Choosing between MEXC and KuCoin can be confusing if you’re looking for a crypto exchange. Both platforms offer various trading options, but they have key differences that might make one better for your needs.

MEXC offers higher leverage trading and lower fees for perpetual contracts compared to KuCoin, while KuCoin provides a more beginner-friendly interface with better educational resources. If you’re new to crypto trading, KuCoin’s intuitive design might help you get started more easily. However, experienced traders might prefer MEXC for its wider selection of coins and trading pairs.

The right choice depends on what you value most. If you want more cryptocurrency options and don’t mind a steeper learning curve, MEXC could be your better option. If you prefer ease of use and strong customer support, KuCoin might be the exchange for you. Both platforms have their own bonus structures and features that could benefit different types of traders.

MEXC Vs KuCoin: At A Glance Comparison

MEXC and KuCoin are popular cryptocurrency exchanges that offer similar services but with some key differences.

Trading Options & Leverage

- MEXC offers up to 200x leverage on futures trading

- KuCoin provides maximum 100x leverage

- Both support spot trading, margin trading, and futures

Cryptocurrency Selection

- MEXC: Approximately 2,960 coins available

- KuCoin: Large selection but fewer than MEXC

- Both exchanges are known for listing newer, smaller cryptocurrencies

Fee Structure

- MEXC: Zero fees on some spot trading pairs, 0.1% on others, 0.01/0.05% for futures

- KuCoin: Generally competitive fees but slightly higher than MEXC for similar services

Trading Platform Experience

Both exchanges offer mobile apps and web platforms with various trading tools. MEXC appears to have advantages for high-leverage traders while KuCoin is often praised for its user interface.

Also Read: Are crypto options halal or haram?

Security & Reliability

Both exchanges implement standard security measures including two-factor authentication and cold storage of funds.

When choosing between these exchanges, consider your specific needs. If you’re looking for maximum leverage or the widest selection of coins, MEXC might be your better option. If you value a more established platform with a strong reputation, KuCoin could be more suitable.

The best exchange for you depends on your trading style, risk tolerance, and which specific cryptocurrencies you want to trade.

MEXC Vs KuCoin: Trading Markets, Products & Leverage Offered

Both MEXC and KuCoin offer diverse trading options, but they differ in key areas that might influence your choice.

MEXC stands out with its massive selection of 2,960 cryptocurrencies, which exceeds KuCoin’s already impressive range. This gives you more options for trading altcoins and emerging tokens.

When it comes to leverage trading, MEXC clearly takes the lead. The platform offers up to 200x leverage for major pairs like BTC and ETH, while KuCoin provides lower leverage limits for the same pairs.

Fee Comparison:

| Exchange | Spot Trading Fees | Perpetual Futures Fees |

|---|---|---|

| MEXC | 0-0.1% | 0.01-0.05% |

| KuCoin | Higher than MEXC | Higher than MEXC |

MEXC also offers zero fees on certain spot trading pairs, making it potentially more cost-effective for frequent traders.

KuCoin compensates with more advanced trading features. You’ll find trading bots and options trading on KuCoin, which aren’t available on MEXC. These tools can help automate your trading strategies.

For beginners, KuCoin provides a more user-friendly interface with better educational resources. This makes the learning curve less steep if you’re new to crypto trading.

Both platforms support spot trading, futures, and margin trading, giving you flexibility in how you approach the market.

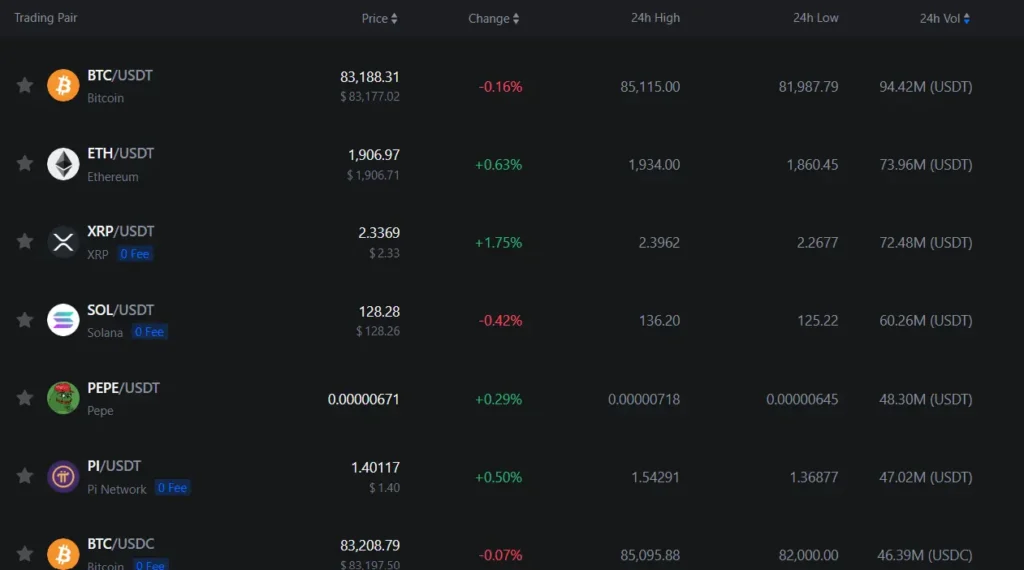

MEXC Vs KuCoin: Supported Cryptocurrencies

When choosing between MEXC and KuCoin, the variety of supported cryptocurrencies is a key factor to consider. According to recent data, MEXC supports over 1,690 coins, making it one of the most extensive exchanges for crypto variety.

In comparison, KuCoin offers around 720+ cryptocurrencies. While this is still an impressive selection, MEXC clearly provides more options if you’re looking to trade lesser-known or emerging tokens.

Both exchanges support all major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. However, MEXC’s larger selection gives you access to more obscure tokens and newer projects that might not be available on KuCoin.

The difference in supported coins also affects the number of trading pairs. MEXC typically offers more trading pairs, which can provide you with greater flexibility when exchanging between different cryptocurrencies without converting to a base currency first.

If you’re interested in niche cryptocurrencies or want to diversify into emerging tokens, MEXC might be your better option. But if you mainly trade popular coins, both exchanges will likely meet your needs.

Remember that having more coins isn’t always better if you prioritize security. KuCoin might offer fewer options but could have more thorough vetting processes for the coins it lists.

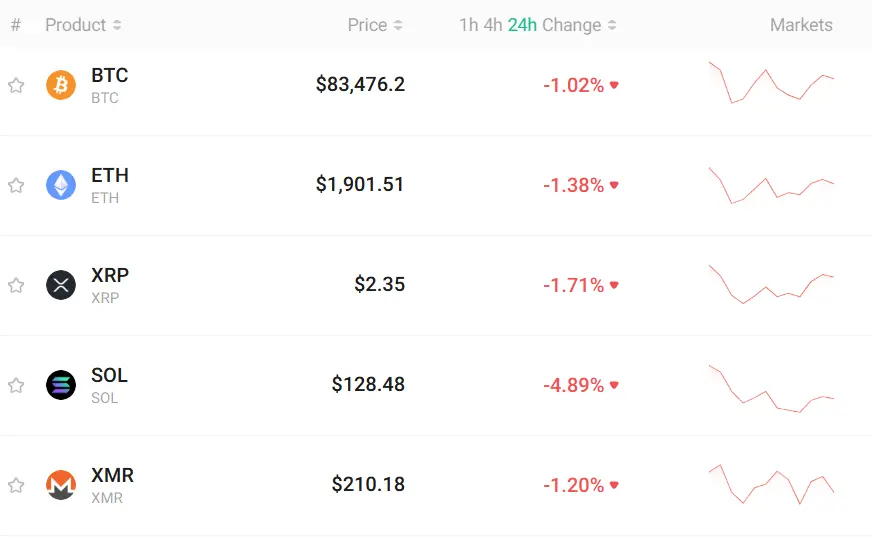

MEXC Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and KuCoin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

MEXC offers some of the lowest trading fees in the market. For spot trading, they charge 0% for makers and 0.02% for takers. This means you can place limit orders without any fees at all.

KuCoin’s standard spot trading fee is 0.1% for both makers and takers. This is higher than MEXC but still competitive compared to many other exchanges.

For futures trading, KuCoin charges varying fees depending on your trading level. MEXC also offers competitive futures trading fees, though specific rates may change.

Deposit Fees

Both exchanges typically don’t charge fees for depositing crypto. This is standard practice across most cryptocurrency exchanges.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. These fees are used to cover the blockchain transaction costs when you move your assets off the exchange.

Both exchanges adjust their withdrawal fees periodically based on network conditions and transaction costs. It’s always good to check the current fee schedule before making withdrawals.

Sign-up Bonuses

Both platforms occasionally offer sign-up bonuses which can offset some of your trading costs when you’re just getting started.

If you’re a high-volume trader, the difference in trading fees between MEXC and KuCoin could result in significant savings over time.

MEXC Vs KuCoin: Order Types

Both MEXC and KuCoin offer a variety of order types to help you execute trades according to your strategy. These options give you flexibility in how you approach the market.

Basic Order Types (Available on Both)

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels Other)

KuCoin provides additional advanced order types that might appeal to experienced traders. You can use their trading bots and automated strategies to execute trades based on market conditions.

MEXC keeps things simpler but still offers all the essential order types needed for most trading activities. Their interface makes placing orders straightforward, even for beginners.

Leverage Differences

| Exchange | Maximum Leverage |

|---|---|

| MEXC | 200x |

| KuCoin | 100x |

When using order types with leveraged positions, MEXC allows you to apply higher leverage. This means you can control larger positions with less capital.

Both platforms support cross and isolated margin modes for your leveraged trades. This lets you manage risk according to your comfort level.

KuCoin’s options trading feature gives you another way to place orders based on price predictions. This isn’t currently available on MEXC.

Both exchanges offer mobile apps where you can place all supported order types, making it convenient to trade on the go.

MEXC Vs KuCoin: KYC Requirements & KYC Limits

MEXC and KuCoin have different approaches to Know Your Customer (KYC) requirements that might affect your trading experience.

MEXC offers more privacy options with optional KYC verification. You can withdraw up to 30 BTC per day without completing KYC verification. This makes MEXC attractive if you value privacy in your crypto transactions.

KuCoin has stricter KYC policies. While they might seem more relaxed compared to major exchanges like Binance, KYC requirements still limit the experience for privacy-focused users. KuCoin also had a security breach in the past, which is worth noting.

MEXC KYC Highlights:

- Optional KYC verification

- Up to 30 BTC daily withdrawal without KYC

- Better for privacy-conscious traders

KuCoin KYC Highlights:

- More mandatory KYC requirements

- Clearer licensing in various jurisdictions

- Less flexible for users wanting anonymity

Recent trends show crypto exchanges moving toward stricter verification requirements. MEXC is following Binance and KuCoin in implementing more KYC measures, though they currently maintain higher non-KYC limits.

The choice between these platforms may depend on how much you value privacy versus regulatory compliance. If maintaining anonymity is important to you, MEXC currently offers more flexibility with its higher non-KYC withdrawal limits.

MEXC Vs KuCoin: Deposits & Withdrawal Options

When choosing between MEXC and KuCoin, deposit and withdrawal methods play a key role in your trading experience.

KuCoin offers more deposit options compared to MEXC. With KuCoin, you can fund your account using Visa/Mastercard, Apple Pay, bank transfers, Skrill, and PayPal for crypto purchases.

MEXC has fewer payment methods, primarily supporting Visa and Mastercard deposits. This limitation might affect users who prefer alternative payment methods.

Both exchanges support cryptocurrency deposits and withdrawals for a wide range of tokens. You can easily transfer your existing crypto from other wallets to either platform.

Deposit Methods Comparison:

| Payment Method | KuCoin | MEXC |

|---|---|---|

| Visa/Mastercard | ✓ | ✓ |

| Apple Pay | ✓ | ✗ |

| Bank Transfer | ✓ | ✗ |

| Skrill | ✓ | ✗ |

| PayPal | ✓ | ✗ |

Withdrawal processes on both platforms follow standard security procedures with verification steps to protect your funds. Processing times vary depending on network congestion and the cryptocurrency you’re withdrawing.

Fees for deposits and withdrawals differ between the platforms and depend on your payment method. Crypto withdrawals on both exchanges typically include network fees that vary by blockchain.

Remember to check the current fee structure before making transactions, as crypto exchange fees can change over time.

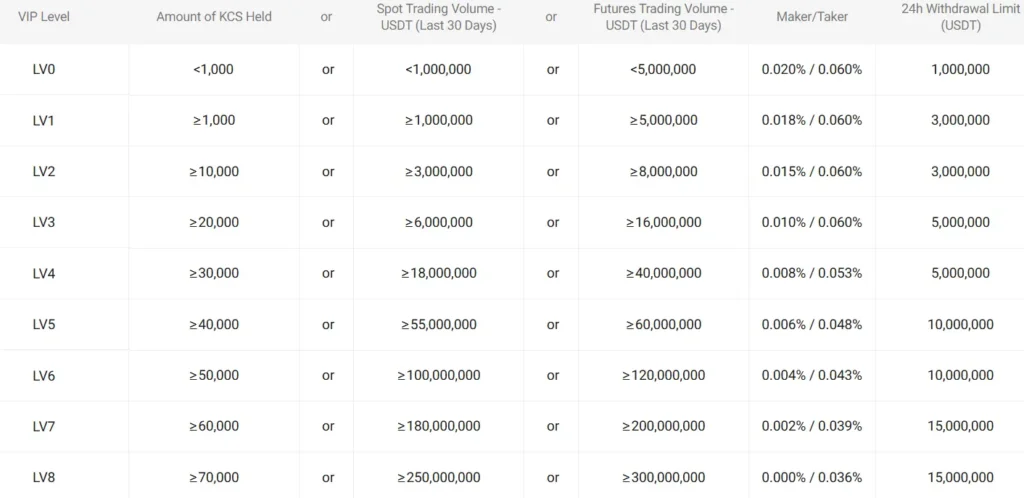

MEXC Vs KuCoin: Trading & Platform Experience Comparison

Both MEXC and KuCoin offer user-friendly interfaces for crypto trading, but they differ in several key areas.

Trading Options:

- MEXC provides higher leverage (up to 200x) compared to KuCoin’s 100x

- Both platforms support spot trading, margin trading, and futures

- MEXC has a larger selection of coins (2,960+) than KuCoin

Fee Structure:

| Exchange | Spot Trading Fees | Futures Trading |

|---|---|---|

| MEXC | 0% to 0.1% | Lower fees |

| KuCoin | Standard rates | Higher than MEXC |

When you use MEXC, you’ll notice lower fees specifically for perpetual futures trading. This makes it potentially more cost-effective for active traders.

The trading interface on both platforms is designed for different types of traders. KuCoin tends to have a more polished look, while MEXC focuses on functionality.

You’ll find that MEXC often lists new tokens faster, giving you early access to emerging projects. However, KuCoin’s security features and established reputation might give you more confidence.

Mobile experiences differ slightly between the two exchanges. Both offer apps that allow you to trade on the go, but some users find KuCoin’s mobile interface more intuitive.

For beginners, both platforms might seem overwhelming at first. You’ll need to spend some time exploring the features to get comfortable with either exchange.

MEXC Vs KuCoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for protecting your investments. Both MEXC and KuCoin have systems in place to manage risk, but they operate differently.

MEXC offers a more trader-friendly liquidation process. Their system uses a progressive liquidation approach that doesn’t immediately close your entire position when prices move against you. This gives you more time to potentially recover from temporary market swings.

KuCoin, on the other hand, implements a stricter liquidation policy. They tend to liquidate positions more quickly when they reach the liquidation threshold, which can be challenging for newer traders.

Key Differences:

| Feature | MEXC | KuCoin |

|---|---|---|

| Warning System | Multiple alerts before liquidation | Fewer warnings |

| Partial Liquidation | Available | Limited availability |

| Liquidation Threshold | More flexible | More rigid |

| Recovery Options | More opportunities to add margin | Fewer recovery options |

MEXC also provides better tools for monitoring your liquidation risk. Their platform displays clear indicators of how close your positions are to liquidation levels, helping you make informed decisions.

Remember that higher leverage increases liquidation risk on both platforms. MEXC allows higher leverage than KuCoin for many trading pairs, which means you need to be extra cautious when setting up your trades.

For beginners, MEXC’s more forgiving liquidation mechanism might be preferable as it gives you more room to learn and adjust your strategies.

MEXC Vs KuCoin: Insurance

When choosing a crypto exchange, understanding their insurance options is crucial for your asset protection. Both MEXC and KuCoin offer some form of insurance coverage, but they differ in approach.

KuCoin maintains a dedicated insurance fund that helps protect user assets. After experiencing a hack in 2020, KuCoin demonstrated its commitment by fully reimbursing affected users. Their Safeguard Program allocates a portion of trading fees to an insurance fund.

MEXC also offers an insurance fund, primarily focused on their futures trading platform. This fund helps prevent auto-liquidations during extreme market volatility and provides some security for traders using leverage.

Both exchanges store most user assets in cold wallets, which provides an additional layer of security against potential hacks. However, neither exchange offers FDIC-type insurance that you might find with traditional financial institutions.

Key Insurance Differences:

- KuCoin: More established insurance fund with proven history of making users whole after security incidents

- MEXC: Focused insurance protection for futures traders to prevent liquidation cascades

Your risk tolerance should factor into your decision. While both exchanges have safety measures, neither offers complete guarantees against all potential losses.

Remember to enable all available security features on your chosen platform, including two-factor authentication and withdrawal address whitelisting, to enhance your personal security posture.

MEXC Vs KuCoin: Customer Support

When choosing between MEXC and KuCoin, customer support is a key factor to consider. Both exchanges offer several ways to get help when you need it.

MEXC provides responsive customer support according to recent reviews. You can reach their team through live chat, email tickets, and social media channels. Many users report getting answers within 24 hours for most issues.

KuCoin offers similar support options with 24/7 live chat and a ticket system. They also maintain active social media channels where you can ask questions. KuCoin’s help center contains detailed guides to solve common problems yourself.

Response Time Comparison:

| Exchange | Live Chat | Email Ticket | Social Media |

|---|---|---|---|

| MEXC | Usually within minutes | 24-48 hours | Within 24 hours |

| KuCoin | Usually within minutes | 24-72 hours | Within 24 hours |

KuCoin’s interface is generally considered more beginner-friendly, which might mean you need support less often. Their help articles are comprehensive and easy to follow.

MEXC has improved their support in recent years, with multilingual assistance available for international users. This is helpful if English isn’t your first language.

Neither exchange offers phone support, which is common in the crypto industry. For urgent matters, live chat is your best option on both platforms.

MEXC Vs KuCoin: Security Features

When choosing between MEXC and KuCoin, security should be one of your top priorities. Both exchanges offer multiple layers of protection, but they differ in several ways.

KuCoin has experienced a major security breach in the past. In 2020, hackers stole approximately $280 million in crypto assets. However, the exchange has since strengthened its security measures and managed to recover most of the stolen funds.

MEXC has not reported any significant security breaches so far. However, some users have criticized the platform for its lack of transparency about security protocols.

Common Security Features:

- Two-factor authentication (2FA)

- Anti-phishing codes

- Advanced encryption

- Cold wallet storage for most funds

KuCoin offers an additional security feature called “Trading Password” that adds an extra layer of protection for your transactions. They also use a combination of hot and cold wallets, with most funds stored offline.

MEXC implements risk control systems that monitor unusual account activities. They also have a dedicated security team that works to prevent potential threats.

Security Comparison Table:

| Feature | MEXC | KuCoin |

|---|---|---|

| 2FA | ✓ | ✓ |

| Anti-phishing | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Trading Password | ✗ | ✓ |

| Insurance Fund | Limited | Available |

You should also enable all available security features regardless of which platform you choose to better protect your assets.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record. According to search results, the platform has never been hacked or lost user funds, which is impressive in the cryptocurrency exchange landscape.

Security is a top priority for MEXC, with the exchange implementing various protective measures to safeguard your assets. This includes two-factor authentication (2FA) and other security protocols to prevent unauthorized access.

MEXC offers optional Know Your Customer (KYC) verification. This provides you with more privacy options compared to some exchanges that require complete verification before trading.

The exchange operates globally and complies with regulations in multiple jurisdictions. However, it’s important to check if MEXC is licensed to operate in your specific country before using their services.

When comparing MEXC to KuCoin on the security front, it’s worth noting that KuCoin experienced a significant security breach in 2020. MEXC has not had any similar incidents reported.

For legal compliance, MEXC follows standard anti-money laundering (AML) procedures, though the specific licensing details aren’t as clearly publicized as some competitors.

Key security features include:

- No history of security breaches

- Two-factor authentication

- Cold storage for majority of assets

- Regular security audits

Always use strong passwords and enable all available security features when using any cryptocurrency exchange, including MEXC.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered a safe and legitimate cryptocurrency exchange. Despite experiencing a significant hack in 2020, the platform has since strengthened its security measures to better protect user assets.

The exchange operates globally and serves users from many countries. However, it’s important to check if KuCoin is licensed to operate in your specific location, as cryptocurrency regulations vary by country.

KuCoin has implemented several security features to protect your funds:

- Two-factor authentication (2FA)

- Anti-phishing security phrases

- Trading password requirements

- Withdrawal limits

Some users consider KuCoin less secure than major exchanges like Binance. While KuCoin is reputable in the crypto space, no exchange is completely risk-free.

Risk management tips when using KuCoin:

- Enable all security features

- Use a strong, unique password

- Don’t store large amounts of crypto on the exchange long-term

- Consider a hardware wallet for significant holdings

For peace of mind, KuCoin now maintains an insurance fund to help protect users against potential security breaches or hacks.

Also Read: Crypto Staking vs. Crypto Options

If you’re deciding between KuCoin and other exchanges like MEXC, both are legitimate options, but they differ in fees, available cryptocurrencies, and platform features.

Frequently Asked Questions

Many traders want to compare MEXC and KuCoin before choosing where to invest. These exchanges have distinct features in fees, available coins, user interfaces, security protocols, and regional availability.

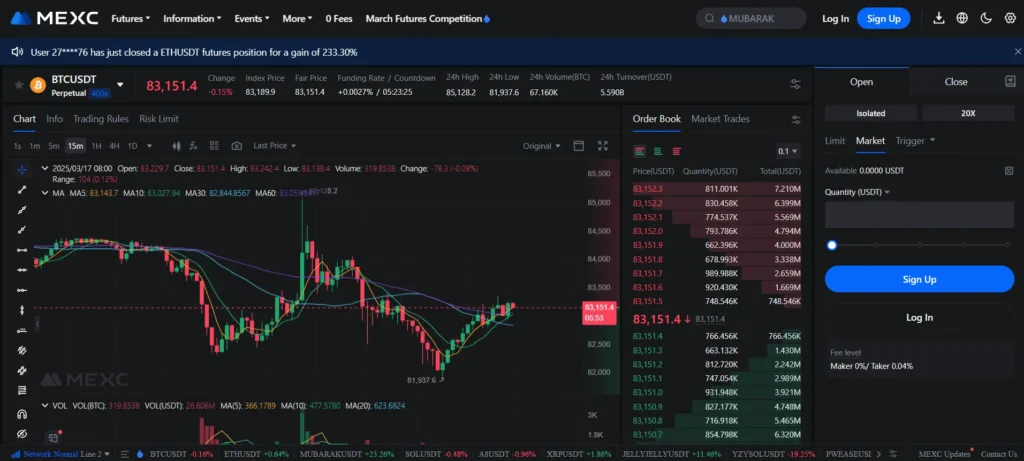

What are the key differences in trading fees between MEXC and KuCoin?

MEXC generally offers lower trading fees than KuCoin, especially for perpetual futures trading. Standard spot trading on MEXC starts at 0.2% for makers and takers.

KuCoin’s fee structure begins at 0.1% for makers and 0.1% for takers on spot trades. Both exchanges offer fee discounts based on trading volume and native token holdings.

MEXC’s lower fees for leverage trading make it more cost-effective for frequent traders who use advanced trading strategies.

How does the user experience compare on MEXC versus KuCoin platforms?

KuCoin offers a more polished user interface that’s easier for beginners to navigate. The platform includes helpful tutorials and a clean dashboard design.

MEXC’s interface has more advanced features but comes with a steeper learning curve. You’ll find more detailed charts and analysis tools on MEXC, which appeals to experienced traders.

Both platforms offer mobile apps, but KuCoin’s app receives higher ratings for stability and ease of use.

What range of cryptocurrencies is available on MEXC compared to KuCoin?

MEXC supports over 1,690 cryptocurrencies, making it the winner in terms of coin selection. This includes many small-cap altcoins and new project tokens.

KuCoin offers around 720+ coins, which is still impressive but provides fewer options than MEXC. You’ll find most major cryptocurrencies on both platforms.

MEXC tends to list new tokens faster, giving you early access to emerging projects before they reach larger exchanges.

Can you highlight the security measures implemented by MEXC and KuCoin?

Both exchanges use two-factor authentication (2FA), anti-phishing codes, and cold storage for most user funds. KuCoin experienced a major hack in 2020 but fully reimbursed affected users.

MEXC implements multi-signature wallets and regular security audits. The platform also maintains an insurance fund to protect user assets.

You should enable all available security features on either platform, including withdrawal whitelists and trading passwords.

How do deposit and withdrawal processes differ between MEXC and KuCoin?

KuCoin typically processes withdrawals faster, with most transactions completing within 30 minutes. Their verification process is streamlined for frequent users.

MEXC may have longer processing times during high network congestion. Both exchanges implement withdrawal limits based on your verification level.

Fee structures differ by cryptocurrency, with MEXC offering free withdrawals on select networks during promotions.

Are there any geographical restrictions affecting users on MEXC or KuCoin?

Both exchanges face restrictions in certain regions. Users from the United States have limited access to KuCoin and cannot use MEXC due to regulatory concerns.

KuCoin doesn’t require KYC verification for basic accounts with limited withdrawal amounts. MEXC requires more complete verification for full platform access.

You should check the current terms of service for both platforms, as geographical restrictions change frequently due to evolving regulations.

KuCoin Vs MEXC Conclusion: Why Not Use Both?

When comparing KuCoin and MEXC, both exchanges offer strong features for crypto traders in 2025. Each platform has its unique strengths that might appeal to different trading needs.

MEXC provides higher leverage options (up to 200x compared to KuCoin’s 100x) and offers more privacy with optional KYC requirements. Their security track record also appears slightly stronger.

KuCoin, on the other hand, has clearer licensing and regulatory compliance. Despite a past security breach, they’ve implemented robust security measures to protect user funds.

But here’s something to consider: using both platforms could be your best strategy. Splitting your assets between multiple exchanges reduces your risk of total loss if one platform experiences issues.

This approach gives you access to:

- Different trading pairs and opportunities

- Varied fee structures

- Multiple promotional offers and bonuses

- Backup access if one exchange faces downtime

You can take advantage of MEXC’s higher leverage for certain trades while using KuCoin for its specific features and offerings.

Remember that diversifying where you store and trade your crypto assets follows the same principle as diversifying your investment portfolio. It’s a smart risk management strategy in the unpredictable crypto space.

By using both exchanges, you get the best of both worlds while reducing your overall risk exposure.

Compare MEXC and KuCoin with other significant exchanges