Choosing the right crypto exchange for your trading needs can make a big difference in your experience and results. Phemex and Bybit are two popular platforms that offer various trading options, tools, and features for crypto enthusiasts.

Both Phemex and Bybit provide advanced trading tools, competitive fee structures, and user-friendly interfaces for beginners and experienced traders alike. While the search results mention Phemex vs Bybit comparisons, they highlight that Bybit has a slightly higher overall score of 8.0 compared to Phemex in some reviews.

You might be wondering about accessibility, security features, and available trading pairs on these platforms. Some users report using Phemex from the US without issues for contract trading, which could be an important consideration depending on your location. Both exchanges also offer bonus incentives for new users, with different promotional amounts to help you get started.

Phemex Vs Aibit: At A Glance Comparison

When choosing between Phemex and Aibit for your crypto trading needs, understanding key differences can help you make an informed decision.

Phemex has earned a solid reputation in the cryptocurrency exchange space with an overall score of approximately 8.0 according to comparison data. It offers a range of features for both beginner and advanced traders.

Aibit, while less mentioned in the search results, competes in the same space as a cryptocurrency exchange platform.

Trading Features Comparison:

| Feature | Phemex | Aibit |

|---|---|---|

| Leverage Trading | Available | Available |

| User Interface | User-friendly | Streamlined |

| Mobile App | Yes | Yes |

| Trading Fees | Competitive | Varies by trade volume |

Phemex has established itself in the leverage trading market, making it appealing if you’re looking to amplify your trading positions.

Both exchanges offer cryptocurrency spot trading, but they differ in the range of available trading pairs. Phemex typically provides access to more established cryptocurrencies.

Security Measures:

- Phemex utilizes cold storage for most user funds

- Both platforms employ two-factor authentication

- Regular security audits help maintain platform integrity

The customer support experience varies between the two platforms, with response times and support channels differing.

When selecting between Phemex and Aibit, consider your trading needs, security preferences, and the specific cryptocurrencies you want to trade.

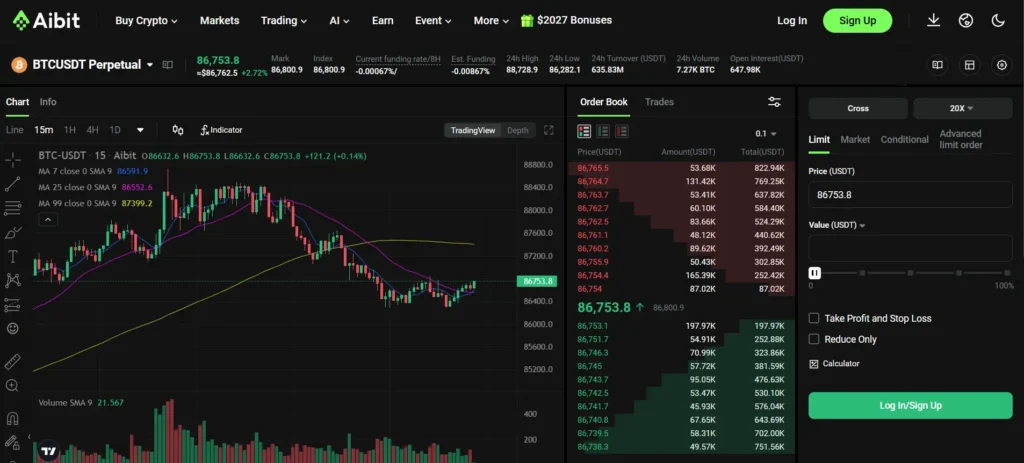

Phemex Vs Aibit: Trading Markets, Products & Leverage Offered

Phemex offers a wide range of crypto derivatives trading options. From the search results, we can see it provides up to 100x leverage for traders looking to maximize their potential returns.

Phemex supports more assets compared to some competitors, giving you more trading choices. Their platform is known for being user-friendly, which is helpful if you’re new to crypto derivatives.

