Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bybit and Deepcoin are two popular options that offer cryptocurrency derivatives trading, but they have some key differences worth exploring.

Based on current comparisons in 2025, Bybit generally comes out ahead with its more straightforward fee structure and available trading fee discounts. Both exchanges handle significant daily trading volumes, with Deepcoin processing over $14 billion according to recent data.

When deciding between these exchanges, you’ll want to consider factors like supported cryptocurrencies, trading types, deposit methods, and user experience. The rest of this article breaks down these differences to help you make the best choice for your trading needs.

Bybit vs Deepcoin: At A Glance Comparison

When choosing between Bybit and Deepcoin exchanges, several key factors can help you make your decision. Here’s a quick comparison of these cryptocurrency platforms as of March 2025.

User Trust & Popularity

Bybit typically ranks higher in trust scores and user confidence compared to Deepcoin. This is reflected in Bybit’s higher overall user ratings and trading volumes.

Security Features

Bybit offers more robust security features than Deepcoin, making it a stronger choice if safety is your top priority.

Trading Options Comparison

| Feature | Bybit | Deepcoin |

|---|---|---|

| Supported Cryptocurrencies | Wider selection | More limited |

| Trading Types | Spot, futures, options | Basic trading options |

| Fee Structure | Competitive | Variable |

Platform Experience

Both exchanges offer mobile and desktop access, but Bybit typically provides a more polished user interface and better customer support options.

Deposit Methods

Bybit supports more deposit methods, giving you greater flexibility when funding your account.

Regulatory Compliance

Bybit generally maintains stronger regulatory compliance in major markets, which can provide additional peace of mind for your investments.

The right choice depends on your specific needs. Consider trading volume requirements, security preferences, and which cryptocurrencies you plan to trade when making your decision.

Bybit vs Deepcoin: Trading Markets, Products & Leverage Offered

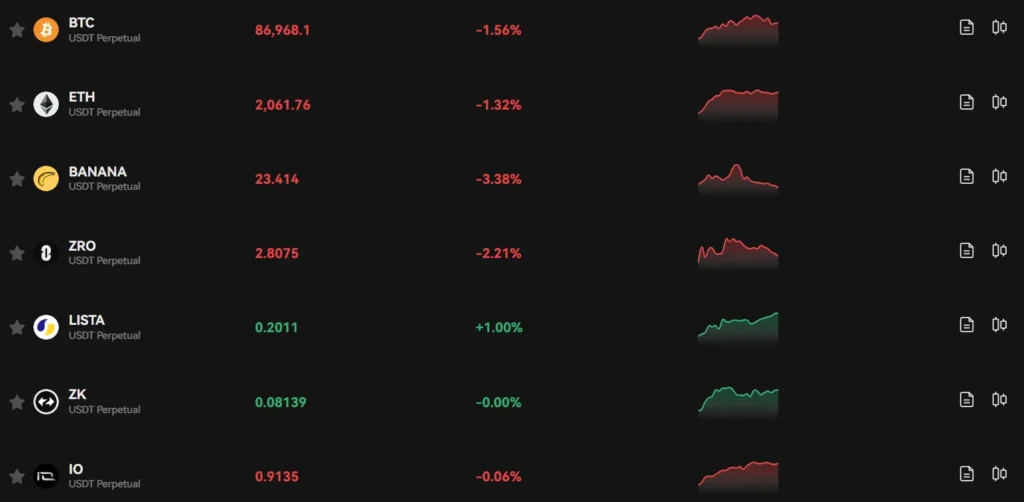

Both Bybit and Deepcoin offer cryptocurrency derivatives trading, but they differ in trading pairs and product offerings.

Trading Pairs

Bybit provides more trading pairs than Deepcoin. This gives you more options to diversify your portfolio and find opportunities in different markets.

Products Available

| Feature | Bybit | Deepcoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Copy Trading | ✓ | ✓ |

| Earn Products | ✓ | ✓ |

Bybit stands out with its robust tools for advanced traders, while Deepcoin offers a competitive but somewhat smaller selection of trading products.

Leverage Options

Both exchanges offer high leverage trading, allowing you to amplify potential returns (and risks). Bybit is known for providing up to 100x leverage on certain pairs.

The actual leverage available to you will depend on:

- The trading pair you select

- Your account tier

- Market conditions

- Regional restrictions

Trading Tools

Bybit offers more advanced trading tools and charting options. This makes it better suited if you’re an experienced trader who needs detailed technical analysis capabilities.

Also Read: Are Crypto Options Legal in Canada, Australia & India?

Deepcoin provides essential trading tools but may not match Bybit’s depth of technical features.

Bybit vs Deepcoin: Supported Cryptocurrencies

Bybit and Deepcoin both offer a range of cryptocurrencies for trading, but they differ in their selections.

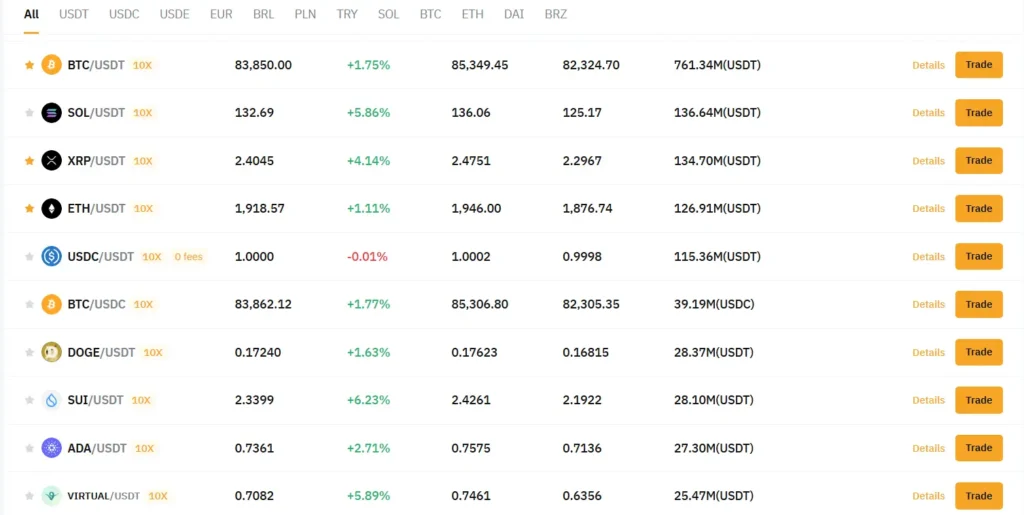

Bybit supports over 300 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You can also find many altcoins and tokens on the platform, giving you diverse trading options.

Deepcoin has a more limited selection compared to Bybit. While exact numbers fluctuate, Deepcoin focuses on supporting major cryptocurrencies and a selection of popular altcoins.

Both exchanges support trading pairs with stablecoins like USDT and USDC. This gives you flexibility when entering and exiting positions.

Key Differences in Supported Cryptocurrencies:

| Feature | Bybit | Deepcoin |

|---|---|---|

| Total Cryptocurrencies | 300+ | Fewer options |

| Major Coins | BTC, ETH, SOL, etc. | BTC, ETH, and other majors |

| Token Support | Extensive altcoin selection | More limited selection |

| New Listings | Regular new coin additions | Less frequent additions |

Bybit typically lists new cryptocurrencies more frequently than Deepcoin. This can be important if you want to trade newer projects or tokens.

When choosing between these exchanges, consider which specific cryptocurrencies you plan to trade. Check both platforms directly for their current listings, as supported coins can change over time.

Bybit vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and Deepcoin, understanding their fee structures can help you make an informed decision. Here’s how these two exchanges compare in terms of trading, deposit, and withdrawal fees.

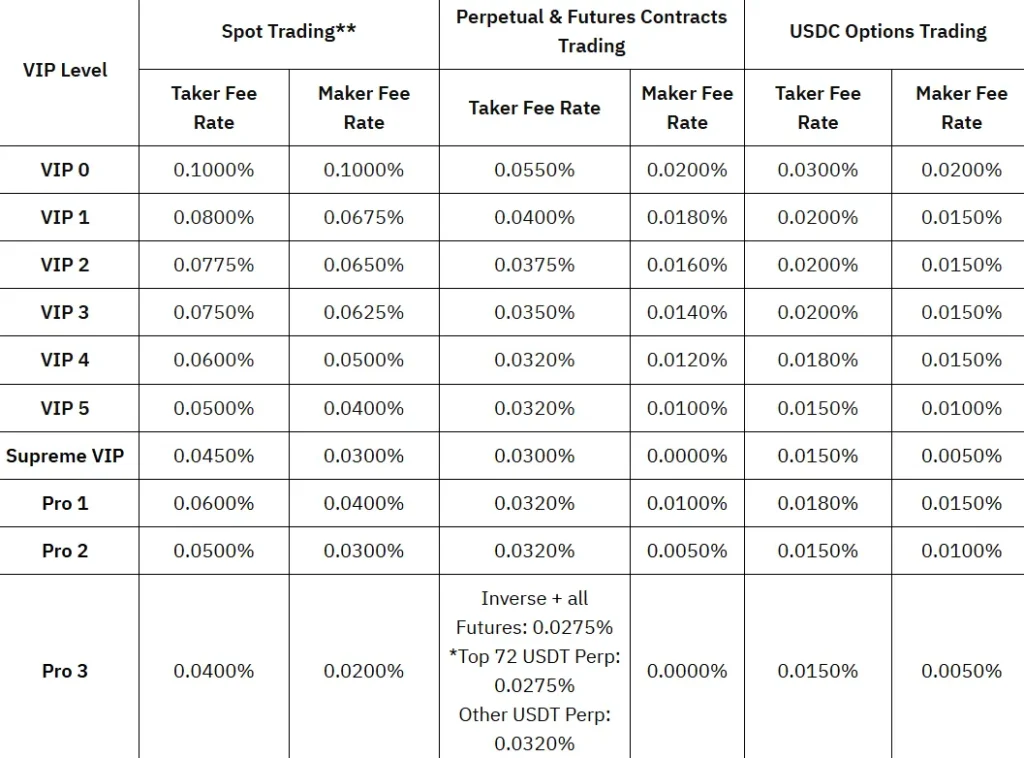

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bybit | 0.02% | 0.055% |

| Deepcoin | 0.05% | 0.07% |

Bybit offers more competitive trading fees, especially for makers who add liquidity to the market. This makes it particularly attractive if you’re an active trader or use limit orders frequently.

Deposit Fees

Both exchanges generally offer free crypto deposits. However, fiat deposit fees vary based on your payment method and location.

Withdrawal Fees

Withdrawal fees on both platforms depend on the cryptocurrency you’re withdrawing. Bybit typically charges network fees that reflect current blockchain conditions.

Deepcoin’s withdrawal fees are comparable but may be slightly higher for some tokens.

Fee Discounts

You can reduce your fees on Bybit by:

- Holding their native token (BYB)

- Increasing your trading volume

- Using VIP tiers

Deepcoin also offers volume-based discounts, though their loyalty program isn’t as extensive as Bybit’s.

Remember that fee structures may change over time, so always check the exchanges’ official websites for the most current information before making your decision.

Bybit vs Deepcoin: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Bybit and Deepcoin offer various order types, but there are some differences worth noting.

Bybit provides a comprehensive set of order options categorized into basic and advanced types. The basic order types include:

- Market Orders: Execute immediately at current market price

- Limit Orders: Set a specific price for execution

- Conditional Orders: Execute when the market reaches a trigger price

Bybit also offers advanced order features like post-only orders, reduce-only orders, and take-profit/stop-loss settings that can be added to your positions.

Deepcoin supports standard order types similar to Bybit, but with a smaller range of advanced options. Their platform includes market orders, limit orders, and stop orders.

One advantage of Bybit is its trading bot options, which include Grid Bot, DCA Bot, and Martingale Bot. These automated trading tools can help you execute complex strategies without constant monitoring.

The user interface for placing orders on Bybit tends to be more intuitive with clearer explanations of each order type. This makes it easier for you to understand the different trading options.

For traders who use advanced order types frequently, Bybit’s more extensive selection may provide better flexibility for implementing sophisticated trading strategies.

Bybit vs Deepcoin: KYC Requirements & KYC Limits

Both Bybit and Deepcoin offer options for users who prefer different levels of identity verification. Your trading experience and withdrawal limits will vary based on your KYC level.

Bybit KYC Levels:

- Non-KYC: You can withdraw up to 2 BTC daily without completing verification

- KYC Level 1: Increases your withdrawal limit to 50 BTC

- KYC Level 2: Provides the highest withdrawal limits

Bybit uses KYC procedures to identify customers and assess risk profiles. This helps prevent money laundering and other illegal activities while protecting the platform.

Deepcoin KYC Levels:

- Basic (No KYC): You can withdraw up to 20,000 USDT daily

- Verified: Higher withdrawal limits and additional platform features

Both platforms give you the flexibility to trade with minimal or no KYC, which some users prefer for privacy reasons.

If you plan to trade larger amounts, completing at least basic verification is recommended on either platform. This will increase your withdrawal limits and give you access to more features.

The KYC process on both platforms typically requires personal information and identity documents such as a government ID and proof of address.

Consider your trading volume and privacy preferences when choosing between these platforms’ verification requirements.

Bybit vs Deepcoin: Deposits & Withdrawal Options

When choosing between Bybit and Deepcoin, understanding their deposit and withdrawal options is essential for your trading experience.

Bybit offers more comprehensive deposit and withdrawal methods compared to Deepcoin. You can fund your Bybit account using cryptocurrencies, bank transfers, and even credit/debit cards in some regions.

Deepcoin primarily supports cryptocurrency deposits. While it has recently expanded its options to include support for global fiat currency deposits, Bybit still provides more versatility overall.

For cryptocurrency transfers, both exchanges support major coins like Bitcoin and Ethereum. Bybit typically processes withdrawals faster, which can be important during volatile market conditions.

Withdrawal fees vary between the platforms. Bybit tends to have competitive withdrawal fees that are clearly displayed on their fee schedule. Deepcoin’s fee structure is less transparent in comparison.

Fiat options are more developed on Bybit, making it easier for beginners to start trading without already owning cryptocurrency. Deepcoin has been improving in this area but hasn’t reached Bybit’s level of convenience yet.

Security measures for deposits and withdrawals are robust on both platforms, with two-factor authentication and withdrawal address whitelisting available.

Based on recent 2025 comparisons, Bybit remains the stronger choice if you value flexible deposit and withdrawal options, particularly if you need to move between fiat currencies and crypto frequently.

Bybit vs Deepcoin: Trading & Platform Experience Comparison

When trading on Bybit, you’ll find a clean, intuitive interface that makes navigation simple. The platform offers advanced charting tools and a responsive design that works well on both desktop and mobile devices.

Deepcoin provides a decent trading experience but lacks some of the polish found on Bybit. Its interface can feel cluttered at times, which might confuse new users.

Trading Features Comparison:

| Feature | Bybit | Deepcoin |

|---|---|---|

| User Interface | Clean, intuitive | Functional but cluttered |

| Mobile Experience | Excellent | Good |

| Charting Tools | Advanced | Basic |

| Order Types | Extensive | Standard |

Bybit stands out with higher liquidity, which means your orders are filled faster with less price slippage. This is particularly important during volatile market conditions.

Both exchanges offer margin trading, but Bybit’s platform feels more stable during high-volume trading periods. You’ll notice fewer delays and platform issues compared to Deepcoin.

For beginners, Bybit’s educational resources and demo account provide a gentler learning curve. Deepcoin offers similar resources but they’re not as comprehensive or well-organized.

Trading fees are competitive on both platforms, though Bybit often provides more opportunities for fee discounts through various promotions and loyalty programs.

Bybit vs Deepcoin: Liquidation Mechanism

When trading with leverage, understanding liquidation mechanisms is crucial for managing risk. Bybit and Deepcoin handle liquidations differently, which could affect your trading outcomes.

Bybit employs a dual price mechanism to manage liquidations. This system uses both mark price and last traded price to determine when to liquidate positions. However, some traders report that Bybit executes liquidations quite efficiently—sometimes too efficiently.

Unlike competitors such as Binance that use “smart liquidation” to reduce user losses, Bybit’s approach appears more straightforward and potentially more severe. This has led to significant liquidation events, including a notable $16M crypto liquidation on the platform.

Deepcoin, with its lower overall score of 7.9 compared to Bybit’s 9.0, handles liquidations differently. While specific details about Deepcoin’s liquidation mechanism are limited in the search results, this is an important factor to consider when choosing between platforms.

Bybit has recently improved transparency by fully disclosing all liquidation events in real-time. This gives you better insight into market conditions and potential risks when trading on their platform.

Key Liquidation Differences:

- Bybit: Dual price mechanism, efficient liquidations, full real-time disclosure

- Deepcoin: Less documented approach, potentially different risk management

When deciding between these exchanges, consider your risk tolerance and how well you can manage leveraged positions under each platform’s liquidation policies.

Bybit vs Deepcoin: Insurance

When choosing a crypto exchange, security should be your top priority. Both Bybit and Deepcoin have insurance systems to protect user assets, but they differ in approach and coverage.

Bybit maintains a dedicated insurance fund to cover potential losses during extreme market volatility. This fund helps protect traders from bankruptcy and negative account balances during liquidations.

As of 2025, Bybit’s insurance fund exceeds $400 million, offering substantial protection for users. The exchange regularly publishes updates on the fund’s size for transparency.

Deepcoin also has an insurance mechanism, though its fund is considerably smaller at approximately $50 million. This reflects the difference in user base, with Bybit serving about 61.72 million users compared to Deepcoin’s 1 million.

Bybit offers additional security features beyond just the insurance fund. These include multi-signature wallets, cold storage for most assets, and regular security audits by third parties.

Deepcoin’s security offerings are more limited, focusing primarily on basic protections. The exchange does implement standard security protocols but doesn’t provide the same depth of protection as Bybit.

For your peace of mind, Bybit clearly provides more comprehensive insurance coverage. This is especially important if you’re trading with significant amounts or using leverage, where market volatility can lead to unexpected losses.

Bybit vs Deepcoin: Customer Support

When choosing a crypto exchange, customer support quality can make a huge difference in your trading experience. Both Bybit and Deepcoin offer support options, but they differ in several ways.

Bybit provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Their response times are generally quick, often within minutes for live chat inquiries.

Deepcoin also offers good customer support solutions. According to search results, they have a live chat feature that lets you connect instantly with available support agents. This immediate access can be valuable when you face urgent trading issues.

Bybit’s support team is known for being knowledgeable about their platform features and cryptocurrency trading in general. They offer assistance in several languages, making it accessible to global users.

Both exchanges provide extensive knowledge bases and FAQs on their websites. These resources can help you solve common problems without needing to contact support directly.

Response quality is another important factor. Bybit’s larger user base (approximately 61.72M users compared to Deepcoin’s 1M) has allowed them to build more robust support systems and train their agents to handle a wider variety of issues.

When facing complex problems, Bybit’s ticket system allows for detailed follow-ups. Deepcoin’s instant chat works well for simpler questions but may be less effective for complicated technical issues.

Bybit vs Deepcoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and Deepcoin offer security features, but there are important differences between them.

Bybit provides more robust security measures overall. It uses multi-signature wallets and stores the majority of user funds in cold storage, keeping them offline and safe from potential hackers.

Bybit also implements two-factor authentication (2FA), which adds an extra layer of protection to your account. This requires you to verify your identity through a second device when logging in.

Deepcoin offers basic security features including 2FA and SSL encryption. However, it has fewer advanced security options compared to Bybit.

Bybit Security Features:

- Multi-signature wallets

- Cold storage for most funds

- Two-factor authentication (2FA)

- Advanced risk management systems

- Regular security audits

Deepcoin Security Features:

- Two-factor authentication (2FA)

- SSL encryption

- Basic risk control measures

Bybit’s larger user base of approximately 61.72 million (compared to Deepcoin’s 1 million) suggests greater trust from the crypto community. This larger user base has also allowed Bybit to invest more heavily in security infrastructure.

You should note that Bybit is more transparent about its security practices. It regularly updates users about security measures and potential risks.

Also Read: Where to Buy Ethereum Options: Top Platforms for Traders

For users who prioritize security, Bybit currently offers a more comprehensive package of protective features than Deepcoin.

Is Bybit Safe & Legal To Use?

Bybit has a strong safety record with no major security breaches or loss of customer funds. The platform encrypts user data during transmission and storage while following global privacy standards.

Security is a priority for Bybit. They implement strict security measures to protect users and have maintained a perfect safety record according to recent reviews.

For US citizens, the legal situation is complex. While trading on Bybit is generally safe from a security standpoint, US regulatory compliance is a different matter.

Bybit feels more uncertain to some users compared to exchanges like Coinbase and Kraken. Despite being the second largest crypto exchange globally, it isn’t always the first recommendation for beginners.

Key Security Features:

- Data encryption (both in transit and storage)

- Compliance with global privacy standards

- Internal security protocols

- Bug bounty programs

When considering safety, compare Bybit with other exchanges based on:

- Security history

- User data protection

- Regulatory compliance

- Transparency

The safety of your funds also depends on your own security practices. Using two-factor authentication and strong passwords adds an extra layer of protection for your Bybit account.

Is Deepcoin Safe & Legal To Use?

Deepcoin implements standard security measures to protect user accounts and funds. The platform uses two-factor authentication (2FA) to provide an extra layer of security for your login process.

When comparing security features, Bybit appears to offer more robust protection mechanisms than Deepcoin. This is an important factor to consider when choosing between these exchanges.

Deepcoin’s legality varies by location. The exchange does not explicitly block users from specific countries, but you should verify the legal status of cryptocurrency trading in your jurisdiction before using the platform.

Security features on Deepcoin include:

- Two-factor authentication

- Password protection

- Standard encryption

The platform does not advertise cold storage for funds or insurance protection, which are important security considerations for many traders.

For optimal security, consider using a hardware wallet to store your crypto assets when not actively trading. Though the Deepcoin wallet is convenient, external hardware wallets provide superior security for long-term holdings.

Always exercise caution when trading on any cryptocurrency platform. Use strong passwords, enable all available security features, and only invest funds you can afford to lose.

Deepcoin vs Bybit Conclusion: Why Not Use Both?

After comparing Deepcoin and Bybit, using both platforms might be the best approach for many traders. Each exchange offers unique advantages that complement each other well.

Bybit scores higher overall with a 7.9 rating compared to Deepcoin. It provides a more robust trading interface that active traders will appreciate.

Deepcoin, however, doesn’t restrict users in different trading markets. It offers two separate trading environments designed for different trader types.

Key Benefits of Using Both:

- Leverage Options: Bybit offers up to 100x leverage on Bitcoin and 50x on other cryptocurrencies

- Risk Management: You can spread your investments across two platforms

- Market Access: More trading pairs and opportunities become available to you

- Liquidity Advantages: Bybit has higher volume and liquidity

When markets are volatile, having accounts on multiple exchanges gives you flexibility. If one platform experiences technical issues, you can quickly switch to the other.

Both exchanges have their fee structures and special features. By using both platforms strategically, you can choose the best option for each specific trade.

Remember to consider your trading style and goals when deciding how to divide your activities between these two exchanges.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Bybit and Deepcoin. These questions typically focus on fees, trading options, security, and support services that impact trading experiences.

What are the main differences in fee structures between top crypto derivatives exchanges?

Bybit charges a maker fee of 0.01% and a taker fee of 0.06% for most futures contracts. Deepcoin offers slightly higher fees at 0.02% for makers and 0.06% for takers.

Both exchanges offer fee discounts through VIP programs based on trading volume. Bybit’s tiered system can reduce fees significantly for high-volume traders.

Transaction fees for deposits and withdrawals vary by cryptocurrency. Bybit typically has more competitive withdrawal fees than Deepcoin for popular coins like Bitcoin and Ethereum.

Which platform offers more competitive futures trading options, Bybit or other exchanges?

Bybit provides better futures trading options with up to 100x leverage on major cryptocurrency pairs. This exceeds Deepcoin’s maximum leverage in several trading pairs.

Bybit offers USDT perpetuals, inverse perpetuals, and USDC futures contracts. Their platform includes more advanced order types like conditional orders and trailing stops.

Bybit’s dual price mechanism helps prevent unnecessary liquidations during volatile market conditions, giving it an edge over Deepcoin for serious futures traders.

How does the liquidity on Bybit compare to that of other major crypto exchanges?

Bybit demonstrates stronger liquidity metrics than Deepcoin across most trading pairs. This results in tighter spreads and less slippage during order execution.

Daily trading volumes on Bybit frequently exceed $5 billion, substantially higher than Deepcoin’s average volumes. Higher liquidity is particularly noticeable in BTC and ETH perpetual contracts.

Bybit’s deeper order books allow traders to execute larger positions without significant price impact. This makes it more suitable for institutional traders and high-volume strategies.

What security features do leading crypto exchanges provide to protect user assets?

Bybit implements comprehensive security measures including two-factor authentication, address whitelisting, and advanced encryption protocols. Their security infrastructure exceeds Deepcoin’s in several aspects.

Bybit maintains a significant portion of user funds in cold storage wallets that are disconnected from the internet. This approach reduces vulnerability to online hacking attempts.

Both exchanges offer risk management tools, but Bybit provides more robust insurance funds to protect against socialized losses during extreme market volatility.

Which crypto exchange is considered the best for futures trading by user reviews?

Bybit consistently receives higher user ratings than Deepcoin for futures trading, with an average score of 7.9 compared to Deepcoin’s lower rating according to BitDegree comparison data.

Traders frequently praise Bybit’s platform stability during high-volatility periods. Many users report fewer outages and technical issues compared to Deepcoin.

Professional traders often prefer Bybit’s advanced trading interface and execution speed. User reviews highlight the importance of reliable order execution for active futures traders.

What customer support and educational resources do prominent exchanges offer to traders?

Bybit provides 24/7 customer support through live chat, email, and social media channels. Their response times are typically faster than Deepcoin’s support system.

Bybit offers more comprehensive educational resources including trading guides, video tutorials, and regular webinars. These materials help new traders understand complex derivatives concepts.

Both exchanges maintain active communities, but Bybit’s knowledge base is more extensive. Their platform includes more detailed documentation on advanced trading strategies and risk management techniques.

Compare Bybit and Deepcoin with other significant exchanges