Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Coinbase and Poloniex are two popular platforms, each with their own strengths and features that might work better for different types of traders.

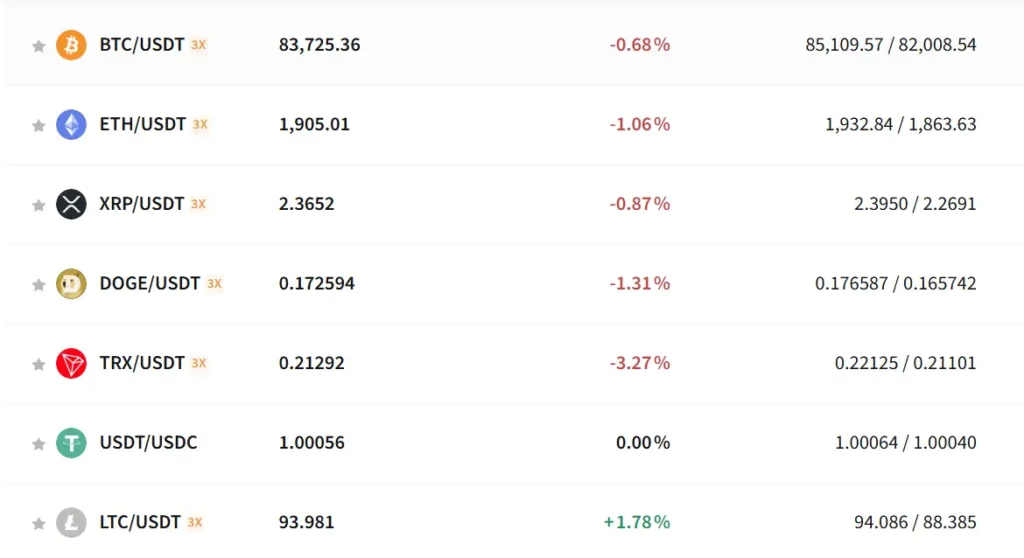

Poloniex offers access to 533 cryptocurrencies compared to Coinbase’s 276, giving you more options if you’re looking to diversify your crypto portfolio. This wider selection might appeal to experienced traders who want to explore beyond mainstream tokens.

The platforms also differ in user support quality, with Coinbase scoring higher in user satisfaction ratings. Coinbase is known for its beginner-friendly interface and strong backing from venture capital, while Poloniex may appeal to those seeking more variety in trading options. Your choice between these exchanges should depend on your specific needs as a crypto trader.

Coinbase Vs Poloniex: At A Glance Comparison

When choosing between Coinbase and Poloniex, understanding their key differences can help you make the right decision for your crypto trading needs.

User Experience

| Platform | Ease of Use Rating | Best For |

|---|---|---|

| Coinbase | 8.7/10 | Beginners, casual traders |

| Poloniex | 7.8/10 | More experienced traders |

Coinbase offers a more intuitive interface, making it easier for newcomers to navigate. Poloniex has a steeper learning curve but provides more advanced trading features.

Fees

Poloniex generally charges lower trading fees than Coinbase. This makes Poloniex more cost-effective for frequent traders or those making larger transactions.

Trading Options

Coinbase focuses on mainstream cryptocurrencies with a straightforward buying experience. Poloniex offers a wider variety of altcoins and more advanced trading options.

Security

Both platforms implement strong security measures to protect your assets. Coinbase is known for its insurance policy on digital assets, while Poloniex emphasizes its security protocols.

Accessibility

Coinbase is available in more countries and offers more payment methods for depositing funds. Poloniex has fewer regional restrictions for certain features but may have more limited payment options.

Mobile Experience

Both offer mobile apps, but Coinbase’s app is generally rated higher for reliability and ease of use. Poloniex’s mobile platform caters more to active traders with advanced features.

Coinbase Vs Poloniex: Trading Markets, Products & Leverage Offered

Coinbase offers a more streamlined selection of cryptocurrencies with 276 available tokens. This makes it simpler for beginners to navigate without feeling overwhelmed by too many options.

Poloniex provides a wider variety of trading options with 533 cryptocurrencies. This diversity gives you more opportunities to invest in emerging tokens and niche projects.

Available Trading Products:

| Feature | Coinbase | Poloniex |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | Limited | ✅ |

| Margin Trading | Limited | ✅ |

| Staking | ✅ | ✅ |

| NFT Marketplace | ✅ | ❌ |

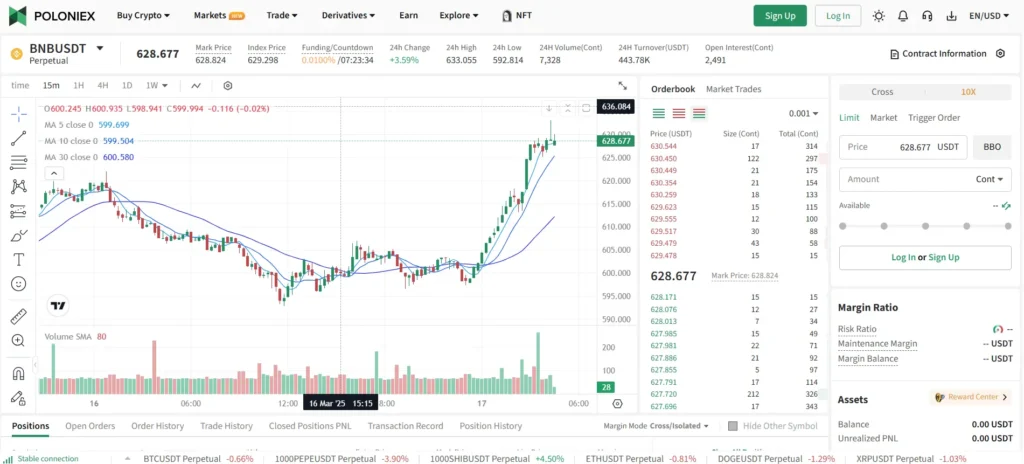

Poloniex excels in offering more advanced trading options including better leverage trading capabilities. This makes it attractive if you’re looking to amplify potential returns.

Coinbase focuses on a user-friendly experience with reliable but more conservative trading products. Their NFT marketplace gives you additional investment opportunities beyond traditional cryptocurrencies.

Trading interfaces differ significantly between platforms. Coinbase provides a clean, intuitive interface that’s easy to understand. Poloniex offers more technical charts and tools that experienced traders might prefer.

Both exchanges support popular cryptocurrencies like Bitcoin and Ethereum, but Poloniex gives you access to more altcoins and trading pairs. This can be important if you’re looking to diversify your portfolio beyond mainstream tokens.

Coinbase Vs Poloniex: Supported Cryptocurrencies

When choosing between Coinbase and Poloniex, the number of available cryptocurrencies is an important factor to consider.

Poloniex currently offers a wider selection with access to approximately 533 different cryptocurrencies. This makes it a good choice if you’re looking to trade lesser-known or emerging tokens.

Coinbase supports fewer options with around 276 cryptocurrencies available. While this is still a substantial number, it’s notably less than what Poloniex offers.

Here’s a quick comparison of their cryptocurrency offerings:

| Exchange | Number of Cryptocurrencies |

|---|---|

| Poloniex | 533 |

| Coinbase | 276 |

Both exchanges support major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many popular altcoins. However, if you’re interested in a specific token, you should check if it’s available on your preferred platform.

Coinbase tends to be more selective about which cryptocurrencies it lists, often focusing on established projects that meet certain criteria. This can be helpful if you prefer a curated selection.

Poloniex’s larger selection gives you more trading opportunities and access to newer projects. This might appeal to you if you’re looking to diversify into emerging tokens.

Both exchanges also offer staking options on certain assets. You can earn interest on cryptocurrencies like USDC, ETH, and SOL through their platforms.

Coinbase Vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and Poloniex, fees play a crucial role in your decision. Understanding the cost structure helps you maximize your crypto trading profits.

Trading Fees Comparison:

| Exchange | Trading Fees |

|---|---|

| Coinbase | Up to 0.40% |

| Poloniex | Up to 0.60% |

Despite what the table shows, Poloniex is generally considered more cost-effective for trading. Many users find Poloniex’s overall fee structure more favorable, especially for frequent traders.

Withdrawal Fees:

| Exchange | Withdrawal Fees |

|---|---|

| Coinbase | Up to $60 |

| Poloniex | Up to 3% |

Withdrawal fees vary based on the cryptocurrency and withdrawal method you choose. Coinbase charges fixed fees that can reach $60 for certain cryptocurrencies. Poloniex uses percentage-based fees that can be up to 3% of your withdrawal amount.

Also Read: Crypto options arbitrage

Payment Methods:

Coinbase offers more payment options for deposits, including bank transfers, credit cards, and PayPal. This convenience comes at a cost, as some payment methods incur higher fees.

Poloniex has fewer payment options but may have lower deposit fees overall. This makes it attractive if you’re comfortable with crypto-to-crypto exchanges.

Before making your final decision, check both platforms’ current fee schedules. Fees sometimes change without much notice in the crypto world.

Coinbase Vs Poloniex: Order Types

When trading on crypto exchanges, the available order types can significantly impact your trading strategy. Both Coinbase and Poloniex offer several order types, but they differ in variety and complexity.

Coinbase Order Types:

- Market orders (buy/sell at current market price)

- Limit orders (set specific price for execution)

- Stop orders (on Coinbase Pro/Advanced Trade)

Coinbase keeps things simple, which benefits beginners. The platform focuses on basic order types that are easy to understand and execute.

Poloniex Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Post-only orders

- Fill-or-kill orders

- Immediate-or-cancel orders

Poloniex clearly offers more advanced trading options. This variety gives you greater flexibility to implement complex trading strategies and manage risk.

The difference in order types reflects each platform’s target audience. Coinbase caters to mainstream and beginning traders with straightforward options. Poloniex targets more experienced traders who need sophisticated tools.

Your trading style should guide your choice. If you prefer simple buy and sell transactions, Coinbase’s limited order types may be sufficient. For active trading with precise entry and exit points, Poloniex’s expanded options provide better control.

Remember that advanced order types come with a steeper learning curve. Make sure you understand how each order type functions before using it in your trading strategy.

Coinbase Vs Poloniex: KYC Requirements & KYC Limits

When choosing between Coinbase and Poloniex, you should consider their different approaches to Know Your Customer (KYC) verification.

Coinbase follows strict KYC protocols. You must complete identity verification before trading on their platform. This includes providing personal information, ID documents, and sometimes a selfie.

Poloniex offers more flexibility with KYC requirements. While they do require some verification, their limits are different from Coinbase.

Without KYC verification on Poloniex, you can withdraw up to 20 BTC per day, which is substantial for most traders. This makes Poloniex potentially more attractive if you prefer more privacy.

Coinbase KYC Requirements:

- Full identity verification mandatory

- Government-issued ID required

- Proof of address may be needed

- No trading without KYC completion

Poloniex KYC Requirements:

- Tiered verification system

- Basic trading possible with minimal information

- Higher withdrawal limits require additional verification

- Up to 20 BTC daily withdrawal limit for certain verification levels

Coinbase’s stricter approach aims to ensure regulatory compliance in all regions they operate. This can mean slower account setup but potentially fewer issues with authorities.

Poloniex offers more cryptocurrencies (533) compared to Coinbase (276), which might influence your decision alongside KYC considerations.

Your preference for privacy vs convenience should guide your choice between these exchanges.

Coinbase Vs Poloniex: Deposits & Withdrawal Options

Coinbase offers more flexibility for new crypto users with direct fiat currency deposits. You can fund your Coinbase account using bank transfers, credit/debit cards, and PayPal in many regions.

Poloniex, on the other hand, doesn’t support direct fiat deposits. This means you’ll need to already own cryptocurrency to start trading on Poloniex, making it better suited for experienced crypto investors.

Deposit Methods Comparison:

| Method | Coinbase | Poloniex |

|---|---|---|

| Bank Transfer | ✓ | ✗ |

| Credit/Debit Card | ✓ | ✗ |

| PayPal | ✓ | ✗ |

| Cryptocurrency | ✓ | ✓ |

For withdrawals, both exchanges allow you to move your crypto to external wallets. Coinbase also lets you withdraw funds directly to your bank account or PayPal.

Withdrawal processing times vary between the platforms. Coinbase typically processes fiat withdrawals within 1-5 business days depending on your region and withdrawal method.

Poloniex withdrawal times depend on blockchain confirmation times for the specific cryptocurrency you’re withdrawing.

Both exchanges implement security measures like withdrawal limits and holding periods for new deposits. These protect your funds but may temporarily restrict access to your assets.

Fees also differ between platforms, with Poloniex generally charging lower withdrawal fees for most cryptocurrencies compared to Coinbase’s fee structure.

Coinbase Vs Poloniex: Trading & Platform Experience Comparison

When choosing between Coinbase and Poloniex, the trading experience is a key factor to consider. According to recent data, Coinbase scores higher for ease of use with an 8.7 rating on G2, compared to Poloniex’s 7.8.

Coinbase offers a more intuitive platform designed with beginners in mind. You’ll find a clean interface with straightforward navigation that makes buying, selling, and managing crypto assets simpler.

Poloniex, while slightly more complex, provides a deeper trading experience. You’ll have access to more advanced trading features and a wider variety of trading pairs.

Trading Fee Comparison:

| Exchange | Maker Fees | Taker Fees | Beginner-Friendly |

|---|---|---|---|

| Coinbase | Higher | Higher | Very High |

| Poloniex | Lower | Lower | Moderate |

Poloniex generally offers lower trading fees, making it more cost-effective for frequent traders. This can significantly impact your returns if you trade regularly.

For new users, Coinbase’s learning resources and simplified platform may be worth the higher fees. You’ll find educational content and a supportive environment for your first steps in crypto.

The mobile experience differs between the platforms too. Coinbase’s app maintains the simplicity of their web version, while Poloniex’s mobile platform includes most of the advanced features of their desktop version.

Coinbase Vs Poloniex: Liquidation Mechanism

When trading on margin, understanding how each platform handles liquidations is crucial for your risk management. Both Coinbase and Poloniex have specific mechanisms in place to protect themselves when your position approaches or exceeds your collateral value.

Coinbase uses a progressive liquidation system where they first issue margin calls as your position approaches risk thresholds. If you don’t add more collateral, they begin partial liquidations to reduce your exposure before full liquidation.

Poloniex employs an automatic liquidation engine that monitors positions continuously. When your margin ratio falls below required levels, the system immediately begins liquidation without necessarily providing stepped warnings.

Key Differences in Liquidation Approaches:

| Feature | Coinbase | Poloniex |

|---|---|---|

| Warning System | Multiple margin calls | Limited warnings |

| Liquidation Speed | Gradual/staged | Rapid execution |

| Partial Liquidation | Available | Less common |

| Liquidation Fees | Lower (0.5-1%) | Higher (1.5-2.5%) |

Your maintenance margin requirements also differ between platforms. Coinbase typically requires 25-35% maintenance margins, while Poloniex often sets these at 20-30% depending on the trading pair.

Both exchanges provide liquidation price calculators, but Coinbase’s tool tends to be more user-friendly and accessible within the trading interface. Poloniex’s calculator requires more navigation to find and use effectively.

Coinbase Vs Poloniex: Insurance

When choosing a cryptocurrency exchange, insurance coverage is an important factor to consider for your digital assets’ protection.

Coinbase offers robust insurance protection. They maintain a commercial crime policy that covers digital assets against theft and cybersecurity breaches. For USD holdings, Coinbase provides FDIC insurance up to $250,000 per customer.

Their insurance policy specifically covers security breaches and employee theft. However, it doesn’t protect against unauthorized access to your personal account due to compromised credentials.

Poloniex has a different approach to insurance. They don’t prominently advertise FDIC insurance for fiat deposits like Coinbase does. Instead, they focus on strong security measures to prevent losses.

Poloniex maintains some coverage against hacks and security breaches, but the specifics of their insurance policies aren’t as clearly outlined as Coinbase’s.

Also Read: Crypto options trading risks & how to mitigate them

Both exchanges store the majority of user funds in cold storage to minimize risk. This practice keeps most digital assets offline and away from potential online threats.

For maximum protection, you should enable all available security features on either platform, including:

- Two-factor authentication

- Strong, unique passwords

- Withdrawal address whitelisting

- Regular security audits of your account

Remember that no insurance policy covers losses from your own errors, like sending cryptocurrency to the wrong address or falling victim to phishing attacks.

Coinbase Vs Poloniex: Customer Support

When choosing a cryptocurrency exchange, customer support quality can make a big difference in your experience. The data shows a clear gap between these two platforms.

Coinbase offers stronger customer support with a G2 rating of 6.9 compared to Poloniex’s 4.3. This significant difference suggests you’ll likely have an easier time getting help when using Coinbase.

Users report that Poloniex customers often struggle more with support issues. This could be frustrating if you encounter account problems or have urgent questions about your transactions.

Coinbase provides multiple support channels including:

- Email support

- Phone support

- Extensive knowledge base

- Active community forums

Poloniex’s support options are more limited, which may lead to longer response times. This is an important consideration if you’re new to cryptocurrency trading.

Response time is another crucial factor. Coinbase typically responds faster, especially for verified users. Poloniex may have longer wait times during high-volume periods.

If customer support is a priority for you, Coinbase appears to be the stronger option based on user feedback and ratings. However, you should weigh this against other factors like fees and available cryptocurrencies to make your final decision.

Coinbase Vs Poloniex: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both Coinbase and Poloniex offer security features to protect your investments, but they differ in implementation.

Coinbase is known for its robust security infrastructure. It stores 98% of customer funds offline in cold storage, protecting them from online threats. You also benefit from two-factor authentication (2FA) and AES-256 encryption for your digital wallet.

Poloniex also provides cold storage solutions but doesn’t publicly specify what percentage of funds are kept offline. Like Coinbase, it offers 2FA, but some users report concerns about customer support response times for security issues.

Key Security Features Comparison:

| Feature | Coinbase | Poloniex |

|---|---|---|

| Cold Storage | 98% of funds | Available (% not specified) |

| Two-Factor Authentication | ✓ | ✓ |

| Insurance | FDIC insurance up to $250,000 (USD only) | No insurance mentioned |

| Security History | Few major incidents | Has experienced hacks |

| Account Freezing | Can freeze suspicious accounts | Can freeze suspicious accounts |

Coinbase offers additional security through its regulatory compliance in multiple countries. Your USD deposits on Coinbase are FDIC insured up to $250,000, providing an extra layer of protection.

Poloniex focuses on trading security with features like withdrawal confirmations and IP address monitoring. However, it lacks the insurance protection that Coinbase offers for fiat currencies.

Is Coinbase A Safe & Legal To Use?

Coinbase is widely considered a safe platform for cryptocurrency trading and storage. Based on search results, Coinbase has maintained a strong security record, with no public knowledge of hacks in its operating history. This safety record stands out in the volatile crypto exchange landscape.

Coinbase operates as a fully licensed and regulated cryptocurrency exchange in the United States. It complies with relevant financial regulations, making it a legal option for users in supported countries.

The platform implements several security features to protect your assets:

- Two-factor authentication

- Biometric login options

- Insurance for digital assets

- Cold storage for majority of funds

However, safety also depends on your own security practices. Even with Coinbase’s protections, your account could be compromised if:

- Your device is hacked

- You lose your phone with saved credentials

- You fall victim to phishing attacks

When comparing support quality with Poloniex, Coinbase appears to offer better customer service based on user ratings. This can be crucial when you need assistance with account security or transaction issues.

Coinbase’s reputation as a publicly traded company adds another layer of accountability and transparency that many users find reassuring.

Is Poloniex A Safe & Legal To Use?

Poloniex offers a secure platform for trading cryptocurrencies. According to search results, the exchange guarantees safety and security during transactions. This commitment to security is essential when choosing a crypto exchange.

However, user experiences vary. Some forum posts mention issues with frozen accounts and delayed withdrawals. These complaints have affected Poloniex’s reputation among some crypto users.

In terms of customer support, Poloniex appears to lag behind competitors. G2 ratings show Poloniex scoring 4.3 for customer support compared to Coinbase’s 6.9. This suggests you might face challenges if you need assistance with your account.

Despite these concerns, Poloniex remains a popular exchange in the crypto market. It continues to serve many users worldwide and is considered a legitimate trading platform.

Safety Features:

- Security protocols for transactions

- Account protection measures

- Established presence in the market

As with any crypto exchange, you should practice good security habits. Use strong passwords, enable two-factor authentication, and keep only trading amounts on the platform.

Regarding legality, Poloniex operates as a legitimate business. However, availability may vary by location due to different cryptocurrency regulations worldwide. You should check if Poloniex is accessible in your region before creating an account.

Frequently Asked Questions

When comparing Coinbase and Poloniex, users often have specific questions about features, security, and costs. Here are answers to the most common questions about these cryptocurrency exchanges.

What are the key differences between Coinbase and Poloniex trading platforms?

Coinbase focuses on being user-friendly for beginners with a simple interface and regulated services. It allows direct fiat currency deposits and withdrawals, making it accessible for new crypto investors.

Poloniex targets more experienced traders with advanced trading tools and features. Unlike Coinbase, Poloniex doesn’t support direct fiat deposits, requiring users to already own cryptocurrency to begin trading.

Coinbase has a higher overall score of 9.6 compared to Poloniex based on comprehensive reviews. This reflects Coinbase’s stronger regulatory compliance and beginner-friendly approach.

In terms of security, how does Poloniex compare with Coinbase?

Coinbase leads in security with robust protections including two-factor authentication, biometric logins, and keeping 98% of user funds in cold storage. It also offers insurance protection for digital assets held on the platform.

Poloniex implements strong security measures like two-factor authentication and cold storage, but lacks the same level of insurance protection as Coinbase.

Coinbase is regulated in numerous countries and complies with financial regulations, providing an additional layer of security. This regulatory compliance gives many users greater peace of mind when using Coinbase.

Which platform, Coinbase or Poloniex, offers a wider range of cryptocurrencies?

Poloniex offers a significantly larger selection with support for 533 cryptocurrencies. This makes it attractive for traders looking to invest in a diverse range of altcoins.

Coinbase supports 276 cryptocurrencies, which is still substantial but more limited than Poloniex. Coinbase tends to be more selective about which cryptocurrencies it lists, focusing on established coins.

If you’re interested in trading newer or less common altcoins, Poloniex provides more options. However, Coinbase’s selection covers most major cryptocurrencies that average investors seek.

How do the fees between Coinbase and Poloniex differ for typical transactions?

Coinbase is known for having higher fees, especially for small transactions. Their fee structure includes fixed fees for small purchases and percentage-based fees for larger transactions.

Poloniex typically offers lower trading fees, with a tier-based structure that rewards high-volume traders. This makes Poloniex more cost-effective for active traders who perform numerous transactions.

The price difference between exchanges can also impact overall costs. For example, Ether has been observed trading at different prices ($293 on Poloniex vs. $306 on Coinbase at the same time), which can affect the total cost of transactions.

Can you highlight the user experience distinctions between using Coinbase and Poloniex?

Coinbase provides a clean, intuitive interface designed for beginners. Its mobile app is highly rated and offers a streamlined experience for buying, selling, and monitoring cryptocurrencies.

Poloniex features a more technical interface with advanced charting tools and trading options. This complexity serves experienced traders well but can overwhelm newcomers to cryptocurrency.

Coinbase offers educational resources to help users learn about crypto, while Poloniex assumes users already understand trading concepts. Your comfort level with trading interfaces should influence which platform you choose.

What are the support options and response times like for Coinbase versus Poloniex?

Coinbase offers more comprehensive support options including email, chat support, and an extensive knowledge base. Response times vary, but Coinbase generally provides faster customer service due to its larger support team.

Poloniex customer support primarily operates through ticket systems and email. Users sometimes report longer wait times for responses compared to Coinbase, especially during high-volume trading periods.

Both platforms offer community forums where users can find answers to common questions. However, Coinbase’s larger user base and resources translate to more readily available support when issues arise.

Poloniex Vs Coinbase Conclusion: Why Not Use Both?

After comparing these two platforms, you might wonder which one to choose. The truth is, you don’t always have to pick just one.

Coinbase offers a better user experience with a smoother interface that’s easier to navigate. It also has stronger customer support with higher user ratings than Poloniex.

Poloniex, on the other hand, provides lower trading fees and supports more cryptocurrencies – over 50 coins and 100+ trading pairs.

Many crypto traders use multiple exchanges to take advantage of different benefits. You could use Coinbase for its user-friendly platform when you’re starting out or making simple trades.

Then you might turn to Poloniex when you want to trade less common cryptocurrencies or benefit from lower fees on larger transactions.

Keep in mind that some users report withdrawal issues with Poloniex, while Coinbase has built a reputation for reliability.

Your trading needs may also change over time. Starting with Coinbase and adding Poloniex as you become more experienced could be a smart approach.

By using both platforms strategically, you can enjoy the best features each has to offer while minimizing their drawbacks.

Just make sure to keep track of your assets across different platforms and consider the security measures of each exchange before depositing significant funds.

Compare Coinbase and Poloniex with other significant exchanges