If you’re looking to trade crypto in 2025, choosing the right exchange matters. BYDFi and MEXC are popular platforms that offer different features for traders. When comparing these exchanges, MEXC stands out with its margin trading options, while both platforms offer various cryptocurrencies and trading features that cater to different needs.

These exchanges differ in several key areas including fees, available cryptocurrencies, and user experience. MEXC typically offers a wider selection of altcoins, which might appeal if you’re interested in trading less common tokens. BYDFi has its own strengths that make it competitive for certain types of traders.

Understanding the differences between these platforms can help you make a better decision about where to trade. Your choice might depend on whether you value lower fees, more trading options, or specific features like margin trading that MEXC provides.

BYDFi Vs MEXC: At A Glance Comparison

When choosing between BYDFi and MEXC for your crypto trading needs in 2025, understanding their key differences can help you make a better decision.

Both exchanges offer cryptocurrency trading services, but they differ in several important ways. Let’s compare them based on essential features.

Trading Fees

BYDFi and MEXC have different fee structures that impact your trading costs. MEXC tends to be competitive in this area, though specific rates may vary based on your trading volume and membership level.

Cryptocurrency Selection

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum. MEXC generally offers a wider selection of altcoins, which might be important if you’re looking to diversify your portfolio with less common tokens.

Trading Features

| Feature | BYDFi | MEXC |

|---|---|---|

| Trading Types | Spot, Futures | Spot, Futures, Margin |

| Charting Tools | Standard | Advanced |

| Mobile App | Yes | Yes |

User Experience

MEXC typically receives higher user scores, suggesting better overall customer satisfaction. The platform’s interface is designed to accommodate both beginners and experienced traders.

BYDFi offers a straightforward experience that some new traders might find more approachable.

Also Read: How to hedge against crypto volatility using options?

Availability

Both exchanges have different regional restrictions. You should check if either platform is available in your location before creating an account.

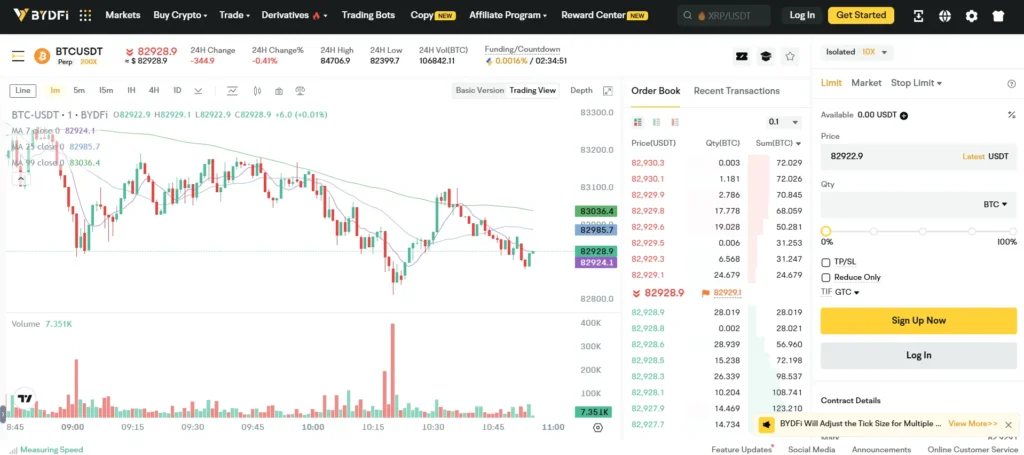

BYDFi Vs MEXC: Trading Markets, Products & Leverage Offered

Both BYDFi and MEXC offer extensive cryptocurrency trading options, but they differ in several key areas.

BYDFi provides futures trading with up to 200x leverage, matching MEXC’s leverage offering. This high leverage allows you to amplify potential returns, though it also increases risk.

MEXC stands out with its margin trading service for experienced traders. This feature lets you borrow funds to increase your trading position size.

Available Products Comparison:

| Feature | BYDFi | MEXC |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | ✅ (200x) | ✅ (200x) |

| Margin Trading | ❌ | ✅ |

| Altcoin Selection | Good | Excellent |

MEXC typically offers a wider range of altcoins and trading pairs. This gives you more options if you’re interested in trading newer or less common cryptocurrencies.

Both exchanges provide spot trading with competitive fee structures. Your trading costs will depend on your trading volume and whether you use their native tokens.

Trading volumes tend to be higher on MEXC, which can result in better liquidity for your trades. Better liquidity means easier entry and exit from positions at expected prices.

The user interfaces differ slightly, with both platforms offering mobile apps for trading on the go.

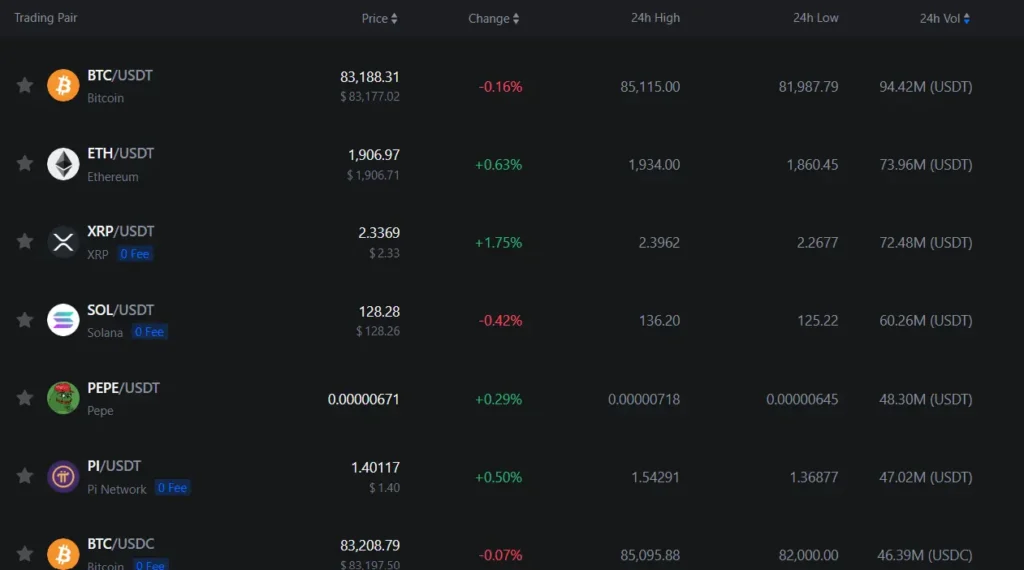

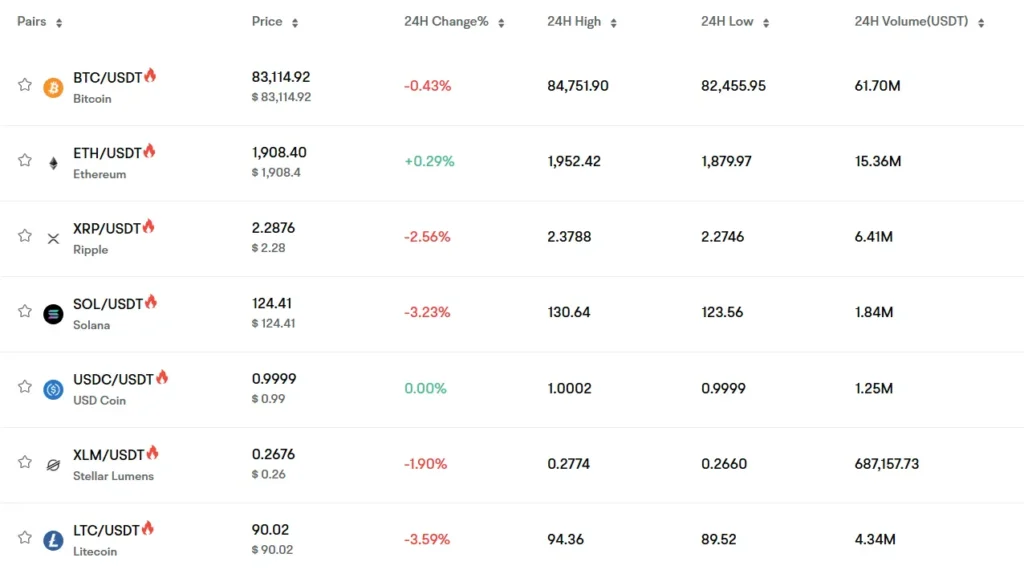

BYDFi Vs MEXC: Supported Cryptocurrencies

When choosing between BYDFi and MEXC, the range of supported cryptocurrencies is an important factor to consider.

MEXC stands out with its extensive selection of over 300 listed coins. This makes it an excellent choice if you’re looking to trade lesser-known altcoins or emerging crypto projects.

BYDFi offers a solid selection of cryptocurrencies, though not quite as extensive as MEXC. However, BYDFi includes popular options like Cardano (ADA) and Polkadot (DOT) that many traders seek.

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum. Your choice may depend on whether you need specific altcoins that might be available on one platform but not the other.

MEXC Advantages:

- 300+ cryptocurrencies

- Wider selection of emerging tokens

- More trading pairs

BYDFi Advantages:

- Clear focus on quality tokens

- Includes popular altcoins like ADA and DOT

- User-friendly for those who don’t need hundreds of options

If you’re primarily interested in trading mainstream cryptocurrencies, either exchange will likely meet your needs. However, if you’re seeking more obscure altcoins or the widest possible selection, MEXC might be the better option for you.

Consider checking both platforms’ current listings before deciding, as available cryptocurrencies can change as the market evolves.

BYDFi Vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and MEXC, understanding their fee structures is crucial for your trading strategy. Based on current information as of March 2025, both exchanges offer competitive fees but with some notable differences.

BYDFi has positioned itself as a low-fee exchange in the crypto market. Their trading fees are generally competitive, with maker fees starting at very low rates.

MEXC offers an even more attractive fee structure with zero fees for makers and taker fees as low as 0.05%. This gives MEXC a slight edge for high-volume traders who can benefit from these reduced costs.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| BYDFi | Very low | Competitive |

| MEXC | 0% (Zero) | As low as 0.05% |

For deposits, both platforms typically offer free options for most cryptocurrencies. However, fiat deposit methods and associated fees vary.

Withdrawal fees differ based on the cryptocurrency you’re transferring. MEXC and BYDFi both set their withdrawal fees according to the network costs of each cryptocurrency.

You should consider your trading volume and preferred cryptocurrencies when choosing between these platforms. High-volume traders might benefit more from MEXC’s zero maker fees, while occasional traders might find either platform suitable.

Remember that fee structures can change, so check both exchanges’ current rates before making your decision.

BYDFi Vs MEXC: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy.

MEXC offers a standard range of order types including limit, market, and stop orders. These basic options allow you to execute trades at specific prices or immediately at market value.

BYDFi provides similar basic order types but also includes post-only orders which ensure your order only enters the order book as a maker, not a taker. This can help you save on trading fees.

Both platforms support stop-loss and take-profit orders to help manage risk in your trading activities. These automated tools execute trades when certain price thresholds are reached.

MEXC has been noted to offer iceberg orders, which allow you to place large orders without revealing the full size to the market. This can be useful for trading larger positions without causing significant market impact.

For advanced traders, both exchanges support OCO (One-Cancels-Other) orders. This lets you set two conditional orders where if one executes, the other automatically cancels.

BYDFi puts emphasis on user-friendly order interfaces, making it potentially easier for beginners to understand different order types.

The choice between these platforms may depend on your specific trading needs. If you require specialized order types like iceberg orders, MEXC might be preferable. For straightforward trading with clear interfaces, BYDFi could be more suitable.

BYDFi Vs MEXC: KYC Requirements & KYC Limits

When trading on cryptocurrency exchanges, understanding KYC (Know Your Customer) requirements is essential. Both BYDFi and MEXC have specific policies that affect how you can use their platforms.

MEXC allows users to withdraw up to 2 BTC per day without completing KYC verification. This option provides some flexibility if you prefer to maintain privacy while trading.

BYDFi also offers services without full KYC, though specific withdrawal limits may vary. Always check the current limits as they can change with regulations.

For US traders specifically, KYC requirements become particularly important. MEXC has restrictions for US-based users, which is why many look for alternatives like BYDFi.

Both exchanges implement tiered verification systems. Higher verification levels typically grant larger withdrawal limits and additional platform features.

Comparison of KYC Features:

| Feature | MEXC | BYDFi |

|---|---|---|

| No-KYC withdrawal limit | ~2 BTC daily | Available with restrictions |

| US trader accessibility | Limited | Better alternative for US users |

| Verification tiers | Multiple levels | Multiple levels |

| ID requirements | Varies by tier | Varies by tier |

Remember that withdrawal limits without KYC are subject to change based on regulatory updates. It’s recommended to check the exchanges’ official websites for the most current information.

BYDFi Vs MEXC: Deposits & Withdrawal Options

Both BYDFi and MEXC offer various deposit and withdrawal methods to accommodate your trading needs. Understanding these options can help you choose the exchange that best fits your requirements.

BYDFi Deposit Methods:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

BYDFi has earned a reputation for reliable deposits and withdrawals. According to search results, users report “no issues with deposits, withdrawals, or trades” on the platform.

MEXC Deposit Methods:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

Both exchanges support a wide range of cryptocurrencies for deposits and withdrawals. This gives you flexibility when moving funds in and out of the platforms.

Withdrawal processing times can vary between the exchanges. BYDFi typically processes withdrawals within 24 hours, while MEXC aims to complete them within a similar timeframe.

Fee Comparison:

| Exchange | Deposit Fees | Withdrawal Fees |

|---|---|---|

| BYDFi | Varies by method | Network fees + small processing fee |

| MEXC | Varies by method | Network fees + small processing fee |

Withdrawal limits differ between the two platforms. Your verification level on either exchange will determine your daily and monthly withdrawal limits.

Remember to verify the current deposit and withdrawal options directly on each platform, as these services may change over time.

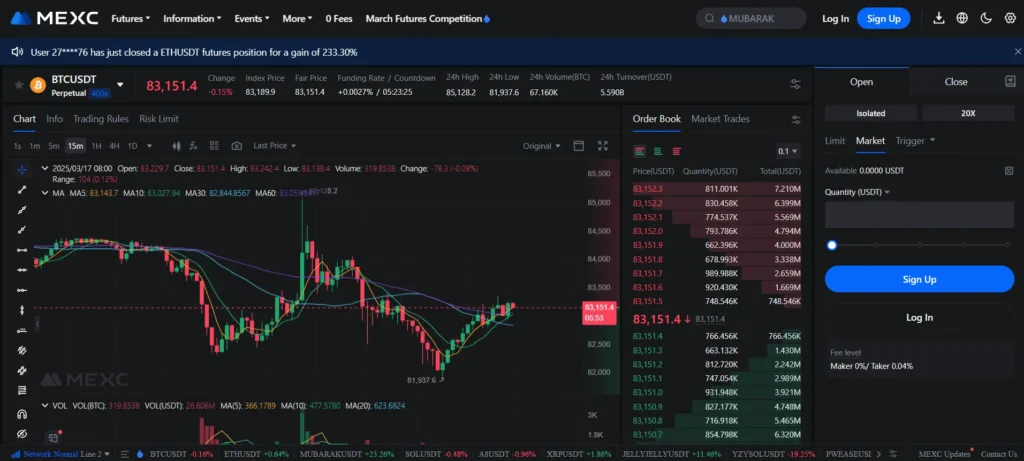

BYDFi Vs MEXC: Trading & Platform Experience Comparison

BYDFi and MEXC offer distinct trading experiences for crypto enthusiasts. BYDFi, established in 2020, has quickly gained recognition as a top leverage trading platform, ranking 3rd among similar exchanges.

MEXC presents itself as more than just a trading platform—it functions as an interconnected ecosystem with various tools and features. This comprehensive approach helps traders access multiple services in one place.

Trading Features Comparison:

| Feature | BYDFi | MEXC |

|---|---|---|

| Founded | 2020 | Earlier than BYDFi |

| Specialty | Leverage trading | Wide array of trading tools |

| User Interface | Clean, focused | Comprehensive ecosystem |

| Target Users | Leverage traders | General crypto traders |

When choosing between these platforms, your trading style matters. BYDFi might be more suitable if you’re interested in leverage trading specifically.

MEXC stands out for its low fees, making it one of the cheapest crypto exchanges available. This can be a significant advantage if you make frequent trades.

Both platforms support altcoin trading, though availability may vary. Each exchange offers different trading volumes, which can affect liquidity when you’re buying or selling.

For U.S. traders, there are specific considerations when choosing between these platforms. Each has different regulatory compliance measures that might impact your access to certain features.

BYDFi Vs MEXC: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. Both BYDFi and MEXC employ liquidation systems to protect themselves when markets move against your position.

BYDFi uses a tiered liquidation system that gradually reduces your position as it approaches the liquidation price. This gives you a chance to add more funds before complete liquidation occurs.

MEXC, on the other hand, implements a more standard liquidation approach. Your position will be automatically closed when your margin ratio falls below the maintenance margin requirement.

Here’s how they compare:

| Feature | BYDFi | MEXC |

|---|---|---|

| Liquidation Warning | Yes, multiple alerts | Yes, but less frequent |

| Partial Liquidation | Available | Limited availability |

| Liquidation Fee | 0.5-2% depending on asset | Flat 1.25% for most pairs |

| Insurance Fund | Yes | Yes |

BYDFi offers more transparency in their liquidation process. You can see the exact liquidation price before entering a trade, helping you manage risk better.

MEXC provides a liquidation calculator tool that helps you understand potential losses based on your leverage and position size.

Both platforms offer stop-loss features to help you avoid liquidation. You can set these at specific price points to exit positions before liquidation occurs.

Remember to monitor your positions carefully when using high leverage on either platform. The higher your leverage, the closer your liquidation price will be to your entry point.

BYDFi Vs MEXC: Insurance

When trading on cryptocurrency exchanges, insurance protection is a crucial consideration for your assets. Both BYDFi and MEXC offer some form of insurance coverage, but with notable differences.

BYDFi maintains an Asset Protection Fund designed to compensate users in case of security breaches or hacks. This fund grows over time as the exchange allocates a portion of its trading fees to strengthen this safety net.

MEXC provides a more robust insurance system through its Investor Protection Fund. This fund specifically aims to protect user assets against potential security incidents and unexpected market events.

Here’s a comparison of their insurance features:

| Feature | BYDFi | MEXC |

|---|---|---|

| Insurance Fund | Asset Protection Fund | Investor Protection Fund |

| Coverage Type | Security breaches, hacks | Security incidents, market events |

| Fund Source | Portion of trading fees | Trading fees and company reserves |

| Transparency | Limited public information | Regular updates on fund size |

| Claims Process | Case-by-case evaluation | Structured reimbursement protocol |

Neither exchange guarantees 100% protection against all losses. The insurance coverage typically applies to platform-wide security issues rather than individual account compromises due to poor security practices.

You should note that insurance details can change periodically. It’s wise to review the current policies on both exchanges’ websites before making your decision.

BYDFi Vs MEXC: Customer Support

Customer support is crucial when choosing a crypto exchange. Both BYDFi and MEXC offer several ways to get help when you need it.

BYDFi provides support through email, live chat, and a help center with guides and FAQs. Their response times typically range from a few hours to 24 hours depending on the complexity of your issue.

MEXC offers similar support channels including email, live chat, and a knowledge base. They also maintain active social media accounts where you can reach out for assistance. According to search results, MEXC has a dedicated support page at support.weex.com.

Response Time Comparison:

- BYDFi: Usually responds within 24 hours

- MEXC: Typically responds within 12-24 hours

Both exchanges offer multilingual support, which is helpful if English isn’t your first language. MEXC appears to have a slight edge in languages supported.

Neither exchange currently offers phone support, which is common in the crypto exchange industry.

User reviews suggest MEXC has invested in improving their customer service experience in 2025, with more responsive agents and better training. BYDFi’s support team gets solid ratings for technical knowledge but sometimes takes longer to resolve complex issues.

When you encounter problems, both platforms provide troubleshooting guides in their help centers that can solve many common issues without needing to contact support directly.

BYDFi Vs MEXC: Security Features

Both BYDFi and MEXC employ security measures to protect your assets, but they differ in several important ways.

MEXC has established a strong reputation for security in the cryptocurrency exchange space. They implement multi-factor authentication to verify your identity when logging in or making transactions.

For asset protection, MEXC uses cold storage solutions to keep the majority of funds offline and away from potential hackers. This significantly reduces the risk of large-scale theft.

BYDFi, being a newer exchange, has implemented security protocols but doesn’t yet have the same established track record as MEXC. This doesn’t necessarily mean BYDFi is less secure, but rather that it hasn’t been tested for as long.

Key Security Features Comparison:

| Feature | MEXC | BYDFi |

|---|---|---|

| Multi-factor authentication | Yes | Yes |

| Cold storage for funds | Yes | Limited information available |

| Security history | Well-established | Newer system |

| Account protection | Strong | Basic |

When choosing between these exchanges, you should consider how important a proven security history is for your trading needs.

Also Read: Bitcoin options expire meaning

Remember that no exchange is completely immune to security threats. You should always use strong, unique passwords and enable all available security features regardless of which platform you choose.

Is BYDFi Safe & Legal To Use?

BYDFi prioritizes safety through both technical and legal compliance measures. The platform requires KYC (Know Your Customer) verification to ensure user security and regulatory compliance.

For U.S. traders specifically, the legal status requires careful consideration. While some exchanges face restrictions in the U.S., BYDFi has positioned itself as a compliant option.

Users should note that cryptocurrency regulations vary by location and change frequently. What’s permitted today might change tomorrow, so staying informed about current regulations is important.

BYDFi implements standard security features expected of reputable exchanges. These typically include two-factor authentication, cold storage for most assets, and encryption protocols.

When comparing safety features with MEXC, BYDFi appears to emphasize its legal compliance as a key differentiator. This focus on being “legally safe” can provide peace of mind for traders concerned about regulatory issues.

Before using any exchange, you should verify:

- If it’s permitted in your specific state or region

- What identity verification is required

- The platform’s history of security incidents

- Insurance or protection measures for your funds

Remember that even “legal” platforms carry inherent risks. Cryptocurrency trading involves volatility and security considerations beyond just the exchange’s legal status.

Is MEXC Safe & Legal To Use?

MEXC is generally considered a legitimate and safe cryptocurrency exchange. It implements proof of reserves and advanced security measures to protect user funds and information.

For U.S. traders, the legal situation is more complicated. Recent restrictions have made MEXC less accessible for U.S. residents. Many U.S. users report increasing difficulties using the platform.

Safety Features:

- Proof of reserves verification

- Advanced security protocols

- Escrow services for P2P trading

Legal Considerations:

- Tightening restrictions for U.S. users

- Following the trend of other exchanges like KuCoin and Gate.io

- Regulatory compliance varies by region

You should be aware that MEXC primarily offers crypto-to-crypto trading. This means you’ll need to purchase cryptocurrency elsewhere before transferring it to MEXC.

When comparing MEXC to alternatives like BYDFi, consider your location and trading needs. U.S. traders may need to explore other options as restrictions continue to evolve.

Remember to always do your own research and consider consulting with a financial advisor before using any cryptocurrency exchange. Regulations change frequently in this space.

Frequently Asked Questions

Traders often have specific questions about cryptocurrency exchanges before choosing where to invest. These common questions address key differences between BYDFi and MEXC platforms.

What are the unique features of BYDFi compared to other platforms?

BYDFi offers a user-friendly interface designed to accommodate both beginner and experienced traders. The platform provides a wide range of trading pairs for diversified investment options.

BYDFi also features competitive trading fees and a straightforward registration process. Its mobile app allows you to trade on the go with full functionality similar to the desktop version.

How does MEXC ensure the security of its users’ funds?

MEXC implements a robust security system that includes multi-factor authentication to prevent unauthorized access to accounts. The exchange stores most user funds in cold storage, keeping them offline and away from potential hackers.

MEXC also conducts regular security audits and has emergency response protocols in place. These measures help protect your assets and maintain the platform’s reputation for security.

Are there any regional restrictions for trading on BYDFi?

Yes, BYDFi is available to US investors, which sets it apart from many other exchanges. However, specific features may still have geographic limitations based on local regulations.

You should verify the current status for your region before registration as cryptocurrency regulations frequently change. BYDFi aims to comply with regulatory requirements in all jurisdictions where it operates.

What fiat currencies are supported by MEXC for deposit and withdrawal?

MEXC supports several major fiat currencies for deposits and withdrawals, including USD, EUR, and others through various payment methods. You can use credit/debit cards, bank transfers, and third-party payment processors.

The availability of specific fiat options may vary based on your location. MEXC regularly updates its supported payment methods to improve accessibility.

How does the fee structure of BYDFi compare to that of MEXC?

BYDFi typically offers competitive trading fees that are comparable to MEXC. Both platforms use a tiered fee structure where higher trading volumes result in lower fees.

BYDFi may have slightly different withdrawal fees depending on the cryptocurrency. Both exchanges occasionally run promotions with reduced fees to attract new users.

What customer support options are available on MEXC?

MEXC provides 24/7 customer support through multiple channels including live chat, email, and ticket systems. You can access help directly from the platform interface.

MEXC also maintains an extensive knowledge base with guides and FAQs. For urgent matters, their support team typically responds quickly to ensure trading issues are resolved promptly.

BYDFi Vs MEXC Conclusion: Why Not Use Both?

When comparing BYDFi and MEXC, there’s no reason to limit yourself to just one platform. Both exchanges offer unique advantages that can benefit your trading strategy.

BYDFi serves users in over 150 countries without requiring a VPN in any region. This accessibility makes it convenient for international traders who value seamless access.

MEXC, on the other hand, has established itself with in-depth educational resources and a wide range of features that appeal to different types of traders.

For US-based traders specifically, BYDFi might offer more straightforward access, as some users report needing workarounds to use MEXC from the United States.

Consider your priorities:

- Security needs

- Available cryptocurrencies

- Fee structures

- User interface preferences

- Additional features like copy trading

You can use BYDFi for its copy trading technology and perpetual futures while leveraging MEXC for its unique coin offerings and educational resources.

Many experienced traders maintain accounts on multiple exchanges to capitalize on different opportunities. This approach lets you benefit from the best features of both platforms.

The crypto exchange landscape continues to evolve. By familiarizing yourself with both BYDFi and MEXC, you position yourself to adapt quickly as features, regulations, and opportunities change.

Compare BYDFi and MEXC with other significant exchanges