Choosing the right cryptocurrency exchange can make a big difference in your trading experience. With many options available, it’s important to compare key features before deciding where to put your money.

Bitunix offers better security features compared to top exchanges, including proof of reserves that adds an extra layer of protection for your assets. While less known than some larger platforms, Bitunix has been gaining attention for its reliability and user-friendly interface.

KuCoin, on the other hand, stands out as a popular, large-scale exchange with diverse earning programs to suit different needs. It provides various options for crypto interest rates, though these rates can vary greatly. Both exchanges have their strengths, and your choice will depend on what matters most to you – security, variety of features, or earning potential.

Bitunix Vs KuCoin: At A Glance Comparison

When choosing between Bitunix and KuCoin, you’ll want to consider several key factors that set these cryptocurrency exchanges apart.

Supported Cryptocurrencies:

- Bitunix: Supports over 270 cryptocurrencies

- KuCoin: Known for supporting a wide range of tokens, including many smaller altcoins

Trading Options:

- Bitunix: Offers both spot and derivatives trading

- KuCoin: Provides spot, margin, futures, and lending services

Security Features:

- Bitunix: Implements proof of reserves for added security

- KuCoin: Uses industry-standard security protocols

Fee Structure:

- Both exchanges offer competitive fees

- KuCoin is noted for having lower fees compared to major exchanges like Coinbase

User Experience:

| Feature | Bitunix | KuCoin |

|---|---|---|

| Interface | User-friendly | Feature-rich but can be complex |

| Mobile App | Available | Available with comprehensive features |

| Customer Support | Standard support options | 24/7 support with multiple channels |

Bitunix appears to be gaining positive user feedback as a centralized exchange, with some users on forums like Reddit suggesting it might be better than some top-tier exchanges.

KuCoin has established itself as one of the top cryptocurrency exchanges by volume, with strong liquidity and trading volumes that have earned it recognition on platforms like CoinMarketCap.

Also Read: Crypto options insurance explained

You can find detailed comparisons of features, pricing, and user reviews for both platforms on comparison sites, helping you make an informed decision based on your specific trading needs.

Bitunix Vs KuCoin: Trading Markets, Products & Leverage Offered

Bitunix and KuCoin both offer diverse trading options, but they differ in several key areas. Let’s compare what each platform provides for traders.

Bitunix supports over 270 cryptocurrencies and focuses on both spot and derivatives trading. You’ll find a robust selection of trading pairs that cater to both beginners and experienced traders.

KuCoin offers access to more than 700 cryptocurrencies, giving you significantly more options for altcoin trading. This makes KuCoin particularly attractive if you’re looking to trade less common tokens.

Leverage Trading Options:

| Platform | Maximum Leverage | Available Markets |

|---|---|---|

| Bitunix | Up to 100x | Futures, Margin |

| KuCoin | Up to 100x | Futures, Margin, Leveraged Tokens |

Both exchanges provide futures trading with competitive leverage options. KuCoin edges ahead with leveraged tokens, which offer a simplified way to access leveraged positions without managing margin requirements.

For margin trading, you’ll find that both platforms let you borrow funds to increase your position size. KuCoin offers cross and isolated margin options, giving you more control over risk management.

Bitunix has been gaining popularity for its user-friendly derivatives interface. Many users report that its trading platform is more intuitive than some top-tier exchanges.

Trading fees are comparable between both platforms, though specific rates vary based on your trading volume and whether you hold their native tokens.

Bitunix Vs KuCoin: Supported Cryptocurrencies

When choosing between Bitunix and KuCoin, the number of cryptocurrencies each platform supports is an important factor to consider.

Bitunix currently supports over 270 cryptocurrencies for trading. This gives you access to a wide range of digital assets, from major coins to emerging tokens.

KuCoin offers an even larger selection with support for over 700 cryptocurrencies. This makes KuCoin a better option if you’re looking to trade less common or newer tokens.

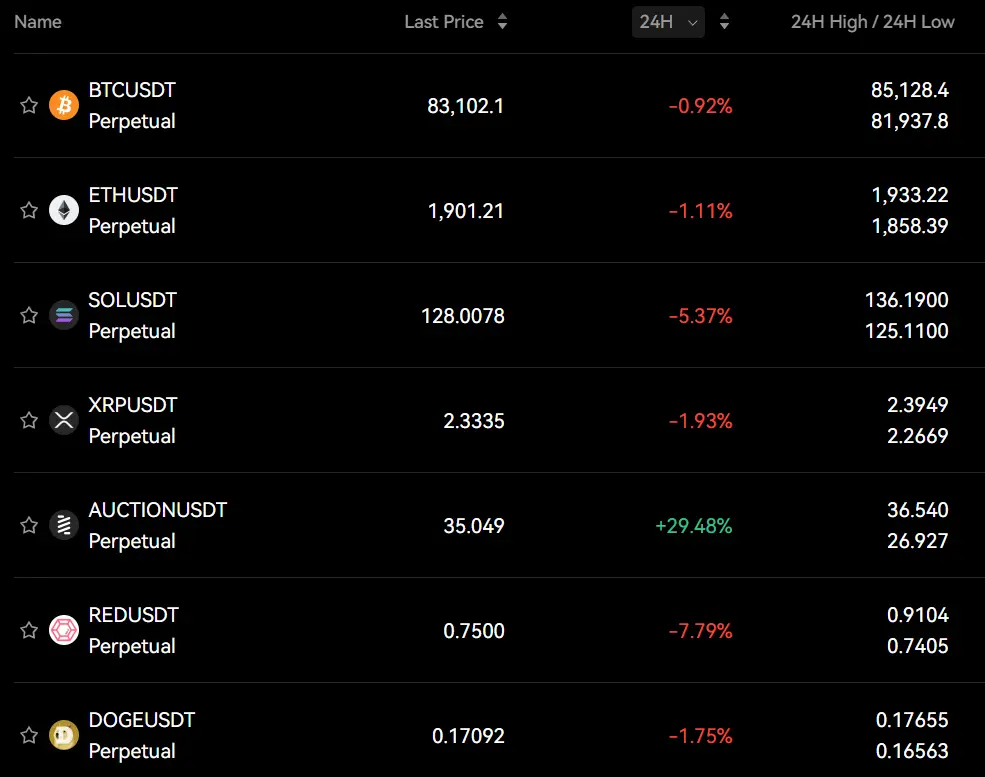

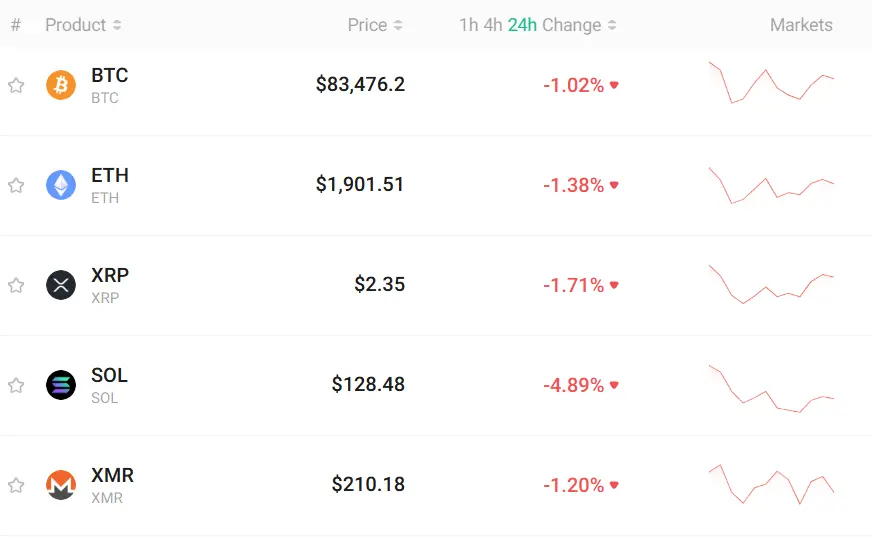

Both exchanges support major cryptocurrencies such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Cardano (ADA)

- Solana (SOL)

KuCoin has an edge when it comes to listing new tokens quickly. This can be valuable if you want to invest in cryptocurrencies early in their development.

Bitunix focuses on quality over quantity, ensuring that the cryptocurrencies they list meet certain security and legitimacy standards.

The trading pairs available also differ between platforms. KuCoin offers more trading pairs, allowing you to directly exchange between a wider variety of cryptocurrencies without converting to a base currency first.

If you’re primarily interested in major cryptocurrencies, either exchange will meet your needs. However, if you want access to a broader range of altcoins and newer tokens, KuCoin provides more options.

Bitunix Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

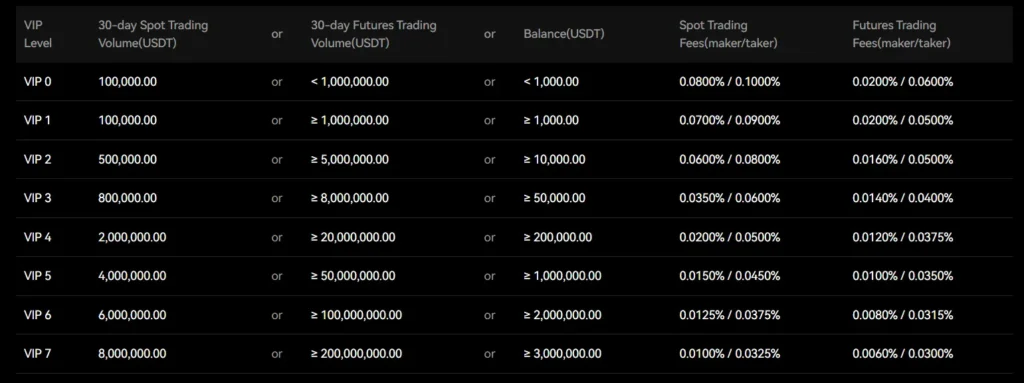

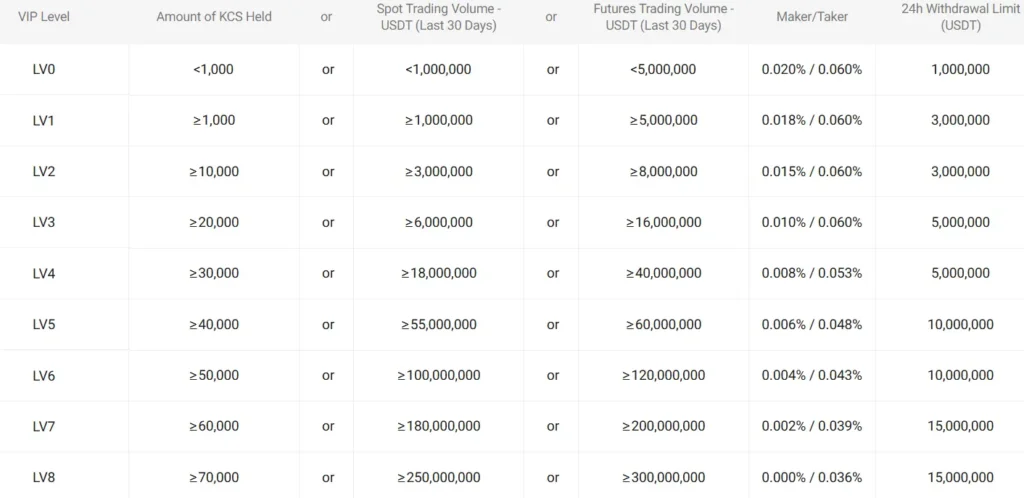

When choosing between Bitunix and KuCoin, understanding their fee structures can help you make the best decision for your trading needs.

Trading Fees

Both exchanges have similar maker/taker fee structures. Bitunix’s trading fees are comparable to other top-tier exchanges, making it competitive in the market.

KuCoin also offers competitive trading fees that match Bitunix in many cases. The similarity in trading fee structures means your choice might depend on other factors.

Withdrawal Fees

KuCoin’s withdrawal fees tend to be higher than Bitunix. As of March 18, 2025, KuCoin charges 0.0002 BTC ($16.57) for Bitcoin withdrawals and 0.0027 ETH ($5.12) for Ethereum withdrawals.

Bitunix generally offers lower withdrawal fees, which can save you money if you frequently move crypto off the exchange. This difference becomes more significant if you make regular withdrawals.

Deposit Fees

Both exchanges typically offer free deposits, which is standard across most crypto platforms.

Security Considerations

Bitunix adds an extra layer of security with its proof of reserves system. This feature allows you to verify that the exchange actually holds the assets it claims to have.

When comparing fees, remember to consider the overall value each platform provides through features, available cryptocurrencies, and security measures.

Bitunix Vs KuCoin: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both Bitunix and KuCoin offer various order options to help you trade effectively.

Bitunix supports standard order types including market orders, limit orders, and stop-limit orders. These basic options let you buy or sell cryptocurrencies at current market prices or set specific price points.

KuCoin goes a step further with additional advanced order types. Besides the basics, KuCoin offers OCO (One-Cancels-the-Other) orders, post-only orders, and iceberg orders that help hide large trade volumes.

For futures trading, both platforms provide several options. Bitunix offers futures traders access to market, limit, and stop orders with leverage options.

KuCoin’s futures platform includes these same options plus trailing stops and advanced conditional orders that give experienced traders more control.

Here’s a quick comparison of order types:

| Order Type | Bitunix | KuCoin |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| OCO Orders | ✗ | ✓ |

| Post-Only | ✗ | ✓ |

| Iceberg Orders | ✗ | ✓ |

| Trailing Stops | ✗ | ✓ |

KuCoin provides more sophisticated order types that might benefit advanced traders. However, Bitunix covers all the essential order types that most traders regularly use.

Bitunix Vs KuCoin: KYC Requirements & KYC Limits

When choosing between Bitunix and KuCoin, their KYC (Know Your Customer) policies might influence your decision.

Bitunix offers a tiered KYC system with different verification levels. The Basic KYC level requires personal information, ID, and a selfie photo. Higher verification unlocks increased daily withdrawal limits.

What makes Bitunix stand out is that KYC is not mandatory for all users. You can trade on the platform with limited functionality without completing verification.

KuCoin, on the other hand, has been facing regulatory scrutiny from the SEC. This has caused some users to switch to alternative platforms like Bitunix.

Bitunix KYC Tiers:

- No KYC: Limited trading and withdrawal capabilities

- Basic KYC: Requires personal info, ID, and selfie

- Advanced KYC: Higher withdrawal limits

KuCoin also uses a tiered verification system, but with the recent regulatory challenges, some traders feel uncertain about its future compliance requirements.

Bitunix states that their KYC process helps prevent money laundering and illegal financing while providing flexibility to users who prefer privacy.

If minimal verification is important to you, Bitunix appears to offer more flexibility with its no-mandatory-KYC option for basic trading. However, to access all features and higher limits, verification is still required on both platforms.

Bitunix Vs KuCoin: Deposits & Withdrawal Options

When choosing between Bitunix and KuCoin, understanding their deposit and withdrawal options can help you make a better decision.

Deposit Options

- KuCoin: Offers free deposits across all cryptocurrencies. However, it has limited fiat deposit options, making it better as a secondary exchange.

- Bitunix: Provides similar crypto deposit options with no fees attached.

Withdrawal Fees

- KuCoin: Charges withdrawal fees that vary by cryptocurrency. Based on recent information, these fees tend to be higher compared to some competitors.

- Bitunix: Generally offers lower withdrawal fees than KuCoin for most cryptocurrencies.

Processing Times

Bitunix typically processes withdrawals faster than KuCoin, especially during high network congestion periods.

Security Features

Bitunix has implemented proof of reserves, adding an extra layer of security for your funds. This feature allows you to verify that the platform actually holds the assets it claims.

Supported Networks

Both exchanges support multiple networks for popular coins like ETH and BTC, giving you flexibility in choosing lower-fee options when moving your crypto.

If you’re looking for the most cost-effective option for regular withdrawals, Bitunix appears to edge out KuCoin in most cases. However, KuCoin might offer more token options overall.

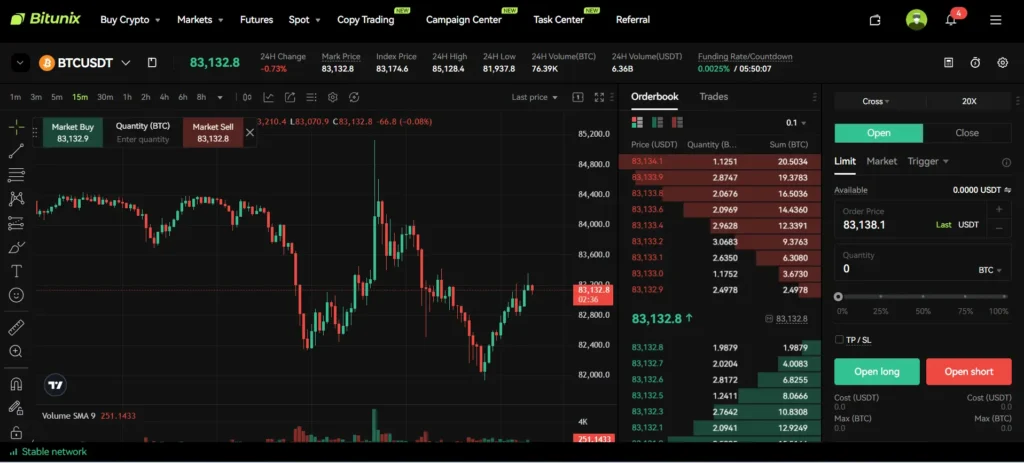

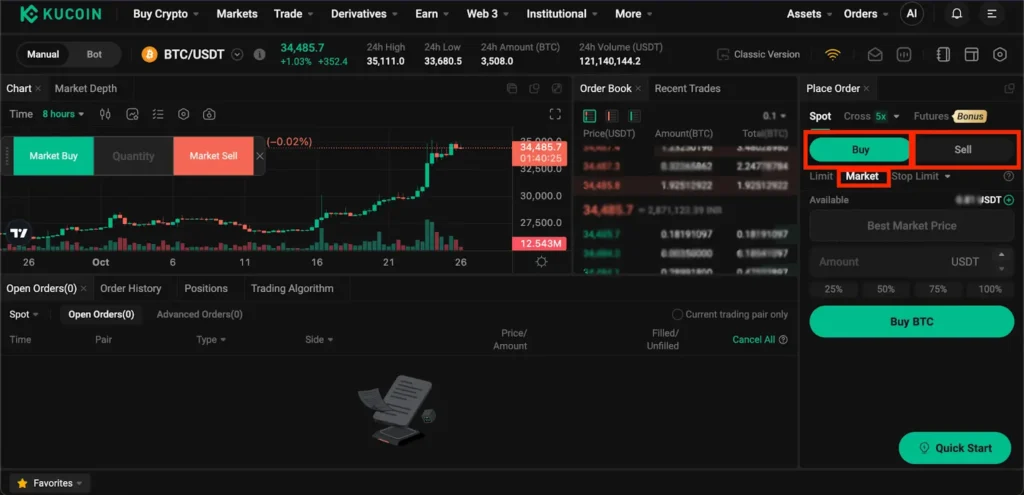

Bitunix Vs KuCoin: Trading & Platform Experience Comparison

Bitunix and KuCoin offer different trading experiences that might affect your choice between them. Bitunix supports over 270 cryptocurrencies and focuses on both spot and derivatives trading.

Bitunix stands out for its simplicity and user-friendly approach. The platform provides a more intuitive trading experience without overwhelming you with complex charts. This makes it particularly suitable if you’re new to crypto trading.

KuCoin, on the other hand, is known as one of the top-tier exchanges with a strong reputation. It offers a more comprehensive set of tools and features that experienced traders might appreciate.

Platform Interface Comparison:

- Bitunix: Cleaner, more straightforward design

- KuCoin: Feature-rich but potentially more complex

User Experience Factors:

- Bitunix emphasizes ease of use

- KuCoin provides more advanced trading options

- Both offer mobile apps for trading on the go

Bitunix has gained trust through its proof of reserves system, which adds to its security credentials. This feature gives you more transparency about the exchange’s holdings.

When choosing between these platforms, consider your trading needs. If you value simplicity and a smooth experience, Bitunix might be your better option. If you need advanced tools and don’t mind a steeper learning curve, KuCoin could serve you well.

Both exchanges rank among popular cryptocurrency platforms, but they target slightly different user groups with their trading experiences.

Bitunix Vs KuCoin: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for your risk management. Both Bitunix and KuCoin have specific approaches to liquidation that affect your trading experience.

Bitunix provides an Estimated Liquidation Price feature that clearly shows you when your position might be closed due to insufficient margin. This transparency helps you plan your trades more effectively.

KuCoin, as one of Binance’s main competitors, also implements liquidation protocols to protect the exchange from losses when traders can’t meet margin requirements.

Key Liquidation Differences:

| Feature | Bitunix | KuCoin |

|---|---|---|

| Liquidation Price Visibility | Clearly displayed | Available but less prominent |

| Warning System | Advanced notifications | Standard alerts |

| Liquidation Process | Gradual position closing | May close positions more rapidly |

Both platforms carry liquidation risks, especially during volatile market conditions. You should always monitor your positions closely and use stop-losses to protect your funds.

Bitunix has gained recognition for its proof of reserves, which adds an extra layer of security for traders concerned about exchange stability during high-liquidation periods.

Some traders report that KuCoin’s extensive feature set sometimes makes liquidation information harder to find compared to Bitunix’s more straightforward interface.

Remember that market conditions can make it challenging to withdraw funds quickly from either platform during extreme volatility, potentially affecting your ability to avoid liquidations.

Bitunix Vs KuCoin: Insurance

When choosing a crypto exchange, insurance protection is an important factor to consider. This safeguard helps protect your assets in case of security breaches or hacks.

Bitunix offers proof of reserves, which adds to its security features. This means they regularly verify that they have enough assets to cover all customer deposits. However, specific details about their insurance coverage are limited in public information.

KuCoin provides more comprehensive insurance protection. They maintain a Safeguard Fund specifically designed to compensate users in case of security incidents. In 2020, KuCoin experienced a major hack but was able to recover most funds and compensate affected users through their insurance measures.

Both exchanges use cold storage for most user funds. This practice keeps the majority of assets offline and away from potential online threats.

You should note that neither exchange offers FDIC insurance, which is common for traditional banks in the US. This is typical across the crypto industry.

When comparing insurance features:

| Feature | Bitunix | KuCoin |

|---|---|---|

| Proof of Reserves | Yes | Limited |

| Dedicated Insurance Fund | Limited information | Yes (Safeguard Fund) |

| Cold Storage | Yes | Yes |

| Security Track Record | No major incidents reported | Recovered from 2020 hack |

Consider your risk tolerance when choosing between these exchanges. If comprehensive insurance coverage is your priority, KuCoin currently offers more transparent protection measures.

Bitunix Vs KuCoin: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both Bitunix and KuCoin offer support options, but they differ in some ways.

KuCoin provides 24/7 customer service through email and live chat. This round-the-clock availability means you can get help whenever you encounter issues, regardless of your time zone.

Bitunix also offers customer support, though specific details about their availability hours aren’t as widely documented. As a newer exchange compared to KuCoin, some users report that response times can vary.

KuCoin Support Features:

- 24/7 availability

- Multiple contact channels (email, live chat)

- Support in several languages

- Extensive knowledge base

Bitunix Support Features:

- Email support

- Chat support

- Help center with guides

Response time is an important factor to consider. KuCoin typically responds within 24 hours for email inquiries, while live chat can connect you with an agent in minutes during busy periods.

Also Read: What are bitcoin options & how do they work?

Both platforms have help centers with FAQs and guides to help you solve common problems without contacting support. This self-service option can save you time for simple issues.

If you’re new to crypto trading, KuCoin’s more established support system might give you more confidence. However, Bitunix is working to improve their customer service as they grow their user base.

Bitunix Vs KuCoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and KuCoin offer robust security measures, but with some key differences.

Bitunix stands out with its proof of reserves system. This transparency feature allows you to verify that the platform actually holds all user funds it claims to have. This adds an extra layer of security that many exchanges don’t offer.

KuCoin protects your assets with industry-standard security protocols. The platform uses multi-factor authentication (MFA), encryption, and cold storage for most cryptocurrencies.

Security Features Comparison:

| Feature | Bitunix | KuCoin |

|---|---|---|

| Proof of Reserves | ✅ | ❌ |

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ | ✅ |

| Insurance Fund | Limited | Yes |

Both exchanges employ cold wallet storage to keep the majority of funds offline and safe from hackers. This is an essential security practice in the industry.

KuCoin offers an insurance fund to protect users in case of security breaches. Bitunix has more limited protection in this area, though its proof of reserves provides different security benefits.

You should enable all available security features on whichever platform you choose. This includes setting up strong passwords and using two-factor authentication to protect your account.

Is Bitunix Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange focusing on both spot and derivatives trading. According to search results, users have found it safe to use, with some even praising its offerings.

However, Bitunix is not available for users in the United States. The platform also restricts access to investors from Syria, Sudan, and North Korea.

Bitunix supports over 270 cryptocurrencies and offers derivatives trading with high leverage options. One notable feature is that Bitunix does not require mandatory KYC (Know Your Customer) verification.

When considering safety aspects, remember that all cryptocurrency exchanges carry inherent risks. While Bitunix is described as offering “secure, flexible trading,” you should always:

- Use strong, unique passwords

- Enable two-factor authentication if available

- Only invest amounts you can afford to lose

- Research thoroughly before trading

The legal status of Bitunix varies by country. Before using the platform, check your local regulations regarding cryptocurrency trading to ensure compliance with your country’s laws.

Remember that the cryptocurrency space is largely unregulated in many regions, which can affect consumer protections available to you as a user.

Is KuCoin Safe & Legal To Use?

KuCoin’s safety and legality have faced serious questions recently. According to search results, KuCoin and two of its founders were criminally charged on March 26, 2024 with violating the Bank Secrecy Act and operating an unlicensed money transmission business.

While KuCoin has implemented standard security measures like encryption and two-factor authentication to protect user assets, the exchange has experienced security issues in the past. In 2020, KuCoin suffered a large-scale hack, though they have since enhanced their security protocols.

The legal status of using KuCoin varies by location. With recent criminal charges in the US, American users should exercise extreme caution. The exchange is now facing allegations that it violated anti-money laundering laws while growing into one of the world’s largest cryptocurrency platforms.

Key Security Features:

- Standard encryption

- Two-factor authentication

- Improved security measures after 2020 hack

Legal Concerns:

- Criminal charges against the company and founders

- Violations of US anti-money laundering laws

- Unlicensed money transmission allegations

When choosing a cryptocurrency exchange, you should consider both security history and legal compliance. These recent developments suggest you may want to explore other options with clearer regulatory standing.

Frequently Asked Questions

Traders comparing Bitunix and KuCoin often have specific questions about features, costs, and security. These common questions highlight the key differences between the two cryptocurrency exchanges.

What features distinguish Bitunix from KuCoin?

Bitunix offers proof of reserves as a standout security feature, which adds transparency about held assets. This feature isn’t prominently mentioned for KuCoin.

KuCoin provides a wider range of trading options including spot trading, futures, margin trading, and staking. The platform is known for listing many smaller altcoins before they reach larger exchanges.

Bitunix appears to focus on security and reliability, while KuCoin emphasizes variety and advanced trading tools.

How do Bitunix’s transaction fees compare to those of KuCoin?

Bitunix’s fee structure is competitive within the cryptocurrency exchange market, though specific rates aren’t detailed in the search results.

KuCoin employs a tiered fee structure based on trading volume and KCS token holdings. Their spot trading fees typically range from 0.1% for makers to 0.1% for takers, with discounts available.

Your trading volume and whether you hold each platform’s native tokens will significantly impact the actual fees you pay on either exchange.

Which exchange between Bitunix and KuCoin offers superior security measures?

Bitunix emphasizes its proof of reserves system as a key security feature. This allows users to verify that the platform actually holds the assets it claims.

KuCoin implements standard security measures including two-factor authentication, encryption, and cold storage for most assets. The platform experienced a major hack in 2020 but eventually recovered all affected funds.

Your security priorities—transparency vs. track record—may determine which approach you find more reassuring.

Can users earn interest on their holdings on both Bitunix and KuCoin, and how do the rates compare?

Information about Bitunix’s interest-earning options isn’t clearly detailed in the search results.

KuCoin offers multiple ways to earn passive income including Soft Staking, KuCoin Earn, and Pool-X for flexible and fixed-term staking. Interest rates vary by asset but typically range from 1-15% APY depending on the cryptocurrency and lock-up period.

You should compare current rates directly on both platforms as yields fluctuate based on market conditions.

What are the differences in user experience and interface between Bitunix and KuCoin?

Bitunix’s interface information isn’t specifically detailed in the search results, though user reviews suggest it offers a straightforward experience.

KuCoin’s interface includes both basic and advanced trading views. Some users find KuCoin’s interface initially complex with its numerous features and options, but appreciate the depth once familiar.

You may want to try both platforms’ demo accounts before committing to see which interface better matches your trading style.

How do the coin and token support lists of Bitunix and KuCoin compare?

Bitunix’s specific token listings aren’t detailed in the search results, making direct comparison difficult.

KuCoin is known for supporting over 700 cryptocurrencies and often lists new, promising tokens before larger exchanges. They support major coins like BTC, ETH, and DOGE, as well as their native KCS token.

You should check both exchanges’ current listings if you need to trade specific cryptocurrencies, as supported assets change regularly.

KuCoin Vs Bitunix Conclusion: Why Not Use Both?

After comparing KuCoin and Bitunix, you might wonder which platform is better for your crypto trading needs. The truth is, you can benefit from using both exchanges.

Bitunix offers strong security features and has never been hacked. It maintains proof of reserves to verify that your assets are safely held. This adds an extra layer of trust for traders concerned about security.

KuCoin, as a more established platform, provides a wider range of trading options and features. Its interface is well-known among many crypto traders, making it comfortable for beginners and experienced users alike.

Both platforms comply with anti-money laundering regulations, showing their commitment to ethical trading practices.

Key benefits of using both platforms:

| Feature | Bitunix | KuCoin |

|---|---|---|

| Security | Strong (proof of reserves) | Established security system |

| Trading options | Growing selection | Extensive variety |

| User experience | Newer interface | Well-known layout |

You can use Bitunix for its enhanced security features while taking advantage of KuCoin’s broader trading options. This strategy helps you diversify your risk across platforms.

Remember that all cryptocurrency investments carry significant risk. Don’t invest more than you can afford to lose, regardless of which platform you choose.

By maintaining accounts on both exchanges, you gain flexibility and can quickly move your trading activities if one platform experiences issues or downtime.

Compare Bitunix and KuCoin with other significant exchanges