Navigating the world of cryptocurrency can be daunting, especially when it comes to finding the right platform for trading options. Kraken, a well-established name in the crypto sphere, offers a robust options trading exchange that stands out for its sophisticated features and secure environment. With Kraken, you gain access to a powerful, reliable platform that facilitates trading in multiple digital currencies with ease.

Kraken suits both novice and experienced traders by providing a comprehensive trading experience with an intuitive interface and in-depth resources. The platform prides itself on offering top-notch security measures alongside 24/7 customer support, ensuring that your trading activities are safe and well-supported.

Kraken’s options exchange delivers a compelling choice for anyone looking to explore crypto derivatives trading. You’ll find transparent fee structures and various funding methods tailored to meet the needs of users across the globe. Engaging with Kraken means tapping into a world of possibilities while trading within a trusted environment that prioritizes your success in the ever-evolving crypto market.

What Are Kraken Options?

Kraken Options offer a unique trading platform for those interested in cryptocurrency derivatives. They allow you to speculate on the future price of digital assets, providing opportunities for both hedging and speculative strategies.

Features of Kraken Options:

- Wide Range of Cryptocurrencies: Access various crypto options markets, expanding your trading possibilities beyond standard spot trading.

- Advanced Trading Tools: Utilize sophisticated tools designed to help you make informed decisions.

- Security and Transparency: Benefit from Kraken’s reputation for maintaining high security and transparency standards.

You can use options to hedge against potential losses in your crypto portfolio. By purchasing options, you gain the right, but not the obligation, to buy or sell a specific quantity of cryptocurrency at a predetermined price.

Types of Options:

- Call Options: These give you the right to buy cryptocurrency at a set price. They’re typically used when you anticipate price increases.

- Put Options: These provide the right to sell at a predetermined price. They are useful when expecting a price decline.

Trading options on Kraken can be complex, requiring a good grasp of market movements and risk management. Being well-informed and cautious will enhance your trading experience.

Kraken Options Products Offerings

Kraken provides a compelling suite of options products that cater to diverse trading strategies. At the forefront, you have access to crypto derivatives, which open opportunities for sophisticated financial maneuvers in the digital currency market.

Among the offerings, Kraken allows for margin trading. This feature lets you trade with leverage, amplifying your buying power and potential for profits.

Kraken also boasts advanced security measures. Assets are protected with a self-custody hardware wallet, enhancing safety and giving you full control over your assets. Additionally, 24/7 customer support ensures any concerns or technical issues are promptly addressed, optimizing your trading experience.

Kraken employs Trustly for funding your accounts, especially for U.S. clients. Though relatively limited in options, it provides a streamlined way to connect your bank for transactions to keep your trading smooth and accessible.

Kraken Supported Coins For Options Trading

When exploring options trading on Kraken, you’ll find a comprehensive selection of cryptocurrencies. Kraken is recognized for providing a broad range of digital assets for trading.

Spot Trading Options:

- Offers trading for over 250 different coins, providing a diverse selection for users.

Margin Trading Capabilities:

- Multiple collateral options ensure flexibility, accommodating various trading strategies.

Futures Trading:

- Fees range from 0% to 0.05%, which are competitive for advanced traders seeking futures contracts.

Noteworthy Coins:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

These popular cryptocurrencies are part of Kraken’s robust offerings, appealing to both seasoned and new traders.

Kraken’s strength lies in its ability to support such a wide variety of assets. It enables you to explore different trading avenues without switching platforms. This is beneficial for traders focused on maximizing opportunities across multiple markets.

Kraken’s platform is also known for its commitment to security and reliability, making it a preferred choice among crypto enthusiasts. Access to numerous coins ensures you can tailor your trading strategy to align with your investment goals.

Kraken Options Leverage

When trading options on Kraken, you have the opportunity to utilize leverage to amplify potential returns. Leverage allows you to trade larger position sizes without requiring the full amount of capital upfront.

Key Features:

- Maximum Leverage: On Kraken, you can access leverage of up to 5x for options trading.

- Risk Management: It is crucial to manage your risks effectively when using leverage to prevent potential losses from escalating.

To make informed decisions, you should always evaluate the leverage available on different timeframes. Kraken offers various option types, each with specific conditions, so make sure to understand how leverage applies to each.

Benefits of Using Leverage:

- Greater flexibility and potential for enhanced profits.

- Ability to diversify your trading strategies.

Potential Risks:

- Leverage can lead to significant losses if the market moves against your position.

- Market volatility may amplify the risk when trading with leverage.

To navigate these challenges, always stay informed and utilize the platform’s resources. Kraken provides educational materials and tools to help you comprehend how leverage works and its implications on your options trading strategy.

Always ensure to maintain a disciplined approach and consider your financial capacity when trading with leverage.

Kraken Options Calculator

Kraken Options Calculator is a powerful tool designed to assist you in trading options on the Kraken platform. It provides a convenient way to calculate potential profits, losses, and the overall risk associated with different option strategies. This tool is essential for making informed trading decisions.

With the calculator, you can input specific details such as option type, strike price, expiration date, and current price. By varying these inputs, you can explore different scenarios and their potential outcomes.

Features:

- User-friendly interface

- Real-time data integration

- Strategy comparison capabilities

The crypto options calculator also allows you to visualize potential payoff scenarios using graphs and tables. These visual aids can enhance your comprehension of how various factors impact your options trades.

How to Use:

- Select your option type (call or put).

- Enter the relevant strike price.

- Input the expiration date.

- Insert the current market price.

- Analyze the results shown.

This tool helps you weigh the risks and rewards associated with your trades, ensuring that you have a clear understanding of what to expect before executing any transactions. Its intuitive interface makes it accessible to both beginners and experienced traders.

Kraken Options Types

When exploring Kraken for crypto options trading, you’ll encounter a variety of choices designed to cater to different trading strategies.

Spot Trading: This is trading cryptocurrency for instant delivery on the market. It is a straightforward method and generally suitable for newcomers.

Margin Trading: Kraken allows you to trade on margin, letting you borrow funds to increase the potential size of your position. This feature is beneficial for traders looking to leverage their investments.

Futures Trading: For advanced traders, Kraken provides futures and options contracts. These contracts allow you to buy or sell an asset at a predetermined future date and price. It requires good market insight.

Order Types: You have access to several order types, including market, limit, stop-loss, and take-profit orders. Each type serves distinct strategic needs.

Collateral Options: Kraken supports multiple collateral types for margin trading, giving you flexibility in securing your trades.

Using these various options, you can strategize and tailor your trading activities to fit your goals and risk tolerance.

Kraken Order Types

When trading on Kraken, you have access to a variety of order types to fit your strategy.

Market Orders are the most straightforward. They execute immediately at the current market price. While fast, they may result in slippage during volatile market conditions.

Limit Orders allow you to specify the price you are willing to pay or receive. They provide more control but do not guarantee an immediate fill.

Stop-Loss Orders help manage potential losses by setting a price at which your position will automatically sell. This is useful if the market moves against your position.

Take-Profit Orders are the counterpart to stop-loss. These sell your position when a certain profit level is reached, helping to lock in gains.

Stop-Loss-Limit Orders and Take-Profit-Limit Orders offer more refined control. They combine elements of stop and limit orders, allowing you to set trigger and execution prices for more precise trading.

For those using the Kraken API, remember to specify your ordertype appropriately, whether it’s market, limit, or others. It’s important to understand the implications of each order type so you can choose what aligns with your trading goals.

Kraken Options Data

Kraken’s options exchange provides various data metrics that enhance a trader’s ability to make informed decisions. Pay attention to both volume trends and price fluctuations to optimize your trading strategy.

Volume & Prices

Understanding volume in Kraken’s options exchange is crucial. Volume refers to the number of contracts traded within a specific period and directly impacts market liquidity. Higher volume often indicates increased market interest and can lead to tighter spreads.

Prices of options contracts on Kraken are determined by various factors including underlying asset prices, volatility, time to expiration, and market demand. Monitoring these variables helps you gauge potential price movements. Historical data can further aid in anticipating price trends, influencing decisions. Tracking both volume and prices enables you to refine your trading approach and identify potential opportunities in the options market.

Kraken Liquidation Mechanism

Managing risk is essential in trading, and Kraken employs a robust liquidation mechanism specifically for its leveraged trading options.

When you open a margin position on Kraken, you must maintain a specific margin level. If your margin level falls below the maintenance threshold—often around 40%—Kraken will initiate an automated liquidation process. This is triggered to manage potential losses effectively.

Kraken distinguishes between crossed and isolated margin positions. If your account’s performance in one affects the overall margin level, reaching the respective liquidation threshold can activate liquidation. However, the specific impact varies between position types.

The system closely monitors your Profit and Loss (PnL) and Margin Equity. Even if your position nears liquidation, your equity could remain above the needed maintenance margin. This could prevent forced liquidation unless the margin further declines.

It’s crucial to regularly check your margin and liquidation levels. This proactive approach can help you make informed decisions and potentially prevent forced liquidation.

By understanding Kraken’s liquidation mechanism, you ensure that your account remains compliant with its requirements, protecting your investments while maintaining market engagement.

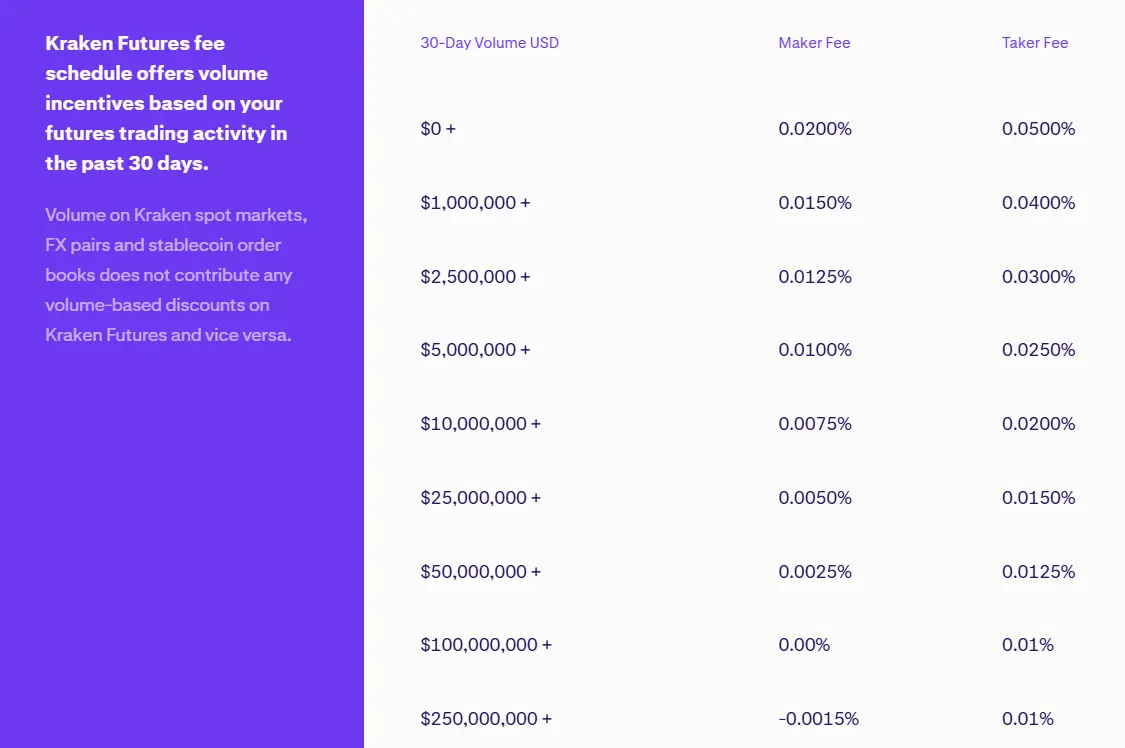

Kraken Options Trading Fees

When you trade options on Kraken, it’s important to know the costs involved. Kraken is praised for its competitive fee structure, which varies based on how you trade and the specific instruments you use.

The fees for options trading on Kraken are structured to encourage high-volume trading. This means the rate decreases as your trade volume increases. It’s tailored to benefit regular traders, offering lower fees as your activity rises.

Key Features:

- Maker Fee: This is applied when you provide liquidity to the market. The fee often starts at a lower percentage.

- Taker Fee: This applies when you take liquidity from the market. It’s generally higher than the maker fee.

Fees are subject to change, so staying updated with Kraken’s fee schedule is crucial. Check Kraken’s official site for any possible updates or changes to the fee structure. Ensuring you stay informed helps you make effective trading decisions and manage your trading costs efficiently.

Kraken Options Funding Rates/Fees

When trading options on Kraken, you need to be aware of the associated fees. These fees can impact your overall trading costs and profits.

Fees Breakdown:

Kraken charges a margin trade fee that ranges between 0.01% and 0.02% of the order value. This fee applies when you open a position.

Additionally, Kraken applies rollover fees every 4 hours at the same rate, 0.01%-0.02%, if you hold your position longer.

Example Fee Chart:

| Order Value | Margin Fee | Rollover Fee (per 4 hours) |

|---|---|---|

| $10,000 | $1 – $2 | $1 – $2 |

| $100,000 | $10 – $20 | $10 – $20 |

This table shows potential fee costs based on your trade size. Remember that fees can accumulate with each rollover period.

Important Considerations:

- These fees are exclusive to options trading and differ from spot or futures markets.

- Always calculate expected costs before entering trades to ensure profitability.

- Monitor your positions to avoid unnecessary rollover fees.

Stay informed of any updates from Kraken, as its fee structure might evolve, directly affecting your trading expenses.

Kraken Account Types & KYC Tiers & Limits

Kraken provides a structured account system to accommodate various trading needs. There are primarily five account tiers, each offering different benefits and limitations. Whether you are a casual trader or a high-volume one, Kraken offers tiers that can fit your requirements.

Account Tiers:

- Starter: Basic functionality with limited features.

- Intermediate: Suitable for most individual traders.

- Pro: Best for experienced traders needing higher limits.

Each tier influences your trading experience by determining the limits for deposits, withdrawals, and the fees applied.

Intermediate and Pro accounts come with higher limits and more customized fee structures compared to Starter accounts. The higher the tier, the lower the fees you pay on transactions.

Verification Levels:

To access different account tiers, you need to adhere to Kraken’s KYC (Know Your Customer) process. This involves submitting identification documents and personal information for validation.

- Intermediate: Requires ID verification and residency proof.

- Pro: Requires additional documentation for higher limits.

These measures protect the platform’s integrity and ensure that all users are genuine.

Limits Overview:

| Tier | Deposit Limits | Withdrawal Limits |

|---|---|---|

| Starter | Lower | Lower |

| Intermediate | Moderate | Moderate |

| Pro | Higher | Higher |

Choosing the correct account type and verification level ensures that your trading activities are seamless and aligned with your needs.

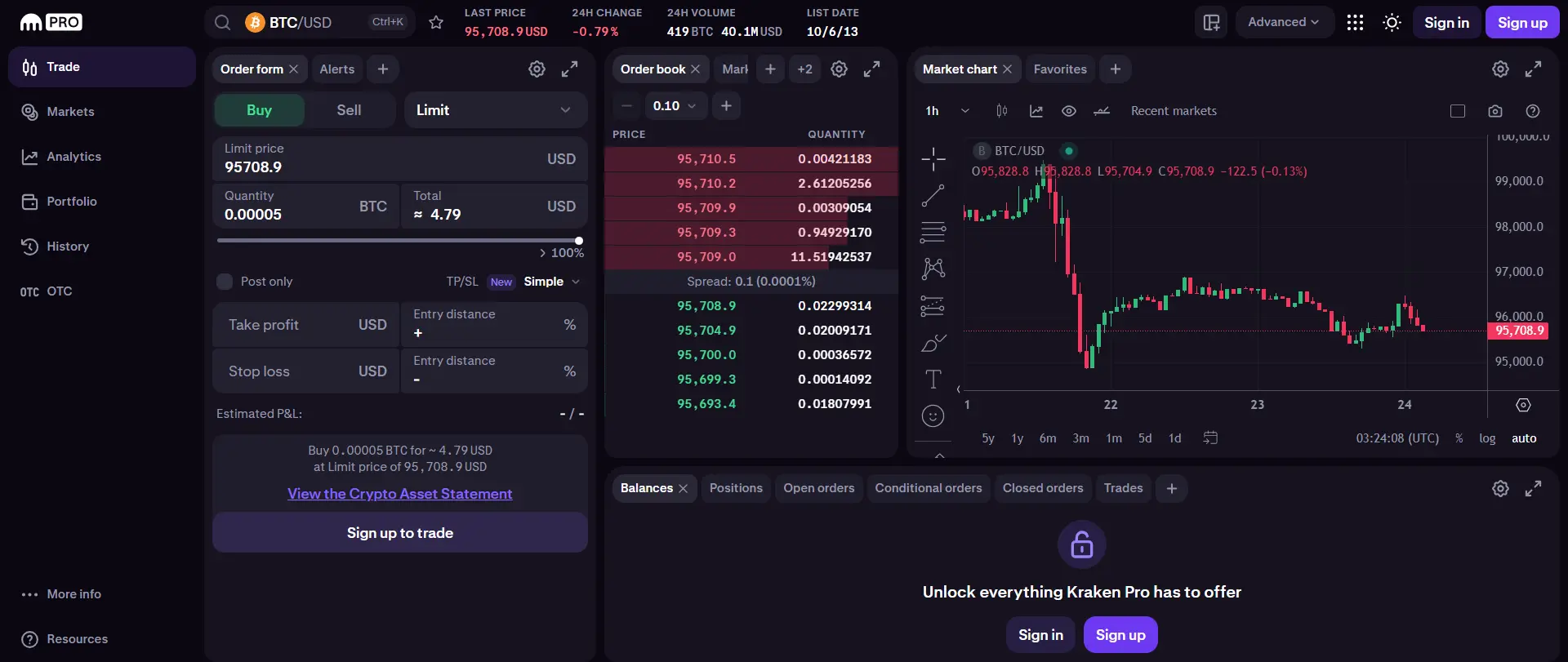

Kraken Trading Platform & Tools

Kraken’s trading platform offers a robust suite of tools tailored for both beginners and experienced traders. You can access Kraken Pro, which delivers advanced features for navigating the cryptocurrency market efficiently.

With Kraken Pro, you can utilize sophisticated order types such as market, limit, stop-loss, and take-profit orders. These tools empower you to implement diverse trading strategies.

To cater to a wide range of traders, the platform supports margin trading with leverage of up to 5X. For eligible users, there’s a borrowing limit of up to $500,000, providing flexibility in trading options.

The user interface may appear complex initially but is designed to allow detailed customization. This permits you to set up your environment according to your trading strategies and preferences.

Available Features:

- Advanced Charting: Analyze markets using technical indicators and drawing tools.

- Order Book View: Observe real-time buying and selling activity.

- Multiple Trading Pairs: Trade various cryptocurrencies and fiat.

For newcomers, Kraken’s intuitive experience on the main platform introduces them gently to the world of crypto trading. As you grow more confident, you can transition smoothly into Kraken Pro.

Kraken also incorporates the Trustly service for U.S. customers, facilitating easy funding of accounts linked to banks. This enhances your ability to manage finances directly through the platform.

With competitive fees and a wide array of features, the tools provided are designed with user convenience in mind, helping you to trade efficiently and effectively.

Kraken Insurance Fund

The Kraken Insurance Fund plays a vital role in providing an extra layer of protection for your trading activities. Established to cover potential losses, it mitigates the impact of market volatility on user accounts.

This fund is strategically maintained with a portion of trading fees and has accumulated over $100 million in assets as of 2025. It serves as a financial cushion in case of extreme market swings, protecting you from potential negative balances and socialized losses.

Kraken utilizes this fund to ensure that your trades are safer and that your investments have an additional security net. For users engaging in high-volume trades or those with significant holdings, this feature can offer peace of mind.

You benefit from Kraken’s focus on security and risk management as the exchange leverages its insurance fund to foster a stable and secure trading environment.

Engaging with Kraken means participating in an ecosystem designed to shield you against certain types of unexpected financial drawbacks, making it a noteworthy platform in the crypto exchange space.

Kraken Deposit Methods

Kraken offers a variety of flexible deposit methods to fund your account efficiently. You can choose between fiat currencies, cryptocurrencies, and traditional bank transfers.

For fiat deposits, bank transfers are widely used, supporting major currencies such as USD, EUR, and CAD. These transfers are usually processed within 1-5 business days.

When depositing cryptocurrencies, you need to send your assets to your unique Kraken wallet address. This method is quick and generally free of charge, allowing you to start trading swiftly.

Most fiat deposits come with either low or no fees. Specific fee structures may vary depending on the chosen method and currency. Always ensure you reference Kraken’s updated fee schedule before proceeding with a deposit.

Kraken requires a unique reference number or specific wallet address for all deposits. This ensures your funds are accurately credited to your account.

Minimum deposit amounts for fiat are generally low, often starting around $1, though this may vary based on the deposit method and currency.

To avoid delays, always double-check your deposit details and follow Kraken’s guidelines. Accurate information ensures smooth transactions.

Kraken Security Features

Kraken is known for its robust security measures designed to protect your funds and personal data. The platform implements multiple layers of protection.

Two-Factor Authentication (2FA): This essential feature adds an extra layer of security to your account. By requiring a second form of identification, 2FA minimizes the risk of unauthorized access.

Global Settings Lock: To safeguard account settings, Kraken provides a global settings lock. This option prevents any unauthorized changes to your account configurations.

Kraken also supports FIDO2 devices, offering an additional level of security. These devices ensure that only you can access your account, even in the event your password is compromised.

Data Encryption is a key aspect of Kraken’s security measures. Sensitive client information is encrypted and kept offline, away from potential cyber threats.

The platform provides advanced control over withdrawal limits and settings to help protect against unauthorized transactions. You can set limits and approve withdrawals only when needed, ensuring your assets remain secure.

PGP Email Encryption secures email communications between you and Kraken, protecting sensitive information exchanged via email.

Master Key: Another layer of protection is the master key, which can be used to lock down your account or reset security features if required.

Kraken prioritizes security with comprehensive measures aimed at keeping your assets and personal information safe from potential threats.

Kraken Customer Support

When it comes to customer support, Kraken provides a wide range of options to assist you effectively. They offer 24/7 support, ensuring that help is available whenever you need it.

You have access to live chat and email support, which can be used to address various concerns promptly. For users who frequently trade, Kraken offers a personal account representative to enhance the support experience.

Reviews of Kraken’s customer service have been varied. Some reports highlight its responsiveness and effectiveness, making Kraken a reliable choice for support.

An independent review conducted in 2021 awarded Kraken with the “Best Crypto Customer Support” based on its comprehensive service offerings.

For those who prefer self-service options, Kraken’s website is equipped with an extensive help center that covers numerous topics and frequently asked questions (FAQs), assisting you in resolving issues independently.

Is Kraken A Legal & Safe Platform?

Kraken operates as a registered financial services provider and is in compliance with regulatory requirements in several countries. In the United States, it was the first crypto exchange to receive the Special Purpose Depository Institution (SPDI) charter in 2020. This designation emphasizes its strong adherence to regulatory standards.

Security is a cornerstone of Kraken’s operations. The platform employs advanced encryption, cold storage for a majority of digital assets, and regular security audits. These measures aim to ensure the safety of users’ funds and personal data.

Kraken provides features like two-factor authentication (2FA) and Global Settings Lock. These options enhance the security of your account and reduce the risk of unauthorized access.

Additionally, Kraken’s transparency in security practices is admirable. The exchange lists its security measures publicly, giving users clarity on how their assets are protected.

Frequently Asked Questions

When exploring options trading on Kraken, it’s essential to understand the offerings, requirements, and limitations. This section addresses common queries about Kraken’s options trading platform, providing clarity on what to expect.

Does Kraken support options?

Yes, Kraken supports options trading. The platform offers a variety of options contracts, allowing you to engage in more strategic trading decisions by speculating on future price movements of various cryptocurrencies.

What is the minimum amount required to trade options on Kraken?

You must meet a minimum funding requirement for options trading, which varies depending on the specific cryptocurrency. Keeping updated with Kraken’s policies ensures you have the necessary balance before initiating trades.

What are the specifications of Kraken options trading contracts?

Kraken’s options trading contracts have specific characteristics, including expiry dates, contract sizes, and premium prices. Each contract is uniquely designed to cater to various trading strategies, so reviewing these specifications is essential before engaging in trades.

What trading pairs are available for Kraken options?

Kraken provides a variety of trading pairs for options, primarily involving popular cryptocurrencies like Bitcoin and Ethereum. The exact pairs may change, so it’s vital to consult Kraken’s platform to see current offerings.

What are the limitations for US citizens trading options on Kraken?

US citizens face specific regulatory restrictions when trading options on Kraken. Due to local regulations, some features and trading pairs might not be accessible. It’s recommended to verify these restrictions based on your jurisdiction.

What is the minimum amount required to trade options on Kraken?

The minimum amount necessary depends on the options contract involved. Kraken may require a specific balance to engage in trading, ensuring you meet the necessary criteria set by the platform before placing trades.

Conclusion

When considering Kraken as an options exchange, it’s crucial to recognize its strengths and limitations. Kraken is known for robust security protocols and comprehensive services, providing a wide range of trading capabilities.

You will find competitive fees, especially in spot and futures trading. However, there might be some complexity in fee structures for Instant Buy options, affecting transparency.

Kraken’s support for over 240 cryptocurrencies offers substantial diversification potential. This includes popular coins, giving you a broad spectrum of choices for trading.

For those interested in advanced features, Kraken offers margin and futures trading. This caters to both casual investors and experienced traders, enhancing trading versatility.

Customer support is available 24/7, reflecting Kraken’s commitment to user experience. You can expect prompt assistance, adding confidence in your trading activities.

Incorporating Kraken into your trading strategy presents numerous opportunities. Considering these aspects will help you decide if it aligns with your specific needs and goals.

Want more options? Check out these crypto exchanges: