Looking for the right crypto exchange? MEXC and BloFin offer different advantages for traders in 2025. As you compare these platforms, understanding their unique features can help you make a better decision.

MEXC stands out with competitive fees and a wide selection of cryptocurrencies, making it a versatile choice if you want to explore various trading options. Meanwhile, BloFin focuses more on security measures and specializes in futures trading with fewer spot pairs than MEXC.

Your trading goals should guide your choice between these exchanges. MEXC might be better if you want variety in crypto options and trading pairs. BloFin could be preferable if futures trading is your priority and you value enhanced security protocols, including their VIP-level protection features.

MEXC Vs BloFin: At A Glance Comparison

When choosing between MEXC and BloFin for your crypto trading needs, understanding their key differences can help you make the right decision.

Trading Features

| Feature | MEXC | BloFin |

|---|---|---|

| Trading Volume | Higher (1st largest non-KYC futures platform) | Lower (2nd largest non-KYC futures platform) |

| Security Measures | Standard | Rigorous security protocols |

| User Interface | Comprehensive | VIP-oriented experience |

Fee Structure

Both platforms offer competitive fee structures, but they may vary based on your trading volume and membership level.

MEXC has been in the market longer and typically shows stronger volume correlation with major exchanges. This can mean more liquidity for your trades and potentially tighter spreads.

BloFin stands out with its emphasis on security measures, making it potentially more appealing if safety is your top priority. The platform also offers a VIP-oriented experience that might benefit high-volume traders.

Prior to recent times, BloFin’s price movements were fairly correlated with MEXC, but some divergence has been noted recently.

Accessibility

Both exchanges operate as non-KYC platforms, meaning you can trade without extensive identity verification. This provides greater privacy but may limit certain features or withdrawal amounts.

Also Read: Are Crypto Options Legal in the US? Current Regulations and Trading Status

You should consider which specific cryptocurrencies you want to trade, as listing differences exist between the two platforms.

MEXC Vs BloFin: Trading Markets, Products & Leverage Offered

MEXC and BloFin offer different trading options for crypto investors. Let’s compare what each platform provides.

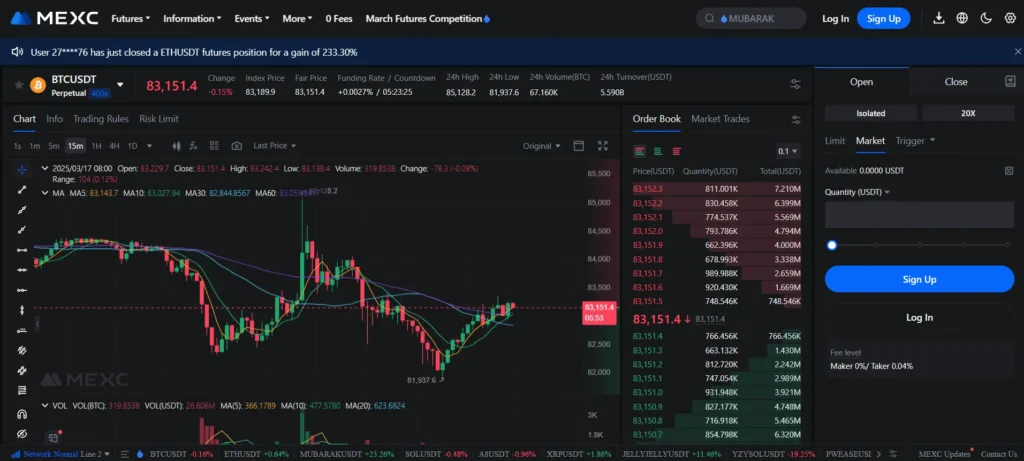

MEXC supports a wide variety of cryptocurrencies across its trading markets. The platform features spot trading, futures trading, and margin trading options. MEXC’s futures platform allows traders to use up to 200x leverage on certain trading pairs.

BloFin, while newer to the market, provides competitive trading options with a focus on derivatives trading. The platform offers futures contracts and has been expanding its spot market offerings.

Leverage Comparison:

- MEXC: Up to 200-400x leverage (depending on trading pairs)

- BloFin: Competitive leverage options for futures trading

Trading Products:

| Feature | MEXC | BloFin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | Limited |

| Copy Trading | Limited | ✓ |

MEXC stands out with its robust trading engine that can process up to 1.4 million transactions per second. This gives you faster execution when markets move quickly.

Both exchanges offer mobile apps so you can trade on the go. The interfaces differ slightly, with MEXC offering more advanced charting tools for technical analysis.

If you’re looking for variety, MEXC offers more trading pairs overall. However, BloFin has been rapidly adding new coins and trading options to remain competitive in the market.

MEXC Vs BloFin: Supported Cryptocurrencies

When choosing between MEXC and BloFin, the variety of cryptocurrencies available is a key factor to consider for your trading needs.

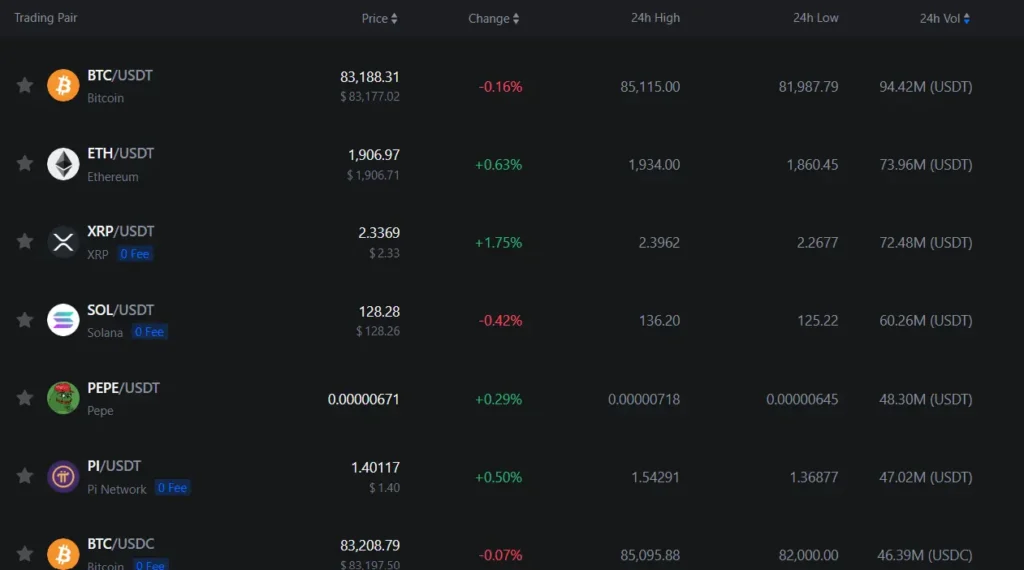

MEXC offers an impressive selection with over 242 coins and 374 trading pairs. This wide range gives you plenty of options for diversifying your crypto portfolio.

BloFin also provides a diverse range of supported cryptocurrencies, though specific numbers aren’t mentioned in the search results. The platform is known for its strong security measures and solid reputation in the crypto community.

Both exchanges support major cryptocurrencies, but MEXC might give you more options if you’re looking to trade less common altcoins.

For futures trading, both platforms are significant players. BloFin is noted as the second-largest non-KYC futures platform, while MEXC holds the top position in this category.

Your choice may depend on which specific cryptocurrencies you want to trade. If you’re focusing on popular coins, either exchange should meet your needs.

It’s worth checking each platform’s current listings before deciding, as supported cryptocurrencies can change as the market evolves.

Consider how important variety is to your trading strategy. If you plan to trade many different coins, MEXC’s larger selection might be more suitable for your needs.

MEXC Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and BloFin exchanges, understanding their fee structures can help you make the best decision for your trading needs.

MEXC Trading Fees:

- Flat trading fee: 0.20% per transaction

- Futures trading: 0.01% maker and 0.04% taker fees (among the lowest in the industry)

BloFin Trading Fees:

- BloFin’s trading fees are competitive, though not as low as MEXC for futures trading

Withdrawal Fees:

- MEXC: 0.0005 BTC for Bitcoin withdrawals, which is better than many competitors

- BloFin: Offers reasonable withdrawal fees, though specific rates aren’t detailed in the search results

Both exchanges aim to keep their fee structures competitive in the crypto market. MEXC particularly stands out for its futures trading fees, which are among the lowest available in 2025.

Your choice between these platforms might depend on the specific cryptocurrencies you trade and your trading frequency. High-volume traders might benefit more from MEXC’s lower futures fees.

Remember to consider other factors beyond fees when selecting an exchange, such as available trading pairs, security features, and user interface. The right choice depends on your individual trading goals and preferences.

MEXC Vs BloFin: Order Types

When trading crypto, the types of orders available can make a big difference in your strategy. Both MEXC and BloFin offer several order types to help you manage your trades effectively.

BloFin provides advanced order types including limit, market, and stop orders. The platform features advanced charting tools that make it easier to set precise entry and exit points for your trades.

MEXC also offers standard order types like market and limit orders. Additionally, they provide stop-limit orders and trailing stop orders for more sophisticated trading strategies.

Here’s a comparison of order types available on both platforms:

| Order Type | BloFin | MEXC |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop Order | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| Trailing Stop | Limited | ✓ |

| OCO (One-Cancels-Other) | ✓ | ✓ |

BloFin seems to focus more on futures trading, with order types designed specifically for this purpose. Their advanced charting makes it easier to execute precise trades.

MEXC offers a wider range of spot trading pairs with versatile order types. You can use these tools to automate parts of your trading strategy.

Both platforms allow you to set take-profit and stop-loss levels to manage risk. This helps protect your investments from significant market downturns.

MEXC Vs BloFin: KYC Requirements & KYC Limits

MEXC stands out as a global crypto exchange that doesn’t make KYC verification mandatory for all users. This allows you to start trading quickly without submitting identity documents in many cases.

BloFin, on the other hand, requires completion of a Know Your Customer (KYC) process before you can use their services. This verification confirms your identity and helps ensure regulatory compliance.

MEXC KYC Structure:

- Basic trading is possible without KYC

- Higher withdrawal limits require completing verification

- Popular with users seeking privacy or faster onboarding

BloFin KYC Structure:

- Mandatory KYC before trading

- Identity verification required for all accounts

- More stringent compliance approach

The difference in KYC requirements creates a clear distinction between these exchanges. If you value quick access and privacy, MEXC’s flexible approach might appeal to you.

For daily limits, MEXC allows unverified users to withdraw limited amounts, while verified users enjoy higher limits. BloFin’s limits are only available after completing their verification process.

Your choice should depend on your priorities. MEXC offers more flexibility and privacy, while BloFin emphasizes security and regulatory compliance through mandatory verification.

Remember that regulations change frequently in the crypto space. Withdrawal limits and verification requirements might be updated by either platform as compliance standards evolve.

MEXC Vs BloFin: Deposits & Withdrawal Options

When choosing between MEXC and BloFin, their deposit and withdrawal options can significantly impact your trading experience.

MEXC offers a variety of deposit methods including cryptocurrency transfers and some fiat options through third-party payment processors. Their withdrawal fees are relatively competitive, with Bitcoin withdrawals costing around 0.0005 BTC.

MEXC supports a wide range of cryptocurrencies for both deposits and withdrawals, giving you flexibility when moving funds in and out of the platform.

BloFin also provides cryptocurrency deposit options but may have a more limited selection compared to MEXC. Their withdrawal fee structure is comparable to industry standards, though specific rates vary by cryptocurrency.

Both exchanges process withdrawal requests within 24 hours, but actual processing time depends on network congestion and verification requirements.

| Feature | MEXC | BloFin |

|---|---|---|

| Crypto Deposit Options | Extensive | Good |

| Fiat Options | Limited third-party | Limited |

| BTC Withdrawal Fee | 0.0005 BTC | Competitive |

| Processing Time | 24 hours (typical) | 24 hours (typical) |

Security measures for deposits and withdrawals are robust on both platforms, with two-factor authentication and withdrawal address whitelisting available to protect your funds.

Both exchanges implement verification steps for larger withdrawals as an additional security measure to protect your assets.

MEXC Vs BloFin: Trading & Platform Experience Comparison

When choosing between MEXC and BloFin for your crypto trading needs, the platform experience plays a crucial role in your decision.

User Interface

MEXC offers a user-friendly interface on both web and mobile applications. The trading platform features clear buy/sell options and intuitive navigation. BloFin also provides a clean interface, though some users find it slightly more complex than MEXC.

Trading Tools

| Feature | MEXC | BloFin |

|---|---|---|

| Charts | Advanced | Advanced |

| Order Types | Multiple | Multiple |

| Mobile App | Yes | Yes |

| API Access | Yes | Yes |

MEXC currently stands as the largest non-KYC futures platform in terms of volume. BloFin ranks as the second largest in this category, making both viable options for traders seeking privacy.

The trading experience on MEXC tends to be more fluid with higher liquidity across various trading pairs. This means you can enter and exit positions more easily during volatile market conditions.

BloFin offers competitive features but sometimes shows different price action compared to MEXC. Before the recent period, their price movements were fairly correlated.

Performance

- MEXC typically handles high traffic better during market volatility

- BloFin provides good execution speeds but with occasionally lower volume

- Both platforms offer leverage trading options

For new traders, MEXC’s clearer interface might provide an easier entry point. Experienced traders may appreciate specific features on either platform depending on their trading strategy.

MEXC Vs BloFin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for managing your risk. Both MEXC and BloFin have specific liquidation mechanisms to protect their platforms during volatile market conditions.

MEXC employs a forced liquidation system that triggers when your margin ratio falls below the maintenance margin level. This happens when market movements go against your position and your account can no longer support the open trades.

BloFin, primarily focused on futures trading, implements a similar but distinct liquidation process. Their system is designed with rigorous security measures that monitor positions continuously.

Key differences between the two platforms:

| Feature | MEXC | BloFin |

|---|---|---|

| Liquidation Warning | Provides alerts as you approach margin thresholds | Offers VIP-tier specific notifications |

| Leverage Limits | Up to 200x on major cryptocurrencies | More conservative leverage options |

| Partial Liquidation | Available to help preserve some position value | Implemented to reduce total loss scenarios |

MEXC’s higher leverage of up to 200x on Bitcoin and Ethereum means potentially faster liquidations during sharp market moves. You should be especially careful when using maximum leverage.

BloFin’s more rigorous security approach might provide better protection against unexpected liquidations, though specific details about their exact liquidation formula aren’t widely published.

Both platforms aim to close positions before they become negative, but the exact timing and method can impact your trading outcomes significantly.

MEXC Vs BloFin: Insurance

When comparing MEXC and BloFin, insurance is a crucial factor to consider for your crypto security.

BloFin offers strong security measures including insurance protection for users’ assets. Their insurance fund helps cover potential losses during extreme market volatility or security incidents.

MEXC also provides an insurance mechanism, primarily focused on their futures trading platform. This helps protect traders from auto-liquidations during severe market fluctuations.

Insurance Coverage Comparison:

| Feature | BloFin | MEXC |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Scope | Broader asset protection | Primarily futures trading |

| Security Focus | VIP-level security measures | Standard protection systems |

BloFin appears to prioritize rigorous security measures as part of their insurance strategy. Their VIP-focused approach aims to provide comprehensive protection for your assets.

MEXC’s insurance tends to be more specialized toward specific trading products. Their system helps maintain market stability during high volatility periods.

Neither exchange guarantees complete protection against all risks. You should review their most current insurance policies before making significant deposits.

Remember to consider insurance as just one factor in your decision. Trading fees, available cryptocurrencies, and platform features should also influence your choice between MEXC and BloFin.

MEXC Vs BloFin: Customer Support

When choosing between MEXC and BloFin, customer support is a crucial factor to consider for your crypto trading experience.

MEXC Customer Support offers 24/7 assistance, giving you round-the-clock access to help whenever you need it. This constant availability can be particularly valuable in the fast-paced crypto market where issues may arise at any hour.

BloFin Customer Support provides assistance through two main channels: live chat and email support. Their system is designed to be responsive, though the search results don’t specify if they offer 24/7 service like MEXC.

Both platforms understand the importance of responsive customer service in the cryptocurrency exchange space. When you encounter problems with deposits, withdrawals, or trading functions, quick resolution becomes essential.

The quality of customer support can significantly impact your trading experience. You may want to test each platform’s responsiveness before committing to large trades.

Consider these factors when evaluating support quality:

- Response time during different hours

- Knowledge level of support agents

- Available communication channels

- Language support options

- Self-help resources like FAQs and guides

Remember that customer support experiences can vary based on the complexity of your issue and current platform traffic. Testing both platforms with a small inquiry might give you a practical sense of their support quality.

MEXC Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both MEXC and BloFin offer strong security features, but with some key differences.

MEXC implements anti-phishing codes in their communications to protect you from scam attempts. This is similar to the system used by Binance and helps prevent unauthorized access to your account.

BloFin is known for its rigorous security measures. The platform stands out with its VIP-level security protocols designed to protect user assets and personal information.

Both exchanges offer two-factor authentication (2FA), which adds an extra layer of security to your account. This means you’ll need both your password and a temporary code to log in.

Key Security Features Comparison:

| Feature | MEXC | BloFin |

|---|---|---|

| Anti-phishing codes | ✓ | Limited info |

| Two-factor authentication | ✓ | ✓ |

| Security level | Standard | Rigorous/VIP |

| Fund protection | Standard | Enhanced |

BloFin appears to place a stronger emphasis on security, with what they describe as VIP-level security measures. This might be appealing if you prioritize maximum protection for your crypto assets.

MEXC offers reliable security features that should satisfy most traders, with its anti-phishing system being a notable strength to protect you from common crypto scams.

You should consider enabling all available security features regardless of which platform you choose.

Is MEXC Safe & Legal To Use?

MEXC Global prioritizes security and compliance with international standards. The platform emphasizes user verification through KYC (Know Your Customer) processes to enhance security for all users.

For legal status, MEXC operates in many countries worldwide but has limitations in some regions. As of March 2025, MEXC is not available for users in the United States due to regulatory constraints.

The exchange implements several security measures to protect your assets:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Regular security audits

- Anti-phishing codes

MEXC has been operating since 2018, building a reputation for reliability in the cryptocurrency market. Their compliance team works to keep the platform aligned with evolving regulations in the crypto space.

When using MEXC, you should be aware of your local laws regarding cryptocurrency trading. Some countries have strict regulations or outright bans on crypto trading.

You should complete the KYC verification process on MEXC to unlock full platform functionality and higher withdrawal limits. This step also helps protect your account from unauthorized access.

For maximum security, always use strong passwords and enable all available security features when trading on MEXC.

Is BloFin Safe & Legal To Use?

BloFin implements several security measures to create a secure trading environment. The platform works to prevent fraud and follows legal standards, which helps protect users’ assets and information.

However, BloFin operates across multiple jurisdictions, which creates some legal complexities. The platform may not fully comply with all global regulations, making its legal status vary depending on your location.

If you’re considering using BloFin, you should check whether it’s authorized to operate in your country. Some regions have strict cryptocurrency exchange regulations that may restrict access to platforms like BloFin.

BloFin is considered the second largest non-KYC futures platform after MEXC. Non-KYC means you can trade without completing full identity verification processes. This offers privacy but might raise legal questions in countries requiring strict identity checks.

The platform’s security appears generally reliable based on available information. However, as with any crypto exchange, you should use strong passwords, enable two-factor authentication, and avoid keeping large amounts of assets on the exchange long-term.

For the safest experience:

- Research your local cryptocurrency regulations

- Use security features offered by the platform

- Consider the risks of using non-KYC exchanges

- Only invest funds you can afford to lose

Frequently Asked Questions

Traders comparing MEXC and BloFin often have specific concerns about security, fees, features, and user experience. These questions address key differences between the exchanges to help you make an informed choice.

What security measures do MEXC and BloFin have in place to protect user funds?

MEXC employs multi-signature wallets and cold storage solutions to safeguard the majority of user funds offline. They also use two-factor authentication (2FA) and advanced encryption protocols to protect accounts.

BloFin implements similar security measures with cold storage for assets and mandatory 2FA for all accounts. They also conduct regular security audits and have insurance coverage for certain types of losses.

Both exchanges have risk management systems that monitor for suspicious activities. Neither has experienced major security breaches, though MEXC has been operating longer with a more established security track record.

How do trading fees compare between MEXC and BloFin?

MEXC offers a tiered fee structure based on 30-day trading volume and MX token holdings. Spot trading fees start at 0.2% for makers and takers, with discounts available when paying with MX tokens.

BloFin generally charges competitive fees that are slightly lower than industry averages. Their fee structure also includes discounts for higher trading volumes and platform token holders.

MEXC provides more fee reduction options through their loyalty program. BloFin offers occasional zero-fee trading promotions for specific trading pairs to attract new users.

What are the main features and tools provided by MEXC and BloFin for traders?

MEXC offers spot trading, futures, margin trading, and staking options. Their platform includes advanced charting tools, API access for algorithmic trading, and a mobile app with most desktop features.

BloFin provides similar core trading options but stands out with their user-friendly trading interface. They offer customizable charts, real-time market data, and portfolio tracking tools.

MEXC has more advanced features for experienced traders, including grid trading bots. BloFin focuses on creating intuitive tools that help newer traders understand market movements and manage risks effectively.

How does the customer support experience differ between MEXC and BloFin?

MEXC provides 24/7 customer support through live chat, email, and an extensive FAQ section. Their support team is known for responding quickly, typically within hours for most inquiries.

BloFin also offers round-the-clock support with multiple contact channels. Their support team is generally responsive, though sometimes with slightly longer wait times during peak periods.

MEXC has more language options for international users. BloFin compensates with more detailed guides and tutorials to help users solve common issues independently.

What range of cryptocurrencies can be traded on MEXC and BloFin?

MEXC supports over 1,500 cryptocurrencies and 2,100+ trading pairs, making it one of the most comprehensive exchanges for token variety. They frequently list new tokens soon after launch.

BloFin offers fewer cryptocurrencies overall but still covers all major coins and many promising altcoins. Their selection process tends to be more selective, focusing on established projects.

MEXC is better for traders seeking exposure to new, low-cap projects. BloFin might be preferable for those who want a more curated selection of vetted cryptocurrencies.

How user-friendly are the interfaces of MEXC and BloFin for new traders?

BloFin’s interface is designed with simplicity in mind, making it accessible for beginners. The dashboard clearly displays essential information, and trading processes are streamlined with helpful tooltips.

MEXC has a feature-rich interface that can initially seem overwhelming to newcomers. However, they offer basic and advanced views to accommodate different experience levels.

BloFin provides more guided onboarding for first-time cryptocurrency traders. MEXC offers more customization options that experienced traders appreciate but might confuse beginners.

BloFin Vs MEXC Conclusion: Why Not Use Both?

After comparing BloFin and MEXC, you might wonder which platform to choose. The answer could be to use both exchanges for different purposes.

BloFin shines as a futures exchange with specialized trading options. If you’re interested in futures trading, BloFin offers a focused environment for these more complex transactions.

MEXC, on the other hand, provides a wider variety of spot trading pairs. This makes it better suited for day-to-day cryptocurrency purchases and sales across many different coins.

Benefits of using both platforms:

- Access to more trading options

- Ability to spread your risk across exchanges

- Take advantage of different fee structures

- Capitalize on unique features from each platform

Security is important on both platforms. MEXC uses anti-phishing codes in their communications to protect users from scams, similar to security measures used by Binance.

Your trading style and goals should guide your choice. If you’re a casual trader, MEXC might be sufficient. For more advanced trading strategies, having accounts on both platforms gives you more flexibility.

Remember that trading volumes differ between the exchanges, which can affect liquidity and pricing. Using both platforms allows you to find the best prices for your trades.

Compare MEXC and BloFin with other significant exchanges