Wondering how to calculate the right leverage for your trading strategy? A leverage calculator is a valuable tool that helps you determine the required margin capital, leverage ratio, and potential profit for your trades. Whether you’re trading in forex, cryptocurrencies, or stocks, understanding leverage is essential for managing risk and maximizing returns.

With a good leverage calculator, you can quickly see how much capital you need to open positions based on your lot size and the leverage offered by your broker. This information helps you make informed decisions about your trading strategy and avoid the dangers of over-leveraging your positions.

Some calculators even allow you to project returns at different target levels—from conservative to ambitious—while showing you the safe leverage limits that keep you away from liquidation points. This balance between opportunity and risk is what makes leverage calculators indispensable for both new and experienced traders.

Understanding Leverage

Leverage allows traders to control larger positions with a relatively small amount of capital. This financial tool can multiply both potential profits and losses, making it essential to understand before incorporating it into your trading strategy.

Definition of Leverage

Leverage is the ratio between the total value of a position and the actual capital required to open it. For example, with 10:1 leverage, you can control $10,000 worth of assets using just $1,000 of your own money. The remaining amount is effectively borrowed from the broker.

In trading platforms, leverage is typically expressed as a ratio (like 10:1, 50:1, or 100:1) or as a percentage (10%, 2%, or 1% respectively). Different markets offer varying leverage limits:

- Forex: Often 50:1 to 500:1

- Stocks: Usually 2:1 to 5:1

- Cryptocurrencies: Commonly 2:1 to 100:1

The required margin capital decreases as leverage increases. With 100:1 leverage, you only need to deposit 1% of the total position value.

Principles of Leveraged Trading

Leveraged trading works through margin accounts that allow you to borrow funds from your broker. Your initial deposit serves as collateral for these borrowed funds.

The key components of leveraged trading include:

- Margin requirement: The minimum amount needed in your account to open and maintain positions

- Liquidation point: The price level at which your broker may close your position to prevent further losses

- Leverage ratio: Determines how much buying power you have relative to your capital

For example, with $1,000 and 20:1 leverage, you can open positions worth up to $20,000. However, this means price movements have a magnified effect on your account balance.

Most brokers implement automatic liquidation systems to protect themselves when your account equity falls below the required margin level.

Advantages and Risks of Using Leverage

Advantages:

- Capital efficiency: Control larger positions without committing all your capital

- Amplified returns: Potentially earn higher profits from smaller price movements

- Diversification: Spread your capital across more assets or markets

- Hedging opportunities: Protect existing investments without liquidating them

Risks:

- Magnified losses: Losses are amplified just as much as gains

- Margin calls: You may need to deposit additional funds if positions move against you

- Liquidation risk: Brokers can close positions automatically when equity falls too low

- Psychological pressure: Higher stakes can lead to emotional trading decisions

To use leverage responsibly:

- Start with lower leverage ratios (3:1 or 5:1)

- Always use stop-loss orders

- Never risk more than 1-2% of your account on a single trade

- Calculate your potential loss before opening positions

Components of a Leverage Calculator

A leverage calculator helps traders make informed decisions by calculating the amount of capital needed for trades and potential returns. The calculator consists of several key components that work together to provide accurate leverage calculations.

Margin Requirement

Margin requirement represents the amount of capital you need to deposit to open and maintain a position. This component is crucial as it determines how much of your own money you must commit to a trade.

Most brokers express margin requirements as a percentage of the total position value. For example, a 2% margin requirement means you need to deposit $2,000 to control a $100,000 position.

Margin requirements vary based on:

- The asset class (forex, stocks, crypto)

- Your broker’s policies

- Market volatility

- Regulatory requirements

Understanding margin requirements helps you avoid margin calls and liquidations. When markets move against your position, your account equity can fall below the required margin, forcing the broker to close your positions.

Trade Size

Trade size refers to the total volume or value of the position you wish to open. This component directly affects the amount of leverage applied to your trade.

Trade sizes are measured differently across markets:

- Forex: Measured in lots (standard = 100,000 units, mini = 10,000, micro = 1,000)

- Stocks: Measured in shares or contract value

- Crypto: Measured in coins or contract value

The formula to calculate the actual leverage used is:

Actual Leverage = Position Size / Account Equity

Larger trade sizes require more margin capital when using the same leverage. For example, trading 1 standard lot of EUR/USD (€100,000) at 100:1 leverage requires $1,000 in margin.

Currency Pair

For forex traders, the currency pair component is essential as it affects pip values, margin requirements, and potential volatility of your trades.

Different currency pairs have:

- Varying pip values: Major pairs like EUR/USD have different pip values than exotic pairs

- Different margin requirements: Exotic or volatile pairs often require higher margins

- Distinct volatility profiles: Some pairs move more predictably than others

The currency pair also determines the contract specifications in your leverage calculator. For instance, EUR/USD has a standard lot size of 100,000 euros, while USD/JPY has a standard lot size of 100,000 US dollars.

When calculating leverage for cross pairs (pairs not involving USD), your calculator must account for additional conversion factors.

Account Currency

Your account currency impacts how the leverage calculator displays results and calculates margins. This component converts all values to your base currency for consistent measurement.

If your account currency differs from the base currency of the pair you’re trading, the calculator must:

- Convert margin requirements to your account currency

- Account for exchange rate fluctuations

- Calculate profit/loss in your account currency

For example, if you trade GBP/JPY with a USD-denominated account, the calculator converts all values to USD.

Some advanced leverage calculators also factor in:

- Overnight funding costs based on your account currency

- Commission calculations in your base currency

- Slippage estimates when converting between currencies

How to Use a Leverage Calculator

Leverage calculators help traders determine potential profits and manage risk when using borrowed funds. These tools simplify complex calculations so you can make informed trading decisions quickly.

Inputting Data

To use a leverage calculator, you’ll need to provide several key pieces of information. Start by entering your entry price (the price at which you buy) and your exit price (the expected selling price). Next, input your position size, which is the amount of money you’re investing.

Select the leverage ratio you plan to use. This is typically shown as a ratio like 5:1, 10:1, or 50:1, depending on your broker and trading strategy. Some calculators may also ask for your account currency and the specific currency pair you’re trading.

Make sure all information is accurate before proceeding. Even small errors can lead to significant miscalculations in your projected profits or losses.

Interpreting Results

Once you’ve entered all required data, the calculator will display several important metrics. The primary result is your potential profit (or loss) based on the leverage ratio. This shows how much you stand to gain or lose from the trade.

Many calculators also show your liquidation point – the price at which your position would be automatically closed due to insufficient margin. Pay close attention to this number to avoid unexpected liquidations.

Some advanced calculators provide additional information such as:

- Required margin amount

- Return on investment percentage

- Risk-to-reward ratio

- Maximum drawdown estimates

Use these results to determine if your leverage is appropriate for your risk tolerance. Higher leverage increases both potential profits and potential losses.

Examples of Leverage Calculations

Let’s look at how leverage works in real trading scenarios. These examples will show you how leverage affects your trading positions and potential profits in different markets.

Forex Trading Scenario

Imagine you want to trade the EUR/USD currency pair which is currently at 1.0500. You have $1,000 in your trading account and want to open a position worth $10,000.

To calculate your leverage:

- Position size: $10,000

- Your capital: $1,000

- Leverage needed: 10:1 (or 10×)

With 10:1 leverage, you only need to put up $1,000 as margin to control a $10,000 position. If EUR/USD rises by 1% to 1.0605, your profit would be $100 (1% of $10,000).

But leverage works both ways. If the price falls by 1%, you would lose $100, which is 10% of your capital due to the leverage effect.

Stock Market Application

When trading stocks with leverage, the calculations work similarly but with different typical ratios. Let’s say you want to buy shares worth $20,000 with $5,000 of your own capital.

Your leverage ratio would be:

- Total position: $20,000

- Your capital: $5,000

- Leverage: 4:1

With this 4:1 leverage, a 5% increase in the stock price would result in a $1,000 profit (5% of $20,000), which represents a 20% return on your $5,000 investment.

Remember that most brokers charge interest on borrowed funds for stock trading, which affects your overall returns. This interest cost must be factored into your profit calculations.

Best Practices for Leverage Management

Managing leverage effectively requires careful planning, consistent monitoring, and disciplined execution. The right approach can help you maximize potential returns while keeping risks under control.

Assessing Your Risk Tolerance

Your risk tolerance is the foundation of leverage management. Start by honestly evaluating how much loss you can realistically withstand without affecting your financial stability. Consider both your financial capacity and your emotional response to market fluctuations.

Use this simple formula to determine your maximum risk per trade:

- Account size × Risk percentage = Maximum risk per trade

- Example: $10,000 × 2% = $200 maximum risk per trade

Different leverage levels suit different risk profiles. Conservative traders typically use 1:1 to 1:5 leverage, while moderate traders might use 1:10. Avoid using the maximum leverage offered by brokers (often 1:100 or more), as this dramatically increases your exposure.

Your experience level should also influence your leverage choices. Beginners should use minimal leverage until they gain more market experience.

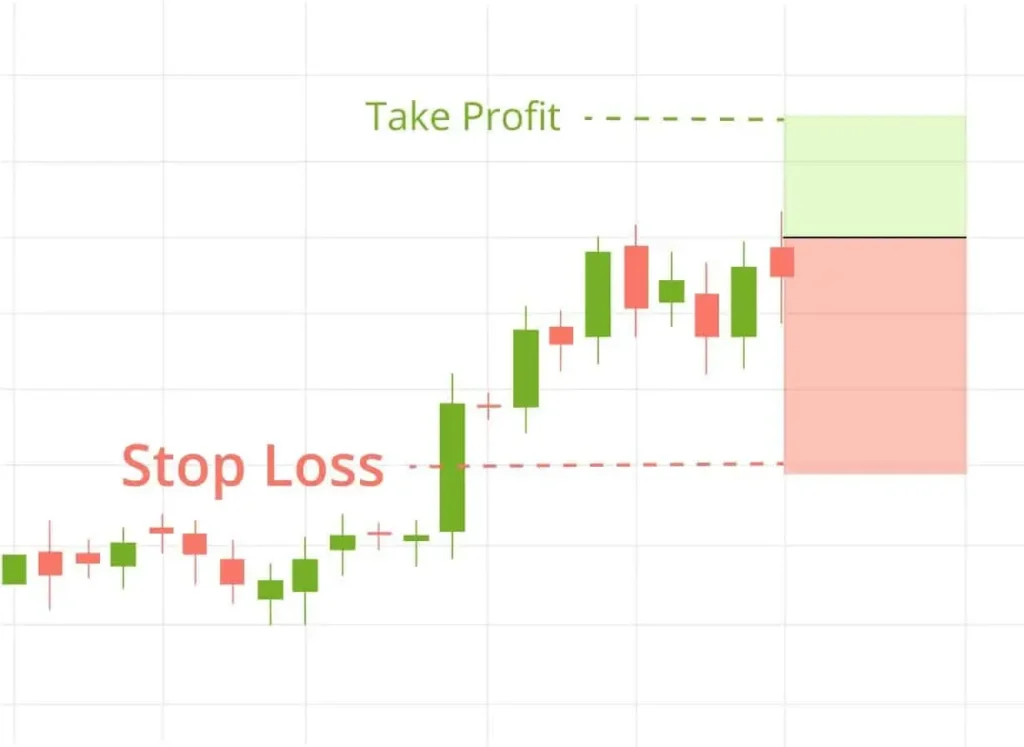

Establishing Stop-Loss Orders

Stop-loss orders are your safety net when using leverage. They automatically close positions when prices reach predetermined levels, limiting potential losses.

Always set stop-loss orders before entering leveraged positions. Calculate your stop-loss point based on:

- Technical levels (support/resistance)

- Percentage of capital you’re willing to risk

- Market volatility indicators

For example, if you’re risking 2% of a $10,000 account on a position with 5:1 leverage, your stop-loss should be placed to limit losses to $200.

Consider using trailing stops that move with profitable positions. This locks in gains while still allowing room for further price movement in your favor.

Regular Monitoring and Adjustments

Leveraged positions require active management. Check your positions daily, or more frequently in volatile markets. Key metrics to monitor include:

- Current leverage ratio

- Account equity percentage

- Distance to stop-loss points

- Overall market conditions

Adjust your leverage levels based on changing market conditions and your trading performance. During high volatility, reduce leverage to limit risk exposure.

Create a leverage management schedule. For example, review positions every morning, adjust stop-losses as needed, and evaluate overall leverage once weekly. Document your decisions to learn from both successful and unsuccessful trades.

When your account grows, resist the temptation to increase leverage proportionally. Instead, maintain consistent risk parameters while gradually increasing position sizes.

Also Read: Best Crypto Options Brokers

Frequently Asked Questions

Leverage calculations vary across different trading platforms and financial instruments. These common questions address specific scenarios traders face when determining appropriate leverage levels for their investments.

How do you determine the leverage ratio in forex trading?

To determine your leverage ratio in forex trading, divide the total value of your position by your margin. For example, if you open a $10,000 position with $1,000 of your own money, your leverage ratio is 10:1.

The formula is: Leverage Ratio = Total Position Value ÷ Margin Used.

Many forex brokers offer leverage ranging from 1:10 to 1:500, depending on your account type and location.

What steps are involved in calculating leverage for cryptocurrency investments?

First, determine how much of your own capital you’re willing to invest. Next, decide what position size you want to open based on your risk tolerance.

Divide your desired position size by your investment amount to find your leverage ratio. For example, if you want to open a $5,000 position with $1,000, you need 5x leverage.

Always check your chosen exchange’s liquidation thresholds before selecting your leverage ratio.

When using 1:500 leverage, how does one compute the potential profit or loss?

With 1:500 leverage, your potential profit or loss is magnified 500 times. To calculate potential profit, multiply the number of pips gained by your position size and the pip value.

For potential loss, do the same calculation with the number of pips lost. For example, with $100 and 1:500 leverage, you control $50,000 in the market.

A 10-pip gain might equal $50 profit, while a 10-pip loss equals $50 loss.

What is the process for calculating leverage using the Binance platform?

On Binance, select the futures trading section and choose your desired trading pair. Enter your position size and scroll down to see the leverage slider.

Adjust the leverage slider to your preferred ratio. Binance will automatically display your required margin, liquidation price, and potential profit/loss based on your selections.

Remember that Binance limits leverage based on your account tier and the specific cryptocurrency you’re trading.

How can investors calculate the impact of 20x leverage on their initial capital?

With 20x leverage, each 1% price move in your favor increases your capital by 20%. Similarly, each 1% move against you decreases your capital by 20%.

To calculate potential returns, multiply your percentage gain by 20. For example, a 5% price increase with 20x leverage yields a 100% return on your initial capital.

Be careful though – a 5% move against you could result in a 100% loss of your investment.

What methodologies are applied in calculating leverage for a $10,000 investment?

For a $10,000 investment, first determine your risk tolerance and the position size you wish to control. If you want to control $50,000 in the market, you need 5x leverage.

Calculate your margin requirement by dividing your position size by your leverage ratio. With $10,000 and 5x leverage, you can open a $50,000 position.

Always account for fees and potential liquidation levels when planning your trade with leverage.

Explore these crypto option trading exchanges: