Trading without a plan is like sailing without a compass. A Take Profit Calculator helps you navigate the unpredictable waters of forex and other markets by showing you where to set your profit targets. This useful tool calculates the optimal take profit level based on your entry price, stop loss, and desired risk-reward ratio, giving you clearer trading decisions and potentially better results.

Using a Take Profit Calculator is straightforward. You enter your entry price, set your stop loss level, and the calculator determines where your take profit should be. For example, if you subtract your stop loss level from your entry price and then add that result to your entry price, you’ll get a basic take profit level with a 1:1 risk-reward ratio.

The best traders know that consistent profit comes from proper risk management. By using a Take Profit Calculator, you can ensure each trade has a defined exit strategy before you even enter the market. This helps you avoid emotional decisions and stick to your trading plan, which is crucial for long-term success in any market.

Understanding the Take Profit Calculator

A Take Profit Calculator helps traders plan their exit strategy before entering a trade. This tool calculates potential profits based on entry price, position size, and target exit points.

Purpose of a Take Profit Calculator

Take Profit Calculators help you lock in profits at predetermined price levels. Instead of making emotional decisions during market fluctuations, you can set clear exit points before trading begins. This calculator shows exactly how much profit you’ll make when your target price is reached.

By using this tool, you can:

- Plan your risk-to-reward ratio before entering a trade

- Remove emotion from trading decisions

- Create consistent trading strategies with defined profit targets

- Test different scenarios to optimize your approach

The calculator transforms abstract price movements into concrete profit numbers, helping you understand the actual value of each trade. This makes your trading more systematic and less reactive.

Also Read: Best Crypto Options Trading Platforms

Key Components and Metrics

When using a Take Profit Calculator, you’ll need to input several important values:

- Entry price – the price at which you buy or sell an asset

- Position size – how many units or contracts you’re trading

- Take profit level(s) – your target exit price(s)

Some advanced calculators also include:

- Stop loss levels to calculate potential losses

- Multiple take profit levels for scaling out of positions

- Leverage settings if you’re using borrowed funds

The calculator processes these inputs to show your:

- Profit amount in your account currency

- Percentage gain on your investment

- Risk-to-reward ratio when combined with stop loss

For example, with a $1000 position at $50 entry price and $55 take profit, you’d see a $100 profit (10% gain) clearly displayed.

How to Use a Take Profit Calculator

Take profit calculators help you determine optimal exit points for your trades. They use mathematical formulas to balance risk and reward, making your trading decisions more systematic and less emotional.

Entering Trade Parameters

To start using a take profit calculator, input your trade details. These typically include your entry price, stop loss level, and position size. Some calculators may also ask for the currency pair if you’re trading forex.

For example, if you’re entering a trade at $50 with a stop loss at $48, you’ll input these values into the calculator. Your position size might be expressed in shares, lots, or contract value depending on the market you’re trading.

Many calculators use the formula TP = EP + (EP – SL), where TP is take profit, EP is entry price, and SL is stop loss. This creates a balanced risk-to-reward ratio of 1:1.

Analyzing Results

After entering your parameters, the calculator will display your potential take profit levels. These results show where you should exit your trade to achieve your desired risk-to-reward ratio.

For instance, if your entry is $50 and stop loss is $48, a 1:1 risk-to-reward ratio would set your take profit at $52. This means you’re risking $2 per share to potentially gain $2.

Some advanced calculators will show multiple take profit levels for different ratios. You might see options for 1:1, 1:2, or even 1:3 risk-to-reward scenarios, allowing you to choose based on your trading strategy.

Pay attention to the potential profit amounts rather than just the price levels. This helps you understand the actual impact on your account.

Adjusting for Different Market Conditions

Market conditions should influence your take profit decisions. In trending markets, consider using wider take profit levels to capture more of the move.

During volatile periods, you might want to set more conservative take profit targets. This helps secure gains before potential market reversals occur.

Some calculators allow you to factor in market volatility using indicators like Average True Range (ATR). For example, you might add 0.2 × ATR to your calculated take profit in low-volatility markets, or subtract a similar amount during high volatility.

Remember to adjust your expectations based on the specific asset you’re trading. Cryptocurrencies typically have different volatility profiles than blue-chip stocks or major forex pairs, requiring different take profit approaches.

Benefits of Using a Take Profit Calculator

Take profit calculators offer traders valuable advantages that can significantly improve trading performance. These tools help determine optimal exit points, manage risk effectively, and make data-driven decisions.

Risk Management Enhancement

Take profit calculators strengthen your risk management strategy by providing clear exit points for trades. You can set precise profit targets based on your risk tolerance and trading plan rather than relying on emotions or guesswork.

With these calculators, you can establish consistent risk-to-reward ratios across all your trades. For example, you might aim for a 1:2 ratio, risking $100 to potentially gain $200.

The calculator helps you visualize potential losses alongside gains, encouraging disciplined trading. You can see exactly what’s at stake before entering a position.

Many calculators allow you to test different stop-loss and take-profit combinations to find the optimal balance for your trading style. This systematic approach helps protect your capital during market volatility.

Also Read: Where to Trade Bitcoin Options: Top Platforms for Crypto Derivatives

Informed Trading Decisions

Take profit calculators provide real-time outcome projections based on your trade parameters. This immediate feedback helps you evaluate if a potential trade aligns with your goals.

You can input different currency pairs, position sizes, and market conditions to compare potential scenarios. This comparison helps you prioritize the most promising opportunities.

The calculator removes emotional bias from your decision-making process. Instead of hoping for unrealistic profits, you work with concrete numbers.

Many calculators include historical data integration, allowing you to see how similar trades performed in the past. This historical context improves your ability to set realistic profit targets.

Using these tools regularly builds your analytical skills and market understanding. Over time, you’ll develop better intuition for profitable trade setups.

Profit Maximization Strategies

A take profit calculator helps you optimize position sizing to match your profit goals. You can adjust your trade volume until the potential reward meets your target.

The calculator enables strategic scaling of positions. You might set multiple take-profit levels—closing portions of your trade at different price points to secure profits while leaving room for additional gains.

You can analyze how different market conditions affect potential profits. This analysis helps you adapt your strategy to changing volatility or trend strength.

The tool encourages systematic evaluation of leverage effects on profitability. You can see exactly how increased leverage amplifies both potential profits and risks.

Many calculators allow you to save successful trade parameters for future reference. This feature helps you replicate profitable strategies and continuously improve your trading approach.

Common Mistakes to Avoid

When using a take profit calculator, certain errors can significantly impact your trading outcomes. Being aware of these pitfalls will help you make more accurate predictions and achieve better results.

Overestimating Profit Targets

Setting unrealistic profit targets is a common error that can derail your trading strategy. Many traders input overly optimistic price movements that rarely occur in real market conditions. This creates false expectations and leads to disappointment.

You should base your profit targets on historical price movements and volatility patterns. For example, if a stock typically moves 2-3% in a day, setting a 10% daily profit target is unrealistic.

Another mistake is ignoring market conditions. Different market environments (bullish, bearish, or sideways) require different profit expectations. What works in a bull market won’t necessarily work during sideways trading.

Always adjust your profit calculations to account for transaction costs like commissions and fees. These expenses can significantly reduce your actual profits, especially for frequent traders.

Neglecting Stop-Loss Settings

Many traders focus solely on profit potential while ignoring proper stop-loss placement. This imbalanced approach creates risk management problems that can lead to substantial losses.

Your stop-loss levels should be based on technical support levels or a predetermined percentage of your investment that you’re willing to risk. Setting stop-losses too close to entry points often results in premature exits due to normal market fluctuations.

Avoid the common mistake of using the same stop-loss percentage for all trades. Different assets have different volatility profiles and require customized stop-loss settings.

Remember to consider the risk-reward ratio in your calculations. A healthy trading approach typically aims for a risk-reward ratio of at least 1:2, meaning your potential profit should be at least twice your potential loss.

Optimizing Take Profit Strategies

Setting effective take profit levels requires strategic planning and adaptation to market conditions. Successful traders blend technical analysis with risk management to maximize returns while protecting capital.

Incorporating Market Analysis

Market analysis forms the foundation of any effective take profit strategy. You should identify key support and resistance levels before placing trades, as these often serve as natural exit points.

Technical indicators like Fibonacci retracements can help you set realistic profit targets. For example, the 127.2% and 161.8% extensions often work well as take profit levels for trend continuation trades.

Volatility measurements matter too. In high-volatility markets, you might want to set closer take profit targets to secure gains before potential reversals occur.

Chart patterns also provide valuable clues. Head and shoulders patterns, double tops, and triangle breakouts each suggest different exit strategies.

Key Analysis Tools:

- Support/resistance levels

- Moving averages

- Volume indicators

- Trend strength measurements

Balancing Conservative and Aggressive Approaches

Finding the right balance between conservative and aggressive take profit strategies depends on your risk tolerance and market conditions.

Conservative approach: Set multiple take profit levels to secure partial gains along the way. This method locks in profits incrementally while allowing some portion to capture extended moves.

Example partial take profit structure:

- TP1: 25% of position at 1:1 risk-reward

- TP2: 50% of position at 2:1 risk-reward

- TP3: 25% of position at 3:1 risk-reward

Aggressive traders might use wider take profit targets but should still employ proper position sizing to manage risk. You can adjust your approach based on market trends—tighter targets in ranging markets, wider targets in trending markets.

The multi-target calculator mentioned in search results helps optimize lot sizes for each take profit level and calculates potential profits for your overall strategy.

Frequently Asked Questions

Take profit calculations vary across different trading instruments and markets. Traders need specific formulas and approaches depending on whether they’re trading forex, cryptocurrency, commodities, or stocks.

How can I calculate my take profit levels in forex trading?

In forex trading, you can calculate take profit levels by determining your desired risk-reward ratio. For example, if you’re risking 50 pips on a trade, a 1:2 risk-reward ratio would set your take profit at 100 pips from your entry point.

The formula is: Take Profit Price = Entry Price + (Pips × Pip Value × Lot Size) for buy orders.

For sell orders, use: Take Profit Price = Entry Price – (Pips × Pip Value × Lot Size).

Most forex platforms like FXTM offer built-in calculators that help you determine potential profits based on your position size.

What formula should I use to determine take profit values in cryptocurrency markets?

For cryptocurrency markets, calculate take profit values using percentage targets rather than pips. Many traders use key resistance levels or Fibonacci extensions to set these targets.

A simple formula is: Take Profit Price = Entry Price × (1 + Target Percentage/100) for long positions.

For short positions: Take Profit Price = Entry Price × (1 – Target Percentage/100).

Cryptocurrency volatility often requires wider take profit targets than traditional markets. Consider using 5-20% targets depending on market conditions.

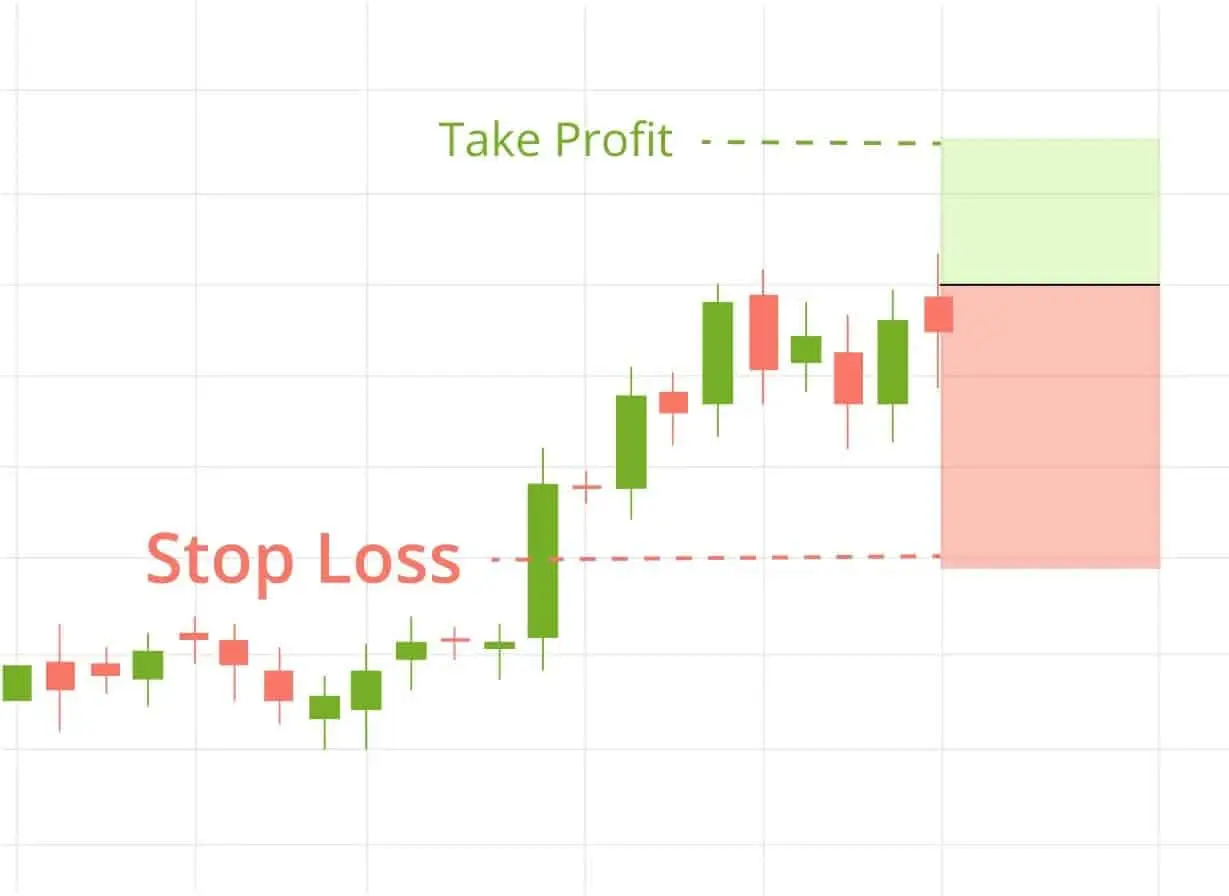

Can you explain the process of setting stop loss and take profit in a single trade?

Setting both stop loss and take profit orders creates a complete risk management strategy. First, identify your entry point based on your analysis.

For stop loss, place it below a support level (for buys) or above resistance (for sells). The distance should reflect your risk tolerance, typically 1-2% of your account.

For take profit, set it at a realistic target based on resistance/support levels. Most trading platforms allow you to enter both values simultaneously when placing your order.

How do I use a profit calculator to estimate my returns for trading Bitcoin against the US dollar?

To estimate Bitcoin/USD trading returns, use a profit calculator by entering your planned entry price, position size, and target exit price. Many cryptocurrency exchanges offer built-in calculators.

The formula is: Potential Profit = (Exit Price – Entry Price) × Position Size for long trades.

For leveraged positions, multiply this result by your leverage. Remember that leverage also increases potential losses proportionally.

What is the appropriate method to calculate potential profits when trading Gold (XAUUSD) or Oil (USOIL)?

When trading commodities like Gold or Oil, calculate potential profits based on price difference and contract specifications. For Gold, profits are typically calculated per ounce.

The formula is: Profit = (Exit Price – Entry Price) × Contract Size × Number of Contracts.

For standard Gold contracts, each $1 move equals $100 profit or loss per contract. Oil contracts vary by exchange but typically represent 1,000 barrels per contract.

Is it possible to set multiple take profit targets, and if so, how is this best achieved?

Yes, setting multiple take profit targets helps you capture gains while letting winners run. This strategy involves dividing your position into parts and closing each at different price levels.

For example, with a 3-tier approach, close 33% of your position at your first target, another 33% at your second target, and the final 34% at your third target.

Most advanced trading platforms support partial take profits through OCO (One-Cancels-Other) orders or by manually placing multiple limit orders. This method helps balance between securing profits and maximizing potential returns.

Explore these crypto option trading exchanges: