When navigating the complex world of cryptocurrency options trading, finding a platform that fits your needs can be daunting. Bybit’s advanced features and comprehensive trading options make it a standout choice for many traders. With an emphasis on high-leverage derivatives and user-friendly tools, this platform is designed for those seeking high-risk, high-reward opportunities while maintaining a focus on security and support.

As you explore Bybit, you’ll discover its reputation as a top-tier crypto exchange. Offering a diverse range of trading options, including USDC-based crypto options, Bybit caters to both seasoned traders and newcomers alike. You can engage in options trading with competitive fees, making it an attractive choice for those looking to optimize their investment strategies.

Bybit’s innovative platform combines professional-grade tools with the convenience of 24/7 customer service, supported by an ultra-fast matching engine. This ensures you have everything you need for efficient trading and investment decisions, positioning Bybit as a preferred platform in the crypto community.

What Are Bybit Options?

Bybit options are a form of cryptocurrency derivatives trading available on the Bybit platform. As a trader, you can utilize these options to speculate on the future prices of cryptocurrencies, similar to traditional financial markets.

Two main types of options are available: call options and put options.

With a call option, you have the right, but not the obligation, to buy a specific cryptocurrency at a predetermined price within a set time frame. This can be advantageous if you predict a price increase.

Conversely, put options give you the right to sell a cryptocurrency at a predetermined price before the option expires. This might be useful when you expect a decline in the asset’s value.

Key Features of Bybit Options:

- Leverage: Options trading on Bybit supports leverage, which allows you to control a larger position with a smaller amount of capital.

- Taker and Maker Fees: Bybit charges a taker fee of 0.03% and a maker fee of 0.02% for options trading.

Bybit options provide flexibility, allowing you to hedge your portfolio or speculate on price movements. The platform’s focus on security measures like KYC verification and two-factor authentication ensures a safe trading environment.

When participating in Bybit options trading, consider market conditions, as this can significantly impact your strategies and outcomes.

Bybit Options Products Offerings

Bybit offers a robust array of options products tailored for your crypto trading needs. You can explore various derivatives, including futures, options, and perpetual contracts.

The platform stands out with its comprehensive selection, allowing you to engage with popular crypto assets through these options.

One of Bybit’s notable features is its collaboration with industry experts to provide highly liquid options. This ensures you have access to competitive option calls and puts, enhancing your trading experience.

Registration with Bybit is straightforward, after which you gain access to options markets. This gives you the flexibility to implement various trading strategies based on market developments.

With Bybit’s focus on security and efficiency, your trading activities are supported by a reliable platform that serves millions globally. This dedication to user experience positions Bybit as a leading choice for cryptocurrency options trading.

Enjoy these diverse offerings with the confidence that Bybit supports your pursuit of opportunities in the dynamic world of crypto trading.

Bybit Supported Coins For Options Trading

When trading options on Bybit, you have access to a select range of cryptocurrencies. This ensures a focused and efficient trading experience.

Supported Coins:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

These coins represent some of the most influential and widely used cryptocurrencies in the market.

The options trading on Bybit uses USD Coin (USDC) as collateral. This can provide a stable base for your trades, given USDC’s reputation for stability.

Contract Style:

- Bybit supports European-style options, which means these can only be exercised at expiration. Understanding this can help you strategize effectively.

Consider the above details when planning your options trading on Bybit. Such specificity in supported coins might help streamline your trading strategy.

Bybit Options Leverage

Bybit provides opportunities for traders to engage in high-leverage trading with its options exchange. You can take advantage of leverage to potentially amplify returns on your investments. It is important to understand how leverage can both increase potential profits and expose you to higher risks.

The maximum leverage available for options trading on Bybit can differ based on the specific market conditions and the type of contract. You are presented with varying leverage levels for different instruments, allowing you to tailor your strategy according to your risk tolerance.

Key Points of Bybit Options Leverage:

- Flexible Leverage Options: Bybit offers a range of leverage settings to fit your trading needs.

- Risk Management: Utilizing leverage requires careful risk management practices to avoid significant losses.

- Market Conditions: The leverage offered can be influenced by market volatility, which affects the risk-reward balance.

Before applying leverage, you should assess your trading goals and the potential risks thoroughly. Leveraging positions in the Bybit options market can provide significant advantages, but it is crucial to trade responsibly.

Bybit Options Calculator

The Bybit Options Calculator is a useful tool for traders to evaluate potential trades and assess risk.

It allows you to calculate the profit and loss for various options strategies. You can input details like the option price, expiration date, strike price, and market position.

Using this cryptocurrency options calculator, you can determine metrics like the break-even point and potential returns on your investment, helping you to make informed decisions.

The tool is designed to be user-friendly, providing quick calculations and results.

It’s essential for managing your trades effectively and maximizing potential gains while mitigating risk.

You can compare multiple scenarios and adjust parameters to see how changes affect your trade.

The Bybit Options Calculator enhances your trading strategy by offering a clear picture of the outcomes of different options strategies.

Whether you are a novice or an experienced trader, utilizing this calculator can improve your trading outcomes significantly.

Bybit Options Types

Bybit offers a variety of options trading products that cater to different trading strategies. These options provide flexibility and leverage, enabling you to take advantage of market movements.

Perpetual Contracts

You have the choice of perpetual contracts, which have no expiry date. This allows you to hold your positions indefinitely. These contracts let you speculate on future price movements without worrying about the limitations of expiry dates.

Inverse Perpetual Contracts

Inverse perpetual contracts are another type, which means the settlement currency is different from the underlying asset. For example, you might trade BTC-based contracts but settle in USD.

Futures Contracts

These futures contracts come with a set expiration date and a pre-agreed price. You can utilize futures for hedging or leveraging potential market opportunities, depending on your market view.

Options

Bybit’s options offer both call and put varieties, allowing you to buy or sell an asset at a predetermined price. The flexibility of these options enhances your ability to strategize around market conditions and potentially optimize your investments.

Key Features

- High Leverage: Enjoy up to 100x leverage on certain derivatives.

- User-Friendly Interface: Navigate a platform designed with advanced traders in mind.

- Versatile Trading: Engage across a range of options to tailor your trading experience.

These tools empower you to manage risk and maximize trading strategies efficiently. Each options type serves distinct purposes and offers varied advantages, helping you to capitalize on your trading skills.

Bybit Order Types

On Bybit, you’ll find a range of order types that cater to various trading strategies and preferences. Here’s a concise overview:

Market Order: Execute a trade instantly at the current market price. This is ideal if your priority is immediate execution over price control.

Limit Order: Set a specific price at which you’re willing to buy or sell an asset. Your order executes only when the market reaches your desired price.

Stop Order: Also known as stop-loss orders, these help protect your investments by executing a trade once an asset reaches a specified price. This can be crucial in managing risk.

Iceberg and TWAP Orders: For advanced trading, you might use Iceberg Orders to execute large orders without disturbing the market. TWAP (Time Weighted Average Price) orders aim to achieve a specific average price over a set time.

Conditional Orders: These include FOK (Fill or Kill), IOC (Immediate or Cancel), and GTC (Good Till Cancelled) orders. They provide added flexibility in how your trades are executed based on specific conditions you set.

Take Profit/Stop Loss Orders: Use these to automate your exit strategy, setting specific prices to lock in profits or limit losses.

Understanding these order types enhances your trading strategy on Bybit, allowing you to respond effectively to changing market conditions while managing risk and optimizing execution strategies.

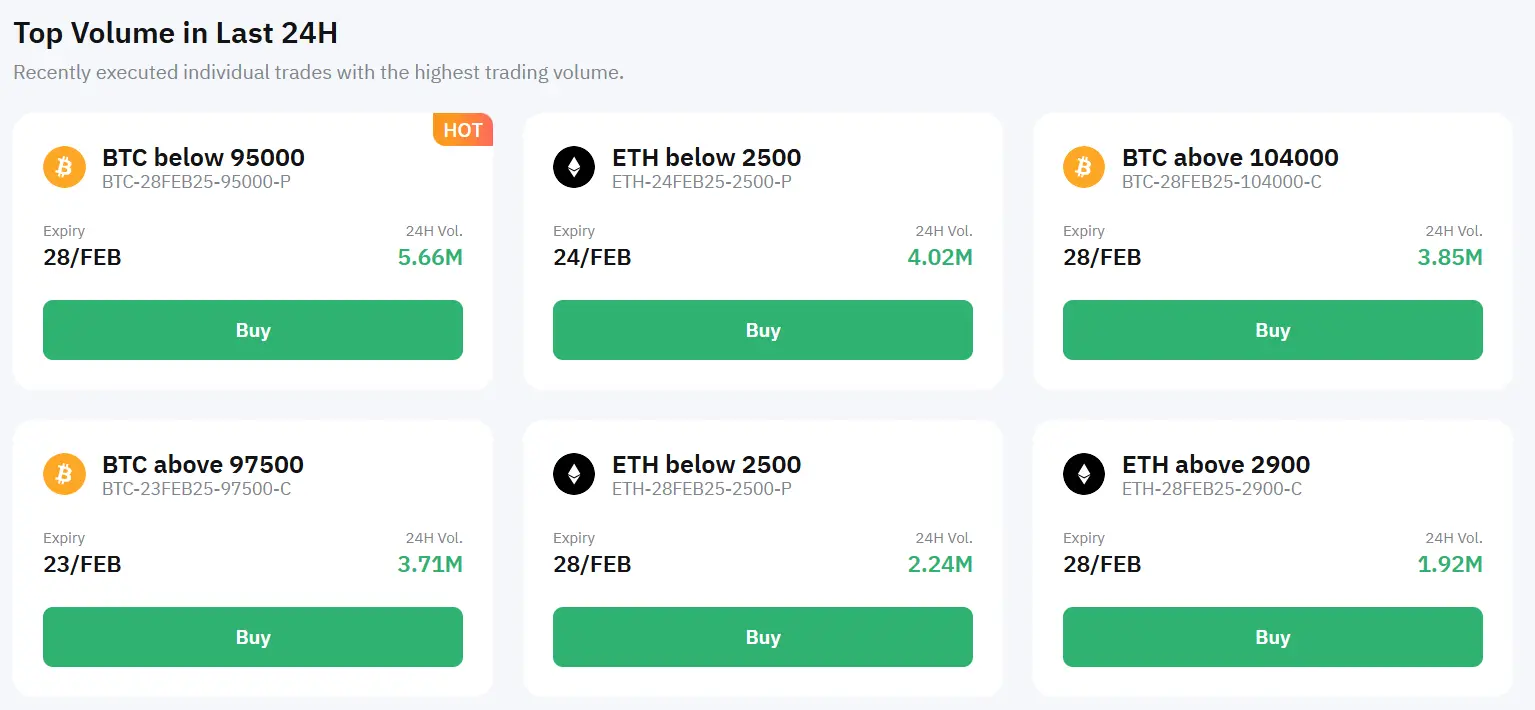

Bybit Options Data: Volume & Prices

Bybit offers a comprehensive range of options data that includes key metrics like trading volume and prices. These metrics are essential for making informed trading decisions. Understanding the dynamics of trading volume can provide insights into market sentiment.

Trading Volume:

Trading volume represents the number of contracts traded over a specific period. High trading volume often indicates strong market interest and liquidity. It can be a signal of upcoming price movements.

Open Interest:

Open interest refers to the total number of outstanding option contracts that are open in the market. It is an indicator of market activity and potential future price action. An increase in open interest, along with trading volume, can imply a bullish trend.

Prices:

Options prices on Bybit are determined by market factors like volatility and time decay. Prices fluctuate based on market conditions and the underlying asset’s price. Monitoring these prices helps you gauge the market’s expectations of future volatility and risk.

For easy reference, here’s a sample list illustrating recent open interest and trading volume figures for BTC above certain price levels:

| Option | Open Interest | Trading Volume |

|---|---|---|

| BTC-14FEB25-104000-C | Large | 861.16K |

| BTC-7FEB25-114000-C | Considerable | — |

Keeping an eye on trading volume and open interest trends can help you make more strategic decisions. Adjust your strategies based on these indicators to optimize your trading approach on Bybit.

Bybit Liquidation Mechanism

When trading on Bybit, understanding the liquidation mechanism is crucial. Bybit employs a dual-price mechanism to prevent price manipulation and ensure fair trading. This system uses Mark Price and Index Price to trigger liquidations and calculates the margin requirements.

For options trading, Bybit prioritizes liquidation of short positions based on the margin recoverable post-liquidation. This approach minimizes the risk of socialized losses and ensures a stable trading environment.

The maintenance margin, set at 0.5% of the Mark Price, dictates when liquidation occurs. A position is liquidated only if the margin level falls below this threshold. This buffer protects you from sudden market volatility and potential losses.

In the event of insufficient liquidity in the order book, Bybit employs over-the-counter (OTC) market makers. This ensures that your positions are squared off efficiently, reducing the potential market maker rate impact.

Key Features of Bybit’s Liquidation Mechanism:

- No liquidation fees for Perpetual and Futures Trading.

- Effective margin management for minimizing losses.

- Utilization of OTC market makers for efficient liquidation.

Trading on Bybit with these liquidation protections can help you manage your investments effectively by mitigating risks associated with market volatility.

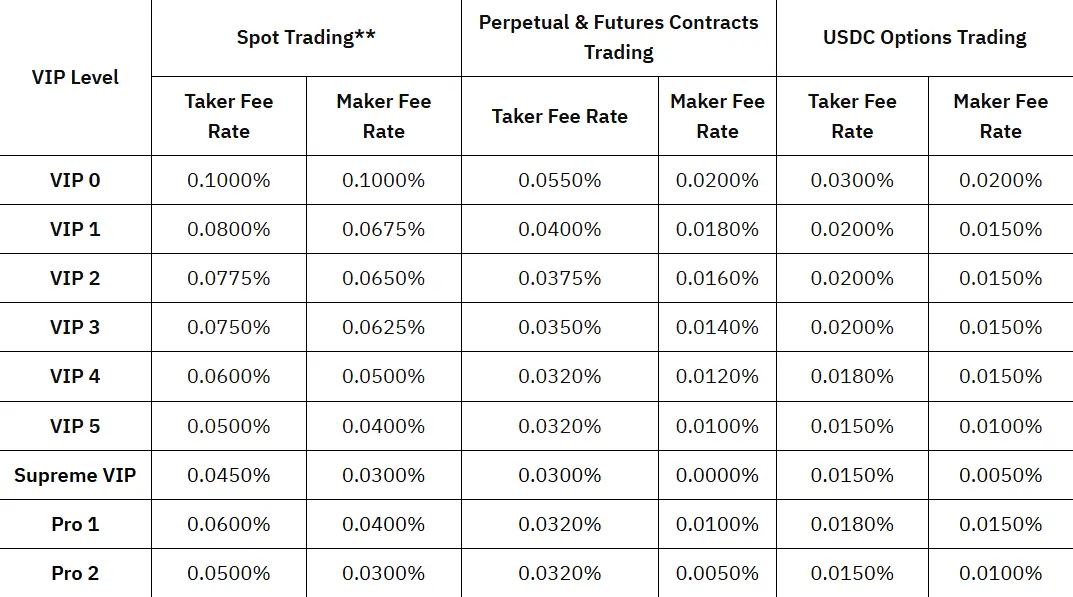

Bybit Options Trading Fees

When trading options on Bybit, you’re presented with a straightforward fee structure that caters to different tiers.

For standard users, the fees are:

- Maker Fee: 0.02%

- Taker Fee: 0.03%

These percentages ensure competitive pricing reflective of Bybit’s market positioning.

If you’re classified under VIP Level 1, you can benefit from reduced fees to enhance your trading efficiency:

- Taker Fee: Starts at 0.02%

- Maker Fee: Remains at 0.02%

This structure is designed to provide well-balanced options for different trading needs.

Another aspect to note is the delivery fee, which applies when options are exercised. These charges underscore Bybit’s comprehensive approach to maintaining an efficient trading environment.

Bybit’s fee system is competitive in the crypto space, enabling you to engage in options trading with clear expectations and costs. Make sure to understand these fees as you plan your trading strategies on their platform.

Bybit Options Funding Rates/Fees

Bybit offers a range of fees associated with its options trading. It’s important for you to understand these to manage your costs effectively.

Delivery Fee: This fee is calculated as the minimum of two values: a percentage of the contract value or 10% of the difference between the settlement price and the initial contract price, multiplied by 0.3. This ensures the fee reflects market conditions.

Liquidation Fee: If a position is liquidated, additional fees apply. These fees are essential to consider, especially in volatile markets.

VIP Discounts: Bybit provides varying fee discounts for different VIP levels. If you are a high-volume trader, you may benefit from reduced maker and taker fees, enhancing your trading cost efficiency.

Funding Fee: In perpetual contracts, the funding fee involves periodic payments between traders who hold long and short positions. This fee aligns the perpetual contract price to the spot market price, providing stability.

Options Trading Fees

| User Level | Maker Fee | Taker Fee |

|---|---|---|

| Non-VIP | 0.1000% | 0.1000% |

| VIP 0 | 0.0550% | 0.0200% |

Understanding these fees will help you make informed decisions. Carefully evaluate each fee and consider your trading strategy to optimize potential returns and manage risks.

Bybit Account Types & KYC Tiers & Limits

When using Bybit, you can choose from several account types, each tailored to meet different user needs. These include basic trading accounts as well as accounts for advanced traders seeking more features and tools for derivatives trading.

KYC Levels

To ensure security, Bybit implements Know Your Customer (KYC) protocols. Standard KYC is a mandatory requirement for accessing most features. For higher transaction limits or certain features like crypto withdrawals via internal transfer, you may need Advanced Individual KYC verification.

KYC Requirements

KYC verification is critical for complying with financial regulations and involves identity verification steps. This process minimizes risks and ensures a safer trading environment. Different products and services require varying levels of identity verification. Failing to complete the necessary KYC steps may restrict some trading functionalities or impose transaction limits.

KYC Tiers and Limits

| KYC Tier | Verification Required | Transaction Limits |

|---|---|---|

| Standard | Basic identity check and document upload | Basic limits for trading and withdrawals |

| Advanced | In-depth identity verification | Higher withdrawal and transaction limits |

Account Funding

Bybit offers various deposit methods, including cryptocurrencies and fiat options. Choose what suits your convenience for funding the account while adhering to KYC requirements.

Understanding these parameters will help you navigate through Bybit account options efficiently.

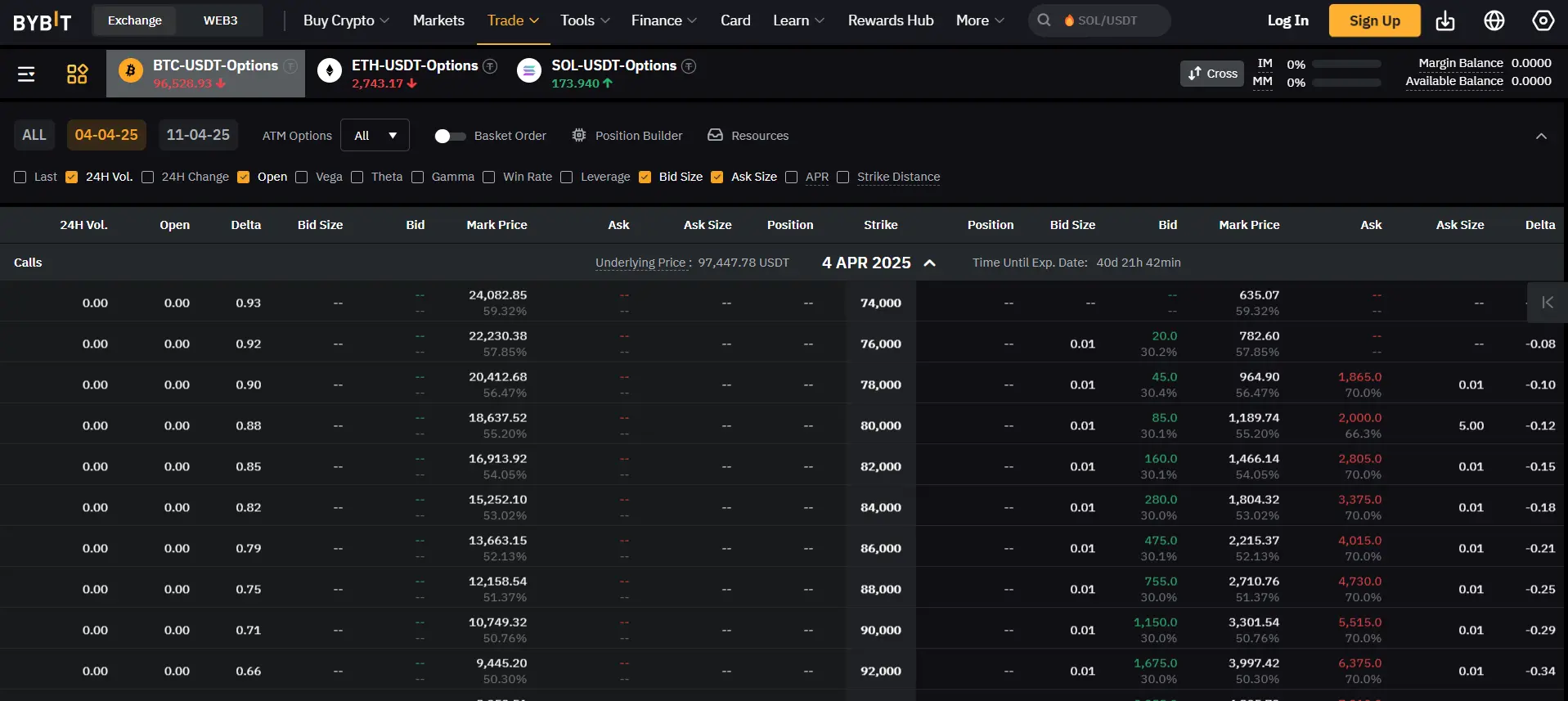

Bybit Trading Platform & Tools

Bybit provides a robust trading platform designed to cater to both novice and experienced traders. A standout feature is its user-friendly interface, which simplifies navigation and trading for all users.

You have access to a variety of advanced trading tools. These include high-leverage trading options up to 100x, which can be particularly useful for those looking to optimize their trading strategies.

Key Features:

- Bybit Earn: This feature allows you to earn passive income on your crypto assets.

- Copy Trading: You can mimic the trades of experienced traders, providing an opportunity to learn and potentially profit.

- Trading Bots: Automate your trades with customizable bots to operate even when you’re not actively trading.

Bybit also offers a two-margin system: cross-margin and portfolio margin. Cross-margin applies to single positions, while portfolio margin assesses risk across your entire portfolio, allowing for flexible risk management.

You will benefit from the platform’s ultra-fast matching engine. This ensures that trades are executed without delay, a crucial factor in high-paced trading environments.

A dedicated team offers 24/7 customer support, available in multiple languages, guaranteeing that help is at hand whenever you need it.

Bybit Insurance Fund

Bybit’s insurance fund acts as a safety net to cover potential losses that might occur during high volatility or unexpected market events. This fund is crucial for maintaining a secure trading environment by protecting traders from incurring losses beyond their initial margin.

Regular contributions are made to the insurance fund through transaction fees. These accumulate over time and are utilized when needed to ensure that users are not negatively impacted by forced liquidations.

The insurance fund’s balance is transparently monitored by Bybit. You can observe both the current amount of the fund and its collection history, providing a clear picture of the fund’s capacity to handle potential losses.

Users of the platform can have confidence in Bybit’s efforts to safeguard their assets. The presence of a well-managed insurance fund offers reassurance while participating in trading activities on the platform.

In essence, the existence of Bybit’s insurance fund is a testament to the platform’s commitment to creating a stable and trustworthy trading experience.

Bybit Deposit Methods

Bybit offers a variety of deposit methods, ensuring you have multiple options to fund your trading account. Deposits are fee-free, but keep in mind that mining or transaction fees may apply depending on your chosen method.

Cryptocurrency Deposits: You can deposit directly using cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and others like EOS, XRP, and USDT. Both ERC-20 and TRC-20 versions of USDT are supported.

Fiat Gateway Options: Bybit supports several fiat deposit options through partners, allowing you to convert your local currency to cryptocurrency. Services like Alipay, Wechat, Apple Pay, and Google Pay are available, along with traditional methods such as credit card and SEPA bank transfers.

The range of options enhances the flexibility and accessibility of the platform for users around the world. With so many deposit methods, you can easily choose the most convenient option based on your needs.

Bybit Security Features

When trading on Bybit, security is a top priority. Bybit employs several security measures to ensure the safety of your assets and information.

Two-Factor Authentication (2FA): You can enhance your account security by enabling 2FA. This adds an extra layer of protection by requiring a verification code in addition to your password.

Cold Wallet Storage: Bybit uses offline cold wallets for storing the majority of funds. This reduces the risk of cyberattacks, as these wallets are not connected to the internet.

Multi-Signature Withdrawals: Withdrawals on Bybit require multiple approvals, providing an additional safeguard against unauthorized transactions. This feature ensures that funds can only be accessed by authorized personnel.

SSL Encryption: Your data is protected through SSL encryption, which helps secure the transmission of information between your device and the platform. This minimizes the risk of data breaches.

Anti-Phishing Code: You can set up an anti-phishing code in your email communications. This feature helps verify the authenticity of emails claiming to be from Bybit, preventing phishing attempts.

These comprehensive security measures ensure a reliable trading environment, allowing you to focus on your trading activities with confidence.

Bybit Customer Support

Bybit is committed to providing comprehensive customer support. You have multiple channels available to reach out for help. 24/7 live chat is accessible on both the website and mobile app, giving you immediate assistance with urgent questions.

When issues are less immediate, email support is a reliable option. Expect responses typically within a few hours, ensuring your concerns are addressed promptly.

For self-service options, explore the Bybit Help Center. It contains a wealth of articles, FAQs, and guides. This resource can be useful for addressing common questions and learning more about the platform’s features.

The availability of multilingual support further ensures you can receive help in a language you understand, enhancing the overall support experience.

Is Bybit A Legal & Safe Platform?

Bybit, launched in 2018, is a well-known cryptocurrency exchange. Its headquarters are located in Dubai. You can rely on its regulation as it is licensed as a Virtual Asset Service Provider in Dubai and also regulated by authorities in Cyprus.

It offers extensive security features to ensure a safe trading environment. Key security measures include KYC verification, two-factor authentication (2FA), and proof-of-reserves data.

For protecting your assets, Bybit employs cold wallet storage and multi-signature withdrawals. This implies that your cryptocurrency is stored offline, minimizing the risk of online threats and hacks.

With over 30 million users globally, Bybit is among the top three exchanges by volume. A professional trading environment with a highly advanced matching engine is available for both investors and traders.

To support your experience, Bybit offers 24/7 customer service and comprehensive multilingual community support. These features ensure that assistance is accessible whenever needed.

Frequently Asked Questions

Bybit is known for its robust security framework, various options trading features, and tailored customer service experiences. Regulation compliance remains a focal point to ensure legal operations across different regions.

What are the security measures implemented by Bybit to protect users’ investments?

Bybit uses advanced security protocols to safeguard your assets. A notable feature is the “360 platform security,” which encompasses measures like multi-signature cold wallets for asset storage and two-factor authentication for account protection. This comprehensive approach minimizes risk and ensures a safer trading environment.

What types of options trading does Bybit offer to its users?

Bybit offers extensive options trading opportunities. You can engage in high-leverage derivatives trading with leverage up to 100x. The platform also supports spot trading, providing flexibility and strategic choices to capitalize on market movements. This variety allows you to tailor your trading strategies effectively.

What has been the general user experience with Bybit’s customer service?

Users generally report a positive experience with Bybit’s customer service. The platform provides responsive and informative support channels, enhancing your trading experience. Their commitment to resolving inquiries swiftly is evident, underlining their dedication to user satisfaction.

How does Bybit ensure regulatory compliance in various jurisdictions?

Bybit actively strives to comply with legal standards across different regions. The exchange engages with local regulatory bodies to align its practices with jurisdictional requirements. This approach helps avert legal complications and reinforces Bybit’s commitment to lawful operations, offering you a compliant trading environment.

Conclusion

Bybit’s options exchange provides a compelling array of features that might align with your trading needs. The platform offers leverage up to 100x on select markets, which can amplify potential returns.

Security measures on Bybit are robust, fostering a safe trading environment. The focus on perpetual contracts allows experienced traders to explore derivative markets with high liquidity.

Trading fees are competitive, with rates such as a taker fee of 0.03% and a maker fee of 0.02%. This structure supports not only frequent trading actions but also aids in cost management.

The user interface is structured to accommodate advanced trading requirements while maintaining a sleek design. This balance ensures you have access to necessary tools without overwhelming complexity.

Bybit remains a noteworthy option for users familiar with derivatives. Consider the platform’s breadth of offerings and strong security as you evaluate whether it fits your objectives.

Want more options? Check out these crypto exchanges: