In the rapidly evolving world of cryptocurrency trading, KuCoin has positioned itself as a leading platform, offering a vast array of options for traders around the globe. If you’re exploring new opportunities in crypto trading, KuCoin Options Exchange provides a rich suite of tools that cater to both beginners and experienced traders alike. KuCoin is known for its extensive selection of cryptocurrency options, diverse trading pairs, and user-friendly interface.

As the seventh-largest crypto exchange by trading volume, KuCoin offers innovative features such as staking options and pre-market trading opportunities, appealing to users seeking an engaging trading experience. Its reputation as ‘the people’s exchange’ underscores the focus on accessibility and community engagement. You can also benefit from partnerships with industry leaders like Talos and Pyth Network, which enhance the trading ecosystem.

Exploring KuCoin’s capabilities further reveals attractive fees and a reliable security framework, which play crucial roles in safeguarding your investments. Understanding these elements can help you make informed decisions and maximize your trading strategy on the platform.

What Are KuCoin Options?

KuCoin offers a versatile options trading platform that allows you to engage in cryptocurrency options. KuCoin Options primarily feature European-style options, meaning they can only be exercised at expiration.

With low capital requirements and capped risk, you can trade options to speculate on market movements without owning the underlying assets.

Supported Cryptocurrencies

You can trade options on popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). This allows you to diversify your trading strategies by leveraging price shifts across different assets.

Features

- Collateral: Tether (USDT) is used as collateral for options trades.

- Trading Fees: A competitive fee structure of 0.03% for both maker and taker trades enhances accessibility and affordability.

Strategy and Diversification

Whether the market is rising or falling, KuCoin Options provide a way to hedge risks and enhance your trading strategy. By speculating on price movements, you can potentially enhance returns. This makes it a potent tool for managing risk in your portfolio.

If you’re starting with options, KuCoin’s platform ensures a simple and efficient way to begin your journey. With its wide range of features and user-friendly approach, exploring KuCoin Options can boost your trading experience.

KuCoin Options Products Offerings

KuCoin offers an extensive range of crypto options designed to cater to various trading strategies. These products primarily include European-style options where contracts can only be executed at expiration. Known for flexibility, KuCoin enables you to trade major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) with options contracts settled in Tether (USDT).

One standout feature of KuCoin’s options platform is its competitive trading fees, set at 0.03% for both maker and taker orders. This can be particularly attractive for active traders seeking to optimize their transaction costs.

With options trading now live, KuCoin has expanded its derivatives market, allowing you a comprehensive trading experience. These offerings are supported by a clean and straightforward interface to help you navigate through various trading possibilities with ease.

Enjoy the advantage of pre-market trading opportunities and institutional-level services that enhance your trading capabilities on KuCoin. These features make it an appealing platform for individuals and institutions alike.

KuCoin’s collaboration with entities such as Talos, Fracton Protocol, and Pyth Network further enriches its offerings, providing additional resources and tools designed to facilitate efficient trading.

Through KuCoin, you gain access to a robust ecosystem designed to support diverse trading needs, whether you are a beginner or an experienced trader aiming to diversify investment portfolios within the crypto space.

KuCoin Supported Coins for Options Trading

When trading options on KuCoin, you can work with a selection of popular cryptocurrencies. Bitcoin (BTC) is widely supported, allowing you to trade options on one of the most stable digital assets available. This can be beneficial if you’re looking for a highly liquid market.

Another standout option is Ethereum (ETH). Recognized for its various applications and smart contract capabilities, ETH options trading on KuCoin can offer diverse opportunities. It’s especially appealing if you’re interested in assets with technological backing.

Solana (SOL) is the third major cryptocurrency supported for options trading on KuCoin. Known for its high-performance blockchain, SOL provides an exciting choice for those interested in newer cryptocurrencies. Its fast transaction times may appeal to traders seeking innovative blockchain solutions.

For all supported cryptocurrencies in options trading, KuCoin utilizes Tether (USDT) for collateral. This stablecoin minimizes volatility in collateral, providing a more stable trading foundation.

These assets form a versatile trifecta for options trading on KuCoin, each with distinct market characteristics to fit various trading strategies.

KuCoin Options Leverage

When trading options on KuCoin, leverage plays a crucial role in enhancing your trading potential.

Leverage in Trading:

Leverage allows you to trade with a larger position than your actual account balance. On KuCoin, you can utilize leverage to amplify your potential returns on option trades.

By using leverage, you can control a significant amount of cryptocurrency with a relatively small investment. This approach increases both potential profits and risks.

Example of Leverage:

Suppose you want to invest in a Bitcoin option with leverage. If Bitcoin’s price increases as anticipated, your returns could be substantially higher compared to an unleveraged position.

Keep in mind that trading with leverage requires careful management of your positions. The potential for higher returns comes with increased risk, which can result in significant losses. Always ensure you fully understand how leverage affects your options trading strategy before entering the market.

KuCoin Options Calculator

When trading options on KuCoin, using a options calculator can be a helpful tool.

The calculator assists in estimating potential profits or losses based on different market scenarios. You input key variables like strike price, asset price, volatility, and expiration date.

This helps you plan your options trading strategies effectively.

Key Variables:

- Strike Price: The agreed price for the transaction.

- Asset Price: The current price of the asset in question.

- Volatility: The expected price fluctuation of the asset.

- Expiration Date: When the option contract will expire.

These factors influence your potential financial outcomes.

Benefits:

Using the KuCoin options calculator helps you gain insights into:

- Profit and loss estimations

- Risk assessment

- Decision-making in varying market conditions

These insights enable more informed trading.

The accurate calculation of potential outcomes improves your strategic planning. Importantly, this precision aids in managing risks effectively.

Utilizing this tool keeps your trading aligned with your financial goals.

Kucoin Options Types

KuCoin offers a variety of options types to cater to different trading strategies. One popular type is the European-style option. This type of option can only be executed at its expiration date, providing you with a straightforward approach to options trading.

Options available on KuCoin include Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You can trade these using Tether (USDT) as collateral. The use of well-established cryptocurrencies provides a flexible trading environment.

Here’s a quick list of what you can do with KuCoin options:

- Hedge Risks: Offset potential changes in asset prices.

- Leverage Market Fluctuations: Benefit from market ups and downs.

- Diversify Strategies: Broaden your trading approaches beyond standard buying and selling.

Trading Fees are competitive, set at 0.03% for maker/taker. This makes managing your options trades on KuCoin both efficient and cost-effective. Use the low capital requirements to minimize risks while maximizing potential returns.

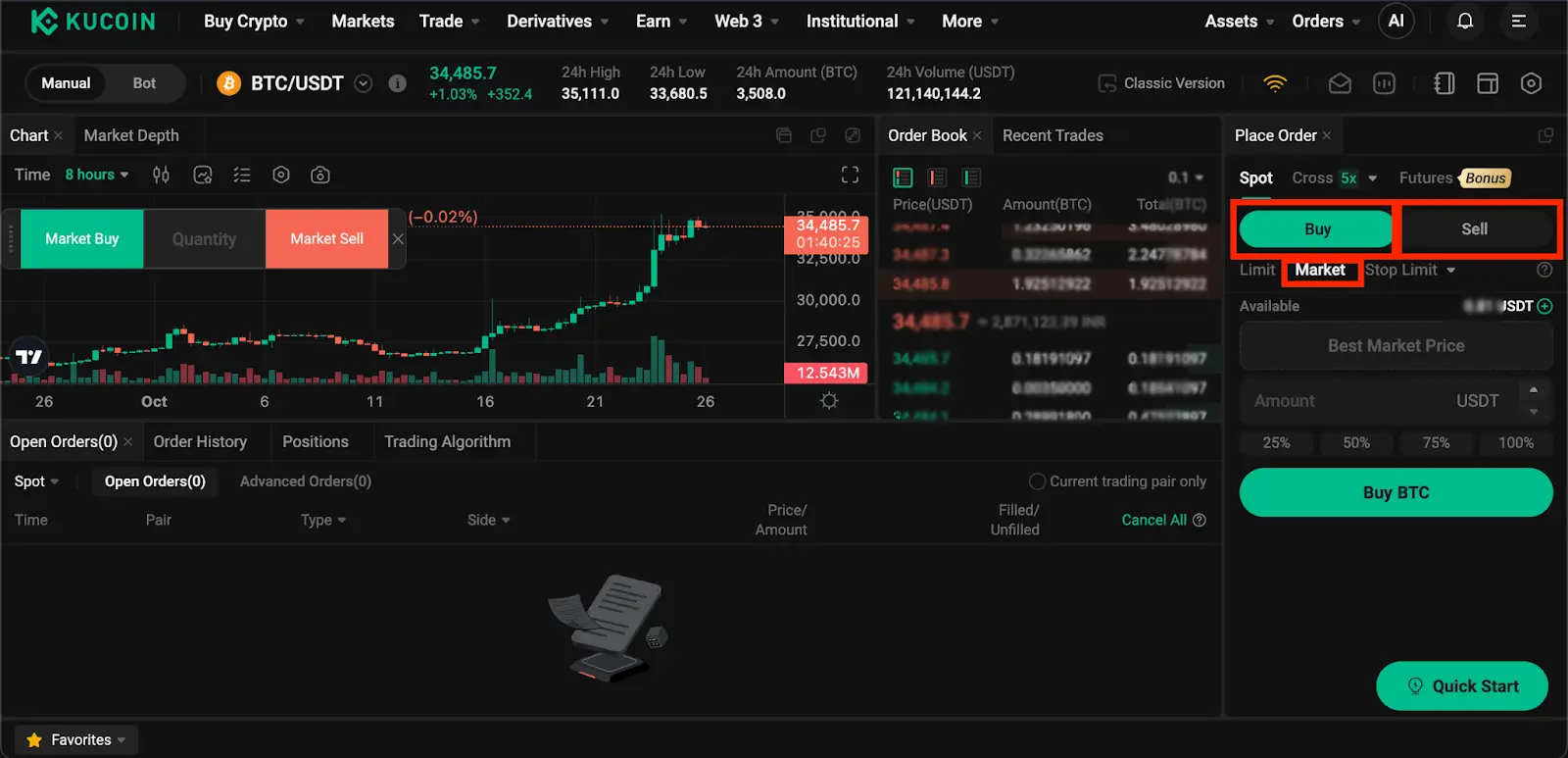

KuCoin Order Types

On KuCoin Exchange, you can access a variety of order types tailored to different trading needs. These include both basic and advanced options.

1. Market Orders

Market orders allow you to buy or sell an asset at the current market price. These orders get executed immediately, providing quick transaction outcomes.

2. Limit Orders

Limit orders let you set the price at which you want to buy or sell an asset. Your order will only be executed when the market reaches this specified price.

3. Stop Orders

Stop orders help you automate trades by triggering a buy or sell order once the asset reaches a certain price. This type is useful for managing risk.

4. Post-Only Orders

With post-only orders, you can ensure your trades are added to the order book before being executed, allowing for potential fee benefits.

5. Iceberg Orders

Iceberg orders break a large order into smaller parts to prevent market disruption. The bulk of the order remains hidden, revealing only a small portion.

Make sure to understand each order type’s function to optimize your trading strategy on KuCoin.

KuCoin Options Data

KuCoin offers a robust trading platform for options contracts, specifically BTC and ETH options settled in USDT. These options provide flexibility and the ability to trade at market prices up until their expiration.

Volume & Prices

You have access to varying options trading volumes on KuCoin, with BTC and ETH options frequently traded. Volume data is essential for assessing market liquidity. Several factors impact volume, including market sentiment and open interest.

On pricing, options are influenced by underlying asset prices and market volatility. Prices are quoted in USDT, and traders must monitor strike prices, expiration dates, and premiums. Understanding these components helps you make informed trades while leveraging market information to optimize strategies.

Kucoin Liquidation Mechanism

KuCoin implements a specific liquidation mechanism to manage risk on their platform. For isolated margin trading, the system initiates a forced liquidation when your debt ratio hits a certain level.

At a 97% debt ratio, your position is automatically liquidated. You receive a warning when your debt ratio reaches 95%, allowing you to manage your position before it’s liquidated.

KuCoin uses a liquidity provider mechanism to improve user experience when handling liquidations. This means that certain measures are in place to ensure an efficient and fair process. The aim is to optimize positions and protect your remaining assets.

While understanding these mechanisms is crucial for risk management, it’s important to be aware that liquidations can result in losing your entire margin without the option to recover those funds. Ensure you monitor your positions and adjust them as needed.

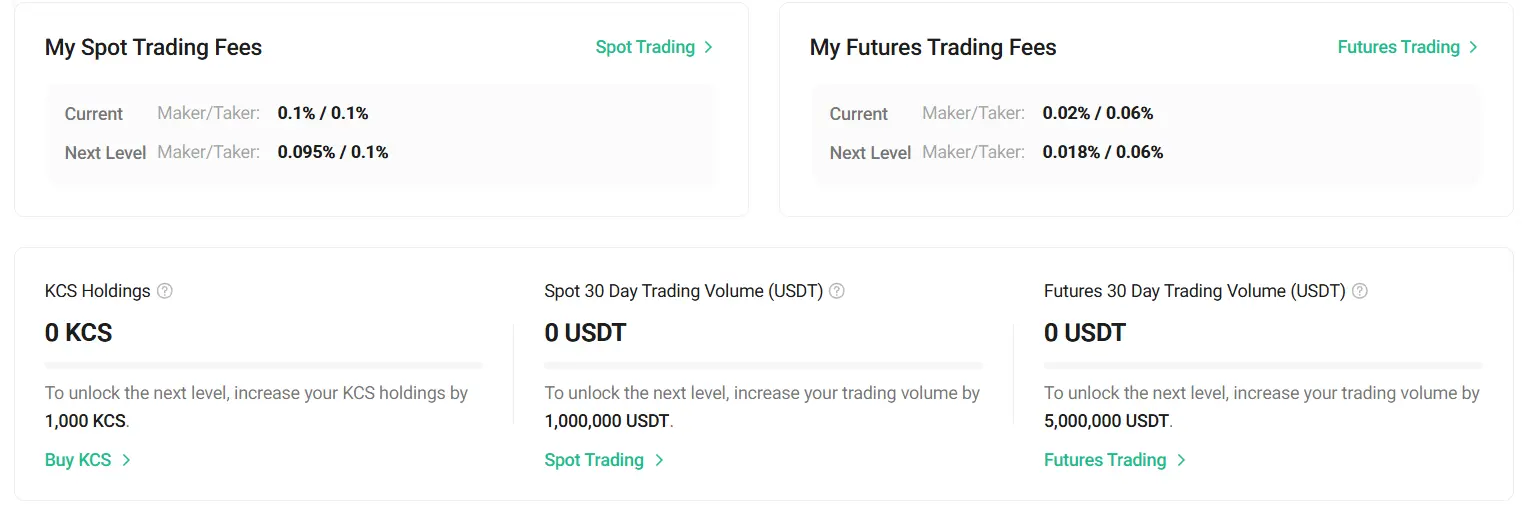

Kucoin Options Trading Fees

When trading options on KuCoin, you’ll find a European-style contract system. This allows you to benefit from price movements in assets without the need for early trades or complex borrowing processes. Your focus remains on holding contracts until the expiration date.

KuCoin’s fee structure for options trading is designed to be straightforward. You only need to consider the cost associated with purchasing or selling the option contracts. These fees are competitive, aimed at providing you with an attractive trading environment.

Unlike some other exchanges that might charge a flat percentage on trades, KuCoin’s fees can vary based on the specific contract and market conditions. This flexibility can be beneficial, as it aligns with the dynamic nature of options trading.

A potential advantage is that fees can be reduced if you decide to pay with KuCoin’s native token, KuCoin Shares (KCS). This is a way for KuCoin to encourage active trading while rewarding users who hold and use their native token.

Overall, the fee structure at KuCoin aims to be competitive and customer-friendly. The focus is on enhancing your trading experience by keeping costs low and offering potential reductions for savvy traders.

Consider all factors involved while trading options to maximize the opportunities available to you. Aim for effective strategies and stay informed about market trends to make the most out of your trades on KuCoin.

Kucoin Options Funding Rates/Fees

When trading options on KuCoin, understanding funding rates and fees is crucial. These are financial charges incurred to balance the price differences between the futures contract and the spot price of the underlying asset. Funding rates act as an incentive mechanism to align the futures price with the index price.

Funding Rate Formula:

- Funding Fee = Position Value × Funding Rate

The position value is determined by the mark price at the time of funding rate settlement. KuCoin uses a specific formula that incorporates two main components: the Interest Rate and the Premium Index. The funding rate is calculated as:

- Funding Rate = Premium Index + clamp (Interest Rate – Premium Index, 0.05%, -0.05%)

Fees can vary depending on market conditions, impacting your cost of trading and potential profitability. It’s important to stay updated on the latest funding rates as they can change based on the market’s volatility and liquidity.

To help manage your trading costs, keep an eye on the daily reset of fiat deposit limits which occurs at 0:00 UTC. Planning your deposits in advance can optimize your funding strategy and minimize unnecessary fees.

This nuanced system ensures that funding costs reflect market dynamics and adherence to these rates is essential for maintaining profitable strategies. Ensure you monitor these rates in your trading decisions to optimize outcomes while using KuCoin’s options platform.

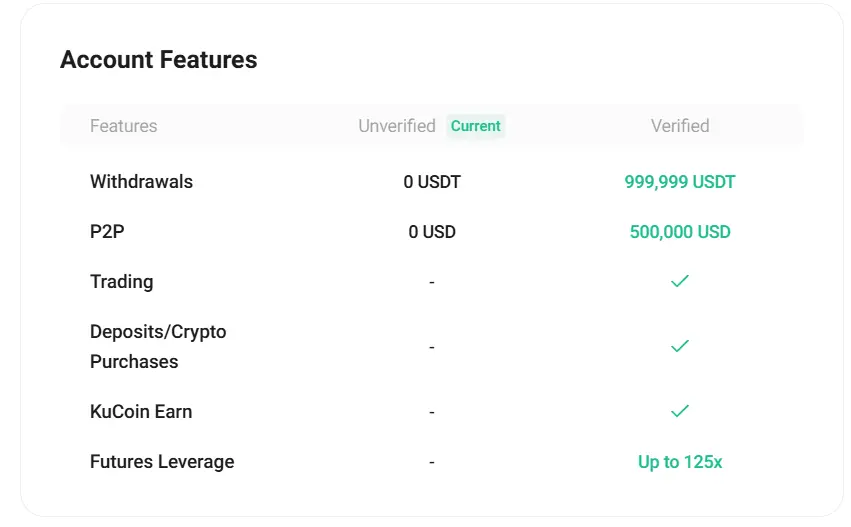

Kucoin Account Types & KYC Tiers & Limits

KuCoin offers a variety of account types to cater to different user needs. Individual accounts are designed for personal use, allowing you to trade and manage your assets conveniently. Corporate accounts serve businesses and institutions, providing features tailored for enterprise-level activities. Sub-accounts enable you to manage multiple trading accounts under one main account.

KYC (Know Your Customer) verification helps ensure a secure trading environment. It aligns with global compliance standards and increases the security of user accounts on KuCoin.

KYC Tiers and Benefits:

- Finished Registration: Allows a daily withdrawal limit of up to 20,000 USDT.

- Higher KYC levels offer increased withdrawal limits. Completing Identity Verification can enhance your withdrawal capabilities.

To gain higher verification status, you must provide identification documents. This step not only increases your withdrawal limits but also grants access to additional platform features. Engaging with KYC can significantly enhance your overall trading experience on KuCoin.

Understanding the different account types and verification levels at KuCoin will empower you to make informed decisions about your trading activities, ensuring you select options that best align with your financial goals and needs.

Kucoin Trading Platform & Tools

KuCoin offers a comprehensive trading platform equipped with a diverse array of tools to assist both beginners and experienced traders. The platform supports spot trading, margin trading, futures, and more advanced derivatives options, suiting a variety of trading needs.

The user interface is intuitive, designed to simplify the trading experience for newer users while providing access to advanced charting and analysis tools for seasoned traders. You can easily switch between different trading interfaces, each tailored to specific types of trading, such as spot or futures.

For traders seeking detailed market data, KuCoin provides an extensive suite of analytical tools. Technical indicators, real-time charts, and detailed order books are standard features that can enhance your trading strategies.

KuCoin’s mobile app ensures you can manage your trades seamlessly from anywhere. The app mirrors the platform’s capabilities, allowing you to track prices, perform trades, and analyze markets with ease.

Security features like two-factor authentication are integrated into the platform to protect your account. It is crucial to enable these features to secure your trades and personal information.

There is also a supportive community and educational resources to help you learn and grow as a trader. This includes tutorials, blogs, and forums where you can discuss strategies and platform functionalities with other users. To gain more experience, you can also consider using crypto options paper trading.

KuCoin Insurance Fund

The KuCoin Insurance Fund is an essential safety net that helps protect your investments on the platform.

It covers losses stemming from hacking incidents and unforeseen events. The fund plays a pivotal role in mitigating the impact on users during security breaches.

Futures Trading on KuCoin benefits from an exclusive insurance fund. It is designed to cover potential losses when liquidated positions drop below a certain market price. You gain an additional layer of security with this specialized protection.

In the unfortunate event of a security breach, the insurance fund is activated to compensate affected users. This not only ensures user trust but also stabilizes the platform during crises.

When engaging in the futures market, each contract’s specific risks are independently managed. The insurance fund balance is displayed according to the settlement currency. This means your investments have targeted protection based on the contracts you’re involved with.

User confidence is a top priority for KuCoin. With a dedicated insurance fund, you can trade knowing there are measures in place to safeguard your assets.

Choose KuCoin for your trading needs and experience a platform committed to your financial security.

Kucoin Deposit Methods

When using KuCoin, you have access to various deposit methods designed to suit your preferences. Both fiat and cryptocurrency deposits are supported.

Fiat Deposits:

You can deposit through credit cards including VISA and MasterCard. These options make it easy to add funds from your bank account directly to KuCoin.

Cryptocurrency Deposits:

Cryptocurrency deposits are a popular choice. Transactions typically take 30 minutes to an hour, depending on network conditions. This variation is due to network fees and the processing time required.

Table of Deposit Methods:

| Method | Currency Type | Processing Time |

|---|---|---|

| Credit Card | Fiat | Instant to few mins |

| Crypto Deposit | Crypto | 30 mins to 1 hour |

Ensure you understand that any transaction fees might vary. It’s advisable to check the current fees on KuCoin before proceeding.

KuCoin Security Features

KuCoin provides a robust security infrastructure to ensure the safety of your digital assets. One of the main features you’ll encounter is two-factor authentication (2FA). This adds an additional layer of security by requiring a second form of verification besides your password.

SSL encryption is employed throughout the platform. This helps protect your data from being intercepted by malicious entities during transactions and browsing.

KuCoin also implements Know Your Customer (KYC) protocols. By verifying user identities, KuCoin increases security and complies with regulatory standards aimed at preventing fraud and other illicit activities.

Anti-phishing phrases provided by the platform allow you to create a unique phrase that appears in emails from KuCoin. This helps in verifying the authenticity of communications and reduces the risk of phishing attacks.

For your peace of mind, KuCoin stores the majority of digital assets in cold wallets. These wallets are not connected to the internet, drastically reducing the risk of online theft or hacking.

Insurance coverage is available to protect a portion of your funds against cybersecurity breaches. This coverage ensures that you have a safety net in case of unexpected security incidents.

KuCoin regularly conducts security audits to identify and rectify vulnerabilities in their system. These audits help maintain a secure environment for trading and storing cryptocurrencies.

KuCoin Customer Support

When using KuCoin, you have access to customer support available 24/7. This service includes live chat, email, and an online form to suit your preferred method of communication.

The platform’s customer support is known for being responsive and proactive. They aim to provide timely assistance to resolve any issues you may encounter during your trading activities.

If you prefer self-help options, KuCoin features an extensive help center. Here, you can find FAQs and detailed articles on various topics related to your trading experience.

For urgent queries, the live chat feature is your best bet. You can expect prompt responses that address your concerns effectively.

Additionally, you can also reach out to KuCoin via email for more detailed inquiries. Typically, you should receive a response within a reasonable timeframe.

Consider exploring the online form option for queries that are specific and require detailed information. This method is useful for issues that may not be immediately urgent.

Utilize these resources to ensure smooth trading on KuCoin. Whether it’s a technical problem or a general inquiry, the customer support team is equipped to help.

Is KuCoin a Legal & Safe Platform?

When considering KuCoin’s legality, it’s important to know that KuCoin is not licensed to operate in the United States. This means U.S. residents should be careful when thinking about using it.

KuCoin, founded in 2017 and based in Seychelles, complies with local regulations where it operates. Check your local laws to ensure compliance.

KuCoin is generally regarded as a reliable and secure cryptocurrency exchange. It employs stringent security measures, including industry-standard encryption protocols and two-factor authentication (2FA).

A standout feature of KuCoin is its ability to offer a wide range of cryptocurrencies alongside staking options. This makes it attractive to users looking for diverse trading opportunities.

KuCoin provides various trading features such as leveraged tokens, Futures trading, and Margin trading. As a user, you will have access to multiple trading tools within a single platform.

Is KuCoin safe? As per user feedback and industry reviews, it’s a reputable platform with a large user base. This contributes to its positive standing in the cryptocurrency community.

Despite its global presence, always remember to secure your account thoroughly. Regularly update passwords and use 2FA for enhanced security.

Consider the exchange’s fee structures and supported assets when evaluating its offerings related to your trading needs. Options trading is available and might present viable opportunities depending on your investment strategy.

Frequently Asked Questions

Discover the essentials about KuCoin options, from geographical restrictions to trading parameters. Gain a clear understanding of what is required to participate in options trading on KuCoin effectively.

Is KuCoin options allowed in the US?

No, KuCoin options trading is not available to residents in the United States due to regulatory restrictions. It’s crucial to verify the legal and accessibility factors based on your location before attempting to trade.

What is the settlement price in KuCoin options trading?

The settlement price for KuCoin options is the price at which an options contract is settled upon expiration. This price is determined based on the underlying asset’s market value on the expiration date and affects the contract payout.

What is the exercise method for KuCoin options?

KuCoin options utilize the European exercise method. This means that options can only be exercised at the expiration date, not before. It’s important to plan your trading strategy accordingly to maximize the benefits of this exercise method.

How to enable option trading in KuCoin?

To enable option trading on KuCoin, navigate to your account settings and complete the required verification process. Once verified, you can activate options trading by agreeing to the terms and conditions associated with it.

What trading pairs are available for KuCoin options?

On KuCoin, options trading pairs typically include major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The availability of specific pairs may vary, so it is advisable to check the most current offerings on the platform.

What is the minimum amount required to trade options on KuCoin?

The minimum amount required to trade options on KuCoin is subject to the specific contract specifications. Typically, you need to have at least the equivalent of $10 in your account to initiate a trade. Ensure you have sufficient funds to cover potential trading fees.

Conclusion

KuCoin provides a robust platform for options trading, accommodating both novice and experienced traders.

Supported Assets:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

Collateral:

- Tether (USDT)

The exchange operates a European-style options trading system, where options can only be exercised at expiration. This feature might appeal to traders who prefer a defined exit strategy.

KuCoin’s security measures are noteworthy, ensuring the safety of your funds and data. The platform’s partnership with industry allies like Talos and Coinrule further bolsters its credibility.

The exchange offers competitive trading fees, set at 0.03% for both maker and taker transactions, which makes it an attractive choice for high-volume traders.

KuCoin remains a notable platform for those looking to engage in crypto options trading efficiently.

Want more options? Check out these crypto exchanges: