When looking for a cryptocurrency exchange in 2025, choosing between BloFin and Poloniex requires careful consideration of their features, security, and user experience. BloFin, established in 2019, has built a reputation as a user-friendly platform suitable for both beginners and experienced traders. Meanwhile, Poloniex has been a long-standing name in the crypto space, offering various trading options.

Understanding the key differences between BloFin and Poloniex will help you make an informed decision based on your specific trading needs and experience level. BloFin emphasizes reliability and accessibility for all skill levels, while Poloniex offers comprehensive cryptocurrency derivatives trading options.

You’ll want to examine factors like security measures, available cryptocurrencies, fee structures, and platform interfaces before deciding. Both exchanges have their strengths – BloFin with its user-friendly approach and Poloniex with its established history in the market.

BloFin vs Poloniex: At A Glance Comparison

BloFin and Poloniex are two cryptocurrency exchanges that offer different features for traders. Based on available information, here’s how they compare:

Trading Options

| Feature | BloFin | Poloniex |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Yes | Limited |

| Leverage Trading | Yes | Yes |

BloFin positions itself as a secure leverage exchange with both crypto futures and spot trading options. Its platform is designed for traders looking for various trading instruments.

Poloniex is one of the older cryptocurrency exchanges in the market. It allows you to purchase and trade Bitcoin and other cryptocurrencies on its marketplace.

KYC Requirements

Poloniex offers optional KYC (Know Your Customer) verification for smaller accounts. However, completing verification increases your account limits and access to more features.

Overall Score

According to BitDegree comparison data, BlockFi has a higher overall score of 6.0 compared to Poloniex. This suggests better performance in certain evaluation criteria.

When choosing between these platforms, you should consider your specific trading needs. BloFin might be better for those interested in futures trading and advanced leverage options.

For beginners or those who prefer spot trading with smaller accounts, Poloniex offers flexibility with its optional KYC for lower limits.

BloFin vs Poloniex: Trading Markets, Products & Leverage Offered

BloFin and Poloniex offer different trading options that might affect your choice between them.

BloFin stands out with over 400 cryptocurrency trading pairs and impressive leverage options up to 150x for contract trading. This high leverage allows you to multiply your potential returns, though it also increases risk.

Poloniex provides a more conservative approach with futures trading that offers up to 100x leverage. Their margin trading is limited to 5x leverage, making it potentially safer for less experienced traders.

Leverage Comparison:

| Platform | Max Contract/Futures Leverage | Margin Trading |

|---|---|---|

| BloFin | 150x | Supported |

| Poloniex | 100x | Up to 5x |

Both exchanges support spot trading for buying and selling cryptocurrencies directly. They also offer futures contracts that let you speculate on price movements without owning the actual assets.

Your trading style should influence your choice. If you’re looking for higher leverage and more trading pairs, BloFin might be more suitable.

If you prefer more moderate leverage options with established margin trading, Poloniex could be the better fit.

Also Read: Crypto Options Arbitrage: How to Profit from Mispricing

Remember that higher leverage means higher risk of liquidation. Always consider your risk tolerance when choosing between these platforms.

