If you’re looking to trade cryptocurrencies, choosing the right exchange is crucial. BitMEX and Kraken are two popular platforms with different strengths and target audiences. While both offer crypto trading services, they cater to different types of traders.

Kraken offers a more comprehensive suite of services than BitMEX, including spot trading, futures, custody, staking, and OTC trading options. This broader range of features makes Kraken appealing if you want a one-stop platform for various crypto activities.

BitMEX specializes in derivatives trading with high leverage options, while Kraken provides a more balanced approach suitable for both beginners and experienced traders. Your choice between these exchanges will depend on your trading goals, experience level, and the specific features you value most in a crypto exchange.

BitMEX Vs Kraken: At A Glance Comparison

When choosing between BitMEX and Kraken for your cryptocurrency trading needs, understanding their key differences can help you make an informed decision.

Based on user reviews and comparison data, Kraken generally receives higher scores for usability and overall features compared to BitMEX.

Ease of Use

- Kraken: More user-friendly interface, easier to set up and navigate

- BitMEX: Steeper learning curve, more complex interface

Features Comparison

| Feature | Kraken | BitMEX |

|---|---|---|

| User Ratings | Higher overall | Lower overall |

| Setup Process | Simpler | More complex |

| Administration | Easier | More technical |

| Business Relations | Preferred by users | Less favorable |

Kraken offers a more straightforward experience for both beginners and experienced traders. The platform’s intuitive design makes it easier to execute trades and manage your portfolio.

BitMEX specializes more in derivatives trading, which might appeal to advanced traders looking for specific trading options. However, this specialization comes with added complexity.

When considering which exchange to use, your trading experience level should play a significant role in your decision. Beginners might find Kraken’s interface more approachable.

Also Read: Crypto Options Scalping vs. Swing Trading

Price comparisons between the two platforms vary based on the specific cryptocurrencies and transaction types, so you’ll want to check current rates for your preferred trading pairs.

BitMEX Vs Kraken: Trading Markets, Products & Leverage Offered

Both BitMEX and Kraken offer crypto trading services, but with notable differences in their markets and products.

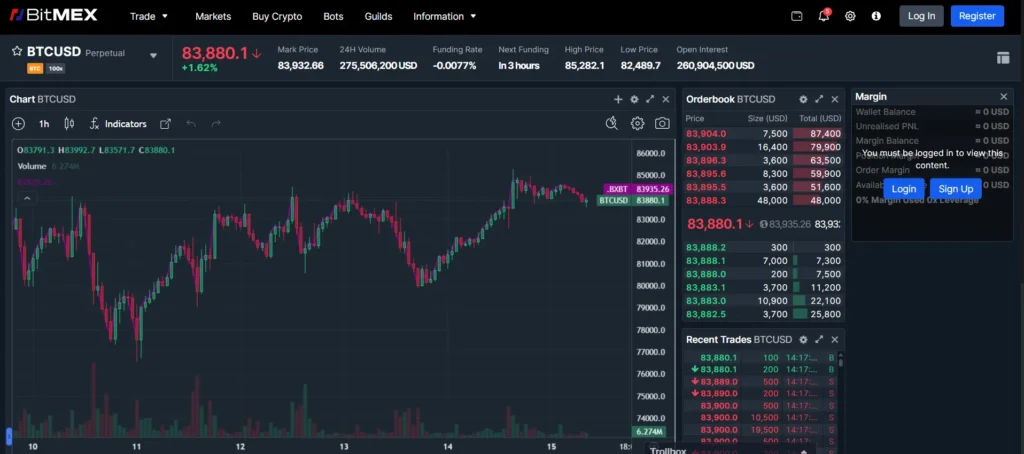

BitMEX specializes in derivatives trading and is known for high leverage options. You can trade with up to 100x leverage on BitMEX, making it attractive for experienced traders looking for amplified positions.

Kraken provides a more diverse range of services. You get access to spot trading, futures, margin trading, and staking options all in one platform.

The trading products available on each platform differ significantly:

| Feature | BitMEX | Kraken |

|---|---|---|

| Spot Trading | Limited | Extensive |

| Futures | Yes | Yes |

| Options | Yes | Limited |

| Margin Trading | Yes | Yes |

| Leverage | Up to 100x | Lower maximums |

| Staking | No | Yes |

Kraken’s product suite is more comprehensive for everyday traders. You can use it for basic buying and selling as well as more advanced trading strategies.

BitMEX focuses primarily on derivatives and leveraged trading. This specialized approach appeals to traders who want to take larger positions with less capital.

When choosing between these exchanges, consider your trading goals. If you’re looking for high-leverage trading, BitMEX might be your choice. For a well-rounded platform with multiple services, Kraken offers more versatility.

BitMEX Vs Kraken: Supported Cryptocurrencies

Kraken offers a much wider selection of cryptocurrencies compared to BitMEX. While BitMEX focuses primarily on Bitcoin and a limited selection of altcoins, Kraken supports over 100 different cryptocurrencies.

On Kraken, you can trade popular coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You’ll also find numerous altcoins, stablecoins, and DeFi tokens available for trading.

BitMEX has a more narrow focus, specializing in Bitcoin futures trading. While they do offer some altcoin futures and perpetual contracts, their selection is significantly smaller than what you’ll find on Kraken.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Cryptocurrencies | Notable Supported Coins |

|---|---|---|

| Kraken | 100+ | BTC, ETH, SOL, DOT, ADA, USDT, USDC, and many more |

| BitMEX | ~15 | Primarily BTC, with limited altcoin futures like ETH, XRP, LTC |

If you’re looking for variety in your cryptocurrency portfolio, Kraken is clearly the better choice. Their extensive range gives you more flexibility to diversify your investments.

BitMEX might be sufficient if you’re mainly interested in Bitcoin trading with high leverage. However, for those seeking a broader range of crypto assets, Kraken provides significantly more options.

BitMEX Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing BitMEX and Kraken, fees are a crucial factor that can significantly impact your trading profits. Let’s examine how these two exchanges stack up in terms of trading, deposit, and withdrawal fees.

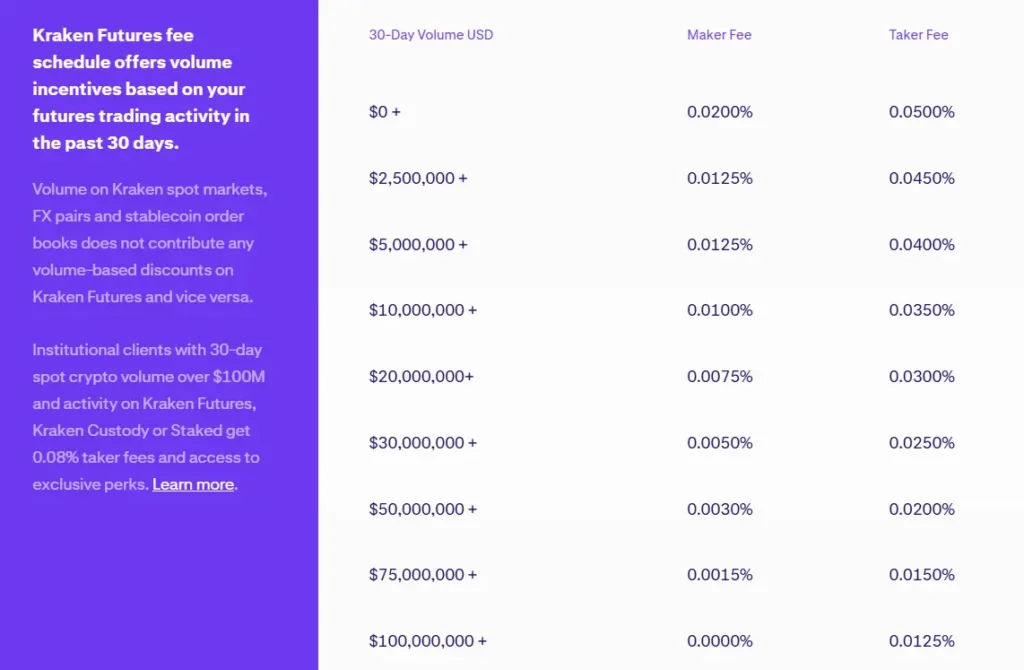

Kraken offers competitive trading fees of up to 0.40%, which is lower than many other exchanges. BitMEX, on the other hand, charges up to 0.075% for trading fees, making it potentially more cost-effective for frequent traders.

For deposits, both platforms have user-friendly policies. BitMEX offers free USDT and BTC deposits, while Kraken doesn’t charge for crypto deposits either.

Withdrawal Fee Comparison:

| Exchange | Withdrawal Fee |

|---|---|

| BitMEX | Up to 0.20% (fixed amount) |

| Kraken | No BTC withdrawal fees |

Kraken stands out with its no-fee Bitcoin withdrawals, which can save you money when moving your assets off the exchange. BitMEX charges a fixed amount that can reach up to 0.20% of your withdrawal.

It’s worth noting that Kraken has an Advance Withdrawal fund that allows immediate bitcoin withdrawals up to 2 XBT. This feature adds convenience when you need quick access to your funds.

The minimum deposit amount on Kraken is 1000 EUR/GBP/PLN/USD, which might be a consideration if you’re starting with a smaller investment.

Your trading volume and frequency will determine which fee structure works better for you. High-volume traders might benefit more from BitMEX’s lower trading fees, while those who withdraw often may prefer Kraken’s free withdrawal policy.

BitMEX Vs Kraken: Order Types

When trading on crypto exchanges, the types of orders available can greatly impact your trading strategy. Both BitMEX and Kraken offer various order types, but they differ in some important ways.

BitMEX provides several specialized order types for futures trading. You can place standard market and limit orders, but BitMEX also offers stop-limit, take-profit, and trailing stop orders.

One of BitMEX’s unique features is the post-only limit order. This ensures your order adds liquidity rather than taking it, which can help reduce fees.

Kraken also offers market and limit orders as basic options. Beyond these, you can use stop-loss and take-profit orders to manage risk in your trading.

Kraken has settlement orders for futures and conditional close orders that execute only after another order is filled. This gives you more control over complex trading strategies.

Order Types Comparison:

| Order Type | BitMEX | Kraken |

|---|---|---|

| Market Orders | ✅ | ✅ |

| Limit Orders | ✅ | ✅ |

| Stop-Loss | ✅ | ✅ |

| Take-Profit | ✅ | ✅ |

| Trailing Stop | ✅ | ❌ |

| Post-Only | ✅ | ✅ |

| Settlement | ❌ | ✅ |

| Conditional Close | ❌ | ✅ |

For beginners, Kraken’s order interface might be more user-friendly. BitMEX tends to cater to more experienced traders with its advanced options.

Your trading style should guide your choice. If you need specialized futures trading orders, BitMEX might work better for you. For a balance of simplicity and functionality, Kraken could be the better option.

BitMEX Vs Kraken: KYC Requirements & KYC Limits

BitMEX and Kraken have different approaches to KYC (Know Your Customer) requirements. These differences may affect which platform you choose based on your privacy preferences and withdrawal needs.

BitMEX KYC Policy:

- Does not require KYC verification for basic trading

- Email verification is required for account setup

- KYC is only required for high-value withdrawals

- You can trade more anonymously compared to many exchanges

This makes BitMEX appealing if you value privacy, but be aware that regulations are changing rapidly in the crypto space.

Kraken KYC Policy:

- Requires full KYC verification for all users

- Multiple verification tiers exist that determine withdrawal limits

- More stringent compliance with international regulations

- You need to provide ID documents before trading

Kraken’s strict KYC approach makes it more regulated and potentially safer for your funds, but with less privacy.

Withdrawal Limits Comparison:

| Exchange | KYC Required | Withdrawal Limits |

|---|---|---|

| BitMEX | Only for high withdrawals | Higher limits without KYC |

| Kraken | For all accounts | Tiered based on verification level |

Your choice between these exchanges might depend on how important privacy is to you versus security and regulatory compliance. Kraken offers better security features but requires more personal information.

BitMEX Vs Kraken: Deposits & Withdrawal Options

When trading cryptocurrencies, how you can deposit and withdraw funds matters a lot. BitMEX and Kraken have different approaches to handling this important aspect.

BitMEX keeps things simple with a crypto-only approach. You can only deposit and withdraw using cryptocurrencies, primarily Bitcoin. According to the search results, BitMEX charges no fees on deposits and withdrawals, making it cost-effective for crypto-to-crypto transactions.

Kraken offers more flexibility with both fiat and cryptocurrency options. You can fund your account using:

- Fiat currencies: USD, EUR, GBP, and others

- Cryptocurrencies: Bitcoin, Ethereum, and many altcoins

This makes Kraken more accessible if you’re starting with traditional currency. However, Kraken does charge varying fees for deposits and withdrawals depending on the method and currency used.

Processing times also differ between the exchanges. BitMEX typically processes withdrawals once per day, which might cause delays. Kraken often provides faster processing, especially for cryptocurrencies.

Security measures for withdrawals are strong on both platforms. Each uses verification steps to protect your funds during the withdrawal process.

Your choice between these exchanges may depend on whether you need fiat currency options. If you only trade crypto-to-crypto, BitMEX’s fee-free structure could save you money. If you need to use bank transfers or want more currency options, Kraken’s versatility might better serve your needs.

BitMEX Vs Kraken: Trading & Platform Experience Comparison

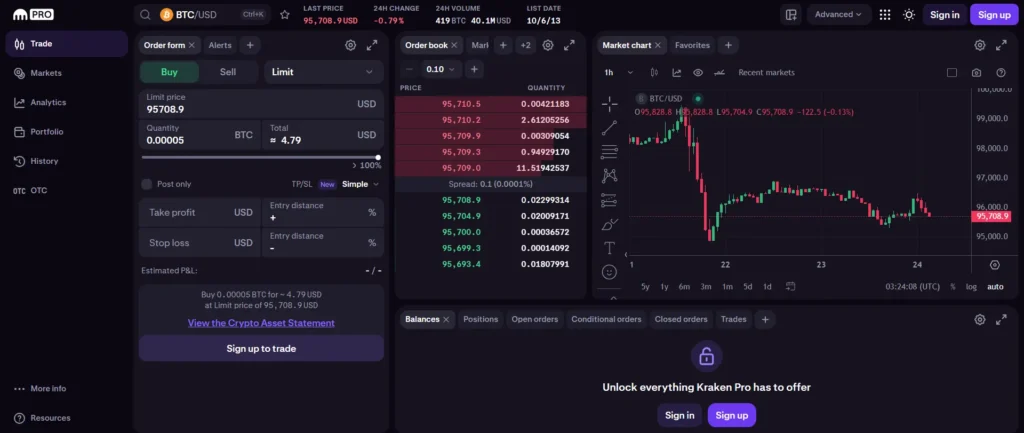

Kraken offers a more user-friendly trading experience compared to BitMEX. Many reviewers have found Kraken easier to set up, use, and administer based on current comparisons.

When using Kraken, you’ll encounter a cleaner interface that’s suitable for both beginners and advanced traders. The platform allows you to buy cryptocurrencies directly with fiat currencies, which BitMEX doesn’t support.

BitMEX specializes in cryptocurrency derivatives trading and focuses on futures contracts. It offers high leverage options but comes with a steeper learning curve.

User Interface Comparison:

- Kraken: Clean, intuitive navigation, suitable for all skill levels

- BitMEX: More complex, designed for experienced traders

Kraken provides more comprehensive security features and has a better track record in this area. You’ll find two-factor authentication, global settings lock, and other security measures to protect your investments.

Trading fees differ between the platforms. Kraken typically charges maker-taker fees ranging from 0.02% to 0.26% depending on your trading volume, while BitMEX fees vary by contract type.

Trading Options:

| Feature | Kraken | BitMEX |

|---|---|---|

| Spot Trading | Yes | No |

| Futures | Yes | Yes |

| Fiat Support | Yes | No |

| Leverage | Up to 5x | Up to 100x |

For customer support, Kraken generally receives better reviews with its 24/7 live chat and extensive help center.

BitMEX Vs Kraken: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial. Liquidation happens when your position can’t meet the margin requirements.

BitMEX Liquidation System:

- Uses an auto-deleveraging system

- Clearly displays position cost and liquidation price

- Follows an inverse futures model where profits and losses are in Bitcoin

- Liquidation occurs when your margin falls below maintenance threshold

Kraken Liquidation System:

- Uses a different liquidation model than BitMEX

- May be less transparent about liquidation prices according to some users

- Offers deep liquidity which can help prevent cascading liquidations

- Provides margin calls before full liquidation in some cases

The main difference is how each platform handles the liquidation process. BitMEX tends to be more explicit about your potential liquidation price. Kraken’s system might be less intuitive for beginners.

Your liquidation risk depends on several factors: position size, leverage amount, and market volatility. Higher leverage means higher risk of liquidation on both platforms.

Before trading on either platform, you should thoroughly understand their liquidation mechanisms. This knowledge will help you manage risk effectively and avoid unexpected losses during volatile market conditions.

BitMEX Vs Kraken: Insurance

When choosing a crypto exchange, insurance protection is a critical factor to consider. Both BitMEX and Kraken offer different approaches to security and insurance.

Kraken provides a more robust insurance framework. They maintain a crime insurance policy that covers digital assets held in their custody. This includes protection against theft, security breaches, and certain types of fraud.

In contrast, BitMEX has a less comprehensive insurance structure. They maintain a dedicated Insurance Fund to prevent auto-deleveraging of positions when markets become volatile. However, this isn’t the same as theft or hack protection.

Kraken stores most customer funds in cold storage (offline) wallets. This security measure keeps about 95% of deposits physically disconnected from the internet, reducing hack risks.

BitMEX also uses cold storage techniques but puts more emphasis on their multi-signature wallet system for protection rather than traditional insurance coverage.

If security is your top priority, Kraken’s approach to insurance and fund protection is generally considered more comprehensive. Their established insurance policies provide better coverage against various risks compared to BitMEX.

Neither exchange offers the same level of protection as traditional banks with government-backed deposit insurance. You should always consider keeping only trading amounts on these platforms and storing larger holdings in personal wallets.

BitMEX Vs Kraken: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both BitMEX and Kraken offer support options, but they differ in quality and availability.

Kraken is known for its responsive customer service. They provide 24/7 live chat support and a comprehensive help center with detailed guides. You can also reach their team through email or submit support tickets for more complex issues.

BitMEX offers more limited customer support options. Their main channel is email-based support, which may lead to longer response times. They do have a knowledge base, but it’s not as extensive as Kraken’s resources.

Response times also vary between the platforms. Kraken typically responds within minutes through live chat, while BitMEX may take several hours or even days to address your concerns.

Support Comparison Table:

| Feature | Kraken | BitMEX |

|---|---|---|

| 24/7 Support | Yes | No |

| Live Chat | Yes | No |

| Email Support | Yes | Yes |

| Phone Support | No | No |

| Help Center | Comprehensive | Basic |

| Response Time | Minutes to hours | Hours to days |

Many users report greater satisfaction with Kraken’s customer service. Their team is often praised for being knowledgeable and helpful when resolving issues.

If you’re new to crypto trading or value quick assistance, Kraken’s more robust support system might be the better choice for you.

BitMEX Vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both BitMEX and Kraken offer strong security features, but with notable differences.

Kraken has earned a strong reputation for security. The exchange has never experienced a major hack since its launch. Most of your funds are stored in cold wallets, disconnected from the internet.

BitMEX also boasts high security levels with no successful hacks reported. They implement a multi-signature wallet system that requires multiple approvals for withdrawals.

Both platforms offer two-factor authentication (2FA) to protect your account. This adds an extra verification step beyond just your password.

Key Security Features Compared:

| Feature | Kraken | BitMEX |

|---|---|---|

| Cold Storage | 95% of assets | Majority of funds |

| 2FA | Yes | Yes |

| API Security | Customizable permissions | Advanced settings |

| KYC Requirements | Comprehensive | Basic |

| Insurance | Limited coverage | Not specified |

Kraken implements stricter Know Your Customer (KYC) procedures, which some users find more secure. This helps prevent fraud and unauthorized account access.

BitMEX offers IP pinning and withdrawal address whitelisting to prevent unauthorized access. You can restrict which addresses can receive your funds.

Both exchanges provide email notifications for account activities like logins, withdrawals, and security setting changes. This helps you quickly spot suspicious activity.

Also Read: Crypto options market makers & their role in liquidity

You should enable all available security features regardless of which platform you choose. The strongest security measures only work when you use them properly.

Is BitMEX Safe & Legal To Use?

BitMEX has maintained a strong security record since 2014 with no reported losses due to hacks or intrusions. The exchange uses multi-party computation (MPC) technology to secure users’ assets.

For safety measures, BitMEX implements standard security features like two-factor authentication and cold storage for most funds. These practices help protect your cryptocurrencies from potential threats.

The legality of BitMEX depends on your location. The platform has faced regulatory challenges in some countries. Before using BitMEX, you should verify that it operates legally in your region.

In terms of trust, BitMEX is generally considered reliable for trading purposes. However, as with any crypto exchange, you shouldn’t store more funds than necessary for your active trades.

Key security features:

- Multi-party computation (MPC) for asset protection

- No history of security breaches since 2014

- Two-factor authentication

- Cold storage for majority of funds

BitMEX has worked to improve compliance with regulations in recent years. This includes implementing more thorough Know Your Customer (KYC) procedures to meet international standards.

Remember that while BitMEX appears secure, crypto exchanges always carry some risk. You should use strong passwords, enable all security features, and consider moving large holdings to private wallets when not actively trading.

Is Kraken Safe & Legal To Use?

Kraken is widely considered one of the most secure cryptocurrency exchanges available today. Operating since 2011, it has established a strong reputation for safety and reliability in the crypto industry.

Security on Kraken includes robust features like two-factor authentication (2FA), encrypted data storage, and regular security audits. The exchange keeps 95% of user funds in air-gapped cold storage to protect against online threats.

Regarding legality, Kraken operates with proper licensing in many jurisdictions. However, in 2023, the SEC charged Kraken for operating as an unregistered securities broker, dealer, and clearing agency in the United States.

For Canadians, Kraken is fully compliant with regulations and undergoes independent audits to verify proper fund management. This makes it a legal option for Canadian users.

Kraken has implemented strong Know Your Customer (KYC) protocols and anti-money laundering procedures to comply with regulatory requirements. These measures help ensure the platform stays on the right side of financial regulations.

Key safety aspects to consider:

- Established history (operating since 2011)

- Majority of funds in cold storage

- Strong security measures

- Regulatory compliance in many regions

- Independent audits

Despite the SEC charges, Kraken continues to operate and work through regulatory challenges as the cryptocurrency landscape evolves.

Frequently Asked Questions

Trading cryptocurrencies involves many important details that affect your experience and profits. BitMEX and Kraken have significant differences in their fees, security protocols, and available features that impact your trading decisions.

What are the differences in trading fees between BitMEX and Kraken?

BitMEX uses a maker-taker fee model with makers receiving a 0.01% rebate and takers paying 0.075% for most contracts. This structure rewards those who add liquidity to the market.

Kraken’s fees are typically higher, ranging from 0.16% to 0.26% for regular traders. These fees decrease as your trading volume increases.

For margin trading, BitMEX offers lower fees but Kraken provides more transparent fee structures. BitMEX also charges funding fees every 8 hours for perpetual contracts.

How do BitMEX and Kraken compare in terms of security measures?

Kraken has a stronger security record with no major hacks since its founding in 2011. They maintain a majority of funds in cold storage and offer two-factor authentication options.

BitMEX implements multi-signature wallets and keeps most funds offline. However, they faced regulatory issues in 2020 that raised some security concerns.

Both exchanges require KYC verification, but Kraken’s security protocols are generally considered more comprehensive with regular security audits and insurance coverage for funds.

Can US residents legally trade on BitMEX and Kraken platforms?

US residents cannot legally trade on BitMEX. The platform explicitly prohibits US users due to regulatory restrictions, and attempts to access it may violate terms of service.

Kraken is fully available to US residents in most states, with proper licensing to operate legally in the country. Some features may be limited in certain states due to local regulations.

US traders should note that Kraken requires additional verification steps for American users to comply with US regulations.

What variety of cryptocurrencies do BitMEX and Kraken offer to traders?

BitMEX focuses primarily on Bitcoin trading derivatives with limited altcoin options. Their main offerings are BTC futures and perpetual contracts with high leverage.

Kraken supports over 60 cryptocurrencies for spot trading including Bitcoin, Ethereum, and many popular altcoins. This makes it more suitable for diversified portfolios.

For those interested in variety, Kraken clearly offers more options, while BitMEX specializes in Bitcoin-focused derivative products for experienced traders.

How do the customer support experiences of BitMEX and Kraken differ?

Kraken offers 24/7 live chat support and a comprehensive help center with quick response times. Their support team is known for being knowledgeable and responsive to user issues.

BitMEX provides mainly ticket-based support with longer response times. While they offer decent documentation, their customer service is generally considered less accessible than Kraken’s.

Both platforms maintain active social media presence, but Kraken’s multi-channel support system tends to resolve issues more efficiently.

What are the margin trading options available on BitMEX and Kraken?

BitMEX specializes in high-leverage margin trading, offering up to 100x leverage on some Bitcoin contracts. This makes it popular among experienced traders seeking amplified positions.

Kraken provides more modest leverage options up to 5x for most users. While this is lower than BitMEX, it reduces risk for traders and may be better for beginners.

BitMEX focuses exclusively on derivative products, while Kraken offers both spot trading and margin trading options on the same platform, giving you more flexibility.

Kraken Vs BitMEX Conclusion: Why Not Use Both?

Both Kraken and BitMEX offer unique advantages that can benefit your crypto trading strategy. Using both platforms might be the optimal approach for many traders.

Kraken provides a more user-friendly interface and a wider range of cryptocurrencies. It also offers additional services like staking, custody, and OTC trading that BitMEX doesn’t have.

BitMEX shines with higher leverage options and more advanced trading features. Its platform tends to have higher liquidity, which is crucial for executing large trades efficiently.

Your trading needs might vary depending on your experience level and goals. Beginners might prefer Kraken’s simpler interface, while advanced traders could leverage BitMEX’s sophisticated tools.

Consider using Kraken for:

- Spot trading with a variety of cryptocurrencies

- Staking and earning passive income

- More straightforward margin trading with up to 5x leverage

Try BitMEX for:

- Advanced derivative trading

- Higher leverage options

- More complex trading strategies

The best approach might be to start with Kraken as you learn the ropes of crypto trading. As you gain experience, you can add BitMEX to your toolkit for more specialized trading activities.

Remember that both platforms have different fee structures and security features. It’s worth comparing these aspects based on your trading volume and security preferences.

Compare BitMEX and Kraken with other significant exchanges