Choosing between Huobi (now HTX) and Bybit can be challenging for cryptocurrency traders looking for the right exchange. Both platforms have established themselves as major players in the crypto market, with Huobi being one of the longest-running exchanges that survived China’s Bitcoin trading ban.

When comparing Huobi and Bybit, you’ll find differences in their fee structures, available cryptocurrencies, trading features, and user experience that can significantly impact your trading success. These exchanges offer various programs like staking, flexible savings, and fixed-term options to help you maximize your crypto holdings.

You can evaluate these platforms based on important criteria including security measures, supported trading types, deposit methods, and overall user satisfaction. Understanding these differences will help you select the exchange that best aligns with your trading style and investment goals.

Huobi Vs Bybit: At A Glance Comparison

When choosing between Huobi and Bybit, understanding their key differences can help you make the right choice for your trading needs.

Huobi has been around longer, surviving through China’s ban on Bitcoin trading. This gives them a strong track record in the crypto industry.

Bybit is newer but has gained popularity quickly among traders looking for alternatives.

Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Huobi | 0.02% | 0.05% |

| Bybit | Slightly higher | Slightly higher |

For futures trading, Huobi offers more competitive fees compared to Bybit. This could save you money if you trade frequently.

Both exchanges support many cryptocurrencies, but their available trading pairs may differ. You should check if your preferred coins are listed on either platform.

User experience is another important factor. Some traders find Bybit’s interface more user-friendly, while others prefer Huobi’s established platform.

Security measures and available features like staking, lending, and margin trading also vary between the two exchanges.

Trading volume can affect liquidity, with Huobi historically having strong global volume across its international exchanges.

Also Read: Crypto Options American Style & Crypto American Options

Both platforms offer mobile apps, allowing you to trade on the go and monitor your investments from anywhere.

Huobi Vs Bybit: Trading Markets, Products & Leverage Offered

Both Huobi and Bybit offer a variety of trading options for crypto investors. Let’s compare what each platform provides.

Trading Markets

Huobi and Bybit both support spot trading with numerous cryptocurrency pairs. Bybit has expanded its offerings significantly in recent years, though Huobi still maintains a competitive selection of coins.

Derivatives Options

- Bybit: Offers futures, perpetual contracts, and options

- Huobi: Provides futures, swap contracts, and margin trading

Bybit stands out with its derivatives platform, which has helped it grow rapidly. The platform now serves over 6 million customers according to recent data.

Leverage Capabilities

Bybit offers impressive leverage options with up to 100x leverage on Bitcoin and 50x on other cryptocurrencies. Huobi provides competitive leverage as well, though generally not as high as Bybit’s maximum offerings.

User Experience

You’ll find both platforms have intuitive interfaces for trading. Bybit has gained popularity for its fast execution speeds and reliable performance during high market volatility.

Trading Tools

| Feature | Bybit | Huobi |

|---|---|---|

| Advanced charts | ✓ | ✓ |

| Stop-loss orders | ✓ | ✓ |

| Mobile trading | ✓ | ✓ |

| API access | ✓ | ✓ |

The comparison reveals that Bybit has a slight edge in trading products and leverage options, which might explain its higher overall score of 8.0 compared to Huobi’s score in recent evaluations.

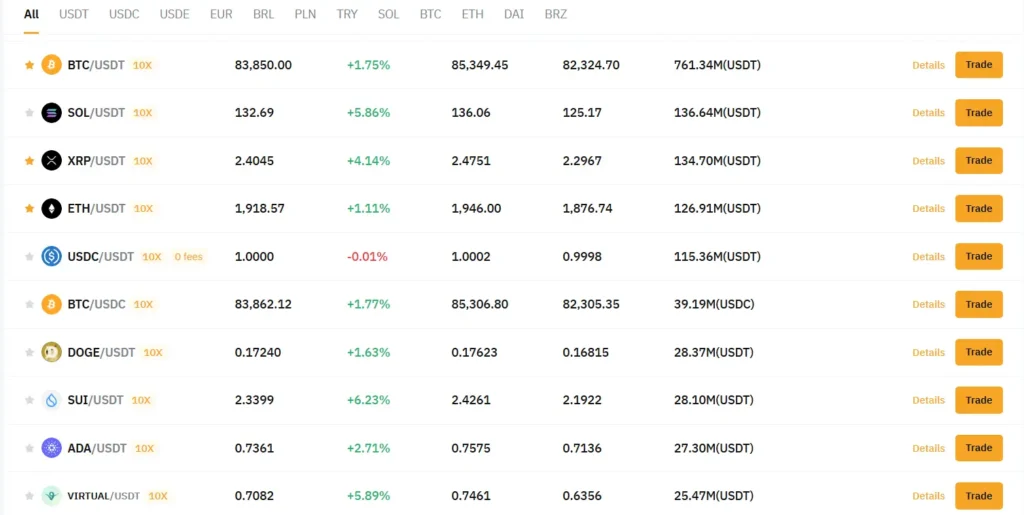

Huobi Vs Bybit: Supported Cryptocurrencies

When choosing between Huobi and Bybit, the variety of cryptocurrencies available for trading is an important factor to consider. Both exchanges offer a wide range of digital assets, but there are some differences worth noting.

Huobi is one of the oldest cryptocurrency exchanges in the market. It supports over 350 cryptocurrencies and offers more than 500 trading pairs. This extensive selection includes major coins like Bitcoin and Ethereum, as well as many altcoins and newer tokens.

Bybit offers fewer cryptocurrencies compared to Huobi, with approximately 250+ coins available for trading. However, Bybit still covers all major cryptocurrencies and many popular altcoins that most traders are interested in.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | Huobi | Bybit |

|---|---|---|

| Total cryptocurrencies | 350+ | 250+ |

| Trading pairs | 500+ | 400+ |

| Major coins (BTC, ETH, etc.) | Yes | Yes |

| DeFi tokens | Extensive selection | Good selection |

| New token listings | Regular additions | Regular additions |

Huobi may be preferable if you’re looking to trade more obscure altcoins or want the widest possible selection. The platform has survived through market changes and maintains a diverse crypto portfolio.

Bybit offers fewer options but covers most cryptocurrencies that average traders use regularly. Their selection is still comprehensive enough for most trading strategies.

You should check each platform’s current listings if you’re interested in specific cryptocurrencies, as available assets can change over time.

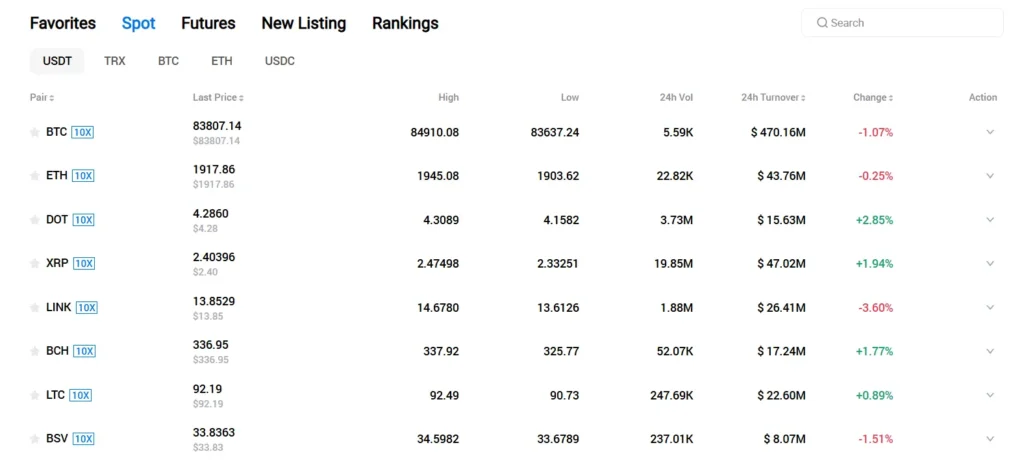

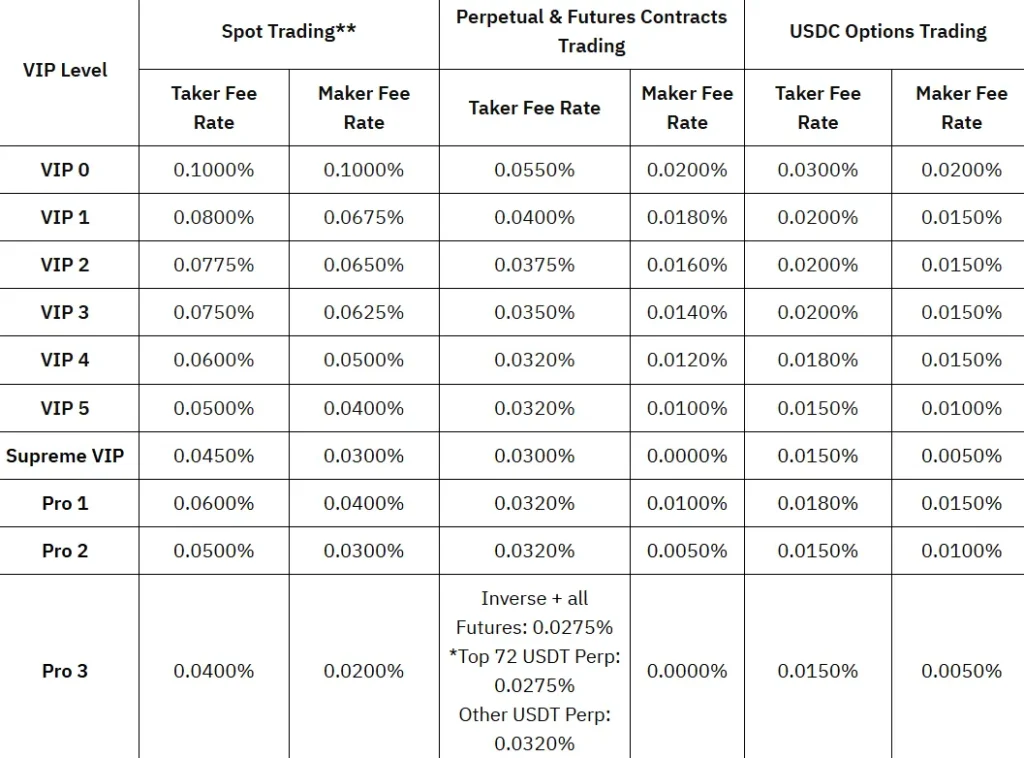

Huobi Vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Huobi and Bybit, understanding their fee structures can help you make a better decision for your trading needs.

- Trading Fees: Both exchanges have competitive fee structures in 2025. Bybit typically offers slightly lower trading fees compared to Huobi for most transaction types.

- Deposit Fees: Neither Huobi nor Bybit charges deposit fees directly. However, you may still need to pay network fees depending on the blockchain you’re using.

- Withdrawal Fees: Huobi doesn’t charge platform withdrawal fees, but you’ll still pay the standard blockchain network fees. Bybit has specific withdrawal fees that vary by cryptocurrency.

Here’s a quick comparison table:

| Fee Type | Huobi | Bybit |

|---|---|---|

| Trading Fees | Moderate | Slightly lower |

| Deposit Fees | None (network fees apply) | None (network fees apply) |

| Withdrawal Fees | None (network fees apply) | Varies by crypto |

You should check each platform’s current fee page before making your decision. Fees in crypto exchanges can change based on market conditions and trading volume.

Remember that lower fees aren’t the only factor to consider. Also look at the available trading pairs, security features, and user interface when deciding between these exchanges.

Huobi Vs Bybit: Order Types

When trading on cryptocurrency exchanges, the variety of order types available can significantly impact your trading strategy. Both Huobi and Bybit offer several order types to help you execute trades effectively.

Huobi provides traditional order types including market orders, limit orders, and stop-limit orders. You can also use trailing stop orders to lock in profits as the market moves in your favor.

Bybit offers a similar range of basic order types but adds some advanced features. You’ll find conditional orders that let you set specific price triggers before your order activates. This is particularly useful for planning trades in volatile markets.

Both platforms support One-Cancels-the-Other (OCO) orders, allowing you to set two orders with the understanding that when one executes, the other automatically cancels.

For futures trading, Bybit provides more specialized order types like Take Profit and Stop Loss orders that can be set simultaneously with your entry order. This gives you better risk management options.

Huobi’s interface organizes order types in a straightforward manner, which beginners might find easier to navigate. Bybit’s order type system tends to be more comprehensive but may require a bit more time to master.

Active traders will appreciate that both exchanges offer post-only orders that ensure you always pay maker fees rather than taker fees, helping reduce your trading costs.

Huobi Vs Bybit: KYC Requirements & KYC Limits

When choosing between Huobi and Bybit, understanding their KYC (Know Your Customer) requirements is important for your trading experience.

Huobi implements a three-tier KYC process. At the basic level, you can trade crypto with minimal information, though this information can be easily falsified. This makes Huobi somewhat accessible for users seeking privacy.

Bybit uses KYC to identify customers and analyze risk profiles. Their verification process helps prevent money laundering and financing of illicit activities.

For privacy-focused traders, Huobi might be more appealing as it offers relatively easier access with limited KYC requirements. Some users consider Huobi convenient specifically because of its less stringent verification process.

However, both exchanges have different withdrawal limits based on verification levels:

Huobi KYC Levels:

- Level 1: Basic trading with limited withdrawals

- Level 2: Increased withdrawal limits

- Level 3: Maximum withdrawal limits

Bybit KYC Levels:

- Unverified: Very limited functionality

- Basic verification: Moderate withdrawal limits

- Advanced verification: Higher withdrawal limits

Your choice between these exchanges may depend on how much personal information you’re willing to share and what trading volume you need.

Remember that KYC requirements can change as regulations evolve, so check the latest requirements on each platform’s official website.

Huobi Vs Bybit: Deposits & Withdrawal Options

When choosing between Huobi and Bybit, understanding their deposit and withdrawal options is crucial for your trading experience.

Deposit Methods

Both exchanges support cryptocurrency deposits. Bybit and Huobi allow you to deposit major cryptocurrencies like Bitcoin, Ethereum, and various altcoins directly.

Huobi offers more fiat currency options for deposits, including USD, EUR, and several Asian currencies. You can use bank transfers and some credit/debit card options.

Bybit has fewer fiat options but provides P2P trading as an alternative way to fund your account.

Withdrawal Options

For withdrawals, both platforms prioritize cryptocurrency transfers. You can withdraw your crypto to external wallets from either exchange.

Huobi generally processes withdrawals faster, with most transactions completing within 30 minutes. Bybit may take slightly longer during busy periods.

Fees Structure

| Feature | Huobi | Bybit |

|---|---|---|

| Crypto deposit fees | Free | Free |

| Fiat deposit fees | Varies by method (0.5-3%) | Varies by method (1-3.5%) |

| Withdrawal fees | Coin-dependent | Coin-dependent |

Withdrawal fees on both platforms depend on the cryptocurrency you’re withdrawing. These fees adjust based on network congestion and the specific coin’s value.

Both exchanges implement minimum withdrawal amounts that vary by cryptocurrency. Always check current limits before initiating a withdrawal to avoid issues.

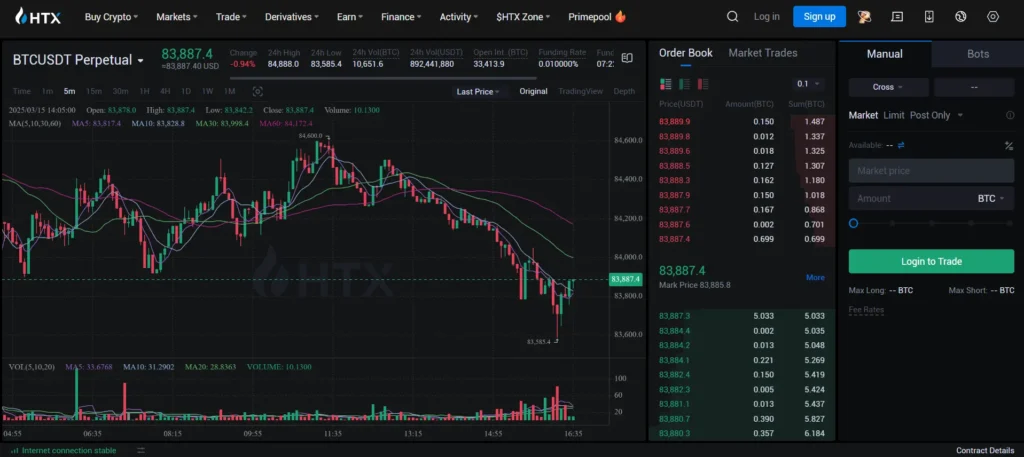

Huobi Vs Bybit: Trading & Platform Experience Comparison

Both Huobi and Bybit offer robust trading platforms, but they have distinct differences that might matter to you as a trader.

Bybit’s interface is often praised for being more user-friendly, making it a good choice if you’re newer to crypto trading. The platform loads quickly and offers a clean, intuitive layout.

Huobi (now also known as HTX) provides a more comprehensive trading experience with more advanced tools, which experienced traders might prefer.

Trading Tools Comparison:

- Bybit: Offers futures trading, spot trading, and copy trading

- Huobi: Provides spot trading, margin trading, futures, and more specialized trading options

When it comes to mobile trading, both exchanges offer functional apps. Bybit’s mobile app maintains the simplicity of its desktop version, while Huobi’s app packs in more features.

Platform Response Times:

| Feature | Bybit | Huobi |

|---|---|---|

| Order Execution | Very Fast | Fast |

| Website Loading | Quick | Standard |

| Chart Tools | Good | Excellent |

Bybit generally has lower trading fees compared to Huobi, which might impact your trading experience if you make frequent trades.

Both platforms offer demo accounts where you can practice trading without risking real money. This is particularly helpful if you want to test their interfaces before committing.

The charting tools on both platforms are comprehensive, though Huobi offers slightly more advanced technical analysis options.

Huobi Vs Bybit: Liquidation Mechanism

When trading with leverage, understanding the liquidation mechanism is crucial. Both Huobi and Bybit have systems in place to protect themselves when your positions move against you.

Bybit typically processes more liquidations than Huobi. According to the search results, Bybit has the highest volume of liquidations among exchanges, while Huobi processed about $290 million worth of Bitcoin futures liquidations during a recent price drop.

Bybit’s Liquidation Process:

- Uses a tiered maintenance margin system

- Implements partial liquidations when possible

- Offers liquidation prevention mechanisms like auto-deleveraging

- Provides more advanced trading tools for managing liquidation risks

Huobi’s Liquidation Process:

- Employs a more traditional liquidation approach

- Has a significant volume of liquidations but less than Bybit

- Offers standard contracts that settle weekly

Both platforms will liquidate your position when your margin falls below the maintenance requirement. However, Bybit offers more advanced tools to help you manage this risk.

You should consider these liquidation differences when choosing between platforms. If you’re an active trader using high leverage, Bybit’s more sophisticated liquidation mechanisms might better suit your needs.

Price volatility affects liquidation risks on both platforms, as evidenced by the recent BTC drop below $40K that triggered massive liquidations on Huobi.

Huobi Vs Bybit: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. It helps safeguard your assets in case of hacks or security breaches.

Bybit offers a dedicated insurance fund that helps protect traders from auto-liquidations during volatile market conditions. This fund has grown steadily over time, providing an additional layer of security for futures traders.

Huobi has less transparent information about its insurance policies. According to search results, there is “no mention of insurance or ownership” in Huobi’s documentation. Their terms include a “Limitation and Exemption of Liability” section that may limit their responsibility in certain situations.

The difference in insurance approaches between these exchanges might affect your trading confidence:

| Exchange | Insurance Information | Transparency |

|---|---|---|

| Bybit | Dedicated insurance fund | High |

| Huobi | Limited information available | Low |

For risk-conscious traders, Bybit’s clearer insurance policies may provide more peace of mind. However, both exchanges implement other security measures like cold storage and two-factor authentication.

Before choosing either platform, you should review their current insurance policies directly on their websites, as these details can change over time.

Huobi Vs Bybit: Customer Support

When choosing between cryptocurrency exchanges, customer support quality can make a significant difference in your trading experience. Both Huobi and Bybit offer multiple support channels to assist users with their issues.

Bybit provides 24/7 customer support through live chat, email, and an extensive help center. Their response times are generally faster, with live chat queries addressed within minutes. Bybit also offers support in multiple languages, making it accessible to a global user base.

Huobi also features 24/7 support with similar channels including live chat and email tickets. Their help center contains detailed guides and FAQs. However, based on user feedback, response times can be slightly longer compared to Bybit.

Both platforms maintain active community forums and social media presence where you can find answers to common questions. Telegram and Discord channels are available for both exchanges where you can connect with other users and support representatives.

For new users, Bybit’s interface appears more intuitive with clear pathways to access support. Huobi’s support system, while comprehensive, may require a few more steps to reach a human agent.

Neither platform offers phone support, which is fairly standard in the cryptocurrency exchange industry. Both provide ticket-based systems to track your support requests.

Your experience may vary based on the complexity of your issue and peak usage times on either platform.

Huobi Vs Bybit: Security Features

When choosing between Huobi and Bybit, security should be a top priority. Both exchanges offer standard protection measures to keep your assets safe.

Huobi has recently strengthened its security systems in response to hacks affecting other crypto exchanges. They’ve added enhanced account verification processes to better protect users.

Huobi’s key security features:

- Two-factor authentication (2FA)

- Enhanced verification requirements

- Additional security measures following industry incidents

Bybit also emphasizes security but has reportedly experienced some losses according to recent reports. Like Huobi, they provide basic protection mechanisms for user accounts.

Bybit’s security features:

- Two-factor authentication

- Statistical filters for cryptocurrency selection

- Account security protocols

Both platforms implement industry-standard security measures, but Huobi appears to be taking more aggressive steps recently to strengthen their protections. This may be important to you if security is your primary concern.

When using either platform, you should always activate all available security options. This includes enabling 2FA, using strong passwords, and being cautious about phishing attempts.

Remember that no exchange is completely immune to security threats. Taking personal security measures is always recommended regardless of which platform you choose.

Is Huobi A Safe & Legal To Use?

Huobi, now known as HTX, has built a solid reputation for security in the cryptocurrency exchange market. According to search results, the platform has earned an AA security rating with an 86% security score, indicating strong safety measures.

One notable point is that Huobi has not experienced major security incidents unlike some other well-known exchanges. This track record helps build trust among users concerned about the safety of their digital assets.

However, when it comes to regulation, both Huobi and Bybit face similar challenges. Neither exchange appears to have regulation in major jurisdictions like France, Spain, UAE, or Singapore based on the provided information.

For U.S. citizens, it’s important to note that Huobi is not available for use in the United States. This means if you’re based in the U.S., you would need to consider alternative exchanges.

Security Features to Consider:

- Strong security infrastructure

- No major reported security breaches

- Two-factor authentication (2FA)

- Cold storage for majority of assets

Legal Considerations:

- Not available for U.S. users

- Limited regulation in major jurisdictions

- Always check current legal status in your country

When choosing any crypto exchange, you should verify its current regulatory status in your jurisdiction as these can change quickly in the evolving crypto landscape.

Is Bybit A Safe & Legal To Use?

Bybit has built a reputation as a secure cryptocurrency exchange. It uses cold storage for most user funds and offers two-factor authentication to protect accounts.

However, Bybit’s legal status varies by country. According to the search results, Bybit is not regulated in France, Spain, UAE, or Singapore.

The Spanish securities regulator (CNMV) has specifically issued warning notices against Bybit. This suggests caution when using the platform in Spain.

Despite lack of formal regulation, Bybit has operated for several years with no major security breaches reported. Many users consider it trustworthy based on its track record.

Security Features:

- Cold storage for majority of assets

- Two-factor authentication

- SSL encryption

- Regular security audits

Legal Considerations:

| Region | Regulatory Status |

|---|---|

| France | Not regulated |

| Spain | Warning issued by CNMV |

| UAE | Not regulated |

| Singapore | Not regulated |

Before using Bybit, you should check if it’s legal in your country. Rules for crypto exchanges change frequently, so verify the current regulations in your location.

Also Read: Are crypto options legal in the US?

Remember that lack of regulation means fewer protections if something goes wrong. Always use strong passwords and enable all security features when trading on any exchange.

Frequently Asked Questions

Traders choosing between Huobi and Bybit often have specific concerns about platform features, costs, and security. These questions address key comparison points to help you make an informed decision for your trading needs.

What are the key differences in trading fees between Huobi and Bybit?

Bybit offers significantly lower fees than Huobi in both spot and futures markets. Bybit’s fee structure is more competitive for active traders, with lower maker and taker fees.

Standard spot trading on Bybit typically costs 0.1% per trade, while Huobi charges slightly higher rates. For futures trading, Bybit’s fee advantage becomes even more apparent.

You can further reduce fees on both platforms through VIP programs and by using their native tokens, though Bybit generally remains the more economical choice.

How do the security measures of Huobi compare with those of Bybit?

Both exchanges implement strong security protocols, including two-factor authentication (2FA) and cold wallet storage for most funds. Huobi has been operating since 2013, giving it a longer security track record than Bybit.

Bybit emphasizes its multi-signature wallet technology and insurance fund for contract trading. Huobi highlights its security team and risk control systems.

You’ll find both platforms take security seriously, though they differ slightly in their approach to user protection and fund security measures.

What variety of cryptocurrencies can traders expect to find on Huobi versus Bybit?

Huobi typically offers a wider selection of cryptocurrencies compared to Bybit. You’ll find hundreds of trading pairs on Huobi, including many smaller altcoins and tokens.

Bybit focuses on a more curated selection of cryptocurrencies but ensures high liquidity for its supported coins. Both platforms regularly add new tokens.

You should check their current listings if you’re looking to trade specific altcoins, as their offerings regularly update.

Which platform, Huobi or Bybit, offers superior customer support and user experience?

Bybit is generally recognized for its more advanced and user-friendly trading platform. The interface is cleaner and more intuitive for active traders.

Huobi offers 24/7 customer support and has a straightforward sign-up process. Both platforms provide multiple language options and educational resources.

You might find Bybit more suitable for technical trading with its advanced charting tools, while Huobi can be more accessible for beginners with its simpler interface options.

How do Huobi and Bybit handle regulations and compliance in different countries?

Both exchanges adjust their services based on local regulations, with certain features restricted in some regions. Huobi has faced more regulatory challenges in recent years, affecting its operations in some countries.

Bybit has worked to become more regulation-compliant, though it has also faced restrictions in certain jurisdictions. Both platforms require KYC verification in most regions.

You should verify availability in your country before signing up, as both exchanges may limit services based on your location.

Can users participate in futures and derivatives trading on both Huobi and Bybit, and if so, how do their offerings compare?

Both platforms offer robust futures and derivatives trading options. Bybit was originally designed as a derivatives exchange and excels in this area with its advanced trading tools and high leverage options.

Huobi provides a comprehensive derivatives marketplace but with slightly higher fees. Bybit offers more competitive leverage rates and more sophisticated order types for futures trading.

You’ll find more advanced trading features on Bybit’s derivatives platform, including conditional orders and better risk management tools, making it preferred by many active futures traders.

Bybit Vs Huobi Conclusion: Why Not Use Both?

Based on our comparison, Bybit comes out ahead with an overall score of 8.0 compared to Huobi’s lower rating. Bybit offers a superior trading platform despite supporting fewer cryptocurrencies.

You might wonder if you should choose just one exchange. The truth is, using both platforms can be advantageous for different reasons.

Why consider using both:

- Diversify your risk: Spreading your assets across multiple exchanges reduces your exposure if one platform faces issues

- Access more trading pairs: Huobi supports more cryptocurrencies, while Bybit excels in derivatives trading

- Compare fees: You can execute trades on whichever platform offers better rates for specific transactions

Remember that neither platform mentions insurance protection for your funds. In fact, Bybit specifically states there is no insurance coverage in section 7.2 of their terms.

If you decide to use both exchanges, keep track of your holdings carefully. Having accounts on multiple platforms requires more attention to security and tax reporting.

For most traders, Bybit’s better trading interface makes it the primary choice. You could use Huobi as a secondary option when you need access to specific cryptocurrencies not available on Bybit.

The best approach is to evaluate your trading needs and risk tolerance before deciding on your exchange strategy.

Compare Huobi and Bybit with other significant exchanges