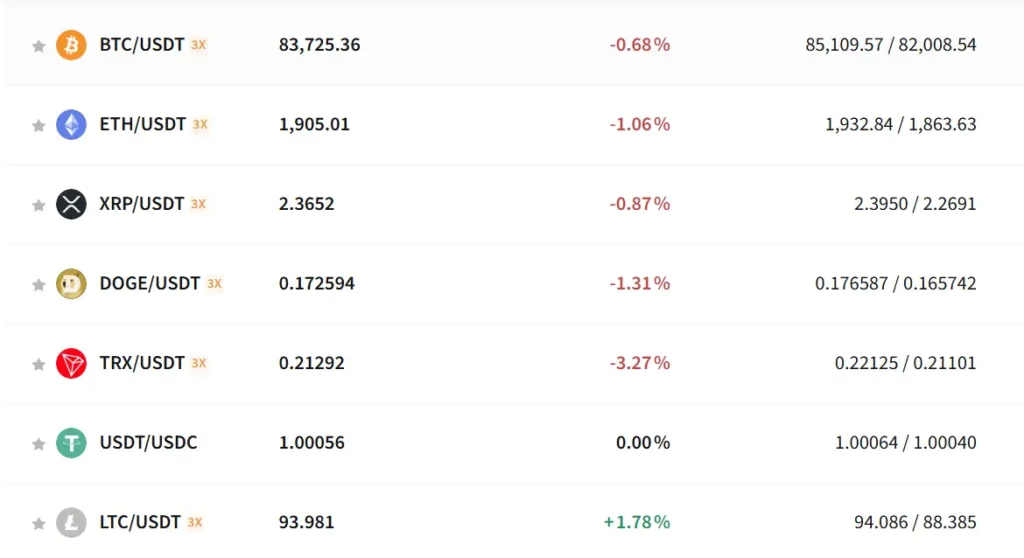

BloFin vs Poloniex: Supported Cryptocurrencies

When choosing between BloFin and Poloniex, the range of supported cryptocurrencies is a crucial factor to consider.

Poloniex offers a diverse selection of digital assets including popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and TRON (TRX). The exchange has been known to support numerous altcoins, giving traders various options.

BloFin, as a newer platform, supports many mainstream cryptocurrencies but typically offers fewer altcoin options compared to more established exchanges.

Key Differences:

| Feature | BloFin | Poloniex |

|---|---|---|

| Major Coins | Bitcoin, Ethereum, etc. | Bitcoin, Ethereum, TRON, etc. |

| Altcoin Selection | Moderate | Extensive |

| Token Listings | Regular updates | Frequent new additions |

| Stablecoins | Major options available | Multiple options |

You’ll find that Poloniex generally maintains a larger cryptocurrency ecosystem, which can be beneficial if you’re looking to trade less common tokens or diversify widely.

BloFin focuses more on quality over quantity, ensuring that their supported cryptocurrencies meet certain standards before listing.

Both platforms regularly update their offerings, but you should check their current listings if you’re interested in trading specific tokens that aren’t mainstream.

For beginners, either platform offers enough variety to start trading popular cryptocurrencies without feeling limited.

BloFin vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and Poloniex, trading fees matter a lot for your bottom line. Let’s compare how these platforms stack up in 2025.

Poloniex Trading Fees:

- Maker fee: 0.02% for futures trading

- Taker fee: 0.075% for futures trading

- Competitive fee structure compared to other exchanges

Poloniex maintains a $0 deposit fee policy, making it easier to fund your account. Withdrawal fees vary depending on the cryptocurrency and network you’re using.

BloFin Trading Fees:

While specific BloFin fee information isn’t detailed in the search results, it appears as an alternative to consider in the cryptocurrency exchange market for 2025.

Each platform offers different fee structures that may benefit different types of traders. If you trade frequently, even small fee differences can significantly impact your profits over time.

When comparing withdrawal processes, remember to check both the fee amount and minimum withdrawal limits. These restrictions can affect how efficiently you access your funds.

Your trading volume and preferred cryptocurrencies should guide your choice between these platforms. Higher-volume traders often benefit from lower maker fees on platforms like Poloniex.

Before committing to either exchange, check their current fee schedules as they may change from the rates mentioned here.

BloFin vs Poloniex: Order Types

When trading on cryptocurrency exchanges, understanding the different order types can help you execute trades more effectively. Both BloFin and Poloniex offer several order types, but they have some key differences.

BloFin provides three main order types: market orders, limit orders, and position-closing orders. Market orders execute immediately at the current market price. Limit orders let you set a specific price for your trade to execute.

If you already have a position on BloFin, you can use their specialized closing option on the K line or choose to reverse your order.

Poloniex offers a similar but slightly expanded selection of order types. Their platform supports market orders and limit orders like BloFin. However, Poloniex also includes stop-limit and stop-market orders for more advanced trading strategies.

Stop-limit orders on Poloniex help you limit losses or lock in profits by setting trigger prices. When the market reaches your trigger price, the platform places your limit order automatically.

Here’s a quick comparison of order types:

| Order Type | BloFin | Poloniex |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Position Closing | ✓ | ✓ |

| Stop-Limit | ✗ | ✓ |

| Stop-Market | ✗ | ✓ |

The additional order types on Poloniex give you more flexibility for advanced trading strategies, while BloFin keeps things simpler with fewer options.

