Managing risk is one of the most crucial aspects of successful trading. A stop loss calculator can help you determine exactly where to place your stop loss orders based on your entry price and risk tolerance. This tool calculates the precise price point at which your trade should automatically close to limit potential losses to a predetermined percentage of your account.

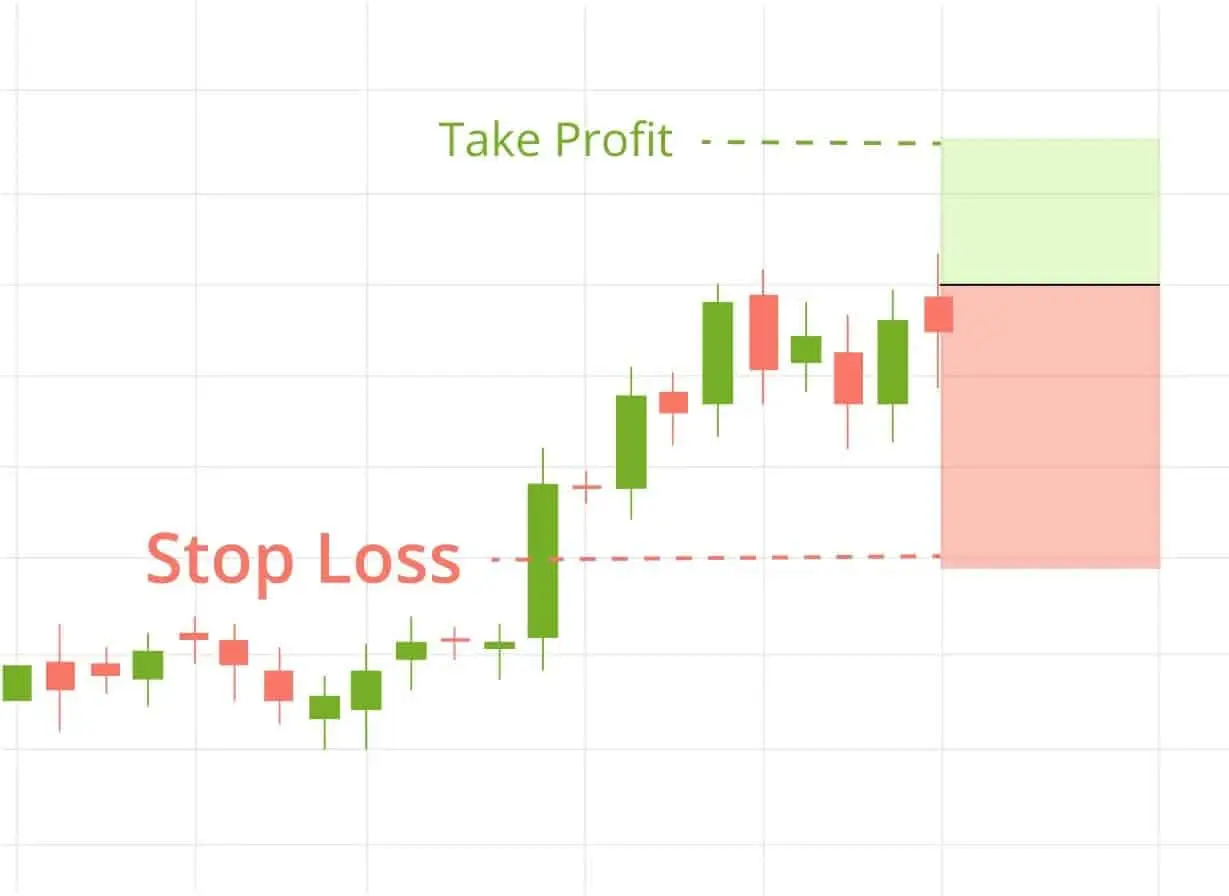

When trading in forex or other markets, you need to know not just when to enter a position, but also when to exit if things don’t go as planned. Stop loss calculators work for both long and short positions, taking into account your entry price and desired risk percentage to generate a stop loss price. Some advanced calculators even help you determine take profit levels so you can see your potential risk-to-reward ratio before entering a trade.

Using a stop loss calculator removes the emotional aspect of trading decisions and helps you maintain consistent risk management across all your trades. Rather than guessing or using arbitrary numbers, you can set your stop loss based on calculated risk, which is essential for long-term trading success and account preservation.

Understanding Stop Loss Calculators

Stop loss calculators are essential tools that help traders manage risk by determining the optimal price level to exit a losing trade. These calculators provide precise measurements of potential losses before entering a position, allowing for more disciplined trading decisions.

Purpose of Stop Loss Calculators

Stop loss calculators help you determine the exact price at which to set your stop loss order based on your risk tolerance and trading strategy. Their primary purpose is to protect your trading capital by limiting potential losses on any single trade.

These tools calculate the maximum amount you’re willing to risk on a trade (usually a percentage of your total capital) and convert that into a specific price point. For example, if you’re willing to risk 2% of your $10,000 account on a trade, the calculator will determine the stop loss price that would result in a $200 loss if triggered.

Stop loss calculators also help maintain trading discipline by removing emotional decision-making from the process. They provide objective exit points based on your predefined risk parameters rather than panic or hope.

Key Features

Most stop loss calculators include several important features designed to enhance your risk management process. Position sizing capabilities allow you to determine how many shares or contracts to trade based on your risk tolerance.

Risk-reward ratio calculations help you assess whether a potential trade offers sufficient upside compared to the downside risk. A good calculator will show if your trade has at least a 1:2 risk-reward ratio, meaning potential profit is twice the potential loss.

Common Calculator Inputs:

- Entry price

- Stop loss price

- Account size

- Risk percentage

- Trade direction (long/short)

Advanced calculators may include multiple order types like trailing stops and bracket orders. Some also provide visual charts showing potential profit and loss scenarios at different price levels.

Also Read: Best Crypto Options Trading Platforms

Benefits of Using a Stop Loss Calculator

Consistent risk management is the primary benefit of using stop loss calculators. They ensure you risk the same percentage of your capital on each trade, preventing outsized losses that can devastate your account.

Stop loss calculators remove guesswork from trading decisions. Instead of arbitrary exit points, you get mathematically sound levels based on your risk tolerance. This leads to more confident trading since you know exactly how much you might lose before entering a position.

These tools also help improve your trading psychology by reducing emotional trading. When losses are predetermined and limited, you’ll experience less anxiety and stress during market fluctuations.

For beginners, calculators provide an educational benefit by reinforcing proper risk management principles. They help develop good habits from the start, teaching you to always consider risk before potential reward.

How to Use a Stop Loss Calculator

A stop loss calculator helps you protect your trading capital by determining where to set your exit points. Using this tool correctly can significantly improve your risk management strategy and trading outcomes.

Inputting Trade Details

Start by entering your trade direction – whether you’re going long (buying) or short (selling). This tells the calculator which direction the market needs to move for you to lose money.

Next, input your entry price – the price at which you plan to open your position. This serves as the baseline for all calculations.

Then enter your position size, which could be in shares, lots, or contracts depending on what you’re trading. Some calculators may ask for your account currency and total account balance to help with risk calculations.

Finally, specify the ticker symbol or asset you’re trading. Different assets have different volatility profiles, which may affect the calculator’s recommendations.

Setting Risk Parameters

Determine how much money you’re willing to risk on this trade. Most professional traders suggest risking only 1-2% of your total account on any single trade.

You can set your stop loss in different ways:

- Fixed amount – a specific dollar amount you’re willing to lose

- Percentage-based – a percentage of your trading capital

- Technical level – based on support/resistance or other chart patterns

Many calculators also let you set a risk-to-reward ratio. A common target is at least 1:2, meaning your potential profit should be twice your potential loss.

Some advanced calculators include options for trailing stops, which move your stop loss as the trade moves in your favor.

Interpreting Calculator Outputs

The calculator will generate your exact stop loss price point – the specific price at which your trade should automatically close if the market moves against you.

It will also show your potential loss amount in actual currency. This helps you verify the risk matches your predetermined limits.

Most calculators display your risk percentage, showing what portion of your account you’re risking on this trade. Keep this under 2% for proper risk management.

You’ll also see your take profit level if you entered a risk-reward ratio. This shows exactly where to set your profit target.

Some tools provide additional metrics like:

- Maximum position size for your risk tolerance

- Required account size for the trade

- Risk-adjusted expected value of the trade

Stop Loss Strategies

Setting the right stop loss is key to managing your trading risk. Different strategies work for different trading styles and market conditions.

Fixed Percentage Stop Loss

The fixed percentage strategy is one of the simplest ways to manage risk. You set your stop loss at a specific percentage away from your entry price. Many traders use 1% to 3% of their total account balance as the maximum they’re willing to lose on a single trade.

For example, if you have a $10,000 account and want to risk 2%, you would risk no more than $200 per trade. The calculator then determines exactly where to place your stop loss order based on your position size.

This approach works well for beginners because it’s straightforward. It also ensures consistent risk management across different trades regardless of market volatility.

To implement this strategy:

- Decide what percentage of your account you’re willing to risk

- Enter this into your stop loss calculator

- Place your stop order at the calculated price level

Trailing Stop Loss

Trailing stops move with the market when it goes in your favor. Unlike fixed stops, they adjust automatically to lock in profits as the price moves.

You can set trailing stops as either a fixed amount or a percentage. For instance, a 10% trailing stop for a long position would move upward as the price increases, always staying 10% below the highest price reached since entry.

This strategy helps you capture more profit during strong trends while protecting your gains if the market reverses. Many professional traders use trailing stops to let their winners run without constant monitoring.

The main advantage is that you don’t need to predict exactly how far the market will move. Your stop adjusts automatically, following the price action and giving your trade room to breathe while still providing protection.

Best Practices for Stop Loss Calculation

Setting effective stop losses requires a careful approach that balances protecting your capital and giving trades enough room to work. Successful traders develop systematic methods based on market data, personal risk tolerance, and consistent review.

Reviewing Historical Data

Historical price action offers valuable insights for placing stop losses. Look at recent support and resistance levels to identify where price has previously reversed. These areas often make logical stop loss points.

Check the average true range (ATR) of the asset you’re trading. This indicator measures volatility and can help you set stops at realistic distances from your entry point. A common approach is setting stops at 1-2 times the ATR value.

Market volatility varies by asset class. Cryptocurrencies typically require wider stops than blue-chip stocks. Study how your specific instruments move during different market conditions.

Backtest your stop loss methods using past market data. This practice reveals whether your approach would have protected you during previous market swings while allowing profitable trades to develop.

Adjusting Stop Loss Orders

Move your stops to breakeven once a trade shows a profit equal to your initial risk. This technique eliminates downside while preserving upside potential.

Consider using trailing stops that automatically adjust as price moves in your favor. These can be percentage-based or set at specific technical levels like moving averages.

Don’t adjust stops based on emotions or market noise. Make changes only when significant price milestones or technical conditions warrant it.

Use time-based adjustments for certain strategies. Day traders might tighten stops near the end of sessions, while swing traders may widen them to account for overnight volatility.

When a trade works well, protect your gains by moving stops behind key support or resistance levels that price has broken through.

Risk Tolerance Alignment

Always calculate your stop loss in terms of percentage risk to your total account. Most professional traders risk only 1-2% per trade.

The formula for setting stops based on account risk is:

Position Size = (Account Size × Risk Percentage) ÷ (Entry Price – Stop Loss Price)

Match your stop distance to your trading timeframe. Short-term trades generally need tighter stops than longer positions.

Consider your psychological comfort. If stops are so wide that losses cause emotional distress, you’ll likely make poor decisions. Find a balance between giving trades room and maintaining peace of mind.

Track your stop loss performance over time. If you’re frequently stopped out before trades would have become profitable, you may need to adjust your methodology.

Common Mistakes to Avoid

Setting your stop-loss too tight is a common error that can lead to premature exits from your trades. Markets naturally fluctuate, and a stop that’s too close to your entry price might get triggered by normal market noise rather than a true trend reversal.

Another mistake is placing stops at obvious round numbers. Many traders set their stops at these levels, making them targets for price manipulation. Try setting your stop-loss slightly beyond these common points.

Ignoring market volatility when setting your stop-loss can be costly. More volatile markets require wider stops to accommodate larger price swings. Your stop-loss distance should reflect the current market conditions.

Failing to adjust your stop-loss as the trade moves in your favor is a missed opportunity. Consider moving your stop to break-even or trailing it behind the price action to protect your gains while allowing room for continued profit.

Using arbitrary pip or dollar amounts for every trade regardless of market conditions is ineffective. Your stop-loss should be based on technical levels relevant to each specific trade.

Placing stops exactly at support or resistance levels is risky. These areas often experience price wicks that can trigger your stop before the market continues in your favor. Place stops beyond these levels instead.

Not using a proper risk calculation method can lead to inconsistent position sizing. Always determine your stop-loss first, then calculate position size based on your risk tolerance.

Frequently Asked Questions

Stop loss placement varies across different markets and trading styles. Here are answers to common questions traders ask about setting effective stop losses for various assets.

How do you determine the appropriate placement for a stop loss in forex trading?

In forex trading, stop losses are often placed below support levels for buy positions and above resistance levels for sell positions. This helps protect your capital from normal market fluctuations.

A common approach is the ATR (Average True Range) method. Multiply the current ATR by 2 or 3 and place your stop loss that distance from your entry point.

Some traders use the percentage method, risking only 1-2% of their account on any single trade. For example, if you have a $10,000 account and want to risk 1%, your maximum loss would be $100.

What are the best practices for setting stop losses in cryptocurrency trading?

Cryptocurrency markets are highly volatile, so wider stop losses are often necessary. A common practice is to set stops 5-15% from your entry price, depending on the coin’s volatility.

Using recent swing lows or highs as reference points works well in crypto. These natural market turning points can provide logical places for your stops.

Consider the volatility of the specific cryptocurrency you’re trading. Bitcoin typically requires different stop loss settings than smaller altcoins with higher volatility.

Can you explain the methods used for calculating stop loss in option trading?

In options trading, stop losses can be based on the underlying asset’s price or on the option’s premium. Premium-based stops are set at a percentage of the option’s value, typically 25-50%.

Delta-based stop losses are popular among experienced options traders. As delta changes with price movements, you can exit when delta reaches a predetermined threshold.

Time decay affects options uniquely, so many traders use time-based stops. If the trade doesn’t move in your favor within a specific timeframe, exit regardless of price movement.

How is stop loss calculated when trading commodities such as gold?

For commodities like gold, technical analysis provides effective stop loss points. Key support and resistance levels, trend lines, and moving averages offer natural places for stops.

Volatility-based stops work well with gold. Calculate the average daily range and place your stop 1-2 times this range away from your entry point.

Some traders use dollar-based stops for gold, risking a fixed amount per contract. For example, you might decide to risk no more than $500 per gold contract.

What strategies are recommended for setting take profit and stop loss levels?

The risk-reward ratio strategy suggests setting take profit levels at least 2-3 times the distance of your stop loss. If risking $100, aim for at least $200-300 in potential profit.

Trailing stops can maximize profits in trending markets. These stops move with the price in your favor, locking in gains while allowing room for further price movement.

Chart pattern stops place take profits at measured move targets. For example, head and shoulders patterns suggest measuring the height of the pattern to determine profit targets.

How does the S&P 500’s volatility affect the calculation of stop losses for equities?

Higher S&P 500 volatility generally requires wider stop losses for individual stocks. During volatile periods, stops might be set 5-8% from entry rather than the typical 2-4%.

The VIX index (volatility index) provides a good gauge for adjusting stops. When the VIX is above 20, consider widening your stops to avoid being shaken out of good positions.

Sector correlation with the S&P 500 matters when setting stops. Highly correlated sectors may need wider stops during market turbulence, while defensive sectors might use tighter stops.

Explore these crypto option trading exchanges: