Exploring the world of cryptocurrency trading can be overwhelming, but Delta Exchange stands out by offering a comprehensive platform for trading crypto derivatives. Delta Exchange provides unique options contracts with competitive fees and advanced features, making it an appealing choice for both beginners and seasoned traders. This platform’s emphasis on leveraging up to 100x on futures contracts demonstrates its commitment to catering to diverse trading strategies.

With a user-friendly interface and robust security measures, Delta Exchange ensures a seamless trading experience while maintaining the security of your assets. The availability of various contracts, including popular cryptocurrencies like SOL, BNB, XRP, and LINK, allows you to diversify your investment portfolio efficiently. These features contribute to its rapid growth and increase in daily trading volume.

Your journey with Delta Exchange can be further enriched by exploring its advanced trading terminal, designed to enhance ease of use for traders at all levels. Engaging with this platform may unlock new opportunities in the evolving landscape of cryptocurrency derivatives trading, making it a valuable consideration for your trading endeavors.

What Are Delta Exchange Options?

Delta Exchange offers a variety of options for traders looking to engage with cryptocurrency derivatives. These options include USDT-settled European call and put options on cryptocurrencies like Bitcoin and Ethereum. You can use these options to hedge your positions or speculate on price movements without having to buy the actual asset.

Turbo Options feature a unique knockout barrier. Unlike vanilla options, which have a fixed expiry date, Turbo options may expire early if the underlying asset’s price crosses a specific knockout level. This feature can add an extra layer of risk management or speculative opportunity depending on your trading strategy.

Daily and Weekly Options: Daily options launch at 5:30 PM, and weekly options are introduced every Friday. This frequent release of options allows you flexibility in choosing the maturity that aligns best with your trading goals.

An options spread, such as call and put spreads, can help you manage risk while optimizing potential returns. Delta Exchange offers a variety of these spreads, giving you multiple strategies to consider when structuring your trades.

Make sure to analyze the conditions and specifications of each type of option before engaging in trading activities. Understanding the different features and mechanics of these options can improve your decision-making and trading outcomes.

Delta Exchange Options Products Offerings

Delta Exchange offers a diverse range of options products to cater to different trading preferences. Focus primarily on cryptocurrency options, giving you the ability to trade Bitcoin and various Altcoin options. This platform allows for hedging, speculation, and income generation through option strategies.

The trading interface is user-friendly, making it accessible whether you’re a beginner or an experienced trader. Flexible contract types, including monthly, weekly, and daily expiries, help you choose the best fitting strategy for your risk appetite and market perspective.

Leverage options are available up to 100x, providing an opportunity to maximize returns while understanding the associated risks. Fee capping on options contracts adds to the competitive edge, allowing you to trade with increased cost predictability.

The platform emphasizes secure trading with robust safety measures. With backing from prominent investors, you can expect reliable and smooth trades. Spot and leveraged trading products are also available, allowing you to further diversify your portfolio.

This combination of features makes Delta Exchange a compelling choice when looking for a comprehensive crypto options trading experience.

Delta Exchange Supported Coins For Options Trading

When exploring options trading on Delta Exchange, you’ll have access to a variety of cryptocurrencies. The platform supports 20 cryptocurrencies and altcoins, offering a broad range for traders.

For instance, popular coins available for options trading include:

- AVAX (Avalanche)

- DOT (Polkadot)

- SOL (Solana)

- ADA (Cardano)

These cryptocurrencies provide a diverse trading portfolio, enhancing potential opportunities.

Here’s a snapshot of some of the key assets:

| Coin | Symbol |

|---|---|

| AAVE | AAVE |

| Bitcoin | BTC |

| Ethereum | ETH |

| Litecoin | LTC |

Delta Exchange’s diverse offerings can help cater to various trading strategies. Whether you’re a seasoned trader or new to the market, the platform offers flexibility and choice.

Engaging in options trading with these coins allows you to leverage their price movements and volatility. Remember to review each asset’s performance and market conditions before trading.

Delta Exchange Options Leverage

On Delta Exchange, you can engage in crypto options trading with substantial leverage. This functionality allows you to potentially increase your returns by controlling a larger position with a smaller investment. Leverage ratios can go up to 1:100, offering significant amplification of trades.

The high leverage means you need only a small margin to enter trades. Risk management is crucial due to the increased exposure and potential for significant losses.

The platform supports options trading on popular cryptocurrencies like Bitcoin, Ethereum, and others. Utilizing leverage effectively can enhance your trading strategies, ensuring optimal use of your capital.

When trading options, you have the flexibility to choose between call and put contracts. These are available with varying levels of leverage, allowing you to tailor your risk and exposure according to your market outlook and strategy.

Risk limits are integrated for managing potential losses. The platform’s risk management tools help ensure that your exposure does not exceed your risk appetite. Incorporating such tools into your strategy is vital for trading safely and effectively with leverage.

Delta Exchange Options Calculator

The Delta Exchange Options Calculator is a valuable tool for traders. It allows you to determine potential outcomes when trading options on the platform.

Key Features:

- Target Price Calculation: Select either ‘Long’ or ‘Short’ and input your leverage, entry price, and desired ROE% to compute the target price.

- User-Friendly Interface: The calculator is designed to be intuitive, making it accessible even for less experienced traders.

Enhanced Trading Decisions:

By using the calculator, you gain insights into how different parameters affect your trading outcomes. This assists in making informed decisions, potentially increasing your trade efficiency and results.

Benefits:

- Risk Management: Provides clear visualizations of potential profits or losses based on input variables.

- Flexibility: Supports a variety of trading scenarios, allowing you to plan various strategies effectively.

Practical Application:

Consider using the calculator before executing any trade. Tailor your strategy by adjusting parameters and observe how different scenarios play out. This can enhance your understanding of market dynamics.

Utilizing such tools on Delta Exchange can streamline your trading experience and potentially improve your performance in the highly competitive digital currency markets.

Delta Exchange Options Types

Delta Exchange offers a variety of options catering to different trading strategies. Turbo options and vanilla options are among the key types available.

Turbo Options have a unique feature known as the “knockout barrier,” allowing an option to expire before the set date if certain price conditions are met. These options are highly suitable for traders looking for dynamic and responsive contracts.

Vanilla Options are traditional options with a fixed expiry date. They provide a straightforward contract structure, ideal for those who prefer standard option mechanisms. You can choose between buying or selling a call or put option at a predetermined price.

Additional options include the European and American options. European options can only be exercised at expiration, while American options offer flexibility, allowing exercise at any point before expiration.

Delta Exchange also provides unique options like the Daily MOVE and Weekly MOVE, which capture expected price movements in cryptocurrencies such as Bitcoin and Ethereum. These MOVE options are designed for traders aiming to capitalize on volatility.

To summarize the available options:

| Option Type | Features |

|---|---|

| Turbo Options | Knockout barrier, expires if price conditions are met |

| Vanilla Options | Fixed expiry date |

| European Options | Can be exercised at expiration |

| American Options | Can be exercised any time before expiration |

| Daily MOVE | Captures daily expected price movement in BTC or ETH |

| Weekly MOVE | Captures weekly expected price movement in BTC or ETH |

Explore these options to align them with your trading strategies and preferences on Delta Exchange.

Delta Exchange Order Types

Delta Exchange offers a variety of order types to cater to different trading strategies. Market Orders are executed immediately at the current market price, ensuring quick transactions.

Limit Orders allow you to specify a price at which you are willing to buy or sell, giving you control over the trade.

The Trailing Stop Order automatically adjusts the stop price at a fixed distance from the market price when it moves in your favor, protecting gains without capping potential profits.

Bracket Orders include a stop-loss order and a take-profit order to manage risk on open positions. They belong to one cancels the other (OCO) orders.

The platform also offers Basket Orders, which bundle multiple contracts under the same underlying asset. This is useful for executing complex strategies efficiently.

For specific needs, you can use Fill or Kill (FOK), Immediate or Cancel (IOC), and Good Till Canceled (GTC) orders.

- FOK: Entire order must be filled immediately or not at all.

- IOC: Any portion of the order not executed immediately is canceled.

- GTC: The order remains active until you cancel it.

Understanding these options can help in optimizing your trading and managing risks more effectively.

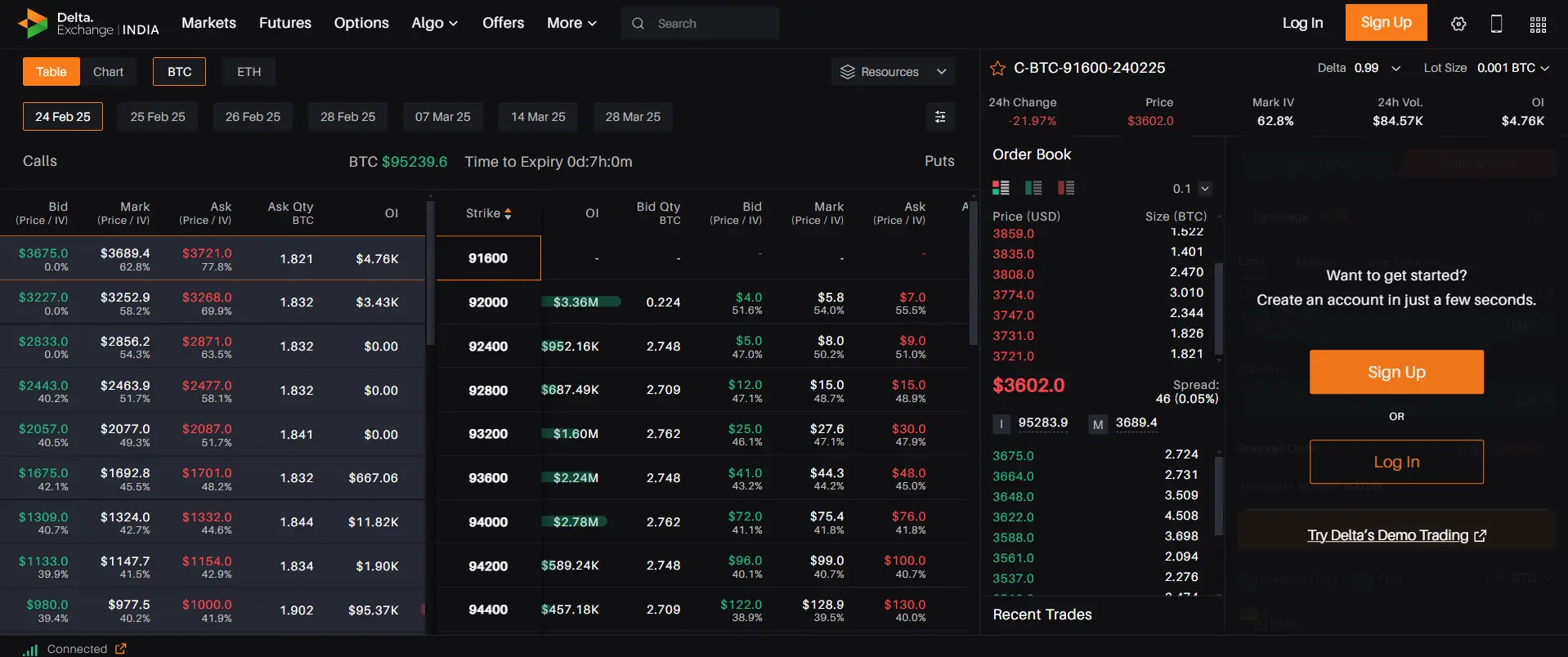

Delta Exchange Options Data

Delta Exchange offers a variety of data points that can help traders make informed decisions. These data include volume metrics and pricing information, which are essential for understanding market dynamics and potential trades.

Volume & Prices

On Delta Exchange, option contracts reflect trading volume and prices that are crucial for assessing market activity. Volume indicates the number of contracts traded over a specific period. Higher volume often signals strong interest and liquidity, making it easier to enter or exit positions.

Prices depend on various factors including implied volatility, market trends, and the underlying asset’s value. Delta Exchange provides tools for analyzing these aspects, allowing you to identify opportunities based on current market conditions. Understanding these metrics can improve your options trading strategy significantly.

Delta Exchange Liquidation Mechanism

Delta Exchange employs an Isolated Margin system. This means a position’s liquidation has no impact on your other positions and open orders. Each position is managed independently, allowing you greater control over risk and capital allocation.

When your position size falls below a certain Position Threshold, the liquidation process initiates. The platform cancels all open orders associated with the liquidated contract. This strategy helps in minimizing potential losses.

The liquidation price depends on factors like leverage. For instance, if you are holding a BTCUSD long position with 50x leverage and the entry price is $8000, the liquidation might occur around $7882.

Fees and Costs:

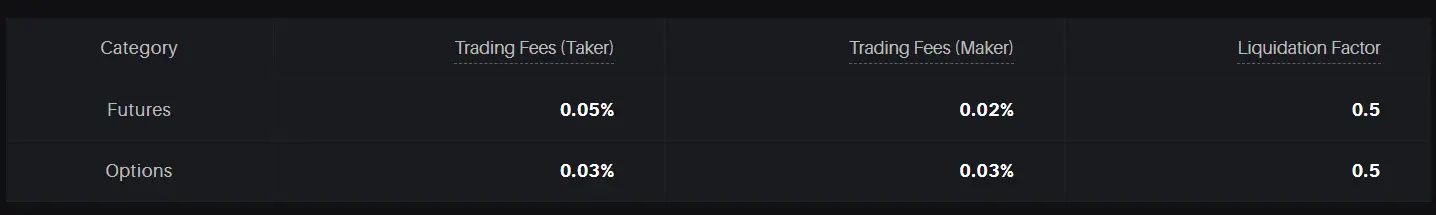

The liquidation factor at Delta Exchange is a key component of the liquidation mechanism. Notably, for different contract types, these factors vary:

- Taker Fee: 0.05%

- Maker Fee: 0.02%

- Settlement Fee: 0.05%

- Liquidation Factor: 0.2

Understanding these fees is crucial as they directly influence potential liquidation costs.

Delta Exchange’s mechanism is designed to handle liquidations effectively, ensuring that traders have a structured risk management approach, while limiting broader market implications.

Delta Exchange Options Trading Fees

Delta Exchange provides a structured fee framework for options trading. The trading fees typically apply based on the notional size, calculated as the product of the spot price and quantity.

The exchange offers fee capping features where the trading fee does not surpass a certain percentage. For example, fees on option trades are capped at 10% of the option premium. This can be advantageous in managing costs.

Here’s a table summarizing key fees:

| Fee Type | Rate |

|---|---|

| Taker Fee for Spot Trades | 0.1% |

| Maker Fee for Spot Trades | 0.1% |

| Taker Fee for Option Trades | 0.05% |

| Maker Fee for Option Trades | 0.05% |

| USDT Linear Futures Maker | 0.02% |

| USDT Linear Futures Taker | 0.05% |

For positions settled, a settlement fee applies to all open contracts. Also, an 18% GST is applicable to trading fees.

Understanding these fees is vital when considering your strategy and potential gains. Make sure to factor these costs into your trades to maximize your returns effectively.

Delta Exchange Options Funding Rates/Fees

When trading options on Delta Exchange, you can expect to encounter various fees. These charges vary depending on the contract type. For options, the trading fee structure is clearly outlined to help you manage costs effectively.

Trading Fees

- Taker Fee: 0.05% of the notional size

- Maker Fee: 0.02% of the notional size

- Fees can be capped at a percentage of the premium for certain trades.

Additionally, you should be aware of settlement fees. These apply to all open contracts during the settlement phase. It’s important to account for these costs when planning your strategy.

One notable aspect of Delta Exchange is the absence of fees for depositing cryptocurrency. This can be beneficial when you’re moving funds into your trading account.

Key Points

- No Deposit Fees

- Withdrawal incurs a network fee based on the cryptocurrency used

- Ensure to differentiate between taker and maker fees for accurate cost estimation

Understanding these fees allows for optimized trading strategies and better financial management. Properly assessing the implications of each fee ensures you are prepared for any transaction cost that may arise.

Delta Exchange Account Types

Delta Exchange offers a clear structure for account types, catering to diverse trader needs. Essential information about KYC tiers and associated limits will guide you in understanding access levels and account benefits.

KYC Tiers & Limits

Your journey with Delta Exchange begins by selecting the appropriate KYC (Know Your Customer) tier. These tiers determine the transaction limits and features accessible to you.

- Tier 1: Basic verification allows limited trading features. This tier lets you trade with a specified cap on withdrawals, offering a minimal security check, usually requiring just an email and basic personal information.

- Tier 2: More comprehensive verification enhances your trading limits and security. It usually requires additional identification documents, providing higher withdrawal limits and full access to all trading features available on the platform.

Understanding these tiers ensures that you have the necessary access required to meet your trading goals efficiently.

Delta Exchange Trading Platform & Tools

Delta Exchange offers a robust trading platform packed with features essential for both novice and experienced traders. You can trade a diverse array of cryptocurrency derivatives, providing options for various trading strategies.

Key functionalities include institution-grade trading tools that cater to professional trading needs. The platform’s intuitive design ensures that navigating through various options and features is seamless and straightforward.

Security is prioritized, integrating stringent measures to protect user funds and data. This creates a trusted environment for trading activities.

Delta Exchange provides competitive leverage options, allowing you to enhance your trading potential. With leverage, you can amplify your investment opportunities in a controlled manner. Leverage settings can be adjusted to suit your individual preferences and risk appetite.

Navigating the interface is user-friendly, aiding in quick execution of trades and management of orders. Tool efficiency supports high-frequency trading with precision.

For options traders, the platform stands out by offering fee capping, which can significantly benefit frequent traders. This approach makes trading more cost-effective and attractive for large volume operations.

Additionally, Delta Exchange supports more than 100 cryptocurrencies, facilitating a wide range of market opportunities. This extensive selection aids in diversifying your trading portfolio.

To aid strategy development, the platform provides analytical tools for market analysis and trend observation. These tools empower you to make informed trading decisions, refining your approach based on market dynamics.

In summary, Delta Exchange’s trading platform and tools present a comprehensive solution aimed at optimizing your trading performance, reinforced by a feature-rich and secure environment.

Delta Exchange Insurance Fund

When trading on Delta Exchange, you might be interested in the platform’s Insurance Fund. This fund plays a crucial role in maintaining stability during liquidation events.

If a liquidation cannot be completed before reaching a bankruptcy threshold, the Insurance Fund activates.

The Liquidation Engine works to handle losses effectively. It covers a 5% loss for Bitcoin (BTC) and Ethereum (ETH) contracts, and 2% loss for other contracts.

These measures aim to protect your interests and ensure a balanced trading environment. You can trust that your trades are supported by a structured approach to risk management.

Having this fund indicates an additional layer of security, reinforcing confidence in engaging with Delta Exchange as a trading service.

Delta Exchange Deposit Methods

When considering your deposit options on Delta Exchange, Bitcoin is primarily used for transactions. The platform supports Bitcoin for both deposit and withdrawal, which can provide a seamless user experience for crypto traders.

Besides Bitcoin, Delta Exchange also supports bank wire transfers. You can transfer funds securely from your bank account to your Delta Exchange account. This method is reliable and widely accepted.

It’s important to note that Delta Exchange does not currently accept fiat currency deposits. Therefore, a strong understanding of cryptocurrency is essential before transferring your funds.

For users needing to convert fiat to crypto before depositing, external exchanges can be utilized. This additional step may require planning to ensure funds are available when needed.

These deposit methods reflect Delta Exchange’s focus on crypto trading, emphasizing Bitcoin while offering a secure banking option. Remember to review daily deposit limits and any associated fees before transferring.

Delta Exchange Security Features

Delta Exchange prioritizes security to protect your assets and personal information. A cornerstone of their approach is the use of multi-signature wallets. This means that transactions require multiple approvals before execution, adding an extra layer of protection.

- Cold Storage: The majority of user funds are stored in cold storage, keeping them offline and away from potential online threats.

Another critical feature is robust two-factor authentication (2FA). You can enable this security measure to ensure that even if someone gains access to your password, they would need a second form of authentication to access your account.

Delta Exchange maintains a focus on system audit trails. By keeping detailed logs and records, they track every significant action within the platform. This helps in identifying and addressing any suspicious or unauthorized activities promptly.

DDoS Protection: Delta Exchange employs Distributed Denial of Service (DDoS) protection measures. This is to prevent service interruptions from attacks that aim to overwhelm their system with traffic.

Regular security audits are conducted by third-party firms to identify potential vulnerabilities and fix them before they can be exploited. This proactive approach keeps security measures up-to-date with evolving cyber threats.

By employing a combination of these security features, Delta Exchange aims to create a secure trading environment for you.

Delta Exchange Customer Support

Delta Exchange offers multiple customer support options to assist users effectively. You can reach out via email support, which is known for its accessibility.

Another way to get help is through the live chat feature. This option allows you to chat directly with a representative, providing real-time solutions to your queries.

For those who prefer a more hands-on approach, Delta Exchange provides a helpful Help Center with a variety of articles and FAQs. These resources cover common issues and procedures, making it a valuable tool for self-service support.

Delta Exchange aims to address customer needs promptly, ensuring you have a smooth experience while trading. While the support is good, it is not rated as the best in the industry.

Is Delta Exchange A Legal & Safe Platform?

Delta Exchange is a prominent platform for trading cryptocurrency derivatives, offering a range of options for both novice and professional traders. When considering its legal standing, Delta Exchange operates within jurisdictions where it is registered and complies with necessary regulatory requirements. Always verify if it is accessible and legal in your country before trading.

Security is paramount for any trading platform. Delta Exchange employs several robust measures to protect user funds and data. Two-factor authentication (2FA) is available, providing an extra layer of security for your account. Additionally, assets are held in cold storage to prevent unauthorized access, minimizing risks associated with online breaches.

Frequent security audits are part of Delta Exchange’s commitment to a safe trading environment. These audits help identify and address any vulnerabilities, ensuring the platform maintains high security standards. By prioritizing these measures, Delta Exchange has built a reputation as a secure trading venue.

User feedback on the platform indicates a mix of positive and negative experiences. While many users appreciate the comprehensive security features, some have reported issues with customer support responsiveness. Evaluate these reviews to make an informed decision based on what matters most to you as a trader.

In conclusion, Delta Exchange appears to take its legal and safety obligations seriously with a clear focus on protecting its users. Always conduct your due diligence and consider consulting legal professionals if needed to ensure that your trading activities comply with your local laws and regulations.

Frequently Asked Questions

Delta Exchange offers competitive fees, robust security measures, and recognizes its operations under certain jurisdictions. You’ll also find unique features that may appeal to various types of traders.

What fees should I expect when trading on Delta Exchange?

The fees on Delta Exchange can vary depending on the type of trading. Generally, options trading comes with specific charges that traders must be aware of. Always review the most current fee structure directly on Delta Exchange’s platform to ensure you are informed of all potential costs involved.

How does Delta Exchange ensure the safety of user funds and data?

Delta Exchange prioritizes security by conducting manual reviews of withdrawal requests every 24 hours, enhancing fund safety. They employ industry-standard encryption and multi-signature wallets to protect user data and assets. These measures are designed to safeguard users’ financial interests and personal information.

Is Delta Exchange a legally recognized trading platform in India?

While Delta Exchange is a global platform, traders should verify its legal status in their respective countries, including India. The platform was founded with an international focus and may comply with regulations from various jurisdictions. It is advisable to consult legal guidelines or governance related to crypto trading in India for clarity.

What are the unique features of Delta Exchange compared to other trading platforms?

Delta Exchange distinguishes itself with its high-performance trading platform and a comprehensive suite of financial products, catering to both retail and institutional traders. It supports a variety of cryptocurrencies and trading options, with manually reviewed withdrawals and competitive liquidity. These features create an appealing environment for high-volume and professional traders.

Conclusion

Delta Exchange offers a variety of options for trading cryptocurrency derivatives, including USDT-settled European call and put options on popular assets like Bitcoin and Ethereum. These options provide flexibility for traders, allowing them to choose between executing the contract or letting it expire worthless.

The platform is known for its strong security measures, giving you peace of mind as you trade. Security is a priority with features designed to protect your assets and data.

Delta Exchange supports over 50 altcoins, along with high leverage of up to 100x on futures and perpetual swaps.

It is a reputable choice backed by notable investors such as CoinFund, Aave, and Kyber Network. This backing highlights its credibility and focus on providing a reliable trading experience.

Available in select countries, including Canada, the UK, and Australia, Delta Exchange caters to a wide geographical range. Consider its offerings if you are looking to trade in supported regions.

Whether you are a seasoned trader or a newcomer, Delta Exchange presents tools and options to suit a spectrum of trading strategies while ensuring a robust and secure environment.

Want more options? Check out these crypto exchanges: