Deribit stands as a specialized cryptocurrency derivatives platform where you can trade Bitcoin and Ethereum futures, perpetual swaps, and options. The exchange operates with institutional-grade infrastructure and serves traders across 200+ countries, making it accessible for global crypto enthusiasts.

If you’re seeking a derivatives platform with up to 50x leverage, advanced trading tools, and deep liquidity pools for BTC and ETH trading, Deribit delivers these features while maintaining a professional trading environment. The platform caters to both experienced traders and institutions, though its advanced features may require some learning for newcomers.

The exchange focuses on creating an efficient marketplace by combining robust risk management systems with low latency trading capabilities. You can trade using USDC as collateral, and the platform offers optional KYC procedures to enhance security measures while maintaining flexibility for different user preferences.

What Are Deribit Options?

Deribit options let you trade contracts based on Bitcoin and Ethereum prices. These options give you the right to buy or sell cryptocurrency at a specific price on a future date.

Trading options on Deribit requires USDC as collateral. You can access both call options (for buying) and put options (for selling) with various expiration dates and strike prices.

The platform offers European-style options, which means you can only exercise them on the expiration date. Options trading on Deribit provides up to 50x leverage, allowing you to control larger positions with less capital.

Each options contract has specific components: the strike price (target price), expiration date, and premium (cost of the option). You can choose from weekly, monthly, and quarterly expiration cycles.

Options on Deribit serve multiple purposes: hedging your existing crypto positions, speculating on price movements, or generating income through premium collection. The platform’s deep liquidity ensures competitive pricing and easier order execution.

You’ll find advanced trading tools and a professional-grade interface to help manage your options positions. The platform displays essential metrics like implied volatility and Greeks to assist with your trading decisions.

Deribit Options Products Offerings

Deribit specializes in cryptocurrency options trading, focusing primarily on Bitcoin and Ethereum derivatives. You can access European-style options contracts with various strike prices and expiration dates.

The platform offers both call options and put options for trading. Call options give you the right to buy the underlying crypto asset, while put options provide the right to sell.

Available options expiration periods include:

- Weekly options

- Monthly options

- Quarterly options

You can trade with leverage up to 50x on the platform, allowing for increased position sizes with less capital. The minimum trade size for Bitcoin options is 0.1 BTC, and for Ethereum options, it’s 1 ETH.

Settlement occurs in the underlying cryptocurrency rather than cash. Your profits and losses are calculated and paid out in either BTC or ETH depending on the traded instrument.

The platform provides real-time market data and advanced charting tools to help you analyze options pricing and market movements. You can execute trades through market orders, limit orders, or stop orders.

Professional traders can utilize advanced strategies like straddles, strangles, and butterfly spreads through Deribit’s comprehensive options suite.

Deribit Supported Coins For Options Trading

Deribit focuses exclusively on Bitcoin (BTC) and Ethereum (ETH) options trading. This specialized approach allows the platform to maintain deep liquidity and tight spreads for these major cryptocurrencies.

For Bitcoin options, you can trade contracts with values ranging from 0.1 BTC to 100 BTC. The minimum trade size is 0.1 BTC, making it accessible for traders with varying capital levels.

Ethereum options on Deribit start at 1 ETH and can go up to 5000 ETH per contract. The minimum trade size is set at 1 ETH, providing flexibility for different trading strategies.

Settlement Currencies:

- BTC for Bitcoin options

- ETH for Ethereum options

Each option contract offers European-style settlement, meaning you can only exercise them at expiration. The platform provides multiple expiration dates and strike prices to match your trading preferences.

You’ll find standardized option contracts with weekly, monthly, and quarterly expiration cycles. This structure helps maintain consistent liquidity across different contract periods.

Market makers provide continuous quotes for both cryptocurrencies, ensuring you can enter and exit positions efficiently during trading hours.

Deribit Options Leverage

Deribit offers substantial leverage options for cryptocurrency derivatives trading. You can access up to 50x leverage when trading Bitcoin and Ethereum options on the platform.

The leverage amount available varies based on the specific cryptocurrency and market conditions. Your maximum position size depends on your account equity and the chosen leverage multiplier.

Risk management features help protect your positions when using leverage. The platform implements automated liquidation protocols if your margin requirements fall below maintenance levels.

You must maintain sufficient collateral in your account to cover potential losses. The minimum required margin varies based on your position size and selected leverage ratio.

Key Leverage Features:

- Maximum 50x leverage multiplier

- Adjustable leverage settings

- Real-time margin monitoring

- Automated liquidation protection

- Flexible collateral requirements

Professional traders can utilize higher leverage to maximize potential returns. Keep in mind that increased leverage also amplifies potential losses and requires careful position management.

The platform provides detailed margin calculators and position sizing tools. These help you determine appropriate leverage levels based on your risk tolerance and trading strategy.

Deribit Options Calculator

Deribit provides a built-in options calculator to help you estimate potential profits and losses before executing trades. The calculator lets you analyze different scenarios by adjusting variables like strike price, expiration date, and volatility.

You can access the calculator directly from the trading interface. It displays key metrics including delta, gamma, theta, and vega – essential Greeks that measure various aspects of options sensitivity.

The calculator features intuitive sliders and input fields for fine-tuning your calculations. You can modify parameters like spot price, time decay, and implied volatility to see how they affect option premiums.

A visual profit/loss chart helps you visualize potential outcomes across different price points. The graph updates in real-time as you adjust the parameters, making it easier to understand risk/reward scenarios.

The calculator supports both call and put options calculations. You can toggle between American and European style options to match your trading strategy.

Key Features:

- Real-time price updates

- Greek calculations

- P/L visualization

- Volatility analysis

- Multiple option styles

- Custom parameter inputs

The tool works seamlessly with both Bitcoin and Ethereum options available on the platform. For advanced traders, it can calculate complex multi-leg options strategies.

Deribit Options Types

Deribit offers both European and American-style options on Bitcoin and Ethereum. European options can only be exercised at expiration, while American options allow exercise at any time before expiration.

You can trade Call and Put options on the platform. Call options give you the right to buy the underlying asset, while put options give you the right to sell it at the strike price.

The available option expiries include:

- Weekly options

- Monthly options

- Quarterly options

- Semi-annual options

Strike prices on Deribit follow standardized intervals based on the underlying asset’s price. For Bitcoin options, strikes typically range from $1,000 to $100,000, while Ethereum options have strikes from $100 to $10,000.

You can choose from three settlement currencies for your options trades:

- Bitcoin (BTC)

- Ethereum (ETH)

- USDC

The platform offers deep liquidity with tight spreads, making it easier to enter and exit positions. Professional traders can access advanced order types like limit orders, stop orders, and trigger orders for options trading.

Each option contract on Deribit represents 1 BTC or 1 ETH, depending on the underlying asset you select. You can trade multiple contracts to increase your position size according to your strategy.

Deribit Order Types

Deribit provides several essential order types to help you execute trades effectively on their platform. Market orders and limit orders form the foundation of basic trading functionality.

Market orders execute immediately at the current best available price. They’re ideal when you need quick trade execution and price isn’t your primary concern.

Limit orders let you set a specific price at which you want your order to be filled. Your order will only execute when the market reaches your designated price point.

Stop orders help protect your positions from significant losses. These trigger when the market hits a predetermined price level, converting to a market order for execution.

You can access stop-limit orders that combine features of both stop and limit orders. When your stop price triggers, it creates a limit order instead of a market order.

Advanced traders can utilize trailing stop orders, which automatically adjust the stop price as the market moves in your favor. This helps lock in profits while maintaining protection against reversals.

Post-only orders ensure your order only executes as a maker, not a taker. This is useful for reducing trading fees and adding liquidity to the market.

Time in force options let you specify how long your orders remain active. You can choose between good-till-cancelled (GTC), immediate-or-cancel (IOC), and fill-or-kill (FOK) conditions.

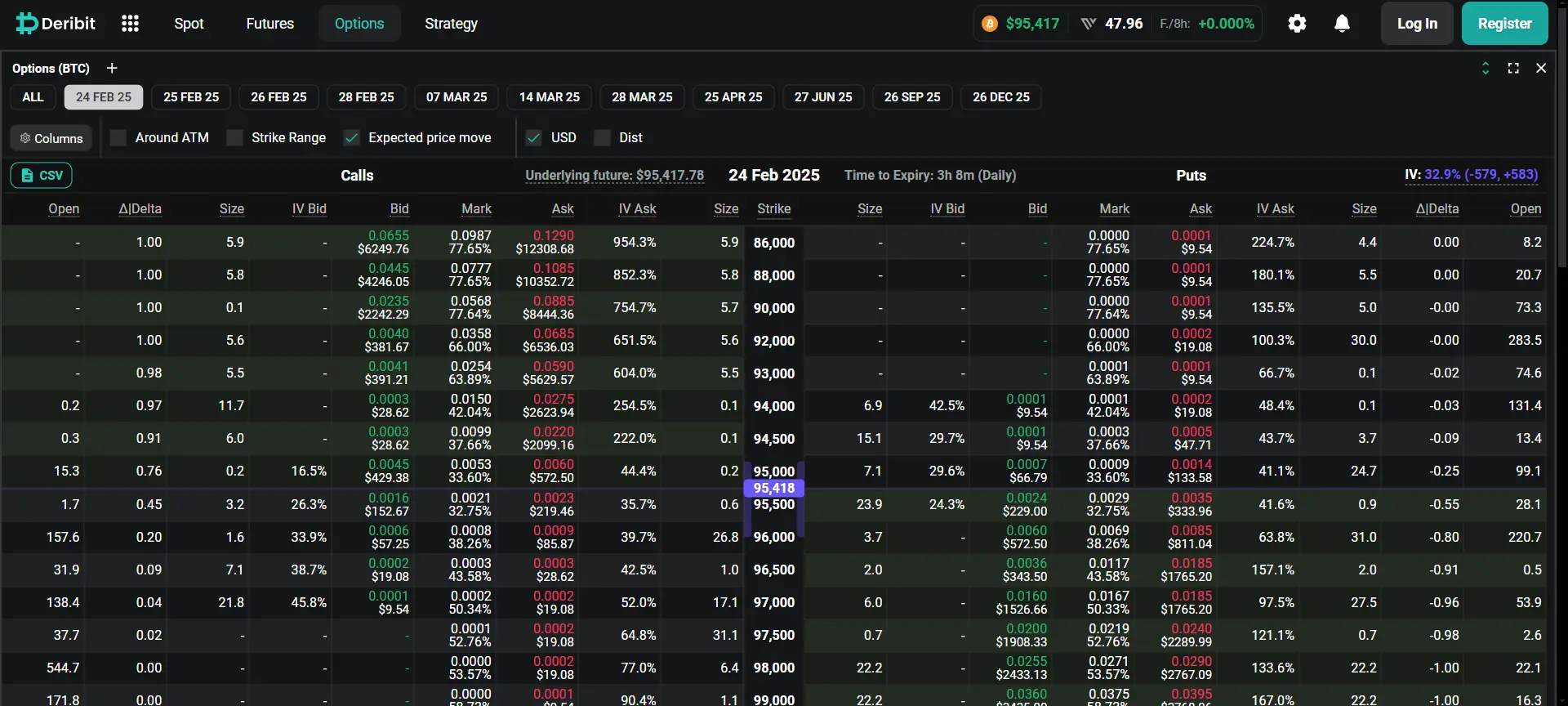

Deribit Options Data

Deribit delivers real-time options data through TradingView charts and its API, enabling traders to track market movements and execute informed trades.

Volume & Prices

You can access comprehensive options trading data through Deribit’s platform, including real-time bid-ask spreads and trading volumes.

The exchange provides detailed price discovery mechanisms for crypto options, displaying mark prices, settlement prices, and index prices for accurate position valuation.

Your trading interface shows open interest metrics across different strike prices and expiration dates, helping identify market sentiment and liquidity zones.

Advanced traders can utilize Deribit’s API to pull historical options data for backtesting strategies or analyzing market patterns. The platform supports both WebSocket and REST API connections for data access.

The exchange updates options prices in real-time with low latency, essential for quick decision-making in fast-moving markets.

Deribit Liquidation Mechanism

Deribit uses an incremental liquidation system to protect traders and maintain market stability. Your positions face liquidation risk when your account balance falls below the minimum margin requirements.

The platform employs a proprietary risk engine to calculate the minimum assets needed to cover your future contract obligations. This system continuously monitors your positions and account balance.

Liquidation fees apply when your positions are forcefully closed. For Bitcoin positions, you’ll pay 0.50% as a maker and 0.45% as a taker. Ethereum positions incur higher fees at 0.90% for makers and 0.85% for takers.

To avoid liquidation, you must maintain sufficient margin in your account. You can monitor your liquidation price through the platform’s interface to manage your risk effectively.

Trading with leverage increases your liquidation risk. Even when using low leverage, it’s essential to understand where your positions would be liquidated and maintain appropriate risk management strategies.

Tips to Avoid Liquidation:

- Monitor your margin levels regularly

- Set stop-loss orders

- Keep additional funds as buffer

- Avoid excessive leverage

- Track market volatility

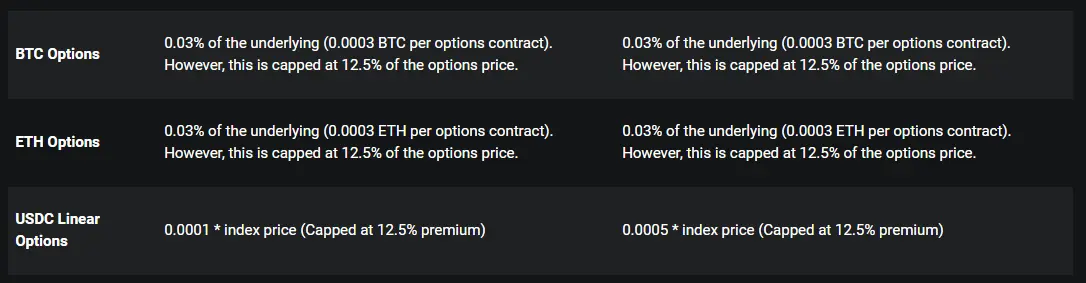

Deribit Options Trading Fees

Deribit maintains a straightforward fee structure for options trading with competitive rates compared to other cryptocurrency derivatives exchanges.

Funding Rates/Fees

Options trading on Deribit comes with a flat 0.03% fee for both maker and taker orders. This consistent rate applies regardless of your trading volume or position size.

When your options contracts expire, Deribit charges delivery fees. These fees are deducted automatically from your account upon contract settlement.

You can reduce your trading costs by using limit orders instead of market orders, as limit orders help you avoid paying higher taker fees.

The platform offers fee discounts for high-volume traders through their VIP program. Your discount tier depends on your 30-day trading volume.

Active traders can contact Deribit’s support team to negotiate custom fee structures based on their trading volume and strategies.

Deribit Account Types

Deribit provides individual and corporate trading accounts, each designed to accommodate different trading needs and requirements.

KYC Tiers & Limits

Deribit implements a four-tier KYC system for account verification and trading limits.

Level 0 requires only basic information like your name and email address. This entry-level tier allows you to start trading with minimal verification.

Higher KYC levels unlock increased withdrawal limits and trading features. To advance through the tiers, you’ll need to submit additional documentation including government ID and proof of address.

Corporate accounts receive special features like sub-account management capabilities. This enables businesses to oversee multiple traders under a single corporate structure.

The verification process typically takes a few hours after document submission. Your trading privileges expand as you complete higher KYC levels, giving you access to more advanced trading options and higher limits.

Deribit Trading Platform & Tools

Deribit offers a professional-grade trading interface designed for both novice and experienced derivatives traders. The platform provides real-time market data, advanced charting capabilities, and customizable layouts to suit your trading preferences.

You can access a comprehensive suite of trading tools, including various order types like market, limit, stop-loss, and take-profit orders. The platform’s order book depth visualization helps you make informed trading decisions.

The trading interface features a Position Builder tool that enables you to create and analyze complex options strategies. You gain access to Greeks calculations, volatility charts, and profit/loss simulators.

Key Trading Features:

- Advanced charting with multiple timeframes

- Real-time market depth visualization

- Portfolio margining system

- Risk management tools

- API access for automated trading

The platform maintains high performance with low latency execution and robust security measures. You can trade on desktop or mobile devices through their responsive web interface.

Technical analysis tools include popular indicators like RSI, MACD, and Bollinger Bands. The platform integrates price feeds from multiple exchanges to ensure accurate market data.

Deribit’s interface allows you to monitor multiple positions simultaneously and provides detailed portfolio analytics. The platform includes built-in risk calculators to help you assess potential losses and gains before executing trades.

Deribit Insurance Fund

Deribit maintains a robust insurance fund worth over $110 million to protect traders from bankruptcy and socialized losses. This fund acts as a safety net when traders’ accounts drop below zero due to market volatility or failed positions.

The exchange collects liquidation fees that contribute directly to the insurance fund. For Bitcoin trading, the fees are 0.30% on futures and perpetuals, and 0.90% for options contracts.

When a trader gets liquidated, their positions are closed at market prices. The insurance fund covers any negative balance that occurs during this process, ensuring winning traders receive their full profits.

If a rare situation occurs where the insurance fund becomes depleted, Deribit implements a socialized loss system. Under this system, any remaining losses are distributed proportionally among profitable traders.

Your trading positions benefit from this protection automatically – there’s no need to opt-in or pay additional fees beyond the standard liquidation charges. The fund’s balance is updated hourly with new liquidation fee contributions.

Deribit Deposit Methods

Deribit only accepts cryptocurrency deposits, with Bitcoin (BTC) and Ethereum (ETH) as the primary deposit options. Your funds can be sent directly from your personal wallet or another exchange to your Deribit wallet address.

The minimum deposit amount varies depending on network conditions and blockchain fees. To deposit funds, you’ll need to generate a unique deposit address in your Deribit account for either BTC or ETH.

Deposits typically confirm within 1-3 network confirmations. BTC deposits require 1 confirmation, while ETH deposits need 2 confirmations before funds become available for trading.

Important Security Features:

- Multi-signature wallets for secure storage

- Cold storage for majority of funds

- Deposit address verification system

- Real-time deposit monitoring

No fiat currency deposits are supported on Deribit. You’ll need to acquire cryptocurrencies elsewhere before transferring them to your Deribit account.

The platform uses an automated deposit detection system, crediting your account immediately after the required number of blockchain confirmations. Make sure to double-check the deposit address before sending any funds.

Deribit Security Features

Deribit implements multiple layers of security to protect your funds and trading activities. The platform maintains 99% of user assets in cold storage wallets, keeping them offline and safe from potential cyber threats.

Your account security starts with mandatory two-factor authentication (2FA). This adds an extra verification step when logging in or making withdrawals, significantly reducing the risk of unauthorized access.

The exchange conducts regular security audits to identify and address potential vulnerabilities. These audits help maintain the platform’s robust security infrastructure and ensure compliance with industry standards.

Key Security Measures:

- Cold storage for 99% of funds

- Mandatory 2FA authentication

- Regular security audits

- Protected trading dashboard

- Secure SSL encryption

A dedicated security team monitors the platform 24/7 for suspicious activities. They track unusual trading patterns and unauthorized access attempts to maintain the integrity of your trading environment.

Your personal data receives strong protection through advanced encryption protocols. Deribit employs SSL encryption to secure all communications between your browser and their servers.

The platform features automated risk checks that help protect your positions. These systems monitor market conditions and can prevent potential losses from system failures or extreme market events.

Deribit Customer Support

Deribit provides 24/7 customer support through multiple channels to assist traders with their questions and concerns.

The primary method of contact is through their ticket system, where you can open a support request for detailed assistance with your trading issues.

For faster responses, you can join Deribit’s official Telegram group to get help from community managers and support staff.

Technical questions about the API or platform features can be directed to [email protected]

The support team is trained to handle both basic and complex trading inquiries, making it suitable for both new and experienced traders.

Response times vary depending on the contact method chosen. Telegram typically offers the quickest responses, while email and support tickets may take several hours.

Available Support Channels:

- Support ticket system

- Official Telegram group

- Email support

- Technical support for API users

The support team can assist with:

- Account verification

- Trading platform navigation

- Deposit and withdrawal issues

- Technical problems

- General trading questions

Is Deribit A Legal & Safe Platform?

Deribit operates legally under Deribit B.V., based in Amsterdam, Netherlands. The platform launched in 2016 and specializes in cryptocurrency derivatives trading.

Safety Considerations:

- Not regulated by top-tier financial authorities

- Implements security measures for user protection

- Focuses on crypto futures and options trading

Your funds face higher risk on Deribit compared to regulated exchanges. The platform lacks oversight from major financial regulators, which limits your protection options if issues arise.

The trading platform offers sophisticated security features and maintains strict compliance standards. You can trade Bitcoin and Ethereum derivatives with up to 100x leverage.

Deribit accepts USDC as collateral and provides professional-grade trading tools. You’ll find a comprehensive range of futures, perpetual swaps, and options contracts.

The platform requires technical knowledge to navigate effectively. You might experience a learning curve when starting out, especially if you’re new to derivatives trading.

Key Security Features:

- Cold storage for majority of assets

- Two-factor authentication (2FA)

- Advanced risk management tools

- Regular security audits

Frequently Asked Questions

Trading cryptocurrency options requires understanding specific fee structures, trading mechanisms, and account requirements that directly impact your trading experience and profitability.

What are the fees associated with trading on Deribit?

Deribit charges a 0.03% maker fee and a 0.05% taker fee for options trading. These fees apply to the premium value of the options contract.

Trading fees are automatically deducted from your account balance upon execution of trades.

Professional traders and high-volume accounts can qualify for fee discounts based on their 30-day trading volume.

How does the options trading mechanism function on Deribit?

Options on Deribit follow European-style exercise rules, which means you can only exercise them at expiration.

The platform offers both call and put options with various strike prices and expiration dates for Bitcoin and Ethereum.

Your maximum loss is limited to the premium paid when buying options, while selling options requires maintaining sufficient margin requirements.

Is Know Your Customer (KYC) verification required to trade on Deribit?

Basic trading on Deribit does not require KYC verification for withdrawals up to 1 BTC per 24 hours.

You can create an account with just an email address and password to start trading immediately.

Verified accounts receive higher withdrawal limits and additional platform features.

Conclusion

Deribit stands as a specialized cryptocurrency derivatives platform focusing on Bitcoin and Ethereum trading. The exchange offers advanced trading features, deep liquidity, and low latency execution for experienced traders.

You’ll find professional-grade tools for futures, perpetual swaps, and options trading with leverage up to 50x. The platform maintains high security standards with optional KYC procedures and robust risk management systems.

The trading interface caters to advanced users, making it less suitable for beginners. The exchange’s focus on derivatives trading sets it apart from general cryptocurrency exchanges.

Trading fees remain competitive, and the platform’s liquidity ensures efficient order execution. USDC collateral options provide flexibility for your trading strategies.

Consider Deribit if you’re seeking a dedicated derivatives trading platform with proven reliability and advanced features. The exchange works best for traders who understand cryptocurrency derivatives and seek professional-grade tools.

Want more options? Check out these crypto exchanges: