When choosing a cryptocurrency exchange, the decision between BloFin and Kraken can impact your trading experience. These platforms offer different features that may suit various types of traders.

BloFin and Kraken serve different segments of the crypto market, with BloFin focusing on advanced security measures and a competitive fee structure while Kraken provides strong security and is better suited for dollar cost averaging strategies. BloFin’s maker fees can go as low as 0.0060% depending on your VIP level, with taker fees starting at 0.0500%.

You’ll find that each exchange has its unique strengths. BloFin stands out with its rigorous security protocols and VIP-oriented services, while Kraken is known for its established reputation in the crypto space and more accessible fiat deposit options. Understanding these differences can help you select the platform that best aligns with your trading goals and experience level.

BloFin vs Kraken: At A Glance Comparison

When choosing between BloFin and Kraken, several key differences stand out. Both platforms offer crypto trading services but with distinct features tailored to different types of traders.

Security Features

- BloFin: Rigorous security measures, appealing to security-conscious traders

- Kraken: Well-established security protocols with long track record

Trading Options

- BloFin: Specializes in futures trading with 300+ perpetual swap contracts

- Kraken: More traditional trading options with strong spot market focus

User Experience

| Feature | BloFin | Kraken |

|---|---|---|

| Interface | Modern, advanced tools | Clean, beginner-friendly |

| Copy Trading | Available | Not available |

| Mobile App | Yes | Yes |

BloFin stands out for advanced traders interested in futures and copy trading. You’ll find its VIP services particularly attractive if you trade in higher volumes.

Kraken appeals more to beginners and traditional traders with its straightforward interface and established reputation. It’s been around longer and has built solid trust in the crypto community.

Fees vary between platforms, with each offering different structures based on trading volume and account types. You should compare current fee schedules as they may have changed since early 2025.

Both exchanges provide solid options depending on your needs. Consider your trading style, experience level, and preferred assets when making your choice.

BloFin vs Kraken: Trading Markets, Products & Leverage Offered

BloFin and Kraken offer different trading options that may suit various investor needs. Let’s compare what each platform provides.

Available Cryptocurrencies:

- BloFin: Features over 400 cryptocurrency pairs

- Kraken: Offers fewer trading pairs but includes major cryptocurrencies

Leverage Trading:

- BloFin: Provides up to 150x leverage across its trading pairs

- Kraken: More conservative with up to 5x leverage through margin accounts

BloFin positions itself as a contract trading platform with extensive options for traders looking to maximize potential returns through high leverage. This appeals to experienced traders comfortable with higher risk.

Kraken takes a more traditional approach with lower leverage limits. This makes it potentially safer for beginners or those with lower risk tolerance.

Fee Structure:

| Platform | Maker Fees | Taker Fees |

|---|---|---|

| BloFin | 0.02% | Higher |

| Kraken | Varies | Varies |

When choosing between these platforms, you should consider your trading style. If you’re interested in high-leverage contract trading with many cryptocurrency options, BloFin might be your preference.

If you prefer a more established exchange with moderate leverage and stronger regulatory compliance, Kraken could be more suitable for your needs.

Also Read: Does Crypto Have Options Trading?

Each platform caters to different trader profiles, with BloFin focusing on variety and high leverage while Kraken emphasizes security and moderation.

BloFin vs Kraken: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is a crucial factor to consider. Both BloFin and Kraken offer different selections that might influence your decision.

Kraken supports over 60 cryptocurrencies for trading and investing. This includes major coins like Bitcoin and Ethereum, as well as a range of altcoins and tokens.

BloFin, while newer to the market, focuses more on cryptocurrency derivatives trading. The platform offers futures contracts and options on popular cryptocurrencies, though with a smaller overall selection than Kraken.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | Kraken | BloFin |

|---|---|---|

| Total cryptocurrencies | 60+ | Fewer options |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Altcoins | Wide selection | Limited selection |

| Stablecoins | Multiple options | Basic options |

| Derivatives trading | Limited | Specialized focus |

If you’re looking for variety in spot trading, Kraken provides more options for direct cryptocurrency purchases and sales. Their larger selection gives you more flexibility to diversify your portfolio.

BloFin might be more suitable if you’re interested in derivatives trading with a focused selection of the most popular cryptocurrencies.

Your trading style and goals should guide your choice between these platforms. Consider whether you need access to many different cryptocurrencies or if trading options on a smaller selection meets your needs.

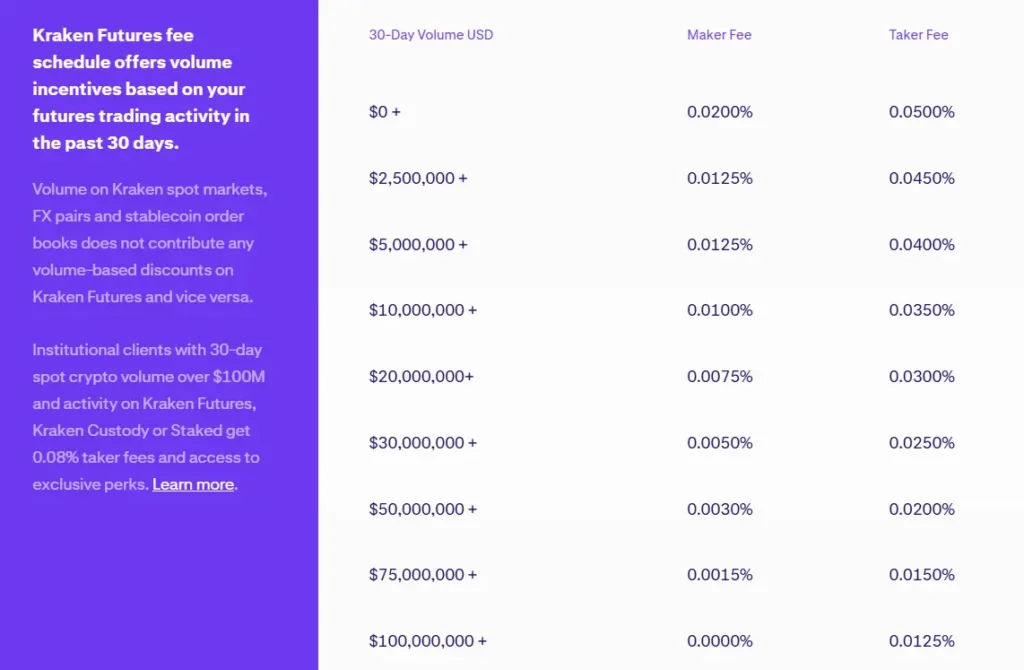

BloFin vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and Kraken, understanding their fee structures can help you make an informed decision for your trading needs.

Trading Fees

BloFin offers a competitive flat trading fee of 0.20% per transaction, which is slightly lower than the industry average. This straightforward pricing makes it easier to calculate your costs.

Kraken, on the other hand, uses a tiered fee structure based on your 30-day trading volume. Their fees start at 0.26% for makers and 0.16% for takers, potentially decreasing as your trading volume increases.

Deposit Fees

Both exchanges offer free crypto deposits. For fiat deposits:

| Method | BloFin | Kraken |

|---|---|---|

| Bank Transfer | Free | $5-$35 depending on method |

| Credit Card | 3.75% | 3.75% + €0.25 |

Withdrawal Fees

Cryptocurrency withdrawal fees vary by asset on both platforms:

- BloFin charges network fees that adjust based on blockchain congestion

- Kraken has fixed withdrawal fees for each cryptocurrency

For fiat withdrawals, Kraken charges $4-$35 depending on your withdrawal method and location.

BloFin’s overall fee structure tends to be more straightforward, while Kraken offers potential savings for high-volume traders. Your best choice depends on your trading style and frequency.

BloFin vs Kraken: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. BloFin and Kraken offer different options to meet various trading needs.

BloFin Order Types:

- Market orders

- Limit orders

- Stop orders

- Take profit orders

- Advanced conditional orders

- Trailing stop orders

BloFin provides a comprehensive suite of tools for futures trading with over 300 perpetual swap contracts. This makes it particularly attractive if you’re looking to execute more complex trading strategies.

Kraken Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

- Conditional close orders

- Settle position orders

Kraken’s interface is often praised for being more user-friendly for beginners while still offering enough order variety for experienced traders.

Both platforms support the basic order types you’ll need for everyday trading. However, BloFin seems to focus more on advanced charting and specialized order types that might appeal to active traders.

You should consider your trading style when choosing between these platforms. If you frequently use complex order strategies and trade futures, BloFin might better suit your needs.

For spot trading with straightforward order requirements, either platform will serve you well, though Kraken’s interface might be easier to navigate if you’re just getting started.

BloFin vs Kraken: KYC Requirements & KYC Limits

BloFin offers more flexibility with KYC requirements compared to Kraken. On BloFin, KYC verification is optional for basic trading activities.

You can register, deposit, and trade on BloFin without completing KYC. However, if you plan to withdraw more than 20,000 USDT, you’ll need to provide personal verification documents.

Kraken, on the other hand, has mandatory KYC for all users. You cannot use Kraken’s services without completing their verification process, which typically includes providing identification documents.

This difference makes BloFin potentially more attractive if you value privacy. The no-KYC option on BloFin allows you to start trading immediately without sharing personal information.

KYC Limits Comparison:

| Exchange | KYC Required? | Withdrawal Limit Without KYC |

|---|---|---|

| BloFin | Optional | Up to 20,000 USDT |

| Kraken | Mandatory | Not available (KYC required) |

Kraken’s strict KYC policy is part of its compliance with regulatory requirements in the jurisdictions where it operates. This may provide additional security but comes at the cost of privacy.

If maintaining anonymity for smaller trading amounts is important to you, BloFin offers a clear advantage. However, for larger withdrawals, both exchanges will require identity verification.

BloFin vs Kraken: Deposits & Withdrawal Options

Both BloFin and Kraken offer various options for funding your account and withdrawing your assets, but they differ in several important ways.

BloFin operates primarily as a crypto-to-crypto exchange with limited fiat options. The platform focuses on cryptocurrency deposits and withdrawals, making it ideal if you already own digital assets.

Kraken provides more robust fiat deposit and withdrawal methods, including bank transfers, wire transfers, and credit/debit card options. This makes Kraken more accessible if you’re looking to convert traditional currency to crypto.

When it comes to fees, BloFin charges reasonable withdrawal fees, including approximately 0.0005 BTC for Bitcoin withdrawals. This rate is competitive in the market.

Kraken’s withdrawal fees vary by cryptocurrency, but they’re generally considered reasonable. However, some users report occasional delays with fiat withdrawals on Kraken.

Processing times can differ between the platforms. BloFin typically processes crypto withdrawals quickly, while Kraken’s processing times depend on the method used, with crypto transactions being faster than fiat.

It’s worth noting that KYC requirements differ between the two. BloFin is often highlighted as a no-KYC option, while Kraken implements stricter verification procedures, especially for fiat transactions.

Your choice between these platforms may depend on whether you prioritize fiat access (Kraken) or prefer primarily crypto-to-crypto transactions with minimal verification (BloFin).

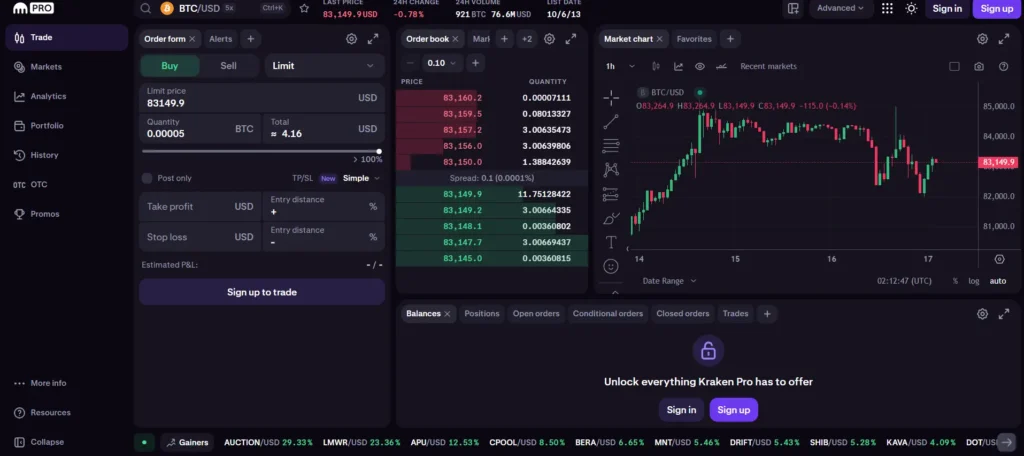

BloFin vs Kraken: Trading & Platform Experience Comparison

Both BloFin and Kraken offer unique trading experiences that cater to different types of crypto traders.

BloFin stands out with its focus on futures trading, offering over 300 perpetual swap contracts. The platform has a modern interface that appeals to advanced traders looking for sophisticated tools.

Kraken provides a more traditional exchange experience with a robust spot trading platform. Its interface is clean and intuitive, making it accessible for beginners while still offering advanced features.

Trading Tools Comparison:

- BloFin: Copy trading feature, advanced charting tools, futures-focused

- Kraken: Margin trading, staking options, spot trading emphasis

When it comes to mobile experience, both platforms offer functional apps. Kraken’s app is more established and has fewer reported bugs, while BloFin’s mobile platform focuses on quick futures trading.

Platform speed matters for serious traders. Kraken has built a reputation for reliability during high market volatility, though its system has experienced occasional downtime. BloFin, being newer, has yet to be fully tested during extreme market conditions.

Fee Structure:

| Feature | BloFin | Kraken |

|---|---|---|

| Spot Trading | Competitive rates | Tiered fee structure |

| Futures | Lower fees | Higher fees |

| Withdrawal | Varies by crypto | Generally higher |

You’ll find BloFin more suitable if futures trading is your priority. Kraken might be your better choice if you value a well-established platform with strong security features and prefer spot trading.

BloFin vs Kraken: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management. Both BloFin and Kraken have systems in place to protect themselves when your position approaches negative equity.

BloFin employs a tiered liquidation system with margin ratios that can change based on market conditions. The platform has faced some criticism for allegedly adjusting margin requirements and liquidation thresholds without proper notice, according to some user reports.

Kraken offers a more transparent liquidation process with clearly defined margin call levels. You’ll typically receive warnings as your position approaches the liquidation price, giving you time to add funds or reduce your position size.

Key Differences:

| Feature | BloFin | Kraken |

|---|---|---|

| Leverage | Up to 150x | Up to 5x (generally lower) |

| Liquidation Warning | Limited | Multiple notifications |

| Transparency | Some user concerns | Well-documented process |

| Partial Liquidation | Available | Available |

You should be aware that BloFin’s higher leverage (up to 150x) creates a higher risk of liquidation compared to Kraken’s more conservative approach.

The liquidation price on both platforms depends on your position size, leverage used, and maintenance margin requirements. Always calculate this carefully before opening leveraged positions.

Remember to set stop-loss orders on both platforms to prevent liquidations during unexpected market volatility.

BloFin vs Kraken: Insurance

When choosing a crypto exchange, insurance coverage is a critical factor to consider for your asset protection.

BloFin maintains a dedicated insurance fund to protect traders against significant market volatility and potential losses during extreme market conditions. This fund helps prevent auto-liquidations when markets move rapidly.

Kraken offers a different approach with its custody insurance program. They maintain reserves that cover 100% of their clients’ assets, providing protection against potential exchange hacks or security breaches.

Both platforms implement cold storage security for most user funds, which serves as an additional layer of protection beyond their insurance offerings.

| Exchange | Insurance Type | Coverage |

|---|---|---|

| BloFin | Market risk insurance fund | Protects against liquidations during high volatility |

| Kraken | Custody insurance | 100% reserves coverage against exchange security issues |

Neither exchange offers FDIC insurance, as this is only available for fiat currency in traditional banks, not cryptocurrency holdings.

You should note that insurance policies on both platforms have limitations. Coverage typically applies to exchange-wide issues rather than individual account compromises due to personal security lapses.

Before deciding, review each platform’s latest insurance policy details, as coverage terms may change over time with evolving regulatory requirements.

BloFin vs Kraken: Customer Support

Both BloFin and Kraken offer customer support options to help you with any issues or questions.

BloFin provides 24/7 customer support through live chat and email in multiple languages. This immediate access to help can be valuable when you’re dealing with urgent trading concerns.

Users generally report satisfaction with BloFin’s customer service team. The platform makes it easy to get assistance whenever you need it.

Kraken also offers 24/7 customer support, which is essential for a global trading platform. Their support system includes:

- Live chat assistance

- Email support

- Extensive knowledge base

Kraken has been operating since 2011, giving them more experience in handling customer issues compared to the newer BloFin platform.

When choosing between these exchanges, consider how important immediate support is for your trading style. Both platforms prioritize customer assistance, but your experience may vary depending on the complexity of your issue.

Response times can differ during high-volume trading periods. Having multiple ways to contact support is an advantage that both platforms offer.

The availability of support in multiple languages is particularly helpful if English isn’t your first language.

BloFin vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both BloFin and Kraken offer strong protections, but with different approaches.

BloFin emphasizes its 1:1 asset reserve policy, ensuring your funds are fully backed. They’ve partnered with Fireblocks, a leading custody firm, to enhance asset protection.

Kraken has built its reputation on security since 2011, with no major hacks reported. They maintain most assets in cold storage and offer two-factor authentication (2FA) for all accounts.

BloFin Security Highlights:

- 1:1 asset reserve policy

- Partnerships with custody firms like Fireblocks

- VIP-based security structure

- Advanced encryption protocols

Kraken Security Highlights:

- Majority of funds in cold storage

- Two-factor authentication (2FA)

- Global Settings Lock for account changes

- Regular security audits

BloFin’s VIP-based fee structure suggests tailored security for different user levels. This approach might appeal if you value customized protection based on your trading volume.

Kraken’s longer track record provides confidence in their security practices. Their Global Settings Lock feature gives you extra protection against unauthorized account changes.

Both platforms use encryption to protect your data and funds. However, Kraken’s proven history might give you more peace of mind if you’re new to crypto trading.

Also Read: How to Trade Crypto Options in India?

Remember to always enable all available security features regardless of which platform you choose.

Is BloFin a Safe & Legal To Use?

BloFin implements robust security measures to protect user assets and data. Based on available information, the platform has not reported any major security breaches as of March 2025.

One notable feature is that BloFin doesn’t require mandatory KYC (Know Your Customer) verification. This means you can open an account, deposit, trade, and withdraw without submitting identity documents.

The platform employs standard security practices including:

- Two-factor authentication (2FA)

- Cold storage for the majority of user funds

- Advanced encryption for data protection

BloFin operates as a cryptocurrency exchange in multiple countries. However, you should verify its legal status in your specific location before using it.

To assess its trustworthiness, consider these steps:

- Read reviews from multiple sources

- Check for pending legal issues

- Verify the company’s registration status

- Use blockchain analysis tools to examine their wallet addresses

The platform uses a VIP-based fee structure, which can be appealing if you’re a high-volume trader who values security.

Despite being newer than established exchanges like Kraken, BloFin focuses on providing a secure environment for crypto trading and investments.

Remember to use only a portion of your investment capital when trying any new exchange platform.

Is Kraken a Safe & Legal To Use?

Kraken has built a strong reputation for security and regulatory compliance in the cryptocurrency exchange industry. Founded in 2011, it’s one of the longest-running exchanges still operating today.

Kraken operates legally in many countries around the world. In the United Kingdom, it’s registered with the Financial Conduct Authority (FCA) as a Cryptoasset Firm under the name ‘Payward Ltd.’

The exchange implements robust security measures to protect your funds and personal information. While Kraken requires personal information for KYC (Know Your Customer) compliance, they ensure privacy through encryption and secure data handling.

Independent auditors often rank Kraken #1 in both security and customer service. This recognition highlights their commitment to maintaining high standards in these critical areas.

However, it’s worth noting that in 2023, the SEC charged Kraken for operating as an unregistered Securities, Broker, Dealer, and Clearing Agency in the United States. This regulatory challenge is something to be aware of if you’re a US-based user.

Despite this challenge, Kraken has worked consistently to demonstrate its ability to securely manage customer funds. Their transparency and security protocols help maintain user trust.

Before using Kraken, you should verify its regulatory status in your specific country. Regulations for cryptocurrency exchanges can vary significantly by location.

Frequently Asked Questions

Investors comparing BloFin and Kraken often have specific concerns about features, security, and costs. These questions address the key differences that might influence your trading decisions.

What are the main differences in features between BloFin and Kraken?

BloFin focuses on advanced trading tools and specialized features for experienced traders. The platform offers detailed analytics, sophisticated order types, and trading bots.

Kraken provides a more balanced approach with both beginner-friendly interfaces and professional trading options. It includes staking services, margin trading, and futures contracts.

BloFin tends to appeal more to professional and high-volume traders, while Kraken serves a broader audience from beginners to institutions.

Can BloFin’s security measures compare favorably to those of Kraken?

BloFin implements rigorous security protocols including cold storage for assets, two-factor authentication, and regular security audits. Their focus on security is a standout feature.

Kraken has established a strong security reputation over its longer history. It offers proof-of-reserves audits, maintains a dedicated security team, and has never experienced a major hack since its founding in 2011.

While both platforms prioritize security, Kraken’s longer track record gives it an edge in demonstrated security resilience.

How do the trading fees of BloFin stack up against those charged by Kraken?

BloFin typically offers competitive maker-taker fee structures that decrease with trading volume. VIP accounts receive additional fee discounts based on activity levels.

Kraken’s fee structure starts slightly higher for casual traders but also decreases with volume. Their fees range from 0.16% to 0.26% for most regular traders.

When comparing the two, BloFin often provides more attractive rates for very active traders, while Kraken might be more cost-effective for occasional investors.

Which platform offers a wider variety of cryptocurrencies, BloFin or Kraken?

BloFin supports a growing selection of cryptocurrencies with a focus on both established coins and promising newer tokens. They regularly add emerging assets to their listings.

Kraken offers over 200 cryptocurrencies and continues expanding its offerings. They carefully vet new additions with a focus on legitimate projects with strong fundamentals.

Overall, Kraken currently provides access to more cryptocurrencies, but BloFin has been rapidly expanding its available trading pairs.

How do user experiences with BloFin’s customer support compare to those with Kraken?

BloFin provides 24/7 customer support through chat, email, and a comprehensive help center. Their response times are generally quick, especially for VIP clients.

Kraken’s customer service includes 24/7 live chat and ticket systems. While they experienced some delays during peak crypto periods, they’ve invested in expanding their support team.

Users report satisfaction with both platforms’ responsiveness, though Kraken’s longer history means more documented customer experiences are available.

Which exchange, BloFin or Kraken, provides more comprehensive tools for professional traders?

BloFin excels with advanced charting tools, API access for algorithmic trading, and detailed market analysis features. Their platform caters specifically to professional traders with complex needs.

Kraken offers Kraken Pro with advanced order types, margin trading up to 5x, and futures contracts. Their tools include detailed charting capabilities and API access.

Professional traders might find BloFin’s specialized tools more suited to high-frequency trading, while Kraken provides a robust all-around package with institutional services.

BloFin vs Kraken Conclusion: Why Not Use Both?

After comparing BloFin and Kraken, you might wonder which platform to choose. The truth is, you don’t necessarily have to pick just one.

BloFin offers advanced trading features with over 300 perpetual swap contracts and copy trading functionality. It’s designed for traders seeking deep liquidity and sophisticated tools.

Kraken, meanwhile, has established itself as a reliable exchange with strong security measures and a user-friendly interface that appeals to both beginners and experienced traders.

Benefits of using both platforms:

- Diversified security – Spreading assets across multiple exchanges reduces your risk exposure

- Access to more trading pairs – Each platform offers different cryptocurrencies and trading options

- Leverage unique features – Use BloFin for futures trading and Kraken for its user-friendly spot trading

Many crypto enthusiasts maintain accounts on multiple exchanges to take advantage of different fee structures, promotions, and trading opportunities.

You could use Kraken for basic spot trading and long-term holdings while utilizing BloFin for more advanced trading strategies and futures contracts.

The key is to understand your own trading needs and risk tolerance. Both platforms have their strengths, and using them strategically can enhance your overall trading experience.

Just remember to keep track of your assets across both platforms and maintain proper security practices for all your accounts.

Compare BloFin and Kraken with other significant exchanges