When it comes to fees, Phemex charges a base trading fee of 0.1%, with discounts available as your trading volume increases.

Key Phemex Features:

- Up to 100x leverage

- Zero-fee spot trading

- User-friendly interface

- Wide asset selection

Aibit (which may be referenced as ByBit in some searches) offers fewer assets than Phemex according to the search results. It provides up to 20x leverage, which is significantly lower than Phemex’s 100x offering.

Comparing Leverage Options:

| Platform | Maximum Leverage |

|---|---|

| Phemex | 100x |

| Aibit | 20x |

Both platforms offer crypto futures markets, but Phemex stands out with its zero-fee spot trading option alongside futures trading.

Also Read: Crypto Options Insurance: Understanding Risk Management Strategies

If you value having more trading choices and higher leverage options, Phemex might be better suited to your needs. However, lower leverage like Aibit’s 20x can sometimes be safer for beginners.

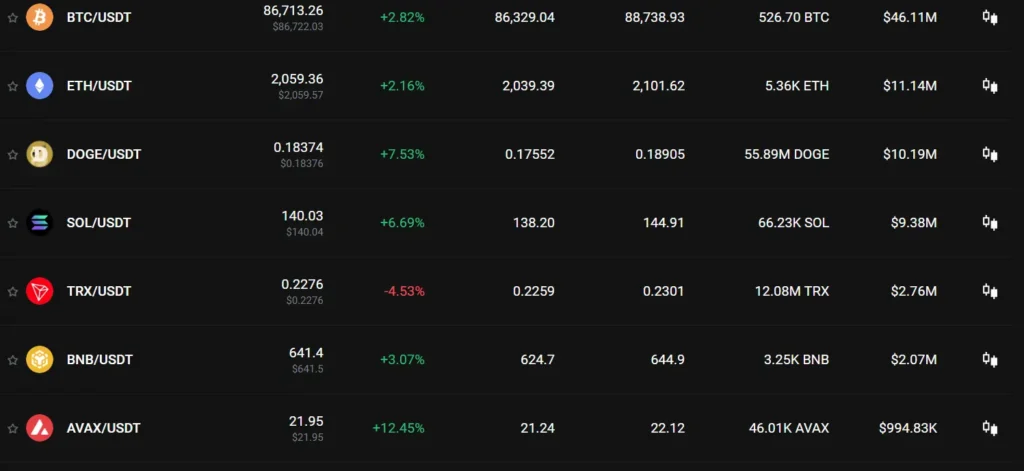

Phemex Vs Aibit: Supported Cryptocurrencies

Phemex offers over 150 trading pairs according to recent data. This gives you access to a wide range of cryptocurrencies to trade on their platform.

The exchange supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and various altcoins. Their selection caters to both beginners and experienced traders who want variety in their trading options.

Aibit, on the other hand, has a more limited selection of cryptocurrencies. While they support the major tokens like BTC and ETH, their overall offering is smaller compared to Phemex.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Trading Pairs | Major Coins Supported | Altcoin Selection |

|---|---|---|---|

| Phemex | 150+ | BTC, ETH, XRP, etc. | Extensive |

| Aibit | Fewer options | BTC, ETH | Limited |

Phemex focuses on both spot trading and derivatives. You can trade perpetual contracts and futures on their platform, which expands your cryptocurrency trading options.

It’s worth noting that neither platform directly supports fiat currencies for purchases. This means you’ll need to transfer cryptocurrency to begin trading on either exchange.

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade. Phemex’s larger selection might be better if you’re looking to diversify into multiple altcoins.

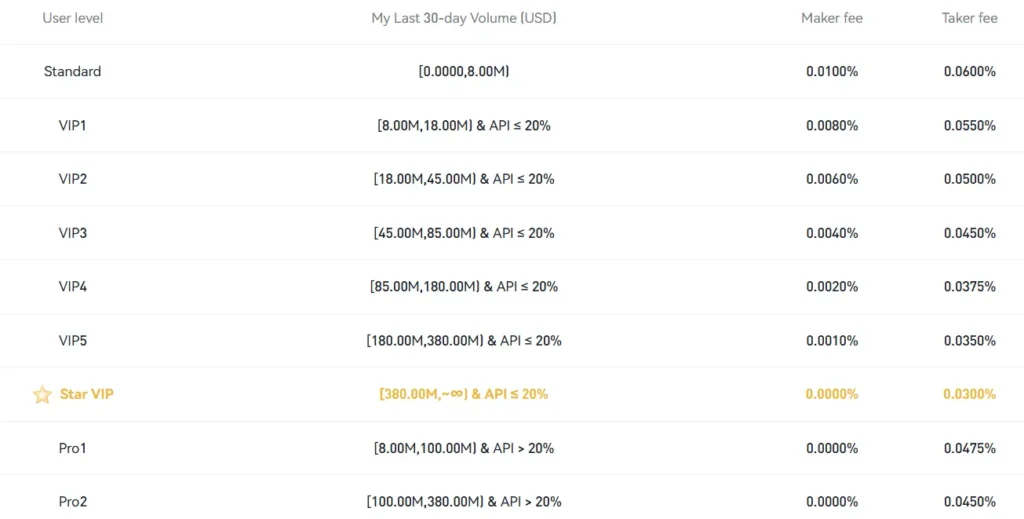

Phemex Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and Aibit, understanding their fee structures can help you make an informed decision.

Phemex charges maker fees of 0.015% and taker fees of 0.065%, plus a platform fee of 0.05%. These rates are competitive within the crypto exchange industry.

For deposits, Phemex has a minimal requirement of 0.00000001 BTC, making it accessible for traders with smaller amounts to invest.

Aibit’s fee structure differs from Phemex. While specific data about Aibit is limited in the search results, it’s important to note that exchanges typically compete on fee structures.

Fee Comparison Table:

| Fee Type | Phemex | Aibit |

|---|---|---|

| Maker Fee | 0.015% | Varies |

| Taker Fee | 0.065% + 0.05% platform fee | Varies |

| Minimum Deposit | 0.00000001 BTC | No minimum specified |

When comparing withdrawal fees, both platforms charge different rates depending on the cryptocurrency you’re withdrawing. These fees can change based on network conditions.

You should also consider that both exchanges may offer fee discounts for higher trading volumes or for holding their native tokens.

Before making your final decision, check both platforms’ current fee schedules as these rates may have changed since March 2025.

Phemex Vs Aibit: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is crucial for your trading strategy. Both Phemex and Aibit offer various order types, but there are some differences worth noting.

Phemex provides a comprehensive range of order options divided into basic and advanced categories. The basic order types include:

- Market Orders: Execute immediately at current market price

- Limit Orders: Set a specific price for execution

- Stop Orders: Trigger at a predetermined price level

Phemex also offers advanced order types such as stop-limit orders and trailing stop orders. These give you more control over your entry and exit points during volatile market conditions.

Aibit, while still providing essential trading functions, typically offers a more streamlined selection of order types. Their platform focuses on user-friendly interfaces that make trading accessible for beginners.

Both exchanges support conditional orders, allowing you to set up automated trading strategies based on specific market conditions.

For leverage trading, Phemex is known for its robust offering, supporting various order types when trading with margin. This makes it particularly appealing if you engage in derivatives trading.

Your trading style will determine which platform’s order types better suit your needs. If you require advanced order functionalities for complex strategies, Phemex might offer more tools. If you prefer simplicity with essential order types, Aibit could be sufficient.

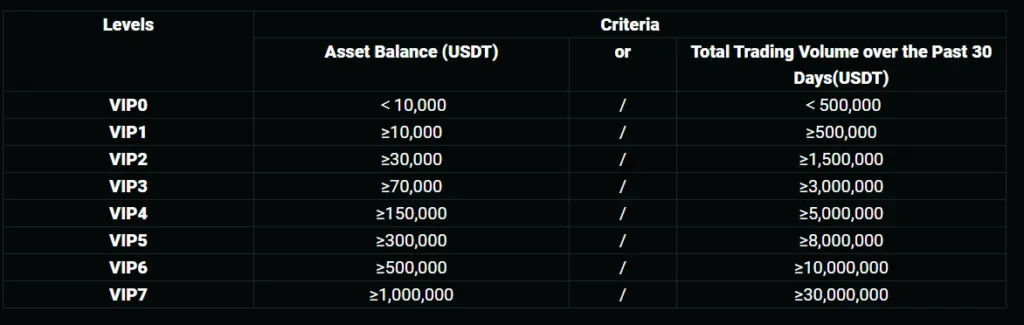

Phemex Vs Aibit: KYC Requirements & KYC Limits

Phemex now requires KYC verification for all users who want to deposit, withdraw, or trade crypto. KYC (Know Your Customer) is a form of identity verification that helps financial institutions confirm who their customers are.

In the past, Phemex allowed some trading without KYC, but this has changed. Now you must complete identity verification before you can use their platform fully.

If you try to use Phemex without completing KYC, you may find yourself in a difficult situation. Users have reported having funds stuck on the platform when they couldn’t complete verification.

Aibit’s KYC approach:

Aibit has different verification levels that affect your trading limits. The basic level requires minimal information, while higher tiers need more documentation for increased limits.

Key differences:

| Feature | Phemex | Aibit |

|---|---|---|

| KYC Required | Yes, for all transactions | Tiered system |

| Verification Speed | 1-3 business days | 24-48 hours typical |

| Document Types | Government ID, proof of address | Similar, with additional requirements for higher tiers |

You should consider these KYC requirements when choosing between Phemex and Aibit. Your comfort level with sharing personal information and your trading volume needs will influence which platform works better for you.

Both exchanges implement these measures to comply with regulations, but their approaches differ in flexibility and user experience.

Phemex Vs Aibit: Deposits & Withdrawal Options

When choosing between Phemex and Aibit exchanges, understanding their deposit and withdrawal options is crucial for your trading experience.

Phemex accepts limited cryptocurrencies for deposits and withdrawals. The platform requires a minimum deposit of 0.00000001 BTC to start trading. You can fund your account with both Bitcoin and credit cards.

While Phemex offers cryptocurrency deposit options, direct USD deposits appear limited based on current information.

Phemex Deposit Methods:

- Cryptocurrencies (limited selection)

- Credit cards

- Minimum deposit: 0.00000001 BTC

Phemex Withdrawal Methods:

- Cryptocurrencies

- Withdrawal fees vary by asset

Aibit, on the other hand, offers a different set of deposit and withdrawal options. The platform does not impose minimum deposit requirements, giving you more flexibility when starting with smaller amounts.

Both platforms implement security measures for your deposits, but processing times and fee structures differ. You should consider these differences when deciding which platform better suits your trading needs.

The ease of moving funds in and out of an exchange can significantly impact your trading strategy, especially during volatile market conditions when quick access to your funds becomes essential.

Phemex Vs Aibit: Trading & Platform Experience Comparison

When comparing Phemex and Aibit trading platforms, several key differences affect your trading experience.

Phemex offers a more extensive selection of tradable assets compared to Aibit. This gives you more options when diversifying your crypto portfolio.

The user interface on both platforms is designed for traders of various experience levels. However, Phemex’s interface tends to be more intuitive for beginners.

Trading Features Comparison:

| Feature | Phemex | Aibit |

|---|---|---|

| Mobile App | Yes | Yes |

| Demo Account | Yes | Limited |

| Trading Bots | Advanced | Basic |

| Chart Tools | Comprehensive | Standard |

Phemex provides more advanced analytical tools that help you make informed trading decisions. Their charting capabilities include more indicators and drawing tools.

Both platforms offer leverage trading, but Phemex typically provides higher leverage options on more trading pairs. This might appeal to you if you’re looking for higher risk/reward scenarios.

The execution speed on Phemex is slightly faster, which can be crucial during volatile market conditions when every second counts.

Aibit does have an advantage with its simpler fee structure, making it easier for you to calculate trading costs.

Security features are robust on both platforms, but Phemex implements additional security layers like cold storage for funds and regular security audits.

Customer support responsiveness favors Phemex, with faster response times and more support channels available when you need assistance.

Phemex Vs Aibit: Liquidation Mechanism

When trading on crypto exchanges, understanding liquidation mechanisms is crucial for your success. Liquidation happens when your position’s value falls below the maintenance margin requirement.

Phemex has a clear liquidation protocol. Your position gets liquidated when the sum of Initial Margin, Realized PnL, and Unrealized PnL drops below the Maintenance Margin level.

To protect traders, Phemex uses a Fair Price Marking mechanism. This helps you avoid forced liquidations caused by market manipulation or lack of liquidity. Phemex also implements Risk Limits as an additional safety feature.

Aibit (formerly known as ByBit) employs a dual price mechanism. This system aims to shield you from sudden price volatility and market manipulation.

However, some users have expressed concerns about Aibit’s liquidation practices. According to forum discussions, traders have questioned how effectively the dual price mechanism actually protects them during volatile market conditions.

Key Differences:

| Feature | Phemex | Aibit |

|---|---|---|

| Protection System | Fair Price Marking | Dual Price Mechanism |

| Additional Safety | Risk Limits | Price Protection |

| User Feedback | Generally positive | Mixed reviews |

You should monitor your positions closely on both platforms. Setting stop-loss orders and using proper risk management techniques will help you avoid liquidations regardless of which exchange you choose.

Phemex Vs Aibit: Insurance

When choosing a crypto exchange, insurance protection is an important factor to consider. Let’s compare how Phemex and Aibit handle user funds security through insurance.

Phemex focuses primarily on cold storage security measures rather than specific insurance coverage. According to the search results, Phemex keeps most user assets in cold storage, but doesn’t mention having dedicated insurance for these funds.

Aibit’s insurance details aren’t mentioned in the provided search results. This could indicate either limited insurance offerings or that this information isn’t widely reported.

Security Approach Comparison:

| Exchange | Primary Security | Insurance Coverage |

|---|---|---|

| Phemex | Cold storage | Not specified |

| Aibit | Insufficient data | Insufficient data |

You should be aware that proper insurance can protect your funds against hacks, theft, or exchange insolvency. Without clear insurance information, you might face greater risk if something goes wrong.

When deciding between these platforms, you might want to directly contact customer support at both exchanges for current insurance details. Insurance policies can change, so getting up-to-date information is crucial.

Remember that the best protection combines exchange insurance with personal security practices like using hardware wallets for long-term storage and enabling all available security features.

Phemex Vs Aibit: Customer Support

When choosing between Phemex and Aibit exchanges, customer support can be a deciding factor. Both platforms offer help when you need it, but there are some differences worth noting.

Phemex provides good customer support according to recent reviews. They offer multiple ways to get help including live chat, email support, and an extensive knowledge base. Many users report quick response times, especially for basic questions.

The platform also maintains active social media channels where you can reach their team. Their support staff can handle both technical issues and trading questions.

Aibit’s customer support system includes similar options, though with some variations in quality and response time. They offer email support and a ticket system for more complex problems.

Support Comparison:

| Feature | Phemex | Aibit |

|---|---|---|

| Live Chat | Yes | Limited hours |

| Email Support | Yes | Yes |

| Response Time | Generally fast | Can vary |

| Knowledge Base | Comprehensive | Basic |

| Languages | Multiple | Fewer options |

Phemex seems to have an edge in supporting users during trading contests and with copy trading features. Their team is trained to help with these specialized services.

For new traders, Phemex’s support materials include more beginner-friendly guides. If you’re just starting out, this might make your experience smoother.

Both exchanges offer support, but current information suggests Phemex puts more resources into their customer service infrastructure.

Phemex Vs Aibit: Security Features

When choosing between Phemex and Aibit, security should be a top priority for your crypto investments. Both exchanges offer various security measures, but there are some key differences to consider.

Phemex implements several robust security features. They use cold wallet storage for most user funds, which helps protect assets from online threats. According to recent search results, even during a reported $68M hack, cold wallets remained secure.

The platform also offers two-factor authentication (2FA) to add an extra layer of protection to your account. Phemex conducts manual reviews for withdrawals, which can help prevent unauthorized transactions.

Aibit also emphasizes security with similar features like 2FA and cold storage solutions. However, they don’t have as extensive a track record in the industry as Phemex.

Key Security Features Comparison:

| Feature | Phemex | Aibit |

|---|---|---|

| Cold Wallet Storage | Yes | Yes |

| Two-Factor Authentication | Yes | Yes |

| Manual Withdrawal Reviews | Yes | Limited |

| Negative Balance Protection | Yes | Not specified |

| Security Track Record | Established | Newer |

Phemex offers negative balance protection as a risk management feature. This prevents you from losing more than your deposited funds during volatile market conditions.

Both platforms use encryption to protect your personal information. You should always enable all available security features regardless of which platform you choose.

Is Phemex A Safe & Legal To Use?

Phemex is considered a safe and legitimate cryptocurrency exchange for traders. As a centralized exchange, it has maintained a strong security record with no reported hacks, which is impressive in the crypto space.

The platform is regulated and offers secure trading options, including contracts with up to 100x leverage. This makes it suitable for both beginners and experienced traders looking for a reliable platform.

For users in the United States, Phemex appears to be accessible for contract trading across various pairs without reported issues. Many traders use Phemex daily without encountering legal problems.

Key security features:

- Strong encryption protocols

- Two-factor authentication (2FA)

- Cold wallet storage for most funds

- Regular security audits

The exchange also offers competitive fees and a user-friendly interface that is quick and responsive. These features contribute to its reputation as a trustworthy platform.

When comparing Phemex to other exchanges, it consistently ranks well for security and reliability. However, availability varies by country, so you should verify if Phemex services are permitted in your location.

Also Read: What Are Bitcoin Options & How Do They Work?

Before using any exchange, remember to follow proper security practices like using strong passwords and enabling all available security features to protect your assets.

Is Aibit A Safe & Legal To Use?

Aibit’s safety and legality depend on several factors, including your location and how you use the platform. Unlike Phemex, which has established itself as a regulated exchange, Aibit’s regulatory status isn’t as clearly defined.

If you’re considering using Aibit, be aware that cryptocurrency exchanges must comply with local regulations. Some countries have strict rules or outright bans on certain crypto activities.

Key safety considerations for Aibit:

- Regulatory compliance in your region

- Security measures for your funds

- Withdrawal policies and limitations

- Customer support responsiveness

Using a VPN to access exchanges not licensed in your country carries significant risks. As seen with other platforms, you might face account freezing or fund seizure with limited legal recourse.

Before depositing funds on Aibit, verify if it’s licensed to operate in your jurisdiction. This information should be available on their website or through your country’s financial regulatory authority.

Always start with small amounts when testing a new exchange. Enable all available security features like two-factor authentication to protect your account.

Remember that even established exchanges can face security issues. It’s wise to keep only trading funds on any exchange and store long-term holdings in a secure wallet you control.

Frequently Asked Questions

Crypto traders often have specific questions about exchanges before committing their funds. These FAQs address the most common comparisons between Phemex and Aibit platforms.

What are the primary differences in fees between Phemex and Aibit?

Phemex charges trading fees starting at 0.1% for makers and 0.06% for takers on spot markets. Their fee structure uses a tiered system based on trading volume.

For derivatives, Phemex fees range from 0.01% to 0.06% depending on your membership level and trading volume.

Aibit typically charges slightly higher fees at 0.15% for standard accounts. They offer rebates for high-volume traders but generally remain less competitive on fees compared to Phemex.

Which platform, Phemex or Aibit, offers a wider range of cryptocurrencies?

Phemex supports over 200 cryptocurrencies for spot trading and offers derivatives for more than 40 assets. This includes major coins and numerous altcoins.

Aibit’s selection is more limited with approximately 150 supported cryptocurrencies. While they cover the major coins like Bitcoin and Ethereum, their altcoin selection falls short.

Search results indicate Phemex offers more assets than competitors like Bybit, suggesting they maintain a broader selection than Aibit as well.

What security measures do Phemex and Aibit implement to protect users’ assets?

Phemex employs cold storage for 99% of user funds, multi-signature technology, and regular security audits. They also offer two-factor authentication and advanced API security protocols.

Phemex has maintained a clean security record with no major hacks reported since its launch.

Aibit uses similar security methods including cold storage and 2FA but has less industry experience. Both platforms require KYC verification with withdrawal limits tied to verification levels.

How do the leverage and margin trading options compare on Phemex and Aibit?

Phemex offers leverage up to 100x on certain cryptocurrency derivatives, allowing for substantial position sizing with less capital. Their platform includes cross and isolated margin options.

Their futures trading interface provides advanced tools for managing leverage risk, including stop-loss and take-profit features.

Aibit offers more conservative leverage options, typically maxing out at 50x for major pairs. Their margin trading tools are less developed, making Phemex the preferred choice for experienced margin traders.

Can users from all countries register and trade on both Phemex and Aibit?

Neither platform serves all countries globally. Phemex restricts users from the United States, Singapore, and several other jurisdictions due to regulatory concerns.

Aibit has similar restrictions but also blocks users from additional regions including Canada and certain European countries.

You should verify the current country restrictions directly on each platform’s terms of service as these can change based on evolving regulations.

What are the customer support experiences like on Phemex versus Aibit?

Phemex offers 24/7 customer support through live chat, email, and an extensive help center. Their average response time is under one hour for most inquiries.

Their support team handles multiple languages and has generally positive reviews for responsiveness and issue resolution.

Aibit’s customer support is more limited with longer response times averaging 5-8 hours. They lack phone support and have fewer language options, making Phemex the stronger option for customer service.

Aibit Vs Phemex Conclusion: Why Not Use Both?

After comparing Aibit and Phemex, you might wonder which platform to choose. The truth is, you don’t have to pick just one.

Both exchanges offer unique benefits that can complement each other in your trading strategy. Phemex stands out with its wider range of assets and professional-grade trading tools, as mentioned in the search results.

Aibit may have different strengths that appeal to your specific needs. Using both platforms allows you to:

- Spread your risk across multiple exchanges

- Take advantage of different fee structures when most beneficial

- Access a wider range of trading pairs and investment options

- Capitalize on unique features exclusive to each platform

Many experienced traders maintain accounts on several exchanges. This approach gives you flexibility and helps you avoid being completely locked out of trading if one platform experiences downtime.

The key is to start small on both platforms. Test their interfaces, customer support, and withdrawal processes before committing larger funds.

Remember that exchange security should be your top priority. Always enable two-factor authentication and use unique passwords for each platform.

By using both Aibit and Phemex strategically, you can create a more robust trading experience that leverages the best features of each exchange.

Compare Phemex and Aibit with other significant exchanges