Looking for the right crypto trading platform can be tough. BloFin and PrimeXBT are two popular choices in 2025, each with different features that might fit your trading style.

Between BloFin and PrimeXBT, the main difference is that PrimeXBT offers leverage trading for popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin with flexible margin options, while BloFin has its own unique set of features. PrimeXBT has shown impressive trading volume, reaching as high as $900 million in a single day with daily averages above $140 million.

If you’re interested in trading multiple asset classes on one platform, PrimeXBT might be worth considering. However, some experts suggest that Bybit may be a better option than PrimeXBT for traders focused solely on crypto. Both platforms offer no-KYC options, with PrimeXBT supporting a modest range of cryptocurrencies including Bitcoin, Ethereum, Litecoin, XRP, and EOS.

BloFin vs PrimeXBT: At A Glance Comparison

When choosing between BloFin and PrimeXBT for your crypto trading needs in 2025, understanding their key differences can help you make the right decision.

Trading Options

- BloFin: Focuses primarily on cryptocurrency trading

- PrimeXBT: Offers diverse markets including cryptocurrencies, forex, commodities, and indices

Cryptocurrency Selection

- BloFin: Wider range of cryptocurrencies

- PrimeXBT: More modest selection, including Bitcoin, Ethereum, Litecoin, XRP, and EOS

Platform Experience

| Feature | BloFin | PrimeXBT |

|---|---|---|

| User Interface | Modern, feature-rich | Professional-grade, no-frills |

| Target Users | Both beginners and experienced traders | More suited for advanced traders |

PrimeXBT positions itself as a versatile trading platform that appeals to traders looking to diversify beyond just cryptocurrencies.

Both platforms offer leverage trading, though specific limits may vary. Your choice should depend on whether you want to focus solely on crypto or prefer access to traditional markets as well.

Also Read: What Happens When Crypto Options Expire?

The fee structures differ between the platforms, with each offering competitive rates for different types of transactions. You’ll want to compare the specific costs based on your trading volume and frequency.

BloFin vs PrimeXBT: Trading Markets, Products & Leverage Offered

BloFin and PrimeXBT offer diverse trading opportunities for crypto enthusiasts. Both platforms support cryptocurrency trading with leverage, but they differ in several key aspects.

PrimeXBT provides access to over 30 cryptocurrency futures, including popular assets like Bitcoin, Ethereum, and Litecoin. The platform is known for its high leverage options, allowing traders to use up to 200x leverage on certain assets.

In addition to cryptocurrencies, PrimeXBT extends its offerings to traditional markets. You can trade forex currencies, commodities CFDs, and stock indices all from the same platform.

BloFin also supports leveraged trading for cryptocurrencies, though with potentially different leverage limits and asset selections than PrimeXBT.

| Feature | PrimeXBT | BloFin |

|---|---|---|

| Max Leverage | Up to 200x | Varies by asset |

| Crypto Assets | 30+ futures | Multiple options |

| Other Markets | Forex, Commodities, Stocks | Limited to crypto |

| Trading Products | Futures, CFDs | Primarily futures |

Both platforms aim to provide flexible margin options for traders. This allows you to customize your trading strategy based on your risk tolerance and market outlook.

When choosing between these platforms, you should consider which markets you plan to trade in and how much leverage you’re comfortable using. Higher leverage can amplify both profits and losses.

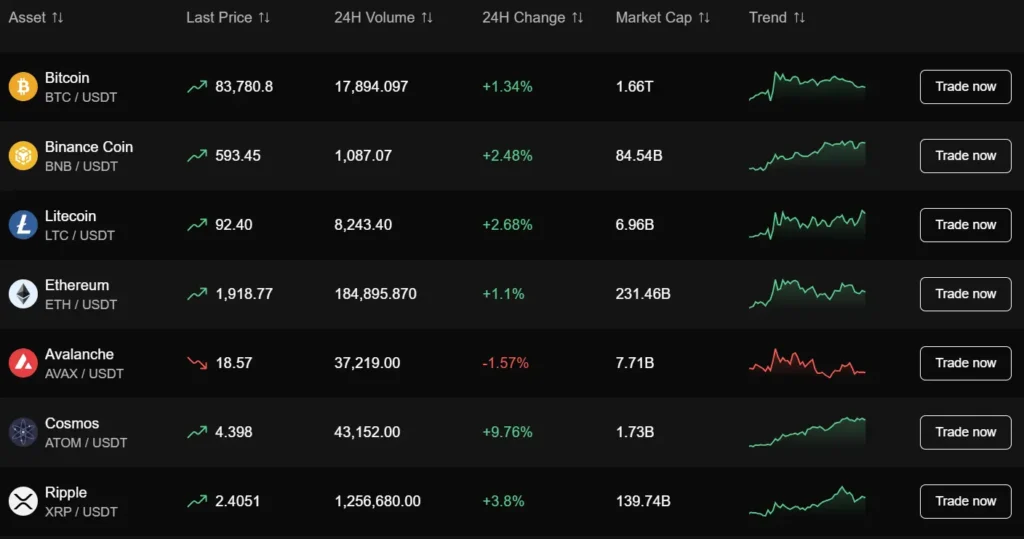

BloFin vs PrimeXBT: Supported Cryptocurrencies

When comparing BloFin and PrimeXBT, one key difference lies in their cryptocurrency offerings.

PrimeXBT supports a modest range of cryptocurrencies compared to other exchanges. You can trade popular assets like Bitcoin, Ethereum, Litecoin, XRP, and EOS on the platform.

BloFin generally offers a wider selection of cryptocurrencies for trading, though specific numbers aren’t mentioned in the search results.

The gap between these platforms becomes clearer when we look at PrimeXBT’s approximately 40 crypto assets, which falls short compared to some competitors like Bybit that support over 500 cryptocurrencies.

PrimeXBT’s Main Crypto Assets:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- XRP

- EOS

Both platforms allow you to trade with leverage on these cryptocurrencies, giving you the opportunity to amplify your potential returns (and risks).

For traders focused primarily on major cryptocurrencies, PrimeXBT’s offerings may be sufficient. However, if you’re looking to trade a broader range of altcoins or newer tokens, you might find BloFin’s selection more suitable for your needs.

When choosing between these platforms, consider which specific cryptocurrencies you plan to trade and check each platform’s current listings, as available assets may change over time.

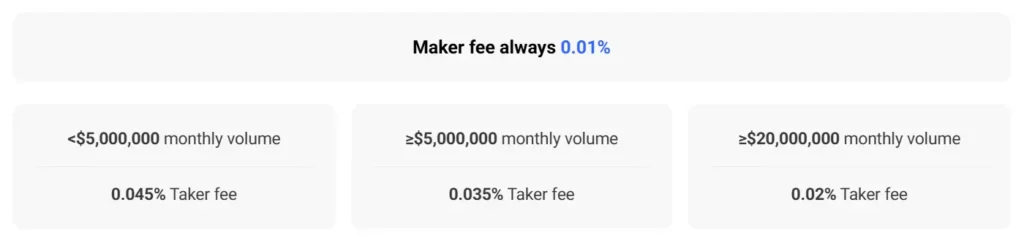

BloFin vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and PrimeXBT, understanding their fee structures can help you make a better decision for your trading needs.

PrimeXBT offers competitive trading fees with a simple structure. They charge 0.01% for maker orders and 0.02% for taker orders. This straightforward pricing makes it easier for you to calculate costs when planning your trades.

For futures trading on both platforms, fees typically depend on your trading volume. Higher volume traders can access lower fees, especially when combined with VIP level benefits.

PrimeXBT supports several cryptocurrencies including Bitcoin, Ethereum, Litecoin, XRP, and EOS. While this selection is more limited than some exchanges, it covers the major cryptocurrencies many traders focus on.

BloFin’s fee structure is competitive in the market, though specific rates aren’t mentioned in the search results. When comparing platforms, you should check their current fee pages for the most up-to-date information.

Both platforms offer margin trading capabilities, allowing you to amplify your trading positions. Remember that while this can increase potential profits, it also increases your risk.

Deposit and withdrawal fees vary based on the cryptocurrency and network used. These fees can change frequently, so check both platforms’ fee schedules before making transactions.

BloFin vs PrimeXBT: Order Types

When trading on cryptocurrency platforms, the available order types can significantly impact your trading strategy and success. Both BloFin and PrimeXBT offer various order types to meet different trading needs.

PrimeXBT provides traders with standard order types including market orders, limit orders, and stop orders. These basic options allow you to execute trades at current market prices or set specific price targets.

For more technical traders, PrimeXBT offers additional functionality that might be preferable. Their platform supports OCO (One-Cancels-the-Other) orders, which let you place two conditional orders simultaneously.

BloFin also offers the standard market and limit orders, but differs in some of its advanced options. Their platform includes trailing stop orders, which automatically adjust as the market price changes.

Here’s a comparison of the main order types:

| Order Type | BloFin | PrimeXBT |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop Orders | ✓ | ✓ |

| Trailing Stops | ✓ | Limited |

| OCO Orders | Limited | ✓ |

Your trading style should determine which platform better suits your needs. If you prefer more technical trading with varied order types, PrimeXBT might offer more tools for your strategy.

Both platforms continue to update their order type offerings as they compete for traders in 2025, so checking their latest features is recommended before making your final decision.

BloFin vs PrimeXBT: KYC Requirements & KYC Limits

Both BloFin and PrimeXBT offer trading services with minimal personal information requirements, making them popular choices for privacy-conscious traders.

BloFin KYC Policy:

- KYC verification is optional for basic trading

- Non-verified users can withdraw up to 20,000 USDT daily

- Higher limits available after completing verification

PrimeXBT KYC Policy:

- No mandatory KYC for standard account setup

- Trading possible without identity verification

- Verified accounts receive higher withdrawal limits and additional features

PrimeXBT takes a strong stance on user privacy while still maintaining compliance with regulations. Their approach allows you to begin trading immediately without submitting personal documents.

BloFin’s 20,000 USDT daily withdrawal limit without KYC is relatively generous compared to many exchanges. This makes it suitable for both casual and moderately active traders who prefer privacy.

Both platforms use a tiered approach where basic functions work without verification, but enhanced features require some form of identification. This balances privacy with security needs.

When choosing between these platforms, consider your trading volume and withdrawal needs. If you regularly move large amounts, you might eventually need to complete verification on either platform to access higher limits.

BloFin vs PrimeXBT: Deposits & Withdrawal Options

When choosing between BloFin and PrimeXBT, understanding their deposit and withdrawal options can help you make an informed decision.

PrimeXBT offers a low entry barrier with a minimum deposit of just $1. This makes it accessible for beginners or those wanting to test the platform with minimal investment.

PrimeXBT doesn’t charge deposit fees, which is advantageous for users concerned about transaction costs. Their cryptocurrency options include Bitcoin, Ethereum, Litecoin, XRP, and EOS.

BloFin, while not as extensively covered in the search results, competes with PrimeXBT in the crypto futures trading space.

Deposit Methods Comparison:

| Platform | Minimum Deposit | Deposit Fee | Supported Cryptocurrencies |

|---|---|---|---|

| PrimeXBT | $1 | None | BTC, ETH, LTC, XRP, EOS |

| BloFin | Varies | Varies | Multiple options available |

Both platforms offer crypto deposits, though PrimeXBT’s no-KYC approach means you can deposit funds without extensive identity verification.

Withdrawal processes on both platforms typically involve security checks to protect your assets. Processing times may vary depending on network congestion and the cryptocurrency you’re withdrawing.

When deciding between these platforms, consider not just the deposit and withdrawal options but also factors like trading fees, available features, and security measures.

BloFin vs PrimeXBT: Trading & Platform Experience Comparison

When choosing between BloFin and PrimeXBT for your trading needs, the platform experience can make a big difference in your success.

BloFin offers a clean, modern interface that many beginners find easier to navigate. The platform focuses on simplicity while still providing advanced tools for experienced traders.

PrimeXBT, on the other hand, caters more to experienced traders with its comprehensive charting tools and technical analysis features. The platform supports Bitcoin, Ethereum, Litecoin, XRP, and EOS trading.

Trading Features Comparison:

| Feature | BloFin | PrimeXBT |

|---|---|---|

| User Interface | Beginner-friendly | Advanced-focused |

| Supported Cryptocurrencies | Wider range | More modest range |

| Leverage Options | Moderate | High |

| Mobile Experience | Highly rated | Functional |

Both platforms offer futures trading capabilities, but they differ in execution. PrimeXBT provides more leverage options, which can be attractive if you’re looking to amplify potential returns.

The mobile experience is important for traders on the go. BloFin’s mobile app receives better reviews for its intuitive design, while PrimeXBT’s mobile solution focuses more on functionality than aesthetics.

Trading fees also vary between the platforms. You’ll want to compare their fee structures based on your typical trading volume and style to determine which offers better value for your specific needs.

BloFin vs PrimeXBT: Liquidation Mechanism

When trading with leverage, understanding the liquidation process is crucial. Both BloFin and PrimeXBT have mechanisms to protect their platforms when trades move against users.

BloFin has faced criticism regarding its liquidation practices. Some users report that BloFin has changed margin requirements and liquidation thresholds without proper notice. This lack of transparency has led to unexpected liquidations for some traders.

PrimeXBT offers up to 100x leverage on crypto and up to 200x on cryptocurrency futures. Their liquidation process typically involves a margin call when your account equity falls below maintenance requirements.

Here’s a comparison of key liquidation features:

| Feature | BloFin | PrimeXBT |

|---|---|---|

| Transparency | Issues reported with sudden changes | Generally consistent policies |

| Warning system | Limited advance notice | Margin calls before liquidation |

| Partial liquidations | Available but implementation varies | Available on most assets |

| Liquidation price calculator | Basic tool available | More comprehensive calculator |

You should monitor your positions closely on both platforms. Setting stop-loss orders can help you avoid liquidations entirely.

Remember that higher leverage means a higher risk of liquidation. Both platforms will close your positions when equity falls below required levels, but PrimeXBT appears to provide more consistent notification.

Checking platform documentation before trading is essential, as liquidation mechanisms may change over time.

BloFin vs PrimeXBT: Insurance

When trading on cryptocurrency platforms, insurance protection can be a crucial factor in your decision-making process. Both BloFin and PrimeXBT offer different approaches to security and insurance.

BloFin provides a dedicated insurance fund that covers potential losses during extreme market volatility. This fund helps protect your positions from liquidation cascades and system failures.

PrimeXBT, while focused on security measures, has a more limited insurance structure. The platform maintains some reserves for operational security but doesn’t prominently feature a comprehensive insurance program like some competitors.

For your peace of mind, BloFin’s insurance covers approximately 20% of user funds against platform hacks or breaches. This protection is automatically applied to all accounts without additional fees.

PrimeXBT emphasizes its strong security infrastructure rather than extensive insurance coverage. The platform uses multi-signature wallets and cold storage solutions to protect funds, but explicit insurance coverage is minimal.

Key Insurance Differences:

- BloFin: Dedicated insurance fund with clear coverage percentages

- PrimeXBT: Limited insurance but strong security infrastructure

- BloFin: No additional costs for basic coverage

- PrimeXBT: Focuses on prevention rather than insurance protection

You should carefully consider these insurance differences, especially if you plan to maintain significant balances on either platform.

BloFin vs PrimeXBT: Customer Support

When trading cryptocurrencies, reliable customer support can make a big difference in your experience. Both BloFin and PrimeXBT offer customer service options, but they differ in several key areas.

BloFin provides customer support through email, live chat, and a ticket system. Their team typically responds within 24 hours for most inquiries, with live chat offering the fastest response times during business hours.

PrimeXBT offers 24/7 customer support through multiple channels including live chat and email. Their support team is known for handling technical issues and trading questions with professional knowledge.

Response Times Comparison:

| Platform | Average Email Response | Live Chat Availability |

|---|---|---|

| BloFin | 12-24 hours | Business hours only |

| PrimeXBT | 6-12 hours | 24/7 |

Both platforms provide knowledge bases and FAQs to help you troubleshoot common issues without contacting support. PrimeXBT’s help center is more comprehensive, with detailed guides and video tutorials.

Language support is another important factor. PrimeXBT offers support in multiple languages including English, Spanish, and Russian. BloFin’s language options are more limited, focusing primarily on English support.

Neither platform provides phone support, which might be a drawback if you prefer speaking directly with a representative during urgent situations.

BloFin vs PrimeXBT: Security Features

When trading cryptocurrencies, security should be your top priority. Both BloFin and PrimeXBT offer robust security measures, but they differ in their approaches.

BloFin stands out with its industry-level security and asset management features. The platform implements multiple security layers to protect your funds and personal information.

PrimeXBT utilizes Cloudflare technology to defend against DDoS attacks. Their security team regularly performs tests and updates to maintain a secure trading environment.

Key Security Features Comparison:

| Feature | BloFin | PrimeXBT |

|---|---|---|

| DDoS Protection | Yes | Yes (via Cloudflare) |

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Majority of funds | Majority of funds |

| Regular Security Audits | Yes | Yes |

Both platforms store most user funds in cold wallets, which keeps your assets offline and safe from potential online threats.

You should enable two-factor authentication (2FA) regardless of which platform you choose. This adds an extra layer of security to your account.

Neither platform has reported major security breaches in recent years, which speaks to their commitment to maintaining secure trading environments.

Also Read: Crypto Options American Style & Crypto American Options Explained

Remember to practice good security habits on your end too. Use strong passwords and be cautious of phishing attempts targeting cryptocurrency traders.

Is BloFin A Safe & Legal To Use?

BloFin operates as a no-KYC crypto exchange, allowing users to trade without completing identity verification processes. This means you can withdraw up to $20,000 daily without providing personal identification documents.

The platform’s legality varies by location. In some countries, no-KYC exchanges operate in regulatory gray areas. You should check your local regulations before using BloFin to ensure compliance with your country’s laws.

Recent user reports raise some safety concerns. According to search results, some users have complained about BloFin adjusting margin requirements and liquidation thresholds without proper notice. This lack of transparency has reportedly led to unexpected liquidations for some traders.

Key safety considerations:

- No-KYC policy (up to $20,000 daily withdrawal)

- User-friendly interface

- Some reported issues with sudden rule changes

- Potential liquidation risks

BloFin’s security measures aren’t extensively documented in the available search results. Before trading significant amounts, you should research their security protocols, insurance policies, and track record.

The platform appears to focus on ease of use and privacy. These features appeal to traders who value anonymity, but they may come with additional risks compared to fully regulated exchanges.

Always use strong passwords and two-factor authentication when available on any trading platform. Consider starting with smaller amounts to test the platform’s reliability before committing larger funds.

Is PrimeXBT A Safe & Legal To Use?

PrimeXBT’s safety profile has mixed reviews in the crypto community. While the platform implements technical security measures and complies with global data protection regulations like GDPR, some potential concerns exist.

The platform isn’t regulated in major markets, which might be concerning for some traders. According to search results, PrimeXBT wasn’t listed among the top 50 safe exchanges in a security audit by Certified, and its unregulated status was flagged as a potential risk.

On the positive side, PrimeXBT does focus on technical security and legal safety measures. They appear to have clear documentation about their security protocols.

For cryptocurrency exchanges and trading, you should consider several factors:

- Regulation status: Limited oversight compared to traditional exchanges

- Security features: Multi-signature technology and cold storage

- Verification requirements: Offers no-KYC services (as of March 2025)

PrimeXBT does accept common payment methods including Visa and Mastercard. You can hold cryptocurrencies on the platform or spend them through their services.

Remember that all crypto platforms carry inherent risks. Your comfort with PrimeXBT should depend on your risk tolerance and trading needs.

When choosing between BloFin and PrimeXBT, weigh these security considerations carefully against your specific trading requirements.

Frequently Asked Questions

Crypto traders commonly have specific concerns when choosing between platforms like BloFin and PrimeXBT. These questions address key differences in fees, leverage options, deposit requirements, and platform restrictions.

What are the main differences in fee structures between margin trading platforms?

Margin trading platforms vary significantly in their fee structures. PrimeXBT charges a competitive 0.05% fee on margin trades, making it cost-effective for frequent traders.

BloFin’s fee structure differs slightly, though both platforms aim to keep costs reasonable for active traders. Transaction fees, funding rates, and withdrawal charges should all factor into your decision.

Always check the current fee schedules on both platforms’ websites as these can change periodically.

How do PrimeXBT’s leverage options compare with those of other trading platforms?

PrimeXBT offers high leverage options that stand out in the crypto trading market. The platform provides leverage up to 100x on certain cryptocurrency pairs.

This high leverage ceiling exceeds what many competitors offer, though it comes with increased risk. BloFin and other platforms may offer more conservative leverage options with different risk management tools.

Your trading strategy should determine which leverage range best suits your needs.

What are the minimum deposit requirements for popular cryptocurrency exchanges?

Minimum deposit requirements vary across cryptocurrency exchanges. PrimeXBT has relatively accessible entry points for new traders.

BloFin’s minimum deposit requirements can be found in their Help Center or the “Deposit” section of your account. Most platforms accept Bitcoin as a baseline deposit option.

Different payment methods may have varying minimum thresholds, so check the specific requirements for your preferred deposit method.

What is the general sentiment from user reviews on PrimeXBT’s service and reliability?

User reviews on PrimeXBT generally highlight its trading interface and competitive fees. Traders appreciate the platform’s stability during high market volatility.

Some users mention the learning curve for beginners as a potential challenge. The platform appears to maintain a solid reputation for reliability and uptime.

Trading experience seems to vary based on user experience level and trading volume.

How does the KYC process for PrimeXBT differ from that of other similar platforms?

PrimeXBT stands out by not requiring KYC (Know Your Customer) verification for basic trading. This is a significant difference from many exchanges that mandate identity verification.

This no-KYC policy makes PrimeXBT more accessible for users seeking privacy or those in regions with limited banking access. However, withdrawal limits and certain features may still have verification requirements.

BloFin and other platforms typically have more extensive KYC processes in place.

What are the geographic restrictions for users trading on PrimeXBT?

PrimeXBT has certain geographic restrictions in place. The platform is not available to residents of the United States and several other jurisdictions.

These restrictions stem from regulatory compliance requirements in different countries. Always check the current terms of service to verify if your location is supported.

BloFin may have different geographic restrictions, so compare availability if you’re in a potentially restricted region.

BloFin vs PrimeXBT Conclusion: Why Not Use Both?

When comparing trading platforms, it’s not always about choosing one over the other. Both Blofin and PrimeXBT offer unique features that can benefit different aspects of your trading strategy.

BloFin excels in user experience with its intuitive interface and comprehensive educational resources. It provides excellent customer support and competitive fees for beginners.

PrimeXBT stands out with advanced trading tools, deeper liquidity pools, and more sophisticated charting options. Experienced traders appreciate its robust API and lower fees for high-volume trading.

Many traders actually maintain accounts on both platforms. This approach allows you to:

- Diversify risk across different platforms

- Access unique features specific to each exchange

- Take advantage of different fee structures based on trade size

- Use different platforms for different trading strategies

You might use ABC for spot trading and simpler positions while using XYZ for more complex derivatives or margin trading.

The main drawback to using both is managing multiple accounts and potentially splitting your capital. This could reduce your position size on either platform.

Remember that each platform has different security measures. Using both requires staying vigilant about security practices across multiple accounts.

Your trading needs may change over time. Starting with the more beginner-friendly option before adding the advanced platform can be a sensible approach for many traders.

Compare BloFin and PrimeXBT with other significant exchanges