BloFin vs Poloniex: KYC Requirements & KYC Limits

When choosing between BloFin and Poloniex exchanges, understanding their KYC (Know Your Customer) requirements can be a deciding factor for many traders.

BloFin operates as a no-KYC crypto exchange, allowing you to trade without submitting personal identification documents. This gives you immediate access to both spot and futures trading without verification delays.

Poloniex offers a tiered approach to KYC. While KYC is optional for smaller accounts, you’ll need to complete verification to access increased limits and features. This two-level system includes:

- Level 1: Basic access with lower trading limits

- Level 2: Enhanced features requiring personal details and identification proof

For privacy-focused traders, BloFin’s no-KYC policy provides a significant advantage. You can start trading immediately without sharing personal information.

Trading limits vary significantly between the platforms based on verification status:

| Exchange | No KYC Limits | Verified Limits |

|---|---|---|

| BloFin | Full access | N/A |

| Poloniex | Limited | Expanded |

Poloniex stores most funds offline in cold storage, offering security even for unverified accounts. However, you’ll face restrictions on withdrawal amounts and certain trading features.

Your choice between these exchanges may depend on your privacy preferences, trading volume needs, and comfort with sharing personal information.

BloFin vs Poloniex: Deposits & Withdrawal Options

When choosing between BloFin and Poloniex, understanding their deposit and withdrawal options is crucial for your trading experience.

BloFin supports various deposit methods including cryptocurrency transfers, credit/debit cards, and some bank transfer options. Their withdrawal process typically completes within 24 hours for cryptocurrencies.

Poloniex focuses primarily on cryptocurrency deposits and withdrawals. Based on available reviews, they have established testing procedures for these methods to ensure reliability.

Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and various altcoins. However, their fee structures differ:

| Feature | BloFin | Poloniex |

|---|---|---|

| Crypto Deposits | Free | Free |

| Fiat Deposits | Available (fees vary) | Limited options |

| Withdrawal Fees | Varies by cryptocurrency | Varies by cryptocurrency |

| Processing Time | 1-24 hours | 1-24 hours |

BloFin offers more fiat currency options for deposits, making it potentially more accessible if you’re new to crypto trading.

Poloniex has been in the market longer and has established withdrawal procedures, though some users report occasional delays during high-volume periods.

Security measures for withdrawals are important on both platforms. You’ll need to complete verification steps for larger withdrawals, and both use two-factor authentication for added protection.

Consider your primary trading needs when choosing between these platforms, as your most frequently used deposit and withdrawal methods should align with the platform’s strengths.

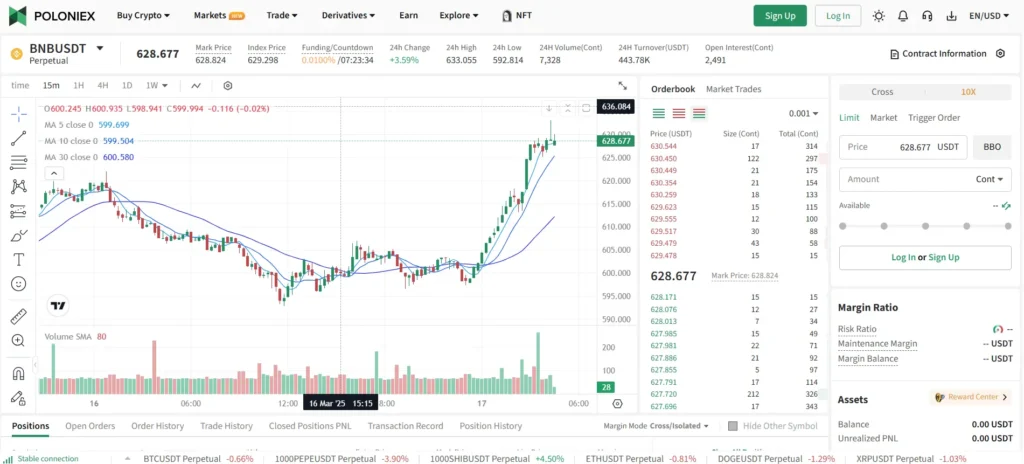

BloFin vs Poloniex: Trading & Platform Experience Comparison

When comparing BloFin and Poloniex trading platforms, several key features stand out that might impact your trading experience.

BloFin offers a clean, modern interface that many beginners find approachable. The platform provides real-time analytics and a customizable dashboard to track your favorite cryptocurrencies.

Poloniex, one of the older exchanges in the crypto space, features a more technical trading interface with advanced charting tools. You’ll find more order types available compared to BloFin.

Trading Features Comparison:

| Feature | BloFin | Poloniex |

|---|---|---|

| User Interface | Modern, beginner-friendly | Technical, feature-rich |

| Mobile App | Yes, highly rated | Yes, mixed reviews |

| Order Types | Market, Limit, Stop | Market, Limit, Stop, OCO, Post-Only |

| Charting Tools | Basic | Advanced |

Both platforms support spot trading, but Poloniex offers margin trading options that BloFin currently doesn’t provide.

Security is a crucial aspect of any trading platform. BloFin implements two-factor authentication and cold storage solutions. Poloniex has enhanced its security measures following past incidents, now using multi-signature wallets.

Trading fees differ between the platforms. BloFin typically charges slightly lower maker-taker fees for average traders, while Poloniex offers better rates for high-volume traders.

The platform speed and reliability favor BloFin during high-volatility periods, with fewer reported outages compared to Poloniex.

BloFin vs Poloniex: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for managing risk. Both BloFin and Poloniex have different approaches to handling liquidations.

BloFin offers higher leverage options, allowing traders to use up to 150x leverage on various crypto trading instruments. However, according to user reports, BloFin has faced criticism for its liquidation practices.

Some users have reported that BloFin has adjusted margin requirements and liquidation thresholds without proper notice. This lack of transparency has led to unexpected liquidations for some traders.

Poloniex, while offering lower maximum leverage than BloFin, tends to maintain more consistent liquidation policies. Their liquidation mechanism typically follows a more predictable pattern, which can help you plan your risk management strategy.

Key Differences:

| Feature | BloFin | Poloniex |

|---|---|---|

| Max Leverage | Up to 150x | Lower than BloFin |

| Liquidation Transparency | Some user complaints about sudden changes | Generally more consistent |

| Margin Requirements | Reports of arbitrary adjustments | More stable thresholds |

You should carefully monitor your positions when using high leverage on either platform. Setting stop-loss orders can help protect your funds from liquidation.

Remember that higher leverage means higher risk. Even small market movements can trigger liquidations when you’re trading with 100x or 150x leverage.

BloFin vs Poloniex: Insurance

When choosing a crypto exchange, insurance protection is a critical factor to consider. Insurance safeguards your assets against potential losses from security breaches or platform failures.

BloFin offers comprehensive insurance coverage for digital assets held in their custody. Your funds stored in BloFin’s wallets are protected against hacks, theft, and other security incidents up to certain limits.

Poloniex provides some insurance protection, but based on the search results, it appears to have regulatory deposit insurance. This suggests that deposits may have some level of protection, though specific coverage details aren’t fully clear.

Neither platform guarantees 100% protection against all possible losses. It’s important to understand that insurance policies in crypto exchanges often have limitations and exclusions.

Insurance Comparison:

| Feature | BloFin | Poloniex |

|---|---|---|

| Insurance Type | Digital asset insurance | Regulatory deposit insurance |

| Coverage Scope | Protection against hacks and theft | Deposit protection |

| Documentation | Detailed policy information available | Limited information available |

You should review each platform’s insurance terms carefully before making a decision. Consider how much of your portfolio will be stored on these exchanges and what percentage would be covered.

Remember that keeping large amounts in self-custody wallets remains the safest option for long-term storage of significant crypto holdings.

BloFin vs Poloniex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both BloFin and Poloniex offer support options, but they differ in quality and response times.

BloFin provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. Users generally report quick response times, typically within a few hours for email inquiries and minutes for live chat.

Poloniex has struggled with customer support in the past. According to search results, they had overwhelmed support teams as early as 2017. While they’ve made some improvements recently, response times can still be inconsistent.

Some Poloniex users have reported difficulties resolving account issues. One search result mentions complaints about money being “stolen,” which likely refers to withdrawal or account access problems that weren’t promptly addressed.

Response Time Comparison:

| Platform | Average Response Time | Support Channels |

|---|---|---|

| BloFin | 1-2 hours | Live chat, email, help center |

| Poloniex | 24-48 hours | Email, ticket system, FAQ |

BloFin’s customer support team is generally more knowledgeable about their platform features. They can help you navigate the 400+ crypto futures pairs they offer.

You’ll find that both platforms provide basic FAQ sections, but BloFin’s help resources tend to be more comprehensive and up-to-date with current features.

BloFin vs Poloniex: Security Features

When choosing a crypto platform, security should be your top priority. Both BloFin and Poloniex offer strong security features, but they differ in several important ways.

BloFin provides a secure leverage exchange environment for crypto futures and spot trading. Their security system includes multi-factor authentication and cold wallet storage for most user funds.

Poloniex has rebuilt its security after a past breach. They now stand alongside major exchanges like Binance in terms of security measures. Their system includes regular security audits and advanced encryption protocols.

KYC Requirements:

- BloFin: Optional for smaller accounts

- Poloniex: Required for higher transaction limits

Both platforms use SSL encryption to protect your data during transfers. They also employ address whitelisting, which restricts withdrawals to pre-approved addresses only.

Security Feature Comparison:

| Feature | BloFin | Poloniex |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Yes | Yes |

| Insurance Fund | Limited | Yes |

| IP Address Monitoring | Yes | Yes |

| Withdrawal Limits | Customizable | Tier-based |

Poloniex offers increased account limits with completed verification. This adds an extra layer of security for users with larger portfolios.

BloFin focuses on transaction monitoring and suspicious activity detection. Their system automatically flags unusual patterns that might indicate unauthorized access.

Is BloFin A Safe & Legal To Use?

BloFin operates as a licensed cryptocurrency exchange, which is an important first step in establishing legitimacy. According to recent information, the platform has proper licensing to operate as a crypto exchange.

Security is a priority for BloFin, with several protective measures in place. The exchange implements two-factor authentication (2FA) to add an extra layer of security for your account. This means you’ll need both your password and a verification code to access your funds.

BloFin also uses cold storage solutions for cryptocurrency assets. This means most user funds are kept offline, away from potential online threats and hackers. This is considered a security best practice in the industry.

For 2025, these security features position BloFin as a relatively safe option for cryptocurrency trading. However, as with any exchange, you should practice personal security measures:

- Use strong, unique passwords

- Enable all available security features

- Be cautious of phishing attempts

- Consider using a hardware wallet for long-term storage

The legality of using BloFin depends on your location. Cryptocurrency regulations vary widely by country. Before using BloFin, verify that cryptocurrency trading is legal in your jurisdiction and that BloFin is permitted to offer services there.

Remember that while an exchange may be secure, cryptocurrency investments still carry inherent risks. Market volatility and potential regulatory changes can impact your investments regardless of the platform you choose.

Is Poloniex A Safe & Legal To Use?

Poloniex has been operating since 2014 as a cryptocurrency exchange. Its long-standing presence suggests some level of reliability, but there are important safety and legal concerns to be aware of.

From a security standpoint, Poloniex implements standard safety measures for crypto exchanges. However, like many exchanges, it has faced some issues over the years.

In 2021, Poloniex was charged by the Ontario Securities Commission for violating securities law in Ontario. This raises questions about its compliance in certain jurisdictions.

The exchange also settled with the U.S. Securities and Exchange Commission (SEC) for operating an unregistered digital asset exchange, paying more than $10 million in penalties.

Some users have reported problems with account freezes and access to funds. According to search results, there have been complaints about accounts being frozen without sufficient warning.

Legal Status by Region:

- United States: Has faced regulatory issues

- Canada: Violated securities law in Ontario

- Other regions: Varies by country

You should check if Poloniex is legally permitted to operate in your specific location before using it.

When considering safety, remember that all cryptocurrency exchanges carry inherent risks. Using strong passwords, two-factor authentication, and storing large amounts of crypto in personal wallets rather than on the exchange is recommended.

Frequently Asked Questions

BloFin and Poloniex have different approaches to fees, derivatives offerings, and user experiences. Many traders compare these platforms when deciding where to trade crypto derivatives and futures.

What are the key differences in terms of trading fees between BloFin and Poloniex?

BloFin typically offers a tiered fee structure with maker fees ranging from 0.02% to 0.05% and taker fees from 0.04% to 0.07%. These fees decrease as your trading volume increases.

Poloniex has a slightly different fee structure with maker fees starting at 0.10% and taker fees at 0.20%. Their VIP levels can reduce these rates for high-volume traders.

BloFin’s fee structure tends to be more competitive for active traders, while Poloniex may charge additional fees for certain withdrawal methods.

Which platform offers a wider range of crypto derivatives: BloFin or Poloniex?

BloFin offers a broader selection of crypto derivatives, including perpetual futures, quarterly futures, and options across more than 100 cryptocurrencies.

Poloniex has a more limited derivatives offering, focusing primarily on perpetual contracts for major cryptocurrencies like Bitcoin and Ethereum.

BloFin also provides more advanced derivative products such as MOVE contracts and leverage tokens, making it more suitable for traders looking for diverse derivative instruments.

How does the user experience compare for derivative trading on BloFin versus Poloniex?

BloFin’s interface is designed specifically for derivatives trading with advanced charting tools, multiple order types, and customizable trading dashboards.

Poloniex’s derivatives platform is more streamlined but may lack some of the advanced features that experienced derivatives traders prefer. Their mobile app rates around 4.3/5, somewhat behind competitors.

BloFin offers more detailed market analysis tools and position management features, while Poloniex provides a simpler experience that newer traders might find less overwhelming.

What are users on Reddit saying about the reliability of BloFin and Poloniex?

Reddit users generally praise BloFin for its responsive customer support and reliable trading engine during high volatility periods.

Poloniex has received mixed reviews on Reddit, with some users warning about account verification issues and difficulties recovering accounts after losing two-factor authentication devices.

Several Reddit threads specifically warn users about potential problems with Poloniex’s MFA recovery process, suggesting caution when using the platform.

Which platform between BloFin and Poloniex is preferred for Bitcoin futures trading?

BloFin is generally preferred for Bitcoin futures trading due to its higher liquidity, tighter spreads, and more advanced trading tools specifically designed for futures contracts.

Poloniex offers Bitcoin futures trading but with lower trading volumes and fewer contract options compared to BloFin.

Professional traders tend to choose BloFin for Bitcoin futures due to its better execution speeds and more flexible leverage options ranging from 1x to 125x.

What are the top alternatives to BloFin and Poloniex for crypto derivatives trading?

Bitget and KuCoin are popular alternatives with comprehensive derivatives offerings and competitive fee structures. Bitget is known for its copy trading features for derivatives.

Binance remains the market leader for derivatives trading with the highest liquidity and broadest selection of contracts, though its regulatory challenges in some regions are a consideration.

Bybit and dYdX are also strong contenders, with Bybit offering a user-friendly interface for derivatives and dYdX providing decentralized derivatives trading options.

Poloniex vs BloFin Conclusion: Why Not Use Both?

Both Poloniex and BloFin offer unique advantages that might benefit your trading strategy. Poloniex, backed by Goldman Sachs, provides solid infrastructure for both individual traders and firms dealing in cryptocurrency.

BloFin stands out with its deep liquidity pools and advanced trading features. The platform prioritizes security and transparency with robust protection measures and clear fee structures.

Instead of choosing just one platform, consider using both exchanges to maximize your trading opportunities:

Benefits of using both platforms:

- Spread risk across multiple exchanges

- Access different trading pairs and markets

- Take advantage of arbitrage opportunities

- Utilize the unique tools each platform offers

When to use Poloniex:

- Institutional-grade trading needs

- Access to established support systems

- Trading with corporate backing

When to use BloFin:

- Advanced trading features required

- Deep liquidity needs

- Focus on transparency and security

You can start with smaller positions on both platforms to test their interfaces and features. This approach lets you experience each exchange’s strengths firsthand before committing larger funds.

Remember to keep track of your assets across both platforms and consider tax implications of trading on multiple exchanges.

Compare BloFin and Poloniex with other significant exchanges