When choosing a cryptocurrency exchange, understanding the differences between platforms like KuCoin and WhiteBIT can save you time and money. Both exchanges have grown in popularity by 2025, each offering unique features for crypto traders and investors.

KuCoin and WhiteBIT differ primarily in their fee structures, available cryptocurrencies, trading tools, and user experience. KuCoin stands out with its wide range of earning products including savings, staking, and lending programs, while WhiteBIT has its own set of distinctive features that appeal to different types of traders.

You’ll want to consider factors like deposit methods, supported cryptocurrencies, and trading types before deciding which platform best fits your needs. Each exchange has received different user scores and reviews, which can provide insight into the actual experience of trading on these platforms in 2025.

KuCoin vs WhiteBIT: At A Glance Comparison

KuCoin and WhiteBIT are popular cryptocurrency exchanges with key differences worth noting. Here’s what you need to know when choosing between them.

Trading Fees:

| Exchange | Trading Fees |

|---|---|

| KuCoin | Lower trading fees in general |

| WhiteBIT | Slightly higher fees than KuCoin |

- Supported Cryptocurrencies: KuCoin typically offers a wider selection of cryptocurrencies compared to WhiteBIT. This makes KuCoin more attractive if you’re looking to trade lesser-known altcoins.

- Interest Features: KuCoin provides crypto staking and lending options with competitive rates. WhiteBIT offers interest-earning options too, but with a rate of around 0.23% for BTC according to the search results.

- User Experience: Both platforms have user-friendly interfaces, but they cater to different types of traders. KuCoin has more advanced trading features for experienced users.

- Security: Both exchanges implement strong security measures including two-factor authentication and cold storage for funds.

- Deposit Methods: KuCoin and WhiteBIT differ in their supported deposit methods. You should check which platform supports your preferred payment method before signing up.

- Trading Types: KuCoin offers more trading types including futures and margin trading. WhiteBIT has a more streamlined approach focused on spot trading.

When choosing between these exchanges, consider your trading needs, preferred cryptocurrencies, and comfort with the platform’s interface.

KuCoin vs WhiteBIT: Trading Markets, Products & Leverage Offered

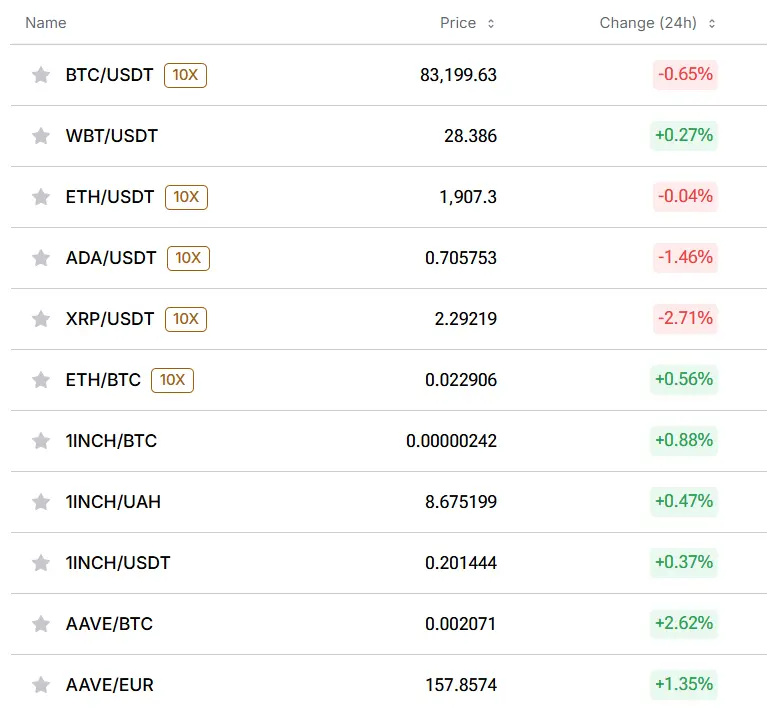

KuCoin and WhiteBIT both offer diverse trading options, but they differ in several key areas.

Available Cryptocurrencies:

- KuCoin supports a wider range of cryptocurrencies with over 700 coins available

- WhiteBIT offers approximately 300 crypto assets, focusing on established tokens

Trading Products:

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Lending | ✓ | Limited |

| Staking | ✓ | ✓ |

KuCoin stands out with its extensive earning products, including savings accounts and multiple staking options. You can access these directly from your main account.

WhiteBIT’s strength lies in its derivatives trading platform. It offers up to 100x leverage for derivatives traders, making it attractive if you’re interested in high-risk, high-reward trading strategies.

Both exchanges provide spot trading with competitive fees, but KuCoin’s Trading Bot feature gives you automated trading options not available on WhiteBIT.

Also Read: How often do crypto options expire & how their expiration affects market prices

For passive income seekers, KuCoin’s lending program allows you to earn interest by lending your crypto to margin traders. While WhiteBIT has some similar features, they’re less developed than KuCoin’s offerings.

If you’re new to crypto, both platforms offer simple trading interfaces, but KuCoin’s additional educational resources might give you a better starting point.

KuCoin vs WhiteBIT: Supported Cryptocurrencies

Both KuCoin and WhiteBIT offer a wide range of cryptocurrencies for trading, but there are some key differences in their offerings.

KuCoin currently supports over 700 cryptocurrencies and more than 1,200 trading pairs. This extensive selection makes it a good choice if you want access to both established coins and newer, emerging tokens.

WhiteBIT offers around 350 cryptocurrencies for trading. While this is fewer than KuCoin, WhiteBIT still covers all major coins and many altcoins that most traders are interested in.

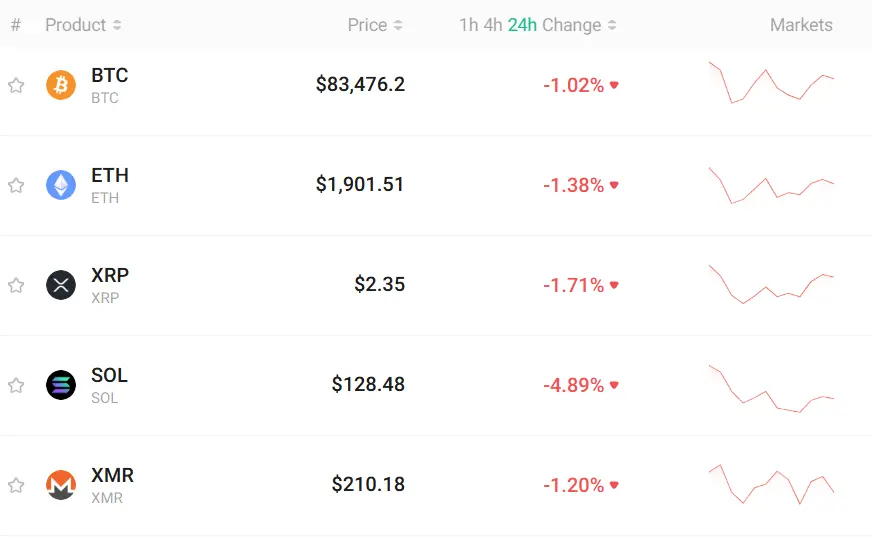

Popular cryptocurrencies supported by both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

KuCoin has gained popularity for listing new tokens earlier than many competitors. If you’re interested in getting in early on promising projects, KuCoin might be your better option.

WhiteBIT focuses more on ensuring the quality and legitimacy of its listed tokens. This approach may offer you added security but less variety.

Both exchanges regularly add new cryptocurrencies to their platforms. KuCoin typically adds new listings more frequently, sometimes adding multiple new tokens in a single week.

Your choice between these exchanges may depend on whether you prioritize having access to the widest possible selection (KuCoin) or a more curated list of established cryptocurrencies (WhiteBIT).

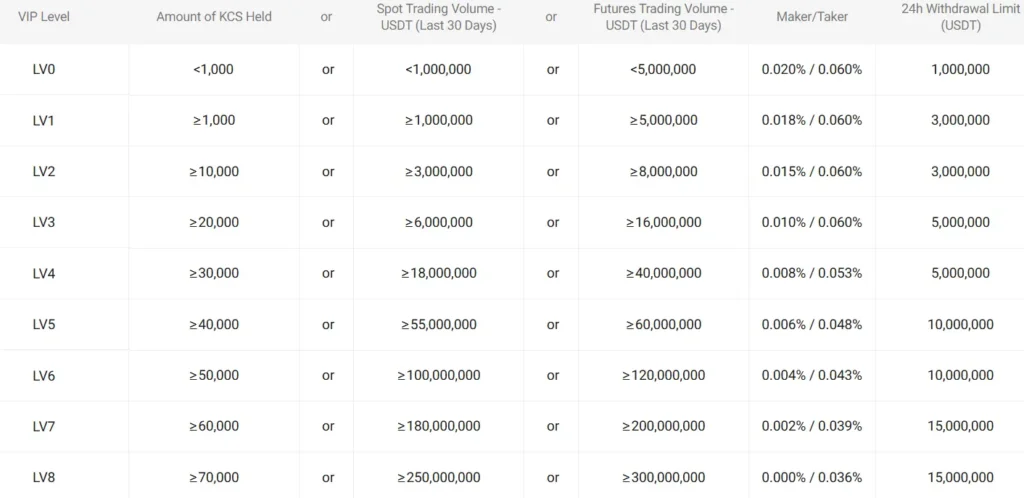

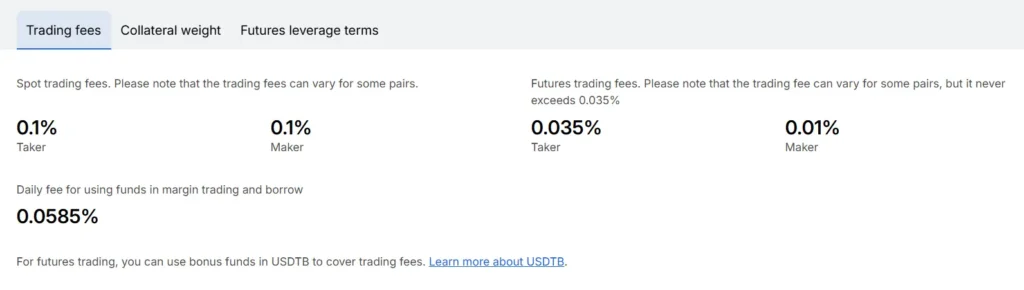

KuCoin vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

Both KuCoin and WhiteBIT offer competitive trading fees at 0.1% for regular users. This puts them on par with other popular exchanges like Binance in terms of cost-effectiveness.

You can reduce your maker fees on WhiteBIT to as low as 0% by holding a minimum amount of their native tokens. KuCoin offers similar fee reductions through their KCS token holdings.

For withdrawals, fees vary significantly depending on the cryptocurrency. As of March 16, 2025, KuCoin’s withdrawal fees are generally competitive but can be higher for certain tokens.

WhiteBIT’s withdrawal fee for USDE (Ethena USDe) is $5.00, while KuCoin charges $17.75 for the same token—a substantial difference of $12.75.

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| Standard Trading Fee | 0.1% | 0.1% |

| Lowest Possible Maker Fee | Near 0% with KCS | 0% with token holdings |

| USDE Withdrawal Fee | $17.75 | $5.00 |

When choosing between these exchanges, you should consider which cryptocurrencies you’ll trade most frequently. The withdrawal fee differences can significantly impact your overall costs, especially for frequent traders.

Deposit methods also differ between the platforms, which may affect your decision depending on your preferred funding options.

KuCoin vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, order types are essential tools that help you execute trades according to your strategy. Both KuCoin and WhiteBIT offer several order types to meet different trading needs.

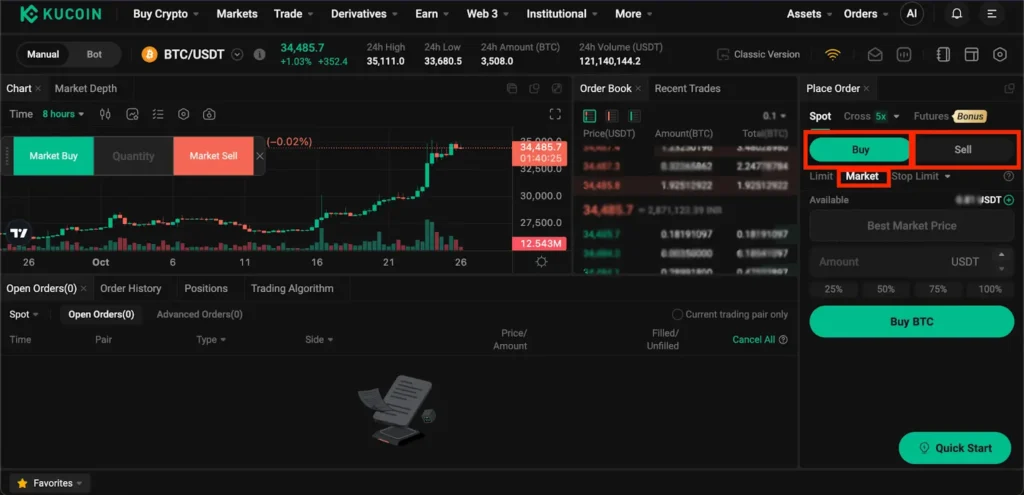

KuCoin provides two primary order types on its spot market: market orders and limit orders. Market orders execute immediately at the current best available price. Limit orders allow you to set a specific price at which you want to buy or sell.

KuCoin also offers advanced order types such as Stop Limit and Stop Market orders. These help you manage risk by triggering trades when prices reach certain levels.

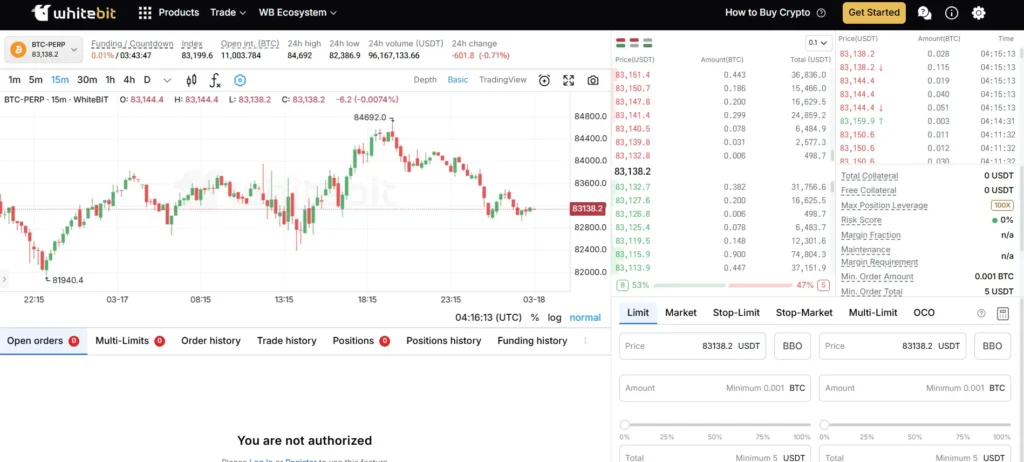

WhiteBIT similarly offers the standard Market and Limit orders for basic trading needs. However, it stands out with its Trailing Stop order functionality. This special order type automatically adjusts your stop price as the market moves in your favor.

The Trailing Stop feature on WhiteBIT can increase your profit potential. It helps you capture more gains during favorable price movements while still providing downside protection.

Both exchanges provide enough order variety for most traders. Beginners may find the basic Market and Limit orders sufficient for their needs.

Advanced traders might appreciate WhiteBIT’s Trailing Stop feature for more sophisticated trading strategies. Meanwhile, KuCoin’s interface organizes these options in a straightforward manner.

Your trading style and risk management approach will determine which platform’s order types better suit your needs.

KuCoin vs WhiteBIT: KYC Requirements & KYC Limits

KuCoin offers more flexibility with KYC verification compared to WhiteBIT. You can withdraw crypto from KuCoin without completing the KYC process, though with lower limits.

For non-KYC KuCoin accounts, withdrawal limits are restricted. Once you complete KYC verification on KuCoin, your withdrawal limits increase significantly, giving you more freedom to move your assets.

WhiteBIT has stricter KYC policies. If you signed up after September 21, 2022, KYC verification is mandatory to use the platform’s full features. Users who registered before this date have more flexibility regarding verification.

Both exchanges use KYC (Know Your Customer) to comply with regulations and prevent fraud. The process typically involves submitting identification documents and personal information.

KYC Comparison Table:

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| Mandatory KYC | No | Yes (after Sept 2022) |

| Non-KYC Withdrawals | Allowed with limits | Limited functionality |

| KYC Process | Identity Verification | Full compliance verification |

| Verification Benefit | Higher withdrawal limits | Full platform access |

WhiteBIT is noted for being fully compliant with KYC regulations, which may provide more security but less privacy than KuCoin’s flexible approach.

Your choice between these exchanges may depend on how important KYC flexibility is to you versus platform features and security.

KuCoin vs WhiteBIT: Deposits & Withdrawal Options

Both KuCoin and WhiteBIT offer several ways to deposit and withdraw funds, but they differ in some important areas.

KuCoin supports cryptocurrency deposits across many networks. You can deposit over 600 different cryptocurrencies to your KuCoin account. For withdrawals, KuCoin charges variable fees depending on the cryptocurrency and network.

WhiteBIT allows crypto deposits too, but also supports fiat currency options that KuCoin doesn’t. You can use bank transfers and some credit/debit card options on WhiteBIT for direct fiat deposits.

Deposit Methods:

- KuCoin: Primarily crypto deposits

- WhiteBIT: Crypto deposits + fiat options (bank transfers, cards)

Withdrawal times vary between the platforms. KuCoin typically processes crypto withdrawals within minutes, but can take longer during high network congestion. WhiteBIT offers similar crypto withdrawal speeds.

For fiat withdrawals, WhiteBIT has an advantage since they support more direct fiat withdrawal options. This can be important if you need to convert your crypto back to traditional currency.

Withdrawal Fees:

| Platform | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| KuCoin | Variable by coin | Limited options |

| WhiteBIT | Variable by coin | Available, fees vary by method |

Both exchanges implement security measures for withdrawals, including email confirmations and 2FA requirements to protect your funds.

KuCoin vs WhiteBIT: Trading & Platform Experience Comparison

KuCoin and WhiteBIT offer different trading experiences that might appeal to various user needs. KuCoin provides a comprehensive platform with multiple trading options including spot, margin, and futures trading.

WhiteBIT’s interface is generally considered more beginner-friendly, with a clean design that makes navigation simpler for new crypto traders. The platform focuses on security and compliance while maintaining an intuitive user experience.

Trading Features Comparison:

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| User Interface | Feature-rich, may be complex | Clean, beginner-friendly |

| Trading Types | Spot, Margin, Futures | Spot, Margin, Futures |

| Mobile App | Yes, well-rated | Yes, basic functionality |

| Compounding | Yes | Limited |

KuCoin’s platform includes more advanced tools for experienced traders, such as detailed charting options and trading bots. This can be valuable if you’re looking to implement complex trading strategies.

WhiteBIT emphasizes security in its platform design, with features that help protect your assets while trading. The exchange has a straightforward order process that makes it accessible to newer users.

Both platforms offer mobile apps so you can trade on the go. KuCoin’s app includes most desktop features, while WhiteBIT’s provides essential functionality for monitoring and executing trades.

Trading fees differ between the platforms, with both offering tiered fee structures based on your trading volume. KuCoin often provides more competitive rates for high-volume traders.

KuCoin vs WhiteBIT: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management strategy. Both KuCoin and WhiteBIT have systems in place to handle positions at risk.

KuCoin uses a tiered liquidation system that gradually reduces your position as it approaches the liquidation price. This gives you some time to react before complete liquidation occurs.

WhiteBIT, on the other hand, employs a more straightforward approach, liquidating positions when they reach predetermined liquidation prices. The platform sends alerts as your position approaches dangerous levels.

Liquidation thresholds comparison:

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| Warning alerts | Yes (multiple stages) | Yes (single warning) |

| Partial liquidation | Yes | No |

| Insurance fund | Yes | Yes |

| Liquidation fees | 0.5-2% | 1-3% |

Both exchanges maintain insurance funds to protect traders from negative balances during extreme market volatility. However, KuCoin’s partial liquidation feature gives traders more flexibility.

The search results mention liquidity risk on both platforms, noting that “some platforms may impose restrictions on withdrawing funds.” This risk applies to both exchanges during high market volatility.

For beginners, WhiteBIT’s simpler liquidation process might be easier to understand, while experienced traders may prefer KuCoin’s more nuanced approach that potentially preserves more of your position.

KuCoin vs WhiteBIT: Insurance

When choosing a cryptocurrency exchange, understanding their insurance policies is crucial for protecting your assets. Both KuCoin and WhiteBIT have different approaches to insurance.

KuCoin maintains an insurance fund called the “Safeguard Fund” to protect users against potential losses. This fund allocates a portion of trading fees to create a safety net in case of security breaches or hacks.

WhiteBIT has been recognized for its security measures, ranking as the second most secure exchange globally as of December 2024 according to Cer.live. Their insurance strategy includes cold storage for most assets and regular security audits.

KuCoin Insurance Features:

- Safeguard Fund for emergency situations

- Partial coverage for potential losses

- Self-insurance model

WhiteBIT Insurance Features:

- Strong focus on preventative security

- Cold storage protection

- Regular third-party security audits

Neither exchange offers complete FDIC-like insurance that covers all user assets. This differs from traditional banking systems where deposits are often insured by government programs.

You should consider keeping large amounts of cryptocurrency in personal wallets rather than on exchanges. As one user mentioned in the search results, they transfer currency to a hardware wallet immediately after purchasing on KuCoin.

The insurance policies of both platforms continue to evolve as the cryptocurrency market matures. Always check their current terms and conditions for the most up-to-date information.

KuCoin vs WhiteBIT: Customer Support

When choosing between KuCoin and WhiteBIT, customer support can be a deciding factor. Both exchanges offer help, but their service quality differs.

WhiteBIT provides more responsive customer support. They offer 24/7 assistance through multiple channels including live chat, email, and a comprehensive help center. Many users report getting answers within minutes through their live chat feature.

KuCoin’s customer support, while available around the clock, can be slower to respond. Some users mention waiting hours or even days for email responses. Their live chat system exists but often directs to automated responses before connecting to a human agent.

Response Time Comparison:

| Exchange | Average Live Chat Response | Average Email Response |

|---|---|---|

| WhiteBIT | 5-10 minutes | 24 hours |

| KuCoin | 30+ minutes | 24-72 hours |

WhiteBIT also offers support in more languages (over 10), while KuCoin primarily supports English and Chinese effectively.

Both exchanges provide extensive FAQs and knowledge bases. You can find tutorials, guides, and answers to common questions without contacting support directly.

If you value quick resolution to problems, WhiteBIT’s more responsive support system might better meet your needs. However, KuCoin’s larger user base means they handle more support requests daily, which may explain some of the delays.

KuCoin vs WhiteBIT: Security Features

When choosing between KuCoin and WhiteBIT, security should be a top priority for your cryptocurrency investments. Both exchanges offer strong protection measures, but they differ in some important ways.

WhiteBIT has gained recognition for its security standards. As of December 2024, it was ranked as the second most secure exchange globally by Cer.live. This shows their commitment to protecting user assets.

The exchange implements several security layers including two-factor authentication (2FA), cold storage for funds, and encryption technologies. These work together to keep your crypto safe from unauthorized access.

KuCoin also prioritizes security with similar features. They use 2FA, multi-layer encryption, and keep most user assets in cold storage away from online threats.

Key Security Features Comparison:

| Feature | KuCoin | WhiteBIT |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Yes | Yes |

| Encryption | Advanced | Advanced |

| Regulatory Compliance | Moderate | Strong |

| Third-Party Security Ratings | Good | Excellent (2nd globally) |

WhiteBIT appears to place additional emphasis on compliance with regulations, which can provide an extra layer of security for your investments.

Both platforms have security teams that monitor for suspicious activities around the clock. This proactive approach helps prevent potential threats before they impact users.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, activating 2FA, and being cautious with account access.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered a legitimate cryptocurrency exchange. It offers standard security features including encryption and two-factor authentication to protect user accounts.

However, KuCoin experienced a major security breach in 2020. This hack raised concerns about its security practices. The good news is that KuCoin has since improved its security measures.

The exchange implements bank-level asset security to protect user funds. This should give you some peace of mind when trading on the platform.

When considering KuCoin’s safety in early 2025, it’s worth noting that some users still recommend caution. Some suggest withdrawing assets if you’re concerned about security risks.

Safety Features:

- Two-factor authentication

- Standard encryption

- Improved security after 2020 hack

- Bank-level asset protection

From a legal standpoint, KuCoin operates globally but lacks regulation in many countries. This creates a gray area regarding its legal status in certain jurisdictions.

You should verify KuCoin’s legal status in your country before using it. Some countries have restrictions on cryptocurrency exchanges that aren’t registered with local financial authorities.

Also Read: Crypto Call & Put Options Explained

The exchange continues to operate and serve millions of users worldwide. If security is your top concern, monitor industry news about KuCoin and consider keeping only trading amounts on the platform.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT has built a strong reputation for security in the cryptocurrency exchange market. It holds an AAA security rating and ranks among the top 3 safest trading platforms according to search results.

The exchange prioritizes user protection by complying with both Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This regulatory compliance helps ensure that your funds and personal information remain secure.

WhiteBIT offers secure storage solutions for your cryptocurrencies, giving you peace of mind when trading or holding assets on the platform.

The exchange is well-established and provides a reliable trading environment. Users benefit from its feature-rich platform that combines security with functionality.

When comparing WhiteBIT to other exchanges like KuCoin, WhiteBIT appears to take a more conservative approach to business operations. This cautious strategy may appeal to traders who prioritize safety over other features.

For legal concerns, WhiteBIT operates as a legitimate cryptocurrency exchange. However, you should always check if the platform is authorized to operate in your specific country or region, as cryptocurrency regulations vary worldwide.

Frequently Asked Questions

Both KuCoin and WhiteBIT have distinct offerings in fees, user experience, cryptocurrency selection, security measures, legal compliance, and customer support. These differences can significantly impact your trading experience.

What are the main differences in trading fees between KuCoin and WhiteBIT?

KuCoin typically charges trading fees of around 0.1% for both makers and takers. This rate can be reduced if you hold KCS tokens or have higher trading volumes.

WhiteBIT’s fee structure starts at 0.1% for makers and 0.1% for takers. The exchange also offers fee discounts based on trading volume and WBT token holdings.

Both platforms provide fee reductions for high-volume traders, but their discount structures differ. WhiteBIT sometimes offers lower fees for certain trading pairs compared to KuCoin.

How do KuCoin and WhiteBIT compare in terms of user experience and interface?

KuCoin features a comprehensive interface with advanced trading tools. The platform may seem complex for beginners but offers depth for experienced traders.

WhiteBIT provides a more streamlined, user-friendly interface. Many users find WhiteBIT easier to navigate when first starting out with cryptocurrency trading.

Both exchanges offer mobile apps, but they differ in layout and functionality. WhiteBIT’s design focuses on simplicity while KuCoin emphasizes feature richness.

Which exchange offers a wider variety of cryptocurrencies, KuCoin or WhiteBIT?

KuCoin lists over 700 cryptocurrencies and 1,100+ trading pairs. This makes it one of the most diverse exchanges for crypto selection.

WhiteBIT offers fewer cryptocurrencies overall, with approximately 350+ tokens available for trading. The exchange focuses more on quality listings than quantity.

If you’re seeking niche altcoins and new token projects, KuCoin typically provides more options. WhiteBIT tends to be more selective with its listings.

What security features distinguish KuCoin from WhiteBIT?

KuCoin implements multi-factor authentication, encryption, and cold storage solutions. The platform has experienced a major hack in the past but fully reimbursed affected users.

WhiteBIT emphasizes its security with regular audits and compliance with international standards. The exchange stores 96% of user assets in cold wallets and has maintained a clean security record.

Both exchanges offer similar security tools for users, including anti-phishing codes and withdrawal protection. WhiteBIT’s lack of security incidents gives it an edge in this category.

Can users from the USA legally trade on KuCoin or WhiteBIT?

KuCoin operates without explicit US regulatory approval. American users can access basic functions but with limitations and potential legal risks.

WhiteBIT explicitly restricts access to users from the United States. The platform’s terms of service prohibit US residents from creating accounts.

Neither exchange is fully compliant with US regulations as of March 2025. US citizens should consider regulated alternatives to avoid potential legal complications.

What are the customer support options available on KuCoin and WhiteBIT?

KuCoin offers 24/7 support through live chat, email, and ticket systems. Response times can vary based on query complexity and platform traffic.

WhiteBIT provides customer support via chat, email, and a comprehensive help center. Many users report faster response times compared to KuCoin.

Both exchanges offer multilingual support, but WhiteBIT is known for having more language options. KuCoin’s larger user base sometimes results in longer wait times for assistance.

WhiteBIT vs KuCoin Conclusion: Why Not Use Both?

Both WhiteBIT and KuCoin offer valuable services to cryptocurrency traders in 2025. While WhiteBIT stands out for its user-friendly interface and security features, KuCoin might be preferred for its wider selection of trading pairs and features.

The best choice depends on your specific needs as a trader. If you prioritize ease of use and robust security, WhiteBIT may be your better option.

If you’re looking for access to a broader range of cryptocurrencies and advanced trading features, KuCoin could be more suitable.

However, many experienced traders don’t limit themselves to just one exchange. Using both platforms allows you to:

- Maximize opportunities across different markets

- Reduce risk by not keeping all assets on one platform

- Take advantage of the unique strengths of each exchange

Consider creating accounts on both exchanges to test their interfaces, fee structures, and available cryptocurrencies firsthand.

You might find that using WhiteBIT for certain trades and KuCoin for others gives you the best trading experience. This approach lets you enjoy the security and simplicity of WhiteBIT alongside the variety and features of KuCoin.

Remember to prioritize security by using strong passwords, enabling two-factor authentication, and only keeping active trading funds on exchanges.

Compare KuCoin and WhiteBIT with other significant exchanges