Trading cryptocurrency can be exciting, but it also comes with risks. One way to manage these risks is by using a crypto position size calculator. This tool helps you figure out how much money to put into a trade based on your account balance, risk tolerance, and market conditions.

A crypto position size calculator determines the optimal amount to invest in a trade by analyzing your account value, the percentage of your account you’re willing to risk, and the difference between your entry and stop loss prices. You can use these calculators for both spot trading and leverage trading, making them versatile tools for any crypto trader.

By calculating your position size before entering a trade, you avoid risking too much of your account on a single transaction. These calculators use live market data to give you accurate recommendations, helping you make smarter trading decisions while protecting your investments from significant losses.

Understanding Position Sizing in Cryptocurrency Trading

Position sizing is a key trading strategy that helps you decide how much of your capital to use in a single trade. It’s not about which crypto to buy, but rather how much of it to purchase.

When trading crypto, proper position sizing helps protect your account from big losses. The main goal is to limit your risk on any single trade to a small percentage of your total funds.

Most experienced traders follow the 1-2% rule. This means they never risk more than 1-2% of their total trading capital on a single position.

To calculate position size, you need to know:

- Your total account balance

- Your risk tolerance (percentage you’re willing to risk)

- Entry price of the cryptocurrency

- Stop-loss level (where you’ll exit if the trade goes against you)

Basic Position Size Formula:

Position Size = (Account Balance × Risk Percentage) ÷ (Entry Price - Stop Loss Price)

For example, if you have $10,000 and want to risk 1% on a Bitcoin trade with an entry at $60,000 and stop-loss at $57,000, your calculation would be:

Position Size = ($10,000 × 0.01) ÷ ($60,000 – $57,000) = $100 ÷ $3,000 = 0.033 BTC

By sizing your positions correctly, you can trade with confidence knowing that a single bad trade won’t significantly damage your portfolio.

Key Components of a Crypto Position Size Calculator

A crypto position size calculator helps traders determine the right amount to invest in each trade. These tools use several critical inputs to calculate position sizes that align with your risk management strategy.

Equity Balance

Your equity balance represents the total funds available in your trading account. This serves as the foundation for all position sizing calculations. When entering this amount, use your actual available balance rather than your total account value.

Most calculators require you to input this value manually. Some advanced calculators might connect directly to your exchange account through APIs to pull this information automatically.

Your equity balance impacts all other calculations. For example, with $10,000 in your account and a 2% risk tolerance, you’d risk $200 per trade. As your balance changes through winning and losing trades, your position sizes should adjust accordingly.

Remember to update this value regularly, especially after significant market movements or deposits/withdrawals.

Risk Percentage

Risk percentage defines how much of your equity you’re willing to lose on a single trade. Most professional traders recommend risking between 1-3% per position.

Setting this percentage is critical to preserving your capital. If you risk 2% per trade, you could withstand 50 consecutive losing trades before losing all your capital. At 10% risk, you could face a complete loss after just 10 bad trades.

The calculator uses this percentage to determine your dollar risk amount:

- 1% risk on a $10,000 account = $100 risk per trade

- 2% risk on a $10,000 account = $200 risk per trade

Your risk tolerance should reflect your experience level and trading psychology. Beginners should stay on the lower end of the spectrum (1-2%) while gaining experience.

Stop-Loss Settings

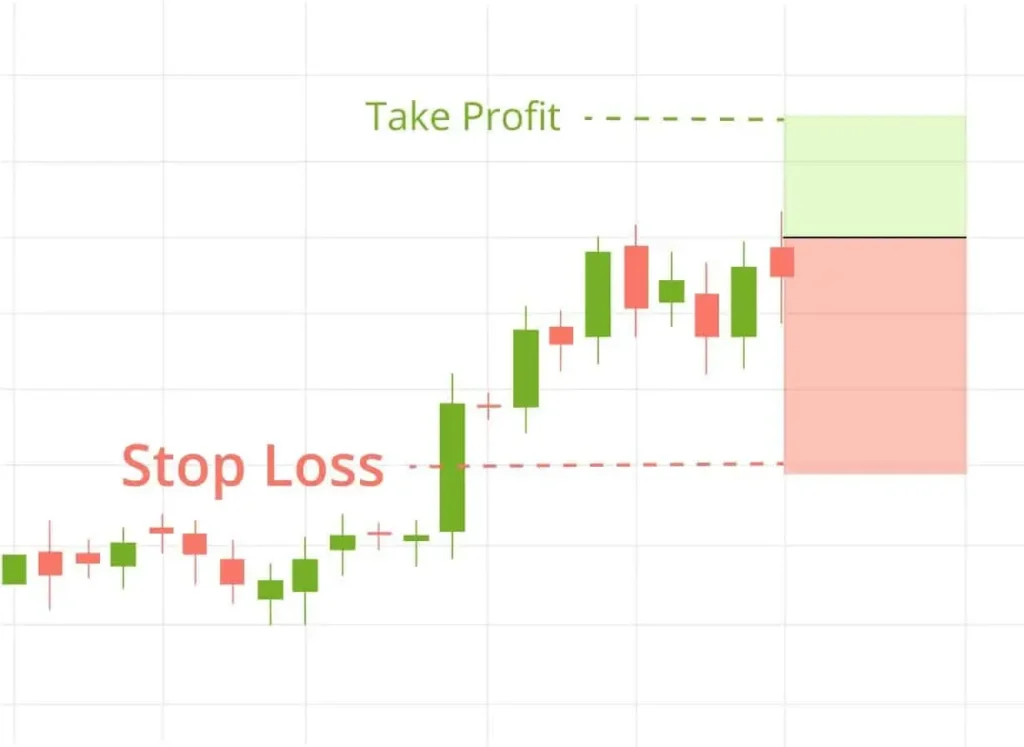

Your stop-loss level is the price at which you’ll exit a losing trade. This critical component helps the calculator determine position size based on how far your stop is from your entry point.

For example, if you enter Bitcoin at $60,000 with a stop-loss at $58,500, you have a $1,500 risk per Bitcoin. If your dollar risk amount is $300, the calculator would determine you should purchase 0.2 BTC ($300 ÷ $1,500).

Effective stop placement considers:

- Technical support/resistance levels

- Volatility (wider stops for volatile assets)

- Recent price action patterns

Never place stops arbitrarily. They should be based on market structure rather than a fixed percentage or dollar amount from your entry.

Trade Entry and Exit Points

Entry and exit points define where you’ll open and close your positions. These values help determine both your position size and potential profit.

Your entry price is typically the current market price or a limit order price you’ve set. The exit includes both your stop-loss (covered above) and your profit target.

The difference between entry and stop-loss determines your risk per unit, while the difference between entry and profit target helps calculate your risk-to-reward ratio:

- Entry at $60,000, stop at $58,500, target at $65,000

- Risk per unit: $1,500

- Potential reward: $5,000

- Risk-to-reward ratio: 1:3.33

Most calculators also factor in trading fees and slippage, which can significantly impact profitability in crypto markets. Some advanced calculators even incorporate options for partial profit-taking at different price levels.

Calculating Position Size: A Step-by-Step Guide

Position sizing is crucial for managing risk in crypto trading. Following a systematic approach helps you protect your funds while maximizing potential returns.

Step 1: Determine your risk per trade

Decide how much of your total account you’re willing to risk on a single trade. Most experts recommend 1-2% of your total balance. For example, if you have $10,000, you might risk $100-$200 per trade.

Step 2: Set your stop loss level

Choose where you’ll exit the trade if it moves against you. This could be based on support/resistance levels or a percentage drop from entry.

Step 3: Calculate your risk per coin

Subtract your stop loss price from your entry price. This gives you the amount you’ll lose per coin if stopped out.

Step 4: Determine position size using this formula:

Position Size = (Account Risk Amount) ÷ (Risk per Coin)

Example Calculation:

- Account balance: $10,000

- Risk percentage: 1% ($100)

- Entry price: $50,000 per Bitcoin

- Stop loss: $48,000 per Bitcoin

- Risk per coin: $2,000

Position size = $100 ÷ $2,000 = 0.05 BTC

This approach ensures you only lose your predetermined risk amount if the trade hits your stop loss. Position sizing calculators can automate this process for you.

Remember that proper position sizing is often more important than entry timing for long-term trading success.

Importance of Consistent Position Sizing

Consistent position sizing forms the foundation of successful crypto trading. It helps you maintain a balanced portfolio while protecting your capital from excessive losses during market volatility.

Risk Management

Position sizing directly impacts your risk exposure in cryptocurrency markets. When you allocate the same percentage of your capital to each trade (like 1-2%), you prevent single trades from causing devastating losses. This method ensures that even a string of losing trades won’t significantly deplete your trading account.

For example, if you have a $10,000 portfolio and limit risk to 1% per trade, you’d only risk $100 maximum on any position. This approach helps you:

- Survive market downturns

- Trade with clearer thinking (less emotional bias)

- Maintain capital for future opportunities

Many traders use position size calculators that factor in your account balance, risk percentage, entry price, and stop-loss level to determine the appropriate amount to invest in each trade.

Long-Term Strategy

Consistent position sizing transforms random trading into a strategic system. By standardizing your approach to capital allocation, you create a repeatable process that can be measured and improved over time.

Your trading data becomes more valuable when position sizes follow a logical pattern. You can:

- Accurately track performance metrics

- Identify which trading strategies work best

- Scale position sizes as your account grows

Professional traders view position sizing as equally important as entry and exit points. Without it, even the best trading signals can lead to poor overall results.

During bull markets, maintaining discipline with position sizing prevents overexposure. In bear markets, it preserves your capital for eventual recovery phases.

Best Practices when Using a Crypto Position Size Calculator

Using a position size calculator effectively requires attention to detail and discipline. The following practices will help you maximize the benefits of these tools while protecting your crypto investments.

Regularly Update Calculator Inputs

Market conditions in cryptocurrency change rapidly, requiring frequent updates to your calculator inputs. Set a schedule to review and update your risk parameters at least weekly. Daily updates may be necessary during volatile periods.

Always input the most current account balance before calculating a new position. Outdated balance information can lead to incorrect position sizing and unexpected risk exposure.

Price volatility metrics should be reassessed for each crypto asset you trade. Bitcoin’s volatility differs significantly from newer altcoins, affecting stop loss distances and position sizes.

When market sentiment shifts dramatically, adjust your per-trade risk percentage accordingly. Consider reducing risk from 2% to 1% during uncertain market conditions or increased market correlation.

Remember to update your calculator with any exchange fee changes, as these impact your actual position size calculations.

Avoiding Overexposure

Never exceed your predetermined maximum risk per trade, regardless of how confident you feel about a particular opportunity. Stick to your 1-2% risk rule consistently.

Calculate your total portfolio exposure across all active positions. Many traders make the mistake of having multiple positions that individually meet risk parameters but collectively create dangerous exposure.

Use correlation analysis to avoid multiple positions in closely related assets. Bitcoin and Ethereum often move together during market-wide events, potentially doubling your effective risk.

Consider implementing a “sector limit” approach. For example, limit your exposure to DeFi tokens to no more than 20% of your portfolio regardless of individual position sizes.

Track your drawdowns carefully. If you experience a series of losses, reduce your position size temporarily until you regain consistent profitability.

Also Read: Crypto Options Canada: A Comprehensive Guide for Investors

Tools and Software for Crypto Position Sizing

Several online calculators can help you determine the right position size for your crypto trades. These tools use your account balance, risk tolerance, and trade specifics to calculate optimal positions.

Popular options include CPS (Crypto Position Size) Calculator, which uses live market data to give precise calculations based on your account balance, risk percentage, entry price, and stop loss level.

CoinCodex offers a similar tool where you input your trading parameters, and it calculates the appropriate position size to match your risk management goals.

For traders who work with various markets, FxVerify provides a comprehensive position size calculator that works for crypto as well as forex, indices, and metals.

Key features to look for in position sizing tools:

- Live market data integration

- Support for different cryptocurrencies

- Risk percentage customization

- Stop loss incorporation

- Leverage trading options

Many trading platforms like Binance, Coinbase Pro, and Kraken have built-in calculators. These integrated tools are convenient as they connect directly to your trading account.

Mobile apps for position sizing are also available on iOS and Android, allowing you to calculate trade sizes on the go. This is particularly useful for active traders who need to make quick decisions.

Remember that while these tools are helpful, they should supplement—not replace—your trading strategy and risk management plan.

Frequently Asked Questions

Position size calculation is a crucial aspect of crypto trading that helps manage risk and optimize returns. These questions address common concerns traders have when determining how much to invest in each trade.

How can I calculate my position size for cryptocurrency trading?

To calculate your position size for crypto trading, start by determining the risk percentage of your total account balance you’re willing to lose on a single trade. Most experts recommend 1-2% per trade.

Next, identify your entry point and stop loss level. The difference between these points represents your risk per coin.

Your position size = (Account balance × Risk percentage) ÷ Risk per coin. For example, with a $10,000 account, 1% risk, and a $500 stop loss from entry, your position size would be $100 ÷ $500 = 0.2 coins.

What tools are available to integrate position size calculation with my trading platform?

Many trading platforms offer built-in position size calculators that integrate directly with your trading interface. Platforms like Binance, Kraken, and FTX provide these tools within their advanced trading screens.

Third-party solutions like TradingView scripts and plugins can add position sizing capabilities to platforms that lack native calculators.

Some platforms also offer API connections that allow external position size calculators to pull real-time data and account information for accurate calculations.

Are there position size calculators that account for leverage in crypto trading?

Yes, specialized leverage-aware position size calculators exist specifically for crypto trading. These tools factor in leverage multipliers when determining appropriate position sizes.

They calculate not only the base position size but also account for liquidation prices at different leverage levels. This helps prevent margin calls and liquidations.

Popular options include the CPS Calculator and Top One Trader’s position size calculator, both designed to handle leveraged crypto positions up to 10x, 50x, or even 100x depending on the exchange.

Can I use a position size calculator for various cryptocurrencies like Bitcoin, Ethereum, etc.?

Most crypto position size calculators work with any cryptocurrency that has price data available. You simply need to input the specific coin’s current price and your stop loss level.

Some advanced calculators pull live market data for major cryptocurrencies like Bitcoin, Ethereum, and others to provide real-time calculations.

The calculation principles remain the same regardless of which cryptocurrency you’re trading, though volatility differences between coins may influence your risk management strategy.

Is there an app or mobile solution for calculating position sizes on the go?

Several mobile apps specialize in crypto position sizing calculations. Trading platforms like Binance and FTX offer mobile versions with built-in calculators.

Dedicated risk management apps like “Crypto Position Size Calculator” and “Trading Position Size” are available on both Android and iOS platforms.

These mobile solutions sync with market data to provide accurate calculations even when you’re away from your computer, ensuring you can manage risk effectively anywhere.

How can I use a position size calculator to manage risk in my trading strategy?

A position size calculator helps establish consistent risk across all trades by determining exactly how much to invest based on your predefined risk tolerance.

Input your account size, maximum risk percentage (typically 1-2%), entry price, and stop loss level. The calculator will determine the appropriate position size that limits your potential loss to your predetermined amount.

For a comprehensive risk management strategy, combine position sizing with diversification by never risking more than 5-6% of your portfolio across all open positions simultaneously.

Explore these crypto option trading exchanges: