Choosing the right cryptocurrency exchange can make a big difference in your trading experience. When comparing Kraken and WhiteBIT in 2025, you’ll find unique features and key differences that may impact your decision. Both platforms offer crypto trading services, but they differ in fees, available cryptocurrencies, deposit methods, and user experience.

These exchanges have developed distinct reputations in the crypto market. Kraken, established earlier, is known for its security features and regulatory compliance. WhiteBIT has gained popularity with its lending product and competitive fee structure. Your trading style, location, and cryptocurrency preferences will help determine which platform better suits your needs.

Understanding how these exchanges compare can help you make a smarter choice for your crypto investments. This comparison will break down the essential differences between Kraken and WhiteBIT to help you decide which platform aligns with your trading goals in 2025.

Kraken Vs WhiteBIT: At A Glance Comparison

Kraken and WhiteBIT are popular cryptocurrency exchanges with distinct features. Let’s compare their key differences to help you decide which platform might better suit your needs.

Available Cryptocurrencies:

- Kraken: Offers a solid selection of cryptocurrencies

- WhiteBIT: Provides access to 325+ cryptocurrencies, giving you more trading options

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Kraken | Moderate | Varies by cryptocurrency |

| WhiteBIT | Low | Varies by cryptocurrency |

WhiteBIT generally offers lower fees compared to Kraken, which could save you money on frequent trades.

- Security Features: Both exchanges prioritize security, but implement different measures. Kraken has built a strong reputation for security over its longer history in the market.

- User Experience: Kraken provides a more established platform with a user interface that caters to both beginners and experienced traders. WhiteBIT offers a clean interface that many users find intuitive, though it might not have all the advanced features that Kraken provides.

- Deposit Methods: You’ll find various deposit options on both platforms, though availability may depend on your location and the specific cryptocurrencies you want to trade.

- Trading Types: Both exchanges support spot trading, but differ in their advanced trading options and features.

When choosing between these exchanges, consider your trading volume, preferred cryptocurrencies, and the importance of fee structure to your strategy.

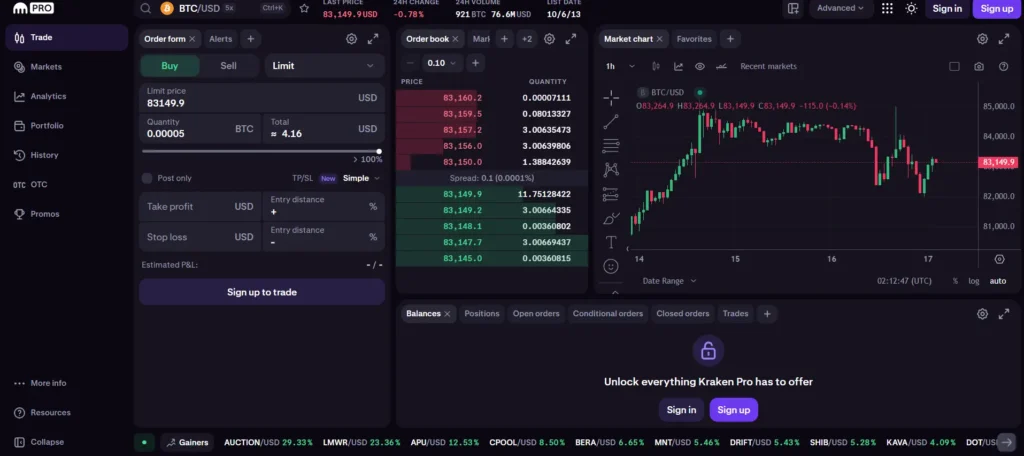

Kraken Vs WhiteBIT: Trading Markets, Products & Leverage Offered

Kraken and WhiteBIT offer different trading options for crypto investors. Let’s look at what each platform provides.

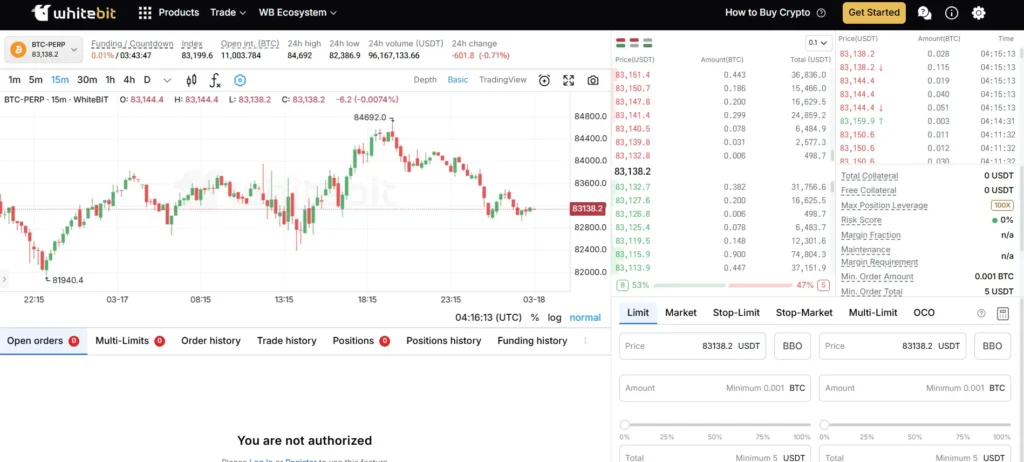

WhiteBIT supports over 300 crypto assets for derivatives trading. The exchange stands out by offering up to 100x leverage for traders who want to amplify their positions. This high leverage option attracts experienced traders looking to maximize potential returns.

Kraken provides a more conservative approach to leverage trading. While it offers fewer assets for margin trading, Kraken is known for its stability and regulatory compliance.

Both exchanges support spot trading for popular cryptocurrencies. You’ll find Bitcoin, Ethereum, and other major coins on both platforms.

Trading Products Comparison:

| Feature | WhiteBIT | Kraken |

|---|---|---|

| Cryptocurrencies | 300+ | 150+ |

| Max Leverage | 100x | 5x |

| Futures Trading | Yes | Yes |

| Spot Trading | Yes | Yes |

| Margin Trading | Yes | Yes |

WhiteBIT might appeal more to aggressive traders seeking high leverage options and a wider variety of altcoins.

Kraken tends to attract traders who prioritize security and regulatory clarity over extreme leverage options.

You should consider your risk tolerance when choosing between these platforms. Higher leverage like WhiteBIT’s 100x option can amplify both profits and losses significantly.

Kraken Vs WhiteBIT: Supported Cryptocurrencies

When choosing between Kraken and WhiteBIT, the variety of cryptocurrencies available for trading is a key factor to consider. Both exchanges offer a wide selection, but there are notable differences.

Kraken supports over 200 cryptocurrencies as of March 2025. You can trade major coins like Bitcoin, Ethereum, and Solana, as well as many altcoins and tokens. Kraken is particularly known for its careful vetting process before adding new coins.

WhiteBIT, on the other hand, offers access to more than 450 cryptocurrencies. This larger selection includes many smaller, emerging projects that you might not find on Kraken.

Popular cryptocurrencies available on both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Solana (SOL)

- Ripple (XRP)

WhiteBIT tends to list new tokens faster than Kraken. If you’re interested in trading newly launched projects, WhiteBIT might be more suitable for your needs.

Kraken focuses on quality over quantity, which means more thorough security checks for listed assets. This approach might give you more confidence when trading on their platform.

Also Read: What is crypto options ETF?

Both exchanges regularly update their offerings based on market demand and regulatory considerations. You should check their current listings if you’re looking for specific cryptocurrencies that might not be widely available.

Kraken Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Kraken and WhiteBIT, understanding their fee structures can help you make a better decision for your trading needs.

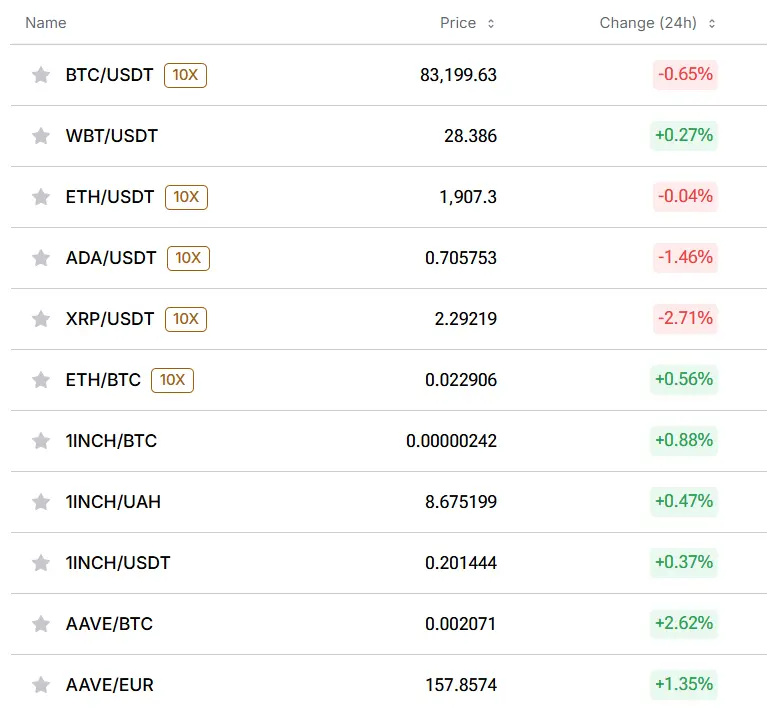

WhiteBIT offers a competitive flat trading fee of 0.1% for both maker and taker orders on spot trading. This rate is quite attractive compared to many other cryptocurrency exchanges in the market.

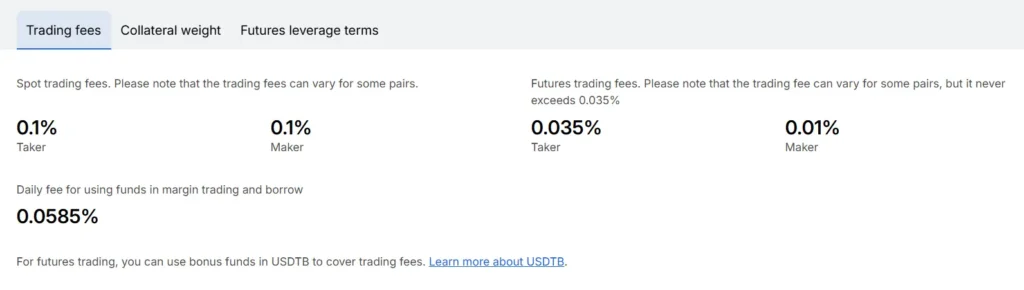

Kraken’s fee structure is a bit different. While specific rates aren’t mentioned in the search results, Kraken typically uses a tiered fee system based on your 30-day trading volume.

Trading Fee Comparison:

| Exchange | Spot Trading Fee | Futures Trading |

|---|---|---|

| WhiteBIT | 0.1% (maker/taker) | 0.02% maker / higher taker fee |

| Kraken | Tiered based on volume | Varies |

For deposit methods, Kraken generally offers more options for fiat deposits compared to WhiteBIT. However, both exchanges support various cryptocurrency deposits.

Withdrawal fees vary by cryptocurrency on both platforms. WhiteBIT is known for its competitive withdrawal fees, though specific numbers aren’t provided in the search results.

When considering these exchanges, look beyond just the base fees. Factor in any potential discounts that might be available based on trading volume or token holdings.

Remember that lower fees directly impact your profitability, especially if you plan to trade frequently or in large volumes.

Kraken Vs WhiteBIT: Order Types

When trading cryptocurrencies, order types can make a big difference in your trading strategy. Both Kraken and WhiteBIT offer various order options to help you execute trades according to your needs.

Kraken provides a comprehensive set of order types for traders. You can use basic market and limit orders for immediate or price-specific trades.

Kraken also offers more advanced options like Take Profit and Stop Loss (bracket) orders. These help you manage risk and lock in profits automatically.

WhiteBIT supports standard market and limit orders as well. Their platform includes stop orders which allow you to set specific price triggers for your trades.

Kraken Order Types:

- Market orders

- Limit orders

- Take Profit orders

- Stop Loss orders

- Bracket orders

WhiteBIT Order Types:

- Market orders

- Limit orders

- Stop orders

- OCO (One Cancels Other) orders

Kraken’s order system tends to be more beginner-friendly with clear guidance on setting prices for limit orders. This feature is especially helpful if you’re new to cryptocurrency trading.

WhiteBIT offers a clean interface for placing orders, though it may have fewer advanced order types compared to Kraken. However, their system is sufficient for most trading strategies.

Both exchanges allow you to modify orders after placement, giving you flexibility as market conditions change. Your trading style will determine which platform’s order types best suit your needs.

Kraken Vs WhiteBIT: KYC Requirements & KYC Limits

Both Kraken and WhiteBIT require users to complete Know Your Customer (KYC) verification before accessing full platform features. These checks help prevent fraud and comply with financial regulations.

Kraken offers two main verification levels for personal accounts: Intermediate and Pro. Most users find the Intermediate level sufficient for basic trading needs.

WhiteBIT’s verification process has been noted to sometimes require multiple KYC checks. Some users report needing to complete verification twice – once during initial setup and again when making withdrawals.

Kraken KYC Levels:

- Intermediate: Allows crypto deposits/withdrawals and trading

- Pro: Higher deposit and withdrawal limits, access to more funding options

WhiteBIT KYC Levels:

- Basic: Limited functionality with small trading amounts

- Advanced: Full platform access with higher limits

The verification process for both exchanges typically requires personal information, government ID, and sometimes a selfie or proof of address.

WhiteBIT offers over 330 cryptocurrencies and 550+ trading pairs, which might influence your decision if specific asset availability matters to you.

KYC completion times vary for both platforms. During busy periods, verification can take anywhere from a few hours to several days depending on backlog and the complexity of your application.

Kraken Vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Kraken and WhiteBIT, understanding deposit and withdrawal options is essential for managing your crypto efficiently.

Kraken supports various deposit methods including bank transfers, cryptocurrency deposits, and in some regions, debit/credit cards. Their withdrawal options are similarly diverse, allowing you to move funds back to your bank or to other crypto wallets.

WhiteBIT offers deposits via credit/debit cards, electronic wallets, and cryptocurrency transfers. You can withdraw using credit/debit cards or direct cryptocurrency transfers to external wallets.

Both exchanges implement security holds on new deposits. For example, Kraken places a 72-hour withdrawal hold on first-time debit/credit card purchases or digital wallet deposits to enhance security.

Fee structures differ between the platforms. WhiteBIT generally aims to maintain competitive fees, though specific rates vary by currency and method. Kraken’s fees are tiered and depend on your verification level and transaction volume.

Processing Times Comparison:

| Platform | Crypto Deposits | Fiat Deposits | Crypto Withdrawals | Fiat Withdrawals |

|---|---|---|---|---|

| Kraken | 30-60 minutes | 1-5 business days | 30-60 minutes | 1-3 business days |

| WhiteBIT | 10-30 minutes | 1-3 business days | 10-30 minutes | 1-5 business days |

Minimum deposit and withdrawal amounts vary by currency on both platforms. You should check their current limits before initiating transactions, as these can change based on market conditions.

Kraken Vs WhiteBIT: Trading & Platform Experience Comparison

Kraken and WhiteBIT offer distinct trading experiences that cater to different types of crypto traders.

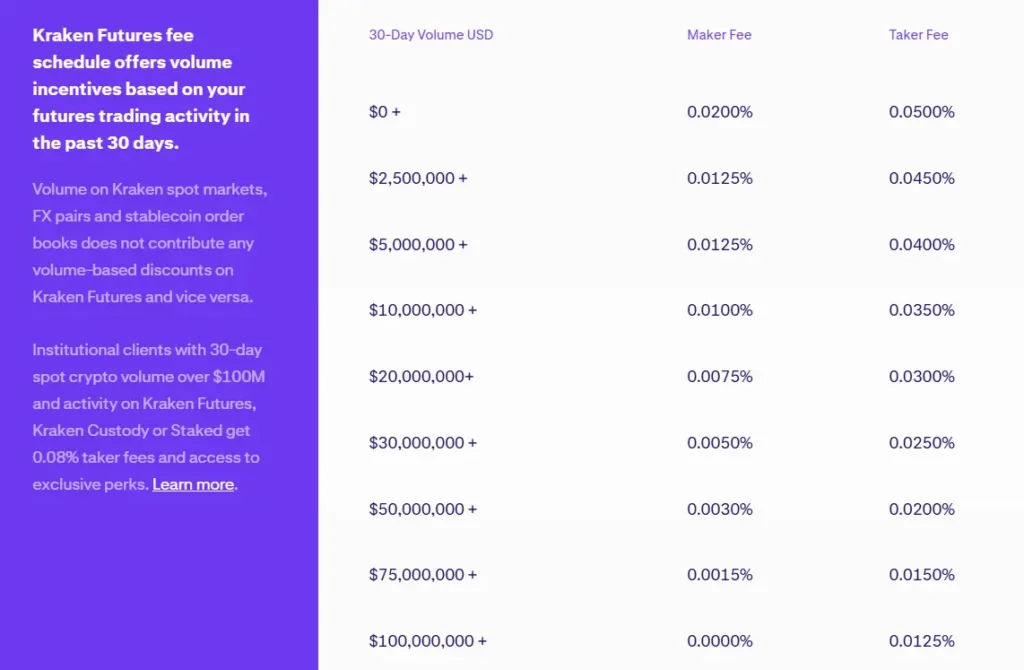

Kraken provides a robust platform with an intuitive interface that works well for beginners and advanced traders. You’ll find the navigation straightforward with clear trading views and multiple order types.

WhiteBIT supports over 300 trading pairs and offers spot trading, futures trading, and staking options. The platform is designed to accommodate both newcomers and experienced traders.

Trading Features Comparison:

| Feature | Kraken | WhiteBIT |

|---|---|---|

| Trading Pairs | 200+ | 300+ |

| Futures Trading | Yes | Yes |

| Staking Options | Yes | Yes |

| Mobile App | User-friendly | Feature-rich |

| Trading View | Professional charts | Advanced charts |

Kraken’s security features are widely respected in the industry. You can trade with confidence knowing your assets have strong protection.

WhiteBIT emphasizes user experience with a clean interface. The platform loads quickly and executes trades efficiently, which is crucial during volatile market conditions.

For new traders, Kraken offers more educational resources and a more gradual learning curve. WhiteBIT provides more advanced trading tools that experienced traders might prefer.

Both platforms offer mobile apps that let you trade on the go. You can set price alerts, check your portfolio, and execute trades from your smartphone with either service.

Kraken Vs WhiteBIT: Liquidation Mechanism

Both Kraken and WhiteBIT have liquidation mechanisms to protect their platforms when traders’ positions fall below certain thresholds. These systems help maintain market stability and prevent excessive losses.

On Kraken, liquidation occurs automatically when your account reaches the liquidation threshold. The platform will close your position without warning once this point is reached. You should monitor your positions carefully to avoid unexpected liquidations.

WhiteBIT offers a more trader-friendly approach to liquidation. Their system includes automatic liquidation mechanisms but adds margin call alerts. These alerts notify you before liquidation occurs, giving you a chance to add funds or adjust your position.

Both exchanges use collateral to secure margin trading positions. When market movements push your position against your trade direction, liquidation may occur.

Here’s a quick comparison of their liquidation features:

| Feature | Kraken | WhiteBIT |

|---|---|---|

| Automatic Liquidation | Yes | Yes |

| Margin Call Alerts | No | Yes |

| Position Management Tools | Basic | Advanced |

| Liquidation Warning | Limited | Yes |

For new traders, WhiteBIT’s alert system provides an extra layer of protection. You’ll have time to react before your positions are closed.

Experienced traders may appreciate Kraken’s straightforward approach, but WhiteBIT’s position management tools offer more control over your trading strategy.

Kraken Vs WhiteBIT: Insurance

When choosing a crypto exchange, insurance protection can be a crucial factor for your peace of mind. Both Kraken and WhiteBIT offer insurance options, but they differ in scope and coverage.

Kraken provides insurance through its reserves. They maintain a significant portion of their assets in cold storage, protected from online threats. However, Kraken doesn’t offer full insurance coverage for all user funds.

WhiteBIT, according to recent information, has expanded its insurance options. The platform offers insurance for digital assets as mentioned in the search results. This is part of their security measures that have earned them high security ratings.

Insurance Comparison:

| Feature | Kraken | WhiteBIT |

|---|---|---|

| Digital Asset Insurance | Partial | Yes |

| Cold Storage Reserves | Yes | Yes |

| Insurance Transparency | Moderate | High (with proof of funds) |

You should note that neither exchange guarantees complete protection against all potential losses. Market volatility risks are typically not covered by exchange insurance policies.

For extra security, consider using hardware wallets for long-term storage of your crypto assets. Exchange insurance should be viewed as an additional layer of protection rather than your primary security measure.

Always verify the current insurance status directly with the exchanges, as policies may change over time.

Kraken Vs WhiteBIT: Customer Support

When choosing between Kraken and WhiteBIT, customer support quality can make a big difference in your trading experience. Both exchanges offer support options, but they differ in important ways.

Kraken provides 24/7 live chat support and maintains a reputation for responsive service. You can reach their team through multiple channels including email and phone support for urgent issues. Their average response time is typically under 1 hour for most inquiries.

WhiteBIT also offers 24/7 support through chat and email. Their team generally responds within 24 hours, though priority is often given to users with higher trading volumes.

Support Comparison:

| Feature | Kraken | WhiteBIT |

|---|---|---|

| Live Chat | 24/7 | 24/7 |

| Email Support | Yes | Yes |

| Phone Support | Yes | Limited |

| Average Response Time | <1 hour | 1-24 hours |

| Knowledge Base | Extensive | Good |

Kraken’s help center is more comprehensive with detailed guides and tutorials. You’ll find solutions to most common issues without needing to contact support directly.

WhiteBIT’s knowledge base is growing but isn’t as extensive as Kraken’s yet. They do offer support in more languages, which is helpful if English isn’t your primary language.

Also Read: Crypto options trading explained

Both platforms provide dedicated support for account security issues. Kraken has a slight edge with their specialized security team that handles account compromise concerns with high priority.

Kraken Vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both Kraken and WhiteBIT offer robust security measures to protect your assets.

Kraken implements modern security features including 2-factor authentication (2FA). This exchange is known for its rigorous security testing and comprehensive user protection protocols.

WhiteBIT has established itself as a security pioneer in the cryptocurrency industry. The exchange uses advanced security measures and has earned various security certifications.

Key Security Features Comparison:

| Feature | Kraken | WhiteBIT |

|---|---|---|

| 2-Factor Authentication | ✅ | ✅ |

| Bug Bounty Programs | ✅ | ✅ |

| Ongoing Security Tests | ✅ | ✅ |

| User Security Protocols | Comprehensive | Advanced |

Both platforms conduct regular security tests to identify and address vulnerabilities. This proactive approach helps prevent potential breaches.

WhiteBIT sets industry benchmarks with its security measures. The platform’s commitment to security is evident in its reputation and certifications.

Kraken’s security framework includes multiple layers of protection. Their security team continuously monitors the platform to detect unusual activities.

You should enable all available security features when using either exchange. This includes setting up 2FA, using strong passwords, and being cautious of phishing attempts.

Is Kraken A Safe & Legal To Use?

Kraken is considered one of the safest cryptocurrency exchanges available today. According to search results, it has maintained a strong security track record with no major hacking incidents reported since its founding.

The exchange has been operating since 2011, building a reputation for security and reliability. Many users have had positive experiences with Kraken, with some noting they’ve trusted the platform since 2017.

Kraken takes several security measures to protect your funds:

- Cold storage protection: Most digital assets are kept in offline storage

- Insurance coverage: Assets in cold storage are insured

- Two-factor authentication: Adds an extra layer of account security

- Global compliance: Follows regulations in countries where it operates

Legally, Kraken operates within regulatory frameworks in multiple jurisdictions. The exchange is registered as a Money Services Business with FinCEN in the United States and complies with legal requirements in other countries where it provides services.

You should be aware that while Kraken is generally considered safe, all cryptocurrency exchanges carry some risk. A small number of users have reported issues, particularly in 2024, according to one search result.

For the most secure experience, use strong passwords, enable all security features, and consider transferring large amounts to personal wallets rather than keeping them on any exchange.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT is considered a safe cryptocurrency exchange with strong security measures in place. The platform has earned an AAA security rating and ranks among the top 3 safest trading platforms according to search results.

One of the most impressive security features is that WhiteBIT keeps more than 95% of user funds in cold storage. This offline storage method significantly reduces the risk of hacking attempts.

The exchange implements multiple security layers including two-factor authentication (2FA) and anti-phishing measures to protect your account. These features help prevent unauthorized access and potential scams.

WhiteBIT operates as a legal entity that complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This regulatory compliance adds another layer of legitimacy and security for users.

The platform conducts routine security checks to identify and address potential vulnerabilities. This proactive approach to security helps maintain the platform’s strong safety record.

When comparing exchanges, WhiteBIT stands out as a well-established cryptocurrency platform that provides a secure trading environment. Its emphasis on security makes it a reliable choice for both new and experienced traders.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Kraken and WhiteBIT. Below are answers to common questions that can help you make an informed decision about which platform might better suit your needs.

What are the primary differences between Kraken and other major exchanges?

Kraken stands out with its strong regulatory compliance and security focus. It operates in more countries than many competitors and maintains licenses in multiple jurisdictions.

Kraken offers more advanced trading features than most mainstream exchanges, including futures trading and margin options. These features appeal to experienced traders looking for sophisticated tools.

Unlike some exchanges, Kraken emphasizes educational resources and provides extensive documentation to help users understand cryptocurrency trading fundamentals.

How do trading fees compare on Kraken versus WhiteBIT?

Kraken typically charges trading fees ranging from 0.16% to 0.26% for regular users, with discounts available for high-volume traders. These rates position Kraken in the mid-range for industry fee structures.

WhiteBIT offers a slightly different fee structure with competitive rates that vary more frequently than Kraken’s. WhiteBIT’s fee schedule can change based on market conditions and promotions.

Both exchanges offer fee discounts for users who hold and stake their native tokens, but WhiteBIT’s variable rate structure requires more attention to current terms.

What security measures do Kraken and WhiteBIT implement for user protection?

Kraken implements industry-leading security protocols including 95% cold storage for assets, mandatory two-factor authentication, and global settings lock. Their security team has maintained a spotless record with no major hacks since founding.

WhiteBIT also employs robust security measures with two-factor authentication and cold storage solutions. They provide additional security through regular security audits.

Both exchanges offer address whitelisting, which prevents withdrawals to unauthorized cryptocurrency addresses. This adds an additional layer of protection against potential account compromises.

What variety of cryptocurrencies do Kraken and WhiteBIT support?

Kraken supports over 200 cryptocurrencies for trading, including all major coins and many emerging altcoins. Their selection emphasizes established projects with proven track records.

WhiteBIT offers a broader range of cryptocurrencies, particularly including newer and emerging tokens. This makes WhiteBIT potentially more attractive if you’re looking to trade less established coins.

Both exchanges regularly add new cryptocurrencies, but WhiteBIT typically integrates newer projects more quickly than Kraken’s more cautious approach.

How do the user interfaces of Kraken and WhiteBIT differ for novice traders?

Kraken’s interface is designed with clarity in mind, offering basic and advanced views. Beginners appreciate the straightforward dashboard that simplifies the trading process with clear buy/sell options.

WhiteBIT features a more modern interface with customizable widgets and trading views. However, some new users find the wealth of information and options initially overwhelming.

Both platforms offer mobile apps, but Kraken’s app receives higher ratings for reliability and ease of use among new traders. WhiteBIT’s app provides more features but with a steeper learning curve.

What are the customer service experiences like on Kraken compared to WhiteBIT?

Kraken provides 24/7 customer support through live chat and email ticket systems. Response times average under 24 hours for most inquiries, and their support team is known for thorough, helpful responses.

WhiteBIT offers support through multiple channels including Telegram and email. Their response times can vary more widely, particularly during high-volume trading periods.

Both exchanges maintain extensive knowledge bases, but Kraken’s documentation is generally considered more comprehensive and beginner-friendly with step-by-step guides for common procedures.

WhiteBIT Vs Kraken Conclusion: Why Not Use Both?

Both WhiteBIT and Kraken have their own strengths that cater to different trading needs. Instead of choosing one over the other, you might benefit from using both platforms.

Kraken is known for its robust security features and is well-established in the crypto market. It offers a reliable trading experience that many long-term crypto users trust.

WhiteBIT, on the other hand, provides a feature-rich platform that some users find better overall. According to search results, some traders have switched from Kraken to WhiteBIT because they preferred its interface and offerings.

Your trading style and goals should guide your choice. For beginners, WhiteBIT might be more user-friendly with its intuitive design. For security-focused traders, Kraken’s reputation for safety is hard to beat.

Consider using Kraken for larger, long-term investments where security is paramount. You can use WhiteBIT for day-to-day trading and exploring newer cryptocurrencies.

The differences in fee structures between the two platforms also mean you can strategically place trades where they’ll cost you less. Smart traders often use multiple exchanges to take advantage of different fee schedules.

By maintaining accounts on both platforms, you gain access to a wider range of cryptocurrencies and trading pairs. This diversity can help you maximize your trading opportunities and minimize risks.

Remember that market conditions change rapidly. Having access to both exchanges gives you flexibility when one platform experiences high traffic or maintenance issues.

Compare Kraken and WhiteBIT with other significant exchanges