Exploring the CME options exchange opens up a world of opportunities for traders and investors looking to navigate diverse markets. As a key player in global trading, CME Group offers access to vast markets, including interest rates, equity indexes, foreign exchange, and commodities. This comprehensive range of options empowers you to tailor your strategies effectively and adapt your portfolio to ever-changing economic landscapes.

CME’s offerings aren’t limited to their variety but extend to innovative tools like short-dated options, which cater to near-term exposures and market events. With this suite of options, you have the flexibility to make precise trades and manage risks with greater confidence. This level of customization can enhance your potential for success in today’s dynamic trading environment.

By trading at CME Group, you gain access to both real-time and historical data, crucial for informed decision-making. The exchange’s emphasis on transparency and efficiency allows you to strengthen your risk management strategies seamlessly. Exploring these resources positions you to capitalize on opportunities as they arise, aligning with your investment goals.

What Are CME Options?

CME options are financial derivatives offered by the CME Group, a leading global marketplace. These options are traded on futures and provide opportunities for managing risk and speculating on various markets. You can find options on a wide range of underlying assets such as equity indexes, interest rates, foreign exchange, and commodities.

CME options include both standard and short-dated options. Short-dated options are particularly useful for managing near-term exposures and responding to market events. This flexibility allows you to tailor your trading strategies to align with specific economic indicators or events.

The marketplace offers a liquid family of option contracts on futures. This liquidity helps you diversify your portfolio while reducing exposure to potential risks. Additionally, CME options allow for strategic positioning, which can be a valuable tool in your trading arsenal.

For trade execution, CME options are supported by efficient clearing services. This ensures secure and reliable processing of your transactions. You can benefit from an extensive network of market participants, which enhances the depth and resilience of the options market.

Understanding the basic fundamentals, strategies, and vocabulary is crucial when engaging in CME options trading. These elements help you to develop a strong foundation and enable you to effectively participate in the market.

CME Options Products Offerings

CME Group serves as a global leader in options and futures trading across multiple asset classes. You can find a diverse selection of products within interest rates, equity indexes, foreign exchange, energy, and soft commodities. This wide range of offerings provides flexibility to meet various trading and risk management needs.

An essential aspect of CME’s offerings is the ability to use short-dated options. These are particularly useful for managing near-term exposures and trading around notable market events. They provide an alternative to over-the-counter trades, thus expanding your strategic possibilities.

CME Group’s options on futures provide robust flexibility and are designed for both individual and institutional traders. Whether you specialize in commodities or equity indexes, there are tailored solutions to support effective risk management. The exchange’s global benchmark products enhance trading diversity, allowing you to focus on strategies that align with your investment goals.

For market-making, your options include leasing a seat under the IOM membership for options within the exchange’s competitive environment. This enables access to key functions and deep liquidity. Given these comprehensive offerings, you can leverage CME’s diverse suite to optimize financial outcomes according to specific needs and market conditions.

CME Supported Coins For Options Trading

When considering crypto options trading through CME Group, you need to focus on a few specific cryptocurrencies.

Bitcoin (BTC): As a trailblazer, Bitcoin is one of the primary cryptocurrencies supported for options trading by CME. This allows you to leverage the high liquidity and volatility associated with Bitcoin options.

Ether (ETH): Ether represents another vital option available for trade. These options let you capitalize on the evolving Ethereum ecosystem, providing substantial trading opportunities.

If you’re engaging in options trading, pay attention to contract details. For instance, each Bitcoin option represents five bitcoins, and each Ether option corresponds to 50 ethers. Such specifics tell you the extent of your potential market exposure.

The trading and clearing times are essential as well. They generally span from Sunday at 5:00 p.m. to Friday at 4:00 p.m. Central Time (CT). Knowing these hours ensures you trade within the correct time frames.

Keep in mind that CME options are not limited to the above coins indefinitely. You should continually check CME Group’s announcements for updates or additions to their supported digital assets. This strategy ensures you’re always aligned with current market offerings.

Understanding these elements of CME’s supported coins positions you well for strategic decision-making in options trading.

CME Options Leverage

When trading options on the CME, you gain access to leverage that can amplify your market position. This leverage allows you to control a large contract with a smaller amount of capital, which is one of the key attractions for traders.

Key Benefits:

- Increased Market Exposure: With leverage, you can increase your exposure without needing the full contract value upfront.

- Capital Efficiency: Use less capital to participate in market movements, which can be especially useful in volatile conditions.

Leverage also comes with increased risk. It’s crucial to manage your positions carefully to avoid potential losses exceeding initial investments. Maintaining a keen understanding of your risk tolerance and having a sound risk management strategy is essential.

Consider exploring short-dated options. They offer flexible alternatives for managing near-term exposures, catering to both risk management and trading strategies around economic events. While providing leverage benefits, they also allow for nimble adjustments to dynamic market conditions.

Here’s a brief list of important considerations:

- Margin Requirements: Requirements can vary based on market conditions and your brokerage. Always check before executing trades.

- Volatility Impact: Leverage in options can magnify both gains and losses, particularly in volatile markets.

By leveraging options on the CME, you can optimize your trading strategy, but be sure to balance opportunities with calculated risk management.

CME Options Calculator

The CME Options Calculator is a valuable tool for traders looking to assess fair value prices and Greeks for options on futures contracts offered by the CME Group. You can customize input parameters such as strike price, option type, underlying futures price, volatility, days to expiration (DTE), and interest rate.

Various pricing models are available, including the widely used Black Scholes model. The calculator caters to diverse needs and aligns with your strategic goals by allowing flexibility in inputs.

Using this tool, you can refine trading strategies with precision. Accessing the calculator online simplifies complex calculations, presenting data in a user-friendly interface. This feature-rich calculator assists in making informed decisions, whether you’re pricing a generic option or analyzing specific trades.

For a better grasp, you have the option to explore the tool’s layout and functionality through tutorials or educational resources provided on platforms like YouTube. These resources can help enhance your understanding and effective use of the calculator.

If you are engaging actively in the futures market, leveraging the CME Options Calculator could provide a strategic edge, assisting you in navigating the complexities of options trading with greater confidence and accuracy.

CME Options Types

You can engage with a diverse array of options at CME that cater to different markets and strategies. Short-dated options are a prominent choice, allowing you to manage short-term exposures effectively.

Options at CME are available across various asset classes including interest rates, equity indexes, foreign exchange, and agricultural commodities like cheese, corn, and feeder cattle.

Additionally, energy and metals options offer avenues into vital industrial sectors. The weather and real estate options provide opportunities in specialized markets you might find intriguing.

Consider the active options contracts on futures like lean hogs, live cattle, and Class III milk. This presents you with choices to explore areas of agriculture beyond the traditional grain markets.

Below is a simplified list of some of the available options asset classes and examples:

- Interest Rates

- Equity Indexes

- Foreign Exchange

- Energy

- Agricultural Commodities: Cheese, Corn, Feeder Cattle

- Metals

- Weather

- Real Estate

This diversity in options types ensures you can tailor your trading strategy according to your position and risk appetite. Take advantage of the flexibility, depth, and liquidity that CME options can provide to maximize your trading potential.

CME Order Types

When trading on the CME options exchange, understanding the various order types can help you execute your strategy with precision. CME provides a range of order types, each serving a specific purpose in managing trades.

A limit order allows you to set a maximum purchase price when buying or a minimum sale price when selling. This type of order ensures that you don’t trade at a price less favorable than what you define.

Market orders execute immediately at the best available price. They are ideal when you want to enter or exit a position quickly. A market limit order is one variation that offers some price protection by including a price limit.

For additional control over your trades, consider using stop orders. A stop order becomes active only when a specified price level is reached. This can be useful for limiting potential losses or securing profits.

The stop-limit order combines aspects of both stop and limit orders. Once the stop price is hit, the order is converted into a limit order and is executed at a specified price.

A market order with protection provides a safeguard against executing at unanticipated prices by setting a limit on how far the execution price can deviate from the market.

These order types can be powerful tools for your trading strategy, providing flexibility and control. By selecting the appropriate order type, you can better align your trades with your specific investment goals on the CME exchange.

CME Options Data: Volume & Prices

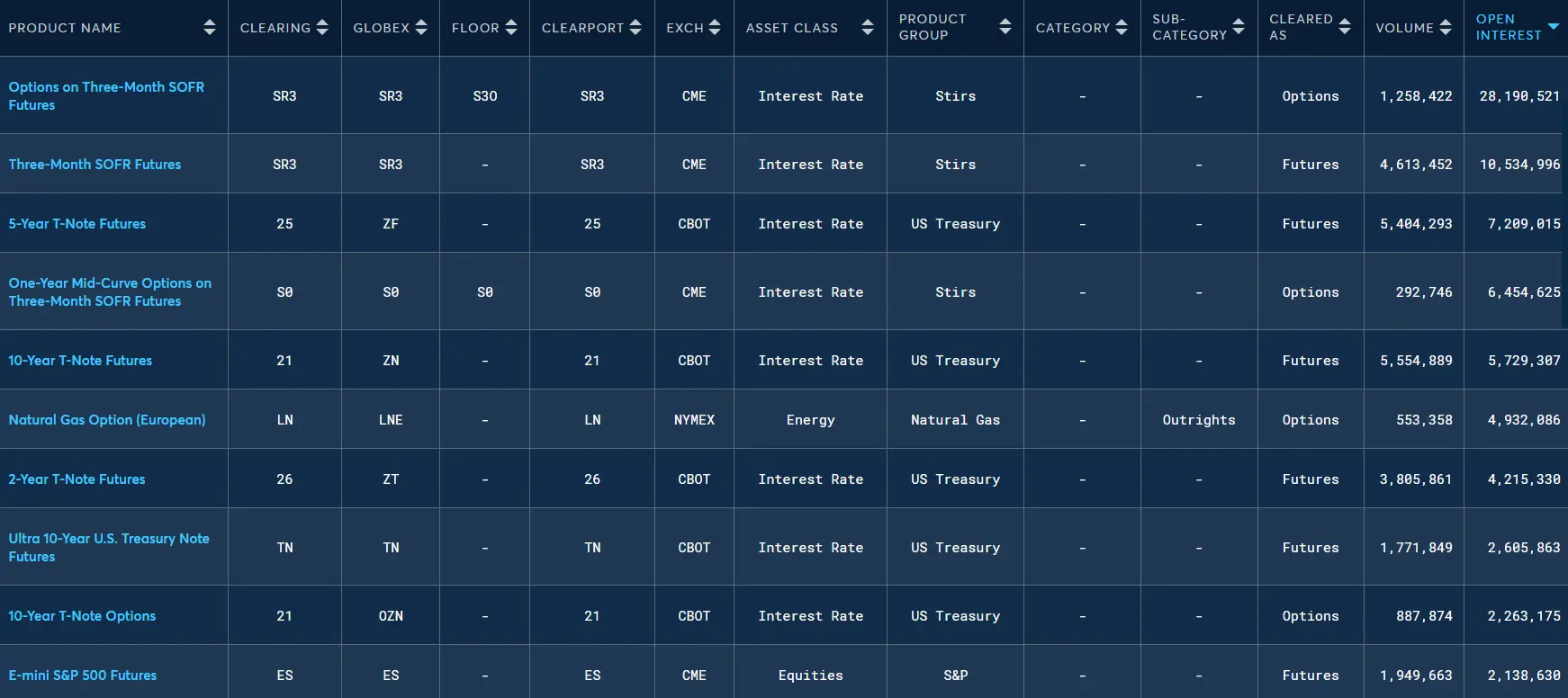

When considering trading options on the CME Group, monitoring volume and prices is crucial. Volume indicates the number of contracts traded, which reflects market activity and liquidity. High volume tends to imply better liquidity, allowing you greater ease in entering and exiting trades.

You also need to track open interest, which shows the total number of outstanding contracts. It helps gauge the market’s depth and potential price movement. A rising open interest often correlates with trends, signaling shifts in trader sentiment.

Options prices are derived from various factors, including the underlying asset’s price, volatility, time to expiration, interest rates, and dividends. The interplay of these variables determines the premium you pay or receive for an option.

For detailed insights, you can explore daily and weekly reports provided by the CME Group. These reports present data on volume and open interest across different products. Detailed tables and charts facilitate tracking trends and making informed decisions.

CME Liquidation Mechanism

When you engage with the CME options exchange, understanding the liquidation mechanism is essential. This aspect involves the process by which CME handles the default of a clearing member to preserve market stability.

Key components of CME’s liquidation mechanism include stress testing methodologies and liquidity add-ons. These tools are designed to estimate and manage the financial impacts during stressful market conditions.

The liquidity add-on is a crucial feature, accounting for the costs associated with hedging and auctioning positions post-default. This estimate helps in managing potential risks that could arise during liquidation.

CME employs reverse stress tests to evaluate scenarios where existing resources might become insufficient. These tests support the integrity of the clearing process by identifying potential vulnerabilities.

CME’s procedures are in alignment with regulatory requirements, such as CFTC regulations. These frameworks ensure that you have access to high-quality liquidity resources.

While utilizing these mechanisms, CME prioritizes maintaining market order, which can provide confidence when trading on the exchange. By incorporating these measures, CME fosters a robust environment for handling liquidation risks efficiently.

CME Options Trading Fees

CME options trading fees are determined by several factors, such as the type of options, volume traded, and whether you are a member or participant in an incentive program. It’s crucial to understand the specific fees that apply to ensure efficient and cost-effective trading.

CME Options Funding Rates/Fees

When trading CME options, you encounter fees that include a CME Globex electronic trading platform fee and a CME Clearing fee.

These fees are typically calculated per side, meaning you’ll be charged for both buying and selling transactions. For example, standard FX options trading incurs a total fee of $1.20 per side. It’s important to verify these fees through your broker, as they can vary depending on your arrangement. Ensure you review your total costs for clarity on what you’ll pay in actual trading scenarios.

CME Account Types & KYC Tiers & Limits

When engaging with the CME options exchange, you’ll encounter various account types tailored for different trading requirements. Accounts typically range from individual to institutional, designed to accommodate the trading volume and needs you might have. Ensure you select an account type that aligns with your trading goals.

KYC (Know Your Customer) procedures are essential when setting up your CME account. These procedures help verify your identity to ensure compliance with regulatory standards. You’ll need to provide personal information, including identification and financial details.

CME implements different KYC tiers, which correspond to the level of verification and limits imposed on your trading activity. Higher tiers generally require more extensive documentation and offer increased trading limits. It’s crucial to understand which tier is best suited for you.

Trading limits and margins vary by product type and account category. The limits are set based on factors like trading volume and risk. Familiarize yourself with the margin requirements for your specific trades to manage your positions effectively.

The principle of “credit usage” and “remaining credit” comes into play, dictating the maximum allowable credit depending on your trading activity. Properly understanding and managing these factors can help optimize your trading strategy.

If you choose to trade on platforms such as CME Globex or CME ClearPort, specific credit limits and account-level requirements will apply, set by your clearing member firm. Make sure you’re clear on these details to avoid disruptions in your trading activities.

CME Trading Platform & Tools

CME Group provides a comprehensive trading platform that caters to a variety of needs in futures and options trading. You can access cutting-edge tools to manage trades on interest rates, equity indexes, foreign exchange, and more.

QuikStrike Tools: These are free pricing and analytics resources to refine your trading strategies. With various web-based tools developed by QuikStrike, you will uncover valuable insights to enhance each phase of your trading journey.

The platform also offers robust clearing services for all products globally. This enhances transparency and ensures a seamless trading experience for you. With CME Direct, you can engage with financially-cleared exchange regulated OTC products, concentrating heavily on energy sectors like natural gas.

For those focused on options, some brokers, like Webull and Charles Schwab, provide commission-free or low-fee options and advanced charting tools. These features enable you to manage and optimize your trading strategies with ease.

CME’s technology ensures that you can handle high-volume trading with stability and reliability. The intuitive design and functionality make navigating through various products straightforward and efficient.

Consider the array of embedded market data and real-time trading capabilities to gain better control over your positions. With these sophisticated tools, you maintain a leading edge in the competitive trading landscape.

CME Insurance Fund

The CME Insurance Fund is an essential component of risk management in the trading ecosystem.

It safeguards market participants against defaults by providing a financial safety net.

The fund acts as a buffer, especially during volatile market conditions or unexpected economic events.

Your assurance in handling trades is enhanced when you know there’s a supporting mechanism to counteract potential losses.

CME Group maintains this fund to ensure that trades are executed smoothly without exposing traders to undue risk.

By prioritizing stability and security, the insurance fund fosters trust and reliability in the marketplace.

The fund’s resources come from contributions made by members, ensuring a collective approach to risk mitigation.

Additionally, it allows CME Group to maintain fair and transparent trading practices.

This infrastructure not only secures interest but also encourages broader participation.

You benefit from a more resilient trading environment, which ultimately contributes to efficient market operations.

CME Deposit Methods

When engaging with CME options, it’s essential to be familiar with deposit methods for a seamless trading experience.

You can start by visiting the deposit page on your broker’s platform. Here, you might find QR codes and unique deposit addresses for convenience. These serve as the destination for your funds transfer.

There are generally two types of accounts you might encounter: Spot Account and Derivatives Account. Ensure you choose the correct account based on your trading needs.

Many brokers support direct bank transfers, a common choice due to its reliability. Check with your broker for specific details and any associated fees.

Cryptocurrency deposits are another option for traders preferring digital currency. This may involve using a wallet and involves following precise instructions to avoid errors.

Stay updated with any changes your broker might announce regarding deposit methods. Adapting to these can improve your trading efficiency.

CME Security Features

When engaging with the CME Group, security remains a top priority. The CME Group uses robust security measures designed to safeguard user data and financial transactions.

One key feature is two-factor authentication (2FA). This adds an extra layer of security, requiring users to verify their identity using a secondary method, enhancing protection beyond just passwords.

To ensure your trading activities remain confidential, the CME Group implements encryption techniques that protect sensitive information. This ensures that your data remains unreadable to unauthorized parties during transmission across networks.

Moreover, the CME Group’s platforms undergo regular system maintenance to optimize performance and maintain the integrity of their security protocols. Scheduled updates provide patches and improvements to existing infrastructure.

You also benefit from a comprehensive monitoring system that detects and responds to potential security threats. This proactive approach helps prevent unauthorized access and safeguards financial assets.

Increased user interface enhancements have been applied, aiming to improve security while providing an intuitive experience. These enhancements ensure a seamless yet secure trading environment.

With these features in place, you can trade confidently knowing that your information and transactions are well-protected by CME’s state-of-the-art security measures.

CME Customer Support

CME Group offers robust customer support to assist you with your trading needs. Their support is available 24/5, ensuring that you can get help whenever markets are open. The support services cater to all users, ranging from individual traders to large institutions.

You can contact CME Group through various channels. Their U.S. support team is available at +1 800 438 8616, while Europe can be reached at +44 20 7623 4747, and Asia at +65 6532 5010. This broad global access ensures that you can receive assistance according to your regional requirements.

For market data-related queries, you have access to a specialized team. CME’s services include real-time, delayed, or historical data. You can find additional resources and support through the CME Data Sales service during regular business hours from Monday to Friday.

A dedicated customer center provides self-service forms for managing account elements, such as Entity Officers and Admin Managers. These tools empower you to efficiently handle updates and administrative tasks without requiring direct intervention from support staff.

Support extends further with tools like the Messaging Efficiency Program and Risk Management Tools. Such offerings allow for a comprehensive trading experience, giving you the confidence to manage your trades effectively.

Is CME A Legal & Safe Platform?

You might wonder if the CME Group is a secure choice for trading futures and options. The CME Group is part of a publicly traded company listed on the Nasdaq under the symbol CME. This adds a level of transparency and regulation, as it must adhere to strict financial and operational standards.

As a leading global derivatives marketplace, CME Group operates under rigorous oversight by U.S. regulatory bodies, such as the Commodity Futures Trading Commission (CFTC). It implements comprehensive risk management procedures to safeguard market integrity and ensure client security. So yes, trading options in the USA is legal with the CME.

Key Features of CME Group:

- Regulation: Heavily regulated by authorities like the CFTC.

- Clearing Services: Offers clearing services integrating security across all products.

- Market Integrity: Committed to maintaining fair and transparent trading environments.

The platform provides access to advanced risk management tools, which enhance your trading experience while maintaining market stability. This positions CME Group as a trusted platform for trading a wide array of futures and options.

Your personal and transaction data is protected using robust security measures, thanks to CME Group’s commitment to best practices in online security. This makes it a reliable choice for traders looking to engage with a well-regulated, secure market.

Given these points, you can feel assured about the legal and safe environment offered by the CME Group for trading.

Frequently Asked Questions

This section provides detailed information about the options offered by CME Group, including the types of options, trading procedures, and associated costs. Each subsection addresses a specific query to enhance your understanding of CME options trading.

What types of options are offered by CME Group?

CME Group offers a variety of options, encompassing European-style options, which can only be exercised upon expiration. These options cover a broad range of asset classes, such as interest rates, equity indexes, foreign exchange, energy, and soft commodities.

Can you trade options directly on CME?

You can trade options directly on CME Group’s electronic trading platform, Globex. This platform allows for efficient access and execution, supporting a comprehensive array of options products across numerous asset classes.

What are the trading hours for CME’s options markets?

CME’s options markets typically operate almost 24 hours a day, five days a week. However, specific trading times can vary based on the product, so it’s crucial to verify schedules for the particular options you plan to trade.

Are CME options cash settled?

Many options offered by CME are cash settled, meaning that the settlement process involves a cash payment based on market value rather than physical delivery. This method simplifies the settlement process and can be favorable for certain trading strategies.

What is the minimum amount required to trade options on CME?

The minimum amount required to trade options on CME varies depending on the specific option and your broker’s requirements. It’s important to consult with your broker to understand their specific margin requirements and the amount needed to initiate a trade.

What is the fee for CME options trading?

CME options trading fees depend on various factors, including the type of account, the number of contracts, and the specific options traded. Consulting CME’s fee schedule or speaking with your broker can provide precise cost details relevant to your trading activities.

Conclusion

When considering CME options, you find a robust trading platform. CME Group offers a wide range of products such as futures and options on interest rates, equity indexes, foreign exchange, and energy. These options create flexibility in strategy and risk management for various traders.

The exchange is renowned for its efficient clearing services, ensuring secure transactions. The adoption of innovative trading instruments boosts your trading experience and provides diversification possibilities.

By its focus on risk management and developed infrastructure, CME options are a vital component of today’s financial markets. These features support various trading strategies that suit your needs.

Overall, CME provides comprehensive tools and markets to support investment portfolios. You benefit from its long-standing reputation, extensive product offerings, and seamless functions needed for effective trading.

Want more options? Check out these crypto exchanges: