When comparing cryptocurrency exchanges, Phemex and Binance stand out as popular options in 2025. Each platform offers unique features that might appeal to different types of traders and investors.

Binance leads with approximately 224 million active users compared to Phemex’s 5 million, making it significantly larger in terms of user base. This difference in size often translates to higher liquidity on Binance, which can mean better prices and faster transactions for you.

Both exchanges provide various trading options and supported cryptocurrencies, but they differ in fees, user experience, and available services. Understanding these differences will help you choose the platform that best fits your trading needs and experience level.

Phemex vs Binance: At A Glance Comparison

When comparing cryptocurrency exchanges, Binance and Phemex both offer strong trading platforms but with notable differences. Based on recent data, Binance US holds a higher overall score of 8.6 compared to Phemex.

Key Features Comparison:

| Feature | Binance | Phemex |

|---|---|---|

| Trading Volume | Higher (industry leader) | Lower but growing |

| Available Cryptocurrencies | 350+ | 150+ |

| Trading Fees | 0.1% standard (can be lower) | 0.1% standard (can be lower) |

| Security Features | SAFU fund, 2FA, whitelisting | 2FA, cold storage |

| Leverage Trading | Up to 125x | Up to 100x |

| User Interface | Comprehensive but complex | Streamlined, easier for beginners |

Binance offers a wider selection of cryptocurrencies and typically maintains higher trading volumes, making it better for finding liquidity on obscure coins.

Phemex provides a more user-friendly experience that you might find easier to navigate if you’re new to crypto trading. Its platform focuses on simplicity without sacrificing essential features.

Both exchanges support spot and futures trading, but they differ in available features for advanced traders. Binance provides more tools and trading options, while Phemex emphasizes speed and simplicity.

You should consider verification requirements when choosing between these platforms. Binance US has stricter KYC (Know Your Customer) procedures, while Phemex offers some functionality with simpler verification.

Remember that availability varies by region, with Binance having specific limitations in certain countries through its Binance US platform.

Phemex vs Binance: Trading Markets, Products & Leverage Offered

When comparing Phemex and Binance, the variety of trading options stands out as a key difference. Binance offers over 350 cryptocurrencies while Phemex provides access to more than 150 cryptocurrencies.

For leverage trading, Binance takes the lead with up to 125x leverage compared to Phemex’s 100x maximum. This higher leverage gives you more trading power on Binance if you’re comfortable with the increased risk.

Both exchanges support spot trading, but their additional products differ slightly:

Binance Trading Products:

- Spot trading

- Futures contracts

- Options trading

- Margin trading

- Leveraged tokens

- Staking options

Phemex Trading Products:

- Spot trading

- Futures contracts

- Copy trading

- Earn products

- Simpler fee structure

Phemex appeals to mobile users with its straightforward interface. The platform is designed for fast-paced trading and offers a more beginner-friendly experience.

Binance provides more advanced trading options and tools that experienced traders might prefer. The wider selection of coins and trading pairs gives you more opportunities to diversify your portfolio.

Your trading style should influence your choice between these platforms. If you want simplicity and good mobile experience, Phemex might work better for you. If you need maximum variety and higher leverage options, Binance offers more choices.

Phemex vs Binance: Supported Cryptocurrencies

When choosing a crypto exchange, the number of available cryptocurrencies is an important factor to consider. Binance clearly takes the lead in this category compared to Phemex.

Binance supports over 350 cryptocurrencies, making it one of the most comprehensive exchanges for crypto variety. This gives you access to both established coins and emerging tokens.

Phemex, while a solid exchange, offers a more limited selection with approximately 40+ cryptocurrencies. This covers the major coins but provides fewer options for trading altcoins.

Popular cryptocurrencies supported by both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

If you’re looking to trade mainstream cryptocurrencies, either platform will work for your needs. However, if you want to explore lesser-known altcoins or new projects, Binance gives you more options.

It’s worth noting that Binance regularly adds new tokens, staying current with market trends and emerging cryptocurrencies. Phemex adds new listings less frequently but focuses on quality over quantity.

For beginners, Phemex’s smaller selection might actually be beneficial as it can be less overwhelming. But more experienced traders often prefer the extensive variety that Binance provides.

Your choice should depend on whether you value having more options or prefer focusing on a curated selection of established cryptocurrencies.

Phemex vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

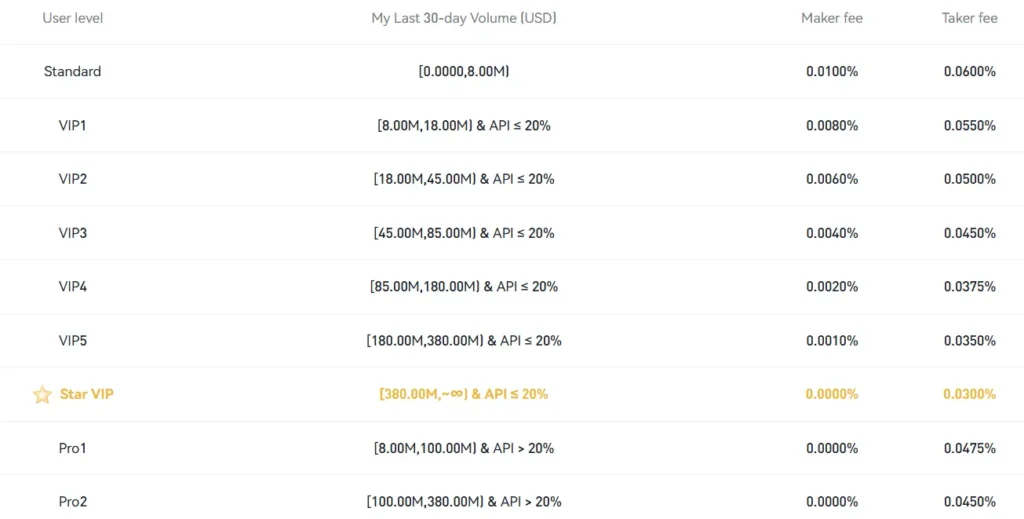

When comparing Phemex and Binance, trading fees are an important factor to consider. Binance offers lower trading fees with rates up to 0.1%, while Phemex charges up to 0.1% for makers and 0.6% for takers.

For regular traders, these differences can add up quickly. Your trading volume and account level will affect the exact fees you pay on both platforms.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Binance | Up to 0.1% | Up to 0.1% |

| Phemex | Up to 0.1% | Up to 0.6% |

Withdrawal fees also differ between these exchanges. Binance charges varying fees depending on the cryptocurrency, with some withdrawals costing up to $60.

Phemex offers more attractive withdrawal terms, with some cryptocurrencies having zero withdrawal fees. For Bitcoin withdrawals, Phemex charges around 0.0001 BTC.

Both exchanges offer multiple deposit methods, but the fees will vary based on your payment method and location. Crypto deposits are typically free on both platforms.

You should check the current fee schedules on both platforms before trading, as these rates can change. Your trading style and volume will determine which platform offers better value for your needs.

Phemex vs Binance: Order Types

When trading on cryptocurrency exchanges, order types are crucial tools that help you execute trades according to your strategy. Both Phemex and Binance offer a variety of order types to meet different trading needs.

Binance provides a comprehensive selection of order types. You can use basic options like Market and Limit orders for straightforward trades. For more advanced trading, Binance offers Stop-Limit, OCO (One-Cancels-the-Other), and Trailing Stop orders.

Phemex also supports the essential Market and Limit orders. Additionally, it features Conditional orders that include Stop, Take Profit, and Trailing Stop variations. These help you manage risk and automate trading decisions.

Both platforms allow you to use Post-Only orders, which ensure your order acts as a maker rather than a taker, potentially saving on fees.

For futures trading, both exchanges offer specialized order types. Binance includes Reduce-Only orders that prevent increasing your position size. Phemex provides similar functionality with its futures-specific conditional orders.

The main difference lies in the interface and execution. Binance’s order system is more extensive but can be complex for beginners. Phemex offers a more streamlined approach while still providing the essential tools needed for most trading strategies.

You’ll find that both platforms allow you to set time-in-force parameters, letting you specify how long your orders remain active in the market.

Phemex vs Binance: KYC Requirements & KYC Limits

Phemex and Binance have different approaches to KYC (Know Your Customer) verification, which affects your trading experience and withdrawal limits.

Phemex offers a more flexible approach to KYC. You can use the platform without KYC verification, but with limitations. Non-KYC users on Phemex can withdraw up to 2 BTC daily, which is generous compared to many exchanges.

For enhanced features, Phemex offers Level 2 KYC verification requiring your ID or passport. This verification removes withdrawal limits completely, giving you unrestricted access to your funds.

Binance implements a stricter KYC policy. Their verification process typically includes multiple levels:

- Basic verification: Requires personal information

- Intermediate verification: Requires ID documentation

- Advanced verification: Requires proof of residence

Binance’s KYC is mandatory for most meaningful platform usage. Without verification, your withdrawal limits will be severely restricted or you may not be able to withdraw at all.

The KYC process on Binance is generally more comprehensive but provides access to their full range of services, including higher withdrawal limits and all trading features.

If privacy is your priority, Phemex might be more appealing with its non-KYC option. However, if you want access to the largest trading platform with full features, completing Binance’s KYC would be necessary.

Phemex vs Binance: Deposits & Withdrawal Options

When choosing between Phemex and Binance, deposit and withdrawal options can be a deciding factor. Both exchanges offer several methods to fund your account and withdraw your assets.

Binance provides more deposit options compared to Phemex. You can fund your Binance account using bank transfers, credit/debit cards, and various third-party payment processors.

Phemex offers fewer deposit methods but still covers the basics with bank transfers and some card options. This might limit flexibility for some users.

For cryptocurrency deposits, both exchanges support a wide range of tokens. Binance has an edge here with support for more cryptocurrencies overall.

Withdrawal fees vary between the platforms:

- Binance charges up to $60 for some withdrawals

- Phemex has a 0.0001 BTC fee for Bitcoin withdrawals

- For other cryptocurrencies, fees depend on the network used

Processing times for withdrawals are similar on both platforms. Crypto withdrawals typically process within minutes to hours, while fiat withdrawals can take 1-3 business days.

Binance offers more withdrawal options overall, making it potentially more convenient if you need flexibility in how you access your funds.

Security for deposits and withdrawals is strong on both platforms, with two-factor authentication and withdrawal address whitelisting available to protect your assets.

Both exchanges may require identity verification before allowing certain deposit or withdrawal methods, especially for fiat currencies.

Phemex vs Binance: Trading & Platform Experience Comparison

When trading on cryptocurrency exchanges, the platform experience can make or break your success. Both Phemex and Binance offer robust trading platforms, but they differ in several key areas.

User Interface

- Phemex: Clean, intuitive design that’s easier for beginners

- Binance: Feature-rich but potentially overwhelming for new users

Binance provides more trading pairs with over 350 cryptocurrencies compared to Phemex’s 150+. This gives you more options when diversifying your portfolio.

Leverage Trading

| Exchange | Maximum Leverage |

|---|---|

| Binance | 125x |

| Phemex | 100x |

Trading tools on both platforms include spot and futures trading. Binance offers a wider range of order types and technical analysis tools that advanced traders might prefer.

Mobile experiences differ slightly between the two. Phemex’s app is streamlined for quick trades, while Binance’s app packs more features but requires more navigation.

Trading Fees

- Binance: Starting at 0.1% per trade

- Phemex: Competitive fee structure similar to Binance

Platform speed and reliability are crucial during volatile market conditions. Both exchanges perform well, but Binance generally handles high-volume periods better due to its larger infrastructure.

You’ll find educational resources on both platforms, though Binance has a more extensive knowledge base through Binance Academy.

Phemex vs Binance: Liquidation Mechanism

When trading with leverage on Phemex or Binance, understanding the liquidation mechanism is crucial to protect your funds. Both platforms use liquidation to close positions when they become too risky.

Binance uses a tiered liquidation system. Your position gets partially liquidated in stages as it approaches the liquidation price. This gives you a chance to add more margin before losing the entire position.

Phemex, on the other hand, uses a full liquidation model. When your position reaches the liquidation price, the entire position is closed at once.

Binance Liquidation Features:

- Progressive liquidation system

- Insurance fund to prevent negative balances

- Auto-deleveraging mechanism as backup

- Email and app notifications before liquidation

Phemex Liquidation Features:

- Complete position liquidation

- Price index averaging to prevent flash crashes

- Dual price mechanism (mark price and last price)

- Strong insurance fund coverage

Both exchanges calculate liquidation prices based on your leverage level, position size, and maintenance margin. Higher leverage means liquidation happens closer to your entry price.

Binance offers a “liquidation fee” of 0.5%, while Phemex charges liquidation fees between 0.3-0.5% depending on the asset.

You can avoid liquidations by using stop losses, monitoring positions regularly, and avoiding excessive leverage. Both platforms provide liquidation calculators to help you understand your risk.

Phemex vs Binance: Insurance

When trading on cryptocurrency exchanges, insurance protection is a critical factor to consider. Both Phemex and Binance offer some form of insurance coverage, but they differ in important ways.

Binance maintains a Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. This fund holds approximately $1 billion in assets to protect users in case of security breaches or hacks.

Phemex, while smaller with about 5 million users compared to Binance’s 224 million, also offers insurance protection. However, their insurance fund is not as substantial as Binance’s SAFU.

Insurance Comparison:

| Feature | Binance | Phemex |

|---|---|---|

| Insurance Fund | SAFU (~$1 billion) | Smaller insurance fund |

| Coverage Type | Protects against hacks and breaches | Basic protection |

| Fund Transparency | Regular proof-of-reserves | Less detailed reporting |

You should note that neither exchange guarantees complete protection of all funds in every scenario. Insurance only activates under specific circumstances like security breaches.

For maximum security, consider these additional protective measures:

- Enable two-factor authentication

- Use hardware wallets for long-term storage

- Keep only trading amounts on exchanges

- Regularly monitor your accounts for unusual activity

The larger size of Binance’s insurance fund potentially offers you more protection against catastrophic events, making it a stronger option if security is your primary concern.

Phemex vs Binance: Customer Support

When choosing between Phemex and Binance, customer support can be a deciding factor. Both exchanges offer multiple ways to get help, but they differ in response times and available options.

Binance Customer Support:

- 24/7 live chat support

- Email ticket system

- Extensive knowledge base

- Active community forums

- Multilingual support in over 20 languages

Binance’s larger user base (around 224 million users) means their support team handles a higher volume of requests. This sometimes results in longer wait times, especially during market volatility.

Phemex Customer Support:

- 24/7 live chat

- Email support

- Help center with tutorials

- Telegram community support

- Discord channel for quick assistance

With a smaller user base of approximately 5 million, Phemex often provides faster response times. Many users report getting help within minutes through their live chat.

Both platforms offer self-help resources. Binance has a more comprehensive FAQ section due to its longer history in the market. Phemex compensates with detailed guides and video tutorials.

If you value personalized support, Phemex might be the better choice. Their smaller size allows for more individual attention to your issues.

For non-English speakers, Binance offers more language options. Phemex primarily serves English-speaking customers, though they’re expanding their language support.

Response quality is generally high on both platforms, with trained staff who understand technical issues and trading concerns.

Phemex vs Binance: Security Features

When choosing a crypto exchange, security should be your top priority. Both Phemex and Binance offer strong security features to protect your investments.

Phemex uses cold storage solutions to keep most user funds offline and away from potential hackers. They implement two-factor authentication (2FA) to add an extra layer of protection to your account.

Binance also uses cold storage for the majority of user assets. Their security includes 2FA, anti-phishing codes, and address whitelisting for withdrawals.

Withdrawal Security:

- Phemex: Email verification, 2FA, withdrawal whitelisting

- Binance: Email verification, 2FA, withdrawal whitelisting, anti-phishing code

Both platforms offer insurance funds to protect users against losses. Binance’s SAFU (Secure Asset Fund for Users) sets aside a portion of trading fees to cover potential security breaches.

Phemex runs regular security audits to identify vulnerabilities. Their system includes real-time monitoring for suspicious activities on user accounts.

Binance has faced security challenges in the past but has responded by strengthening their protocols. They now offer more security options than Phemex, including hardware key support.

You can enable additional security measures on both platforms through your account settings. Taking time to set up all available security features will significantly reduce your risk of unauthorized access.

Is Phemex Safe & Legal To Use?

Phemex is considered a secure and legitimate cryptocurrency exchange. According to recent data, it has maintained a strong security record with no reported hacks as of March 2025.

As a centralized exchange, Phemex implements standard security measures to protect user funds and information. These include two-factor authentication (2FA), cold storage for assets, and regular security audits.

Phemex operates legally in many countries, but availability varies by region. It’s important to check if Phemex services are permitted in your location before creating an account.

Key safety features of Phemex include:

- Strong encryption protocols

- Regular security updates

- Asset insurance policies

- Withdrawal safety measures

When comparing to Binance, both exchanges maintain similar security standards. However, each platform may have different regulatory compliance depending on your country.

For most traders, Phemex provides a legitimate trading environment with multiple verification layers. The platform is regulated in its operating jurisdictions, adding an extra layer of safety for users.

Remember to always use proper security practices regardless of which exchange you choose. This includes using unique passwords, enabling all security features, and being cautious about phishing attempts.

Is Binance Safe & Legal To Use?

Binance is generally considered a safe platform for cryptocurrency trading. It ranks among the world’s largest exchanges and has built a strong reputation in the crypto community.

Security is a top priority for Binance. They implement various protective measures including two-factor authentication (2FA), address whitelisting, and cold storage for most user funds.

Despite these protections, no exchange is completely immune to threats. Binance has experienced security incidents in the past, though they typically cover user losses in such cases.

For legality, Binance’s status varies by location. The platform operates in many countries worldwide, but regulatory compliance differs by region.

Key safety features:

- Two-factor authentication

- Anti-phishing codes

- Advanced encryption

- Regular security audits

- Insurance fund for potential breaches

You should verify if Binance is legal in your country before signing up. Some regions have restrictions or bans on cryptocurrency trading platforms.

Binance requires identity verification to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This helps ensure the platform remains legal and reduces fraud.

When using Binance, follow basic security practices. Use strong passwords, enable all security features, and consider using a hardware wallet for large holdings.

Frequently Asked Questions

Here are answers to common questions about Phemex and Binance exchanges. These details will help you make an informed decision when choosing between these trading platforms.

What are the differences in trading fees between Phemex and Binance?

Binance generally offers lower trading fees, starting at 0.1% for makers and takers. This rate decreases as your trading volume increases.

Phemex charges slightly higher fees, typically starting at 0.1% for makers and 0.2% for takers on spot trading. For futures trading, Phemex offers competitive rates similar to Binance.

Both platforms provide fee discounts when using their native tokens—BNB for Binance and PHX for Phemex.

How do the security features of Phemex compare to those of Binance?

Both exchanges offer strong security measures. Binance utilizes two-factor authentication, address whitelisting, and maintains a Secure Asset Fund for Users (SAFU).

Phemex also implements two-factor authentication and cold storage for most user funds. Their security system includes multi-signature wallets and regular security audits.

Binance has faced some security breaches in the past but has compensated affected users. Phemex has maintained a relatively clean security record since its launch.

Which platform offers a wider range of cryptocurrencies, Phemex or Binance?

Binance clearly leads in cryptocurrency selection with support for over 350 different coins and thousands of trading pairs. This makes it suitable for those looking to trade obscure altcoins.

Phemex offers a more limited selection of around 40+ cryptocurrencies. They focus on major coins and popular altcoins rather than providing an extensive list.

For most traders who primarily deal with popular cryptocurrencies, both platforms offer sufficient options.

What are the customer support options available with Phemex versus Binance?

Phemex provides 24/7 customer support through live chat, email, and an extensive knowledge base. Their response times are generally quick, averaging a few hours.

Binance offers similar support channels but has faced criticism for slow response times due to their massive user base. They provide support through chat, tickets, and a comprehensive help center.

Both platforms maintain active community forums and social media channels where users can seek help from peers.

How user-friendly is the trading interface on Phemex in comparison to Binance?

Phemex features a cleaner, more straightforward interface that beginners find easier to navigate. Their mobile app is well-designed with intuitive controls.

Binance offers a more comprehensive but potentially overwhelming interface with advanced tools and charts. They have both basic and advanced viewing options to accommodate different user experience levels.

For new traders, Phemex may be easier to use initially, while experienced traders often prefer Binance’s extensive features.

Can users from the USA trade on both Phemex and Binance platforms?

USA traders cannot use the main Binance platform due to regulatory restrictions. Instead, they must use Binance.US, which offers fewer features and cryptocurrencies than the international version.

Phemex officially stopped serving USA customers in 2023 due to regulatory concerns. Neither platform fully supports USA-based traders on their main exchanges.

USA users should verify the current regulatory status of both platforms before attempting to register, as policies may change.

Phemex vs Binance Conclusion: Why Not Use Both?

Both Phemex and Binance offer valuable features for crypto traders. Based on the search results, Binance provides a smoother user experience compared to Phemex.

Binance stands as the #1 exchange globally with comprehensive trading options and a well-designed interface. Their platform is often praised for being intuitive even for beginners.

Phemex, while not as large as Binance, has earned strong ratings on both Android and iOS platforms. They offer unique features that might appeal to specific trading styles.

Why consider using both platforms:

- Diversify your trading options: Each platform has different coin listings and trading pairs

- Take advantage of different fee structures during various market conditions

- Access exclusive features that may only be available on one platform

You can use Binance for its liquidity and wide selection of cryptocurrencies while utilizing Phemex for its specific trading tools or lower fees on certain transactions.

Many experienced traders maintain accounts on multiple exchanges to capitalize on price differences and promotional offers. This strategy helps minimize risk through diversification.

Remember to consider security when using any exchange. Both platforms offer security features like two-factor authentication, but always practice good security habits regardless of which platform you choose.

Compare Phemex and Binance with other significant exchanges