Choosing the right cryptocurrency exchange can make a big difference in your trading journey. BYDFi and Crypto.com are two popular platforms that offer various features for crypto enthusiasts.

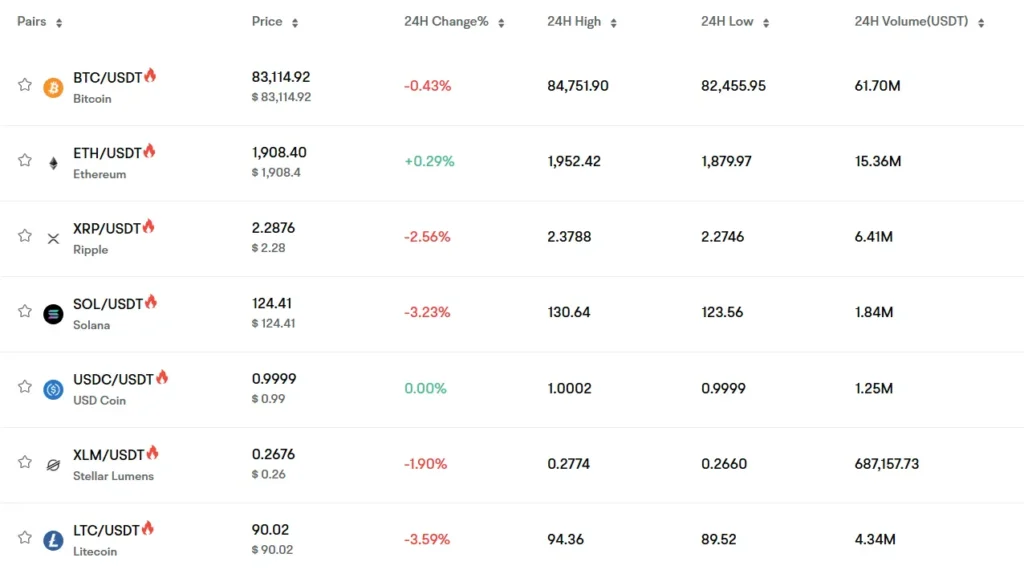

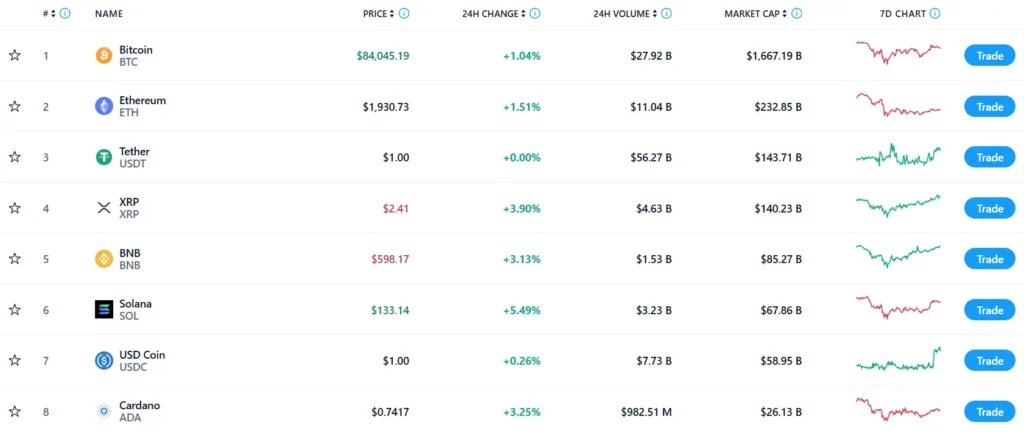

BYDFi supports up to 400 cryptocurrencies while Crypto.com offers more than 290, giving BYDFi an edge in terms of selection variety. Both exchanges provide tools to help you track prices and stay updated on market trends for Bitcoin, Ethereum, and other major cryptocurrencies.

When selecting between these platforms, you’ll want to consider factors beyond just the number of supported coins. Trading fees, withdrawal costs, deposit methods, and user interface all play important roles in your overall experience. This comparison will help you decide which exchange better suits your crypto trading needs.

BYDFi vs Crypto.com: At A Glance Comparison

When choosing between BYDFi and Crypto.com, understanding their key differences can help you make the right decision for your crypto needs.

Security Features

Crypto.com offers stronger security measures compared to BYDFi. This includes advanced encryption and multi-factor authentication options that give users extra peace of mind.

Trading Features

BYDFi stands out with its copy trade option, allowing you to mirror successful traders’ strategies. Crypto.com, however, provides a more extensive range of trading tools.

Track Record

Crypto.com has been around longer and built a more established reputation in the crypto space. BYDFi is newer but offers competitive features for traders looking for alternatives.

Performance

BYDFi features a fast, reliable trading engine with real-time order execution. Both platforms provide access to a wide range of cryptocurrencies.

User Experience Comparison

| Feature | BYDFi | Crypto.com |

|---|---|---|

| Copy Trading | ✓ | ✗ |

| Security Level | Good | Excellent |

| Trading Engine | Fast | Standard |

| Established History | Newer | Well-established |

| Market Access | Wide range | Wide range |

BYDFi works well for traders who want to explore spot markets and derivatives with copy trading benefits.

Crypto.com might be better for you if security and established reputation are your top priorities when choosing a crypto exchange.

BYDFi vs Crypto.com: Trading Markets, Products & Leverage Offered

When comparing trading options, BYDFi offers access to approximately 400 cryptocurrencies, while Crypto.com supports over 290. This variety gives BYDFi a slight edge for traders seeking more diverse asset choices.

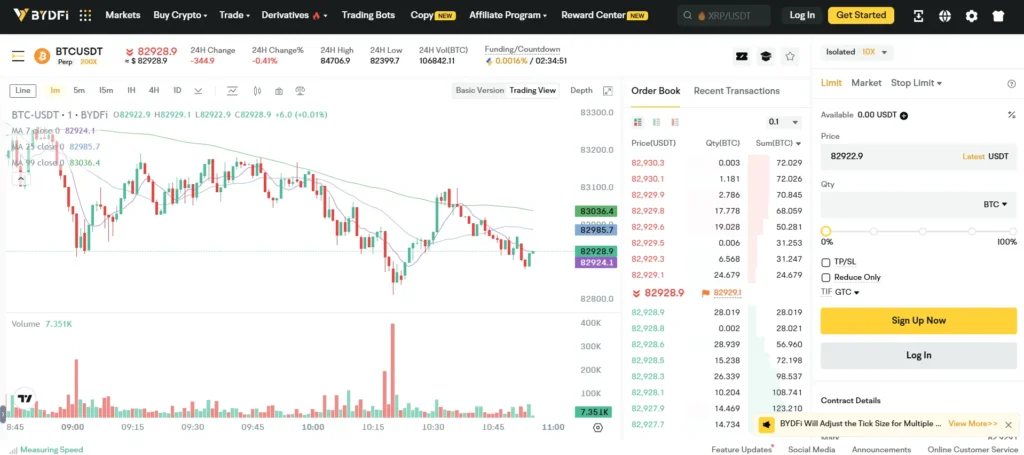

BYDFi stands out with its leverage trading capabilities, offering up to 200x leverage on perpetual futures contracts. This high leverage option attracts experienced traders looking to maximize their position sizes.

Crypto.com provides a more comprehensive ecosystem including a visa card, earn products, and NFT marketplace. Their trading products are integrated with their broader financial services, making it convenient if you need an all-in-one platform.

Available Products Comparison:

| Feature | BYDFi | Crypto.com |

|---|---|---|

| Cryptocurrencies | ~400 | 290+ |

| Max Leverage | Up to 200x | Lower leverage options |

| Futures Trading | 150+ pairs | Available but fewer options |

| Spot Trading | Yes | Yes |

| Additional Services | Limited | Visa card, Earn products, NFT marketplace |

BYDFi excels if you’re focused primarily on trading with high leverage. Their platform specializes in futures trading with 150+ pairs available.

For newer traders, both platforms offer spot trading with competitive fee structures. However, you might find Crypto.com’s interface more beginner-friendly despite having fewer trading pairs.

Also Read: What Happens When Crypto Options Expire?

If you’re looking for advanced trading features like high leverage options, BYDFi provides more technical tools geared toward experienced traders.

BYDFi vs Crypto.com: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is often a deciding factor. Both BYDFi and Crypto.com offer impressive selections, but they differ in some important ways.

BYDFi supports approximately 400 cryptocurrencies for trading, making it a robust platform for those seeking variety. This extensive selection gives you access to both established coins and emerging tokens.

Crypto.com, while still comprehensive, offers around 290 cryptocurrencies. Though this is fewer than BYDFi, it still provides more than enough options for most traders.

Here’s a quick comparison of their cryptocurrency offerings:

| Exchange | Number of Cryptocurrencies |

|---|---|

| BYDFi | ~400 |

| Crypto.com | ~290 |

Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. This ensures you can trade the most common digital assets regardless of which exchange you choose.

If you’re looking to explore less common or newer cryptocurrencies, BYDFi might give you more options with its larger selection. This can be particularly valuable if you’re interested in diversifying into emerging digital assets.

For most everyday traders, either platform will likely meet your needs. The decision may come down to whether specific cryptocurrencies you’re interested in are available on one platform but not the other.

BYDFi vs Crypto.com: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and Crypto.com, understanding their fee structures can help you make a better decision for your trading needs.

Crypto.com offers more competitive trading fees, with rates up to 0.3%. This gives you a slight advantage compared to BYDFi’s trading fee structure.

Deposit Fees:

- BYDFi: No deposit fees

- Crypto.com: Varies by payment method

BYDFi stands out by not charging any fees for deposits, making it a cost-effective option when you’re funding your account.

Withdrawal Fees:

Both exchanges charge withdrawal fees that may vary based on the cryptocurrency network and current conditions. These fees aren’t fixed and can fluctuate over time.

Trading Fee Comparison:

| Exchange | Trading Fees | Deposit Fees | Withdrawal Fees |

|---|---|---|---|

| Crypto.com | Up to 0.3% | Varies | Network-dependent |

| BYDFi | Slightly higher than 0.3% | Free | Network-dependent |

The overall fee structure shows that Crypto.com may be better for active traders concerned with trading fees. However, if you make frequent deposits, BYDFi’s no-deposit-fee policy could save you money.

You should consider your trading volume and habits when choosing between these platforms. Lower fees directly impact your profitability, especially if you trade frequently.

BYDFi vs Crypto.com: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Both BYDFi and Crypto.com offer various order types to meet different trading needs.

BYDFi provides traders with conditional orders similar to those found on Bybit. These orders allow you to set specific conditions that must be met before your order is executed.

Crypto.com offers standard market and limit orders. Market orders execute immediately at the current market price, while limit orders execute only when the market reaches your specified price.

Both platforms support stop-loss and take-profit orders to help manage risk. These allow you to automatically sell your assets when they reach certain price points.

BYDFi has a notable feature with its conditional orders that can be particularly useful for more complex trading strategies. These orders give you more control over when and how your trades are executed.

Here’s a quick comparison of order types:

| Order Type | BYDFi | Crypto.com |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Conditional Orders | ✓ | Limited |

Advanced traders might prefer BYDFi’s more sophisticated order options. However, Crypto.com’s straightforward order types are sufficient for most common trading strategies.

BYDFi vs Crypto.com: KYC Requirements & KYC Limits

When choosing between BYDFi and Crypto.com, understanding their KYC (Know Your Customer) requirements can help you make an informed decision.

BYDFi stands out by offering basic trading without mandatory KYC verification. You can create an account and start trading immediately without submitting personal documents. This makes BYDFi an attractive option if you value privacy and quick onboarding.

Crypto.com takes a more traditional approach with stricter KYC policies. All users must complete identity verification before accessing trading functions. This verification typically includes submitting government-issued ID and proof of address.

BYDFi KYC Tiers:

- No KYC: Basic trading available

- Basic KYC: Higher withdrawal limits

- Advanced KYC: Access to all platform features

Crypto.com KYC Tiers:

- Basic: Required for all users (ID verification)

- Intermediate: Higher limits (additional documentation)

- Advanced: Maximum limits (comprehensive verification)

The withdrawal limits differ significantly between the platforms. BYDFi allows modest withdrawals without KYC, while Crypto.com requires verification for any withdrawal.

Your choice between these exchanges might depend on how you prioritize privacy versus security. Crypto.com’s comprehensive KYC approach contributes to its higher security rating of 9.4 compared to BYDFi.

If immediate trading access without identity verification is important to you, BYDFi offers this advantage. However, if you don’t mind the verification process and prefer an exchange with extensive security measures, Crypto.com might be the better choice.

BYDFi vs Crypto.com: Deposits & Withdrawal Options

When choosing between BYDFi and Crypto.com, understanding deposit and withdrawal options is crucial for your trading experience.

BYDFi stands out by offering free deposits across all supported methods. This zero-fee deposit policy can save you money when funding your account regularly.

Crypto.com supports over 290 cryptocurrencies, giving you more variety for deposits and withdrawals than BYDFi. This broader selection might be important if you work with less common tokens.

Both exchanges support cryptocurrency deposits, but their fiat options differ. BYDFi offers various fiat currency deposit methods, though specific options may vary by region.

Withdrawal fees are an important consideration for both platforms. BYDFi’s withdrawal fees may fluctuate based on network conditions, which can affect your withdrawal costs.

Crypto.com structures its withdrawal fees differently, and they may be higher than BYDFi in some cases. You should check current fee schedules before making large withdrawals.

Processing times also differ between the exchanges. Some users report faster processing with BYDFi for certain transaction types, but this can vary based on network congestion.

Both platforms implement security measures for deposits and withdrawals, including address whitelisting and two-factor authentication to protect your funds during transfers.

BYDFi vs Crypto.com: Trading & Platform Experience Comparison

When choosing between BYDFi and Crypto.com, the trading experience differs significantly. BYDFi supports approximately 400 cryptocurrencies, while Crypto.com offers around 290 trading pairs.

BYDFi stands out with its 200X leverage options for futures trading, making it appealing if you’re interested in higher-risk trading strategies. The platform also includes a unique demo trading feature that lets you practice without risking real funds.

Crypto.com offers a more mainstream experience with a polished mobile app and intuitive interface that beginners often find easier to navigate.

Feature Comparison:

| Feature | BYDFi | Crypto.com |

|---|---|---|

| Cryptocurrencies | ~400 | ~290 |

| Max Leverage | 200X | 20X |

| Copy Trading | Yes | No |

| Demo Account | Yes | No |

| Mobile App | Yes | Yes |

BYDFi’s copy trading functionality allows you to automatically mimic successful traders’ strategies – a helpful tool if you’re new to crypto trading.

Both platforms prioritize security, but they implement different approaches to protect your assets. BYDFi focuses on robust technical security measures, while Crypto.com offers additional features like insurance on deposited assets.

The user interface on BYDFi caters more to active traders with detailed charts and technical analysis tools. If you prioritize having access to more cryptocurrencies and advanced trading features, BYDFi might be your preferred choice.

BYDFi vs Crypto.com: Liquidation Mechanism

Liquidation is a crucial aspect of cryptocurrency trading that affects your assets during market volatility. Both BYDFi and Crypto.com have systems in place to handle this process, but they differ in several key ways.

BYDFi’s liquidation mechanism is designed with a focus on protecting traders during market fluctuations. The platform provides clear warnings before liquidation occurs, giving you time to add more funds to your position.

Crypto.com, on the other hand, operates with slightly different liquidation thresholds and may execute liquidations more quickly in some cases.

Liquidation Thresholds Comparison:

| Platform | Warning Level | Liquidation Level | Partial Liquidation |

|---|---|---|---|

| BYDFi | 80% of margin | 97% of margin | Yes |

| Crypto.com | 85% of margin | 95% of margin | Limited |

BYDFi’s copy trading feature can help you avoid liquidations by following experienced traders’ strategies. This unique tool isn’t available on Crypto.com.

The psychological impact of liquidations can affect market sentiment. BYDFi tries to minimize this by offering partial liquidations, allowing you to keep some of your position rather than losing it all.

Both platforms ensure security through their liquidation processes, but BYDFi’s approach tends to be more trader-friendly with more warning signals and flexible options to manage risk.

You should consider these differences when choosing between the platforms, especially if you plan to trade with leverage where liquidation risk is higher.

BYDFi vs Crypto.com: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. It can protect your assets in case of hacks or security breaches.

Crypto.com offers insurance coverage for funds held in cold storage. Their partnership with Ledger Vault provides additional security protection. They also maintain a reserve fund called the Crypto.com Insurance Fund to help cover potential losses.

BYDFi also implements security measures to protect client funds. While specific insurance details for BYDFi are less documented in public sources, they focus on preventative security through robust protocols.

Your crypto assets on Crypto.com benefit from their $750 million insurance policy. This coverage helps protect against external theft and direct losses.

Neither exchange typically offers insurance for market volatility or personal errors. If you send crypto to the wrong address, insurance won’t help you recover those funds.

When comparing these platforms, you should look beyond just insurance. Consider their overall security practices:

- Two-factor authentication (2FA)

- Cold storage for most funds

- Regular security audits

- Withdrawal protection features

Insurance is just one component of a secure crypto exchange. The best protection comes from exchanges that combine multiple security layers with proper insurance coverage.

BYDFi vs Crypto.com: Customer Support

When choosing between cryptocurrency exchanges, customer support quality can make a big difference in your trading experience.

BYDFi offers responsive customer service according to user feedback. They provide an Expert Q&A Hub where you can find answers about trading, taxes, and secure investing. This resource helps users navigate cryptocurrency complexities.

Crypto.com’s customer support system is comprehensive with multiple contact channels. They offer 24/7 support through live chat and email assistance. Their help center contains detailed guides and FAQs.

Response Time Comparison:

- BYDFi: Generally quick responses within 24 hours

- Crypto.com: 24/7 availability with typical response times under 12 hours

Both platforms provide support through multiple channels:

| Support Channel | BYDFi | Crypto.com |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | ✓ | ✓ |

| Knowledge Base | ✓ | ✓ |

| Social Media | ✓ | ✓ |

| Phone Support | ✗ | ✗ |

User satisfaction ratings show Crypto.com with a slightly higher overall score of 9.4 compared to BYDFi. However, BYDFi receives positive feedback specifically for their customer support responsiveness.

For new crypto traders, both platforms offer beginner-friendly resources. You’ll find tutorials, FAQs, and community forums to help you get started.

BYDFi vs Crypto.com: Security Features

When choosing between BYDFi and Crypto.com, security should be a top priority for your digital assets. Both exchanges have implemented robust security measures, but they differ in several aspects.

Crypto.com has earned a higher overall security score (9.4) compared to BYDFi. This rating comes from their more extensive track record and comprehensive security infrastructure.

BYDFi offers several key security features including:

- Two-factor authentication (2FA)

- Multi-signature wallets

- Regular security audits

- Certifications from reputable security firms

- Advanced encryption for personal data

The exchange conducts frequent security assessments to ensure your funds remain protected. BYDFi’s commitment to security is evident through their continuous system updates.

Crypto.com counters with:

- Top-tier security protocols

- Longer history in the market

- More comprehensive security infrastructure

- Cold storage for most user funds

- Regular penetration testing

You’ll find both platforms prioritize protection against unauthorized access. However, Crypto.com’s longer market presence provides more evidence of their security effectiveness over time.

For traders focused primarily on security, Crypto.com’s more established reputation gives it a slight edge. However, BYDFi’s security measures are still quite robust for typical trading needs.

Your choice will ultimately depend on which specific security features matter most to your trading style and risk tolerance.

Is BYDFi Safe & Legal To Use?

BYDFi prioritizes security and compliance in the cryptocurrency trading space. The exchange has implemented industry-standard security measures to protect user funds, similar to those used by Crypto.com.

For U.S. traders, BYDFi is registered as a Money Services Business with FinCEN. This registration means the platform can legally operate in the United States, providing a legitimate option for American crypto traders.

BYDFi allows U.S. traders to access leverage trading of up to 200x on over 500 cryptocurrencies without requiring KYC verification. This feature makes it attractive if you’re looking for high-leverage trading options.

The exchange views regulatory compliance not just as a legal obligation but as a commitment to providing a secure trading environment for its users. This approach helps build trust with traders who prioritize safety.

When choosing between BYDFi and Crypto.com, consider your specific needs regarding:

- Security features

- Regulatory compliance

- Trading options available

- Leverage limits

- KYC requirements

While both platforms implement strong security measures, Crypto.com has received a slightly higher overall score (9.4) in comparative analyses. However, BYDFi may offer advantages if you’re specifically looking for high-leverage trading with minimal verification requirements.

Always conduct your own research before depositing significant funds on any cryptocurrency exchange.

Is Crypto.com Safe & Legal To Use?

Crypto.com is generally considered a safe platform for cryptocurrency trading and investing. It follows strict security protocols to protect user funds and personal information.

One standout security feature is that Crypto.com stores 100% of customer funds in cold wallets. This means your crypto assets are kept offline, making them much harder for hackers to access.

The platform is legally operating in most countries where cryptocurrency trading is permitted. It complies with regulatory requirements in the jurisdictions where it operates.

Crypto.com uses industry-standard security measures like:

- Two-factor authentication (2FA)

- Anti-phishing codes

- Regular security audits

- Insurance protection for digital assets

While all cryptocurrency platforms carry some risk, Crypto.com has built a solid reputation for safety in the industry. User reviews often highlight the platform’s reliability compared to other exchanges.

The fees on Crypto.com tend to be higher than some competitors, but many users find this acceptable given the security benefits and additional features offered.

Also Read: Crypto Options American Style & Crypto American Options

If you’re planning to simply hold and accumulate cryptocurrency, Crypto.com provides a secure environment for your assets. The platform continues to improve its security measures to adapt to evolving threats in the crypto space.

Frequently Asked Questions

Investors often have specific concerns when choosing between cryptocurrency exchanges. These questions address the main comparison points between BYDFi and Crypto.com based on current information as of March 2025.

What are the key differences between BYDFi and Crypto.com platforms?

Crypto.com offers a more comprehensive ecosystem with a wider range of services including a visa card, NFT marketplace, and DeFi wallet. The platform has earned a higher overall score of 9.4 compared to BYDFi.

BYDFi focuses more on trading features with zero deposit fees. The platform was formerly known as BitYard and maintains simpler operations with fewer additional services.

The user interfaces also differ significantly, with Crypto.com offering a more polished but sometimes complex experience, while BYDFi provides a more straightforward trading environment.

Which platform offers better security features, BYDFi or Crypto.com?

Crypto.com implements stronger security measures including mandatory two-factor authentication, anti-phishing codes, and cold storage for cryptocurrencies. The platform also maintains insurance coverage for digital assets.

BYDFi provides standard security features like two-factor authentication and withdrawal address whitelisting. However, it doesn’t offer the same level of comprehensive protection as Crypto.com.

Both exchanges use SSL encryption for data transfers, but Crypto.com’s security infrastructure is more robust overall with additional layers of protection.

How do the transaction fees compare between BYDFi and Crypto.com?

BYDFi charges no fees on deposits, which is a significant advantage for users making frequent transfers. Their withdrawal fees vary based on network conditions and cryptocurrency type.

Crypto.com uses a tiered fee structure based on your 30-day trading volume and CRO token holdings. Higher volume traders and those staking CRO tokens can access lower fees.

For typical retail traders, BYDFi often offers more competitive trading fees, while Crypto.com provides better rates for high-volume traders who stake their native token.

Which exchange offers a wider range of cryptocurrencies, BYDFi or Crypto.com?

Crypto.com supports over 290 cryptocurrencies, making it significantly more diverse in its offerings. This allows for more trading pairs and investment opportunities on a single platform.

BYDFi offers fewer cryptocurrencies, focusing on major coins and selected altcoins. This limitation might affect traders looking for exposure to newer or more niche digital assets.

The difference in available cryptocurrencies matters most to diversified investors or those interested in emerging tokens and projects.

What customer support options are available on BYDFi and Crypto.com?

Crypto.com provides 24/7 live chat support, an extensive help center, and email ticket systems. Response times average between a few minutes to several hours depending on query complexity.

BYDFi offers email support and a knowledge base but has more limited live support options. Users report longer response times compared to Crypto.com, especially during high-volume periods.

Both platforms maintain active community forums where users can find answers to common questions, though Crypto.com’s resources are generally more comprehensive.

How do BYDFi and Crypto.com compare in terms of user experience?

Crypto.com features a modern, feature-rich interface across its web and mobile applications. The platform can feel overwhelming to beginners but offers extensive functionality for experienced users.

BYDFi provides a more streamlined experience with less complexity, making it potentially more accessible for newcomers to cryptocurrency trading. The learning curve is less steep but offers fewer advanced tools.

Mobile app experiences differ significantly, with Crypto.com’s app receiving higher ratings on app stores and offering more integrated services than BYDFi’s mobile solution.

Crypto.com vs BYDFi Conclusion: Why Not Use Both?

Both Crypto.com and BYDFi offer valuable features that might benefit your crypto journey. Crypto.com scores higher overall with a 9.4 rating and supports more than 290 cryptocurrencies, making it ideal for traders seeking variety.

BYDFi stands out with its zero maker fees for spot trading and no deposit fees. This platform also offers some unique features like copy trading, crypto perpetuals, and demo trading that Crypto.com doesn’t provide.

For beginners, BYDFi’s user-friendly interface makes it particularly appealing. The platform is designed with new traders in mind, offering an intuitive experience with competitive fees.

Why choose just one? Using both exchanges allows you to:

- Take advantage of BYDFi’s zero maker fees for spot trading

- Access Crypto.com’s wider selection of cryptocurrencies

- Test strategies with BYDFi’s demo trading before using real funds

- Utilize the unique features each platform offers

Maintaining accounts on multiple exchanges helps you capitalize on different fee structures and trading options. You can use BYDFi for certain activities and Crypto.com for others.

Remember that withdrawal fees on both platforms may fluctuate due to network conditions. Compare the current fees when moving your assets to ensure you’re getting the best deal.

Compare BYDFi and Crypto.com with other significant exchanges