When it comes to buying and selling cryptocurrency, choosing the right exchange platform is crucial for your success. Two popular options that often come up in comparison are Bitstamp and Coinbase. Both have established themselves as reliable crypto exchanges, but they differ in important ways that could impact your trading experience.

Coinbase charges nearly six times higher trading fees than Bitstamp, with Coinbase taking 1.49% per transaction while Bitstamp offers much lower rates. This significant difference in cost can add up quickly, especially if you trade frequently. Beyond fees, these platforms also differ in their target audiences, with Coinbase focusing primarily on US users and beginners, while Bitstamp caters to international and more professional traders.

The platforms also differ in their cryptocurrency offerings. Coinbase provides a wider selection of cryptocurrencies for trading, making it a good choice if you’re looking to diversify your portfolio beyond the major coins. Bitstamp takes a more conservative approach with fewer options, but both platforms have evolved significantly since their bitcoin-only beginnings.

Bitstamp Vs Coinbase: At A Glance Comparison

When choosing between Bitstamp and Coinbase, several key differences stand out. Here’s a quick comparison to help you decide which platform might work better for your crypto needs.

Trading Fees:

| Platform | Fee Structure |

|---|---|

| Bitstamp | Lower fees, especially for high-volume trading |

| Coinbase | Higher fees (approximately 1.49% per transaction) |

Bitstamp offers more competitive fees compared to Coinbase. According to search results, Coinbase fees can be nearly six times higher than Bitstamp.

Available Cryptocurrencies:

Coinbase supports more cryptocurrencies, making it better if you want access to a wider range of digital assets. Bitstamp focuses on established cryptocurrencies with a more limited selection.

User Experience:

Coinbase is known for its beginner-friendly interface and mobile app. Bitstamp offers a more traditional trading experience that might appeal to experienced traders.

Security Features:

Both exchanges prioritize security, but Coinbase implements more robust security measures. Your funds are generally well-protected on either platform.

Also read: Does crypto have options trading?

Verification Process:

Coinbase has stricter verification requirements. This might mean a longer setup time, but it adds an extra layer of security to your account.

Trading Volume:

Coinbase typically handles higher trading volumes, which can mean better liquidity for popular cryptocurrencies. This makes it easier to buy and sell quickly at market prices.

Bitstamp Vs Coinbase: Trading Markets, Products & Leverage Offered

Both Bitstamp and Coinbase offer a variety of cryptocurrencies for trading, but they differ in their offerings and features.

Coinbase provides access to over 200 cryptocurrencies, making it a more diverse platform for traders looking to explore different digital assets. You can trade popular coins like Bitcoin, Ethereum, and many altcoins on their platform.

Bitstamp supports fewer cryptocurrencies, focusing on established coins. This makes the platform less overwhelming for beginners who want to focus on mainstream options.

When it comes to products, Coinbase offers more variety. You can access:

- Standard spot trading

- Staking services

- NFT marketplace

- Coinbase Card for everyday purchases

- Educational resources with Coinbase Earn

Bitstamp’s product lineup is more streamlined, with:

- Spot trading

- API trading for advanced users

- Mobile trading app

- Institutional services

For leverage trading, neither platform offers significant options compared to specialized exchanges. Coinbase does not provide direct leverage trading for retail customers in most regions.

Bitstamp similarly doesn’t offer leverage trading as part of its core services, focusing instead on spot trading.

Both exchanges support multiple fiat currencies. Coinbase works with USD, EUR, GBP and others, while Bitstamp supports USD, EUR, and GBP.

Trading tools are more extensive on Coinbase with advanced charting options and portfolio management features. Bitstamp offers solid but more basic trading tools.

Bitstamp Vs Coinbase: Supported Cryptocurrencies

When choosing between Bitstamp and Coinbase, the range of available cryptocurrencies is an important factor to consider.

Coinbase currently offers a much wider selection with over 250 supported cryptocurrencies. This gives you access to both popular coins and emerging altcoins.

Bitstamp provides a more curated selection with approximately 80 cryptocurrencies available for trading. While smaller in number, Bitstamp focuses on established coins with proven track records.

Cryptocurrency Support Comparison:

| Exchange | Number of Cryptocurrencies | Notable Inclusions |

|---|---|---|

| Coinbase | 250+ | Bitcoin, Ethereum, Solana, Dogecoin, and many altcoins |

| Bitstamp | 80+ | Bitcoin, Ethereum, XRP, Litecoin, Bitcoin Cash |

If you’re looking to trade popular mainstream cryptocurrencies, both platforms will meet your needs. Major coins like Bitcoin and Ethereum are available on both exchanges.

For traders interested in newer or more obscure altcoins, Coinbase offers a clear advantage with its broader selection. You’ll have more options for diversifying your crypto portfolio.

Bitstamp’s more limited selection might actually benefit beginners who could feel overwhelmed by too many choices. Their focus on established cryptocurrencies helps reduce some of the complexity.

Both exchanges regularly add new cryptocurrencies to their platforms, so the available options continue to expand over time.

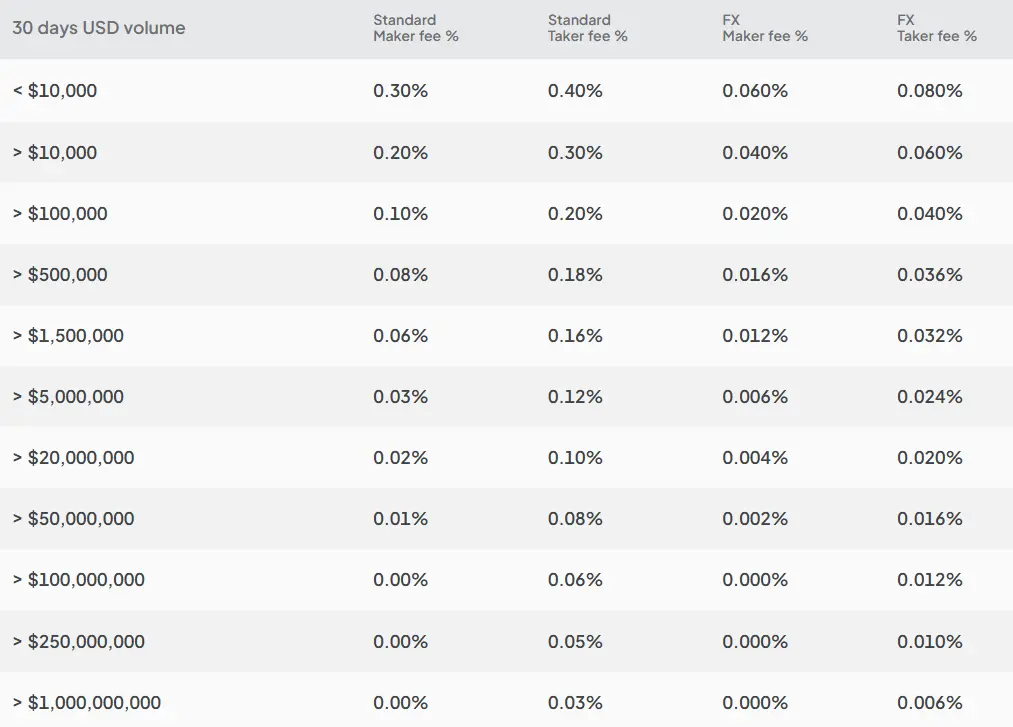

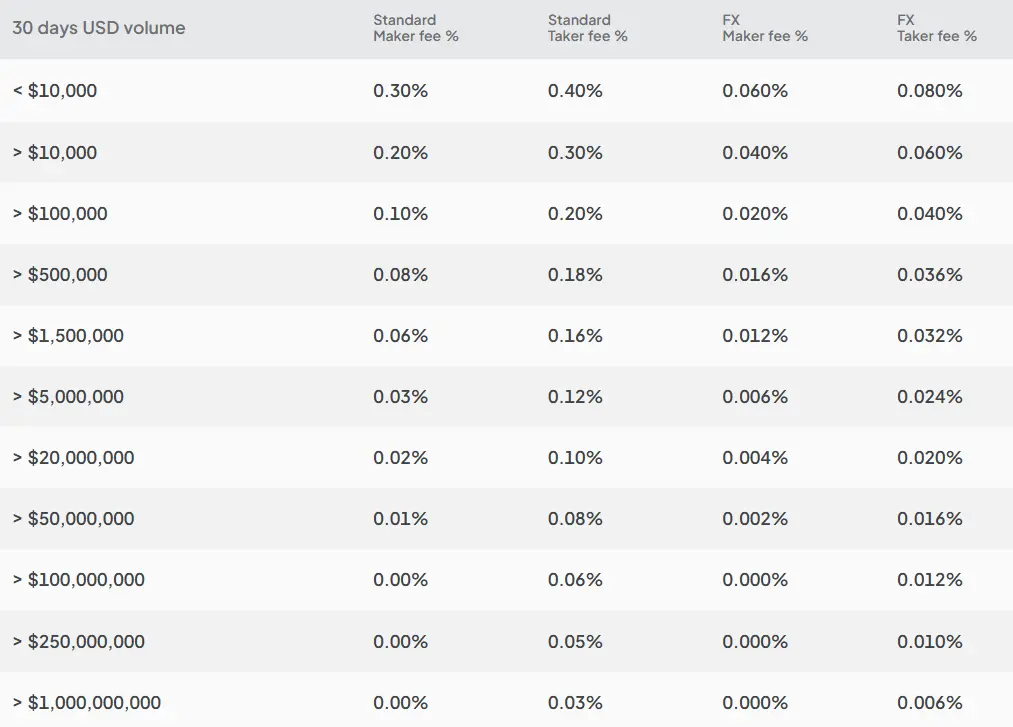

Bitstamp Vs Coinbase: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitstamp and Coinbase, fees play a crucial role in your decision. Each platform has different fee structures that can impact your trading costs.

Coinbase typically charges higher fees than Bitstamp. Their trading fees can go up to 0.40%, while Bitstamp’s fees reach up to 0.60% but are often lower for higher volume traders.

For regular traders, Bitstamp offers more competitive rates. They charge 0.25% for trades under $20,000, making them more affordable for medium-volume trading.

Trading Fee Comparison:

| Exchange | Standard Trading Fee |

|---|---|

| Bitstamp | Up to 0.60% (0.25% for trades under $20k) |

| Coinbase | Up to 0.40% |

Withdrawal fees also differ between the platforms. Coinbase can charge up to 3% for certain withdrawal methods, while Bitstamp’s withdrawal fees can reach up to $60 depending on the currency.

Deposit and Withdrawal:

- Coinbase offers more payment methods but at higher costs

- Bitstamp has fewer payment options but generally lower fees

- Both platforms adjust fees based on payment method and location

If you’re a beginner, you might find Coinbase’s interface worth the extra cost. However, if you’re making larger or more frequent trades, Bitstamp’s lower fee structure could save you money over time.

Bitstamp Vs Coinbase: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Bitstamp and Coinbase offer several order types, but there are some key differences.

Coinbase provides a more beginner-friendly approach with its basic order types. On Coinbase regular, you can place market orders (buying or selling immediately at the current price) and limit orders (setting a specific price at which you want to buy or sell).

If you use Coinbase Pro, you’ll have access to more advanced options including:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

Bitstamp offers a similar range of order types that will satisfy most traders:

- Instant orders (similar to market orders)

- Limit orders

- Market orders

- Stop orders

- Stop-limit orders

Both platforms support the core order types needed for basic and intermediate trading. However, Bitstamp’s interface might be slightly more intuitive for those who want to execute different order types quickly.

Neither platform offers extremely specialized order types that some advanced traders might look for, such as trailing stops or OCO (One-Cancels-the-Other) orders.

For most regular traders, both exchanges provide sufficient order type options. Your choice may come down to which interface you find easier to navigate rather than specific order type availability.

Bitstamp Vs Coinbase: KYC Requirements & KYC Limits

Both Bitstamp and Coinbase follow strict Know Your Customer (KYC) policies as part of their legal compliance requirements. These measures help prevent fraud and ensure platform security.

Coinbase KYC Process:

- Basic identity verification (name, email, phone)

- Photo ID verification (driver’s license or passport)

- Simple user interface makes the process beginner-friendly

- Verification usually completes within minutes to hours

Bitstamp KYC Process:

- More thorough verification requirements

- Requires front and back pictures of government ID

- May request additional documentation

- Verification can take longer to process (sometimes 1-2 business days)

Coinbase offers a more streamlined verification experience that’s easier for newcomers. Their interface guides you through each step with clear instructions.

Bitstamp’s verification is more detailed and can feel more challenging. You’ll need to provide more documentation upfront.

Both platforms implement these procedures to comply with regulations and protect users. The verification process limits what you can do on the platform until you complete certain KYC levels.

Neither exchange allows you to trade significant amounts without completing their verification processes. Once verified, your account limits will increase based on your verification level and trading history.

Bitstamp Vs Coinbase: Deposits & Withdrawal Options

When choosing between Bitstamp and Coinbase, deposit and withdrawal features play a key role in your decision.

Deposit Fees:

- Bitstamp: Charges at least $7.50 for USD deposits with a 0.05% fee

- Coinbase: Varies by payment method, but generally higher than Bitstamp

Withdrawal Fees:

- Bitstamp: 0.1% with a $25 minimum for bank transfers, no fees for crypto withdrawals

- Coinbase: Can be quite high, up to $60 in some cases or up to 3% depending on your withdrawal method

Bitstamp offers free cryptocurrency withdrawals, which gives it an edge for users who frequently move crypto off exchanges.

Deposit Methods:

| Method | Bitstamp | Coinbase |

|---|---|---|

| Bank Transfer | ✓ | ✓ |

| Credit/Debit Card | ✓ | ✓ |

| Crypto Deposits | ✓ | ✓ |

Coinbase provides unlimited crypto deposits but may impose limits on fiat deposits depending on your payment method and verification level.

For wire transfers specifically, Bitstamp tends to be more cost-effective despite its minimum fee structure. The 0.05% rate becomes advantageous for larger deposits.

If you make frequent small withdrawals, Coinbase’s high minimum fees might significantly impact your funds. For large transactions, Bitstamp’s percentage-based fee structure is often more economical.

Bitstamp Vs Coinbase: Trading & Platform Experience Comparison

When choosing between Bitstamp and Coinbase, the trading experience and platform design significantly impact your decision.

User Interface

Coinbase offers a more beginner-friendly interface with an intuitive design. Bitstamp’s platform is slightly more technical but still navigable for most users.

Trading Options

Bitstamp provides traditional trading pairs between cryptocurrencies. Coinbase uses a conversion service rather than direct pairs, which simplifies the process for beginners.

Advanced Features

- Bitstamp: Offers order books, charting tools

- Coinbase: Provides simpler buy/sell options on basic platform

- Coinbase Pro: Available for advanced traders who need more tools

Mobile Experience

Both exchanges offer mobile apps that let you trade on the go. Coinbase’s app is often praised for its clean design and ease of use.

Trading Fees

Bitstamp typically offers lower fees for high-volume traders compared to Coinbase. Your trading costs will decrease as your monthly volume increases on both platforms.

Supported Cryptocurrencies

Coinbase supports a wider range of cryptocurrencies than Bitstamp, giving you more trading options if you’re interested in altcoins.

Security Features

Both platforms offer two-factor authentication and cold storage for most funds. Your assets have similar protection levels on either exchange.

The platform you choose should match your trading style and experience level. Consider trying both interfaces before committing to large trades.

Bitstamp Vs Coinbase: Liquidation Mechanism

When trading on margin or futures platforms, understanding the liquidation process is crucial. Both Bitstamp and Coinbase have specific mechanisms to handle liquidations.

Coinbase uses a gradual liquidation process. When your account falls below maintenance margin requirements, you’ll receive a margin call notification. You typically have time to add funds before a forced liquidation occurs.

Coinbase’s liquidation threshold is generally set at 80% of your initial margin. This gives you a buffer zone before your positions are closed.

Also read: How do crypto options work?

Bitstamp employs a more direct approach to liquidations. Their system automatically closes positions when your account equity drops below the maintenance margin level, which is usually around 75% of required initial margin.

Neither platform uses auto-deleveraging (ADL) systems that are common on some other exchanges. This means your profitable positions won’t be used to balance others’ losses.

Both platforms charge liquidation fees:

| Exchange | Liquidation Fee |

|---|---|

| Coinbase | 1.0% – 1.5% |

| Bitstamp | 0.5% – 1.0% |

For risk management, Bitstamp offers stop-loss and take-profit orders that can help you avoid liquidations. Coinbase provides similar tools plus trailing stops for more advanced protection.

You should regularly monitor your positions on either platform. Both exchanges provide mobile alerts when your positions approach liquidation levels.

Bitstamp Vs Coinbase: Insurance

When choosing a crypto exchange, insurance protection is a critical factor to consider. Both Bitstamp and Coinbase offer insurance, but with some notable differences.

Coinbase provides robust insurance coverage for digital assets. They maintain a commercial crime policy that covers losses from theft, including cybersecurity breaches, up to $255 million. This coverage applies to assets held in their hot wallets (online storage).

For USD deposits, Coinbase offers FDIC insurance up to $250,000 per customer. This means your dollar funds are protected even if something happens to the exchange.

Bitstamp also takes insurance seriously but operates differently. They keep 98% of crypto assets in cold storage (offline) to minimize risk. Their insurance primarily covers the small percentage of assets kept in hot wallets.

Unlike Coinbase, Bitstamp doesn’t offer FDIC insurance for fiat currencies. Your cash deposits don’t have the same government-backed protection.

Insurance Comparison:

| Feature | Coinbase | Bitstamp |

|---|---|---|

| Crypto Insurance | Up to $255 million | Limited to hot wallet funds |

| Cold Storage | Yes | Yes (98% of assets) |

| FDIC Insurance | Yes (up to $250,000) | No |

| Crime Policy | Yes | Yes |

You should consider these insurance differences when deciding which platform better suits your security needs.

Bitstamp Vs Coinbase: Customer Support

When choosing between Bitstamp and Coinbase, customer support is a key factor to consider. Both exchanges offer support options, but they differ in quality and accessibility.

Coinbase Support Options:

- Email support

- Phone support (limited hours)

- Help center with extensive documentation

- Social media responses

- Live chat (for Coinbase Pro users)

Coinbase is known for its user-friendly approach, which extends to their support system. However, during high-volume periods, response times can stretch from hours to days.

Bitstamp Support Options:

- 24/7 email support

- Phone support

- Detailed knowledge base

- Ticket system for issue tracking

Bitstamp tends to provide more personalized support for traders. Their team has significant experience handling various cryptocurrency-related issues.

Response times vary for both platforms. Coinbase might be quicker for basic questions, while Bitstamp often handles complex trading problems more thoroughly.

You’ll find that verification and account issues are handled efficiently by both exchanges, though Bitstamp sometimes offers more direct paths to resolution for sophisticated trading concerns.

Neither platform is perfect – both can experience delays during market volatility or when cryptocurrency prices fluctuate dramatically.

The best choice depends on your needs. If you’re new to crypto, Coinbase’s intuitive help center might work better for you. If you’re an active trader requiring detailed assistance, Bitstamp’s support structure might be more valuable.

Bitstamp Vs Coinbase: Security Features

Both Bitstamp and Coinbase put security at the forefront of their operations. Each platform employs robust measures to protect your funds and personal information.

Coinbase Security Features:

- 98% of assets stored in cold storage

- Two-factor authentication (2FA)

- AES-256 encryption for digital wallets

- FDIC insurance on USD deposits (up to $250,000)

- Biometric fingerprint logins on mobile

- Insurance against cybersecurity breaches

Coinbase has never experienced a significant security breach since its founding in 2012. Their security team actively monitors for suspicious activity and potential threats.

Bitstamp Security Features:

- 95% of cryptocurrency in cold storage

- Multi-signature technology

- Two-factor authentication

- Account activity notifications

- Regular security audits

- Insurance policy covering digital assets

Bitstamp did face a security breach in 2015, losing approximately 19,000 bitcoins. However, they’ve since rebuilt their security infrastructure from the ground up.

Both exchanges offer address whitelisting, which prevents withdrawals to non-approved addresses. This adds an extra layer of security to your account.

When it comes to regulatory compliance, both platforms are well-established. Coinbase operates with licenses in over 40 countries, while Bitstamp holds licenses in the EU and US.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts.

Is Bitstamp Safe & Legal To Use?

Bitstamp is one of the oldest cryptocurrency exchanges, operating since 2011. It takes security seriously, especially after experiencing a hack in January 2015 when 19,000 BTC were stolen.

After this security breach, Bitstamp completely rebuilt its platform to strengthen security measures. No similar incidents have occurred since the rebuild, suggesting their improved security protocols are working effectively.

Bitstamp is fully regulated by multiple European financial authorities including:

- Financial Conduct Authority (FCA) in the UK

- Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg

- Malta Financial Services Authority (MFSA)

- Financial Services and Markets Authority (FSMA) in Belgium

This multi-country regulation makes Bitstamp a legal option for users in many regions worldwide. You can trade with confidence knowing the platform follows strict compliance standards.

Bitstamp implements industry-standard security features such as:

- Two-factor authentication (2FA)

- Cold storage for most customer funds

- Email notifications for account activity

- Withdrawal address whitelisting

The verification process on Bitstamp is known to be strict and thorough. While this can sometimes make account setup more time-consuming, it adds an extra layer of security and compliance.

For most users in Europe and the US, Bitstamp is both safe and legal to use, though always check your local regulations before trading.

Is Coinbase Safe & Legal To Use?

Coinbase is a legal cryptocurrency exchange based in the United States. As a US-based platform, Coinbase must follow all federal and state laws, giving it a strong regulatory foundation.

Safety is a top priority for Coinbase, which has built a good reputation for security. The exchange has a better safety record than many competitors in the crypto space.

Security Features:

- Two-factor authentication (2FA)

- Advanced encryption

- Insurance on digital assets

- Secure storage systems

Most of your funds on Coinbase are kept in cold storage, away from potential online threats. This approach significantly reduces the risk of hacking.

For small investors storing less than $1,000, Coinbase offers reasonable security if you use a strong password and enable two-factor authentication.

Coinbase holds various licenses across multiple countries including Canada, Italy, and Japan. These licenses categorize Coinbase as a Money Service Business (MSB) or Virtual Asset Service Provider (VASP).

The platform’s legal compliance creates a safer environment for users compared to unregulated exchanges. However, no exchange is completely risk-free.

Remember to practice good security habits when using Coinbase. Create strong passwords, enable all security features, and consider using a hardware wallet for large amounts of cryptocurrency.

Frequently Asked Questions

Investors considering these popular exchanges often have specific concerns about fees, security, and user experience. Here are answers to the most common questions about Bitstamp and Coinbase.

What are the differences in transaction fees between Bitstamp and Coinbase?

Bitstamp typically offers lower fees for high-volume traders compared to Coinbase. Their fee structure starts higher but decreases more significantly as your trading volume increases.

Coinbase is known for its higher fee structure, especially on the standard platform. Fees can range from 0.5% to 4.5% depending on payment method and transaction size.

For serious traders, Coinbase Pro and Bitstamp both offer more competitive maker-taker fee models. Bitstamp generally edges out Coinbase in this comparison for users trading large amounts regularly.

Can users from the United States trade on both Bitstamp and Coinbase?

Yes, both platforms are available to US users. Coinbase is US-based and fully regulated in all 50 states, making it a seamless option for American traders.

Bitstamp also accepts US customers and is registered with FinCEN. However, there may be certain state-specific restrictions with Bitstamp that don’t apply to Coinbase.

US users might find Coinbase’s compliance and integration with US banking systems more straightforward, while Bitstamp operates primarily as a European exchange that serves US markets.

How does the security of Bitstamp compare to that of Coinbase?

Coinbase has more robust security measures overall. They store 98% of customer funds in offline cold storage and offer insurance on digital assets held on the platform.

Bitstamp also employs cold storage for the majority of funds but has experienced a major hack in 2015. Since then, they’ve significantly upgraded their security protocols.

Both exchanges require two-factor authentication and use encryption for personal data. Coinbase has the added advantage of being a publicly traded company, which requires additional security compliance and transparency.

Which platform offers a wider variety of cryptocurrencies, Bitstamp or Coinbase?

Coinbase clearly wins in terms of cryptocurrency selection. They support over 100 different cryptocurrencies and regularly add new tokens.

Bitstamp offers a much more limited selection, focusing on established cryptocurrencies like Bitcoin, Ethereum, and a few major altcoins. They currently support around 60 cryptocurrencies.

If you’re looking to trade newer or less common tokens, Coinbase will likely be your better option due to its extensive and growing list of supported digital assets.

What are the advantages and disadvantages of using Bitstamp for cryptocurrency trading?

Advantages of Bitstamp include lower fees for high-volume trading, a strong reputation as one of Europe’s oldest exchanges, and excellent liquidity for major pairs. Their trading interface works well for more experienced traders.

The platform also offers fiat currency deposits in EUR and USD with relatively low fees compared to some competitors.

Disadvantages include a less intuitive interface for beginners, fewer cryptocurrencies available compared to Coinbase, and potentially longer verification times for new accounts. Customer support can also be slower during high-volume periods.

How do the user interfaces of Bitstamp and Coinbase differ in terms of ease of use?

Coinbase has a simpler, more intuitive interface designed specifically for beginners. The clean layout makes basic buying and selling straightforward even for first-time crypto users.

Bitstamp’s interface is more technical and geared toward experienced traders. It includes more detailed trading views, advanced charting tools, and order book information.

If you’re new to cryptocurrency, Coinbase’s user-friendly design will likely feel more comfortable. Experienced traders might prefer Bitstamp’s more data-rich interface that provides deeper market insights.

Coinbase Vs Bitstamp Conclusion: Why Not Use Both?

Both Coinbase and Bitstamp offer strong services for crypto traders, but they shine in different areas. You don’t necessarily need to choose just one.

Coinbase provides a more user-friendly experience and supports a significantly larger number of cryptocurrencies. This makes it ideal if you want to explore different coins beyond the major ones.

Bitstamp, on the other hand, typically offers lower fees. If cost is your main concern when trading, Bitstamp might save you money in the long run.

Key differences to consider:

| Feature | Coinbase | Bitstamp |

|---|---|---|

| User Experience | More intuitive | Slightly more complex |

| Cryptocurrency Selection | Wider variety | More limited |

| Fees | Higher (0.5%-4%) | Lower (0.5%-5%) |

| Trading Options | Conversion service | Trading pairs |

You might find that using both platforms gives you the best experience. For example, you could use:

- Coinbase for its user-friendly interface when you’re just starting out

- Bitstamp for lower fees when making larger trades

Many experienced traders maintain accounts on multiple exchanges to take advantage of different fee structures, coin offerings, and features.

Your specific needs should guide your choice, but don’t feel limited to just one platform. The crypto world is constantly evolving, and having access to multiple exchanges can be beneficial.

Compare Bitstamp and Coinbase with other significant exchanges