Choosing the right crypto exchange can make a big difference in your trading experience. OKX and Bitget are two popular platforms that offer various features for crypto traders in 2025. Each has unique strengths that might better suit your specific needs.

Bitget wins over OKX in several key areas, including support for more coins and trading pairs, the ability to make SEPA bank transfers, and zero-fee deposits for EUR and GBP currencies. However, OKX often provides higher trading volume and liquidity, which can be important if you’re trading large amounts or less common cryptocurrencies.

When comparing these platforms, you’ll want to consider factors beyond just the number of coins offered. Trading fees, security features, user interface, and available tools can all impact your trading success. Both exchanges have continued to evolve their offerings through 2025, making them competitive options in the crypto marketplace.

OKX vs Bitget: At A Glance Comparison

OKX and Bitget are both popular cryptocurrency exchanges in 2025, but they differ in several key areas.

Trading Pairs: Bitget offers more trading pairs than OKX, giving you more options for diversifying your crypto portfolio.

Fee Structure: Bitget has lower fees compared to OKX, which can save you money on transactions, especially if you trade frequently.

| Feature | OKX | Bitget |

|---|---|---|

| Trading Pairs | Fewer options | More options |

| Trading Fees | Higher | Lower |

| Wallet Features | Standard features | Includes Tap to Earn & task-based rewards |

| User Interface | Professional | User-friendly |

Bitget Wallet stands out with unique earning opportunities that OKX Wallet doesn’t offer. These include Tap to Earn features and task-based rewards that can boost your crypto holdings.

When choosing between these exchanges, consider your trading needs. If you value more trading pairs and lower fees, Bitget might be your better option.

Both platforms offer comprehensive crypto trading services, but the differences in their features might make one more suitable for your specific needs.

Also Check: Where to trade bitcoin options?

You should also consider the user interface when making your choice. Your comfort with the platform’s design can significantly impact your trading experience.

OKX vs Bitget: Trading Markets, Products & Leverage Offered

Both OKX and Bitget offer a variety of trading markets and products for crypto enthusiasts. Let’s compare what each platform brings to the table.

Available Cryptocurrencies:

- Bitget offers more cryptocurrencies for trading than OKX

- Both exchanges support major coins like Bitcoin, Ethereum, and popular altcoins

Leverage Trading:

- OKX provides up to 100x leverage on futures trading

- Bitget offers higher leverage options, making it more appealing for experienced traders

Trading Products:

| Feature | OKX | Bitget |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Copy Trading | ✓ | ✓ |

| Passive Income | Limited | More options |

OKX has been a reliable crypto margin trading exchange since 2017. It offers a solid range of financial products that cater to different types of traders.

Bitget stands out with its simple user interface that makes trading more accessible. You’ll find more passive income products on Bitget compared to OKX.

If you’re looking for higher leverage and more crypto options, Bitget might be your better choice. The platform is designed to accommodate both beginners and advanced traders.

OKX shines with its regulatory compliance and reliability. You can trade with confidence knowing the platform has a strong focus on security.

OKX vs Bitget: Supported Cryptocurrencies

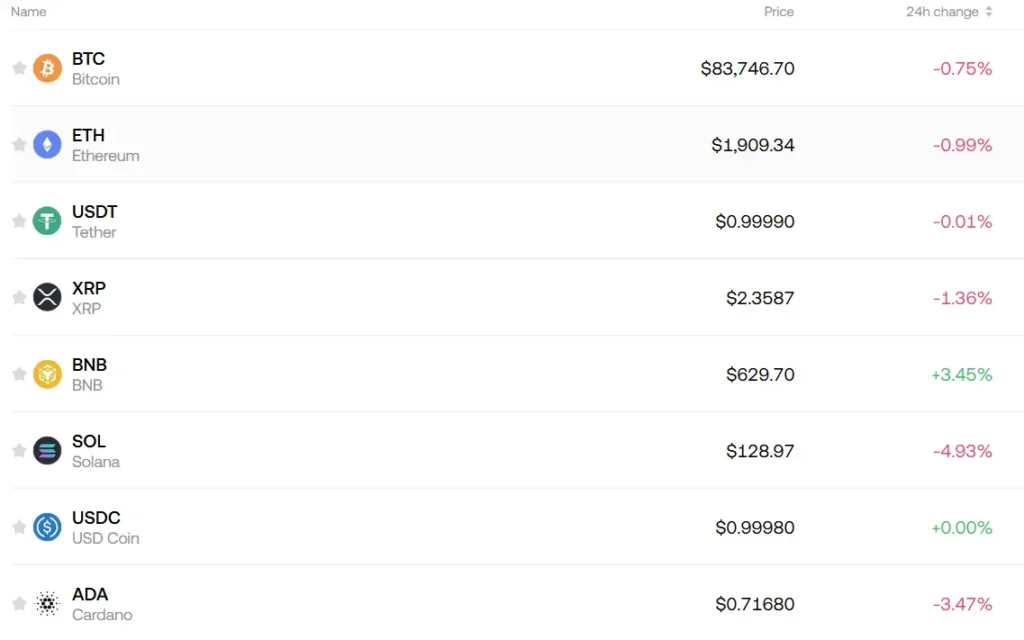

When choosing between OKX and Bitget, the variety of cryptocurrencies available is a key factor to consider. Both platforms support major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many altcoins.

Based on recent information, Bitget has the edge in terms of supported coins and trading pairs. The platform offers a more extensive selection of cryptocurrencies compared to OKX.

Bitget provides users with a comprehensive list of active trading pairs. This makes it easier for you to find specific cryptocurrency pairings that match your trading strategy.

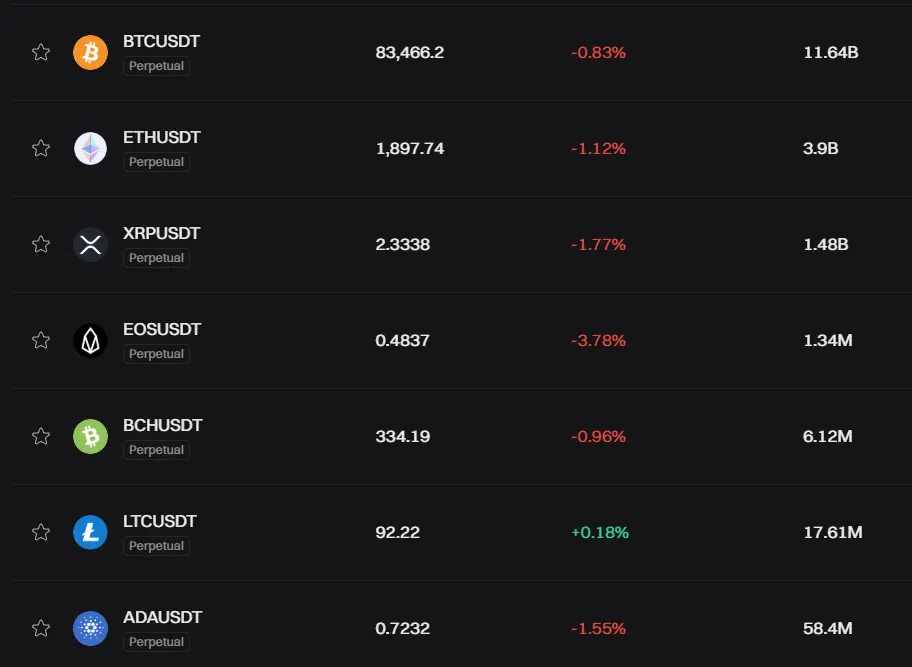

OKX, while offering fewer coins overall, displays the top 10 movers on its platform. This feature helps you quickly identify cryptocurrencies experiencing significant price movement.

Despite having fewer supported cryptocurrencies, OKX often demonstrates higher trading volume and liquidity for the coins it does list. This can result in better execution prices and less slippage when trading popular tokens.

Both exchanges regularly add new cryptocurrencies to their platforms. You should check their official websites for the most up-to-date listings if you’re looking for specific tokens.

Your choice between these exchanges may depend on whether you prioritize access to a wider variety of coins (Bitget) or potentially better liquidity for major cryptocurrencies (OKX).

OKX vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

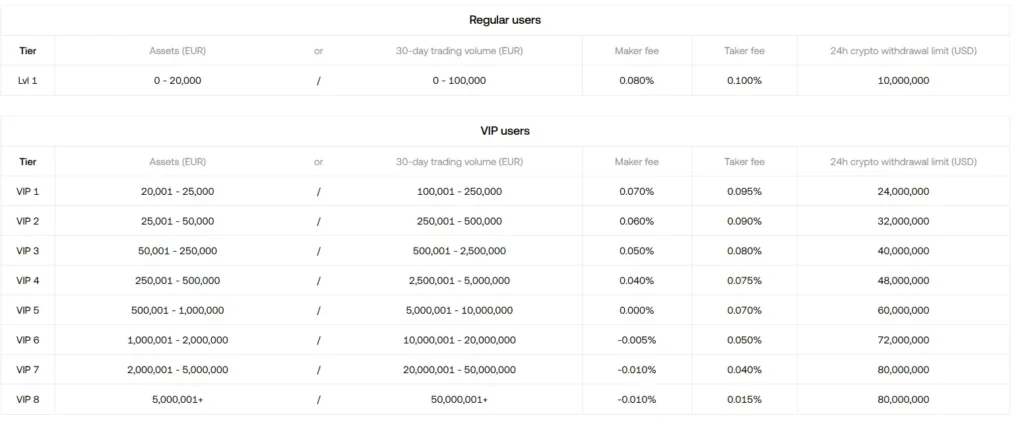

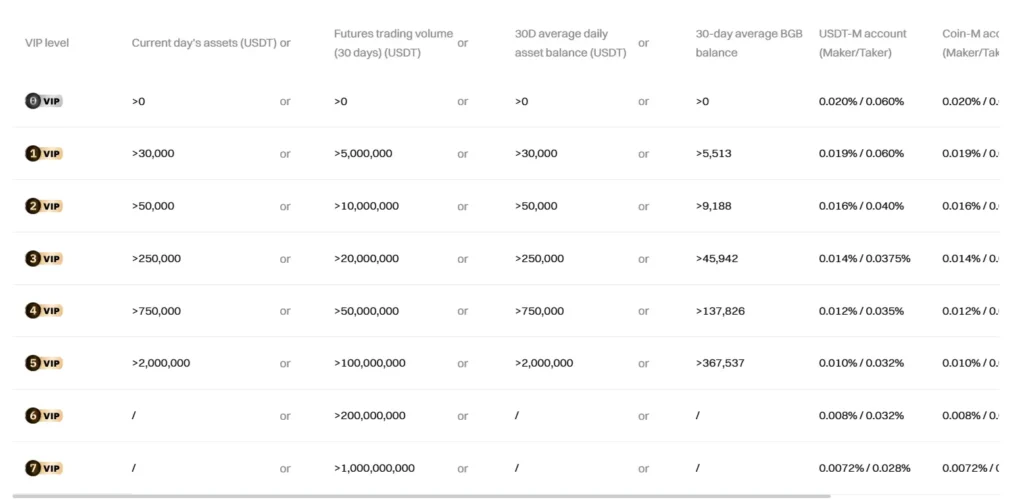

When comparing OKX and Bitget, fees play a crucial role in your decision-making process. The information about which platform offers better fees seems mixed based on different sources.

Spot Trading Fees

| Platform | Maker Fee | Taker Fee |

|---|---|---|

| OKX | 0.08% | 0.10% |

| Bitget | Lower than OKX | Lower than OKX |

Some sources indicate Bitget has lower fees for both spot and futures trading compared to OKX. However, other sources suggest OKX offers better rates, especially when you hold OKB tokens for spot trading.

Fee Reduction Options

OKX provides opportunities to reduce your trading costs through their token-based discount system. When you hold OKB tokens, you can access generous discounts on your trades.

Bitget also offers competitive fee structures, but the exact comparison depends on your trading volume and account level on each platform.

Withdrawal Fees

Both exchanges charge network fees for withdrawals that vary by cryptocurrency. These fees change based on network congestion and the specific coin you’re withdrawing.

You should check the current fee schedules on both platforms before making significant trades, as fee structures in crypto exchanges can change frequently.

Trading fees impact your overall profitability, especially if you trade frequently or in large volumes. Even small fee differences can add up to significant amounts over time.

OKX vs Bitget: Order Types

When trading on cryptocurrency platforms, the variety of order types can greatly impact your trading experience. Both OKX and Bitget offer several order types to help you execute trades according to your strategy.

OKX provides a comprehensive selection of order types including market orders, limit orders, and stop orders. You can also use advanced options like trailing stops, iceberg orders, and time-weighted average price (TWAP) orders.

Bitget matches many of these basics but adds some unique options. Their platform includes grid trading tools that automatically buy low and sell high within set price ranges.

Common Order Types on Both Platforms:

- Market orders (instant execution at current price)

- Limit orders (execution at specified price or better)

- Stop-limit orders (protection against significant losses)

- Take-profit orders (secure gains at target prices)

OKX Advanced Features:

- One-cancels-the-other (OCO) orders

- Post-only orders

- Time-weighted average price orders

Bitget Special Features:

- Copy trading orders

- Grid trading automation

- Futures ADSL orders

For beginners, both platforms offer simple market and limit orders that are easy to understand. Advanced traders will appreciate OKX’s depth of order types, while those interested in automated strategies might prefer Bitget’s grid trading tools.

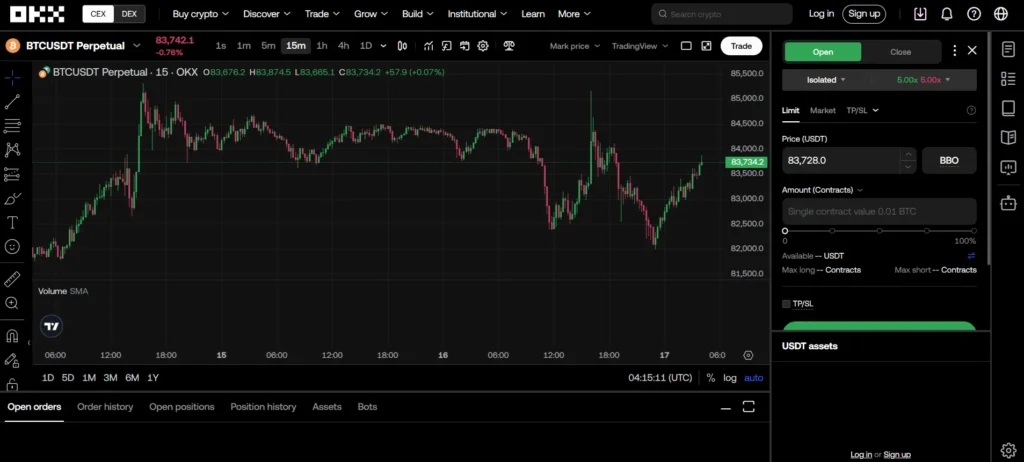

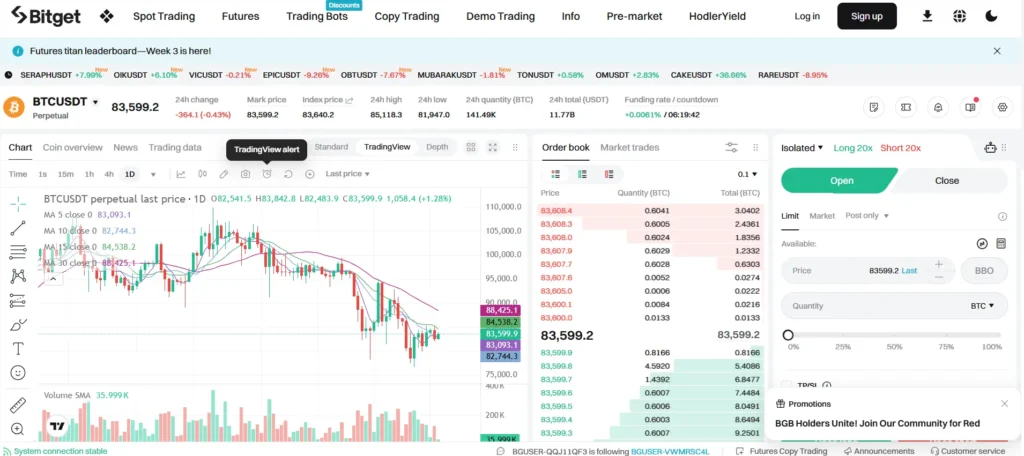

Trading interface design also matters. OKX offers a cleaner, more professional layout, while Bitget focuses on user-friendly navigation for newer traders.

OKX vs Bitget: KYC Requirements & KYC Limits

KYC (Know Your Customer) requirements differ significantly between OKX and Bitget, which might impact your trading experience.

OKX KYC Requirements:

- KYC verification is more stringent

- KYC is recommended for full platform access

- Without KYC, you face significant withdrawal limitations

OKX has a multi-tier KYC system that gradually increases your account privileges as you complete higher verification levels.

Bitget KYC Requirements:

- KYC is not mandatory for basic trading

- You can trade without identity verification

- KYC completion removes account restrictions

Bitget offers a more flexible approach to verification, allowing you to begin trading immediately without submitting personal documents.

Withdrawal Limits Comparison:

| Exchange | Without KYC | Basic KYC | Full KYC |

|---|---|---|---|

| OKX | Very limited | Up to 10 BTC/day | Up to 500 BTC/day |

| Bitget | Limited | Up to 20 BTC/day | Up to 200 BTC/day |

If privacy is your priority, Bitget might be the better choice since you can trade without mandatory verification.

However, OKX’s stricter KYC policy provides better regulatory compliance, which could mean better security for your funds and trading activities.

Both platforms prohibit traders from the United States, as neither is licensed to operate there.

OKX vs Bitget: Deposits & Withdrawal Options

When choosing between OKX and Bitget, deposit and withdrawal options play a key role in your trading experience. Both exchanges offer multiple ways to fund your account and cash out your profits.

Bitget provides more withdrawal options than OKX. This includes support for fiat withdrawals, giving you more flexibility when you want to convert your crypto back to traditional currency.

OKX also offers various deposit methods, but with fewer withdrawal choices compared to Bitget. The platform still maintains competitive withdrawal speeds for most cryptocurrencies.

Both exchanges support bank transfers and crypto deposits. You can easily move your Bitcoin, Ethereum, and other popular coins to either platform.

Withdrawal fees vary between the exchanges:

- Bitget typically offers more competitive withdrawal fees

- OKX charges standard market rates that may be slightly higher

Processing times for withdrawals are comparable on both platforms, with most crypto transactions completing within minutes to hours depending on network congestion.

For those who frequently move money in and out of exchanges, Bitget’s additional withdrawal options might be more convenient. This extra flexibility can save you time and potentially reduce costs when managing your crypto assets.

OKX vs Bitget: Trading & Platform Experience Comparison

When choosing between OKX and Bitget, the trading experience makes a big difference in your day-to-day usage. Both platforms offer comprehensive tools, but they differ in several key areas.

Interface Design: OKX provides a clean, professional interface that might appeal to experienced traders. Bitget offers a more user-friendly experience that newer crypto traders can navigate easily.

Trading Tools:

- OKX: Advanced charting, demo trading, and algorithmic tools

- Bitget: Social/copy trading features, simpler charts, and one-click trading

Mobile Experience: Both exchanges have mobile apps, but Bitget’s app receives higher ratings for its simplicity and quick access to key features.

Trading Fees:

| Exchange | Spot Trading | Futures Trading |

|---|---|---|

| OKX | Higher | Higher |

| Bitget | Lower | Lower |

The search results suggest Bitget typically offers lower fees for both spot and futures trading compared to OKX.

OKX shines with its depth of analytical tools and range of advanced trading options. If you’re comfortable with complex interfaces and need professional-grade tools, it might be your better choice.

Bitget stands out with its copy trading feature, allowing you to automatically mirror successful traders’ strategies. This can be valuable if you’re looking to learn or prefer a more passive approach.

OKX vs Bitget: Liquidation Mechanism

When trading with leverage on OKX or Bitget, understanding the liquidation mechanism is crucial for protecting your funds. Both platforms use liquidation to prevent traders from losing more than their initial investment.

OKX uses a tiered liquidation system that gradually reduces positions as they approach the liquidation price. This gives you a chance to add funds or adjust positions before complete liquidation occurs.

Bitget employs a similar mechanism but offers a unique “Partial Liquidation” feature that liquidates only portions of your position in stages, potentially helping you avoid complete liquidation during market volatility.

Here’s how they compare on key liquidation aspects:

| Feature | OKX | Bitget |

|---|---|---|

| Liquidation Warning | Yes, multiple alerts | Yes, with push notifications |

| Liquidation Fee | 0.2% – 0.5% | 0.2% – 0.3% |

| Insurance Fund | Yes (larger fund) | Yes |

| Position Risk Indicator | Real-time risk meter | Color-coded risk level |

OKX provides more detailed liquidation data and analytics to help you assess market conditions. Their February 2023 adjusted liquidation data showed 7,390M compared to December’s 3,980M.

Bitget offers a more beginner-friendly liquidation interface with clear visual indicators when positions approach dangerous levels.

Both platforms allow you to set stop-loss orders to prevent liquidation, but OKX offers more advanced conditional order types for liquidation prevention.

OKX vs Bitget: Insurance

When trading on crypto exchanges, insurance can protect your funds in case of security breaches or hacks. Both OKX and Bitget offer some form of insurance protection, but there are key differences.

OKX maintains a dedicated protection fund worth over $300 million. This fund is designed to cover user losses in case of major security incidents. The exchange also implements regular security audits to minimize risks.

Bitget, on the other hand, has a protection fund of approximately $300 million as well. They’ve committed to maintaining this fund to safeguard user assets against potential threats.

Insurance Comparison:

| Feature | OKX | Bitget |

|---|---|---|

| Protection Fund | $300+ million | $300 million |

| Coverage Scope | Trading losses, security breaches | User assets, security incidents |

| Transparency | Regular fund reports | Monthly fund updates |

Both exchanges use cold storage for most user funds. This means your assets are kept offline, which provides an additional layer of security against online threats.

You should note that neither exchange offers complete insurance for all types of losses. Market volatility losses, for example, are not covered by either platform’s protection funds.

The insurance policies at both exchanges continue to evolve as the crypto market matures. It’s advisable to check their current insurance terms before making your final decision.

OKX vs Bitget: Customer Support

When choosing between OKX and Bitget, customer support plays a crucial role in your trading experience. Both platforms offer multiple support channels to help resolve your issues.

OKX provides 24/7 customer support through live chat, email, and a ticket system. You can access their help center with detailed guides and FAQs that cover most common questions.

Bitget also offers round-the-clock support with similar contact options. Their support team is known for responding quickly to user inquiries through their in-app chat feature.

According to user reviews, OKX has a slight advantage in their support documentation. Their FAQ section is more comprehensive, allowing you to find answers without contacting support directly.

Bitget’s interface is considered more user-friendly by some traders. This can reduce the need for support in the first place, as you may encounter fewer navigation issues.

Both platforms offer support in multiple languages, making them accessible to global users. You can expect response times of a few minutes for live chat and up to 24 hours for email queries on both platforms.

Neither platform currently offers phone support, which might be a drawback if you prefer speaking with a representative directly.

OKX vs Bitget: Security Features

When comparing crypto exchanges, security is a top priority. Both OKX and Bitget offer robust security measures to protect your assets.

OKX implements two-factor authentication (2FA), cold storage for most user funds, and regular security audits. Their security system includes anti-phishing codes in emails to help you verify legitimate communications.

Bitget also uses 2FA and cold storage solutions, keeping up to 99% of user funds offline. They add an extra layer of protection with facial recognition for account verification on mobile devices.

Key Security Features Comparison:

| Feature | OKX | Bitget |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ (majority of funds) | ✓ (up to 99% of funds) |

| Insurance Fund | $750 million | $300 million |

| Anti-phishing Protection | ✓ | ✓ |

| Biometric Verification | Limited | Advanced (facial recognition) |

Both platforms offer insurance funds to protect against potential losses. OKX’s fund is larger at approximately $750 million compared to Bitget’s $300 million fund.

You’ll find regular security updates on both platforms, though OKX typically releases more detailed security reports. Bitget focuses on user-friendly security features that don’t compromise convenience.

Also Check: Crypto F&O trading explained

For withdrawal security, both exchanges require email confirmations and have waiting periods for large transactions. This helps prevent unauthorized withdrawals from your account.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe cryptocurrency exchange with strong security measures in place. As of 2025, the platform has maintained a solid security record and implements industry-standard protections for user funds.

The exchange uses cold storage for most user assets, keeping them offline and away from potential hackers. OKX also employs two-factor authentication (2FA) and advanced encryption to protect user accounts.

Regarding legality, OKX operates with regulatory compliance in various jurisdictions. However, availability varies by location due to different cryptocurrency regulations worldwide.

You should verify if OKX is available in your country before signing up. Some regions have restrictions on cryptocurrency trading platforms, so it’s important to check local laws.

OKX has worked to improve its regulatory standing over time. The platform implements Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to comply with financial regulations.

Key security features include:

- Cold storage for majority of funds

- Two-factor authentication

- Advanced encryption protocols

- Regular security audits

- Insurance fund for certain assets

Remember that while OKX takes significant security measures, no exchange is completely immune to risks. Always use strong passwords, enable all security features, and consider using hardware wallets for long-term storage of large crypto holdings.

Is Bitget Safe & Legal To Use?

Bitget is generally considered a safe cryptocurrency exchange for users. According to search results, the platform has never experienced a security breach or hack, which is significant in the crypto space.

The exchange has implemented several important security measures to protect user assets. One standout feature is Bitget’s 300 Million USDT Protection Fund, which adds an extra layer of security for users.

Bitget also employs proof of reserves, allowing users to verify that their funds are actually held by the exchange. This transparency helps build trust with customers.

From a legal standpoint, Bitget’s regulatory status varies by country. The search results don’t specify all jurisdictions where Bitget operates legally. Before using Bitget, you should check if it’s properly licensed in your country.

When comparing safety features with OKX, both exchanges prioritize security. OKX is noted for strong regulatory compliance, while Bitget focuses on user interface simplicity and security implementations.

For your protection when using Bitget, consider:

- Enabling two-factor authentication

- Using strong, unique passwords

- Storing large amounts in cold wallets

- Keeping your account details private

Remember that all cryptocurrency exchanges carry some level of risk, so only invest funds you can afford to lose.

Frequently Asked Questions

Traders often have specific questions when comparing OKX and Bitget exchanges. These questions cover important aspects like security features, fees, and user experience that can impact your trading decisions.

What distinguishes OKX from Bitget in terms of security features?

OKX implements multi-signature technology and stores most user funds in cold wallets to protect against cyber attacks. They also offer two-factor authentication and regular security audits.

Bitget provides similar security measures but adds an additional layer with their Protection Fund, which reached $300 million in 2023 to safeguard user assets against potential breaches.

Both platforms use SSL encryption for data transmission, but OKX has a longer track record of security incident management.

How do the trading fees compare between OKX and Bitget?

OKX typically charges maker fees ranging from 0.08% to 0.10% and taker fees from 0.10% to 0.15% for spot trading. Their fee structure uses a tiered system based on your 30-day trading volume.

Bitget offers slightly lower fees with maker fees starting at 0.065% and taker fees at 0.075%. They also provide fee discounts when using their native token for payments.

For futures trading, Bitget often edges out OKX with more competitive rates, especially for high-volume traders.

What are the differences in customer support quality between OKX and Bitget?

OKX provides 24/7 customer support through live chat, email, and a comprehensive help center. Their response times average around 10-15 minutes for live chat inquiries.

Bitget also offers round-the-clock support but adds telephone support in multiple languages. Users report faster response times, typically under 5 minutes for urgent issues.

Both platforms maintain active community forums, but Bitget tends to have more localized support teams for different regions.

Which exchange between OKX and Bitget offers a wider variety of cryptocurrencies?

Bitget supports more cryptocurrencies and trading pairs compared to OKX. The platform lists over 500 cryptocurrencies and 800+ trading pairs as of early 2025.

OKX offers around 350 cryptocurrencies but compensates with deeper liquidity for major pairs. This makes OKX better for trading popular coins while Bitget gives you access to more altcoins.

Both exchanges regularly add new tokens, but Bitget typically lists new projects more quickly after their launch.

How do user interfaces and trading experiences differ between OKX and Bitget?

OKX features a professional interface with advanced charting tools and customizable layouts. Their platform caters to experienced traders with complex order types and detailed market analysis.

Bitget offers a more intuitive interface that beginners find easier to navigate. They display the top 10 market movers prominently, while OKX provides more comprehensive market data displays.

Mobile app experiences differ too, with Bitget’s app receiving higher ratings for speed and reliability compared to OKX’s feature-rich but sometimes slower application.

What are the pros and cons of leverage and margin trading on OKX versus Bitget?

OKX provides higher maximum leverage of up to 125x on certain futures contracts. They offer cross and isolated margin modes with a wider range of advanced order types for risk management.

Bitget limits leverage to 100x but provides more user-friendly tools for managing leveraged positions. Their copy trading feature allows you to mirror successful traders’ leverage strategies.

OKX has stricter liquidation mechanisms, while Bitget offers partial liquidation options that can help preserve portions of your position during volatile market conditions.

Bitget vs OKX Conclusion: Why Not Use Both?

After comparing these exchanges, you might wonder which one to choose. The answer might surprise you—why not use both?

Key advantages of each platform:

- OKX: Lower fees for spot trading, especially with OKB token discounts

- Bitget: More competitive futures trading fees and unique earning features like Tap to Earn

Using both platforms lets you leverage their specific strengths. You can conduct spot trading on OKX to benefit from lower fees, while using Bitget for futures trading and its special earning opportunities.

Each exchange offers unique tools that might help different aspects of your trading strategy. OKX displays top movers prominently, while Bitget provides a comprehensive list of active trading pairs.

Your trading goals should guide your choice. If you primarily do spot trading and hold OKB tokens, OKX might save you more money. For futures trading or if you enjoy task-based rewards, Bitget could be more appealing.

Remember that diversifying across platforms can also reduce risk exposure to any single exchange. This approach gives you flexibility as market conditions change.

Many experienced traders maintain accounts on multiple exchanges to capitalize on different fee structures, features, and trading opportunities as they arise.

Compare OKX and Bitget with other significant exchanges