safety on BitMEX depends on several factors. The platform has implemented security measures like two-factor authentication and cold storage for funds.

According to the search results, BitMEX funds were not impacted during the recent Bybit hack. This suggests they maintain separate security systems.

BitMEX is generally considered better for experienced traders. Its interface and trading options can be complex for beginners.

Key Safety Features:

- Two-factor authentication (2FA)

- Cold storage for most cryptocurrency assets

- Insurance fund to prevent auto-deleveraging

Legal Considerations:

- Not regulated by major financial authorities

- Restricted in some countries including the US

- Requires KYC (Know Your Customer) verification

You should check if BitMEX is legal in your country before signing up. Many traders use VPNs to access the platform, but this may violate terms of service.

For maximum safety, never keep large amounts of cryptocurrency on any exchange long-term. Transfer funds to a personal wallet when not actively trading.

Is Bybit A Safe & Legal To Use?

Bybit is considered one of the most trusted unregulated offshore cryptocurrency exchanges. It has been operating since 2018 and has built a reputation for strong security measures.

However, Bybit is not legal to use in the United States. The exchange faces trading restrictions in the US because it has failed to comply with US regulations. This is important to know if you’re a US resident.

For users outside the US, Bybit implements several security features:

- Two-factor authentication (2FA)

- Cold storage for most funds

- Regular security audits

The platform has a good track record regarding security incidents. Unlike some exchanges, Bybit hasn’t experienced major hacks or breaches since its launch.

When considering safety, remember that all cryptocurrency trading involves risk. The cryptocurrency market is highly volatile, and trading on platforms like Bybit can lead to significant financial losses.

Before using Bybit, check if it’s legal in your country. Many regions have specific regulations about cryptocurrency exchanges. What’s legal in one country might be prohibited in another.

If you decide to use Bybit, start with small amounts and learn about the platform’s features. Use strong passwords and enable all security options available to protect your account.

Frequently Asked Questions

Traders often have specific questions about BitMEX and Bybit before choosing a platform. These questions cover fees, leverage options, country restrictions, security features, trading volumes, and available products.

What are the key differences in the fee structures between BitMEX and Bybit?

BitMEX uses a flat fee structure for both makers and takers. This means all traders pay the same rate regardless of trading strategy.

Bybit offers a different approach with varying fees for makers and takers. Makers typically receive better rates or even rebates, making Bybit potentially more cost-effective for high-volume traders who provide liquidity.

The fee difference can significantly impact profitability, especially for traders who execute many transactions.

How do the leverage options on BitMEX compare to those available on Bybit for traders?

Both platforms offer high leverage trading, but with different maximums and mechanics.

BitMEX provides leverage up to 100x on some contracts, allowing traders to amplify potential profits with smaller capital.

Bybit also offers up to 100x leverage on certain pairs, but many users report that Bybit’s leverage system feels more intuitive and user-friendly, especially for beginners.

The platforms differ in how they handle liquidations and margin requirements at different leverage levels.

Can users from the United States trade on BitMEX or Bybit, and what are the restrictions?

Neither BitMEX nor Bybit officially allows users from the United States to trade on their platforms.

Both exchanges implement geo-blocking measures and require KYC (Know Your Customer) verification that excludes US residents.

US traders attempting to access these platforms may face account closures and potential loss of funds if discovered using VPNs or other workarounds.

What security measures do BitMEX and Bybit implement to protect user assets and information?

Both exchanges prioritize security through cold storage solutions, keeping the majority of user funds offline.

BitMEX uses multi-signature wallets and requires email confirmations for withdrawals, adding extra layers of protection.

Bybit implements two-factor authentication, SSL encryption, and regular security audits to protect user accounts and data.

Neither platform has experienced major security breaches, though BitMEX has been operating longer in the market.

How do the trading volumes and liquidity of BitMEX compare with Bybit?

BitMEX historically maintained higher trading volumes as one of the first major derivatives exchanges in crypto.

Bybit has been gaining significant market share and liquidity since its launch, with some pairs now showing comparable depth to BitMEX.

Liquidity affects slippage and execution speed, with both platforms now offering sufficient depth for most retail traders.

Trading volumes fluctuate based on market conditions, but both exchanges maintain enough liquidity for smooth trading experiences.

What variety of derivatives products do BitMEX and Bybit offer to their users?

BitMEX focuses primarily on perpetual swaps and futures contracts for Bitcoin and other major cryptocurrencies.

Bybit offers a similar range of perpetual contracts but has expanded more aggressively into additional trading products like spot trading and USDT-settled contracts.

Both platforms allow traders to go long or short on various cryptocurrencies with leverage.

Bybit appears to update its product offerings more frequently, adding new trading pairs and contract types at a faster pace than BitMEX.

Bybit vs BitMEX Conclusion: Why Not Use Both?

When deciding between Bybit and BitMEX, you don’t necessarily have to choose just one. Each platform has unique strengths that might benefit your trading strategy.

Bybit generally offers a more user-friendly interface and trading experience. Many traders find its platform easier to navigate, especially if you’re newer to crypto derivatives trading.

BitMEX, as the older platform, has established credibility in the market but comes with a steeper learning curve. Its advanced features appeal to experienced traders who need sophisticated tools.

Key considerations for using both:

| Feature | Bybit | BitMEX |

|---|---|---|

| User Experience | More intuitive | More technical |

| Security | Cold storage, 2FA | Strong security protocols |

| Fee Structure | Generally competitive | Higher for some transactions |

| Trading Tools | Modern, accessible | Advanced, comprehensive |

Using both platforms allows you to leverage their different strengths. You might prefer Bybit for its smoother experience while using BitMEX for specific advanced trading strategies.

Remember to consider your personal trading needs. If you’re just starting out, you might focus more on Bybit before expanding to BitMEX as your skills develop.

Diversifying across platforms can also reduce your risk exposure. Having accounts on multiple exchanges gives you flexibility if one platform experiences downtime or technical issues.

Compare BitMEX and Bybit with other significant exchanges