When looking for a cryptocurrency exchange, the choice between Phemex and BYDFi can impact your trading experience. Both platforms offer unique features that may suit different trading styles and preferences.

Comparing BYDFi and Phemex helps you make an informed decision based on their fees, features, and trading options. While Phemex stands out with its zero-fee spot trading structure, BYDFi offers privacy-focused trading without KYC requirements. This distinction matters if privacy is your priority.

Each platform also differs in leverage options, with BYDFi providing up to 50x leverage for traders seeking higher risk and reward potential. Your trading goals, whether focused on spot trading or leveraged positions, will help determine which platform better meets your needs.

Phemex vs BYDFi: At A Glance Comparison

When choosing between Phemex and BYDFi for your crypto trading needs, understanding their key differences can help you make the right choice.

Both platforms offer cryptocurrency exchange services, but they have distinct features that set them apart. Here’s a quick comparison to help you decide which might work better for you.

Trading Fees Comparison:

| Feature | Phemex | BYDFi |

|---|---|---|

| Trading Fees | Competitive | Low, among cheapest options |

| Deposit Fees | Minimal | None |

| Withdrawal Fees | Standard | Low |

Platform Features:

- Phemex: Higher overall score (8.0), strong trading tools, good for experienced traders

- BYDFi: User-friendly interface, strong privacy features, great for beginners

Phemex offers more advanced trading options and has established a solid reputation in the crypto community. Its platform might appeal to you if you’re looking for a robust trading experience.

BYDFi stands out for its simplicity and privacy-focused approach. You’ll appreciate its straightforward interface if you’re new to crypto trading.

One drawback of BYDFi is its limited customer support compared to Phemex. This could be important if you value responsive help when issues arise.

Also Check: How Do Crypto Options Work: A Clear Guide to Understanding Digital Asset Derivatives

Both exchanges work to keep costs low, making them good choices if you’re fee-conscious. Your specific needs will determine which platform is the better fit for your trading style.

Phemex vs BYDFi: Trading Markets, Products & Leverage Offered

Phemex and BYDFi both offer a variety of trading options for cryptocurrency enthusiasts. When choosing between these platforms, it’s important to understand what each provides in terms of markets and leverage.

Leverage Options:

- Phemex: Up to 100x leverage

- BYDFi: Up to 200x leverage (some sources indicate 50x for certain pairs)

BYDFi takes the lead with higher leverage options, making it attractive if you’re looking for greater potential returns on your trades. However, remember that higher leverage also means increased risk.

Trading Products:

| Feature | Phemex | BYDFi |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures/Contracts | Yes | Yes |

| Margin Trading | Yes | Yes |

| Zero-Fee Options | Available | Limited |

Both exchanges support the core cryptocurrency trading products you’ll need. Phemex offers zero-fee trading options which might save you money depending on your trading volume.

For contract traders specifically, BYDFi provides faster execution speeds which can be crucial when making time-sensitive trades. This feature, combined with its higher leverage ceiling, makes it particularly suitable for active traders.

The platforms support most major cryptocurrencies and trading pairs. You’ll find the standard options like BTC, ETH, and various altcoins on both exchanges.

Your choice between Phemex and BYDFi might come down to whether you prioritize higher leverage (BYDFi) or potentially lower fees (Phemex) for your trading strategy.

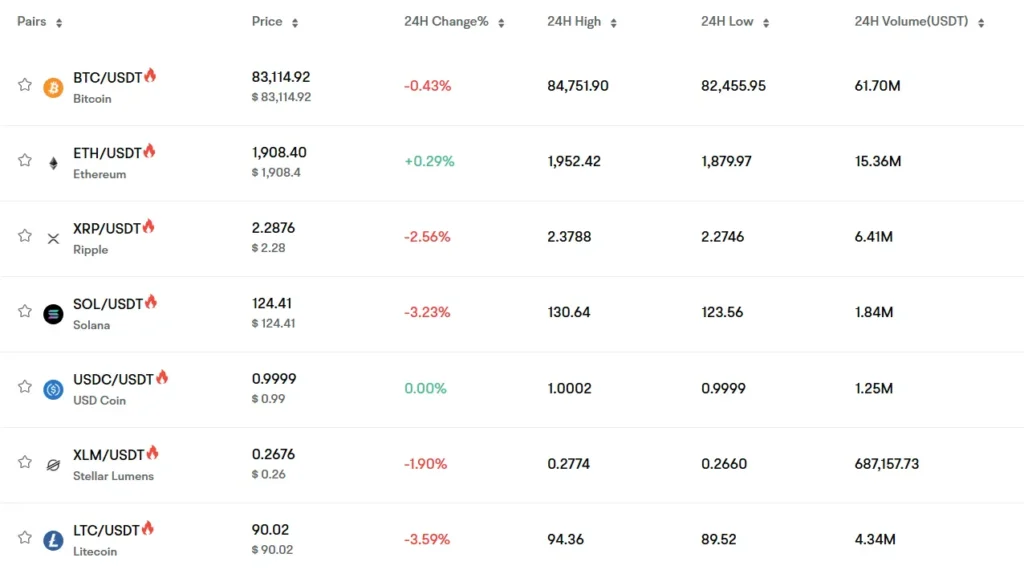

Phemex vs BYDFi: Supported Cryptocurrencies

Both Phemex and BYDFi offer a range of cryptocurrencies for trading, but they differ in their selection and approach.

Phemex supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other popular altcoins. Their platform focuses on providing solid options for mainstream crypto traders.

BYDFi also supports the major coins but is known for its privacy-focused approach with no-KYC trading requirements. This makes it easier for you to start trading quickly without extensive verification processes.

Here’s a comparison of their supported cryptocurrencies:

| Feature | Phemex | BYDFi |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Major Altcoins | ✓ | ✓ |

| New/Emerging Tokens | Limited | More variety |

| Trading Pairs | 40+ | 50+ |

Phemex offers zero-fee spot trading for certain cryptocurrencies, which can save you money on frequent trades.

BYDFi tends to list newer cryptocurrencies more quickly, giving you access to emerging projects earlier in their lifecycle.

When choosing between these platforms, consider which specific cryptocurrencies you want to trade. Check both platforms’ current listings as they regularly update their supported coins.

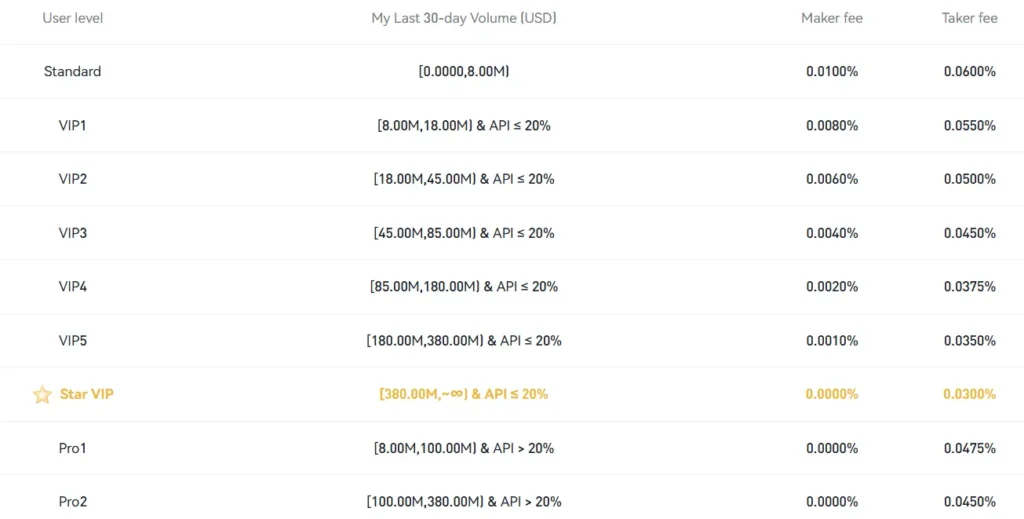

Phemex vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and BYDFi, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Special Discounts |

|---|---|---|---|

| Phemex | 0.1% | 0.1% | VIP tiers available |

| BYDFi | 0.075% | 0.075% | Lower fees with native token |

BYDFi offers slightly lower standard trading fees compared to Phemex. This small difference can add up if you’re an active trader making frequent transactions.

Deposit Fees

Both exchanges typically don’t charge fees for cryptocurrency deposits. This is standard across most crypto exchanges, allowing you to move your assets onto the platform without extra costs.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. BYDFi generally maintains competitive withdrawal fees across popular cryptocurrencies like Bitcoin and Ethereum.

Phemex structures their withdrawal fees based on the specific cryptocurrency network costs. During high network congestion, these fees might increase temporarily.

Fee Reduction Options

You can reduce your trading costs on both platforms. Phemex offers a membership system that can lower or eliminate certain fees. BYDFi provides fee discounts when using their native platform token.

For high-volume traders, both exchanges offer VIP tiers with progressively lower fees as your trading volume increases. This rewards active traders with more cost-effective transactions.

Phemex vs BYDFi: Order Types

When trading on cryptocurrency exchanges, having access to different order types gives you more control over your trading strategy. Both Phemex and BYDFi offer several order types to help you execute trades according to your preferences.

Phemex provides the standard limit orders, market orders, and stop orders. Limit orders let you set a specific price at which you want to buy or sell. Market orders execute immediately at the current market price. Stop orders help you limit losses or lock in profits by triggering when the price reaches a certain level.

BYDFi also offers limit, market, and stop orders as mentioned in the search results. These basic order types allow you to implement various trading strategies based on your goals and risk tolerance.

Both platforms support conditional orders, which execute only when certain market conditions are met. This feature is particularly useful for traders who can’t monitor the market constantly.

One key difference is in the user interface. Some traders find BYDFi’s order placement system more intuitive, while others prefer Phemex’s layout. The best choice depends on your personal preferences and trading style.

Advanced traders might appreciate the order type flexibility that both platforms offer, as it allows for more sophisticated trading strategies and risk management techniques.

Phemex vs BYDFi: KYC Requirements & KYC Limits

Phemex and BYDFi differ significantly in their KYC (Know Your Customer) requirements. These differences might influence which platform you choose for crypto trading.

Phemex requires users to complete KYC verification, which includes providing personal information and proof of address. This process is mandatory for full access to their platform features.

For non-KYC users on Phemex, withdrawal limits are capped at 2 BTC daily. However, once you verify your identity, these withdrawal limits are removed entirely.

BYDFi takes a more flexible approach. You can create an account and start trading without completing KYC verification. This allows for a quicker onboarding process if you prefer privacy.

Both platforms offer no-KYC withdrawal options up to certain limits. Along with BTCC, they allow withdrawals without ID verification, though specific limits apply.

KYC Comparison Table:

| Feature | Phemex | BYDFi |

|---|---|---|

| KYC Required | Yes | No (for basic trading) |

| Non-KYC Withdrawal Limit | 2 BTC daily | Yes (limit varies) |

| KYC Process | Personal info + address proof | Simplified for higher limits |

| Account Creation | KYC needed | No KYC for basic access |

If privacy and quick trading access are your priorities, BYDFi might be more suitable. For those preferring platforms with strong regulatory compliance, Phemex offers that security with its comprehensive KYC requirements.

Phemex vs BYDFi: Deposits & Withdrawal Options

When choosing between Phemex and BYDFi, understanding their deposit and withdrawal systems can help you make a better decision.

Phemex stands out by not charging any deposit fees. This is a significant advantage for traders who make frequent deposits.

For withdrawals, Phemex only charges the minimum Bitcoin network fee rather than adding their own service charges. This fee structure can save you money over time.

BYDFi offers similar options but may have different fee structures. Both platforms support major cryptocurrencies for deposits and withdrawals.

Both exchanges allow users to trade without extensive KYC verification up to certain withdrawal limits. This feature provides some privacy for users who prefer not to share personal information.

Withdrawal Limits:

| Exchange | No-KYC Withdrawal Limit |

|---|---|

| Phemex | Yes (with limits) |

| BYDFi | Yes (with limits) |

Payment Methods:

- Cryptocurrency deposits and withdrawals

- Bank transfers (availability varies by region)

- Third-party payment processors

Remember to check the current minimums and processing times for both platforms. These details can change based on network conditions and exchange policies.

Processing times for withdrawals typically range from a few minutes to a few hours, depending on blockchain congestion and verification requirements.

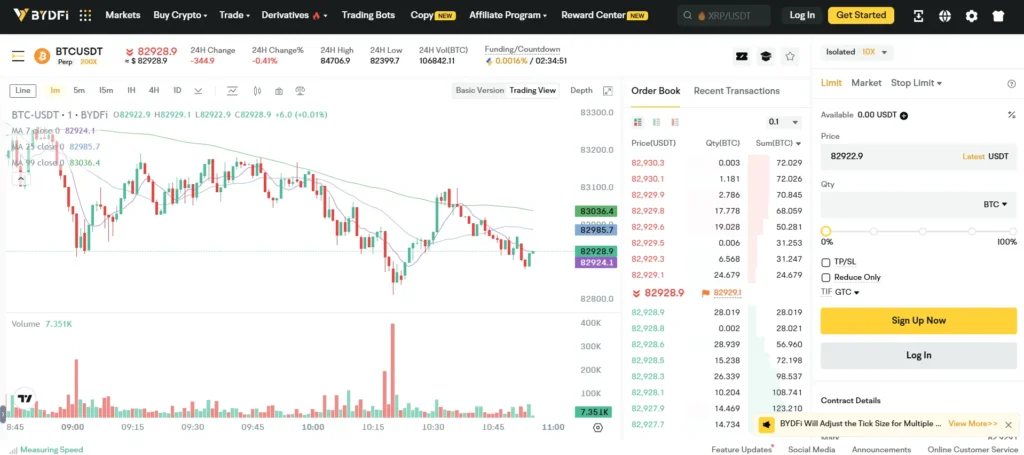

Phemex vs BYDFi: Trading & Platform Experience Comparison

When choosing between Phemex and BYDFi, the trading experience differs significantly. Phemex offers zero-fee spot trading, making it attractive for frequent traders who want to maximize profits.

BYDFi stands out with its privacy-focused approach, offering no-KYC (Know Your Customer) trading options. This means you can start trading without extensive identity verification processes.

User Interface:

- Phemex: Clean, professional design with advanced charting tools

- BYDFi: Straightforward interface with essential features for beginners

Phemex provides a testnet environment where you can practice trading strategies with virtual currency. This is helpful if you’re new to crypto trading or want to test new approaches without risking real money.

Both platforms support leveraged trading, but they differ in maximum leverage amounts and available trading pairs. You’ll find more advanced trading features on Phemex, making it better suited for experienced traders.

Mobile Experience:

| Feature | Phemex | BYDFi |

|---|---|---|

| App Stability | High | Good |

| Trading Tools | Comprehensive | Basic |

| Notifications | Real-time | Standard |

For new traders, BYDFi’s simpler approach might be less overwhelming. Experienced traders will likely appreciate Phemex’s advanced order types and analytical tools.

Response time matters in volatile markets. Both platforms perform well, but Phemex often gets higher marks for execution speed during high-volume trading periods.

Phemex vs BYDFi: Liquidation Mechanism

When trading with leverage on exchanges like Phemex and BYDFi, understanding their liquidation mechanisms is crucial for your risk management strategy. Liquidation happens when your position’s losses reach a certain threshold of your margin.

Both platforms implement liquidation to protect themselves from losses when markets move against traders’ positions. However, they handle this process differently.

Phemex uses a tiered liquidation system that gradually reduces your position size as it approaches the liquidation price. This partial liquidation approach gives you a chance to add funds or adjust your strategy before complete liquidation.

BYDFi employs a more standard liquidation model where positions are fully closed when they reach the liquidation price. Their system monitors positions continuously and executes liquidation when maintenance margin requirements aren’t met.

Liquidation Price Calculation:

| Feature | Phemex | BYDFi |

|---|---|---|

| Calculation Method | Progressive | Standard |

| Early Warning System | Yes | Yes |

| Partial Liquidation | Yes | No |

| Liquidation Fee | Lower | Higher |

Both exchanges provide liquidation calculators to help you determine potential liquidation prices before entering trades. These tools are valuable for planning your entry points and stop-loss levels.

The maintenance margin requirements differ between the platforms. Phemex typically requires 0.5-1% maintenance margin while BYDFi’s requirements range from 0.5-2% depending on the trading pair and leverage used.

You should regularly monitor your positions and maintain adequate margin to avoid unexpected liquidations during volatile market conditions.

Phemex vs BYDFi: Insurance

When comparing cryptocurrency exchanges, insurance coverage is an important factor to consider. This protection can safeguard your assets in case of security breaches or platform failures.

Phemex offers an insurance fund that helps protect users against losses due to liquidations and system issues. The exchange maintains this fund to cover potential gaps when liquidating underwater positions, preventing socialized losses among traders.

BYDFi also provides an insurance mechanism, though details about its specific coverage are less prominently advertised than Phemex. Their insurance system similarly aims to protect users from extreme market volatility and potential liquidation issues.

Neither exchange offers the comprehensive insurance coverage you might find on larger platforms like Coinbase or Gemini, which have specific third-party insurance policies for digital assets.

You should note that both exchanges’ insurance funds primarily protect against trading-related issues rather than covering all types of potential losses. They don’t typically cover personal account breaches caused by poor security practices on your end.

Before choosing either platform, you should review their current insurance policies on their official websites, as coverage details may change over time. The specific terms and conditions of these insurance funds might affect how well your assets are protected.

Phemex vs BYDFi: Customer Support

When trading crypto, good customer support can make a big difference when you have questions or problems. Both Phemex and BYDFi offer customer support, but they differ in quality and availability.

Phemex provides more robust customer support options. You can reach their team through 24/7 live chat, email support, and an extensive help center. Their support team typically responds within minutes for urgent issues.

BYDFi, on the other hand, has more limited customer support. Based on user feedback, this is one of BYDFi’s weak points. You might experience longer wait times when seeking assistance.

Both platforms offer:

- Email support

- Help center/FAQ sections

- Social media support

Phemex Exclusive Support Features:

- 24/7 live chat

- Faster response times

- More language options

- Community forums with staff moderators

Phemex also provides better multilingual support, which is helpful if English isn’t your first language. You’ll find their help documents translated into more languages than BYDFi’s resources.

For new users, Phemex’s better support structure can be particularly valuable as you learn to navigate the platform. Their team can help with account verification, trading questions, and technical issues more efficiently.

If customer support is a priority for you, Phemex has a clear advantage in this category.

Phemex vs BYDFi: Security Features

When choosing a crypto exchange, security should be your top priority. Both Phemex and BYDFi offer robust security measures, but they differ in certain aspects.

Phemex implements strong security protocols including two-factor authentication (2FA) and cold storage for most user funds. Their platform uses a cold wallet system that keeps approximately 99.5% of assets offline, protecting them from potential online attacks.

BYDFi also offers 2FA but places additional emphasis on privacy with its no-KYC trading options for certain account levels. This feature appeals to users who prioritize anonymity in their trading activities.

Key Security Features Comparison:

| Feature | Phemex | BYDFi |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ (99.5% of funds) | ✅ |

| No-KYC Options | ❌ | ✅ |

| Anti-Phishing Code | ✅ | ✅ |

| IP Verification | ✅ | ✅ |

Both exchanges use advanced encryption technologies to protect user data and transactions. You’ll find regular security audits are conducted on both platforms to identify and address potential vulnerabilities.

Phemex has built a reputation for its strong security record with no major hacks reported. BYDFi similarly maintains strict security standards while offering more privacy options.

Remember to always enable all available security features regardless of which platform you choose. This includes setting up strong passwords, enabling 2FA, and being cautious of phishing attempts.

Is Phemex Safe & Legal To Use?

Phemex is generally considered a secure cryptocurrency exchange with strong security measures in place. The platform uses cold storage for most funds and offers two-factor authentication to protect user accounts.

U.S. residents can legally use Phemex for cryptocurrency trading without issues. The exchange welcomes users from the United States, as confirmed by the search results.

Phemex offers some notable features that enhance its appeal:

- Zero-fee spot trading – saving you money on transactions

- Regular security audits – helping protect your funds

- Intuitive interface – making trading easier for beginners

The exchange operates within regulatory frameworks in most jurisdictions where it offers services. However, regulations for crypto exchanges can vary by location, so it’s wise to check your local laws.

When comparing safety aspects with BYDFi, there are key differences to consider. BYDFi focuses more on privacy with no-KYC trading options, while Phemex emphasizes security and compliance.

You should enable all available security features when using Phemex. This includes strong passwords, two-factor authentication, and being cautious of phishing attempts.

Also Check: Are Crypto Options Legal in the US: Understanding Regulations and Guidelines

Remember that all cryptocurrency exchanges carry inherent risks. Market volatility, technical issues, and regulatory changes can impact your trading experience.

Is BYDFi Safe & Legal To Use?

BYDFi operates as a registered Money Service Business (MSB) with FinCEN, making it fully compliant with U.S. regulations. This is uncommon among global cryptocurrency exchanges and gives BYDFi an advantage for U.S. users.

The exchange implements standard security measures to protect user funds and data. These likely include two-factor authentication (2FA), cold storage for assets, and encryption protocols.

U.S. residents can legally use BYDFi for cryptocurrency trading. However, you should always verify your local state regulations, as cryptocurrency laws can vary by jurisdiction.

When comparing BYDFi to Phemex regarding compliance, both exchanges aim to follow relevant regulations. BYDFi appears to have a stronger position in the U.S. market thanks to its FinCEN registration.

Key Safety Features:

- FinCEN registration

- Compliance with U.S. regulations

- Standard security protocols

Before using BYDFi, you should:

- Check your local state laws regarding cryptocurrency trading

- Enable all available security features on your account

- Use strong, unique passwords

- Consider using hardware wallets for long-term storage

BYDFi’s legal status makes it a viable option for U.S. traders looking for platforms that accept American users.

Frequently Asked Questions

Traders considering Phemex and BYDFi often have specific concerns about fees, security, and available features. These exchanges differ in several important ways that can impact your trading experience.

What are the key differences in trading fees between Phemex and BYDFi?

Phemex and BYDFi use different fee structures that affect your trading costs. BYDFi generally scores higher in overall fee competitiveness with a 9.1 rating compared to Phemex.

Phemex typically charges 0.1% for spot trading, with reduced rates available through their membership program. Their futures trading fees follow a maker-taker model with competitive rates.

BYDFi often offers lower base fees and more generous discounts for high-volume traders. You’ll find their fee schedule particularly advantageous if you trade frequently.

How do the security measures of Phemex compare to those of BYDFi?

Both exchanges prioritize security but implement different approaches. Phemex uses multi-signature cold wallets and robust encryption to protect user funds.

BYDFi employs advanced security protocols including two-factor authentication, anti-phishing codes, and regular security audits. Their system includes insurance funds to protect against unexpected losses.

You’ll find that both platforms maintain strong security records, though they differ in specific implementation details of their protection measures.

Are there any differences in the range of cryptocurrencies available on Phemex versus BYDFi?

The cryptocurrency selection varies between these exchanges. Phemex offers major cryptocurrencies and a growing list of altcoins, focusing on quality over quantity.

BYDFi typically provides a wider range of trading pairs and emerging cryptocurrencies. You’ll find more options for altcoin trading on BYDFi compared to Phemex.

Both platforms regularly add new tokens, but BYDFi generally moves faster in listing new projects.

What are the strengths and weaknesses of Phemex’s and BYDFi’s user interfaces?

Phemex features a clean, intuitive interface with advanced charting tools. Its strength lies in balancing simplicity for beginners while providing depth for experienced traders.

The platform occasionally faces sluggishness during high traffic periods. You’ll appreciate Phemex’s mobile app, which mirrors most desktop functionality.

BYDFi offers a more customizable trading experience with multiple layout options. Its interface includes more advanced features upfront, which might overwhelm new users but pleases experienced traders.

How do the customer support experiences differ between Phemex and BYDFi?

Phemex provides 24/7 customer support through live chat, email, and an extensive knowledge base. Response times average around 1-2 hours for most inquiries.

Their support team handles English queries well, but might be slower with other languages. You can also find community support through their active Telegram and Discord channels.

BYDFi customer support also operates 24/7 but often delivers faster response times, typically under an hour. Their multi-language support is more comprehensive, serving a broader international user base.

Can international users access both Phemex and BYDFi, and what are the restrictions if any?

Both exchanges serve international audiences, but with different regional restrictions. Phemex is available in most countries worldwide except the United States and a few other restricted jurisdictions.

You’ll need to complete KYC verification to access full functionality on Phemex, with requirements varying by region and account tier.

BYDFi maintains a similar global presence but has fewer restrictions in certain Asian markets. Their verification requirements tend to be less stringent for basic account functions.

Both platforms comply with local regulations, meaning service availability changes based on your location and evolving regulatory landscapes.

BYDFi vs Phemex Conclusion: Why Not Use Both?

After comparing BYDFi and Phemex, there’s no need to choose just one platform. Each exchange offers unique advantages that can benefit your trading strategy.

BYDFi stands out with its impressive 200x leverage options, exceeding Phemex’s 100x cap. This makes BYDFi particularly attractive for traders looking to maximize their position sizes with limited capital.

Phemex, however, delivers a more professional trading experience that appeals to advanced users. Its platform offers robust tools that experienced traders often prefer.

Key Strengths of Each:

| Feature | BYDFi | Phemex |

|---|---|---|

| Leverage | Up to 200x | Up to 100x |

| User Experience | Beginner-friendly | Professional-focused |

| Overall Score* | 9.1 | Slightly lower |

| Best For | New traders, high leverage | Advanced trading features |

*Based on search result data

You might consider using BYDFi for its simplicity when you’re just starting out or when you need higher leverage options. Its user-friendly interface makes it ideal for beginners.

Meanwhile, Phemex can serve as your platform for more complex trading strategies as you gain experience.

By utilizing both exchanges, you gain access to a wider range of trading options and can select the platform that best suits your specific trading goals for each transaction.

Compare Phemex and BYDFi with other significant exchanges