Choosing between Kraken and MEXC for your crypto trading needs can be a tough decision. Both exchanges offer various features to help you buy, sell, and trade digital assets, but they differ in important ways.

Kraken tends to have stronger security measures and physical protections for your investments, while MEXC offers competitive trading fees of 0.2% per trade. Each platform has its own set of supported cryptocurrencies, fee structures, and trading options that might make one better suited for your specific needs.

You should consider factors like available deposit methods, the range of supported cryptocurrencies, and the types of trading available on each platform. While Kraken might appeal to those prioritizing security, MEXC could be a better choice if you’re looking for a wider variety of trading pairs or competitive fee structures.

Kraken Vs MEXC: At A Glance Comparison

When choosing between Kraken and MEXC exchanges, understanding their key differences can help you make the right choice for your trading needs.

Kraken stands out with its strong security measures. Based on search results, many traders consider it one of the most secure options available in the market today.

MEXC offers competitive features that make it popular among crypto traders looking for variety. The platform has gained recognition for its extensive offering of trading options.

Here’s a quick comparison of both platforms:

| Feature | Kraken | MEXC |

|---|---|---|

| Security | Advanced security features | Standard security measures |

| User Interface | Clean, professional | Feature-rich interface |

| Fees | Moderate trading fees | Competitive fee structure |

| Coin Selection | Established cryptocurrencies | Wide range including newer tokens |

| Regulatory Compliance | Strong focus on compliance | Varies by region |

Both exchanges serve different types of traders. You might prefer Kraken if security is your top priority and you want a more established platform.

MEXC could be better for you if you’re looking for access to a wider range of cryptocurrencies, including newer and less established tokens.

Consider your trading volume, security needs, and which cryptocurrencies you want to trade when making your decision between these two platforms.

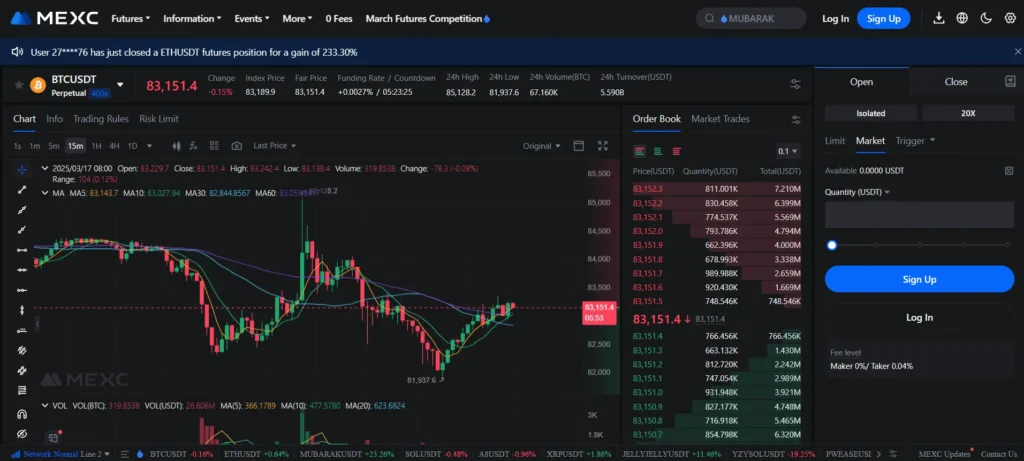

Kraken Vs MEXC: Trading Markets, Products & Leverage Offered

Kraken and MEXC both offer a variety of trading markets, but there are notable differences in what you can access on each platform.

Kraken provides a more conservative selection with approximately 200+ cryptocurrencies available for trading. You’ll find major coins like Bitcoin and Ethereum, along with a solid range of altcoins.

MEXC offers a much wider selection with over 1,500 cryptocurrencies, including many smaller and newer tokens that aren’t available on Kraken. This makes MEXC more appealing if you’re looking to trade emerging cryptos.

Available Products Comparison:

| Feature | Kraken | MEXC |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Options | Limited | ✓ |

| Copy Trading | Limited | ✓ |

| Staking | ✓ | ✓ |

When it comes to leverage, MEXC offers higher options with up to 200x leverage on some futures contracts. Kraken is more conservative, typically offering up to 5x leverage for margin trading.

For derivatives traders, MEXC provides more expansive options with various contract types and settlement currencies. The platform is particularly strong for those interested in trading with higher risk tolerance.

Kraken focuses more on security and regulatory compliance, which limits some of its offerings but may provide you with more peace of mind for your trading activities.

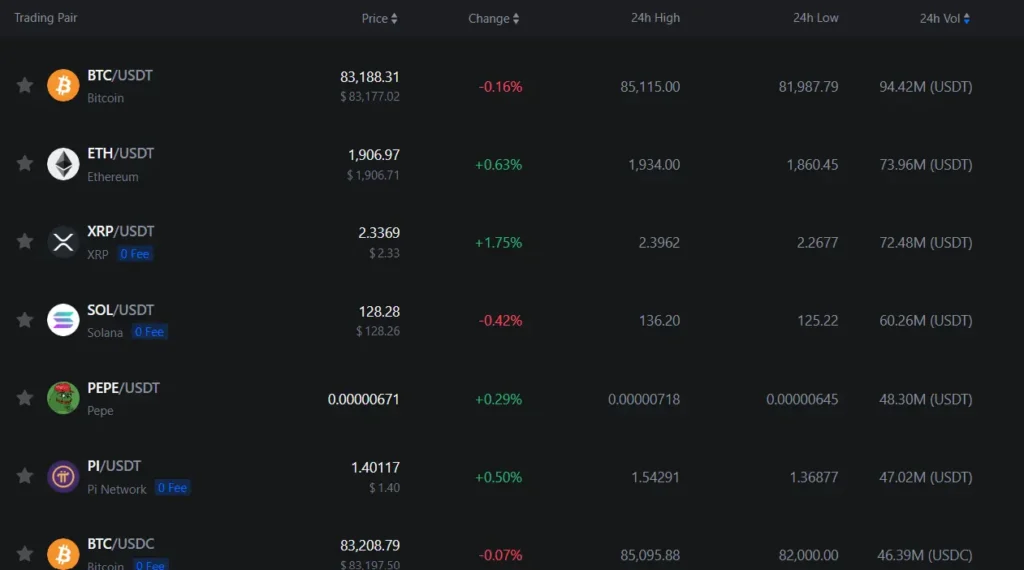

Kraken Vs MEXC: Supported Cryptocurrencies

Kraken offers a solid selection of over 60 cryptocurrencies for trading. This includes major coins like Bitcoin and Ethereum, as well as a range of altcoins and tokens.

MEXC provides a much larger variety with support for hundreds of cryptocurrencies. You’ll find many smaller, newer tokens on MEXC that aren’t available on Kraken.

When choosing between these exchanges, consider which specific coins you want to trade.

Kraken Cryptocurrency Highlights:

- Strong focus on established cryptocurrencies

- Approximately 60+ supported coins

- Rigorous vetting process for listed assets

- Better for traders focused on major market coins

MEXC Cryptocurrency Highlights:

- Wider selection with hundreds of cryptocurrencies

- Early access to many new tokens

- More trading pairs available

- Better for those seeking exposure to emerging projects

If you primarily trade popular cryptocurrencies, either platform will meet your needs. However, if you’re looking to invest in newer or more obscure tokens, MEXC likely offers what you’re seeking.

Remember that a larger selection doesn’t always mean better quality. Kraken’s more selective approach means the coins they list have typically undergone more thorough assessment.

The right choice depends on your trading strategy and which specific cryptocurrencies you want to access.

Kraken Vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Kraken and MEXC, fees play a big role in choosing the right exchange for your crypto trading needs.

MEXC generally offers lower trading fees than Kraken. For spot trading, MEXC charges 0.050% for both makers and takers, while you can get an additional 20% discount when using MX tokens to pay fees.

For futures trading, MEXC charges 0.02% for makers and 0.03% for takers. Kraken’s futures fees are slightly higher at 0.02% for makers and 0.05% for takers.

Deposit & Withdrawal Comparison:

| Fee Type | MEXC | Kraken |

|---|---|---|

| Deposit fee | No | No |

| BTC withdrawal fee | 0.0003 BTC | 0.0005 BTC |

Both exchanges don’t charge deposit fees, which is good news for you. However, MEXC has a lower Bitcoin withdrawal fee at 0.0003 BTC compared to Kraken’s 0.0005 BTC.

MEXC is often cited as one of the best low-fee crypto exchanges in 2025. Some reports even mention they offer 0% fees for makers in spot trading, though their standard rate is 0.050%.

You can reduce your trading costs on both platforms through various loyalty programs and by holding their native tokens.

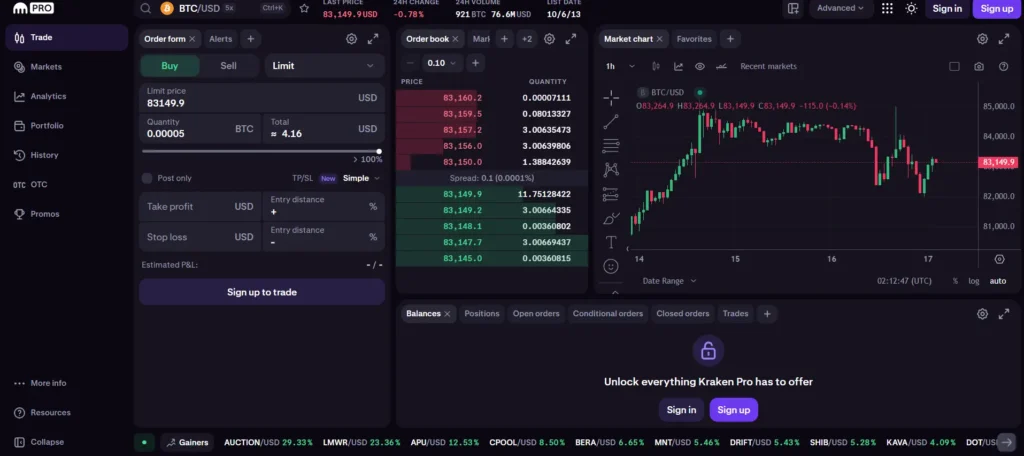

Kraken Vs MEXC: Order Types

Kraken and MEXC offer various order types to help you manage your cryptocurrency trades effectively. Understanding these options can make a big difference in your trading experience.

Kraken provides a solid range of order options. You can use basic market and limit orders for quick trades. Kraken Pro users have access to more advanced options like Take Profit/Stop Loss (bracket) orders and standard stop loss orders.

MEXC also offers the essential market and limit orders that most traders need. Their platform includes additional order types to help you manage risk and execute more complex trading strategies.

Kraken’s Key Order Types:

- Market orders

- Limit orders

- Stop loss orders

- Take Profit/Stop Loss (bracket) orders

Kraken’s advanced charting tools work well with these order types to give you better control over your trades. The platform is known for its strong security features, which add an extra layer of protection for your orders.

MEXC provides comparable order functionality, though some traders find Kraken’s interface more intuitive for setting up complex orders. Both platforms allow you to set specific prices for limit orders.

When choosing between these exchanges, consider which order types you’ll use most often. If you need specialized order types for day trading, check if your preferred options are available on both platforms.

Kraken Vs MEXC: KYC Requirements & KYC Limits

Kraken and MEXC have different approaches to Know Your Customer (KYC) requirements, which directly impact how you can use these exchanges.

Kraken strictly enforces KYC verification for all users. You must complete identity verification before trading on their platform. This compliance with regulations means verified Kraken accounts have a daily limit of $100,000.

MEXC offers more flexibility with KYC requirements. You can trade on MEXC without completing KYC verification, making it appealing if you value privacy.

However, MEXC’s non-KYC status comes with limitations. Non-verified users face a combined deposit and withdrawal cap of 1,000 USDT, depending on your country of residence.

MEXC KYC Tiers:

- Unverified: 10-30 BTC daily withdrawal limit

- Verified: Higher limits and access to more features

It’s important to note that MEXC has been known to enforce KYC selectively. Some users report that while MEXC advertises as “no KYC,” they may require verification when it suits them, especially during withdrawals.

Key Differences:

- Kraken: Mandatory KYC for all users, higher limits after verification

- MEXC: Optional KYC with basic functionality available without verification

- Kraken: Consistent policy enforcement

- MEXC: Potentially inconsistent application of KYC requirements

Your preference will depend on how much you value privacy versus security and consistent policy enforcement.

Kraken Vs MEXC: Deposits & Withdrawal Options

When choosing between Kraken and MEXC exchanges, deposit and withdrawal options are key factors to consider.

Kraken offers free crypto deposits and no fees for most fiat deposits. You can deposit USD through ACH transfers or EUR via SEPA without extra costs. This makes Kraken appealing for users who regularly move money in and out of the platform.

MEXC also provides various deposit options, though specific fee structures may differ. Based on current information, MEXC’s deposit fees appear competitive compared to other exchanges.

For withdrawals, both exchanges charge varying fees depending on the cryptocurrency. The exact amounts change based on network congestion and the specific asset you’re withdrawing.

Payment Methods Comparison:

| Method | Kraken | MEXC |

|---|---|---|

| Crypto Deposits | Free | Free for most coins |

| Bank Transfer | Supported (ACH, SEPA) | Supported |

| Credit/Debit Cards | Available (with fees) | Available (with fees) |

| Wire Transfers | Available | Limited availability |

Processing times also differ between the two exchanges. Kraken is known for reliable processing times, while MEXC’s speeds are generally competitive.

Security is another important aspect. Kraken offers advanced security features for your deposits and withdrawals, which many users consider a significant advantage.

Before making large transfers on either platform, you should verify current fees and limits, as these can change over time.

Kraken Vs MEXC: Trading & Platform Experience Comparison

Kraken and MEXC offer different trading experiences that might affect your decision when choosing between them.

User Interface

- Kraken provides a clean, professional interface suitable for beginners and experienced traders

- MEXC features a more complex dashboard with more data points visible at once

- Both platforms offer mobile apps, but Kraken’s app is generally rated better for stability

Trading Options

| Feature | Kraken | MEXC |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Limited | Extensive |

| Trading Pairs | 200+ | 1,500+ |

| Staking Options | Multiple | Limited |

MEXC stands out with its wider selection of altcoins and trading pairs. You’ll find many new and emerging cryptocurrencies here before they reach other exchanges.

Kraken excels in reliability and performance during high market volatility. Your trades are less likely to face delays or execution issues during busy periods.

The trading fees differ significantly between platforms. Kraken typically charges higher fees but offers institutional-grade security. MEXC attracts traders with lower fees and frequent promotions.

Advanced trading tools are available on both platforms. Kraken provides better educational resources for newcomers, while MEXC offers more complex trading products for experienced users.

Order execution speed is generally faster on Kraken, which can be crucial if you’re an active day trader looking for quick entries and exits.

Kraken Vs MEXC: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management strategy. Both Kraken and MEXC have systems in place to protect themselves when your position approaches a loss threshold.

Kraken uses a progressive liquidation process. Your position isn’t immediately closed completely when it reaches the liquidation price. Instead, Kraken gradually reduces your position size to bring your margin level back to acceptable limits.

MEXC employs a more standard liquidation approach. When your margin ratio falls below the maintenance margin requirement, the system will automatically liquidate your position. This happens all at once rather than progressively.

Liquidation Thresholds Comparison:

| Exchange | Initial Margin | Maintenance Margin | Liquidation Process |

|---|---|---|---|

| Kraken | 10-50% depending on pair | 3-40% depending on pair | Progressive |

| MEXC | 1-50% depending on product | 0.5-40% depending on product | Complete at threshold |

Both exchanges send notifications as your position approaches liquidation levels. MEXC offers a slightly higher leverage ratio on some pairs, which can increase your liquidation risk.

Kraken’s progressive liquidation might help you avoid complete position closure in some market conditions. This can be beneficial during short-term price spikes or dips.

You should always use stop-loss orders on both platforms to manage risk proactively rather than relying on the exchange’s liquidation mechanism.

Kraken Vs MEXC: Insurance

When choosing a cryptocurrency exchange, insurance protection is a key factor to consider. This protection can safeguard your assets if the exchange faces security breaches or insolvency.

Kraken provides significant insurance coverage for users. They maintain a crime insurance policy that covers digital assets held in their custody, both in hot and cold storage systems. This coverage helps protect you against theft and certain types of security breaches.

MEXC’s insurance approach differs somewhat. They maintain a User Protection Fund designed to compensate users in case of security incidents. However, their insurance coverage is generally considered less comprehensive than Kraken’s.

Here’s a quick comparison of insurance features:

| Feature | Kraken | MEXC |

|---|---|---|

| Insurance Type | Crime insurance policy | User Protection Fund |

| Coverage Scope | Digital assets in hot/cold storage | Limited to specific security incidents |

| Transparency | Detailed information available | Less detailed information published |

| Third-party Audits | Regular audits conducted | Limited information on audits |

You should note that neither exchange offers complete protection against all types of losses. Market volatility and personal account security breaches typically fall outside insurance coverage.

For maximum security, consider using hardware wallets for long-term storage of significant cryptocurrency holdings, regardless of which exchange you choose.

Kraken Vs MEXC: Customer Support

When choosing between Kraken and MEXC exchanges, customer support quality can make a big difference in your trading experience.

Kraken offers 24/7 customer support through multiple channels. You can reach their team via live chat and email at any time. Many users praise Kraken’s support for being responsive and helpful.

MEXC also provides customer support services, though specific details about their availability aren’t as widely documented in the search results.

Response Time Comparison:

| Exchange | Average Response Time | Support Channels |

|---|---|---|

| Kraken | Fast (usually minutes to hours) | Live chat, Email |

| MEXC | Varies | Not clearly specified in results |

User satisfaction with Kraken’s support appears to be high. The search results mention that Kraken’s interface is “beautiful and intuitive,” which may reduce the need for customer support in the first place.

When trading cryptocurrencies, quick access to help during urgent situations can be crucial. You should consider how important responsive customer support is to your trading style before making your choice.

Remember that support quality can change over time, so checking recent reviews may give you the most accurate picture of current service levels.

Kraken Vs MEXC: Security Features

When choosing a crypto exchange, security should be your top priority. Both Kraken and MEXC offer security features, but they differ in several ways.

Kraken is widely recognized for its strong security standards. It uses advanced security features that many competitors lack. The platform has maintained a solid security track record since its founding.

Some of Kraken’s key security features include:

- Two-factor authentication (2FA)

- Email verification for withdrawals

- Global Settings Lock for account changes

- PGP email encryption

- Air-gapped cold storage for most funds

MEXC also offers security protections, though less information is publicly available about their specific measures. Their security features include:

- Two-factor authentication

- Anti-phishing code protection

- Regular security audits

Kraken has never experienced a major security breach, which speaks to its robust security protocols. This clean record gives many users peace of mind when trading on the platform.

When comparing the two exchanges, Kraken appears to have more comprehensive security measures in place. Its longer history in the market has allowed it to develop and refine its security infrastructure.

Also Read: How to hedge against crypto volatility using options?

Your trading needs and risk tolerance should guide your decision between these platforms. If security is your highest concern, Kraken’s established security reputation may better meet your needs.

Is Kraken A Safe & Legal To Use?

Kraken stands out as one of the most secure cryptocurrency exchanges available today. The platform has maintained a strong security record and has never been hacked since its founding, which is impressive in the crypto world.

Kraken implements advanced security features that many competitors lack. These include:

- Two-factor authentication (2FA)

- SSL encryption

- Cold storage for the majority of assets

- 24/7 security monitoring

For legal compliance, Kraken operates as a fully regulated exchange in multiple jurisdictions. It follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, requiring personal information verification before allowing full account access.

While Kraken prioritizes privacy with encryption and secure data handling, it still collects personal information for regulatory compliance. This balance between security and regulatory requirements is why many consider it trustworthy.

Kraken’s fees may be higher than some competitors like MEXC, but this reflects its investment in security infrastructure and regulatory compliance. Many users find this trade-off worthwhile for peace of mind.

You can legally use Kraken in most countries, though availability of specific features may vary based on your location due to local regulations. Always check Kraken’s terms for your specific country before signing up.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has built a reputation for security. The exchange has never been hacked or lost user funds, which is impressive in the cryptocurrency industry.

In 2025, MEXC is considered both safe and legitimate for buying and selling cryptocurrency. They implement various security measures to protect user assets and information.

One significant change to note is that while MEXC previously allowed users to trade without KYC (Know Your Customer) verification, as of 2024, KYC became mandatory. This change actually improves the platform’s regulatory compliance.

MEXC is available in most countries, even in regions with strict cryptocurrency regulations. However, you should always check if it’s permitted in your specific location before signing up.

When comparing security features with other exchanges like Kraken, MEXC offers standard protections, though Kraken is often cited as having more advanced security features.

Key security features of MEXC include:

- Multi-factor authentication

- Cold storage for majority of assets

- Regular security audits

- Anti-phishing measures

You should always use strong passwords and enable all available security features when using any cryptocurrency exchange, including MEXC.

Frequently Asked Questions

Traders often have specific questions when comparing crypto exchanges like Kraken and MEXC. These common concerns focus on fees, security, user experiences, and trading limitations that directly impact your trading decisions.

What are the differences in trading fees between Kraken and MEXC?

MEXC generally offers lower trading fees than Kraken. According to recent comparisons, MEXC rates are more favorable for beginners and casual traders.

Most MEXC spot trading fees range from 0.1% to 0.2%, while Kraken’s fees typically start at 0.16% and can go higher. This difference can result in significant savings when trading frequently.

Some users report getting 5-10% more coins for the same price on MEXC compared to other exchanges like Kraken.

Which platform offers better security features, Kraken or MEXC?

Kraken has built a strong reputation for security in the crypto industry. The exchange has never experienced a major hack and offers features like two-factor authentication, email confirmation, and whitelisting.

MEXC provides similar security features but has a shorter track record. Both exchanges use cold storage for most user funds.

You should enable all available security options regardless of which platform you choose.

How do user experiences on Kraken compare to those on MEXC, according to online forums like Reddit?

Reddit users often praise Kraken for its reliability and transparent practices. Many consider it one of the more trustworthy exchanges, especially for beginners.

MEXC receives positive feedback for its wider selection of coins and lower fees. Some Reddit users specifically mention moving coins to personal wallets after purchasing on MEXC.

Customer support experiences vary on both platforms, though MEXC offers 24/7 support through multiple channels including live chat.

Are U.S. traders permitted to engage in transactions on MEXC, and under what conditions?

U.S. traders face significant restrictions on MEXC. The exchange does not officially serve U.S. customers and may limit or block accounts identified as U.S.-based.

Kraken fully supports U.S. traders with proper licensing and regulatory compliance in most states. This makes Kraken a more straightforward option if you’re based in the United States.

Always check current regulations as crypto exchange policies can change quickly.

What potential disadvantages should users be aware of when using Kraken for cryptocurrency trading?

Kraken’s higher fees can reduce profitability, especially for high-volume traders. These fees may be 5-10% higher than competitors like MEXC.

The coin selection on Kraken is more limited compared to MEXC. You might not find newer or more obscure altcoins.

Some users report that Kraken’s interface is less intuitive for beginners, with more complex trading options that can overwhelm new traders.

How do the liquidity and volume metrics compare between Kraken and MEXC for the average trader?

Kraken typically offers better liquidity for major cryptocurrencies like Bitcoin and Ethereum. This means lower slippage and more stable prices when executing larger trades.

MEXC shows stronger liquidity for smaller altcoins and new token listings. If you trade lesser-known cryptocurrencies, you might find better execution on MEXC.

Daily trading volumes fluctuate, but Kraken generally maintains higher overall volume while MEXC may have better volume for specific altcoin pairs.

MEXC Vs Kraken Conclusion: Why Not Use Both?

Both MEXC and Kraken offer unique advantages that can benefit different types of crypto traders. Kraken stands out for its strong security features and reliability, making it a solid choice for those who prioritize safety.

MEXC, on the other hand, offers highly competitive fees and is known for its fast listing of new tokens. This makes it appealing if you’re interested in emerging cryptocurrencies before they hit larger exchanges.

You don’t have to choose just one platform. Many experienced traders use multiple exchanges to take advantage of different strengths. For example, you might use Kraken for your core holdings and long-term investments where security is paramount.

Meanwhile, MEXC could be your go-to for trading newer tokens or taking advantage of their lower fee structure for certain transactions.

Be aware that MEXC has received some criticism regarding withdrawal issues and customer support. Kraken generally has a stronger reputation in these areas.

Your trading needs and priorities should guide your decision. If you’re new to crypto, Kraken’s security focus might give you more peace of mind. If you’re hunting for the next big token or need the lowest possible fees, MEXC offers those advantages.

Consider starting with the exchange that best matches your immediate needs, then expanding to the other as you become more comfortable with cryptocurrency trading.

Compare Kraken and MEXC with other significant exchanges