Choosing between Phemex and Bybit can be challenging if you’re looking to trade cryptocurrencies. Both exchanges offer similar services but differ in key areas that might influence your decision.

Phemex stands out for its zero-fee spot trading, deep liquidity pool, and more available crypto assets compared to Bybit. However, Bybit offers options trading which Phemex doesn’t have, giving you more ways to manage risk and try different trading strategies.

Your trading style and needs will determine which platform works better for you. If you value more asset choices and no fees for spot trading, Phemex might be your pick. If you want to use options trading tools, Bybit could be the better choice. Both platforms continue to compete by improving their features and user experience as of March 2025.

Phemex vs Bybit: At A Glance Comparison

Phemex and Bybit are popular cryptocurrency exchanges that offer leverage trading options. Let’s compare their key features to help you decide which platform might work better for your needs.

Trading Fees:

Bybit offers slightly lower trading fees compared to Phemex, giving traders a cost advantage for frequent transactions.

Available Products:

| Feature | Bybit | Phemex |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Yes | Yes |

| Options | Yes | Limited |

| Copy Trading | Yes | Yes |

Both platforms provide a wide range of cryptocurrencies to trade, but they differ in their advanced features.

- User Experience: Bybit has a more refined user interface that many beginners find easier to navigate. Phemex offers a clean design as well, but some users report a steeper learning curve.

- Security Features: Both exchanges prioritize security with two-factor authentication and cold storage solutions. Neither platform has experienced major security breaches as of March 2025.

- Payment Methods: You can deposit funds using cryptocurrencies on both platforms. Bybit offers more fiat payment options than Phemex, making it easier for beginners to get started.

- Mobile Experience: Both exchanges have mobile apps available for iOS and Android devices. Bybit’s app tends to receive higher ratings in app stores for its reliability and feature set.

- Customer Support: Phemex and Bybit both offer 24/7 customer support through live chat and email, but response times can vary based on trading volume and time of day.

Phemex vs Bybit: Trading Markets, Products & Leverage Offered

Both Phemex and Bybit offer a variety of crypto trading options, but they have some key differences that might matter to you as a trader.

Phemex provides spot trading with over 230 cryptocurrencies, making it a solid choice if you want access to many digital assets. One standout feature is their zero-fee spot trading structure.

Bybit also offers extensive spot trading but adds margin trading capabilities that Phemex doesn’t have. This gives you more flexibility if you want to borrow funds to increase your position size.

Leverage Options:

- Phemex: Up to 100x leverage on futures

- Bybit: Up to 100x leverage on futures

Available Products:

| Feature | Phemex | Bybit |

|---|---|---|

| Spot Trading | ✓ (230+ coins) | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✗ | ✓ |

| Copy Trading | ✓ | ✓ |

Both platforms support derivatives trading with futures contracts on major cryptocurrencies. Their trading interfaces are designed for both beginners and experienced traders.

Phemex requires a minimum deposit of 0.00000001 BTC, while Bybit has no minimum deposit requirement. This makes Bybit slightly more accessible if you want to start with very small amounts.

Also Read: What are crypto option vaults?

Each platform maintains deep liquidity pools, which helps ensure your orders get filled at fair prices, especially important when trading with leverage.

Phemex vs Bybit: Supported Cryptocurrencies

When choosing between Phemex and Bybit, the range of available cryptocurrencies is an important factor to consider.

Phemex supports approximately 350 spot cryptocurrencies for trading. This gives you a wide selection of digital assets to buy and sell on their platform.

Bybit also offers an extensive range of cryptocurrencies, though the exact number may vary as exchanges frequently update their listings to include new tokens.

Both platforms support major cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Binance Coin (BNB)

For futures and derivatives trading, both exchanges offer contracts on popular cryptocurrencies, though the specific trading pairs might differ.

Key differences:

- Phemex has a minimum deposit requirement of 0.00000001 BTC for its trading account

- Bybit does not impose minimum deposit limits

- The platforms may differ in the availability of certain altcoins and newer tokens

The selection of cryptocurrencies on both platforms caters to different trading strategies and investment goals. You should check their current listings before signing up.

Remember that cryptocurrency availability can change frequently as exchanges add new tokens or remove others based on regulatory requirements and market demand.

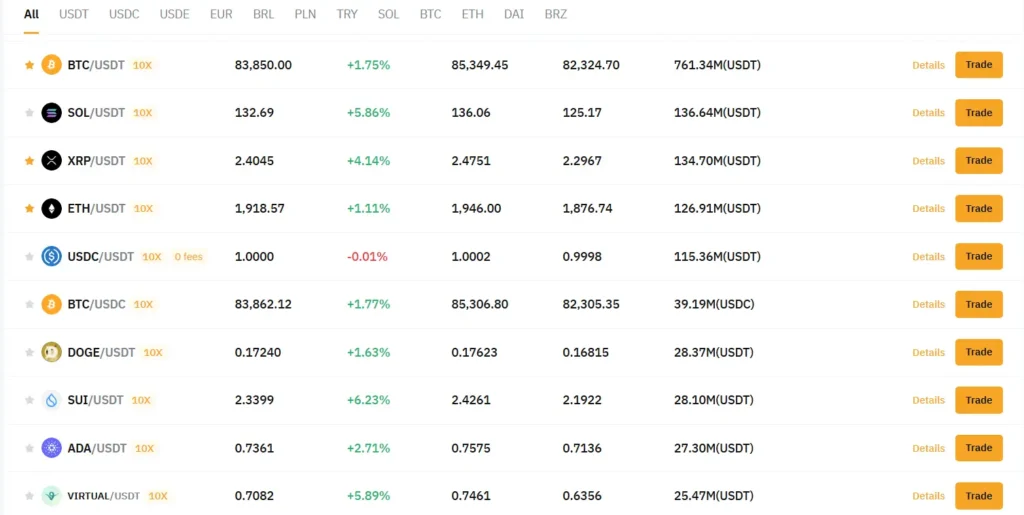

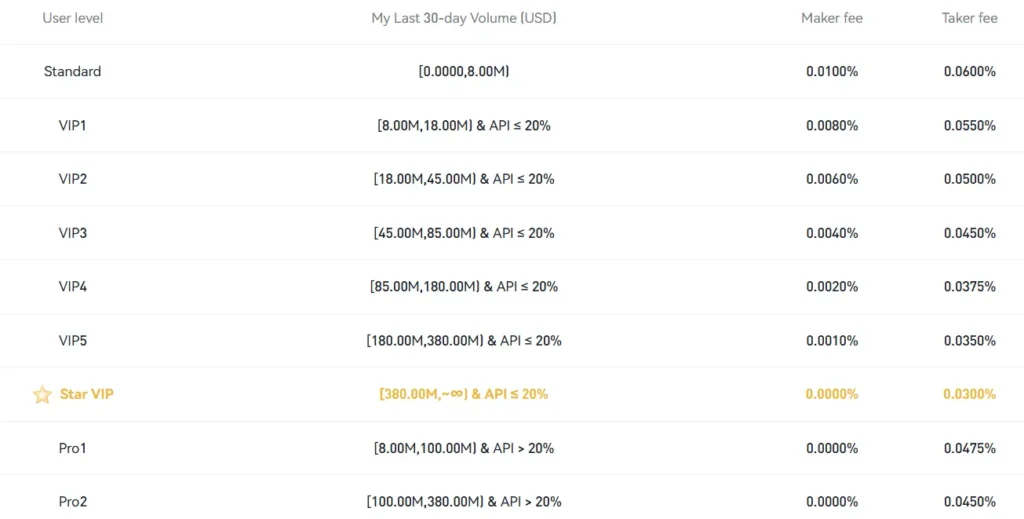

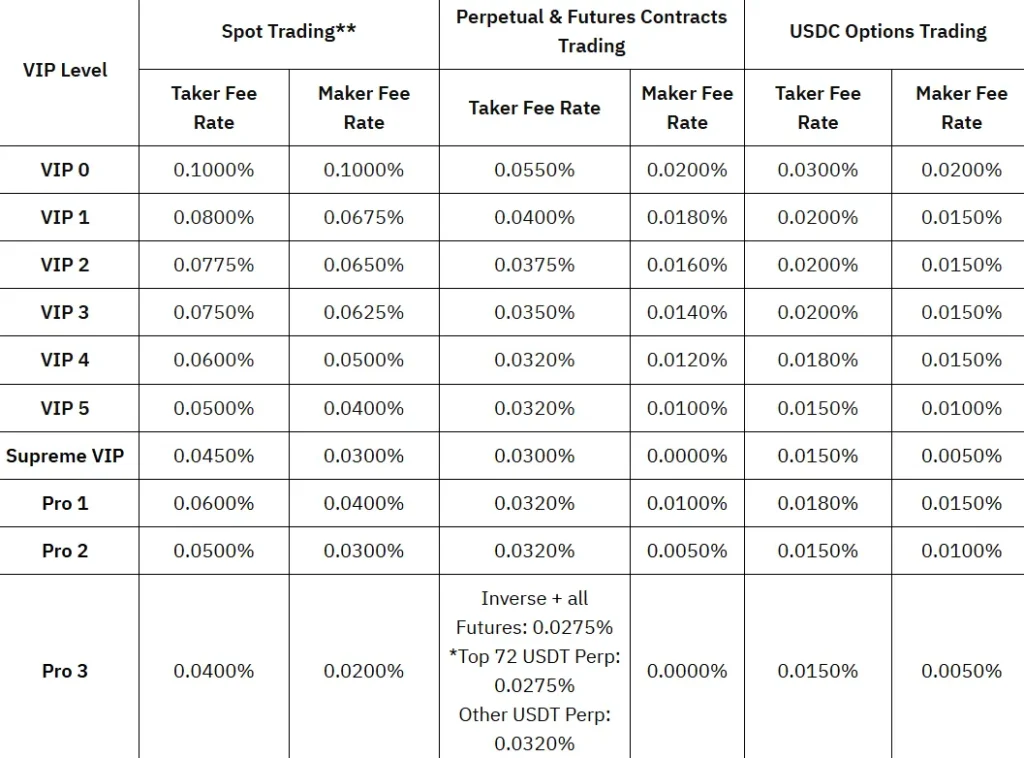

Phemex vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and Bybit, understanding their fee structures is crucial for your trading decisions. Both platforms offer competitive rates, but there are key differences to consider.

Bybit generally offers lower trading fees compared to Phemex. This advantage can make a significant difference if you’re a high-volume trader.

For spot trading, Phemex stands out with its zero-fee option for certain trading pairs. This can be appealing if you primarily engage in spot trading.

Regarding withdrawal fees, Bybit charges approximately 0.0005 BTC for Bitcoin withdrawals, while Phemex has a slightly lower fee at 0.0004 BTC. These small differences add up over multiple transactions.

Deposit Fees Comparison:

- Phemex: No deposit fees

- Bybit: No deposit fees

Minimum Deposit Requirements:

- Phemex: 0.00000001 BTC minimum deposit

- Bybit: No minimum deposit requirement

Both exchanges implement maker-taker fee models for futures trading, with rates varying based on your trading volume and VIP level.

If you’re new to crypto trading, Bybit’s fee structure might be more straightforward to understand. Their fees are clearly displayed and predictable.

Remember that fees can change over time, so it’s worth checking the official websites for the most current rates before making your decision.

Phemex vs Bybit: Order Types

When trading on crypto exchanges, the types of orders available can make a big difference in your trading strategy. Both Phemex and Bybit offer a variety of order types to help you execute trades effectively.

Phemex Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

- Conditional orders

- OCO (One-Cancels-the-Other)

Bybit Order Types:

- Market orders

- Limit orders

- Conditional orders

- Stop-loss orders

- Take-profit orders

- Trailing stop orders

Phemex provides flexibility with its OCO orders, which let you set both stop-loss and take-profit levels simultaneously. This helps you manage risk without constantly monitoring the market.

Bybit stands out with its trailing stop orders, which automatically adjust your stop price as the market moves in your favor. This feature can help you lock in profits while giving your trades room to grow.

Both platforms offer post-only limit orders that ensure you pay maker fees rather than taker fees. This can save you money if you’re a high-volume trader.

The conditional orders on both exchanges allow you to set triggers based on market conditions, giving you automated entry points when certain price levels are reached.

For beginners, both platforms provide simple market and limit orders that are easy to understand. More advanced traders will appreciate the specialized order types that help with complex strategies.

Phemex vs Bybit: KYC Requirements & KYC Limits

Both Phemex and Bybit have KYC (Know Your Customer) procedures in place, but they differ in their requirements and limits.

Phemex allows users to trade without ID verification up to certain withdrawal limits. This means you can start trading quickly without going through lengthy verification processes.

Bybit does not have minimum deposit limits, giving you more flexibility when starting out. In contrast, Phemex requires a minimum deposit of 0.00000001 BTC to begin trading.

For those concerned about privacy, both platforms offer no-KYC options with limited functionality. However, to access full features and higher withdrawal limits, you’ll need to complete verification on either platform.

Withdrawal Limits Comparison:

| Platform | No-KYC Withdrawal Limit | Verified Account |

|---|---|---|

| Phemex | Limited | Higher limits |

| Bybit | Limited | No specific limits mentioned |

Phemex puts emphasis on user account security, implementing withdrawal limits as part of their security strategy. These limits help protect your funds and the platform from potential fraud.

As regulations evolve in 2025, both exchanges continue to adapt their KYC policies. You should check their current requirements directly on their websites before making your decision.

Remember that completing KYC verification not only increases your limits but also provides additional security for your account.

Phemex vs Bybit: Deposits & Withdrawal Options

When choosing between Phemex and Bybit, understanding their deposit and withdrawal options can help you make the right decision for your trading needs.

Phemex supports cryptocurrency deposits with a minimum requirement of 0.00000001 BTC for its trading accounts. The platform doesn’t charge fees for deposits, making it cost-effective to fund your account.

Bybit, on the other hand, doesn’t have minimum deposit limits. This flexibility allows you to start trading with any amount you’re comfortable with.

Withdrawal Methods:

- Phemex: Supports cryptocurrency withdrawals

- Bybit: Offers cryptocurrency withdrawals

Both exchanges process withdrawals relatively quickly, though exact times can vary depending on network congestion.

Withdrawal Fees:

| Exchange | Fee Structure |

|---|---|

| Phemex | Variable fees based on cryptocurrency |

| Bybit | Network fees apply |

Neither exchange currently supports direct fiat deposits through bank transfers or credit cards. You’ll need to purchase crypto elsewhere and transfer it to your exchange wallet.

Security for deposits and withdrawals is robust on both platforms, with two-factor authentication required for withdrawals to protect your funds.

Processing times can vary between the two exchanges, with network congestion sometimes causing delays regardless of which platform you choose.

Phemex vs Bybit: Trading & Platform Experience Comparison

When comparing Phemex and Bybit, both platforms offer robust trading experiences with some key differences worth noting.

Phemex stands out with its zero-fee spot trading structure, which can be attractive if you’re looking to save on transaction costs. The platform provides a clean interface that both beginners and experienced traders find easy to navigate.

Bybit, with an overall score of 8.0 (compared to Phemex’s slightly lower rating), offers a more comprehensive suite of trading tools. You’ll find advanced charting capabilities and a wider range of order types on Bybit.

Both exchanges support futures trading with leverage, but Bybit typically provides higher liquidity for derivative products. This means your larger trades are less likely to cause significant price slippage.

Mobile Experience:

- Phemex: Intuitive app with quick execution speeds

- Bybit: Feature-rich mobile platform with advanced trading options

Trading Features:

| Feature | Phemex | Bybit |

|---|---|---|

| Spot Trading Fees | Zero-fee structure | Standard fee model |

| Futures Trading | Yes, with good liquidity | Yes, with deeper liquidity |

| Order Types | Basic to intermediate | Comprehensive selection |

| Trading Tools | Good selection | More extensive options |

Phemex typically appeals to traders who value simplicity and cost-effectiveness. You might prefer its straightforward approach if you’re newer to crypto trading.

Bybit caters to more experienced traders with its advanced features and deeper liquidity pool. You’ll benefit from its comprehensive toolset if you engage in complex trading strategies.

Phemex vs Bybit: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. This system helps protect both you and the exchange when trades move against your position.

Bybit’s Dual Price Mechanism uses both mark price and last traded price to determine liquidations. This system helps protect you from sudden price spikes or market manipulation that might otherwise trigger an unnecessary liquidation.

Despite this protection, some Bybit users report confusion during liquidation events. The platform’s liquidation process can sometimes feel less transparent than desired.

Phemex’s Liquidation Approach also employs a mark price system to prevent premature liquidations from price wicks or momentary volatility. This helps ensure your positions aren’t closed due to temporary market fluctuations.

Both platforms send warnings as your position approaches liquidation price. You’ll receive notifications when your margin ratio falls below certain thresholds.

Here’s how they compare:

| Feature | Bybit | Phemex |

|---|---|---|

| Price Mechanism | Dual price system | Mark price system |

| Liquidation Warnings | Yes | Yes |

| Partial Liquidations | Available | Available |

| Auto-Deleveraging | Used in extreme cases | Used in extreme cases |

When trading with leverage on either platform, you should always use stop losses and proper position sizing to avoid liquidations entirely.

Phemex vs Bybit: Insurance

When trading on cryptocurrency exchanges, security should be a top priority. Both Phemex and Bybit offer insurance funds to protect their users against unexpected losses.

Phemex maintains an insurance fund to prevent auto-deleveraging (ADL) in most market conditions. This fund helps cover losses from liquidated positions that couldn’t be closed at the bankruptcy price. As of March 2025, Phemex’s insurance fund holds approximately $50 million.

Bybit also operates a substantial insurance fund, currently valued at around $400 million. This larger fund provides more robust protection against market volatility and potential losses during extreme trading conditions.

Both exchanges publish their insurance fund balances regularly for transparency. You can check the current status on their respective websites.

Key insurance features comparison:

| Feature | Phemex | Bybit |

|---|---|---|

| Insurance Fund Size | ~$50 million | ~$400 million |

| Transparency | Regular updates | Regular updates |

| ADL Protection | Yes | Yes |

| Emergency Insurance | Limited | More extensive |

If insurance coverage is your primary concern, Bybit holds an advantage with its significantly larger fund. This provides better protection during market crashes or extreme volatility.

Neither exchange offers personal account insurance similar to traditional banking’s FDIC insurance. Your funds remain subject to other risks like hacking or operational failures.

Phemex vs Bybit: Customer Support

When choosing a crypto exchange, reliable customer support is crucial. Both Phemex and Bybit offer various support channels to help you with your trading needs.

Phemex is recognized for its responsive customer support team. You can reach them through live chat, email, and social media platforms. Their support staff typically responds quickly to queries and technical issues.

Bybit also provides multiple support channels including live chat, email support, and an extensive knowledge base. Their team is available 24/7 to address your concerns.

Response time is a key factor to consider. Phemex often resolves tickets within hours, while Bybit may take slightly longer during peak periods.

Both platforms offer comprehensive FAQs and tutorial sections. These resources can help you solve common issues without contacting support directly.

Language support is another important aspect. Bybit offers customer service in more languages than Phemex, which might be beneficial if English isn’t your first language.

For technical problems, both exchanges provide dedicated technical support teams. However, Phemex has received positive feedback for their troubleshooting capabilities.

The mobile app support experience differs slightly between the two. Phemex’s mobile support is particularly well-regarded, allowing you to get help while trading on the go.

Remember that support quality can vary based on the complexity of your issue and current trading volume on the platform.

Phemex vs Bybit: Security Features

When choosing a crypto exchange, security should be your top priority. Both Phemex and Bybit offer robust security measures to protect your assets.

Phemex implements a cold wallet system, storing the majority of user funds offline to prevent hacking attempts. They also use multi-signature technology for withdrawals and enforce two-factor authentication (2FA) for all accounts.

Bybit matches these security features with their own cold wallet storage system. They maintain approximately 99% of user assets in cold storage, making them less vulnerable to online threats.

Key Security Features Comparison:

| Feature | Phemex | Bybit |

|---|---|---|

| Cold Storage | Yes | Yes (99% of funds) |

| Two-Factor Authentication | Required | Required |

| Multi-signature Wallets | Yes | Yes |

| Insurance Fund | Yes | Yes |

| KYC Verification | Optional | Optional |

Both exchanges maintain insurance funds to protect users against unexpected losses during volatile market conditions. This adds an extra layer of financial security for your trading activities.

Phemex offers regular security audits of their platform, while Bybit employs advanced encryption protocols for data protection. Both exchanges have strong track records with no major security breaches reported.

Also Read: Crypto options trading strategies

You’ll find that both platforms take user account security seriously by offering anti-phishing codes and withdrawal address whitelisting. These features help prevent unauthorized access to your accounts.

Is Phemex A Safe & Legal To Use?

Phemex is generally considered a safe cryptocurrency exchange with strong security measures. The platform uses cold storage for most user assets and has a solid track record regarding security.

However, legal status varies by location. According to the search results, Phemex is not legally available to users in the United States. If you’re a US resident, you should not use Phemex for cryptocurrency trading.

For users outside restricted regions, Phemex operates legally in many countries. The exchange follows regulatory requirements in the jurisdictions where it operates.

Phemex requires a minimum deposit of 0.00000001 BTC to start trading. This extremely low threshold makes it accessible for beginners who want to start with small amounts.

Security features on Phemex include:

- Cold storage for majority of assets

- Two-factor authentication (2FA)

- Anti-phishing measures

- Regular security audits

When considering safety, remember that all cryptocurrency exchanges carry inherent risks. Even the most secure platforms can face technical issues or market volatility.

Before using Phemex, check if it’s legal in your country. Many regions have specific regulations about cryptocurrency trading that may affect your ability to use the platform.

Is Bybit A Safe & Legal To Use?

Bybit has established itself as a popular crypto exchange platform. The exchange offers various security measures to protect user funds and data.

According to recent information, Bybit experienced a security incident in 2025. A forensic review indicated that the exchange itself had no security vulnerabilities, and the attack stemmed from issues with Safe Custody.

When comparing safety features with Phemex, both exchanges implement standard security protocols. However, there appears to be a connection between recent hacks on both platforms, as hackers consolidated stolen funds into a single wallet.

Regarding legality, Bybit operates as a crypto-to-crypto exchange. This means you can use it as long as you’re not on a restricted list or suspected of illegal activities.

Before using Bybit, consider these safety practices:

- Enable two-factor authentication

- Use a strong, unique password

- Never share your private keys

- Withdraw large amounts to cold storage

- Keep your account information updated

The legal status of Bybit varies by country. You should check your local regulations before signing up. Some jurisdictions have restrictions on cryptocurrency trading platforms.

Bybit does not have deposit limits, unlike Phemex which requires a minimum deposit of 0.00000001 BTC. This flexibility can be beneficial for new traders starting with small amounts.

Bybit vs Phemex Conclusion: Why Not Use Both?

Choosing between Bybit and Phemex doesn’t have to be an either/or decision. Both exchanges offer valuable features that can complement each other in your trading strategy.

Bybit stands out with lower trading fees and a user-friendly interface. According to recent comparisons, Bybit has a higher overall score of 8.0 compared to Phemex.

Phemex, however, offers more assets for derivatives trading. This variety can be crucial if you’re looking to diversify your trading portfolio beyond the most common pairs.

Benefits of using both platforms:

- Access to a wider range of trading pairs

- Ability to take advantage of different fee structures

- Reduced risk through platform diversification

- Opportunity to use unique features exclusive to each platform

You might consider using Bybit for your frequent trades to benefit from lower fees, while keeping Phemex for access to its broader selection of assets.

Remember that market conditions and platform features change regularly. What works best today might not be optimal tomorrow, so having accounts on both exchanges gives you flexibility.

Many traders in the community already use this dual-platform approach. As one Reddit user mentioned, they use Phemex daily and have never experienced problems with contract trading.

The best strategy may be to test both platforms with small amounts first. This hands-on experience will help you determine which aspects of each exchange best suit your specific trading needs.

Frequently Asked Questions

Crypto traders often have specific questions when comparing Phemex and Bybit. These platforms differ in several key areas including fees, leverage options, and available features that can impact your trading experience.

What are the main differences in trading fees between Phemex and Bybit?

Phemex and Bybit have different fee structures. Bybit typically charges maker fees between 0.01% to 0.06% and taker fees between 0.06% to 0.1% depending on your trading level.

Phemex offers a membership option that can reduce or eliminate trading fees for frequent traders. For standard accounts, Phemex’s fees are competitive with Bybit but may vary based on the specific assets traded.

Fee discounts are available on both platforms for high-volume traders or users who hold the platforms’ native tokens.

How does the leverage offered on Phemex compare to that of Bybit?

Both exchanges offer high leverage options. Bybit provides up to 100x leverage on certain trading pairs, particularly major cryptocurrencies like BTC and ETH.

Phemex also offers up to 100x leverage on similar assets. The exact leverage available to you on either platform depends on the specific cryptocurrency pair you’re trading and sometimes your account level.

Remember that higher leverage means higher risk. Both platforms include liquidation mechanisms to protect themselves when leveraged positions move against traders.

Is there a difference in the variety of tradable assets between Phemex and Bybit?

Bybit generally offers a wider selection of cryptocurrencies and trading pairs compared to Phemex. Bybit supports trading for major cryptocurrencies and numerous altcoins.

Phemex focuses more on major cryptocurrencies but has been expanding its offerings. Both platforms support spot trading and futures contracts, but their available markets differ slightly.

If you’re looking to trade specific altcoins, you should check both platforms to see which ones list your preferred assets.

Can users from the United States legally trade on Phemex or Bybit?

Based on the search results, some US users have reported using Phemex without issues for contract trading. However, regulatory compliance is complex and constantly changing.

Both Phemex and Bybit have faced regulatory scrutiny in the United States. Many cryptocurrency exchanges limit or restrict services to US users due to regulatory requirements.

You should check the current terms of service for both platforms and possibly consult legal advice before trading if you’re a US resident.

Which platform offers more robust security features, Phemex or Bybit?

Both Phemex and Bybit emphasize security, implementing measures like two-factor authentication, cold storage for funds, and regular security audits.

Bybit has a strong reputation for security with no major hacks reported. Phemex also maintains strong security protocols and promotes its system as being secure.

When choosing between the two, look at specific security features like insurance funds, withdrawal confirmation periods, and anti-phishing protections that matter to you.

How do the user interfaces of Phemex and Bybit compare in terms of ease of use?

Bybit’s interface is often praised for being user-friendly while still offering advanced trading features. It provides clear navigation and comprehensive charting tools.

Phemex offers a clean interface that appeals to both beginners and experienced traders. Both platforms are available as mobile apps and web platforms.

Your preference might depend on specific features like customizable layouts, charting indicators, or order types that you use most frequently.

Compare Phemex and Bybit with other significant exchanges